For decades, infrastructure investing has been synonymous with government-funded highways, airports, and utilities. But today, that is changing. Aging infrastructure, the global energy transition, and the recent growth in digital infrastructure – think AI and Data Centers – are creating some of the most compelling investment opportunities today.

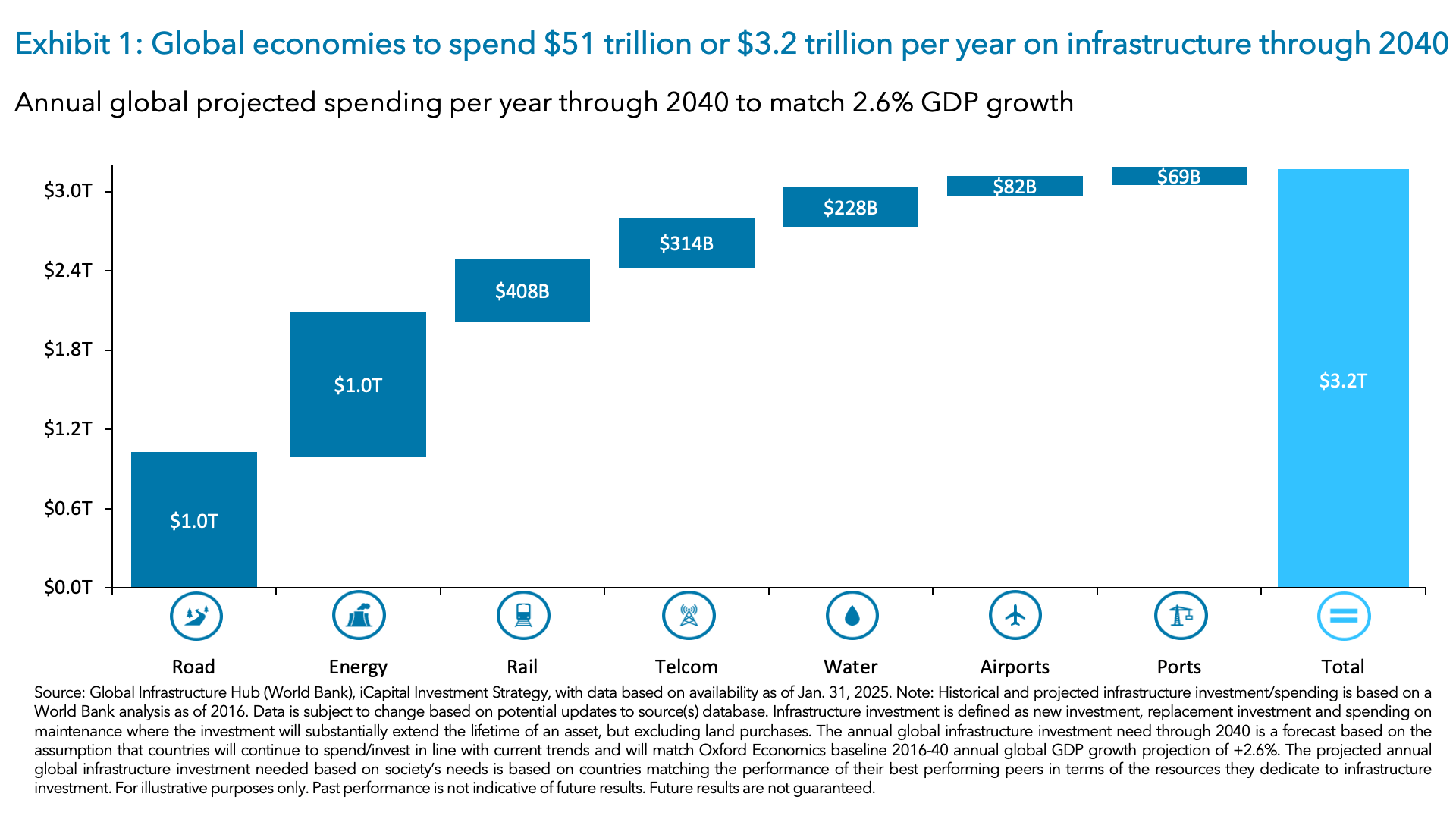

And the scale of it is staggering. Just to keep up with economic and population growth across the globe, we will need an astounding $51 trillion in infrastructure investment through 2040 or about $3.2 trillion per year (Exhibit 1).1 But, with government budgets increasingly constrained, private capital is stepping in to meet the demand.

