Key Takeaways:

- Data centers are increasingly being financed with debt where private credit lenders are emerging to help solve a funding gap. The big spending behind this data center AI arms race raises questions around the risk and returns of these investments. This is where the underwriting approach and risk mitigants are critical.

- Investor concerns over borrowings to fund the AI buildout have been evident in bond prices and credit risk (mentioned here). We believe there are ways to gain risk-adjusted access in select private credit vehicles which can provide access to AI growth without the equity volatility.

- It’s early to quantify return profiles. However, the tailored nature of private credit provides opportunities to structure unique risk mitigants which, combined with varying forms of credit risk (duration, borrower/tenant creditworthiness) will likely produce a dispersion of returns.

One of the timeliest topics in private credit is taking on new forms: Data center financing. For some, this is a real estate investment. For others, it’s squarely infrastructure. The return profiles can be vastly different depending on how the investments are structured—with duration, the right partners, and the appropriate credit risks at the center of the equation.

With every day bringing new headlines about the AI-driven economy, there are fresh questions about how a capital expenditure (CapEx) boom is getting paid for. Alongside syndicated debt markets opening up, private credit is also underwriting more deals. In fact, the largest private credit deal in history is behind the construction of a new AI data center.

And while construction loans are pretty straightforward, data centers are different. Power is a constraint. Technology eventually becomes obsolete. Development times are long. All of this can leave investors wondering what they’re getting into, what they’re exposed to, and how returns will be generated.

There are several ways to gain exposure to the AI data center investment theme—each with different risk profiles. We see private credit opportunities as one approach but without the same degree of equity volatility. In other words, investors can participate in the AI infrastructure cycle with an attractive risk-reward profile.

