At yesterday’s July rate setting meeting, the Federal Open Market Committee (FOMC) implemented a widely anticipated 25 basis points (bps) rate hike, bringing the benchmark rate to a target range of 5.25-5.5%, the highest rate since 2001.1 During the subsequent press conference, Fed Chair Powell took a cautious approach and refrained from signaling an imminent end to the rate hiking cycles. He emphasized that the FOMC will continue to proceed “meeting-by-meeting” and remain responsive to incoming data.2

Despite this, with the latest move and commentary from Fed Chair Powell, there is a good chance that we might have seen the last rate hike of the Fed tightening cycle. Indeed, the market continues to view yesterday’s hike as one of the last in the cycle and expects the Fed to remain on hold at the next meeting in September and conclude in November that a final hike is not needed.3 Below we explore why the potential hike and hold strategy from the Fed could be effective, and what this means for markets. Additionally, we discuss why this development is supportive for financials and tech stocks.

Three Reasons to Hold Steady

Although the Fed didn’t explicitly signal that this is the last rate hike of this tightening cycle (nor would we expect them to say that at this point), we see three reasons to consider why adopting a policy of holding rates steady could be effective.

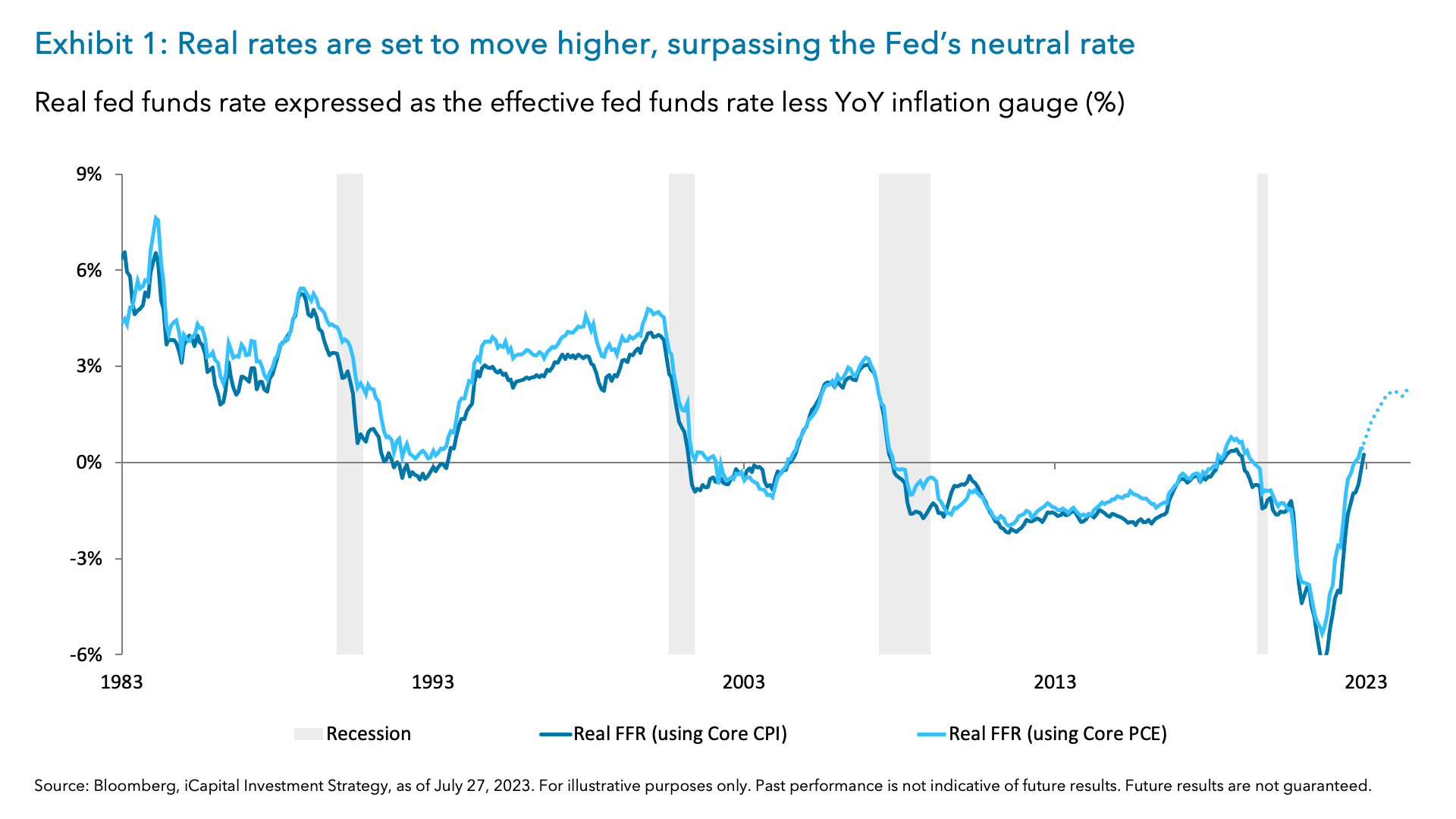

1. Gradual disinflation and higher real rates: Both the Consumer Price Index (CPI) and the Fed’s preferred measure of inflation, the Personal Consumption Expenditures (PCE) price index, continue to gradually decline off their respective peaks in 2022. Core CPI has now decreased from 6.6% in September of 2022 to 4.8% today, while core PCE has shown a similar trend and is expected to reach 4.2% for June before falling to 3.7% by year-end 2023.4 Should these disinflationary pressures persist, there is a possibility of a “passive” tightening, where real rates would rise even in the absence of further rate hikes from the Fed. This would lead to a more restrictive monetary policy. Currently, the effective real fed fund rate, calculated as the effective fed funds rate less year-on-year core PCE, stands at 0.7%, with expectations of it rising to 1.1% following the release of the June PCE price index data tomorrow, and eventually reaching 1.6% by the end of 2023 (Exhibit 1).5 As we wrote about here, the real fed funds rate is now approaching restrictive, surpassing the Fed’s so-called neutral rate – the real interest rate that neither stimulates nor contracts the economy – of 0.7%.6

