Last month, we took a look at the state of the U.S. IPO (initial public offering) market and concluded that the conditions may finally be coming into place to spur an uptick in IPO activity in the second half of this year. As we identified here, the outlook for IPOs is dependent on several factors, including how far the central bank is away from the end of its hiking cycle, the direction of valuations, CEO confidence, and the level of IPO backlog. Building on this framework to also consider implied volatility, economic growth, and business conditions, we now explore the global state of the IPO market, assessing the current strength and outlook across regions. We conclude that while deal activity was off to a slow start in the first half of 2023, green shoots have started to emerge as the global macro picture becomes incrementally more constructive, albeit with varying trends across different regions.

Tepid state of global IPOs over the last six months

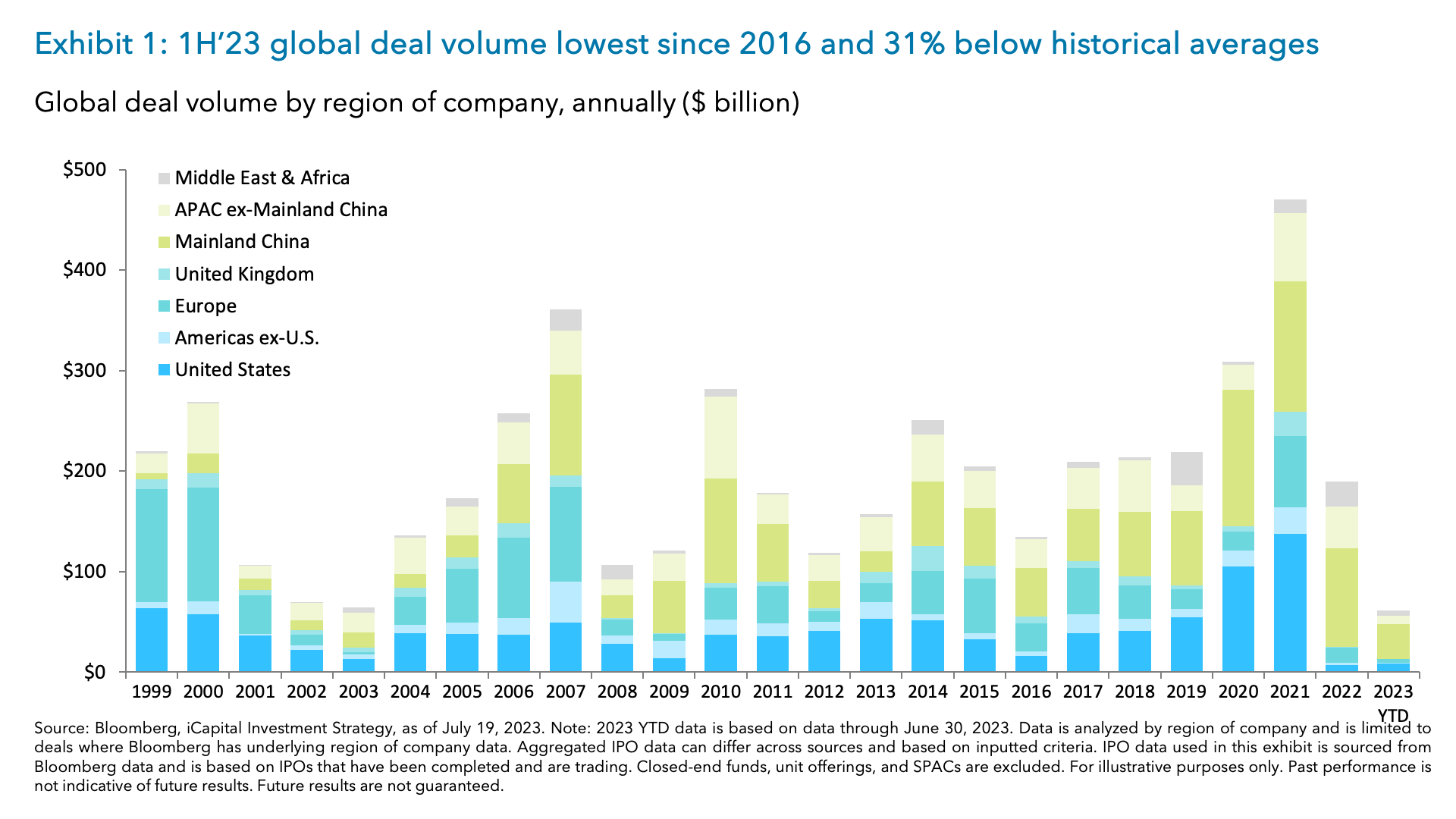

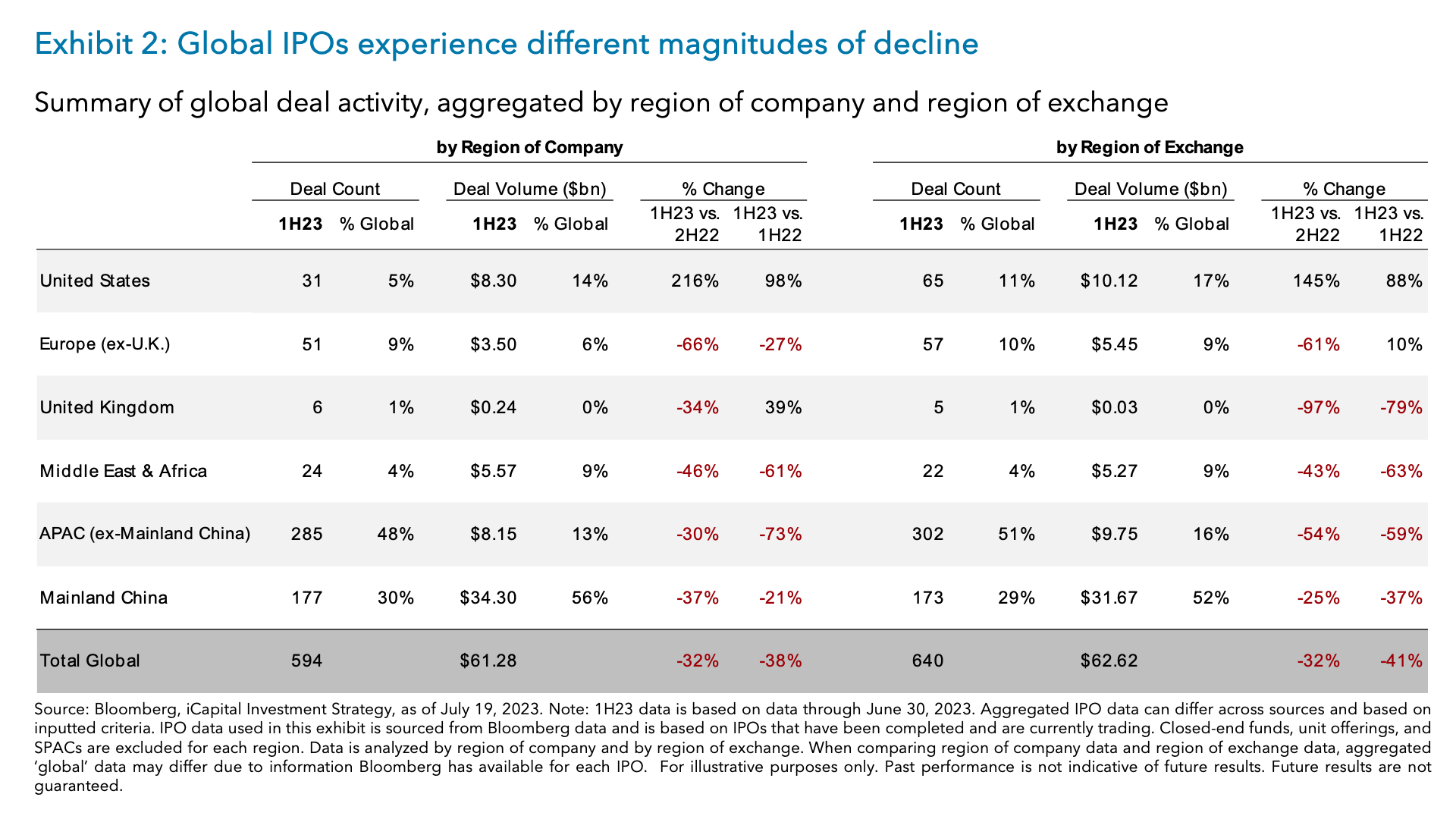

In the first six months of this year, the global IPO market experienced a significant decline, with deal volume down 38% when compared to the same period in 2022 (Exhibit 1).1 This marked the lowest first-half deal volume since 2016, and represented a 31% drop below the historical average of the past 20 years.2 Notably, while declines were observed across all major regions there has been significant dispersion in terms of the magnitude of the declines (Exhibit 2). For instance, IPO deal volumes in Mainland China saw a comparatively moderate year-over-year decline of about 21% in the first half of 2023, while the rest of the Asia-Pacific region (APAC excluding Mainland China) faced a staggering decrease of approximately 73%.3 Europe’s IPO activity declined by 27%, but the U.K. saw a notable increase of 39%, albeit from very depressed levels in the first half of 2022.4 The U.S. exhibited a noteworthy increase in deal volume, up by an impressive 98%, but again from a low base in the first half of 2022.5

Which region is generating the biggest volume of IPO activity this year? Among all regions, Asia-Pacific stands out as the frontrunner in generating the largest volume of IPO activity in 2023. Notably, Mainland Chinese companies take the lead, contributing to 30% of the global deal count and an impressive 56% of the global deal volume during the first half of the year.6 Additionally, the rest of the Asia-Pacific region accounts for 48% of the global deal count, although its deal volume is relatively lower at 13%.7 Consequently, the Asia-Pacific region, as a whole, maintains its strong dominance in the global IPO activity landscape, even in spite of year-over-year (1H ‘23 vs. 2H ‘22) regional weakness.