An Expanding Opportunity Set

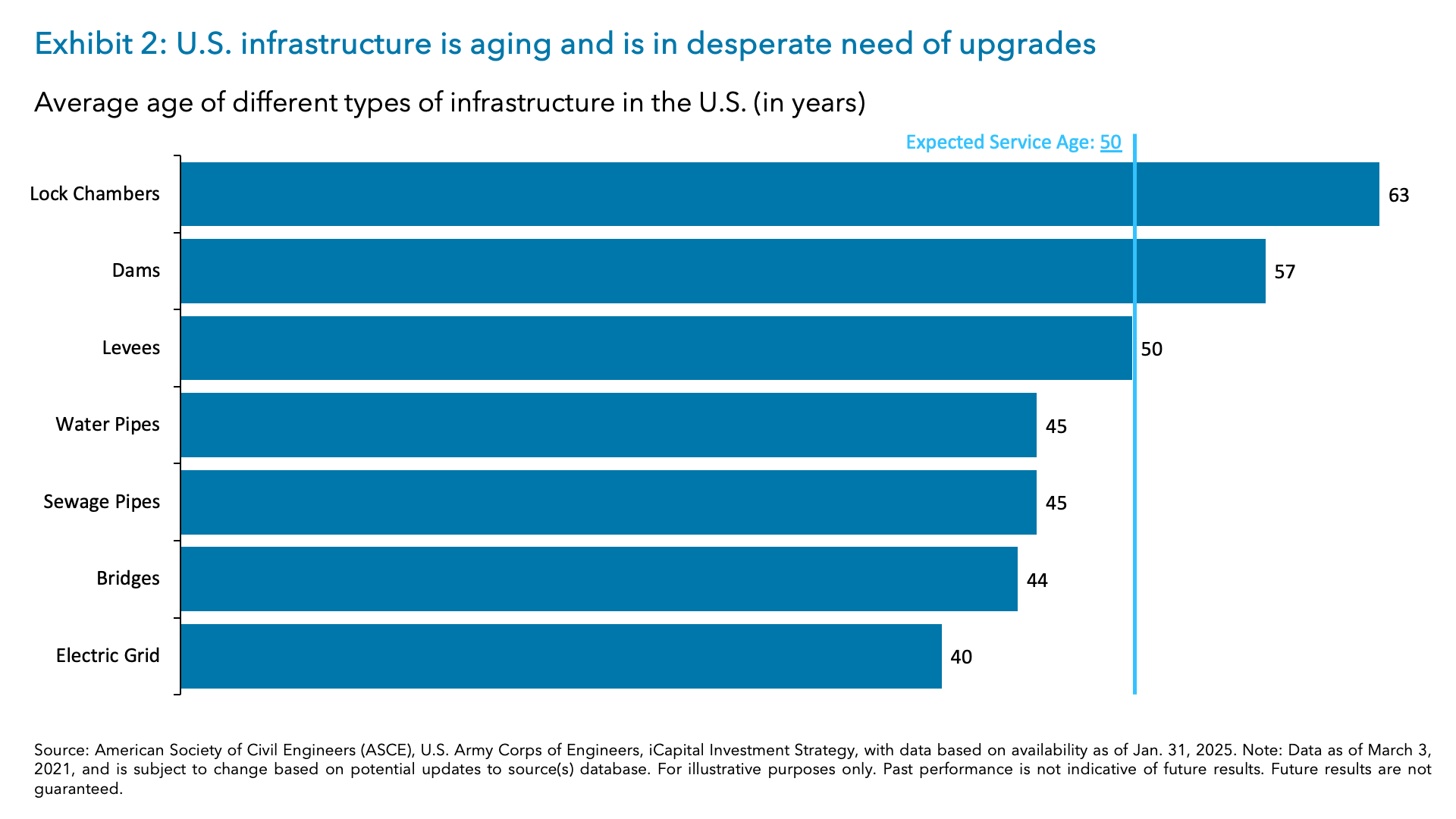

So what’s driving this? Well, for starters, much of the developed markets infrastructure is aging and is in desperate need of upgrades. In the U.S., nearly 43% of roads and over 46,000 bridges are in poor condition and deemed structurally deficient.2 In fact, most U.S. infrastructure is at or near its useful life (Exhibit 2). The average age of the U.S. electric grid? 40 years. Water systems? 45 years though some date back over a century. Oh, and everyone’s favorite – the New York City subway? Over 120 years old, and within a decade, nearly 75% of its power substations will be more than 50 years old.3