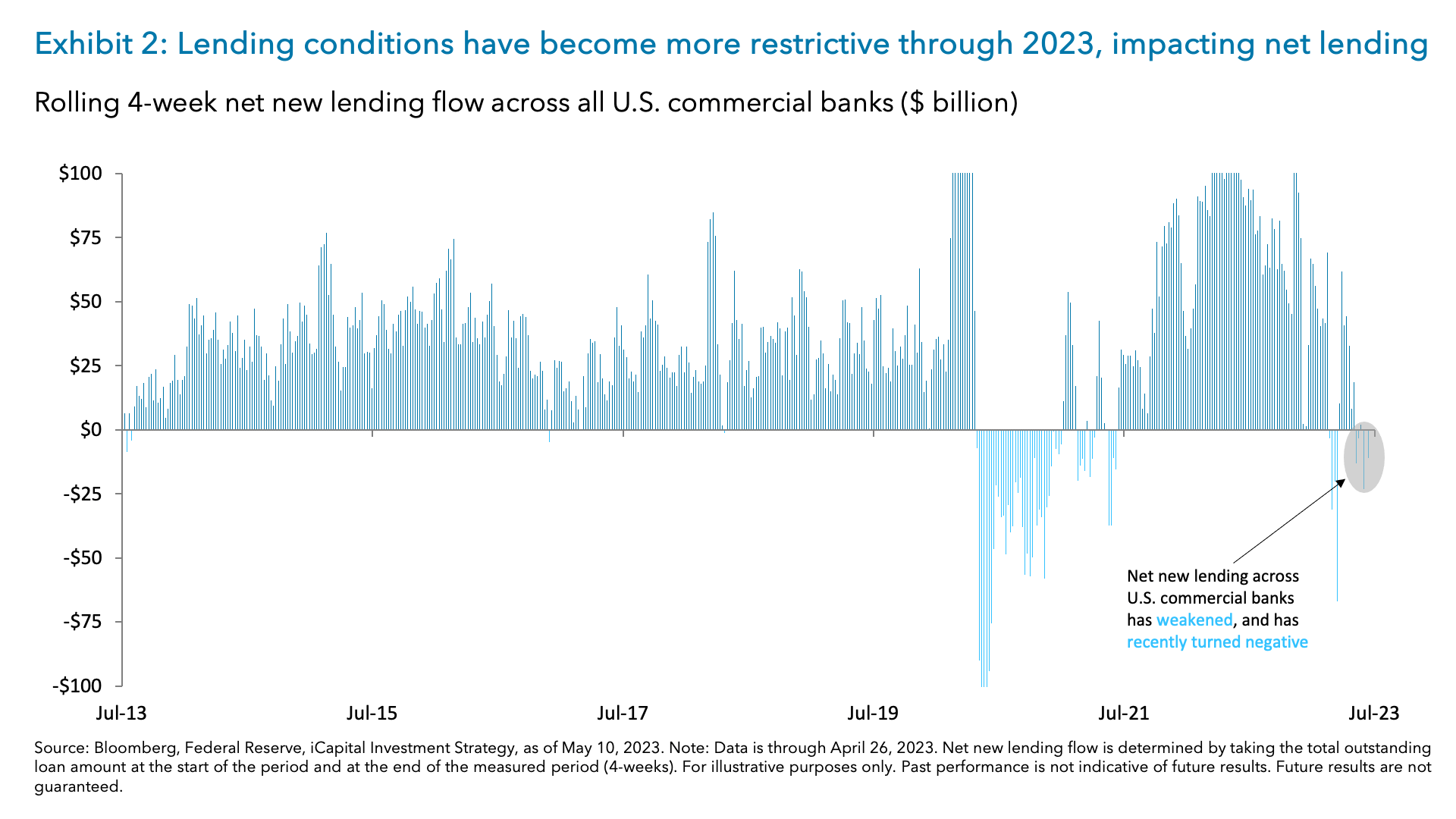

2. Restrictive bank lending conditions: Although the acute bank lending crisis appears to have faded, lending conditions remain restrictive, and Fed Chair Powell foresees further tightening ahead. Since the start of 2023, lending for all U.S. commercial banks has been slowing.7 Notably, rolling 4-week net new lending has weakened, and has recently turned negative (Exhibit 2).8 This is a sign that lenders continue to move toward even stricter lending standards, resulting in lower loan demand and high interest rates. This continued tightness in bank financing conditions is likely to exert downward pressure on both the economy and inflation, offsetting the need for additional rate hikes.