Region of Exchange vs. Region of Company – An Interesting Dynamic

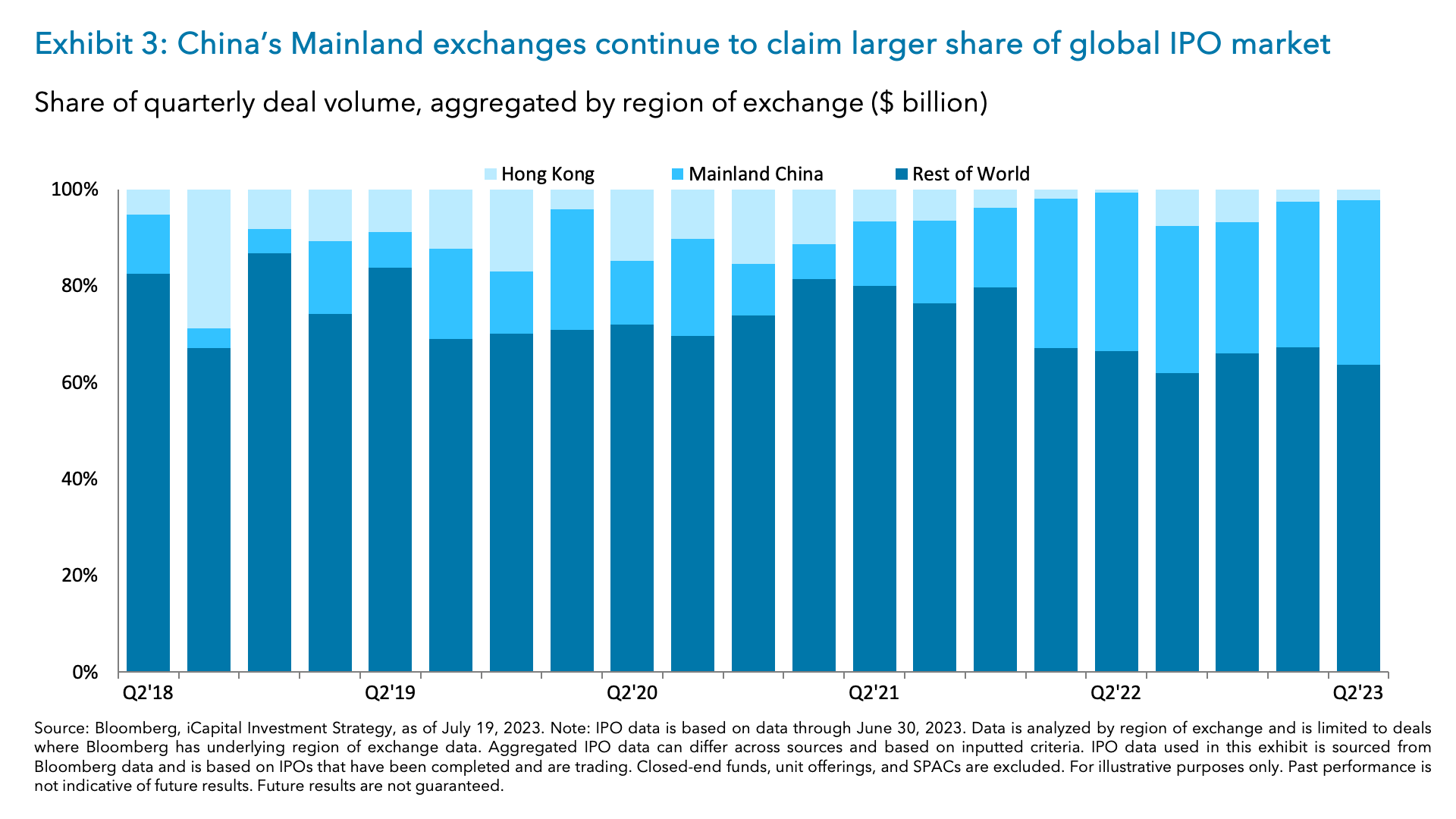

Interestingly, when looking at IPO activity from the perspective of the listing exchange location, rather than from the company’s country of origin, another dynamic stands out. Mainland China is attracting both the largest and greatest number of IPOs, with its exchanges hosting four of the world’s top ten largest IPOs and accounting for 52% of global deal volume in the first half of this year (Exhibit 2).8 While this is partly due to a post-COVID reopening tailwind that was delayed in Mainland China compared to the broader world, regulatory improvements in China’s Mainland capital markets have contributed to a greater desire for companies to list within the country. Recently, China has relaxed strict information disclosure regulations for public companies and removed regulations that capped price changes after an IPO.9 As a result, China’s Mainland exchange listings continue to account for a larger share of the global IPO market, potentially affecting Hong Kong listings, which have seen a decline over the prior quarters (Exhibit 3).10

