Artificial Intelligence (AI) has already reshaped the digital world – and now it is coming for the physical one. Over the past two years, generative AI has revolutionized knowledge work, powered by the rise of large language models (LLMs) like ChatGPT (OpenAI) and Claude (Anthropic). While much of the attention has focused on chatbots and virtual tasks, the next frontier of AI is far more tangible and highly physical.

Enter humanoids – AI-powered robots designed to move, perceive, and act like humans, capable of performing real-world tasks in real-world settings. With a projected Total Addressable Market (TAM) of roughly $4.5 trillion by 2050, what once felt like sci-fi is now becoming one of the most expansive opportunities in the AI ecosystem.1 Tech leaders from Nvidia to OpenAI have suggested we could see humanoids in regular use as early as 2027 – an optimistic take, but one that reflects accelerating momentum.2

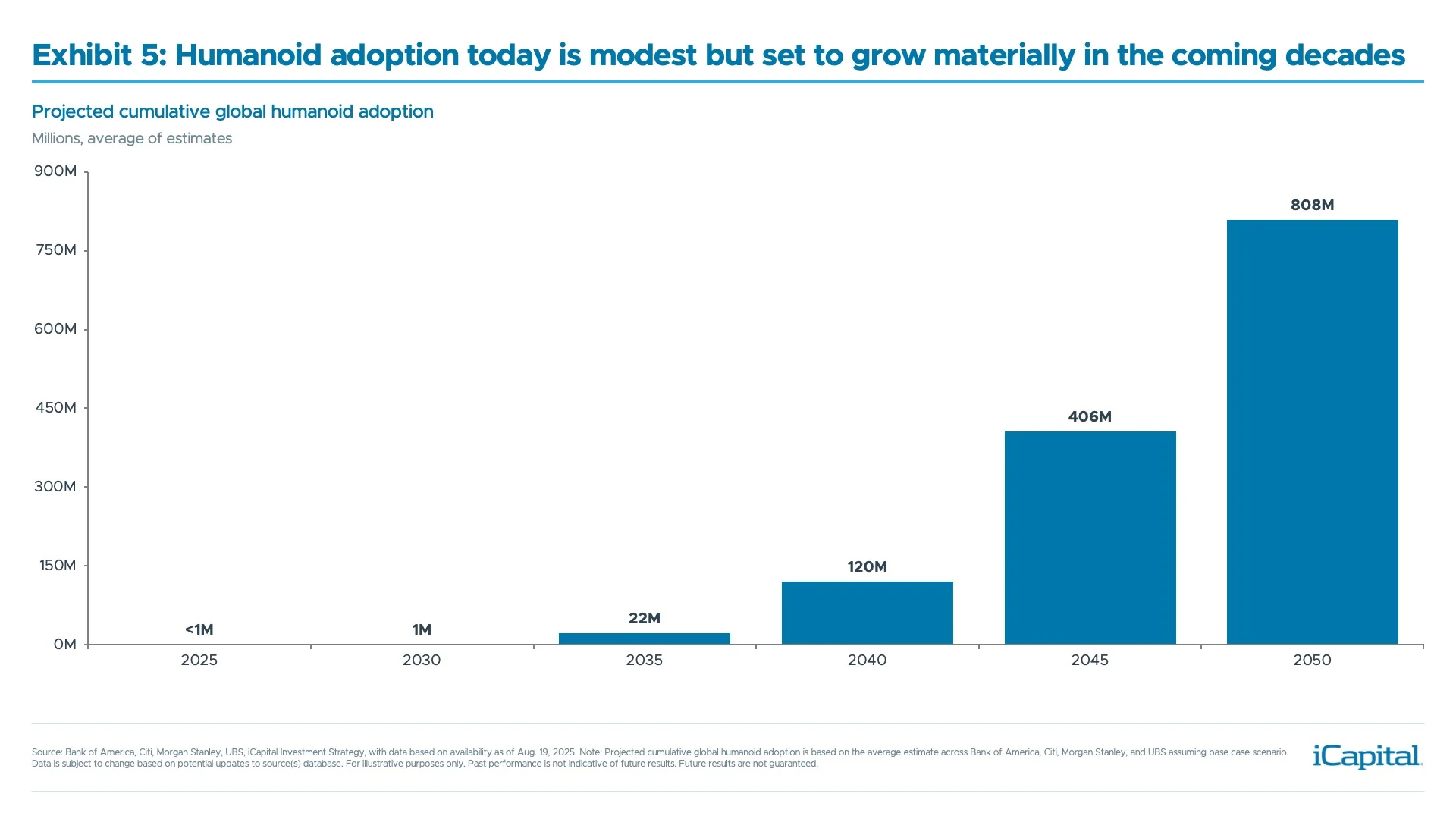

And the shift is already underway. While still nascent today with fewer than 10,000 humanoids globally, these robots are already being tested and deployed in factories. From this small base, adoption is expected to scale materially, with the global install base projected to reach as many as 800 million humanoids by 2050.3 Aging demographics, tightening labor markets, and the push to reshore manufacturing are driving demand, while advances in hardware, software, and falling unit costs are setting the stage for wider adoption.

