We are back from spring break and the Nasdaq is back from its March 14 lows, rallying 14.1% higher.1 Outperforming that, unprofitable tech jumped 32.2% and NYFANG stocks rose 24.6% over the same period.2 We highlighted in our last note on March 17 the reasons why we expected a further tactical bounce and advised adding exposure to the Nasdaq.

The tech trade, including speculative tech (“spec tech”), has been working again. Why is this? And will it last? We do think the Nasdaq could continue to be a near-term catch-up trade—it is still down 8.3% year-to-date versus a 4.0% decline for the S&P 500.3 Investors should not exit this rally too early, but we’d definitely take advantage of lower volatility to layer in some hedges.

Why tech rebounded and why it could continue

Two factors have been driving tech higher in recent weeks.

First is short-covering activity.4 We wrote in early February that shorts were elevated in spec tech trades and a rally could trigger a wave of short covering that would in turn amplify the rally.

The second factor is individual investors buying the dip. According to JPMorgan, last week retail traders bought a net $5.6 billion—a standard deviation of 1.6 above the 12-month average of $3.3 billion, with notably strong inflows into Nasdaq 100 stocks.5

This begs the question, why tech versus anything else? Well, in a highly uncertain economic environment you first buy things in which you have a really high long-term conviction. For most people, that would be tech. But more broadly, we see three main market drivers for the rebound:

1) The valuation reset in bonds and tech stocks

Bonds are on track to suffer their worst quarterly selloff since the first quarter of 1980.6 A lot of U.S. Federal Reserve (Fed) hawkishness has been priced in—the Fed is now aiming to get policy back to neutral by the end of the year. There are also signs that the rate of change in inflation is peaking, including: a pause in one-year inflation breakeven rates; a decline in the NFIB Small Business survey of intentions to raise prices in the next three months7; an apparent peak in used car prices8; a fall in oil prices of roughly 20% from their recent peak9; and a decrease in future wage growth forecasts.10

Tech stock valuations had also reset lower.11 For NYFANG stocks, valuations had dipped back to 2019 lows.12

2) A seasonally strong period for equities

We entered into what has historically been the best rolling 30-day total return period on the calendar for global equities on March 23.13 Between now and earnings season we could be in a risk-on window.

The earnings per share (EPS) growth rate for the S&P 500 is nevertheless expected to have been lackluster in the first quarter of 2022, at just 4.8%, while the number of companies issuing negative EPS guidance is at its highest since the fourth quarter of 2019.14 However, this could be a contrarian indicator, suggesting expectations have already reset lower.

Of course, for the recent tactical bounce back to be sustained we are assuming no-worse-than-feared developments in Ukraine and no significant fall in economic data. This would reinforce the Fed narrative that the economy can withstand rate hikes, which has been a big driver of the market rally.

3) Recessionary concerns from the yield curve are seen as longer term

We have not seen significant cracks in the data yet, and they will likely take some time to materialize. However, we do think that one-year recession probabilities are rising and there are plenty of red flags.

For example, yield curve inversion has preceded each of the last eight recessions going back to 1967.15 The recent rise in rates fundamentally changes the calculus for people and companies to borrow, save, or invest. Also, negative real wage growth, slumping consumer confidence, and real-time data pointing to lower oil demand all seem to suggest a coming slowdown in consumer spending.16 Finally, the economy does not typically tip into a recession when the labor market is weak (i.e., it is recovering from a recession), but the probability of a recession rises when labor market conditions are tight and wage growth is likely unsustainable, much as we see today.17

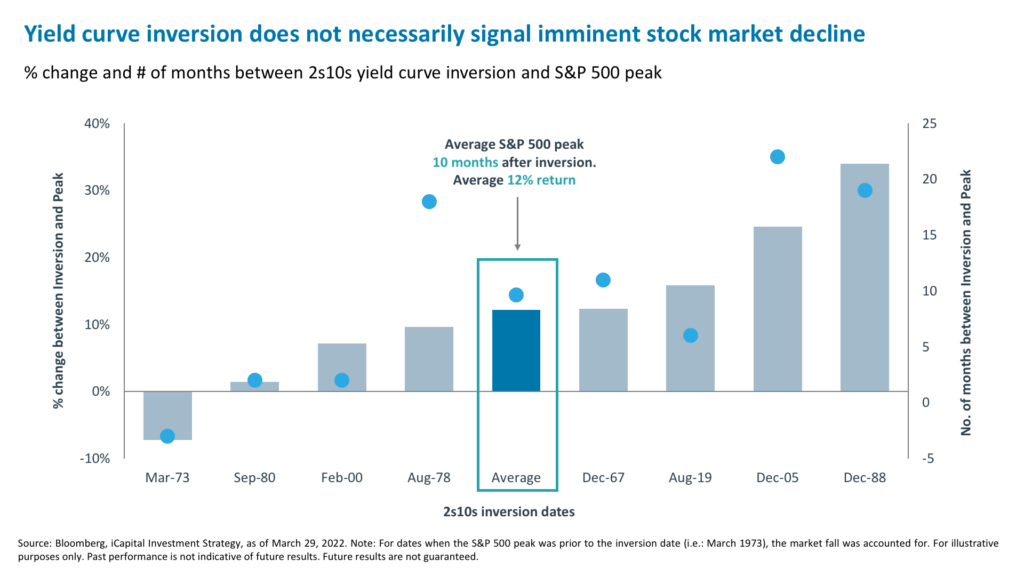

However, markets do not usually peak until closer to the start of a recession, and they can still perform when the yield curve is flat.18 The average number of months between yield curve inversion in the United States and a recession has been 15 months, which makes a recession in 2023 probable.19 From a stock market perspective, the historical peak has been on average five months before a recession, with an average return from yield curve inversion to market peak of 12.2%.20

