On July 4th President Trump signed into law the One Big Beautiful Bill Act (OBBBA), extending and making permanent the individual tax rates established under the 2017 Tax Cuts and Jobs Act (TCJA).1 With new provisions introduced and some made permanent, we believe the OBBBA, like the TCJA, will have important implications for economic growth and financial markets. That said, the OBBBA delivers policy clarity and durable tax incentives which should support and create further tailwinds for private markets – particularly within real estate, specifically qualified opportunity funds (QOF), private equity and venture capital.

The Macro Impact of OBBBA

As we discussed in our mid-year outlook, here, more policy certainty was expected in the second half of 2025. With the tax extensions now signed into law, we think market participants will get more comfortable with the economic outlook, especially as the tax bill should help offset some of the drag from the Administration’s tariff policy.

While the OBBA should be supportive of growth, there are concerns surrounding the bill – specifically how it will add to the national debt and budget deficit. Based on the latest scoring, the bill is expected to increase the national debt by $4.1 trillion.2 However, this will be partially offset by the revenue raised from tariffs. Indeed, it is currently estimated that tariffs are generating roughly $200 billion in annualized revenue year-to-date (YTD) and is expected to raise $2.5 trillion over a 10-year budget window.3 Given the deficit impact may not be as large as initially anticipated, this may reduce some of the upward pressure on yields, especially as the U.S. 10-year Treasury remains around 4.5% – or the high-end of the range we thought it would trade this year.4

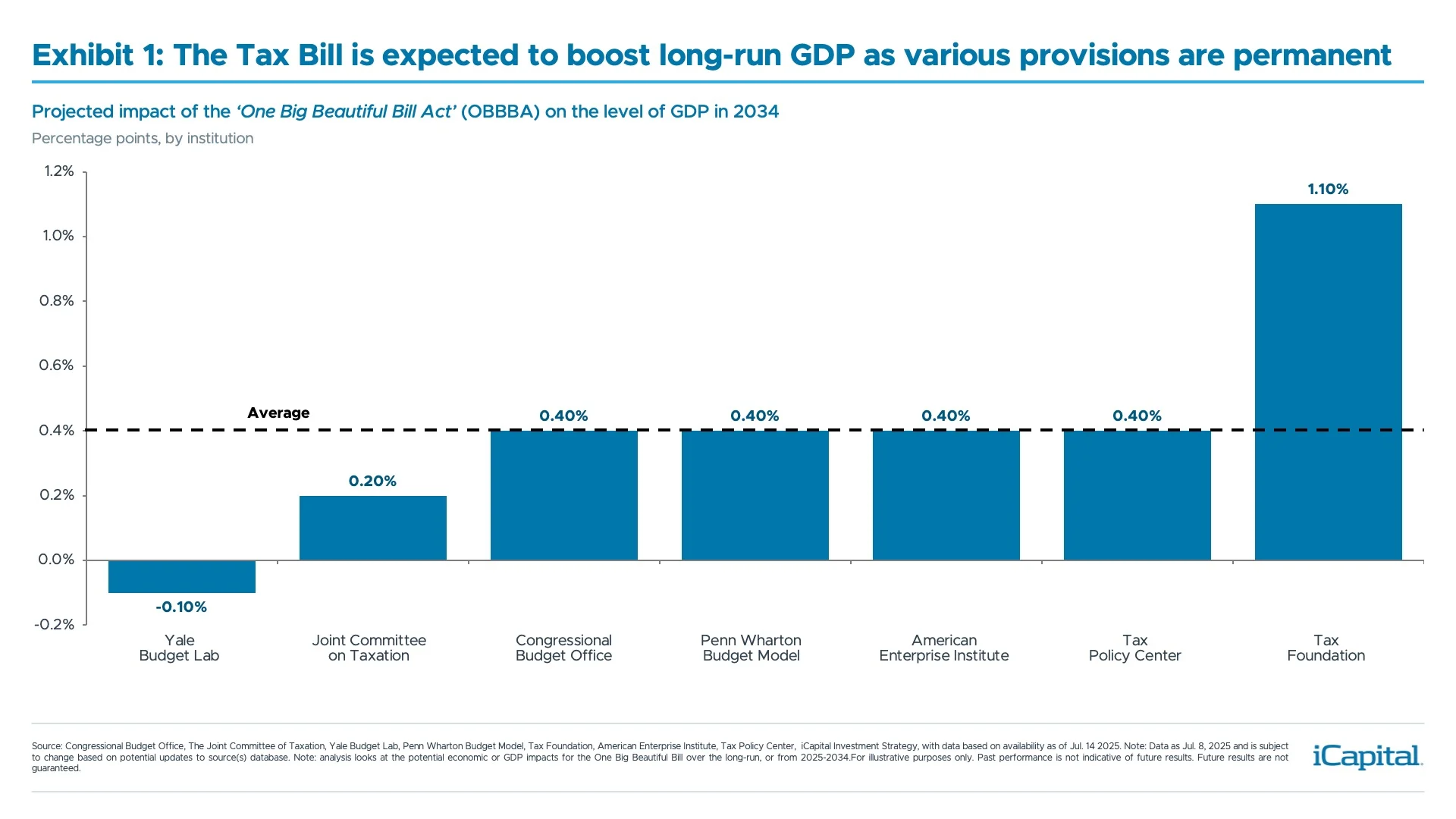

But, this bill should also provide a tailwind for economic growth. Indeed, the OBBBA is expected to boost growth by 0.1% to 0.2% this year, and by 0.5% to 1.2% in 2026.5 However, these economic tailwinds are not just limited to the near-term outlook. Given several key provisions in the bill were made permanent, this should be supportive of long-run GDP growth. Indeed, based on various estimates, this could boost long-run GDP by an average 0.4% (Exhibit 1).6

