FTX, once the world’s third largest crypto exchange and a private company previously valued at $32.5 billion1, is reportedly on the brink of bankruptcy after its rival Binance walked away from a deal to acquire it. This in turn unnerved the broader crypto markets, putting pressure on bitcoin, which is now trading at $16,700.2 It’s clear that crypto is the “something that breaks” as the Fed aggressively hikes rates. The question now is – how systemic is it? In this week’s commentary, we address this question and conclude that while crypto contagion is unlikely to materially impact the broader economy, the collapse will dampen overall market sentiment, especially around tech.

“Liquidity crunch” may be a throwback to the Global Financial Crisis (GFC), but we don’t anticipate this to be the GFC all over again

The phrase “liquidity crunch” is eerily reminiscent of what we heard during the financial crisis, so when Binance said that in a statement about FTX, it raised concerns about systemic implications. Latest reports suggest that FTX investors were told that without more capital, bankruptcy is likely.3 Given the current state and persistent weakness of the market, there could be other bankruptcies, especially in companies that relied on trading volumes to grow and price appreciation of cryptocurrencies to continue.

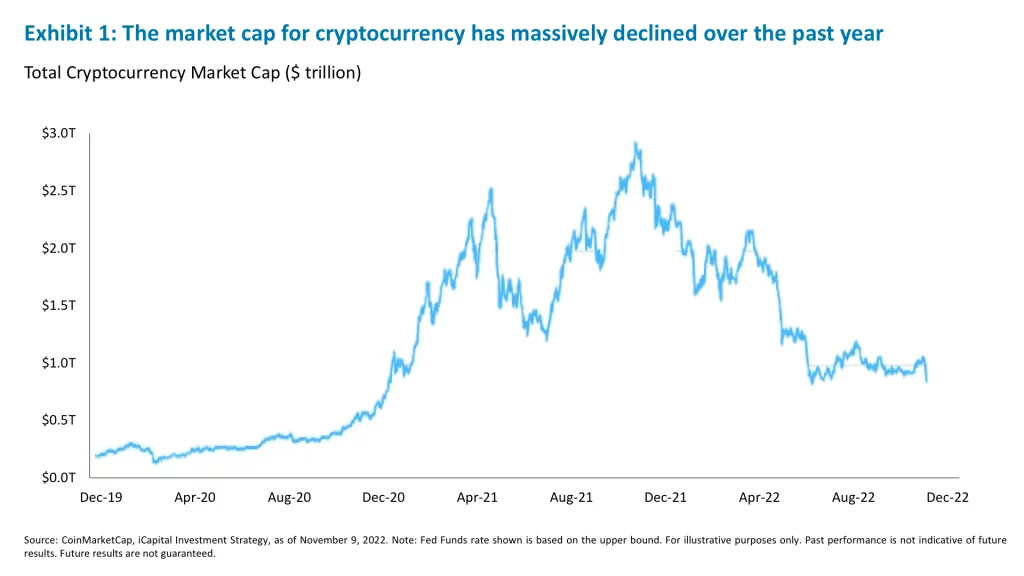

Overall trading volumes have risen significantly most recently, with the current daily trading volume across the crypto universe at $610 billion vs. the year-to-date average of roughly $300 billion per day.4 However, this year this average is lower than the 2021 average daily trading which peaked at just north of $1.5 trillion.5 And the market cap of cryptocurrencies declined by 72% in a year falling from nearly $3 trillion a year ago to roughly $800 billion today.6 This is a massive wipe-out and wealth destruction, almost on par with the $3.3 trillion in home equity U.S. homeowners cumulatively lost during 20087 or the nearly $4 trillion lost in the overall market cap of the Nasdaq Composite Index between 2000-2001.8 However, we believe the crypto meltdown should not have the same systemic consequences as the housing crisis did in 2008.

Still limited household exposure to crypto. Roughly 10% of all households in both the U.S. and in Europe have some cryptocurrency exposure.9 Of those households in Europe that have exposure, roughly 65% hold less than $5,000 worth of cryptoassets.10 Within the U.S., the average crypto holding is roughly $1,000.11 This is in stark contrast to housing, for example, where a significant share of the population was exposed, as 66.0% of U.S. households are homeowners and the share of homeowners with a mortgage is 64.8%.12