This marks the next frontier in AI. And for investors, the question now turns to how do you position for the rise of physical AI? We believe the opportunity spans across both public and private markets. Indeed, we think key verticals, such as the “body” (hardware) and the “brain” (software), represent some of the most compelling opportunities across the humanoid theme. But momentum is also building in private markets, where a pick-up in deal activity should benefit the venture asset class.

Three Converging Factors Driving Humanoids Momentum

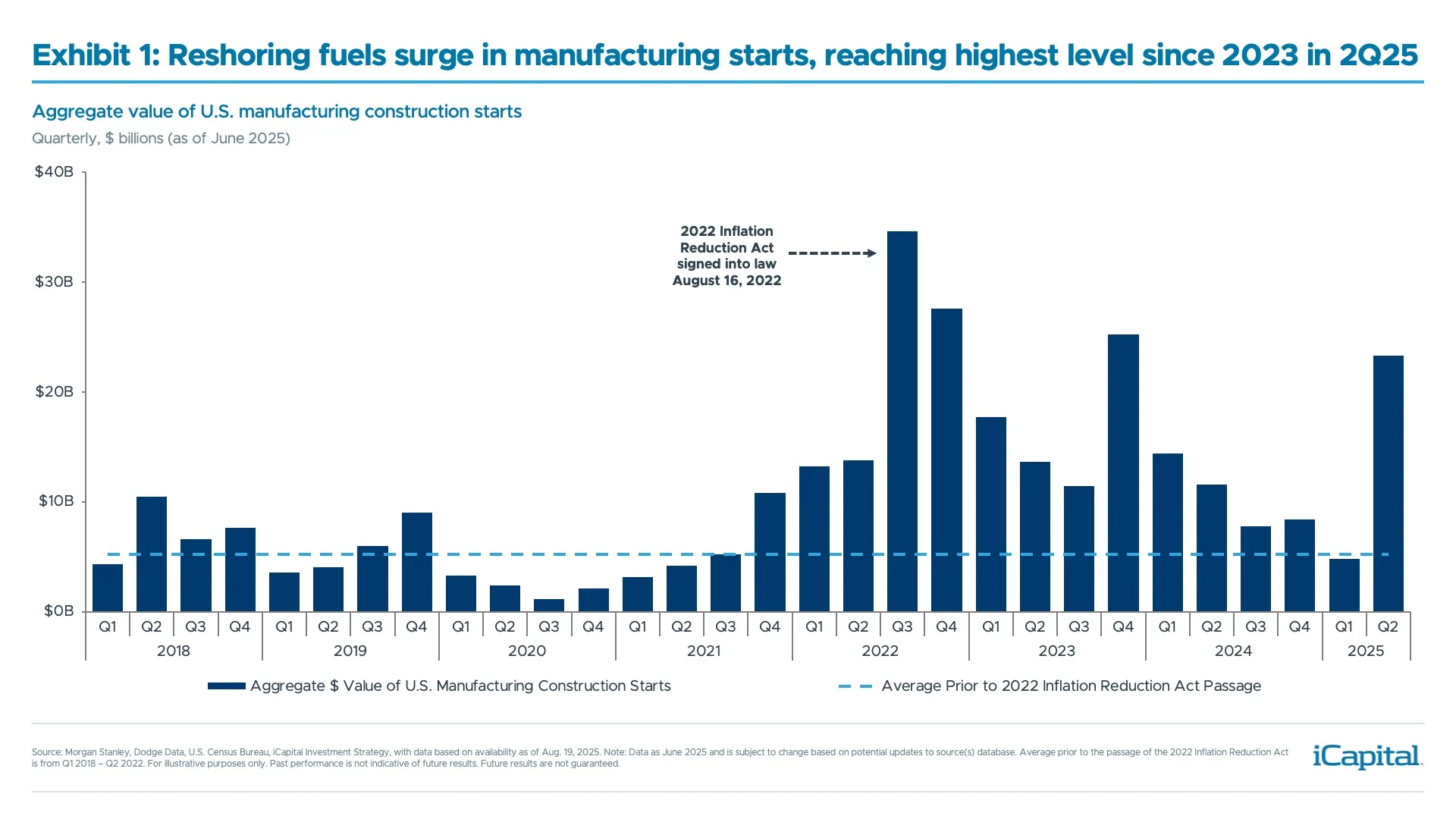

1. Reshoring is fueling labor demand. Since the 2018 U.S.–China trade war, companies have ramped up investment in U.S. manufacturing. This trend has only accelerated under Trump 2.0, as higher global tariffs, which include transshipment levies on Chinese intermediaries, are pushing more firms to reshore directly to the U.S. Indeed, reshoring momentum picked up materially in Q2 2025, with the aggregate value of U.S. manufacturing construction starts coming in at nearly 4.5x the quarterly average prior to the passage of the 2022 Inflation Reduction Act (Exhibit 1).4 And in June alone, monthly activity surged to levels not seen since the 2022–2023 mega-project wave.5

This reshoring wave is creating substantial new demand for domestic labor, particularly in critical sectors like semiconductors, batteries, and defense. Yet, many of these industries are highly labor-intensive, and the U.S. simply doesn’t have enough skilled workers to fill the need. In the manufacturing industry alone, roughly five in 10 positions are expected to remain vacant through 2033 due to persistent skill gaps, with reshoring likely fueling this further.6 As a result, physical automation, and specifically through humanoids, is emerging as a practical solution to fill these workforce gaps without requiring complete facility redesigns.