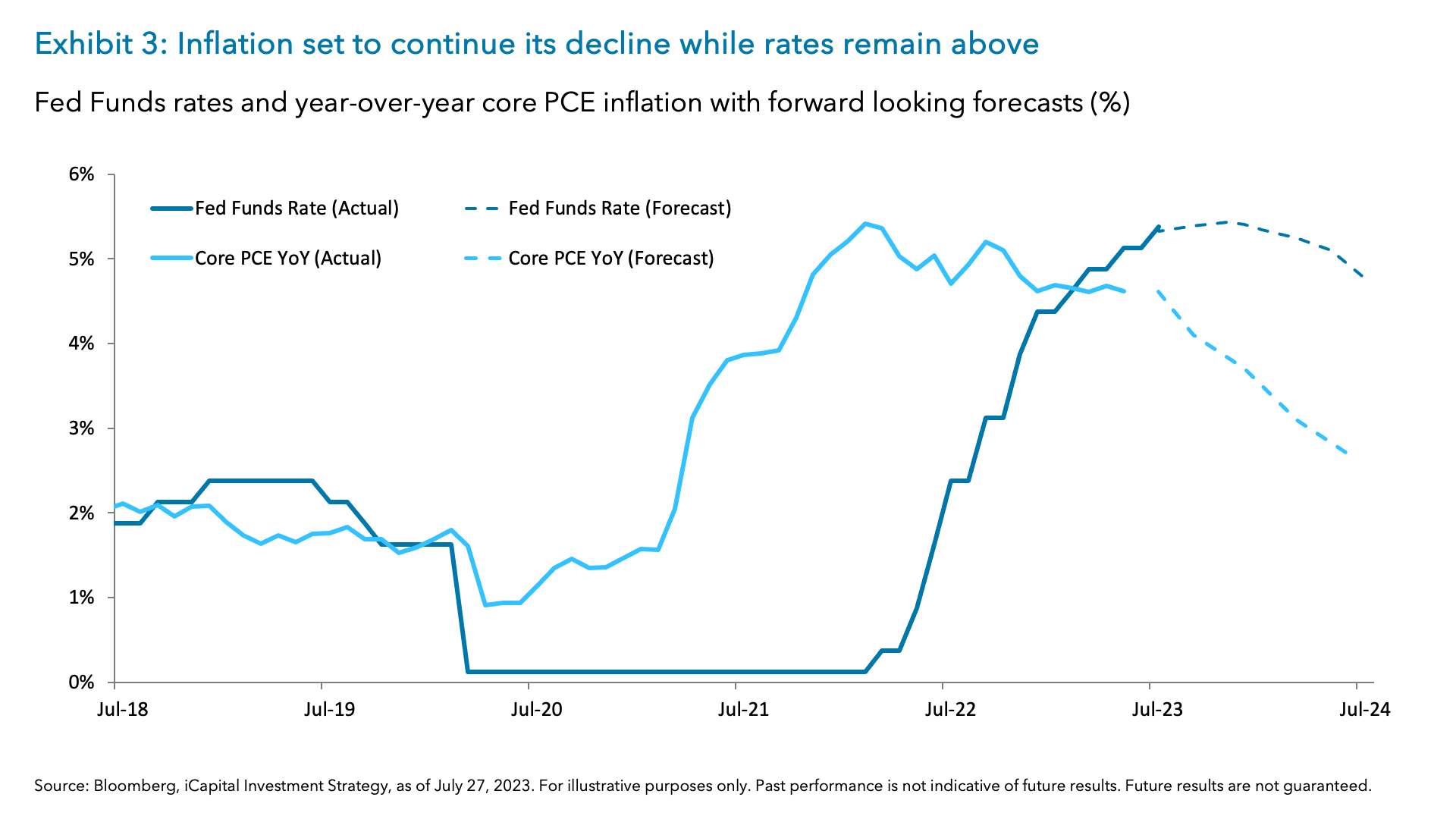

3. No longer a state of emergency on inflation: Headline inflation is no longer at “emergency” levels seen earlier in 2022, when it was around 9%.9 This has given Fed Chair Powell and the FOMC the flexibility to carefully assess the incoming economic data before making further decisions. For instance, the committee’s decision to wait nearly three months before implementing a rate hike (between the May and July FOMC meetings) allowed them to observe core CPI decline from 5.5% read for April to 4.8% most recently for June (though the core PCE price index remained relatively stable around 4.7%) and headline CPI reaching 3%.10 Looking ahead, economists forecast a further decline in inflation – specifically over the next three months – creating a widening gap between inflation and the fed funds rate (Exhibit 3).11

Given the three reasons above, chances are the Fed is now much more content with the outlook on inflation and therefore, its current policy stance. And if the next move from the Fed is a hold, this bodes well for risk assets.

Potential Last Rate Hike Is Supportive for Equities and a Steeper Yield Curve

It continues to be increasingly evident that central banks worldwide are nearing their peak interest rates this year. Similar to how the market views the Fed, the recent dovish stance of the European Central Bank (ECB) has led to a reduction in expectations of further actions, bringing it more in line with the market’s projected path for the Fed. As central banks worldwide, namely the Fed, approach peak interest rates this year, a crucial question arises: what if this was the last rate hike from the Fed? Historically, the last rate hike has been associated with higher equity prices and a steeper yield curve.12