The extension of the tax cuts is also expected to support U.S. consumers, as after-tax income should rise by 2.9% this year and 5.4% in 2026 – with 85% of households receiving a tax cut in 2026.7 Specifically, consumers in the middle-income cohort are expected to see the largest increase in take home pay next year as measures such as no tax on overtime, tips and the bonus deduction for seniors should all benefit this cohort.8

The extension of the tax cuts is also expected to support U.S. consumers, as after-tax income should rise by 2.9% this year and 5.4% in 2026 – with 85% of households receiving a tax cut in 2026.7 Specifically, consumers in the middle-income cohort are expected to see the largest increase in take home pay next year as measures such as no tax on overtime, tips and the bonus deduction for seniors should all benefit this cohort.8

Implications for Private Markets – Key Legislative Changes We are Monitoring:

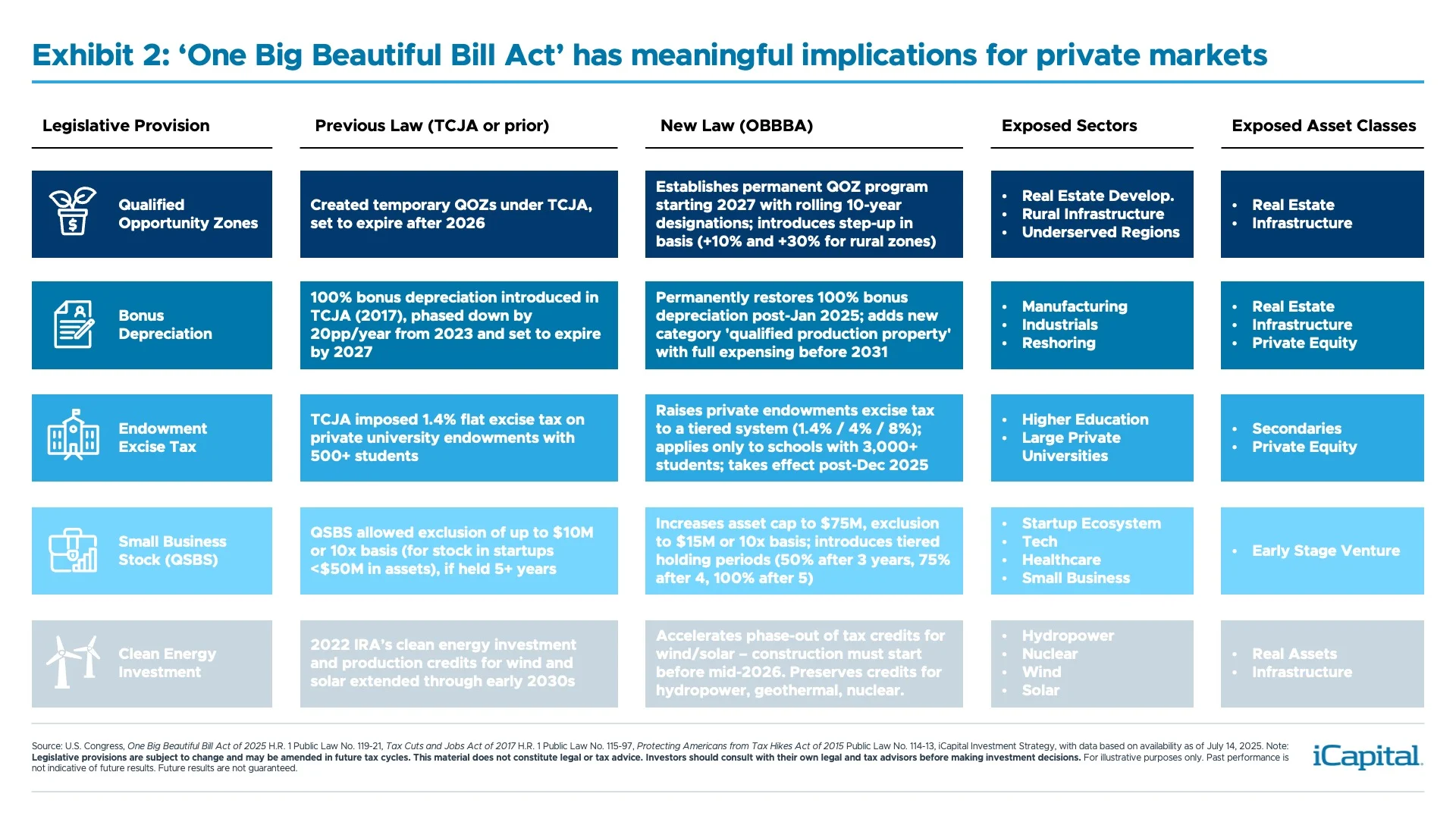

Against this backdrop, we highlight five key provisions and legislative changes in the OBBBA that we believe are especially relevant to private market investors. Further, we look to explain their nature, importance and potential impacts going forward.