Supply-Demand Imbalance

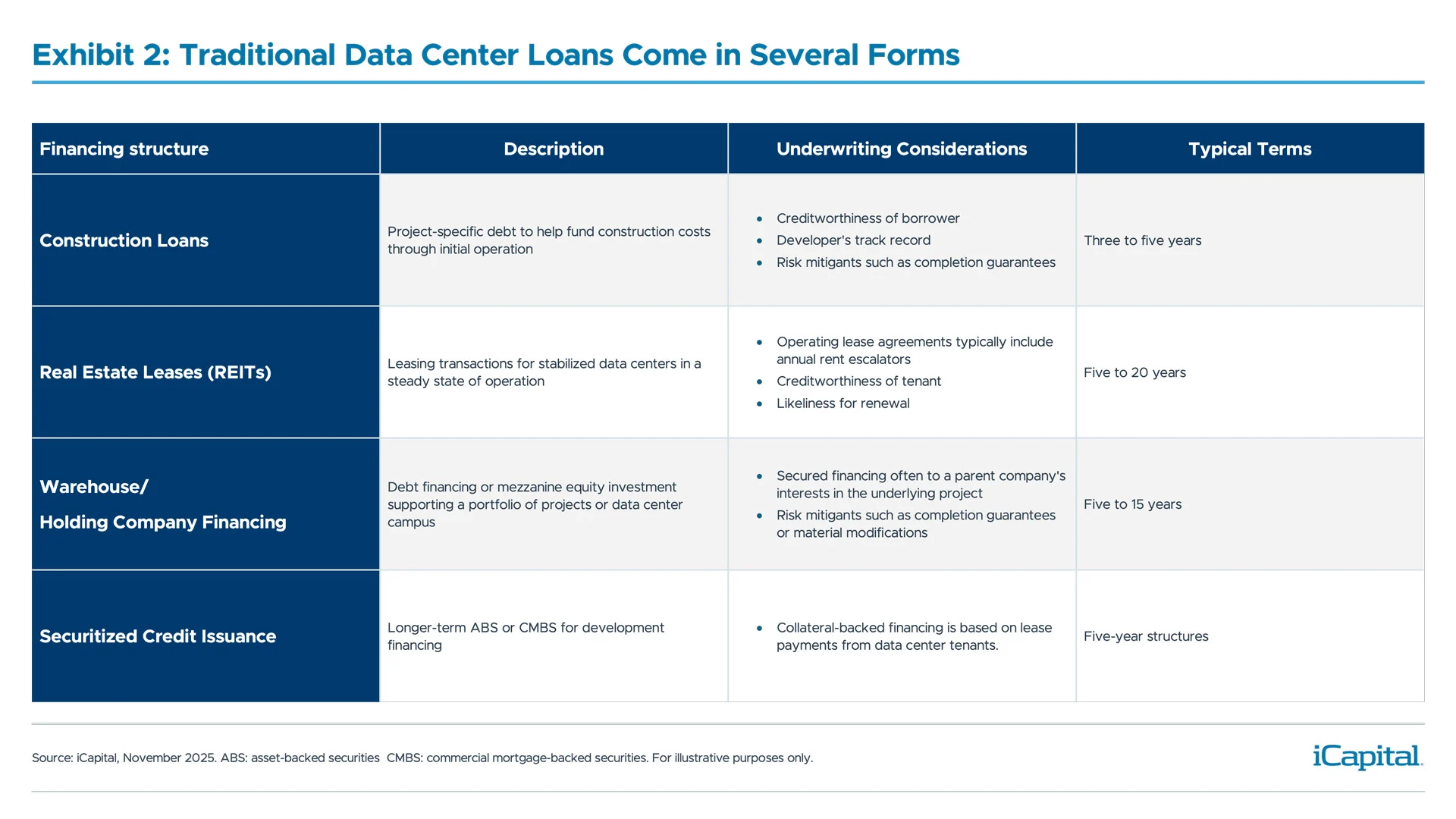

Generally speaking, data center financing has taken the form of project finance or through sector-specific REITs, which own and lease data center facilities. For years, a broad range of customers have outsourced their technology infrastructure as data growth and digitization has accelerated, creating demand for new data center development.

What’s changing is the sharp increase in the computing capacity needed for AI development which is currently growing twice as fast as AI chip efficiency, creating a massive shortage. The compute needed to train a transformer AI model increases 275x every two years, according to Nvidia.1 This is because the models are trained on internet-scale datasets with hundreds of billions of parameters in order to instantly generate answers from any type of question. The data centers that hyperscalers are building maintain and house the IT infrastructure necessary to train and deploy these AI applications.

This amounts to a supply-demand imbalance for data center compute. For the hyperscalers that are in the business of training and deploying AI applications, additional data center compute is the only answer. This creates scarcity value that we haven’t seen before. For example, a company can tap a different energy source or substitute a raw material. But more data centers are the only thing that can solve the demand for AI development.