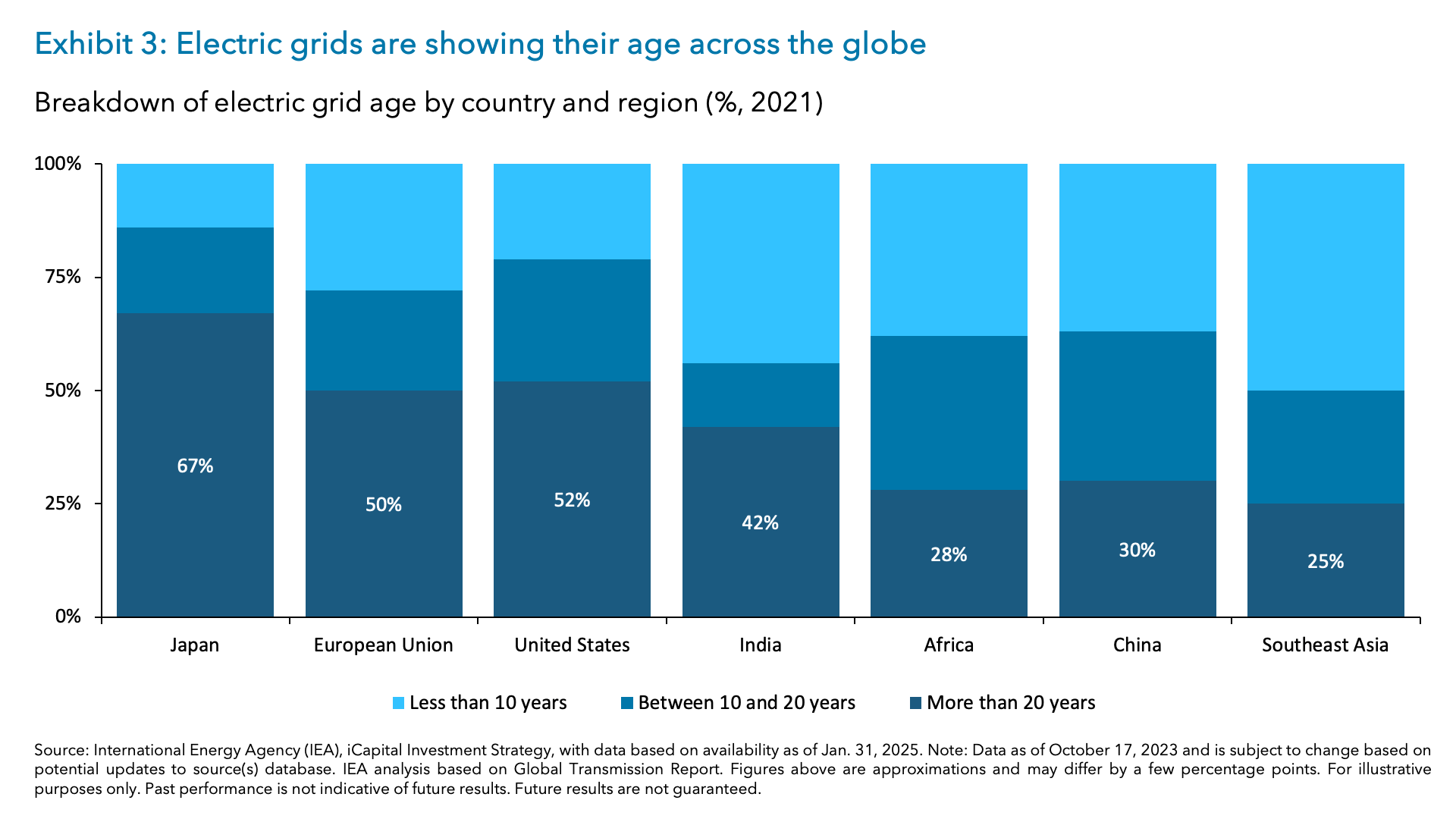

And it’s not just the U.S. In Europe, 40% of the electric grid is over 40 years old.4 In Japan, more than 60% of its grid is halfway through its useful life (Exhibit 3),5 and much of its physical infrastructure (roads, bridges, etc.) is around 50 years old.6 The need for upgrades is urgent.

Second, there’s the energy transition. The global shift toward renewables and clean energy is creating a multi-trillion-dollar investment cycle. Indeed, by 2030, around $4.5 trillion will need to be invested annually in clean energy to meet net-zero goals.7 That includes everything from solar and wind farms to battery storage and EV charging networks.