1. Permanent Renewal of the Qualified Opportunity Zone Program:

1. Permanent Renewal of the Qualified Opportunity Zone Program:

What is it: The bill created a permanent qualified opportunity zone (QOZ), with a 10-year rolling designation.9 This will take effect on January 1, 2027, when the new decennial designation begins – reflecting current economic conditions, versus relying on the 2010 census data.10 The provision was designed to take capital gains and reinvest them in economically underrepresented areas. Based on the current write-up of this provision, it would increase the investment basis by 10% for all QOZs and raise it to 30% for qualified rural areas.11 In addition, qualified opportunity funds (QOFs)12 must invest 90% of their assets in QOZs.13

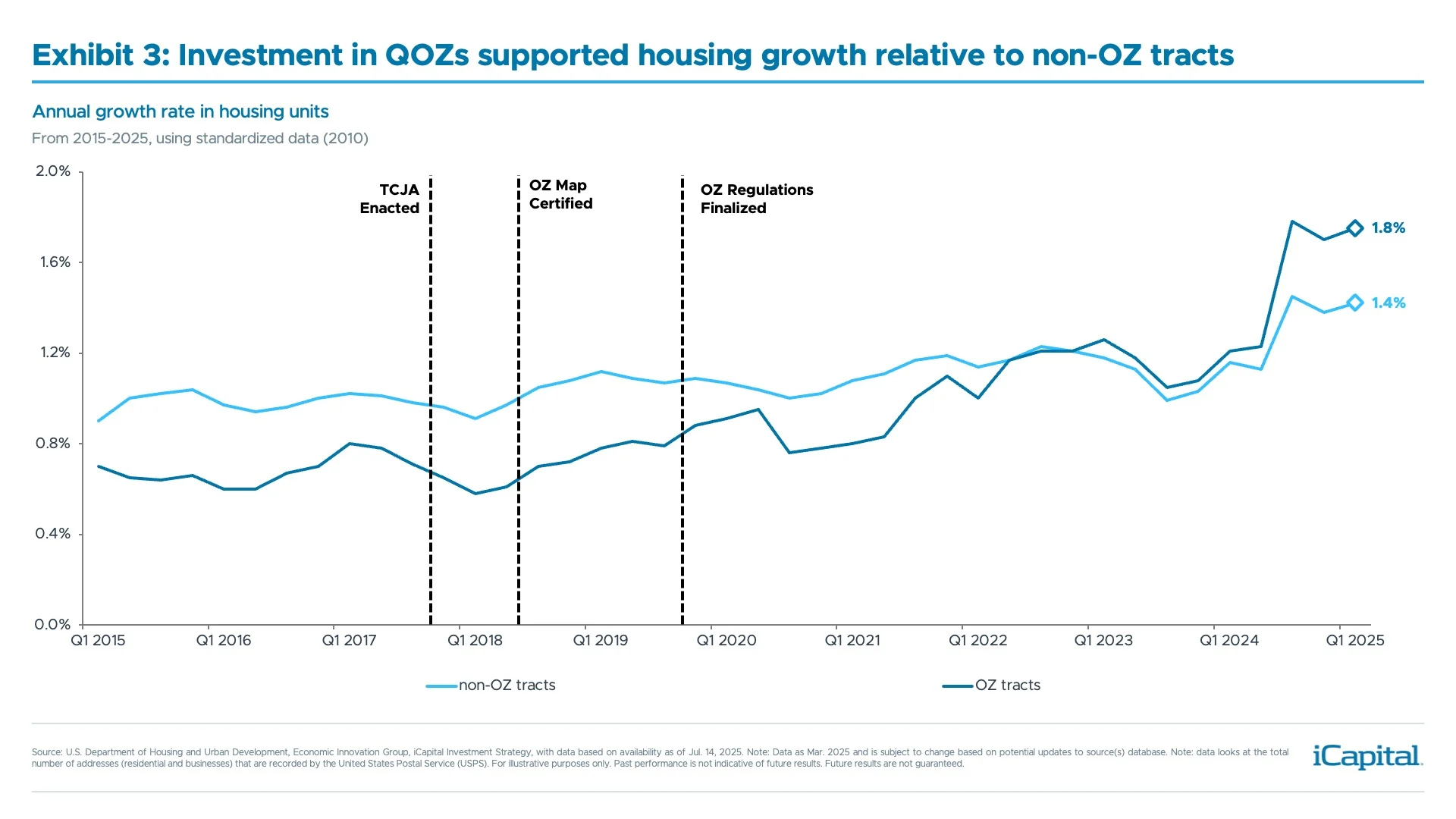

Why it matters: It is estimated that 35 million people currently live in Opportunity Zones.14 Based on recent studies, it was believed that QOZs boosted employment growth by 3.0% to 4.5%15, had a “large and immediate effect” on development activity across 47 large cities16 and led to an increase in 313,000 housing units, that otherwise wouldn’t have been built, from 2019 to 2024 (Exhibit 3).17 However, urban areas were the biggest beneficiaries, which is why we think the provision has a bigger basis step-up to incentivize investment in rural Opportunity Zones.

Implications for Private Markets: With more than $100 billion of invested capital going into opportunity zones from 2018-2024, we would expect to see an increase in fundraising for real estate funds over the course of 2026 as the QOZ provision will take effect in 2027.18 This would build on the momentum from this year, as fundraising activity is expected to outpace 2024 levels – specifically for QOFs and opportunistic funds.19 Real estate general partners (GPs) may also benefit from the permanent extension of the New Markets Tax Credit, which is meant to attract private capital for low-income communities.