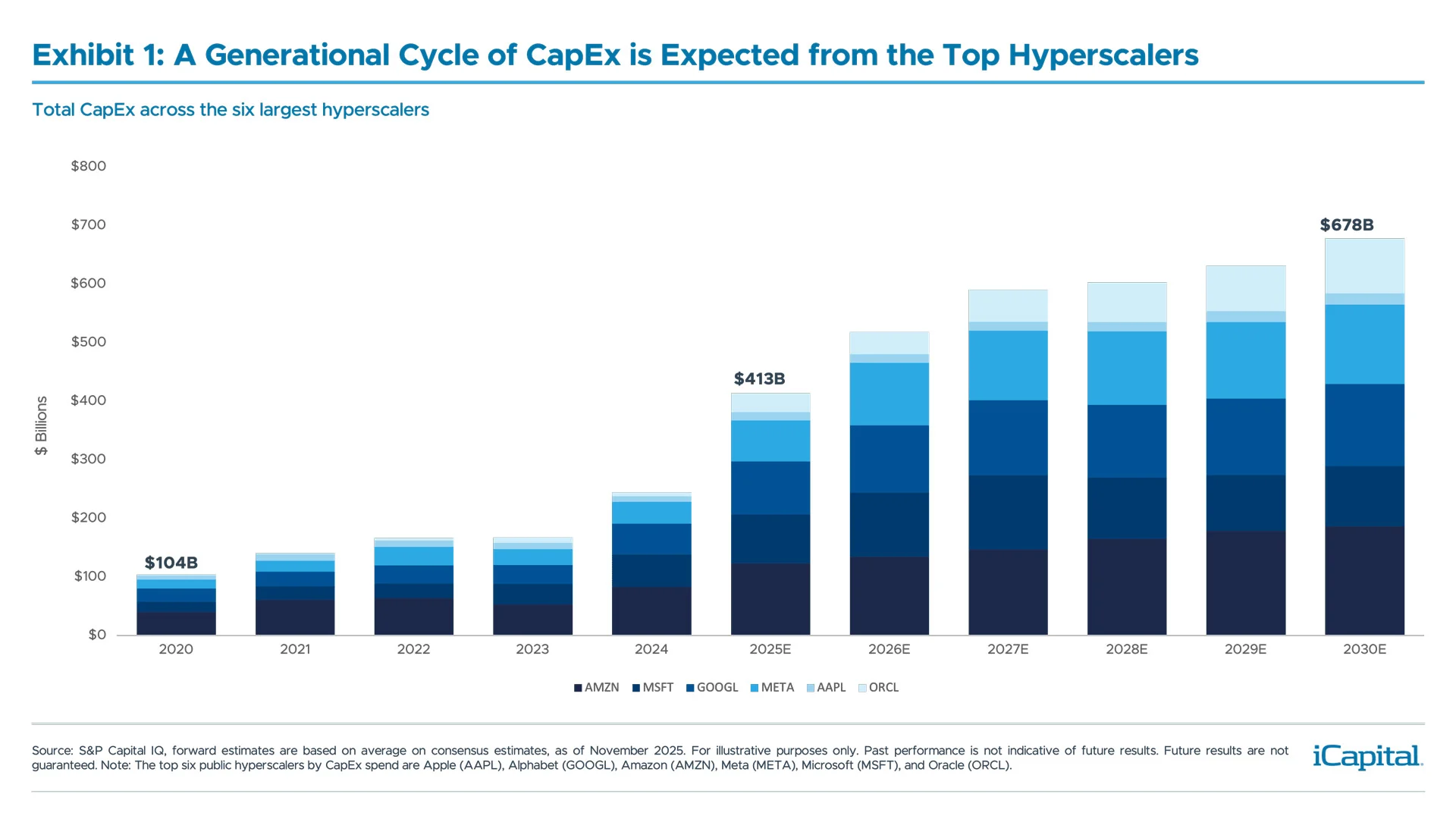

The world’s largest hyperscalers have so far self-funded their data center costs. Over the last five years, the top six hyperscalers spent over $800 billion in CapEx, with the majority on AI infrastructure (Exhibit 1). To put the spending in context, CapEx from these companies is expected to exceed $3 trillion from 2026 through 2030 (Exhibit 1). So, the need for compute is stretching beyond the ability for these companies to self-fund more development. Despite cash-rich, high margin models, spending at the pace desired for AI development could hurt their balance sheets or credit ratings.

Private Market Lenders Step-In

An estimated $5.3 trillion will be needed to support AI infrastructure development through 2030, according to JP Morgan.2 About half of this might come from external capital based on how much hyperscalers can spend from their own cash balances. Project finance bank loans and securitized credit will fill some of this gap. But we expect private lenders to step in given their ability to provide large-ticket, long duration, tailored financing arrangements that traditional lenders may not want to underwrite.