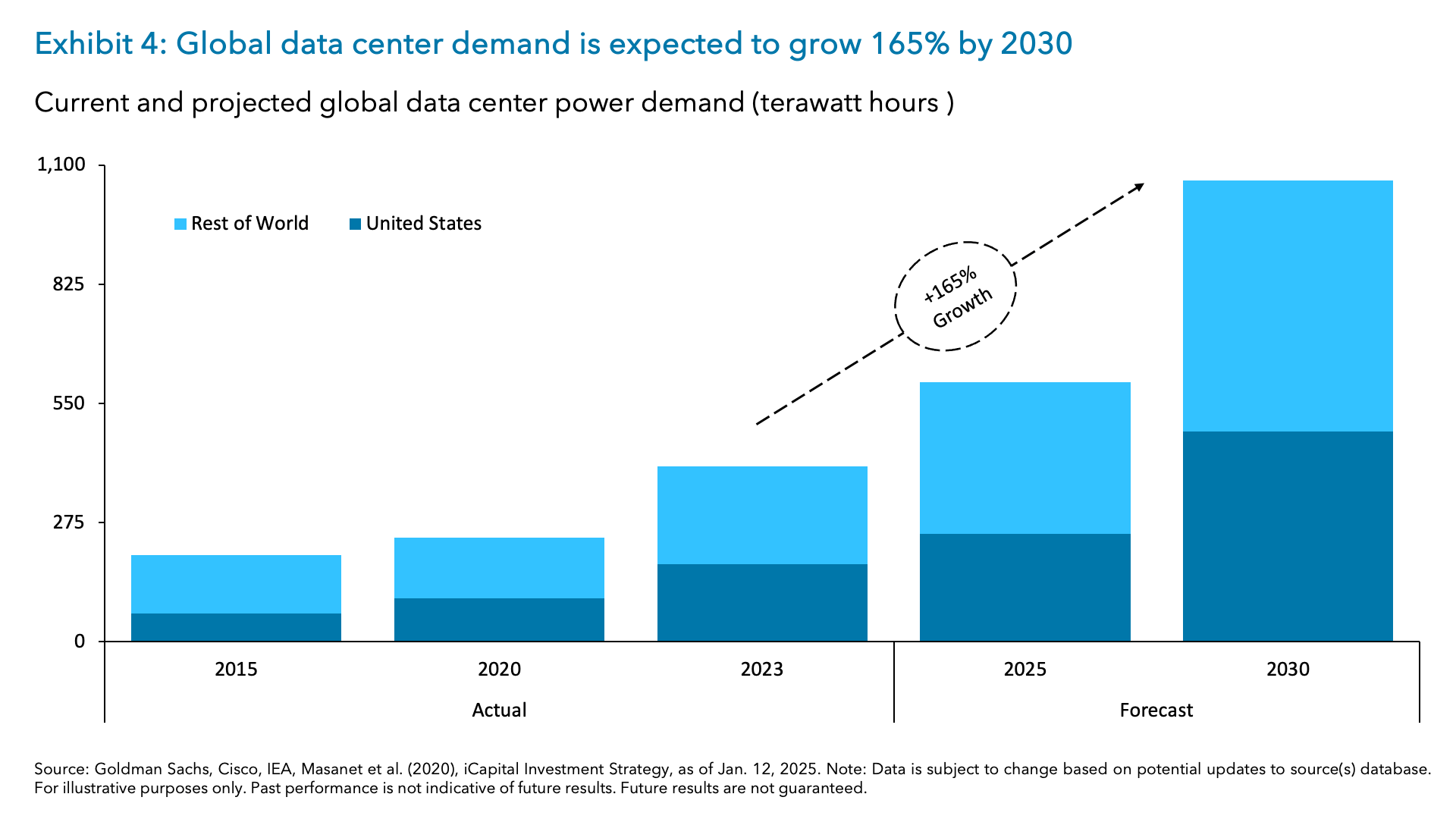

And then there’s digital infrastructure – the backbone of today’s economy. The growth in cloud computing and artificial intelligence is driving demand for data centers. By 2030, global data center power demand is expected to soar +165%, with the U.S. driving nearly 40% of that growth (Exhibit 4).8 To keep up, this means the U.S. will need to double its data center capacity by 2030 or add the equivalent of three New York Cities worth of power demand by 2030.9