This reshoring wave is creating substantial new demand for domestic labor, particularly in critical sectors like semiconductors, batteries, and defense. Yet, many of these industries are highly labor-intensive, and the U.S. simply doesn’t have enough skilled workers to fill the need. In the manufacturing industry alone, roughly five in 10 positions are expected to remain vacant through 2033 due to persistent skill gaps, with reshoring likely fueling this further.6 As a result, physical automation, and specifically through humanoids, is emerging as a practical solution to fill these workforce gaps without requiring complete facility redesigns.

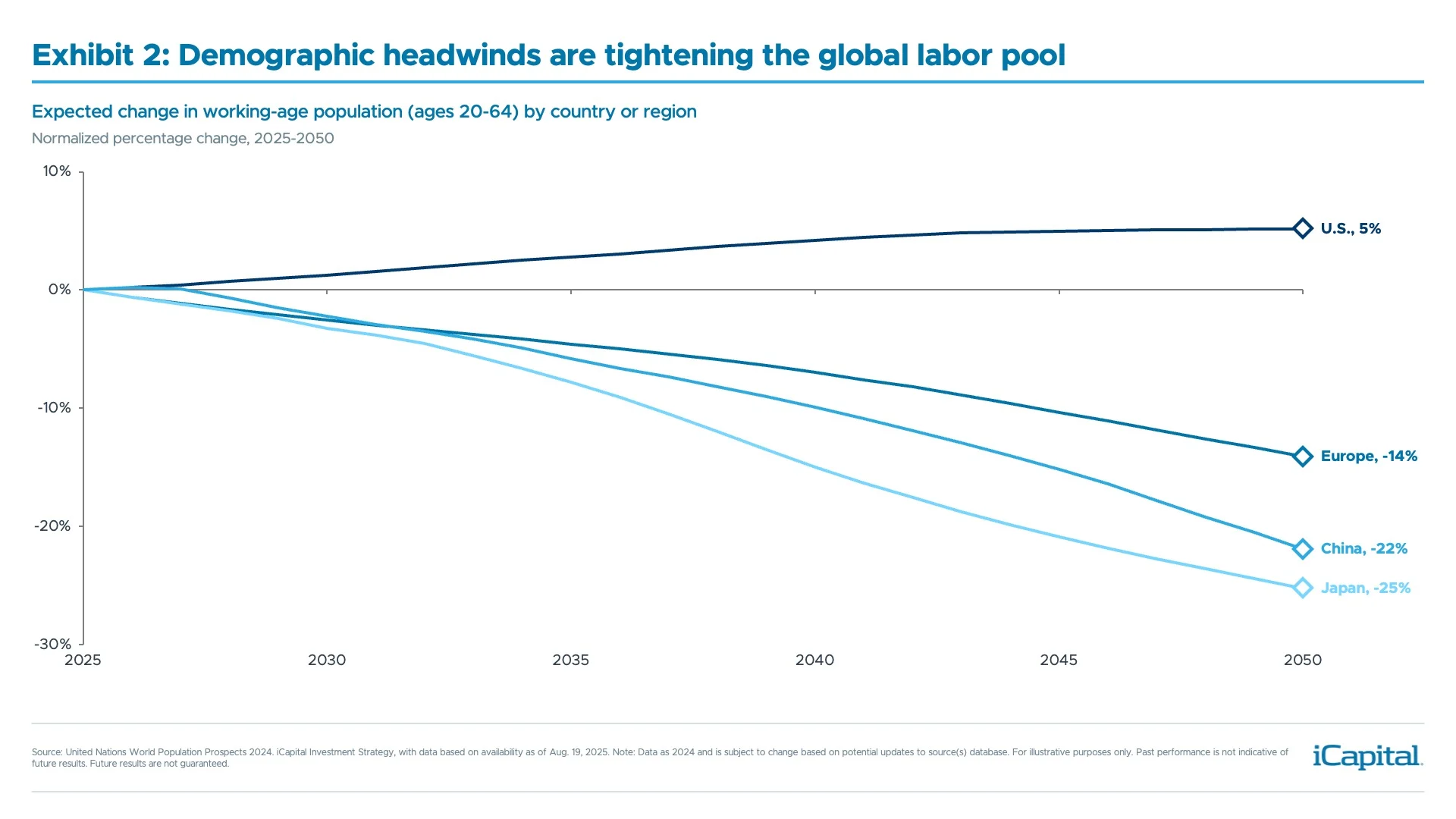

2. Demographics are tightening the labor pool. An aging population, slower growth in the working-age cohort, weaker immigration following recent legislation, and shifting attitudes among younger workers toward certain manufacturing and warehouse jobs, are creating structural headwinds for U.S. labor supply. Globally, the picture is even more amplified. China faces a 22% labor force decline by 2050, while key manufacturing hubs like Germany and Japan are experiencing similar workforce contractions (Exhibit 2).7 This means the U.S. can’t necessarily rely on foreign labor to offset its own demographic challenges. And so, embracing robotics and humanoids is increasingly becoming the most viable alternative to fill the labor gap to maintain production capacity.