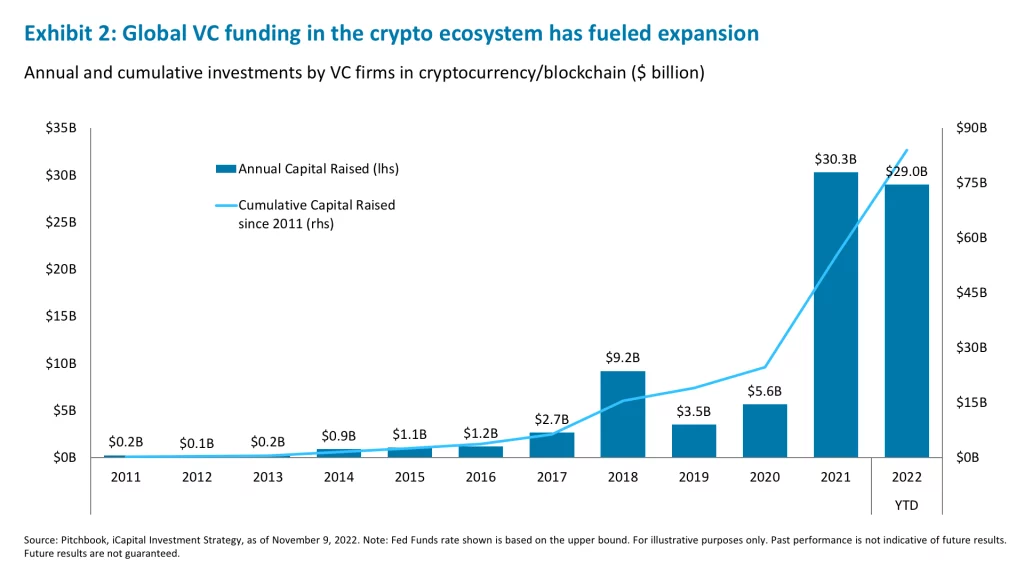

Limited banks’ exposure to crypto, expansion of which was largely financed by venture capital. Banks have made efforts to add crypto to their offerings, but are just getting started, having largely avoided the space to date. According to the Basel Committee on Banking Supervision as of the end of 2021, total cryptoasset exposures reported by banks amounted to roughly $9 billon, which is less than 0.14% of the surveyed banks overall risk exposure.13 And given that most of the crypto ecosystem is private – there are 10,036 private crypto companies globally vs. 218 that are public14 – the growth of it has mostly been financed by venture capital (VC). For example, global VC funding in the crypto ecosystem has reached $29.0 billion through the first three quarters of 2022 after a banner $30.3 billion in 2021, which was an 5.4x step-up from 2020 funding levels.15 Cumulatively, $83.9 billion has been invested by VC firms in various cryptocurrency and blockchain companies since 2011, and unfortunately, some portion of this funding is now at risk of a write down.16 For example, Sequoia Capital just put out a note to LPs stating that it is reducing its investment in FTX to zero.17

Select institutions and corporates have bumped up their allocation to crypto, but not uniformly and to manageable levels. In fact, while a recent study found that 94% of state and government pension plans invest in cryptocurrencies18, most pension still allocate a very small portion to cryptos. For example, crypto ventures within northern Virginia’s Fairfax County Board of Trustees pension fund account for less than 1% of overall assets.19 Similarly, the Houston Firefighters’ Relief and Retirement Fund, which has the ability to allocate up to 5% of its overall portfolio to cryptocurrencies, has 0.5% of its portfolio in crypto.20 Also, as we wrote about in our crypto primer, corporate treasuries are also allocating to cryptocurrencies, but in very small percentages and the number of treasuries doing so is still relatively small. In fact, given roughly $10 trillion of corporate treasury worldwide, general allocations of less than 3% would imply less than $300 billion worth of crypto related assets on corporate balance sheets – though this assumes all corporate treasuries have invested in crypto which is not the likely case.21 Sovereign wealth funds have also allocated to this space, but similar to pension and corporate treasuries, in small amounts. The New Zealand’s sovereign wealth fund – KiwiSaver Growth Strategy Fund – was reported to have invested just under 5% of its assets in Bitcoin.22

Given this lack of broad exposure within the finances of most stakeholders, we don’t view the crypto meltdown as systemic, however, the impacts on tech and growth can be more far reaching.