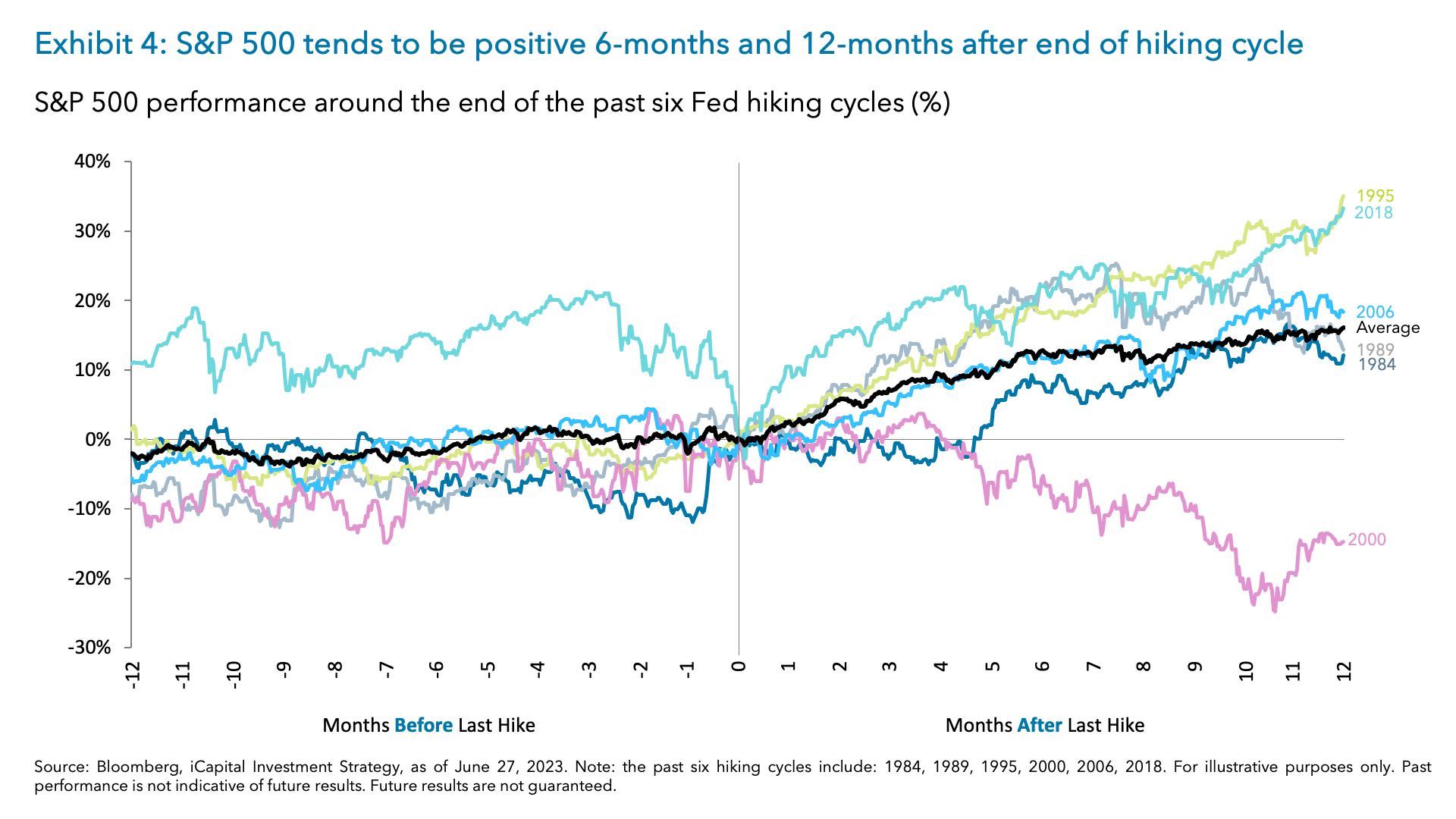

For equities, the end of rate hiking cycles has historically supported continued market upside in the absence of a recession. Since 1984, the S&P 500 has been positive five out of six instances in the subsequent 6- and 12-month periods following the end of a hiking cycle, with an average return of roughly 12% and 16%, respectively (Exhibit 4).13 Another way to look at how equities performed around the end of hiking cycles is by looking at how the S&P 500 performed after the peak in the 2-year yield, which the market uses to price-in the end of the hiking cycle. Out of the 11 tightening episodes since 1965, in six instances where no recession occurred after the peak in the 2-year yield, the S&P 500 experienced a substantial rally of around 20% on average in the subsequent 12 months.14 Conversely, in the 5 instances where a recession occurred after the last rate hike, the S&P 500 pulled back slightly in the first 6 months on average before ending relatively flat 12 months out.15