Don’t leave the party early but layer in some hedges

This cycle could be different, and potentially shorter, given inflation of 7.9% and a Fed that is trying to get back to neutral much quicker than before.

However, for now at least, we would be staying with the momentum in the tech trade. Tech has historically been able to rally despite rate hikes, as it did in the 2018 to 2019 period, and has typically outperformed the broader market in the 12 months after the first rate hike in a cycle.21 Investors are also likely to have more faith in earnings for tech than for cyclical sectors. Indeed, earnings revisions for semiconductors and software held up much better than those for consumer discretionary and financial stocks in recent months.22

That said, we are likely to have more Fed-induced growth scares this year that could trigger pullbacks. We would not leave the market early given the positive performance of markets during rate hiking cycles and following yield curve inversion23, but we would take advantage of lower volatility to layer in some tail risk hedges to prepare for rising recession probabilities.

Enjoy the rally, but perhaps don’t get too comfortable about it.

1. Bloomberg, as of March 28, 2022.

2. Bloomberg, as of March 28, 2022. The NYSE FANG+ Index is an equal-dollar weighted index designed to represent a segment of the technology and consumer discretionary sectors consisting of highly-traded growth stocks of technology and tech-enabled companies such as Facebook, Apple, Amazon, Netflix, and Alphabet's Google.

3. Bloomberg, as of March 28, 2022.

4. Goldman Sachs, as of March 25, 2022

5. JPMorgan Retail Radar, March 23, 2022

6. Bloomberg, as of March 28,2022. Refers to Bloomberg Barclays US Aggregate Bond Index.

7. National Federation of Independent Business, “Small Business Optimism Index”, February 2022.

8. Bloomberg, as of March 28, 2022.

9. Bloomberg, as of March 28, 2022.

10. Bloomberg, iCapital Investment Strategy, as of March 28, 2022.

11. Bloomberg, as of March 28, 2022.

12. Bloomberg, as of March 28, 2022.

13. Morgan Stanley, as of March 18, 2022. Note: Return data based on returns starting in 1999.

14. Factset, as of March 25, 2022.

15. Bloomberg, as of March 28, 2022.

16. Bloomberg, iCapital Investment Strategy, as of March 28, 2022.

17. JPMorgan, as of March 25, 2022

18. Bloomberg, iCapital Investment Strategy, as of March 28, 2022.

19. Ibid.

20. Bloomberg, iCapital Investment Strategy, as of March 28, 2022.

21. Bloomberg, iCapital Investment Strategy, as of March 28, 2022.

22. Bank of America, as of March 24, 2022

23. Bloomberg, iCapital Investment Strategy, as of March 28, 2022.

IMPORTANT INFORMATION

The material herein has been provided to you for informational purposes only by iCapital, Inc. (“iCapital”). This material is the property of iCapital and may not be shared without the written permission of iCapital. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of iCapital.

This material is provided for informational purposes only and is not intended as, and may not be relied on in any manner as, legal, tax or investment advice, a recommendation, or as an offer to sell, a solicitation of an offer to purchase or a recommendation of any interest in any fund or security. You should consult your personal accounting, tax and legal advisors to understand the implications of any investment specific to your personal financial situation. This material does not intend to address the financial objectives, situation or specific needs of any individual investor. Alternative investments are complex, speculative investment vehicles and are not suitable for all investors.

The information contained herein is an opinion only, as of the date indicated, and should not be relied upon as the only important information available. Any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets is not necessarily indicative of the future or likely performance. The information contained herein is subject to change, incomplete, and may include information and/or data obtained from third party sources that iCapital believes, but does not guarantee, to be accurate. iCapital considers this third-party data reliable, but does not represent that it is accurate, complete and/or up to date, and it should not be relied on as such. iCapital makes no representation as to the accuracy or completeness of this material and accepts no liability for losses arising from the use of the material presented. No representation or warranty is made by iCapital as to the reasonableness or completeness of such forward-looking statements or to any other financial information contained herein.

Securities products and services are offered by iCapital Markets, an SEC-registered broker-dealer, member FINRA and SIPC, and an affiliate of iCapital, Inc. and Institutional Capital Network, Inc. These registrations and memberships in no way imply that the SEC, FINRA, or SIPC have endorsed any of the entities, products, or services discussed herein. Annuities and insurance services are provided by iCapital Annuities and Insurance Services LLC, an affiliate of iCapital, Inc. “iCapital” and “iCapital Network” are registered trademarks of Institutional Capital Network, Inc. Additional information is available upon request.

© 2023 Institutional Capital Network, Inc. All Rights Reserved.