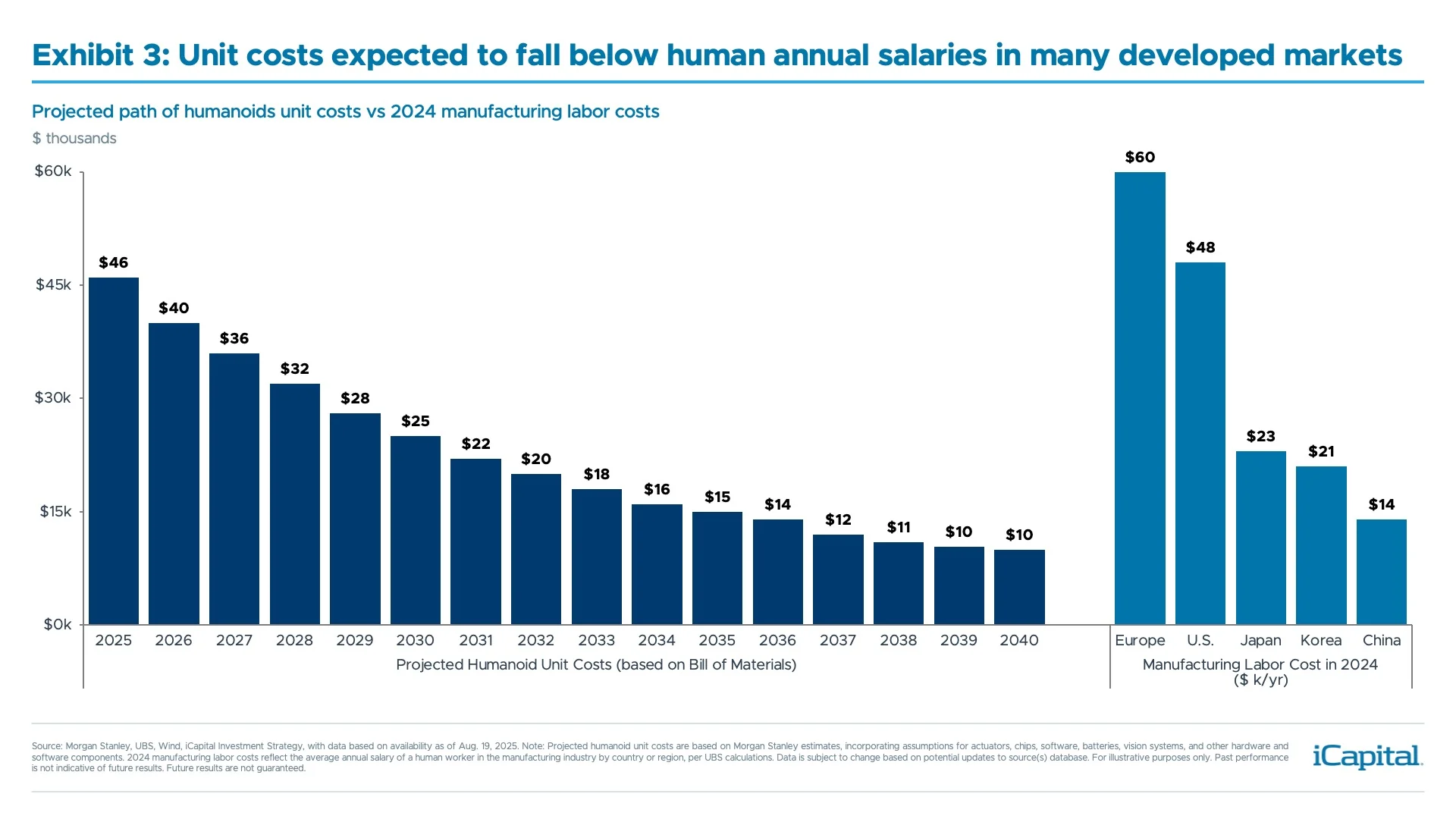

3. Unit costs are approaching cost parity. Advancements in AI models, component design, and manufacturing continue to drive humanoids closer to cost parity with human labor. Between 2022 and 2024, average unit costs – often referred to as Bill of Materials (BoM) or hardware costs – fell roughly 40%8, and they are projected to decline another ~50% by 2030.9 Interestingly, by 2026, the average humanoid BoM is expected to cost around $40k – comparable to, and in many cases below, the annual salary of a human worker in many developed markets – before declining further to ~$10k by 2040 (Exhibit 3).10 That said, it is worth noting that current trade policies and tariffs could slow the path to cost parity in places like the U.S. Still, looking further out, as prices fall, humanoids are set to expand beyond industrial and manufacturing applications, increasingly entering households and other consumer spaces.