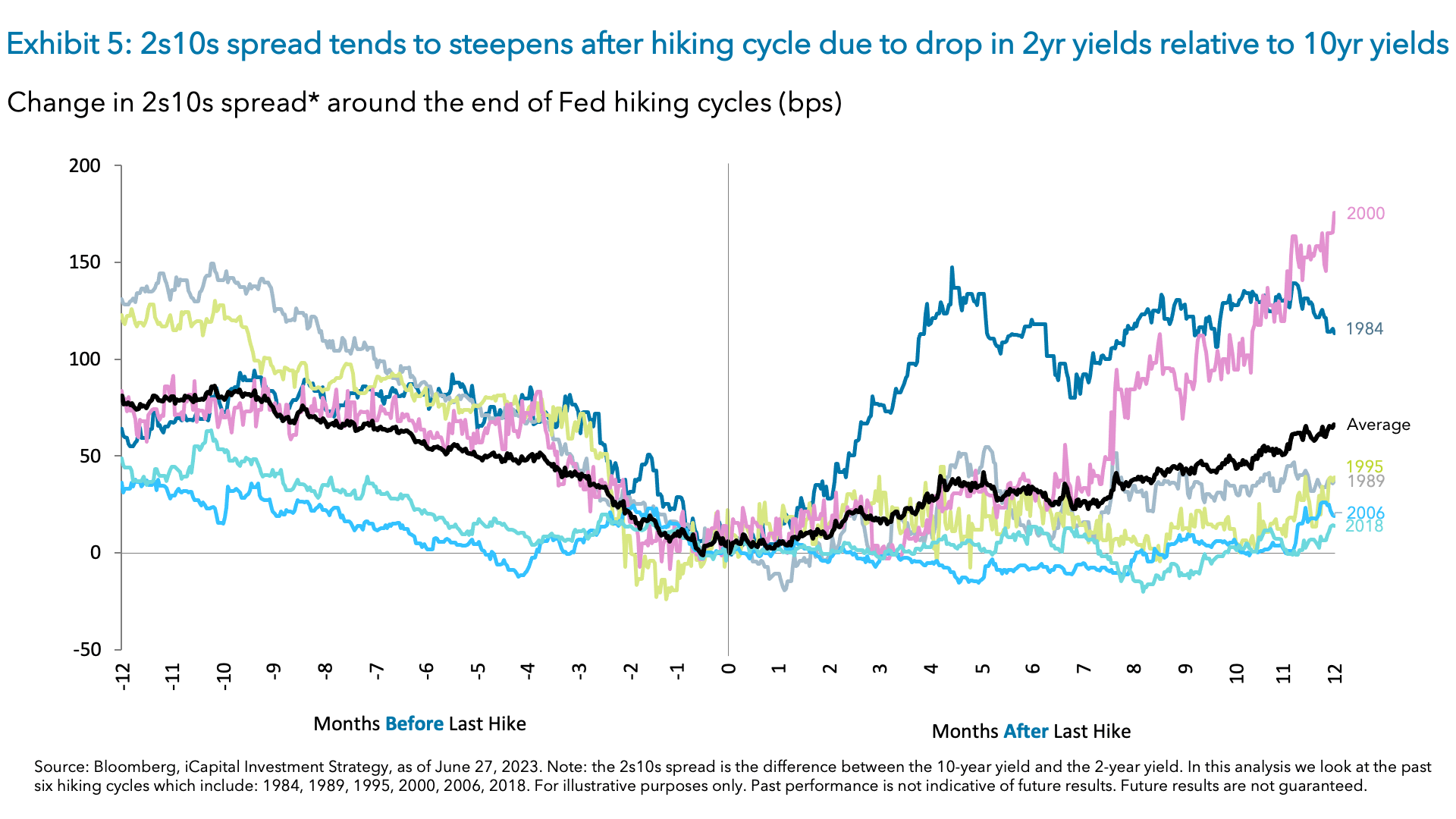

For rates, the yield curve displays an interesting dynamic around the last rate hike of a hiking cycle. Typically, the yield curve steadily flattens or inverts leading up to the last hike, but that is followed by a quick reversal post-hiking cycle. Historically, over the last six hiking cycles, the yield curve, proxied by the spread between the 10-year U.S. Treasury yield less the 2-year U.S. Treasury yield (2s10s), steepened on average by 28 bps over the subsequent 6 months following the last rate hike (Exhibit 5).16 Over a 12-month period, the yield curve steepened further with the 2s10s spread widening by over 50 bps; this is due to a significant drop in 2-year yields relative to 10-year U.S. Treasury yields.17 This pattern also makes sense given the academic research on monetary policy forecasting errors, which shows that market participants tend to correctly forecast the direction of policy, but underestimate the magnitude of those policy changes. For example, once the Fed reaches its peak rate, market participants are consistently surprised by how quickly rates are cut, causing the front end of the yield curve to decline and the yield curve to steepen.18