2. Reinstatement and Expansion of Bonus Depreciation:

2. Reinstatement and Expansion of Bonus Depreciation:

What is it: The OBBBA permanently restores full 100% bonus depreciation, allowing businesses to immediately deduct the entire cost of qualifying assets acquired and placed in service after January 19, 2025.20 This reverses the phase-out schedule introduced by the 2017 TCJA, which had reduced the deduction by 20 percentage points annually beginning in 2023 with full expiration by 2027.21 The bill also introduces a new category of “qualified production property” – primarily assets used for manufacturing, refining, or processing – that qualifies for full expensing if placed in service before 2031.22

Why it matters: This provision could spur investment in physical infrastructure. Immediate expensing can lower the after-tax cost of capital, boosts cash flows, and improve returns. Indeed, this provision could lift private-sector investment growth by two percentage points over the next year.23 And over the longer run, it could add +0.6% to U.S. GDP.24

Implications for Private Markets: This is a meaningful tailwind for private equity portfolio companies with near-term capex plans, as it can enhance after-tax IRRs and shorten payback periods. It also strengthens the case for strategies focused on industrial real estate, domestic manufacturing, and infrastructure, especially when considering that the provision could drive renewed interest in domestic production and reshoring themes.

3. Increase to Higher Education Endowment Tax:

What is it: Building on the 2017 TCJA push to tax endowments, the OBBBA significantly raises the tax burden – raising the excise tax on investment income of private college and university endowments from a flat 1.4% to a tiered rate of up to 8.0%, based on the size of the institution.25 At the same time, it narrows the scope of institutions subject to the tax, exempting schools with fewer than 3,000 full-time paying students compared to 500 previously under TCJA. These changes apply to each university’s full taxable year that begins after December 31, 2025—meaning most institutions likely won’t be affected until late 2026 or even 2027, depending on their fiscal year.26

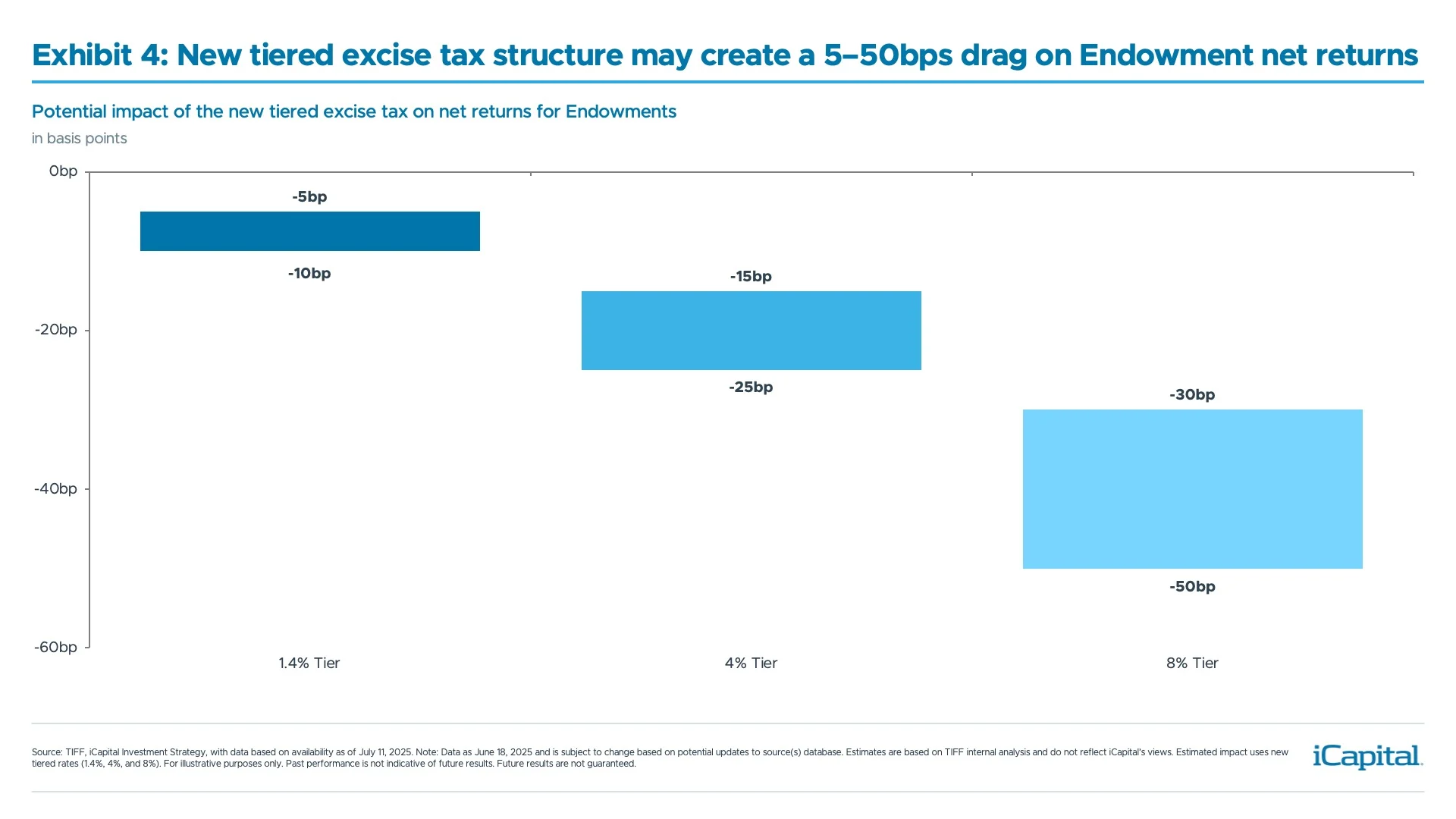

Why it matters: In 2023, under TCJA’s flat 1.4% tax, 56 universities paid a combined $380 million.27 Under the OBBBA, while only around 45 institutions28 may now qualify, those with larger student-adjusted endowment values will pay materially more. Yale and Harvard alone are projected to owe an estimated $280 million29 and $200 million30 per year, respectively—up sharply from prior years. That said, with nearly half of qualifying schools now facing rates above the former 1.4% baseline, the higher tax could reduce net returns, pressure liquidity, and prompt reassessments of spending and portfolio construction.