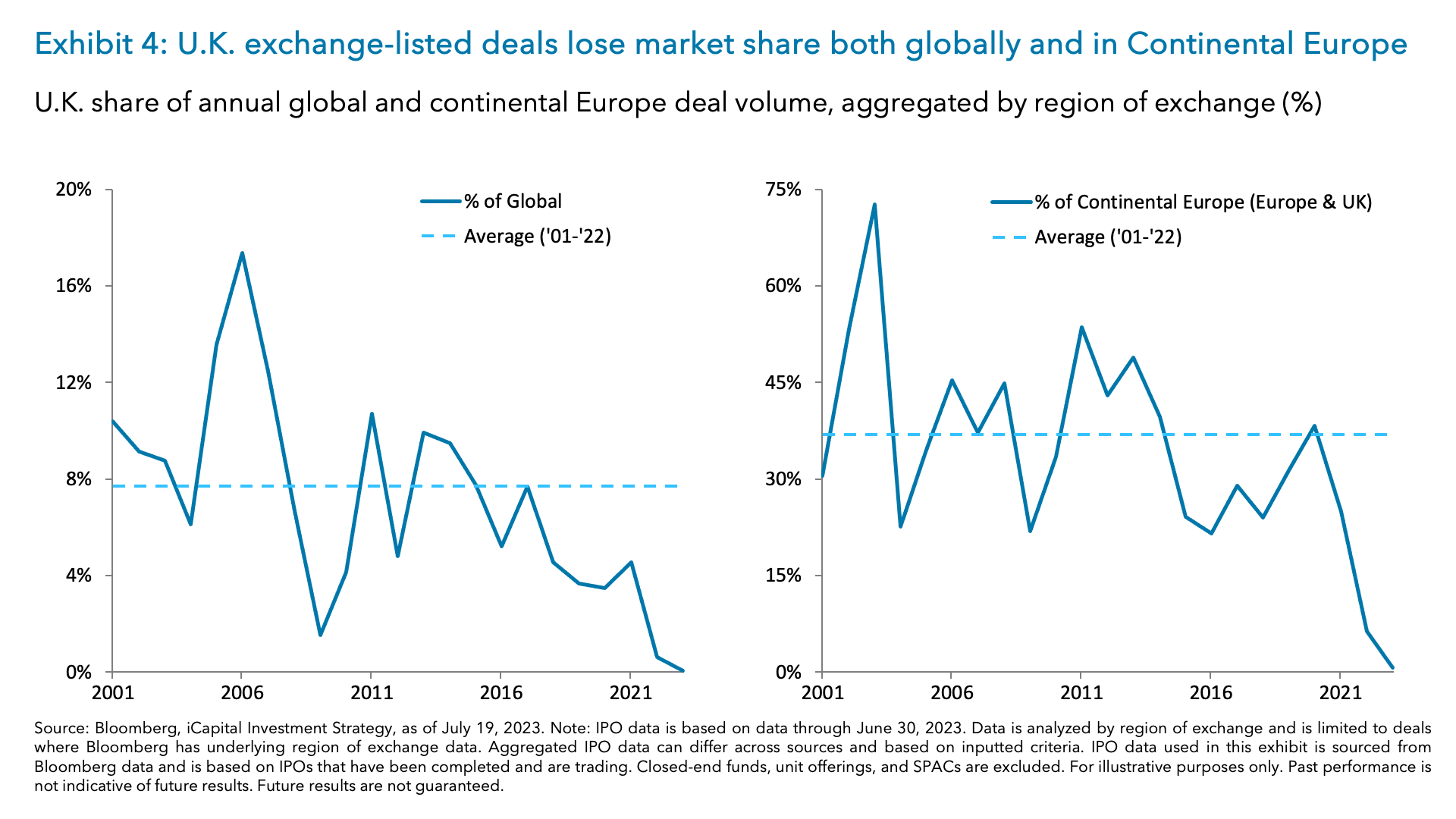

On the other hand, U.K. exchange-listed deals made up a mere 0.1% of global deal volumes in the first half of 2023, showing a significant decline from historical trends.11 Since 2001, U.K. exchanges accounted for an average of 7.7% of global deal volume annually, and an average of 36.9% of continental Europe (defined as Europe and U.K.) deal volume annually (Exhibit 4).12

We attribute a part of that development to the broader macro drivers of IPO markets (which we detail below), but namely to the post-Brexit impact and the structural challenges posed by the U.K. regulatory framework. Specifically, the rules regarding dual-class share structures, which are commonly used by founder-led companies and other companies going public, have limited IPO activity in the country. Until the end of 2021, such structures were not allowed on the prestigious “premium” tier of the London Stock Exchange.13 Although listing rules for the premium tier have since been relaxed to allow companies with “specified weighted voting rights shares,” this alternative structure still negates many of the benefits that founders and companies seek when adopting the dual-class share structure. However, in May of this year, U.K. regulators proposed relaxing the restrictions on dual-class share structures, which could serve to reignite deal activity in the future.14