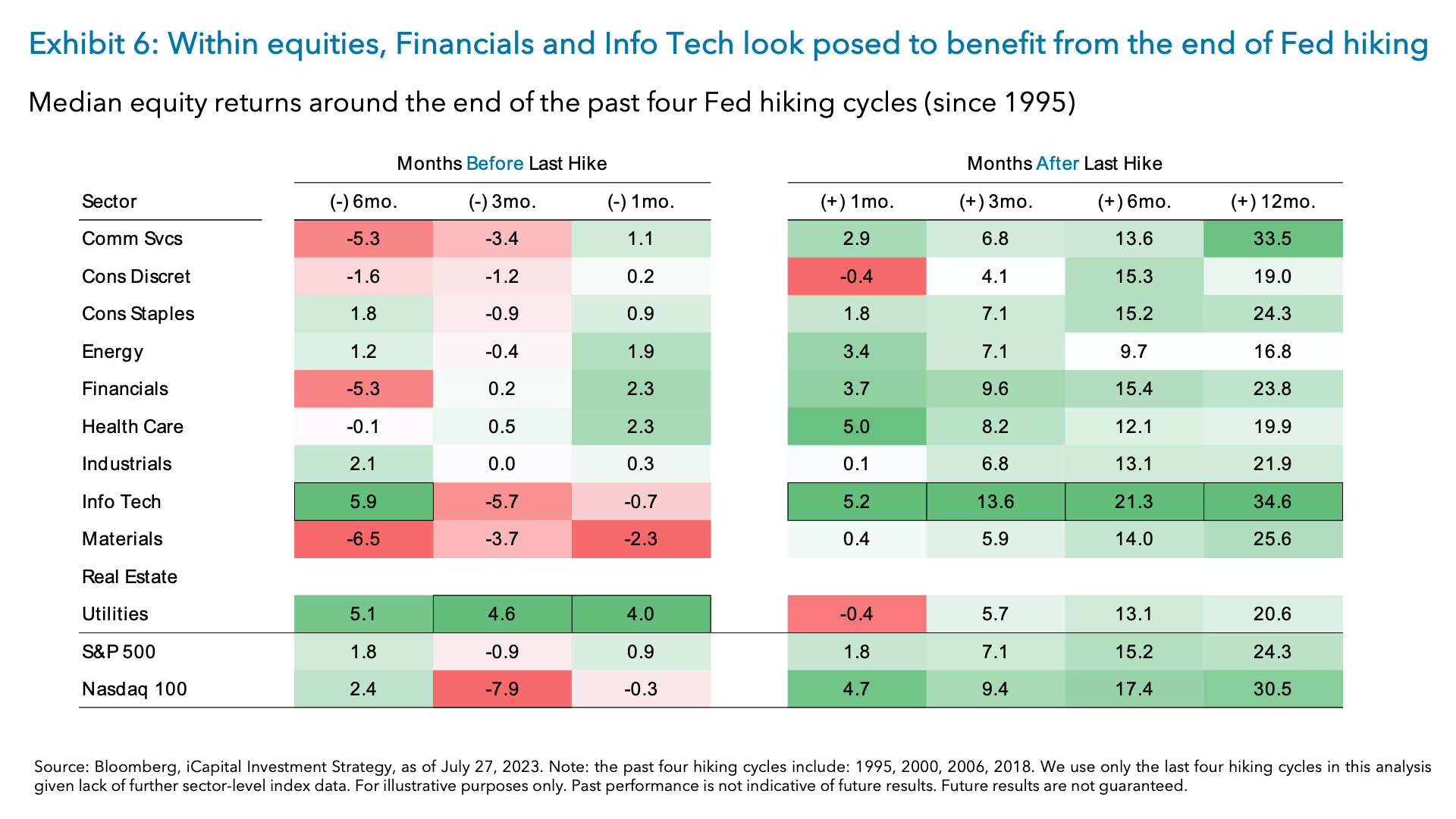

Within equities, Financials and Info Tech look posed to benefit from the end of Fed hiking

Based on data from the past four hiking cycles dating back to 1995, the Financials and Information Technology (Info Tech or Tech) sectors tended to outperform in the months following the last rate hike (Exhibit 6). For instance, during these periods, the S&P 500 showed a median 3-month forward return of +7.1%, while the Nasdaq, Financials, and Info Tech sectors demonstrated even stronger performance with median 3-month forward returns of +9.4%, +9.6%, and +13.6%, respectively.19

Financials: Benefiting from a lessening yield curve inversion among other things

The potential for the yield curve inversion to lessen bodes well for banks, as potentially lower front-end yields should reduce pressure on funding costs and improve spreads with longer-term lending rates. Besides this, there are other compelling reasons to be more optimistic on Financials, specifically large banks, including:

1. No imminent recession: With no imminent recession in sight, delinquencies and net charge-offs are expected to remain in check, and while loan growth may be slow, it is still expected to be net positive on a year-over-year basis.20

2. Stable or lower rates: Potentially stable or lower rates could result in stable or higher mark-to-market adjustments on banks’ available-for-sale (AFS) securities portfolio. This is in contrast to the period leading up to the regional bank crisis in March, where mark-to-market adjustments caused market jitters.

3. Potential for capital market activity rebound: The second half of the year could witness a rebound in capital market activity, especially with around 800 VC- and PE-backed IPOs in registration globally, which we highlight here and here.21 If conditions fall into place, this could lead to more companies coming to market, potentially benefiting larger banks capital market groups and alternatives asset managers.

4. Attractive valuations and solid earnings growth: Financials continue to offer attractive valuations, favorable profit margins, and solid earnings growth relative to the broader S&P 500. Specifically, Financials are trading at a forward price-to-earnings (PE) multiple of 14.3x compared to 19.9x for the S&P 500.22 Financials also boast a net profit margin of 17.7%, outperforming the 12.5% margin of the S&P 500.23 And for the 2023 calendar year, Financials are expected to achieve a year-on-year earnings growth of 8.4%, while the S&P 500 is projected to have earnings growth of only 0.1%.24