Implications for Private Markets: Based on the new tiered rates (1.4%, 4.0%, and 8.0%), the estimated drag on endowment net returns could range from -5 basis points (bps) to -50bps (Exhibit 4).31 As a result, endowments may raise their required rate of return, leading to greater performance pressure on GPs. And in the near-term, some endowments may look to offload top-performing assets before the tax increase takes effect, potentially increasing deal activity in the secondaries market. Over the longer term, however, endowments are likely to lean further into private markets, particularly seeking more small and middle market deals, as a way to build tax-free unrealized gains through long-duration alternative strategies.32

4. Qualified Small Business Stock (QSBS) Benefit Expanded:

4. Qualified Small Business Stock (QSBS) Benefit Expanded:

What is it: The OBBBA preserves and expands the QSBS tax exemption, which allows founders and investors in eligible early-stage companies to avoid capital gains taxes incurred when selling qualifying stock or exiting an investment. Under prior law, investors and founders in qualifying startups with assets under $50 million could exclude up to $10 million (or 10x their investment basis, whichever is greater), if held for at least five years.33 The OBBBA raises the asset cap to $75 million, increases the maximum exclusion to $15 million (or 10x investment basis), and introduces a tiered holding period: 50% of gains excluded after three years, 75% after year four, and 100% in following years.34 Importantly, only stock acquired after the bill’s enactment on July 4, 2025 qualifies for the updated enhancements.35