Private Capital Is Stepping Up

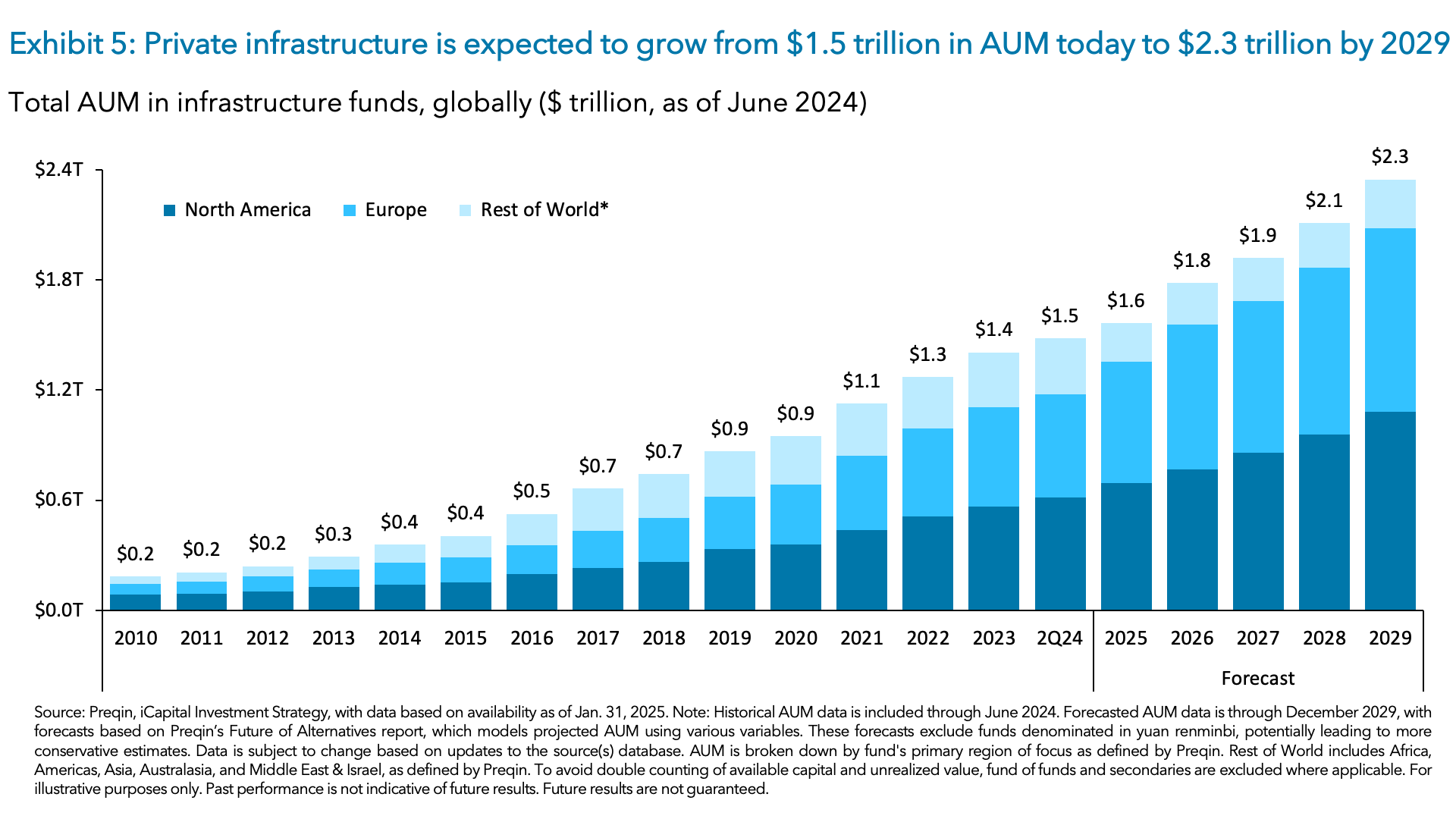

But here’s the challenge – governments are facing rising budget constraints and can’t fill this gap alone. That’s where private capital is increasingly stepping in. Over the past five years (2020-24) private infrastructure funds have raised more than $625 billion and currently have $350 billion in dry powder waiting to be deployed.10 Deal activity was strong last year and is not likely to slow down. The asset class is expected to grow from $1.5 trillion in AUM as of the second quarter of 2024 to $2.3 trillion by 2029 (Exhibit 5).11

It is also worth noting that since infrastructure assets are relatively expensive today, funds in this space are larger than average and often managed by firms with platform scale.12 Major players like Blackstone, KKR, and Brookfield have launched multi-billion-dollar funds targeting everything from toll roads to data centers in recent years.