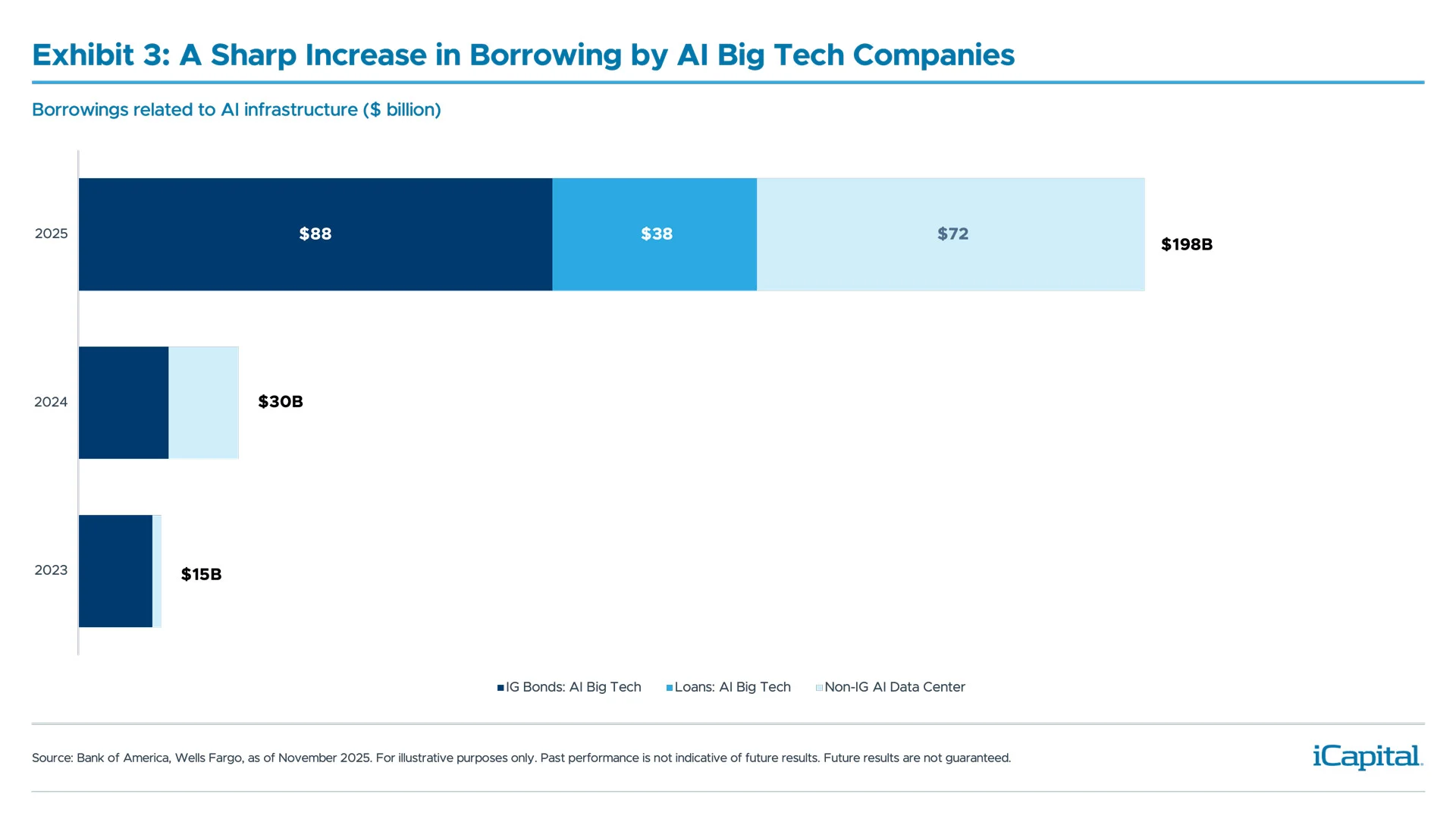

If data center development needs are in fact outgrowing what traditional lenders can provide, private credit lenders are stepping up to help fill the financing gap. There has been nearly $200 billion in total debt raised for data centers development in 2025 (Exhibit 3), including several $10 billion-plus private credit transactions such as the record $27 billion joint venture between Meta and Blue Owl Capital.3 The growth for debt financing will likely ramp up further as CapEx forecasts are a leading indicator and thus far in the private credit world, lending has come from private funds rather than business development companies (BDCs).