Green shoots emerging amidst diverging trends

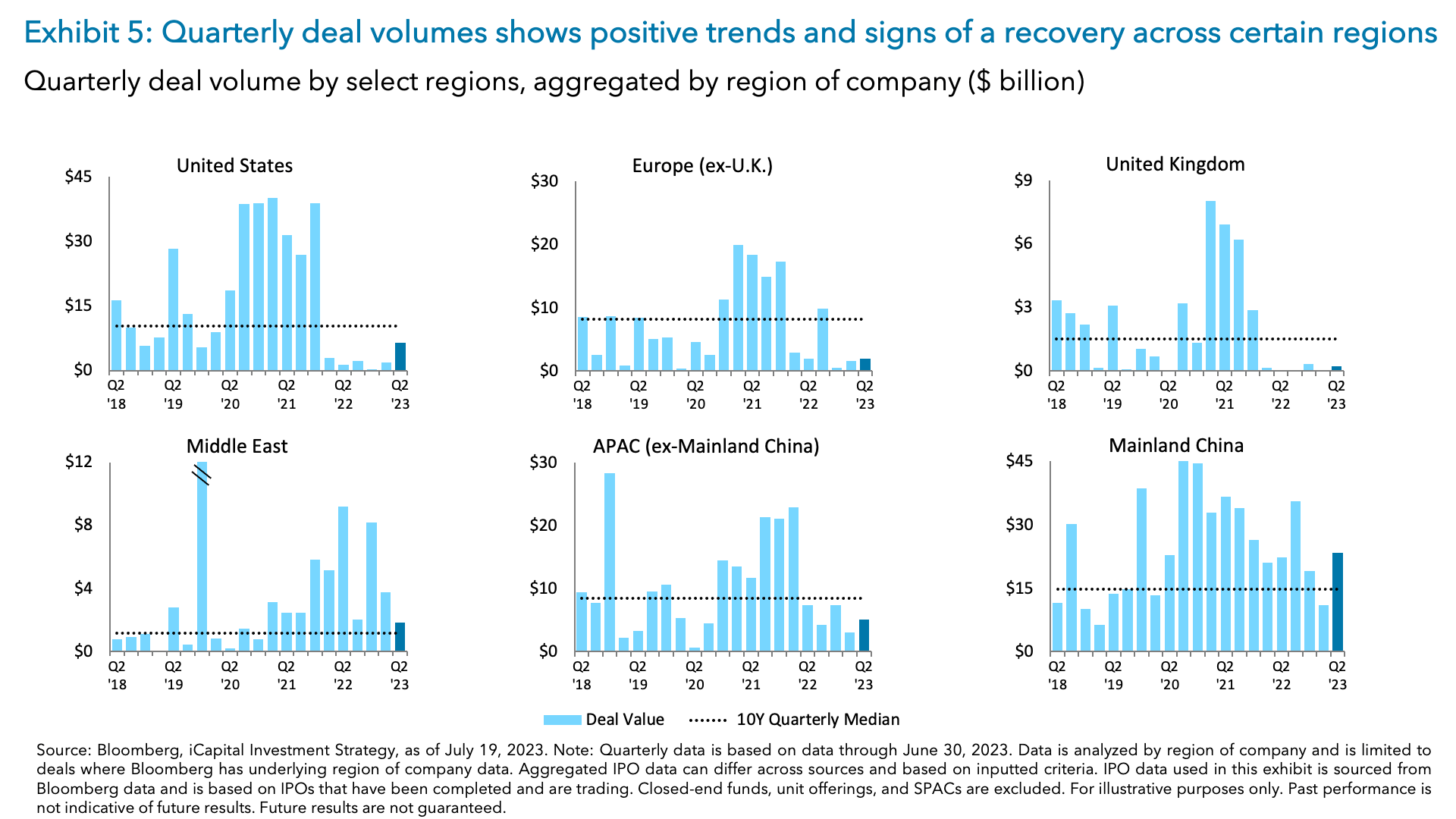

Despite overall downbeat year-over-year numbers in the first half of 2023, there are some positive signs of a recovery in certain regions, with higher frequency data showing an improvement in quarterly trends and interesting inflection points. In the U.S., activity continued to rebound in the second quarter of this year, thanks in large part to the IPO of Kenvue – the largest U.S. IPO since November 2021.15 Europe and the U.K. also showed slight improvements, recovering from a slow start in the first quarter (Exhibit 5).16 Elsewhere, IPO activity in Mainland China gained momentum in the second quarter and is now at a comparable level to 2022. On the other hand, deal activity in the Middle East, which was robust in 2022,17 has slowed significantly, partly due to pressures on oil and natural gas prices so far this year.18

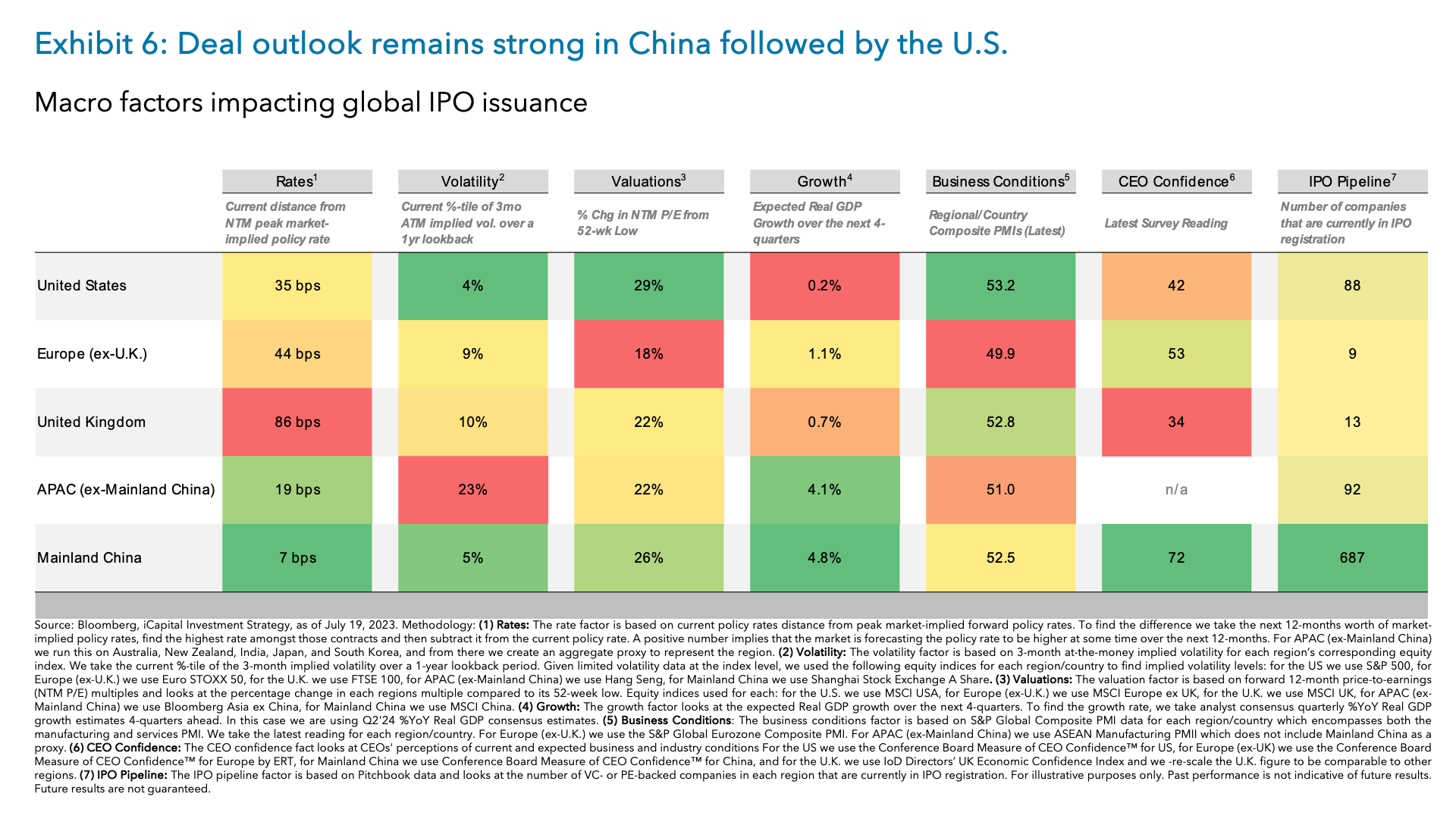

Looking ahead to the second half of the year, the strength of these regional IPO markets will largely depend on the direction of several key explanatory factors, including rates, volatility, valuations, growth, business conditions, CEO confidence, and the IPO pipeline. Below is a heatmap that summarizes the extent to which these factors are more or less favorable for each region, and a region-by-region outlook follows:

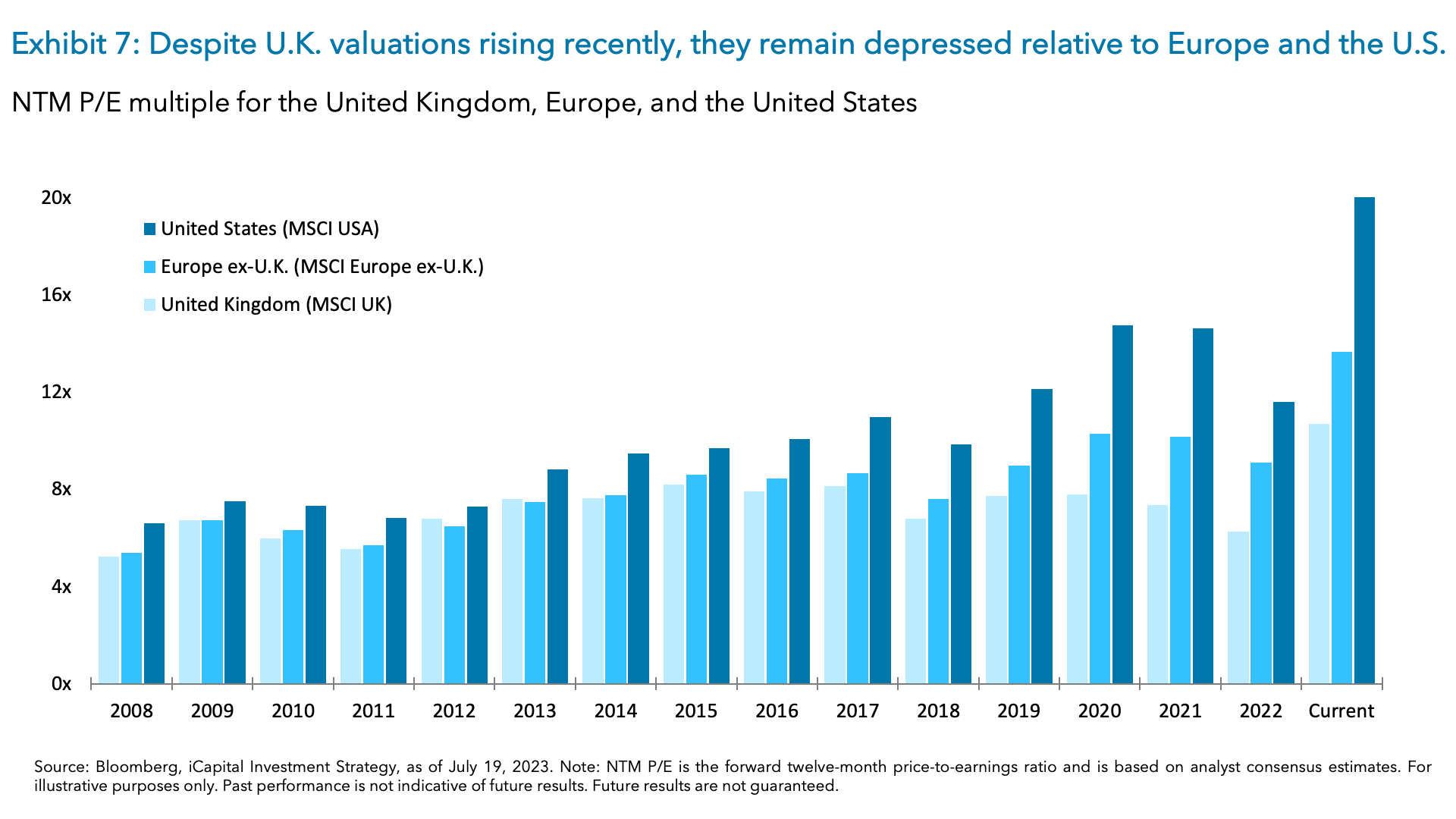

United Kingdom: For now, the U.K. may continue to be the most challenged IPO market, as rates, valuations, growth, and a still-unsupportive regulatory backdrop limit the willingness for companies to go public. With the latest read on inflation running at 7.9% in the U.K., and the expectation for it to average 7.5% through 2023, inflation will remain above the current level of rates.19 As long as this dynamic persists, the market view will skew towards higher rates, and in fact, it is currently expecting the Bank of England to raise rates by almost another 100 bps – significantly more than what the market is pricing-in for the Federal Reserve and European Central Bank (ECB).20 This could limit economic growth and potentially cap a rise in valuations in the U.K., which, despite a recent rebound of 22% off their 52-week low, are still depressed relative to Europe and the U.S. (Exhibit 7).21 Alongside these challenges, structural obstacles from regulation, which are not yet fully resolved, further compound the situation, potentially suppressing sentiment and the near-term outlook for IPOs in the region.

Europe: Following a slow start, there are signs of a potential rebound in IPO activity in the second half of the year. Major risk factors have subsided, namely Europe averting a commodity-driven recession, and volatility has eased to more manageable levels. Also, there are positive indications of improving confidence among business leaders in the region. CEO confidence in Europe is now higher than in the U.S., and this positive sentiment could influence IPO activity in the region. Despite facing challenges with valuations, Europe’s IPO market might gain momentum if confidence continues to strengthen, and economic conditions improve further as ECB winds down its rate hiking campaign.