3. Unit costs are approaching cost parity. Advancements in AI models, component design, and manufacturing continue to drive humanoids closer to cost parity with human labor. Between 2022 and 2024, average unit costs – often referred to as Bill of Materials (BoM) or hardware costs – fell roughly 40%8, and they are projected to decline another ~50% by 2030.9 Interestingly, by 2026, the average humanoid BoM is expected to cost around $40k – comparable to, and in many cases below, the annual salary of a human worker in many developed markets – before declining further to ~$10k by 2040 (Exhibit 3).10 That said, it is worth noting that current trade policies and tariffs could slow the path to cost parity in places like the U.S. Still, looking further out, as prices fall, humanoids are set to expand beyond industrial and manufacturing applications, increasingly entering households and other consumer spaces.

Dissecting the Anatomy – Humanoids vs. Industrial Robots

Dissecting the Anatomy – Humanoids vs. Industrial Robots

Humanoids combine two core components: the “brain” and the “body”.

- Brain: refers to the AI systems that power perception and decision-making, ranging from computer vision and auditory processing to LLMs enabling communication and understanding.

- Body: refers to the physical structure comprised of actuators, sensors, motors, and batteries. These components give humanoids the overall ability to perceive and interact with the physical world in a humanlike way.

This is where humanoids diverge from traditional industrial robots. Industrial robots are already deeply embedded in global supply chains, with more than 4 million deployed worldwide.11 In fact, Amazon’s workforce is now nearly one-to-one human-to-robot, up from five-to-one in 2017.12 But these robots are single-purpose and tend to excel only in repetitive, structured tasks. Humanoids, by contrast, are general purpose and designed for versatility. Their humanlike form allows them to perform a broad array of tasks without modifying their surroundings. Network effects amplify their progress: each task performed feeds data back into AI systems, accelerating learning and capability across the network of deployed robots.