Tech: The beneficiary of stable rates and multi-year growth opportunity in Artificial Intelligence

Tech has been the obvious beneficiary of the slower rate hikes this year, which we first highlighted here. But as is the case for Financials, even beyond the (probable) last rate hike, we believe there remains reasons to be optimistic on Tech. Amidst the Big Tech earnings this week, we see a multi-year growth opportunity, driven by better than expected economic data and of course, Artificial Intelligence (AI).

1. Strength in digital advertising market: The digital advertising market has shown signs of strength as of late, fueled further by a resilient consumer and a robust economy. In the past week, major tech companies reported notable improvements in their advertising businesses, exceeding analysts’ ad revenue expectation and better top-line revenue acceleration.25 Additionally, today’s preliminary read of second-quarter Gross Domestic Product (GDP), which came in at 2.4% compared to 2.0% in the previous quarter, further underscores the impact stronger economic growth has had on the digital ad market.26

2. Massive multi-year opportunity with AI: AI is a massive multi-year opportunity, and many analysts are likely modeling this conservatively. Microsoft CEO Satya Nadella recently called next-generation AI a partner ecosystem opportunity that can increase the company’s total addressable market (TAM) by over 50%, which could have significant upside implications.27 Also, current forecasts by the International Data Corporation (IDC) suggest that AI spending could double from roughly $150 billion in 2023 to $300 billion in 2026.28 Considering the vast prospects of AI and its long-term growth, we will delve deeper into this topic in our forthcoming commentary.

In conclusion, with central banks worldwide nearing their peak interest rates and the possibility of the last rate hike from the Fed, there are reasons to be optimistic about equities, particularly in the Financials and Tech sectors. A hold on rates could support the market, and historical patterns indicate positive outcomes for equity prices and a steeper yield curve.