Such financings will come in many types but will share features of traditional infrastructure debt. Given the size of the projects, financing will likely be tailored to accommodate specific location, technological, and operational (power) requirements.

The magnitude and customization of these types of projects could minimize competition and should allow for attractive spreads. In addition to build-to-operate projects, some lenders might be more comfortable underwriting just the construction loans. These shorter loans (three to five years) can avoid risks such as technological obsolescence associated with the tenant or tenant vacancies. Other lenders may focus on opportunities tied to the long-term cash flows stream from stabilized data center lease payments.

Drivers of Return: AI Exposure Without the Volatility

The return profile for data center lending straddles project finance and real estate strategies. In a number of cases, cash flow is generated through lease income from stabilized data centers. Potential capital appreciation is a smaller, harder to forecast return element and is derived from the difference between the cost of the project and the value of the stabilized data center asset.

Long-term contractual leases can provide valuable inflation-protected income as contract terms generally include annual rest escalators. The underlying drivers of cash flow also results in a relatively low correlation with other assets—while not a perfect measure, private infrastructure has a 0.32 correlation to a global equities.4

Ultimately, excess returns are what will create investor interest. In looking at data center ABS pricing, over the last two years the average spread for A-rated transactions has been +210 basis points (bps).5 Similar to other asset classes, there has been spread compression on new deals; for example A-rated data center ABS pricing has been closer to +160 bps over the last six months.6 This type of yield can be attractive, especially with high quality borrowers and when risks are mitigated. In looking at the Meta-Blue Owl joint venture, the debt priced at a spread of +225; double the spread of Meta’s long-term debt and a premium yield for an AA- rated borrower.7

Mitigating the Risks: The Devil is in the Details

The big spending of the AI arms race raises questions including whether the returns will justify the spending. This is where the underwriting approach and risk mitigants are critical. Each opportunity will have unique characteristics that aim to mitigate distinct risks. Two vital considerations are the creditworthiness of the borrower/tenant and the protection of the principal and/or cash flow stream. At a high level, there are specific areas advisors and investors should consider when evaluating an opportunity.

- Borrower/tenant creditworthiness: For large scale developments, some lenders will only extend credit to a short list of borrowers (i.e., investment-grade hyperscalers). A focus on high creditworthiness borrower/tenant provides visibility to long-term contracted cash flow and can mitigate non-renewal risk.

- Concentration risk: Strategies with a focus on stabilized assets, such as REITs, will have hundreds to thousands of tenants forming a diversified portfolio. But for a new development project designed for a hyperscaler, the data center will largely be for a single-tenant.

- Exposure: Questions of overexposure come from the end investor that may already own the equity of a hyperscaler or chip supplier (i.e., Amazon, Google, Nvidia). As mentioned, the drivers of the debt cash flows are very different from that of the equity and consequently, the assets can have a low correlation.

- Asset type risks: Stabilized and new development opportunities have distinct risks. Investments focused on stabilized assets come with occupancy and renewal risk but tend to have lower maintenance costs. For development opportunities, completion guarantees or guaranteed maximum price can mitigate risk for what is generally a longer construction timeline. Most developers also aim to pre-lease the facility prior to completion and provide funding once permitting and power capabilities are complete.

- Technology obsolescence: Generally, all data center infrastructure financing is for the facility, with the tenant responsible for the equipment (i.e., servers). That said, there is still obsolescence risk for the facility. Lenders that focus on construction-only opportunities generally avoid this risk as they have shorter exposure. Lenders that underwrite longer-term operate transactions may look to other risk mitigants such as value guarantees, effectively shifting technology obsolescence risk to the tenant. Value guarantees can also mitigate risk in the event that compute forecasts are simply wrong, and there is an overbuilding of data centers.