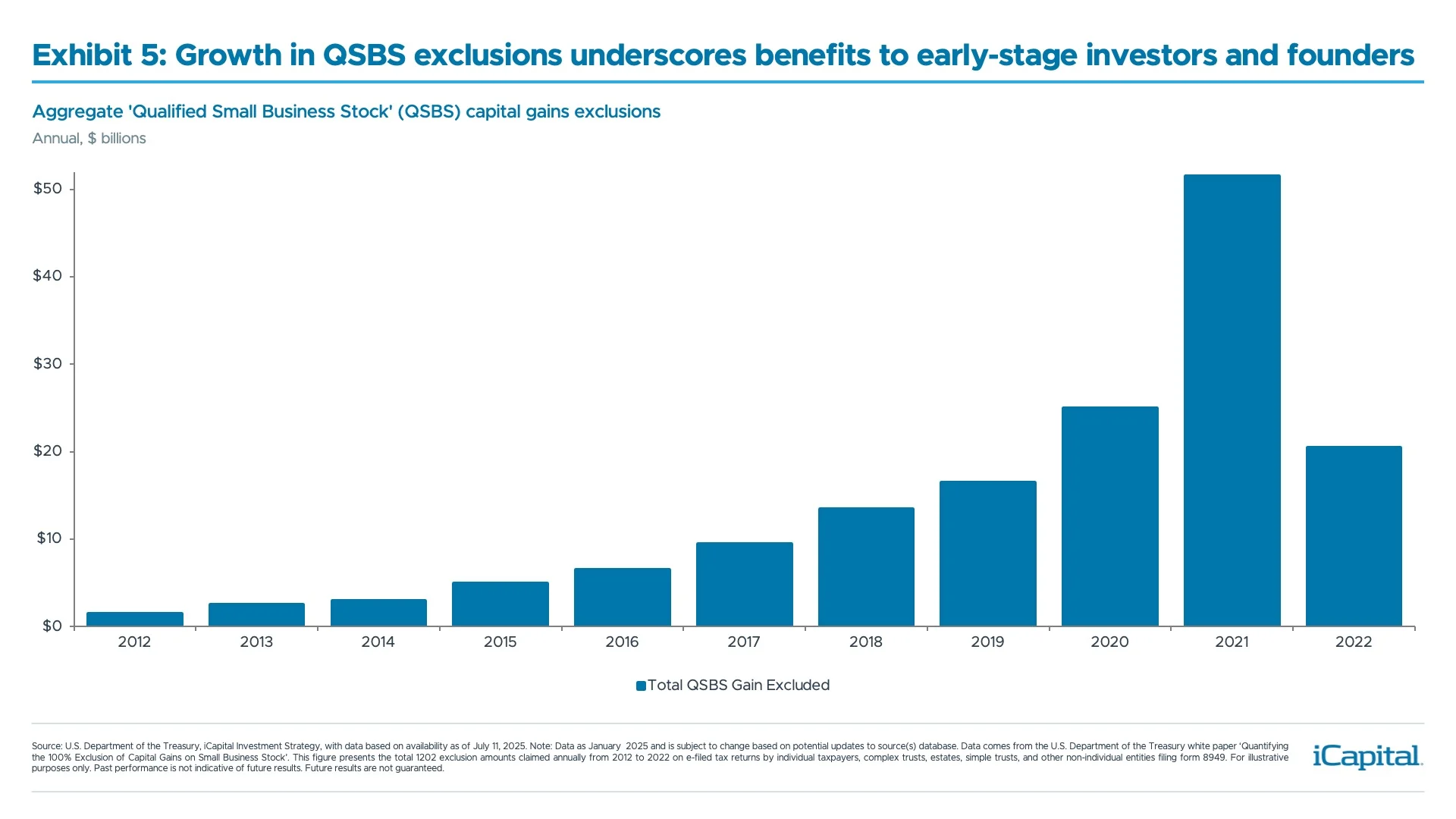

Why it matters: According to the Treasury, nearly 33,000 founders and investors have benefited from the QSBS exemption each year over the past decade, with $20 to $50 billion in gains claimed annually in recent years (Exhibit 5).36 By raising the asset and exclusion limits and introducing partial exclusions starting after just three years, the OBBBA makes QSBS more attractive. Indeed, under the new law, GPs and limited partners (LPs) in early-stage venture capital funds could potentially realize up to $749 million in tax-exempt gains on a $74.9 million investment – assuming a sale at 10x basis – highlighting the potential advantages for both GPs and LPs.37

Implications for Private Markets: QSBS expansion is a clear win for the startup and venture ecosystem and may drive incremental allocations to early-stage deals. For GPs and venture managers, the increased exclusion cap and accelerated benefit timeline could boost demand for early-stage exposure—particularly within tax-sensitive vehicles and separately managed accounts. From a sector deployment perspective, the law is most valuable for those in high-growth sectors like technology or biotech that can grow quickly and generate large capital gains.

5. Reset in Clean Energy Investment:

5. Reset in Clean Energy Investment:

What is it: Rather than a single provision, the OBBBA includes a series of changes that, on net, scales back parts of the 2022 Inflation Reduction Act’s (IRA) energy transition agenda. Most notably, it accelerates the phase-out of clean energy investment (ITC) and production (PTC) tax credits for wind and solar – requiring projects to start construction before July 5, 2026, or be placed in service by the end of 2027, shortening the prior timelines by up to three years.38 In contrast, the bill largely preserves incentives for alternative renewables like hydropower, nuclear, and geothermal.