The Three Phases of Humanoid Adoption

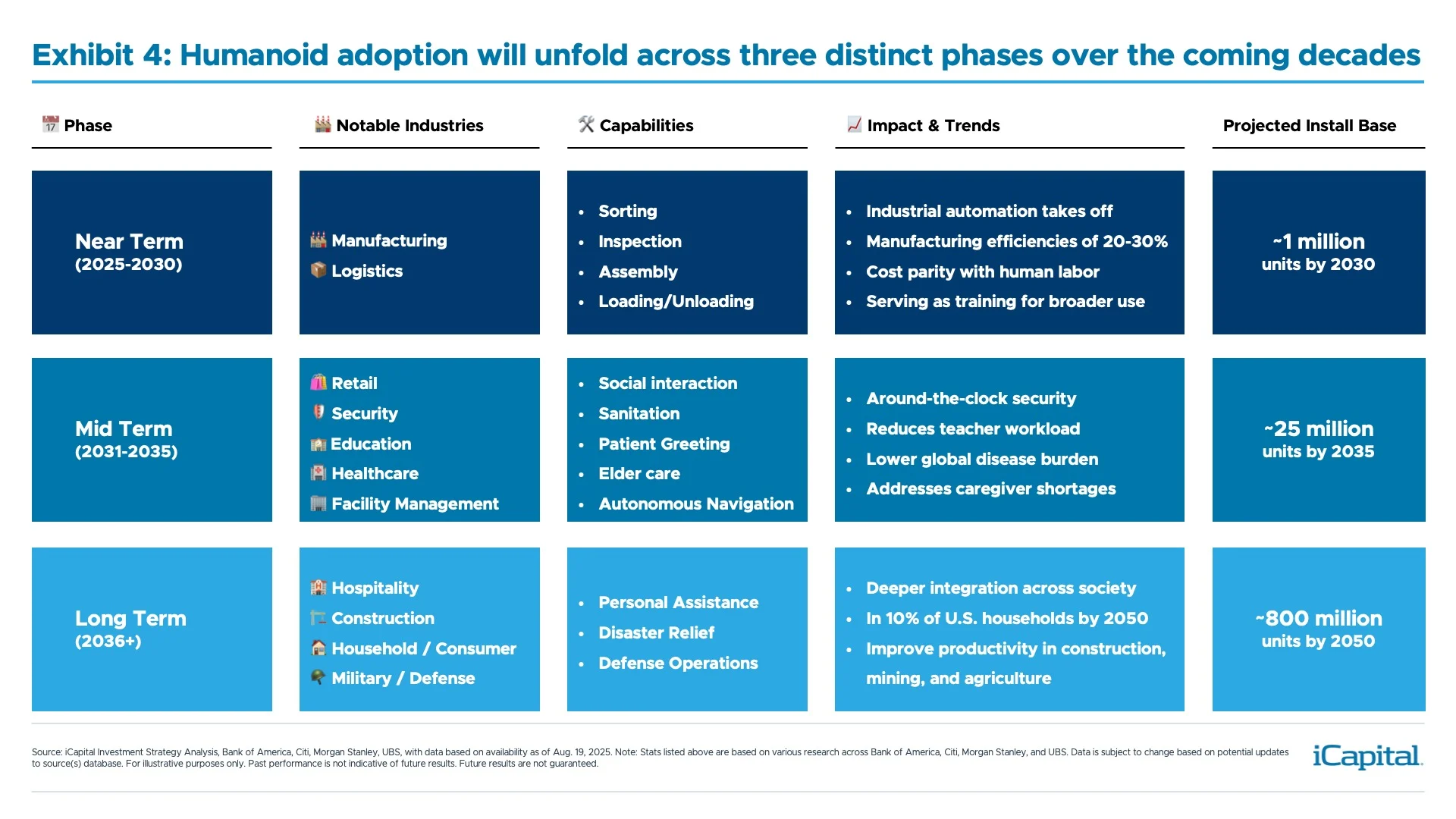

Although key tech leaders are predicting increased humanoid usage as early as 2027, we anticipate this adoption will unfold across three distinct phases over the coming decades.

Near Term (2025 – 2030): Industrial Automation Takes Off

Near Term (2025 – 2030): Industrial Automation Takes Off

- Projected cumulative global install base: ~1 million units by 203013

Manufacturing will drive early adoption. Building on decades of productivity gains from single-use industrial robots, humanoids could boost manufacturing efficiency by an additional 20–30% in the next five years, performing tasks like sorting, inspection, assembly, and loading/unloading.14 And with unit costs continuing to decline closer to parity with human labor over this period, this will make humanoids an increasingly viable and scalable solution in industrial settings. Indeed, this phase will not only accelerate automation across manufacturing but also serve as a critical training ground for broader use in everyday life.

Mid Term (2031 – 2035): Expansion into Services and Healthcare

- Projected cumulative global install base: ~25 million units by 203515

This phase will see humanoids move beyond industrial settings and into more public-facing roles, requiring more advanced social interaction capabilities, emotional recognition, and language processing. As costs decline and capabilities improve – driven by advances in battery technology, hardware, and Robot Operating Systems (aka the humanoid “brain”) – adoption will expand into commercial and service sectors including retail, security, education, and healthcare. In healthcare especially, humanoids could play a transformative role. Robots are already proving useful in hospitals, saving nurses hundreds of miles of walking each year by managing tasks like transport, sanitation, and patient greetings.16

Long Term (2036+): Deeper Integration Across Society

- Projected cumulative global install base: ~800 million units by 205017

Beyond 2035, humanoids will become embedded in everyday life, with adoption also beginning to expand into households. With capabilities maturing and network effects compounding, they’ll operate across homes, hospitality, construction, and even military and rescue missions. Humanoids will be increasingly viewed as robotic partners rather than tools leading to increased household use. In the household setting, adoption could be significant, with some estimates projecting ~10% of U.S. households owning a humanoid by 2050.18

How to Invest in the Humanoid Theme

How to Invest in the Humanoid Theme

Humanoids present a multi-stage investment opportunity across both public and private markets and can be expressed through many different verticals. For us, we see three key areas of exposure for investors looking to participate in the humanoid robotics theme:

- Brain Technology: refers to the intelligence layer powering humanoids – primarily AI software and semiconductors. These technologies enable perception, decision-making, and communication, making them central to humanoid functionality.

- Body Technology: On the physical side, body technology encompasses Actuators & Motors, Sensors & Feedback Systems, Battery & Energy Storage, and Materials Science. These industries supply the components that enable movement, perception, and power, making them foundational to humanoid hardware development.

- End-Market: companies that fully design and produce humanoids. These span across robotics and automation, as well as the electric vehicle industry, where several major manufacturers are actively expanding into humanoid development and factory deployment.

Today, given the relative infancy of the space, public market exposure to the theme is largely indirect – via robotics, semiconductor, software, and AI leader – and many of these companies are not pure-plays. However, with much of the innovation being driven in private markets, more direct opportunities are emerging in the venture capital space.