Why Investors Are Paying Attention

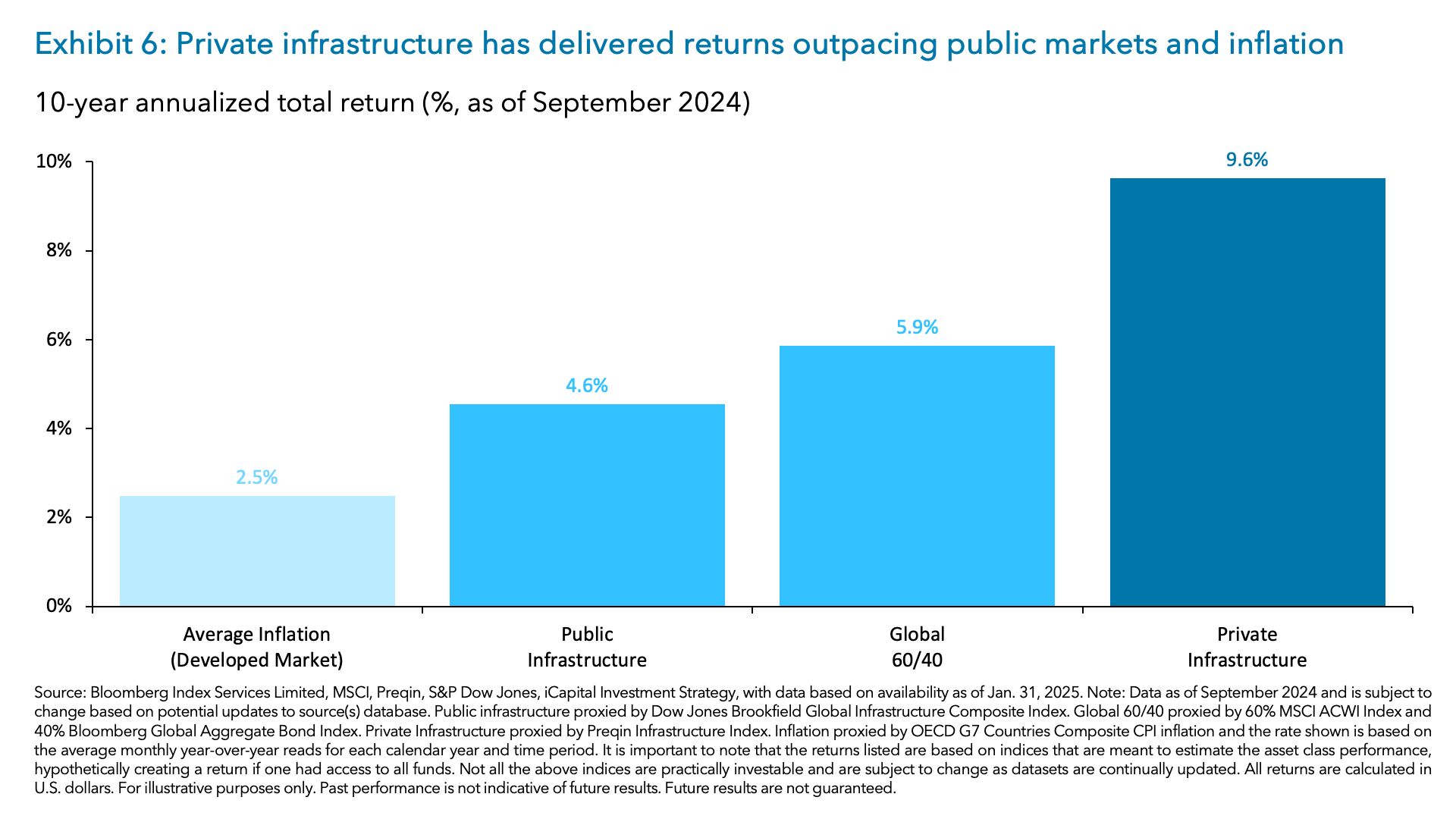

For investors, this is a major opportunity. First, infrastructure continues to deliver strong, inflation-protected returns. Over the past decade, private infrastructure has generated an annualized return of +9.6%, far outpacing the global 60/40 portfolio’s annualized return of 5.9% and average developed market (G7 Countries) inflation of 2.5% (Exhibit 6).13 Second, the broadening of the asset class into digital infrastructure means greater growth potential.