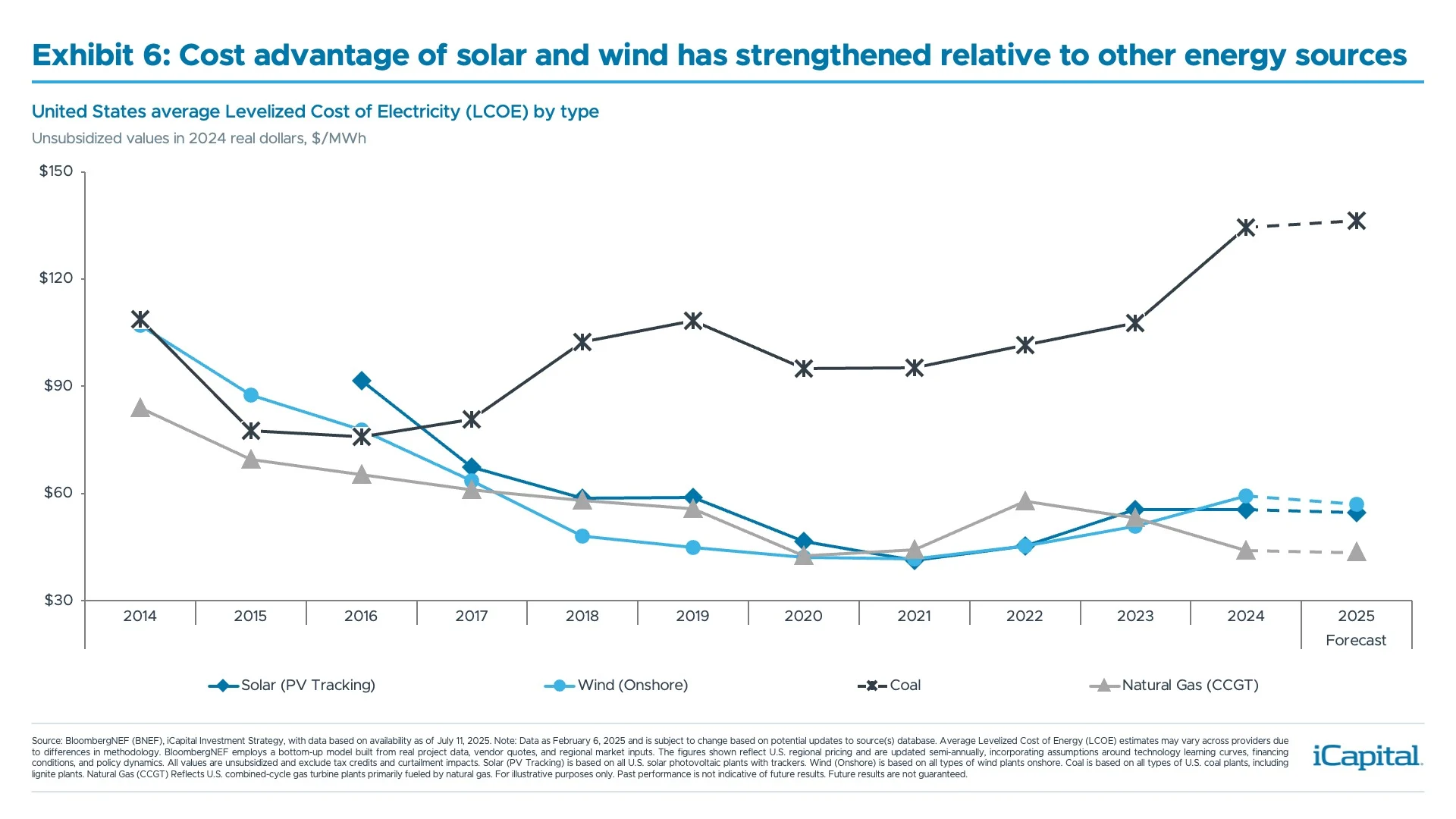

Why it Matters: By accelerating the phase-out of tax credits for wind and solar, the bill may introduce some near-term uncertainty that could, in theory, slow momentum for these renewables and redirect capital toward alternative clean energy technologies. However, because wind and solar remain among the lowest-cost sources of power39 – cheaper than conventional sources like oil and on par with natural gas – their market share is likely to keep expanding regardless (Exhibit 6). In fact, that cost advantage may have been one reason why policymakers pushed for an earlier phase-out. Meanwhile, interest in other clean energy sources may continue to grow, though much of that – particular for nuclear – is likely being driven by more structural themes around AI and data center demand.40

Implications for Private Markets: The earlier phase-out of wind and solar credits may drive a near-term flurry of deal activity through mid-2026, as GPs try to lock in renewable infrastructure projects before the new deadline. Over the longer term, interest in wind and solar opportunities will likely remain strong given their favorable cost dynamics. That said, managers may still look to diversify exposure by increasing allocations to other areas still benefiting from tax incentives, such as nuclear or geothermal—though the scale and timing of that shift remain unknown and unclear.

In addition to the key provisions that made it into the final version of the bill, several notable proposals were either excluded or never made it into the initial draft—many of which would have posed headwinds for GPs and LPs. Notably, no changes were made to carried interest treatment, preserving a key source of compensation for GPs. Large private foundations avoided new tax hikes, despite proposals in earlier drafts. The Senate also scrapped the House-passed Section 899 “Retaliatory Tax”41 which would have been a negative for GPs that rely on non-U.S. holding companies to own U.S. assets, along with offshore funds structured as master-feeder arrangements.

Key Provisions Should Set Up a Multi-Year Opportunity for Several Alternative Asset Classes:

The OBBBA provides meaningful fiscal clarity and extends many pro-growth provisions from the 2017 TCJA. While concerns around deficits and the tariff overhang remain, the bill’s mix of permanent and targeted provisions creates a more durable backdrop – one that provides powerful structural tailwinds that should support private market activity in the years ahead. This backdrop offers fresh momentum at a time when markets have been seeking greater clarity and certainty. We see this as being a catalyst for a multi-year upswing in private market activity, namely across real estate, private equity, and venture capital.

ENDNOTES

- Legislative provisions are subject to change and may be amended in future tax cycles. This material does not constitute legal or tax advice. Investors should consult with their own legal and tax advisors before making investment decisions

- Committee for a Responsible Federal Budget, as of June 30, 2025.

- Congressional Budget Office, as of Jun. 4, 2025.

- Bloomberg Index Services, as of July 8, 2025.

- Tax Policy Center, Tax Foundation, as of July 8, 2025.

- Yale Budget Lab, Join Committee on Taxation, Congressional Budget Office, Penn Wharton Budget Model, American Enterprise Institute, Tax Policy Center, Tax Foundation and iCapital Investment Strategy, as of July. 8, 2025.

- Tax Policy Center, as of July 3, 2025.

- Tax Policy Center, as of July 3, 2025.

- S. Congress, One Big Beautiful Bill Act, H.R. 1, Public Law No. 119-21, § 70421, as of July 4, 2025.

- S. Congress, One Big Beautiful Bill Act, H.R. 1, Public Law No. 119-21, § 70421, as of July 4, 2025.

- S. Congress, One Big Beautiful Bill Act, H.R. 1, Public Law No. 119-21, § 70421, as of July 4, 2025.

- Note: Qualified Opportunity Funds (QOFs) are investment vehicles established as part of the 2017 Tax Cuts and Jobs Act (TCJA) to incentivize investments in designated economically distressed areas known as Opportunity Zones (OZs)

- S. Congress, One Big Beautiful Bill Act, H.R. 1, Public Law No. 119-21, § 70421, as of July 4, 2025.

- Northern Trust, as of Jun. 30, 2025.

- Arefeva, Alina and Davis, Morris A. and Ghent, Andra C. and Park, Minseon, The Effect of Capital Gains Taxes on Business Creation and Employment: The Case of Opportunity Zones (July 3, 2023).

- Coyne, David and Johnson, Craig E., Use of the Opportunity Zone Tax Incentive: What the Tax Data Tell Us (November 22, 2022).

- Economic Innovation Group, HUD, as of Mar. 2025.

- Urban Institute, as of May 12, 2025.

- Preqin, as of Jul. 9, 2025.

- S. Congress, One Big Beautiful Bill Act, H.R. 1, Public Law No. 119-21, §70301, as of July 4, 2025. Note: Qualifying assets acquired and placed in service between January 1 and January 19, 2025, remain subject to the previous 40% bonus depreciation rate for the year 2025 under TCJA.

- S. Congress, Tax Cuts and Jobs Act, H.R. 1, Public Law No. 115-97, §13201, as of December 22, 2017.

- S. Congress, One Big Beautiful Bill Act, H.R. 1, Public Law No. 119-21, §70307, as of July 4, 2025.

