It’s August. Many of us will likely travel on vacation this month. And this week, many leisure and hospitality companies (hotels and cruise lines) will report their Q2 earnings and provide rest-of-the-year outlooks.

Indeed, the Hotels, Restaurants & Leisure subsector is projected to report 108% revenue growth in Q2, well above the 23.1% expected for the overall S&P 500. But amid this strength, the questions for investors will be: Will the now-dominant Delta variant deter travel activity? And will “travel reopening” companies suffer a setback from an otherwise speedy recovery?

Our answer is that travel reopening is unlikely to be meaningfully deterred by the Delta variant in high vaccination economies (the United States and parts of Europe), and that currently low global vaccinations should ramp up significantly into year-end. In the near-term, there is a potential for worsening news flow on the Delta variant, as cases spike in the U.S. and parts of Asia. But with an eye on a more sustained travel recovery in 2022, we would consider adding to travel reopening trades like hospitality real estate after the recent pause and on any further weakness.

Vaccination rates should reduce the risk of Delta variant left-tail scenario

The Delta variant has been surging in the United Kingdom since late May, but daily cases seem to have peaked a couple of weeks ago. The most likely reason behind this drop in cases is that an estimated 92% of UK adults have COVID antibodies.1

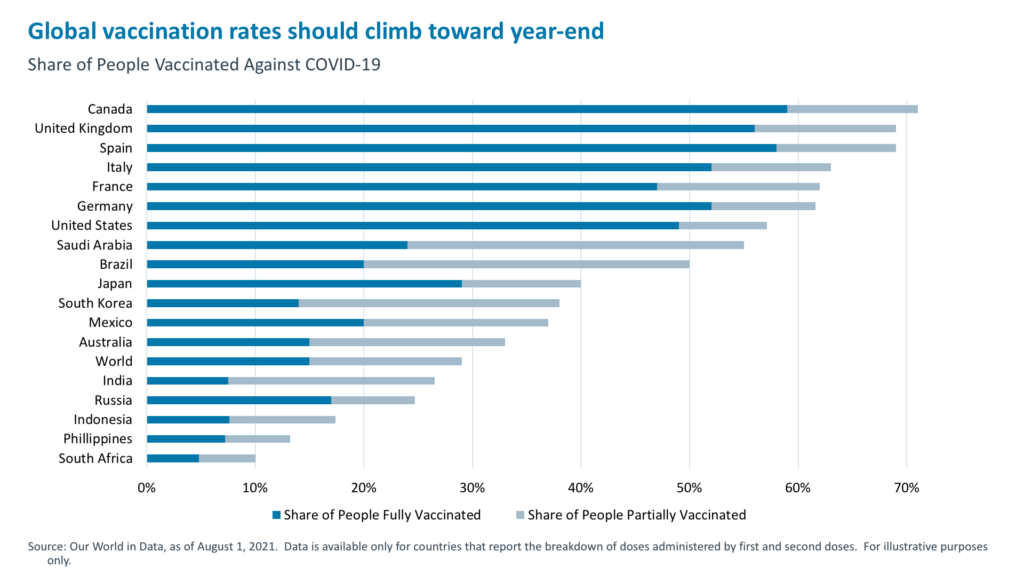

Indeed, in the United Kingdom, the share of population receiving a first shot stands at 69%. Canada, the United Kingdom, parts of Europe, and the United States lead the world in the percentage of the population with vaccinations. High vaccination rates are one major reason why the spikes in new COVID cases are not followed by equally sharp increases in hospitalizations.

Vaccines in real world settings have been shown to hold their effectiveness, especially against hospitalizations. For example, UK hospitalizations are 80% below their prior peak. Another likely reason for that is that vaccination rates for age groups most vulnerable to COVID are much higher than for the overall population. In the United States, even in the states with the lowest overall vaccination rates (e.g., Alabama and Mississippi, with vaccination rates around 45% for ages 18-64), more than 85% of adults aged 65 and over have been vaccinated.2

One note of caution – hospitalized (mostly unvaccinated) patients in Florida are reported to be younger on average than before. Because of high vaccine availability and the effectiveness of vaccinations against hospitalizations due to the Delta variant, however, we think new lockdown measures in economies with high vaccination rates are unlikely.

Globally, only 28.5%3 of the population has received at least one dose. But this too should ramp up in the months ahead. By some estimates, the world will produce 11.4 billion doses of vaccines by year-end.4 Allowing for some administrative bottlenecks, this could still mean the global vaccination rate rises to 50% by the end of 2021. Combined with natural immunity, economies such as Brazil, Russia, China, and India should see overall immunity rates move toward 65% to 80% by year-end. This would go a long way toward putting the pandemic behind us and paving the way for a more sustainable leisure and hospitality recovery.