1. Bloomberg, Federal Reserve, iCapital Investment Strategy, as of July 27, 2023.

2. Bloomberg, Federal Reserve, iCapital Investment Strategy, as of July 27, 2023.

3. Bloomberg, iCapital Investment Strategy, as of July 27, 2023.

4. Bloomberg, iCapital Investment Strategy, as of July 27, 2023.

5. Bloomberg, iCapital Investment Strategy, as of July 27, 2023.

6. Federal Reserve Bank of New York, as of May 19, 2023.

7. Bloomberg, iCapital Investment Strategy, as of July 27, 2023.

8. Bloomberg, iCapital Investment Strategy, as of July 27, 2023.

9. Bloomberg, iCapital Investment Strategy, as of July 27, 2023.

10. Bloomberg, iCapital Investment Strategy, as of July 27, 2023.

11. Bloomberg, iCapital Investment Strategy, as of July 27, 2023.

12. Bloomberg, iCapital Investment Strategy, as of July 27, 2023.

13. Bloomberg, iCapital Investment Strategy, as of July 27, 2023.

14. Bloomberg, Goldman Sachs, iCapital Investment Strategy, as of July 18, 2023.

15. Goldman Sachs, iCapital Investment Strategy, as of July 18, 2023.

16. Bloomberg, iCapital Investment Strategy, as of July 27, 2023.

17. Bloomberg, iCapital Investment Strategy, as of July 27, 2023.

18. Bank for International Settlements, “Monetary Policy Expectation Errors,” as of January 27, 2022.

19. Bloomberg, iCapital Investment Strategy, as of July 27, 2023.

20. Bloomberg, iCapital Investment Strategy, as of July 27, 2023.

21. Pitchbook, as of July 19, 2023.

22. Bloomberg, iCapital Investment Strategy, as of July 27, 2023.

23. Bloomberg, iCapital Investment Strategy, as of July 27, 2023.

24. Factset Earnings Insight, as of July 21, 2023.

25. Bloomberg, iCapital Investment Strategy, as of July 27, 2023.

26. Bloomberg, iCapital Investment Strategy, as of July 27, 2023.

27. Microsoft Inspire 2023 Conference, as of July 18, 2023.

28. International Data Corporation (IDC), “Worldwide Artificial Intelligence Spending Guide,” as of March 7, 2023.

S&P 500: The S&P 500 is widely regarded as the best single gauge of large-cap U.S. equities. The index includes 500 of the top companies in leading industries of the U.S. economy and covers approximately 80% of available market capitalization.

Nasdaq 100: The Nasdaq-100 Index (NDX®) defines today’s modern-day industrials—comprised of 100 of the largest and most innovative non-financial companies listed on the Nasdaq Stock Market based on market capitalization.

IMPORTANT INFORMATION

The material herein has been provided to you for informational purposes only by iCapital, Inc. (“iCapital”). This material is the property of iCapital and may not be shared without the written permission of iCapital. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of iCapital.

This material is provided for informational purposes only and is not intended as, and may not be relied on in any manner as, legal, tax or investment advice, a recommendation, or as an offer to sell, a solicitation of an offer to purchase or a recommendation of any interest in any fund or security. You should consult your personal accounting, tax and legal advisors to understand the implications of any investment specific to your personal financial situation. This material does not intend to address the financial objectives, situation or specific needs of any individual investor. Alternative investments are complex, speculative investment vehicles and are not suitable for all investors.

The information contained herein is an opinion only, as of the date indicated, and should not be relied upon as the only important information available. Any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets is not necessarily indicative of the future or likely performance. The information contained herein is subject to change, incomplete, and may include information and/or data obtained from third party sources that iCapital believes, but does not guarantee, to be accurate. iCapital considers this third-party data reliable, but does not represent that it is accurate, complete and/or up to date, and it should not be relied on as such. iCapital makes no representation as to the accuracy or completeness of this material and accepts no liability for losses arising from the use of the material presented. No representation or warranty is made by iCapital as to the reasonableness or completeness of such forward-looking statements or to any other financial information contained herein.

Securities products and services are offered by iCapital Markets, an SEC-registered broker-dealer, member FINRA and SIPC, and an affiliate of iCapital, Inc. and Institutional Capital Network, Inc. These registrations and memberships in no way imply that the SEC, FINRA, or SIPC have endorsed any of the entities, products, or services discussed herein. Annuities and insurance services are provided by iCapital Annuities and Insurance Services LLC, an affiliate of iCapital, Inc. “iCapital” and “iCapital Network” are registered trademarks of Institutional Capital Network, Inc. Additional information is available upon request.

© 2023 Institutional Capital Network, Inc. All Rights Reserved.