- Goldman Sachs, US Economics Analyst: 2025 Capex Outlook, as of November 11, 2024. Note: Potential changes to investment growth is based on estimates from economic research of the impact of the 2017 tax cuts on investment, per Goldman Sachs.

- Tax Foundation General Equilibrium Model, as of June 2025

- S. Congress, One Big Beautiful Bill Act, H.R. 1, Public Law No. 119-21, §70415, as of July 4, 2025.

- S. Congress, One Big Beautiful BillAct, H.R. 1, Public Law No. 119-21, §70415, as of July 4, 2025. Note: For example, Harvard University, for example, would begin paying its new tax rate on returns generated in 2027 given its fiscal year starts July 1, 2026 and ends June 30, 2027.

- IRS Statistics of Income, Table 1. Excise Taxes Reported by Charities, Private Foundations, and Split-Interest Trusts on Form 4720, as of July 9, 2025.

- NACUBO-Commonfund Study of Endowments, as of July 2025.

- Yale University, Office of the President – Update on tax legislation, as of July 3, 2025.

- The Harvard Crimson, as of July 5, 2025.

- TIFF, as of June 18, 2025.

- Buyouts Insider, Looming endowment tax could mean increased PE allocation: Commonfund CEO, as of February 13, 2025.

- S. Congress, Protecting Americans from Tax Hikes Act of 2015, Public Law No. 114-13, as of December 17, 2015.

- S. Congress, One Big Beautiful Bill Act, H.R. 1, Public Law No. 119-21, §70431, as of July 4, 2025.

- S. Congress, One Big Beautiful Bill Act, H.R. 1, Public Law No. 119-21, §70431, as of July 4, 2025.

- S. Department of the Treasury, Quantifying the 100% Exclusion of Capital Gains on Small Business Stock, as of January 2025.

- Note: Under the OBBBA, a taxpayer—whether a founder or investor—can exclude the greater of $15 million or 10x their investment basis under the expanded QSBS rules. In the case of a venture capital fund, the exemption can be allocated across the fund’s limited partners (LPs), as each LP is entitled to their own $15 million QSBS exclusion per qualifying investment.

- S. Congress, One Big Beautiful Bill Act, H.R. 1, Public Law No. 119-21, §70512 and §70513, as of July 4, 2025.

- BloombergNEF, as of March 17, 2025.

- S&PGlobal, iCapital Investment Strategy, as of July 11, 2025.

- United States House Committee on Ways & Means, TheOne, Big, Beautiful, Bill, §112029, as of July 4, 2025. Note: This is the House-based bill and not the final bill.

IMPORTANT INFORMATION

The material herein has been provided to you for informational purposes only by Institutional Capital Network, Inc. (“iCapital Network”) or one of its affiliates (iCapital Network together with its affiliates, “iCapital”). This material is the property of iCapital and may not be shared without the written permission of iCapital. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of iCapital.

This material is provided for informational purposes only and is not intended as, and may not be relied on in any manner as, legal, tax or investment advice, a recommendation, or as an offer or solicitation to buy or sell any security, financial product or instrument, or otherwise to participate in any particular trading strategy. This material does not intend to address the financial objectives, situation, or specific needs of any individual investor. You should consult your personal accounting, tax and legal advisors to understand the implications of any investment specific to your personal financial situation.

ALTERNATIVE INVESTMENTS ARE CONSIDERED COMPLEX PRODUCTS AND MAY NOT BE SUITABLE FOR ALL INVESTORS. Prospective investors should be aware that an investment in an alternative investment is speculative and involves a high degree of risk. Alternative Investments often engage in leveraging and other speculative investment practices that may increase the risk of investment loss; can be highly illiquid; may not be required to provide periodic pricing or valuation information to investors; may involve complex tax structures and delays in distributing important tax information; are not subject to the same regulatory requirements as mutual funds; and often charge high fees. There is no guarantee that an alternative investment will implement its investment strategy and/or achieve its objectives, generate profits, or avoid loss. An investment should only be considered by sophisticated investors who can afford to lose all or a substantial amount of their investment.

iCapital Markets LLC operates a platform that makes available financial products to financial professionals. In operating this platform, iCapital Markets LLC generally earns revenue based on the volume of transactions that take place in these products and would benefit by an increase in sales for these products.

The information contained herein is an opinion only, as of the date indicated, and should not be relied upon as the only important information available. Any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets is not necessarily indicative of the future or likely performance. The information contained herein is subject to change, incomplete, and may include information and/or data obtained from third party sources that iCapital believes, but does not guarantee, to be accurate. iCapital considers this third-party data reliable, but does not represent that it is accurate, complete and/or up to date, and it should not be relied on as such. iCapital makes no representation as to the accuracy or completeness of this material and accepts no liability for losses arising from the use of the material presented. No representation or warranty is made by iCapital as to the reasonableness or completeness of such forward-looking statements or to any other financial information contained herein.

Securities products and services are offered by iCapital Markets, an SEC-registered broker-dealer, member FINRA and SIPC, and an affiliate of iCapital, Inc. and Institutional Capital Network, Inc. These registrations and memberships in no way imply that the SEC, FINRA, or SIPC have endorsed any of the entities, products, or services discussed herein. Annuities and insurance services are provided by iCapital Annuities and Insurance Services LLC, an affiliate of iCapital, Inc. “iCapital” and “iCapital Network” are registered trademarks of Institutional Capital Network, Inc. Additional information is available upon request.

©2025 Institutional Capital Network, Inc. All Rights Reserved.