Next leg higher in travel stocks is likely led by international recovery and corporate demand

The rebound in leisure and hospitality activity has been pronounced. Hotel occupancies are rebounding around the world, with China, U.S., and European weekly hotel occupancy reaching 72%, 71%, and 57%, respectively, for the week ended July 24.5 U.S. revenue per available room (RevPAR) is now positive versus 2019, up 8% for weekend bookings for the week of July 21 as hotel pricing rebounded sharply during the month.

Interest in travel is showing other signs of heating up. For example, downloads of Expedia (reporting earnings this week) are up 165% in July, and average daily users increased 19% year-over-year. These trends are directionally similar for other online travel and transportation stocks.6

Finally, in recent earnings commentary, airline company executives noted that they are not seeing any impact on bookings and revenue trends attributable to the Delta variant. This broadly bodes well for hotel operators and cruise lines that report this week.

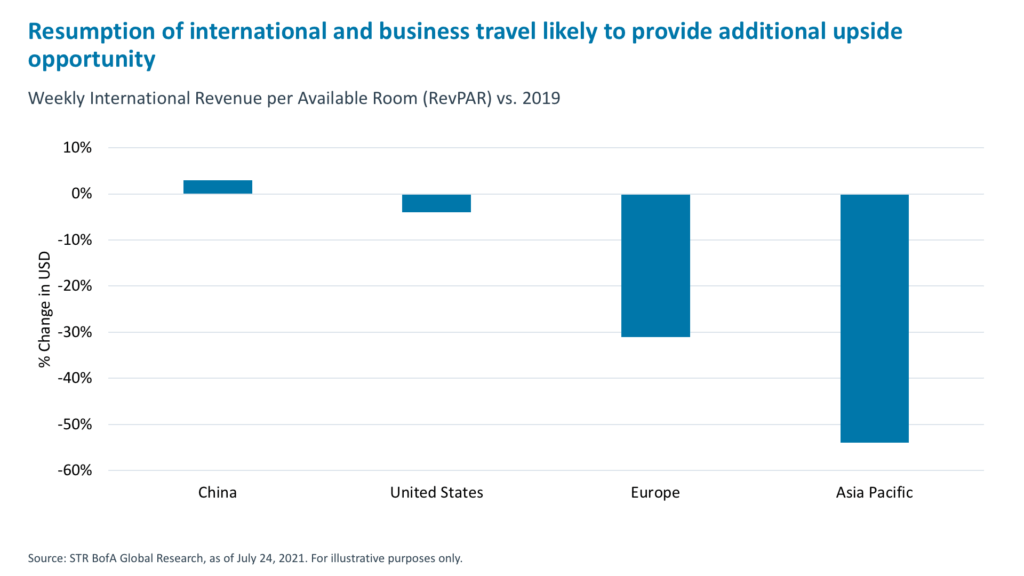

Looking ahead, while U.S. domestic leisure trends have recovered strongly, the next leg of upside for the industry should come from resumption of international and business travel. For example, in Europe, 22% of hotels are still closed (versus 2% in the United States), and RevPAR is down 31%, compared with 2019. In Asia Pacific, while only 5% of hotels are closed, RevPAR is down even more, 54%.7

We think the consensus view may be still too conservative (skeptical) on a 2022 recovery. Consensus Metrix estimates have 2022 RevPAR down 15% to 20% for the lodging group in aggregate.8 But this fall should bring a meaningful recovery of business travel and group bookings, and rising global vaccinations should eventually help lift international travel. With Delta variant concerns manageable in our view, positioning for the next leg of recovery in travel makes sense.

Should we be adding to reopening names? We (selectively) would.

Reopening stocks peaked in mid-March and have been down 17% since then, underperforming the S&P 500 by 32% as peak demand and the Delta variant posed a concern.9 In response, investors – hedge funds and others – reduced their positions in reopening stocks. Assuming our view is borne out that variant risks are manageable, given increasing vaccinations globally, these price moves suggest that the near-term concerns are now reflected in the valuations of many leisure and hospitality stocks.