Mainland China & Hong Kong: Both Mainland China and Hong Kong are poised to see robust IPO activity in the second half of this year to the extent the right conditions materialize. For example, in Mainland China, rates are likely to be cut, not hiked, valuations are recovering, growth could accelerate (especially as we expect more government stimulus in the second half of the year), and CEO confidence is among the highest across regions. The latest Conference Board CEO Confidence Measure for China, conducted at the end of May 2023, indicated a significant improvement in sentiment among CEOs of major multinational corporations (MNCs) operating in the country over the past six months.22 CEOs attribute this improved sentiment to the better business conditions resulting from the lifting of COVID restrictions in Mainland China and positive economic results in the first quarter, though we note weaker second quarter economic data in China may put a temporary cap on broader increases in sentiment.

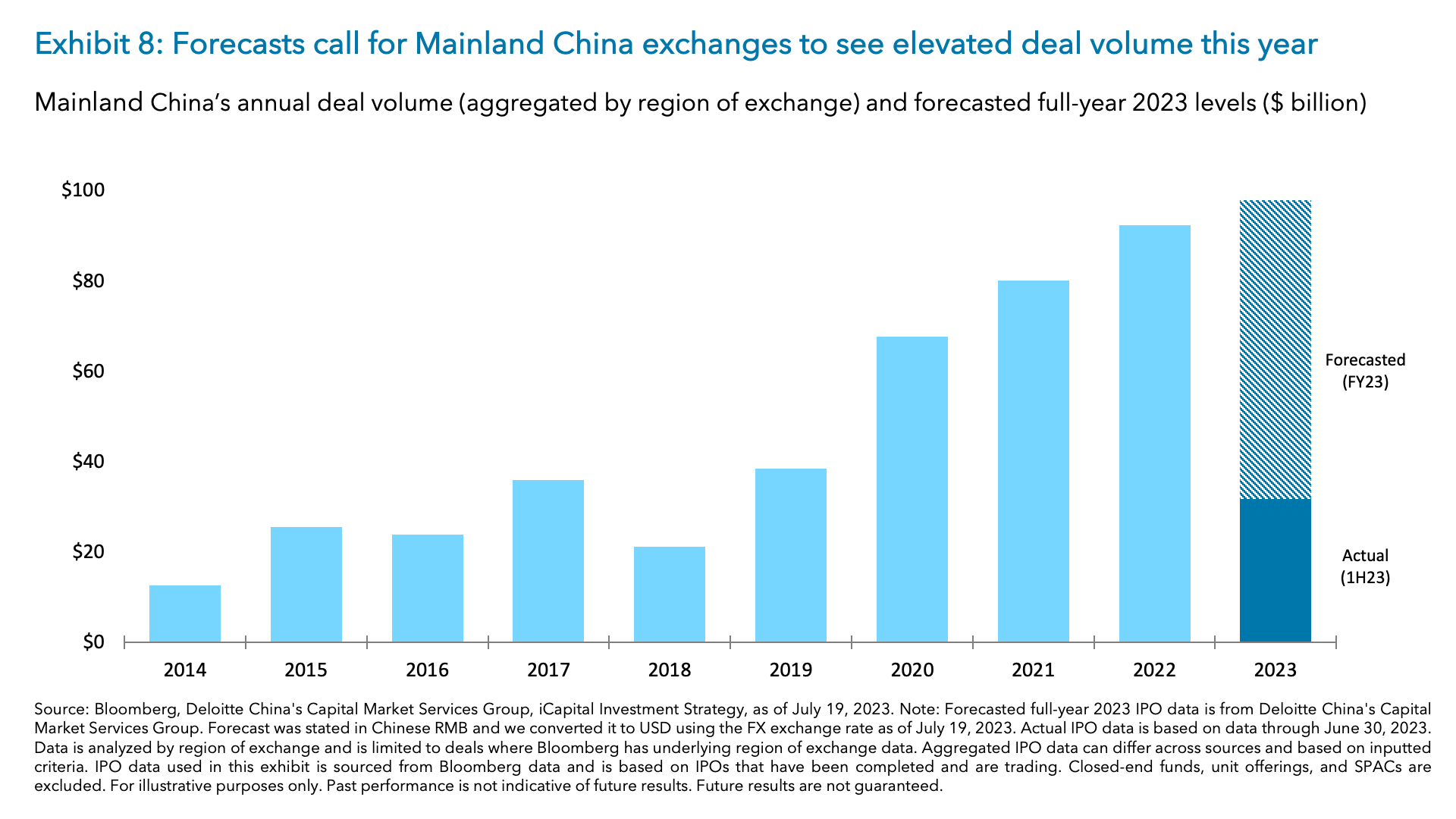

Beyond this, China’s IPO pipeline is by far the largest in the world. A stunning 687 out of the 844 PE- and VC-backed companies that are currently in IPO registration globally are in Mainland China with Hong Kong also exhibiting a robust and stable IPO pipeline.23 This extensive pipeline indicates the potential for a substantial pickup in public listings if the right conditions fall into place. Indeed, current forecasts call for Mainland China exchanges to top the global chart again this year with its exchanges expected to record 430 to 510 IPOs (A-share listings) for the full year 2023.24 These forecasts suggest that China’s Mainland exchanges may experience a record deal volume this year (Exhibit 8).25 Similarly, Hong Kong’s IPO market is also expected to regain momentum in the upcoming quarters, with forecasts of 100 IPOs on its exchanges for the full year, a notable increase from the roughly 30 IPOs in the first half of the year.26

United States: The macro backdrop in the U.S. continues to stabilize with inflation leveling off, regional banking disruptions having largely faded, and the growth outlook being revised higher. The Federal Reserve is also nearing the end of its rate hiking cycle, with markets currently pricing in just one more 25 basis point hike.27 These positive developments have supported a move higher in valuation – valuations are 29% higher than the 52-week low for MSCI USA Index – and have also boosted CEO confidence since the start of the year.28 With a record IPO backlog and a strong IPO pipeline, the U.S. IPO market could see significant strength through the back half of 2023, so long as the macro backdrop continues to stabilize further.