The ramifications of the crypto exuberance unwind is likely reduced ability and willingness to take on tech risk

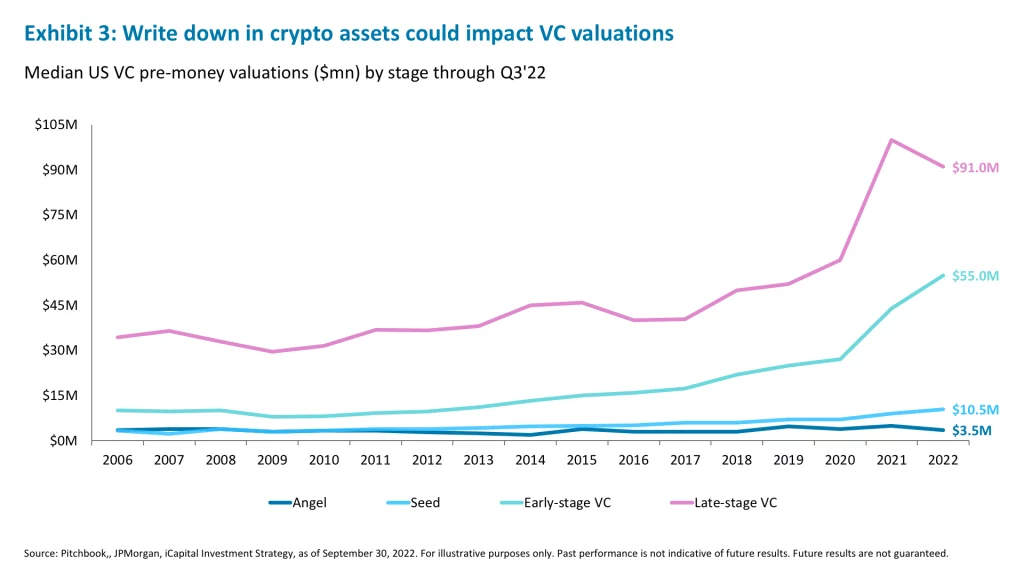

First, venture capital funds will bear the brunt of the losses. These same funds were likely funding deals in other areas of growth and tech. And having to write down their crypto investments could limit their ability and willingness to take on risk to finance other areas of growth. All in, this will create a more subdued risk-taking environment. VC valuations have grown rapidly from 2020 through the first half of 2022 which generated spectacular returns for VC firms – 3-year annualized return of 30.5% for VC vs. 3.9% for the Russell 2000.23 Now we are likely facing a period of repair and valuation deflation, and therefore, lower returns.

Second, crypto is a part of the tech ecosystem, and as a result, the impact of its collapse will be felt in other parts of tech earnings adversely impacting earnings. For example, as new coin creation stalls and existing coin mining declines, so should demand for cryptomining processor semiconductor chips. AMD24 estimated that 5-10% of overall demand comes from cryptominers, which would decline significantly during period of turmoil. Taiwan Semi estimates while crypto accounted for 10% of sales in 2018, but this percentage declined to 1% in 2021.25 While these percentages are not large, they add to other overhangs facing the semiconductor industry.

Third, the other concern is as crypto leverage unwinds and investors face margin calls, other assets may need to be liquidated. And given the overweight to tech many investors held in recent years, that could be a candidate for liquidations. The bottom line is if together with crypto there is selling pressure on other parts of tech, this will certainly cap (if not depress) any market upside since Information Technology and Communications Services account for a third of the overall S&P 500 market cap.

As leverage unwinds, the crypto froth and unsustainable use cases evaporate – the strongest viable players will survive, emerge from the collapse, and carry on

While we don’t see crypto unwind as systemic, what’s playing out is reminiscent of the tech and housing bubbles, where valuations rose without a corresponding rise in revenues/profits. They collapsed when too much leverage and “asset packaging” accumulated in the system. The realities of unsustainable crypto schemes are coming to the forefront right now. The amount of crypto financial engineering appears to be staggering. Lack of regulation, lack of consumer protections, and lack of liquidity buffers are blatantly apparent and unfortunate. Select actors, knowingly or unknowingly, created business models that are untenable if asset values decline, withdrawals pile up, and liquidations occur.

The good news is that those untenable use cases will be exposed and will fail. The crypto correction is healthy for the overall ecosystem as froth and exuberance will be flushed out. Crypto applications solving real-world problems should survive. And in an interesting turn of events, TradFi (traditional finance) is actually among those building sustainable DeFi (de-centralized finance) solutions.26 Despite the meltdown in many parts of the crypto ecosystem, traditional finance players are leveraging blockchain technology to process cross-border payments, issue digital bonds, or make private equity available on the public blockchain to expand access to individual investors.27 These are some examples of viable use cases and types of applications that have merit and should survive. And importantly, they are being done within the established regulatory framework.