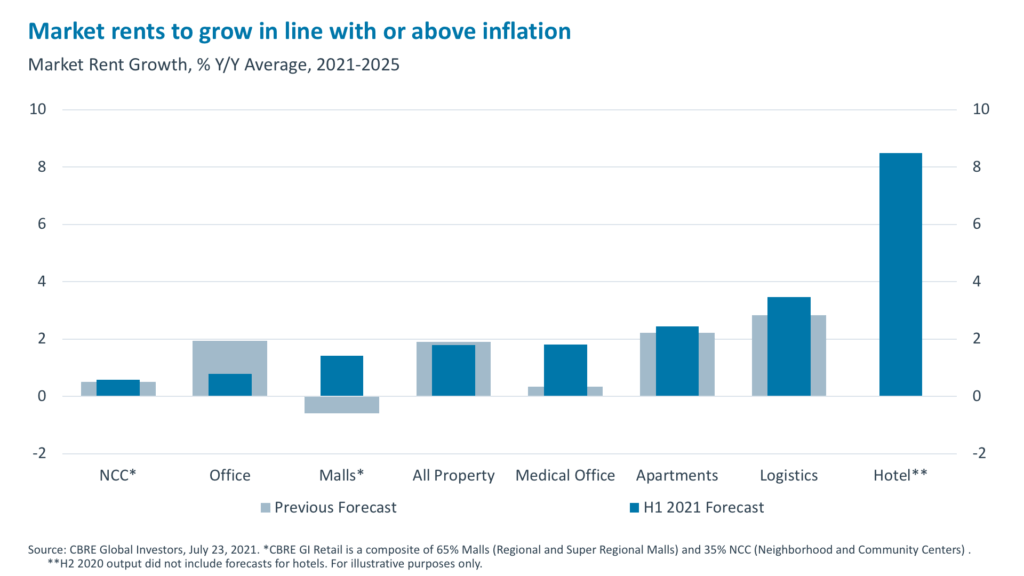

The next few weeks could see more masks, less travel momentum, some self-imposed caution from consumers, and potentially some office reopening delays. But with valuations off the recent highs, vaccinations picking up, and market rents improving, we view the hospitality real estate sector as well positioned to capture more cyclical upside. In fact, according to our partners at CBRE, market rents are forecast to grow over 8% on average in 2021-2025, well above forecasted inflation, and much more than most other real estate sectors. For these reasons, amid this pause in travel sentiment, public and private market participants should consider taking a longer-term, opportunistic look at the leisure and hospitality sector.

1. UK Office for National Statistics, July 26, 2021

2. https://www.mayoclinic.org/coronavirus-covid-19/vaccine-tracker

3. https://ourworldindata.org/covid-vaccinations

4. Goldman Sachs, July 26, 2021

5. BAML Global Research, 7/24/2021

6. BAML Global Research, 8/1/2021

7. BAML Global Research, STR, 7/24/2021

8. Goldman Sachs, STR, July 26, 2021

9. Measured by GS Global Health Risk Index - GSXUPAND Index, consisting of US listed stocks predominantly in leisure industries (airlines, hotels, gaming, cruise lines, theme parks, restaurants, mall based retail etc) which may be impacted by the perceive thereat of a global health issue.

IMPORTANT INFORMATION

The material herein has been provided to you for informational purposes only by iCapital, Inc. (“iCapital”). This material is the property of iCapital and may not be shared without the written permission of iCapital. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of iCapital.

This material is provided for informational purposes only and is not intended as, and may not be relied on in any manner as, legal, tax or investment advice, a recommendation, or as an offer to sell, a solicitation of an offer to purchase or a recommendation of any interest in any fund or security. You should consult your personal accounting, tax and legal advisors to understand the implications of any investment specific to your personal financial situation. This material does not intend to address the financial objectives, situation or specific needs of any individual investor. Alternative investments are complex, speculative investment vehicles and are not suitable for all investors.

The information contained herein is an opinion only, as of the date indicated, and should not be relied upon as the only important information available. Any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets is not necessarily indicative of the future or likely performance. The information contained herein is subject to change, incomplete, and may include information and/or data obtained from third party sources that iCapital believes, but does not guarantee, to be accurate. iCapital considers this third-party data reliable, but does not represent that it is accurate, complete and/or up to date, and it should not be relied on as such. iCapital makes no representation as to the accuracy or completeness of this material and accepts no liability for losses arising from the use of the material presented. No representation or warranty is made by iCapital as to the reasonableness or completeness of such forward-looking statements or to any other financial information contained herein.

Securities products and services are offered by iCapital Markets, an SEC-registered broker-dealer, member FINRA and SIPC, and an affiliate of iCapital, Inc. and Institutional Capital Network, Inc. These registrations and memberships in no way imply that the SEC, FINRA, or SIPC have endorsed any of the entities, products, or services discussed herein. Annuities and insurance services are provided by iCapital Annuities and Insurance Services LLC, an affiliate of iCapital, Inc. “iCapital” and “iCapital Network” are registered trademarks of Institutional Capital Network, Inc. Additional information is available upon request.

© 2023 Institutional Capital Network, Inc. All Rights Reserved.