Across regions, we continue to expect China’s Mainland deal environment to remain robust, while macro factors favor U.S. over Europe, and Europe over the U.K. Of course, regulation across regions and geopolitical developments can also play a big role in determining the direction of travel. But for now, it’s fair to say that central banks globally are closer to the end of their rate hiking cycles than the beginning, most economies are managing to avert a recession, and elevated IPO backlogs suggest many companies might be awaiting the opportune moment to go public. The second half of 2023 holds potential for this moment to materialize.

1. Bloomberg, iCapital Investment Strategy, as of July 19, 2023. IPO data is through June 30, 2023. Note: Aggregated IPO data can differ across sources and based on inputted criteria. IPO data used in this commentary is sourced from Bloomberg data and is based on IPOs that have been completed and are currently trading. Closed-end funds, unit offerings, and SPACs are excluded for each region. Data is analyzed by region of company and by region of exchange. When comparing region of company data and region of exchange data, aggregated “global” data may differ due to information Bloomberg has available for each IPO.

2. Bloomberg, iCapital Investment Strategy, as of July 19, 2023. IPO data is through June 30, 2023.

3. Bloomberg, iCapital Investment Strategy, as of July 19, 2023. IPO data is through June 30, 2023.

4. Bloomberg, iCapital Investment Strategy, as of July 19, 2023. IPO data is through June 30, 2023.

5. Bloomberg, iCapital Investment Strategy, as of July 19, 2023. IPO data is through June 30, 2023.

6. Bloomberg, iCapital Investment Strategy, as of July 19, 2023. IPO data is through June 30, 2023.

7. Bloomberg, iCapital Investment Strategy, as of July 19, 2023. IPO data is through June 30, 2023.

8. Bloomberg, iCapital Investment Strategy, as of July 19, 2023. IPO data is through June 30, 2023.

9. Bloomberg, South China Morning Post, as of July 4, 2023.

10. Bloomberg, iCapital Investment Strategy, as of July 19, 2023. IPO data is through June 30, 2023.

11. Bloomberg, iCapital Investment Strategy, as of July 19, 2023. IPO data is through June 30, 2023.

12. Bloomberg, iCapital Investment Strategy, as of July 19, 2023. IPO data is through June 30, 2023.

13. Source, University of Oxford, Oxford Business Law Blog, as of June 20, 2023.

14. Source, University of Oxford, Oxford Business Law Blog, as of June 20, 2023.

15. Bloomberg, iCapital Investment Strategy, as of July 19, 2023. IPO data is through June 30, 2023.

16. Bloomberg, iCapital Investment Strategy, as of July 19, 2023. IPO data is through June 30, 2023.

17. Bloomberg, iCapital Investment Strategy, as of July 19, 2023. IPO data is through June 30, 2023.

18. Bloomberg, iCapital Investment Strategy, as of July 19, 2023. IPO data is through June 30, 2023.

19. Bloomberg, iCapital Investment Strategy, as of July 19, 2023.

20. Bloomberg, iCapital Investment Strategy, as of July 19, 2023.

21. Bloomberg, iCapital Investment Strategy, as of July 19, 2023.

22. Bloomberg, Conference Board, as of May 24, 2023.

23. Pitchbook, iCapital Investment Strategy, as of July 19, 2023.

24. Deloitte China's Capital Market Services Group, as of June 19, 2023.

25. Deloitte China's Capital Market Services Group, as of June 19, 2023.

26. Deloitte China's Capital Market Services Group, as of June 19, 2023.

27. Bloomberg, iCapital Investment Strategy, as of July 19, 2023.

28. Bloomberg, iCapital Investment Strategy, as of July 19, 2023.

IMPORTANT INFORMATION

The material herein has been provided to you for informational purposes only by iCapital, Inc. (“iCapital”). This material is the property of iCapital and may not be shared without the written permission of iCapital. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of iCapital.

This material is provided for informational purposes only and is not intended as, and may not be relied on in any manner as, legal, tax or investment advice, a recommendation, or as an offer to sell, a solicitation of an offer to purchase or a recommendation of any interest in any fund or security. You should consult your personal accounting, tax and legal advisors to understand the implications of any investment specific to your personal financial situation. This material does not intend to address the financial objectives, situation or specific needs of any individual investor. Alternative investments are complex, speculative investment vehicles and are not suitable for all investors.

The information contained herein is an opinion only, as of the date indicated, and should not be relied upon as the only important information available. Any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets is not necessarily indicative of the future or likely performance. The information contained herein is subject to change, incomplete, and may include information and/or data obtained from third party sources that iCapital believes, but does not guarantee, to be accurate. iCapital considers this third-party data reliable, but does not represent that it is accurate, complete and/or up to date, and it should not be relied on as such. iCapital makes no representation as to the accuracy or completeness of this material and accepts no liability for losses arising from the use of the material presented. No representation or warranty is made by iCapital as to the reasonableness or completeness of such forward-looking statements or to any other financial information contained herein.

Securities products and services are offered by iCapital Markets, an SEC-registered broker-dealer, member FINRA and SIPC, and an affiliate of iCapital, Inc. and Institutional Capital Network, Inc. These registrations and memberships in no way imply that the SEC, FINRA, or SIPC have endorsed any of the entities, products, or services discussed herein. Annuities and insurance services are provided by iCapital Annuities and Insurance Services LLC, an affiliate of iCapital, Inc. “iCapital” and “iCapital Network” are registered trademarks of Institutional Capital Network, Inc. Additional information is available upon request.

© 2023 Institutional Capital Network, Inc. All Rights Reserved.