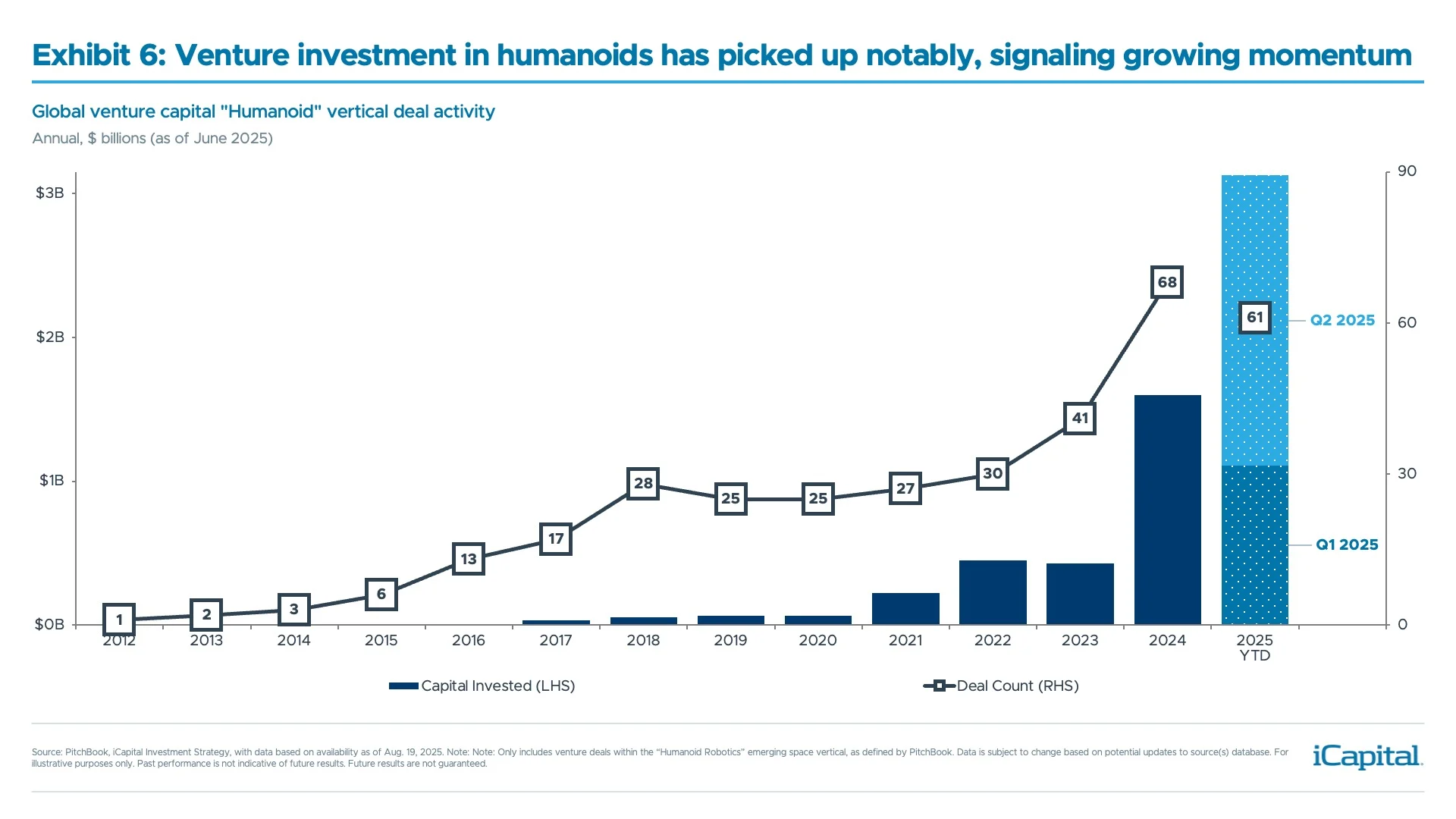

Indeed, in just the 1H 2025 alone, $3.1 billion was invested across 61 venture deals in the “Humanoids” vertical (Exhibit 6).19 For context, that’s more than the $2.9 billion invested in the entire period from 2010 to 2024.20 And the pace of dealmaking has also surged, with the current run rate exceeding historical annual averages by more than 6x – a clear signal that momentum is building and humanoids are gaining traction as a next-generation frontier in AI and automation.21

Bottom Line:

Bottom Line:

Humanoids represent the next chapter in AI. While adoption will play out over decades, there are durable signs that momentum is starting to build with structural drivers – reshoring, demographic changes, and falling unit costs – already here. For investors, this is a multi-stage investment opportunity across both public and private markets. In the near-term, given humanoid adoption is still in its infancy, we think venture capital is best positioned to capture the wave of innovation, especially given the pickup in deal activity. But investors can also look to public markets to access the theme. While there are not many “pure plays” for humanoids in public markets, increased adoption should benefit themes such as AI software and AI semiconductors, which will be key components in the buildout and installation of humanoids globally.

We would like to thank Luke Kovensky, our Intern on the Investment Strategy team, for his contributions to this piece.

- iCapital Investment Strategy Analysis, Bank of America, Citi, Morgan Stanley, UBS, as of August 19, 2025. Note: Total Addressable Market listed is the average of estimates across Bank of America, Citi, Morgan Stanley, and UBS assuming base case scenario.

- Barrons, as of June 12, 2025.

- iCapital Investment Strategy Analysis, Bank of America, Citi, Morgan Stanley, UBS, as of August 19, 2025. Note: Projected cumulative global humanoid adoption is based on the average estimate across Bank of America, Citi, Morgan Stanley, and UBS assuming base case scenario.

- Dodge Data, U.S. Census Bureau, as of July 22, 2025. Note: Average prior to the passage of the 2022 Inflation Reduction Act is from Q1 2018 – Q2 2022.

- Ibid.

- Deloitte Research Center for Energy & Industrials, Bureau of Labor Statistics, as of April 3, 2024.