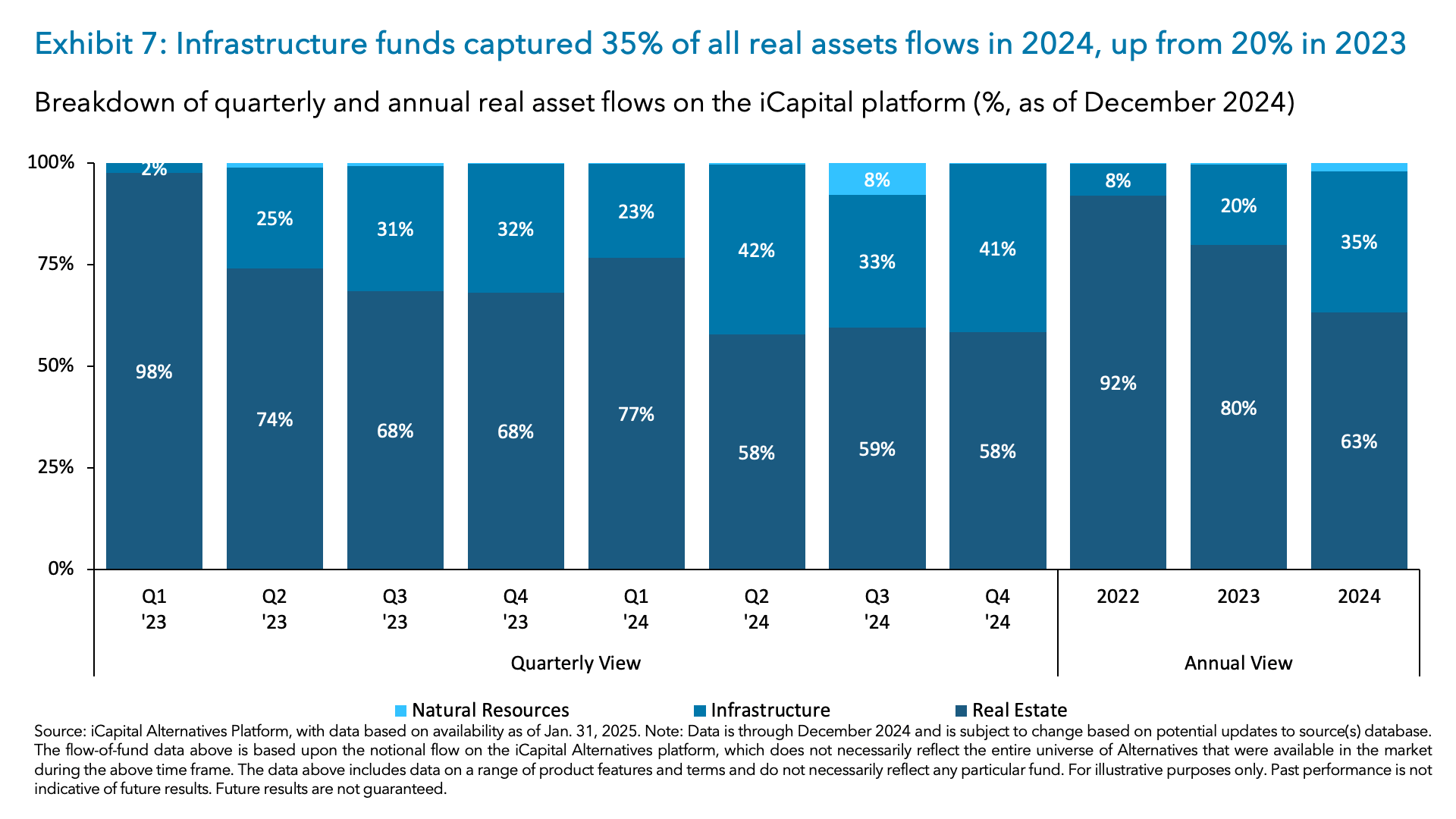

With stable cash flows and powerful secular growth drivers, this space is becoming an increasingly attractive part of private markets. Indeed, at iCapital, we’re seeing this play out in real time. In 2024, 35% of real assets flows on our platform were directed into infrastructure funds, up from 20% in 2023 and just 8% in 2022 (Exhibit 7).14

The Bottom Line

The world is undergoing a once-in-a-generation infrastructure transformation and governments can’t meet the challenge alone. From aging infrastructure to energy transition to digital infrastructure, the opportunity set is larger than ever, and private capital is playing a critical role.

For investors, that means exposure to long-term, inflation-protected cash flows in an asset class that now offers both stability and growth potential.

To dive deeper into private capital’s role in infrastructure investing, check out our latest Beyond 60/40 episode, where we sit down with Keith Derman, Partner and Co-Head of Ares Infrastructure Opportunities at Ares Management.

1. Global Infrastructure Hub (World Bank), iCapital Investment Strategy, as of Jan. 31, 2025.

2. American Society of Civil Engineers (ASCE), “America's Infrastructure Report Card 2021”, as of Mar. 3, 2021,

3. Metropolitan Transportation Authority (MTA), “MTA 20-Year Needs Assessment”, as of Feb. 6, 2025.

4. European Commission, “EU Action Plan for Grids”, as of Nov. 2023.

5. International Energy Agency (IEA), “Electricity Grids and Secure Energy Transitions”, as of Oct. 17, 2023.

6. International Trade Administration, Japan’s Ministry of Land, Infrastructure, and Transportation (MLIT), as of Apr. 4, 2023.

7. International Energy Agency (IEA), “Net Zero Roadmap”, as of Sep. 2023.

8. Goldman Sachs, “GS Sustain - AI/data centers' global power surge”, as of Jan. 12, 2025.

9. Apollo, NYISO 2022, McKinsey, Nextgen, as of Oct. 25, 2024.

10. Preqin, iCapital Investment Strategy, as of Jan. 31, 2025.

11. Preqin, iCapital Investment Strategy, as of Jan. 31, 2025.

12. Preqin, iCapital Investment Strategy, as of Jan. 31, 2025.

13. Bloomberg Index Services Limited, MSCI, Preqin, iCapital Investment Strategy, as of Sep. 2024. Note: The Group of Seven (G7) countries are Canada, France, Germany, Italy, Japan, the United Kingdom, and the United States.