Bitcoin overtime should also find more viable applications. It is not financially over engineered and does have applications in payments. But in an environment where cash pays 4%, bitcoin will likely struggle.28 History suggests that it takes time for broken leaders to regain their dominance. For crypto broadly, we would expect any recovery after the FTX collapse to be L-shaped.

1. Pitchbook, as of January 31, 2022.

2. Bloomberg, as of November 9, 2022.

3. Bloomberg, as of November 9, 2022.

4. Coincodex.com, as of November 9, 2022.

5. Coincodex.com, as of November 9, 2022.

6. Coinmarkecap.com, as of November 9, 2022.

7. Zillow, as of February 2009.

8. Bloomberg, Nasdaq, as of November 9, 2022.

9. U.S. Federal Reserve, European Central Bank, as of May 24, 2022.

10. European Central Bank, as of May 24, 2022.

11. Finder.com, “A rising number of Americans own crypto”, as of June 14, 2021.

12. U.S. Census Bureau, “Quarterly Residential Vacancies and Homeownership, Third Quarter 2022”, as. of November 2, 2022.

13. Basel III Monitoring Report, as of September 2022.

14. Pitchbook, as of November 10, 2022.

15. Pitchbook, as of November 10, 2022.

16. Pitchbook, as of November 10, 2022.

17. Sequoia Capital, as of November 9, 2022.

18. 2022 CFA Institute Investor Trust Study, as of April 2022.

19. FT, Fairfax County Retirement System, as of August 2022.

20. Institutional Investor, HFRRF, as of November 2021.

21. Cointelegraph, as of November 2021.

22. New Zealand Funds Management Limited, Coindesk, as of March 26, 2021.

23. Cambridge Associates, as of June 30, 2022. Notes: VC annualized return is based on Cambridge Associates US Venture Capital Index which calculates a pooled horizon return, net of fees, expenses, and carried interest. Russell 2000 performance is based on Cambridge Associates Modified Public Market Equivalent (mPME) which replicates private investment performance under public market conditions.

24. Cointelegraph, The Verge, as of April 2022.

25. How Cryptocurrency Affects the Semiconductor Industry (waferworld.com)

26. Bloomberg, Pitchbook, as of November 9, 2022.

27. Examples include: UBS AG launches the world’s first ever digital bond that is publicly traded and settled on both blockchain-based and traditional exchanges | UBS Global; JPMorgan (JPM) Had Its First Live Trade on Public Blockchain Polygon - Bloomberg; KKR Makes Piece of PE Fund Available on Public Blockchain - WSJ

28. Bloomberg, as of November 9, 2022.

IMPORTANT INFORMATION

The material herein has been provided to you for informational purposes only by iCapital, Inc. (“iCapital”). This material is the property of iCapital and may not be shared without the written permission of iCapital. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of iCapital.

This material is provided for informational purposes only and is not intended as, and may not be relied on in any manner as, legal, tax or investment advice, a recommendation, or as an offer to sell, a solicitation of an offer to purchase or a recommendation of any interest in any fund or security. You should consult your personal accounting, tax and legal advisors to understand the implications of any investment specific to your personal financial situation. This material does not intend to address the financial objectives, situation or specific needs of any individual investor. Alternative investments are complex, speculative investment vehicles and are not suitable for all investors.

The information contained herein is an opinion only, as of the date indicated, and should not be relied upon as the only important information available. Any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets is not necessarily indicative of the future or likely performance. The information contained herein is subject to change, incomplete, and may include information and/or data obtained from third party sources that iCapital believes, but does not guarantee, to be accurate. iCapital considers this third-party data reliable, but does not represent that it is accurate, complete and/or up to date, and it should not be relied on as such. iCapital makes no representation as to the accuracy or completeness of this material and accepts no liability for losses arising from the use of the material presented. No representation or warranty is made by iCapital as to the reasonableness or completeness of such forward-looking statements or to any other financial information contained herein.

Securities products and services are offered by iCapital Markets, an SEC-registered broker-dealer, member FINRA and SIPC, and an affiliate of iCapital, Inc. and Institutional Capital Network, Inc. These registrations and memberships in no way imply that the SEC, FINRA, or SIPC have endorsed any of the entities, products, or services discussed herein. Annuities and insurance services are provided by iCapital Annuities and Insurance Services LLC, an affiliate of iCapital, Inc. “iCapital” and “iCapital Network” are registered trademarks of Institutional Capital Network, Inc. Additional information is available upon request.

© 2023 Institutional Capital Network, Inc. All Rights Reserved.