- United Nations World Population Estimates 2024, as of August 18, 2025.

- Bain & Company, Goldman Sachs, UBS, as of August 18, 2025.

- Bank of America Global Research, Morgan Stanley, as of April 29, 2025. Note: Assumes Bill of Material (BOM) costs with a China Supply Chain

- Bank of America Global Research, as of April 29, 2025. Note: This is based on the assumption that: 1) a humanoid robot uses 16 rotary actuators and 14 linear actuators; 2) its rotary actuator uses harmonic reducers; 3) its linear actuator is based on planetary roller screw; 4) its dexterous hand has 6 degrees of freedom; 5) its vision system includes one depth camera and one LiDAR; and 6) the humanoid robot mainly uses Chinese-made components, if possible, in order to save costs.

- Wind, UBS, as of June 17, 2025.

- Wall Street Journal, as of June 30, 2025.

- iCapital Investment Strategy Analysis, Bank of America, Citi, Morgan Stanley, UBS, as of August 19, 2025. Note: Projected cumulative global humanoid adoption is based on the average estimate across Bank of America, Citi, Morgan Stanley, and UBS assuming base case scenario.

- International Federation of Robotics (IFR), as of March 25, 2025.

- iCapital Investment Strategy Analysis, Bank of America, Citi, Morgan Stanley, UBS, as of August 19, 2025. Note: Projected cumulative global humanoid adoption is based on the average estimate across Bank of America, Citi, Morgan Stanley, and UBS assuming base case scenario.

- California Association of Healthcare Leaders, as of March 9, 2025.

- iCapital Investment Strategy Analysis, Bank of America, Citi, Morgan Stanley, UBS, as of August 19, 2025. Note: Projected cumulative global humanoid adoption is based on the average estimate across Bank of America, Citi, Morgan Stanley, and UBS assuming base case scenario.

- Morgan Stanley, as of April 29, 2025.

- PitchBook, as of August 19, 2025. Note: Only includes venture deals within the “Humanoid Robotics” emerging space vertical, as defined by PitchBook.

- Ibid.

- Ibid.

IMPORTANT INFORMATION

The material herein has been provided to you for informational purposes only by Institutional Capital Network, Inc. (“iCapital Network”) or one of its affiliates (iCapital Network together with its affiliates, “iCapital”). This material is the property of iCapital and may not be shared without the written permission of iCapital. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of iCapital.

This material is provided for informational purposes only and is not intended as, and may not be relied on in any manner as, legal, tax or investment advice, a recommendation, or as an offer or solicitation to buy or sell any security, financial product or instrument, or otherwise to participate in any particular trading strategy. This material does not intend to address the financial objectives, situation, or specific needs of any individual investor. You should consult your personal accounting, tax and legal advisors to understand the implications of any investment specific to your personal financial situation.

ALTERNATIVE INVESTMENTS ARE CONSIDERED COMPLEX PRODUCTS AND MAY NOT BE SUITABLE FOR ALL INVESTORS. Prospective investors should be aware that an investment in an alternative investment is speculative and involves a high degree of risk. Alternative Investments often engage in leveraging and other speculative investment practices that may increase the risk of investment loss; can be highly illiquid; may not be required to provide periodic pricing or valuation information to investors; may involve complex tax structures and delays in distributing important tax information; are not subject to the same regulatory requirements as mutual funds; and often charge high fees. There is no guarantee that an alternative investment will implement its investment strategy and/or achieve its objectives, generate profits, or avoid loss. An investment should only be considered by sophisticated investors who can afford to lose all or a substantial amount of their investment.

iCapital Markets LLC operates a platform that makes available financial products to financial professionals. In operating this platform, iCapital Markets LLC generally earns revenue based on the volume of transactions that take place in these products and would benefit by an increase in sales for these products.

The information contained herein is an opinion only, as of the date indicated, and should not be relied upon as the only important information available. Any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets is not necessarily indicative of the future or likely performance. The information contained herein is subject to change, incomplete, and may include information and/or data obtained from third party sources that iCapital believes, but does not guarantee, to be accurate. iCapital considers this third-party data reliable, but does not represent that it is accurate, complete and/or up to date, and it should not be relied on as such. iCapital makes no representation as to the accuracy or completeness of this material and accepts no liability for losses arising from the use of the material presented. No representation or warranty is made by iCapital as to the reasonableness or completeness of such forward-looking statements or to any other financial information contained herein.

Securities products and services are offered by iCapital Markets, an SEC-registered broker-dealer, member FINRA and SIPC, and an affiliate of iCapital, Inc. and Institutional Capital Network, Inc. These registrations and memberships in no way imply that the SEC, FINRA, or SIPC have endorsed any of the entities, products, or services discussed herein. Annuities and insurance services are provided by iCapital Annuities and Insurance Services LLC, an affiliate of iCapital, Inc. “iCapital” and “iCapital Network” are registered trademarks of Institutional Capital Network, Inc. Additional information is available upon request.

©2025 Institutional Capital Network, Inc. All Rights Reserved.