Managers with deep teams across the digital infrastructure spectrum (site selection, permitting, development, power) likely have the experience of underwriting de-risked transactions for an attractive risk-reward profile. That said, there are factors that are beyond a manager’s control—especially with the free spending that is occurring in the space. There are data center companies and developers that are not household names and do not have long credit histories. These more speculative deals can create headline risk to the aggregate AI theme in the event that something goes wrong.

ENDNOTES

- Nvidia Glossary, Large Language Models, November 2025.

- J P Morgan, as Nov. 10, 2025.

- Meta, Meta Announces Joint Venture with Funds Managed by Blue Owl Capital to Develop Hyperion Data Center, Oct. 21, 2025.

- iCapital, Alternatives Decoded, August 2025. Note: A basis points is 1/100th of a percentage point.

- Bank of America, MUFG and GlobalCapital, October 2025.

- Bank of America, MUFG and GlobalCapital, October 2025.

- S&P Capital IQ, SEC flings, November 2025. CNBC, October 2025.

IMPORTANT INFORMATION

The material herein has been provided to you for informational purposes only by Institutional Capital Network, Inc. (“iCapital Network”) or one of its affiliates (iCapital Network together with its affiliates, “iCapital”). This material is the property of iCapital and may not be shared without the written permission of iCapital. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of iCapital.

This material is provided for informational purposes only and is not intended as, and may not be relied on in any manner as, legal, tax or investment advice, a recommendation, or as an offer or solicitation to buy or sell any security, financial product or instrument, or otherwise to participate in any particular trading strategy. This material does not intend to address the financial objectives, situation, or specific needs of any individual investor. You should consult your personal accounting, tax and legal advisors to understand the implications of any investment specific to your personal financial situation.

ALTERNATIVE INVESTMENTS ARE CONSIDERED COMPLEX PRODUCTS AND MAY NOT BE SUITABLE FOR ALL INVESTORS. Prospective investors should be aware that an investment in an alternative investment is speculative and involves a high degree of risk. Alternative Investments often engage in leveraging and other speculative investment practices that may increase the risk of investment loss; can be highly illiquid; may not be required to provide periodic pricing or valuation information to investors; may involve complex tax structures and delays in distributing important tax information; are not subject to the same regulatory requirements as mutual funds; and often charge high fees. There is no guarantee that an alternative investment will implement its investment strategy and/or achieve its objectives, generate profits, or avoid loss. An investment should only be considered by sophisticated investors who can afford to lose all or a substantial amount of their investment.

iCapital Markets LLC operates a platform that makes available financial products to financial professionals. In operating this platform, iCapital Markets LLC generally earns revenue based on the volume of transactions that take place in these products and would benefit by an increase in sales for these products.

The information contained herein is an opinion only, as of the date indicated, and should not be relied upon as the only important information available. Any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets is not necessarily indicative of the future or likely performance. The information contained herein is subject to change, incomplete, and may include information and/or data obtained from third party sources that iCapital believes, but does not guarantee, to be accurate. iCapital considers this third-party data reliable, but does not represent that it is accurate, complete and/or up to date, and it should not be relied on as such. iCapital makes no representation as to the accuracy or completeness of this material and accepts no liability for losses arising from the use of the material presented. No representation or warranty is made by iCapital as to the reasonableness or completeness of such forward-looking statements or to any other financial information contained herein.

Securities products and services are offered by iCapital Markets LLC, an SEC-registered broker-dealer, member FINRA and SIPC, and an affiliate of iCapital, Inc. and Institutional Capital Network, Inc. These registrations and memberships in no way imply that the SEC, FINRA, or SIPC have endorsed any of the entities, products, or services discussed herein. Annuities and insurance services are provided by iCapital Annuities and Insurance Services LLC, an affiliate of iCapital, Inc. “iCapital” and “iCapital Network” are registered trademarks of Institutional Capital Network, Inc. Additional information is available upon request.

©2025 Institutional Capital Network, Inc. All Rights Reserved.