14. iCapital Alternatives Platform, with data based on availability as of Jan. 31, 2025. Note: Data is through December 2024 and is subject to change based on potential updates to source(s) database. iCapital Flow-of-Funds data is based upon the notional flow on the iCapital Alternatives platform, which does not necessarily reflect the entire universe of Alternatives that were available in the market during the above time frame. The data above includes data on a range of products and funds and do not necessarily reflect any particular fund.

INDEX DEFINITIONS

Bloomberg Global Aggregate Bond Index: A flagship measure of global investment grade debt from a multitude local currency markets. This multi-currency benchmark includes treasury, government-related, corporate and securitized fixed-rate bonds from both developed and emerging markets issuers.

Dow Jones Brookfield Global Infrastructure Composite Index: An index designed to measure the performance of pure-play infrastructure companies domiciled globally. The index covers all sectors of the infrastructure market and includes Master Limited Partnerships (MLPs) in addition to other equity securities. To be included in the index, a company must derive at least 70% of cash flows from infrastructure lines of business.

OECD Major 7 CPI Total Index: A consumer price index for all items non-food non-energy for G7 countries. The Group of Seven (G7) countries are Canada, France, Germany, Italy, Japan, the United Kingdom, and the United States

Preqin Infrastructure Index: The index covers over 14,000 closed-end funds captured in the broader Private Capital index including funds/strategies listed as Infrastructure core, infrastructure core-plus, infrastructure debt, infrastructure fund of funds, infrastructure opportunistic, infrastructure secondaries, infrastructure value added, as defined by Preqin.

MSCI ACWI Index: MSCI’s flagship global equity index is designed to represent performance of the full opportunity set of large- and mid-cap companies from developed and emerging markets around the world.

S&P 500 Index: The S&P 500 is widely regarded as the best single gauge of large-cap U.S. equities. The index includes 500 of the top companies in leading industries of the U.S. economy and covers approximately 80% of available market capitalization.

IMPORTANT INFORMATION

The material herein has been provided to you for informational purposes only by Institutional Capital Network, Inc. (“iCapital Network”) or one of its affiliates (iCapital Network together with its affiliates, “iCapital”). This material is the property of iCapital and may not be shared without the written permission of iCapital. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of iCapital.

This material is provided for informational purposes only and is not intended as, and may not be relied on in any manner as, legal, tax or investment advice, a recommendation, or as an offer or solicitation to buy or sell any security, financial product or instrument, or otherwise to participate in any particular trading strategy. This material does not intend to address the financial objectives, situation, or specific needs of any individual investor. You should consult your personal accounting, tax and legal advisors to understand the implications of any investment specific to your personal financial situation.

ALTERNATIVE INVESTMENTS ARE CONSIDERED COMPLEX PRODUCTS AND MAY NOT BE SUITABLE FOR ALL INVESTORS. Prospective investors should be aware that an investment in an alternative investment is speculative and involves a high degree of risk. Alternative Investments often engage in leveraging and other speculative investment practices that may increase the risk of investment loss; can be highly illiquid; may not be required to provide periodic pricing or valuation information to investors; may involve complex tax structures and delays in distributing important tax information; are not subject to the same regulatory requirements as mutual funds; and often charge high fees. There is no guarantee that an alternative investment will implement its investment strategy and/or achieve its objectives, generate profits, or avoid loss. An investment should only be considered by sophisticated investors who can afford to lose all or a substantial amount of their investment.

iCapital Markets LLC operates a platform that makes available financial products to financial professionals. In operating this platform, iCapital Markets LLC generally earns revenue based on the volume of transactions that take place in these products and would benefit by an increase in sales for these products.

The information contained herein is an opinion only, as of the date indicated, and should not be relied upon as the only important information available. Any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets is not necessarily indicative of the future or likely performance. The information contained herein is subject to change, incomplete, and may include information and/or data obtained from third party sources that iCapital believes, but does not guarantee, to be accurate. iCapital considers this third-party data reliable, but does not represent that it is accurate, complete and/or up to date, and it should not be relied on as such. iCapital makes no representation as to the accuracy or completeness of this material and accepts no liability for losses arising from the use of the material presented. No representation or warranty is made by iCapital as to the reasonableness or completeness of such forward-looking statements or to any other financial information contained herein.

Securities products and services are offered by iCapital Markets, an SEC-registered broker-dealer, member FINRA and SIPC, and an affiliate of iCapital, Inc. and Institutional Capital Network, Inc. These registrations and memberships in no way imply that the SEC, FINRA, or SIPC have endorsed any of the entities, products, or services discussed herein. Annuities and insurance services are provided by iCapital Annuities and Insurance Services LLC, an affiliate of iCapital, Inc. “iCapital” and “iCapital Network” are registered trademarks of Institutional Capital Network, Inc. Additional information is available upon request.

©2025 Institutional Capital Network, Inc. All Rights Reserved.