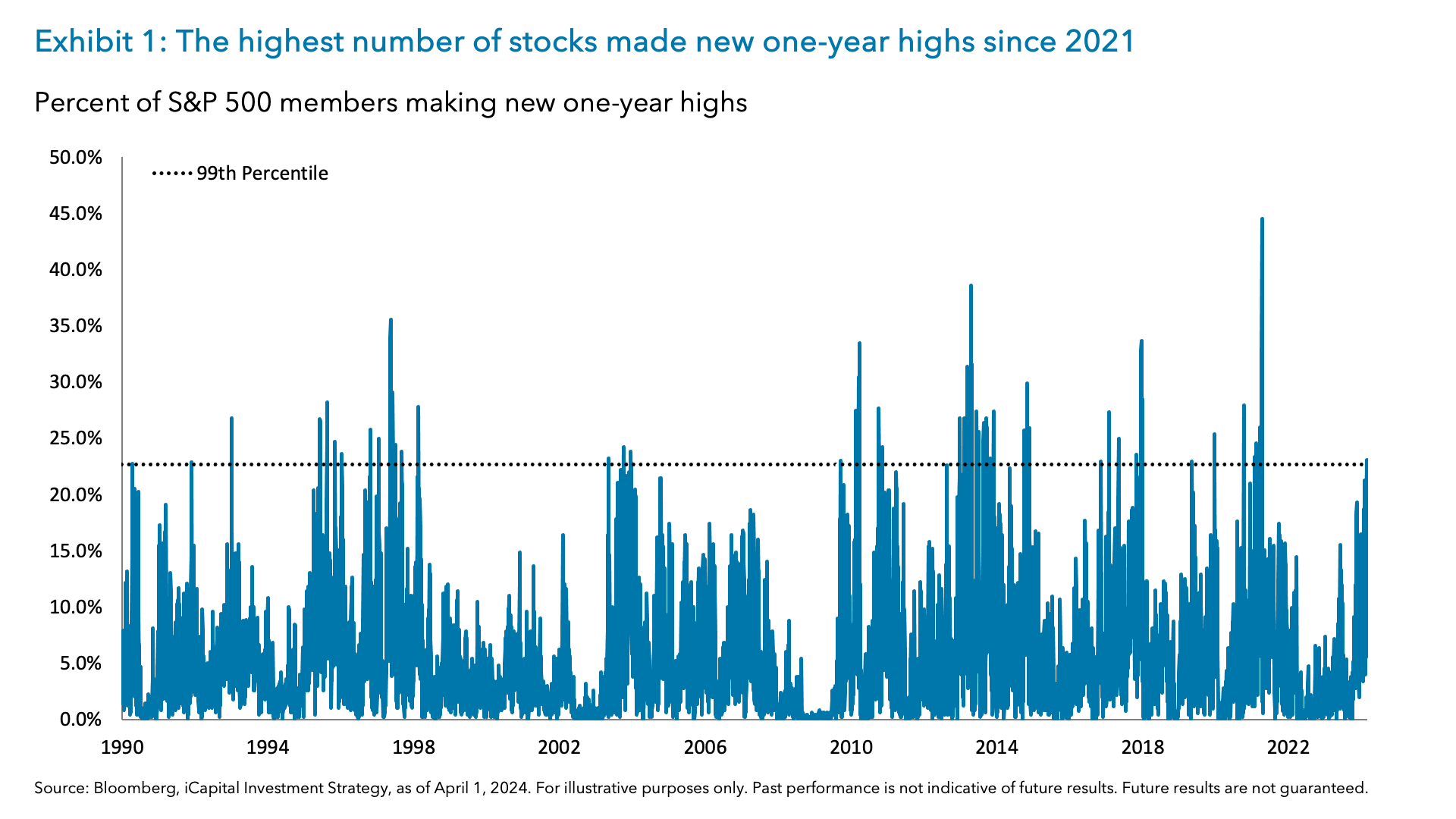

In our 2024 outlook, we discussed why this year should be a year of greater investor optionality and a broader opportunity set. As we finished the first quarter of 2024, Technology and the AI theme continue to outperform markets; suggesting the same narrow leadership. But looking across sectors, we see tangible signs of a broadening out in markets. For example, Industrial, Energy and Financials all outperformed the S&P 500 in the first quarter. The S&P 500 equal weight index outperformed the cap-weighted index by 1.24% for the month of March—its largest outperformance since December 2023.1 And after the March FOMC meeting, 23% of individual stocks within the S&P 500 made new one-year highs—in the 99th percentile of all observations.

However, not only did we see a broadening out of market performance, but we also saw a broadening out of the global economy. For much of the post-pandemic timeframe, the strength of the economy has largely been a result of consumer resiliency.2 However, recent data suggests a notable uptick in global manufacturing, the sector that lagged behind. In this week’s iCapital Market Pulse we discuss why we expect a further upturn in manufacturing and why we would be adding exposure to cyclicals – across both sectors and regions – to portfolios.

Global manufacturing activity finally returns to an expansion

The J.P. Morgan Global Purchasing Manager Index (PMI) returned to an expansion territory in February 2024, or a reading above 50, for the first time in 17 months.3 This was the longest downturn in global manufacturing activity on record, surpassing the 2000-2001 downturn, which lasted 15 months.4 The improvement was broad—out of the 32 countries that have a manufacturing PMI, 27 are now at levels higher than they were at the start of the year.5

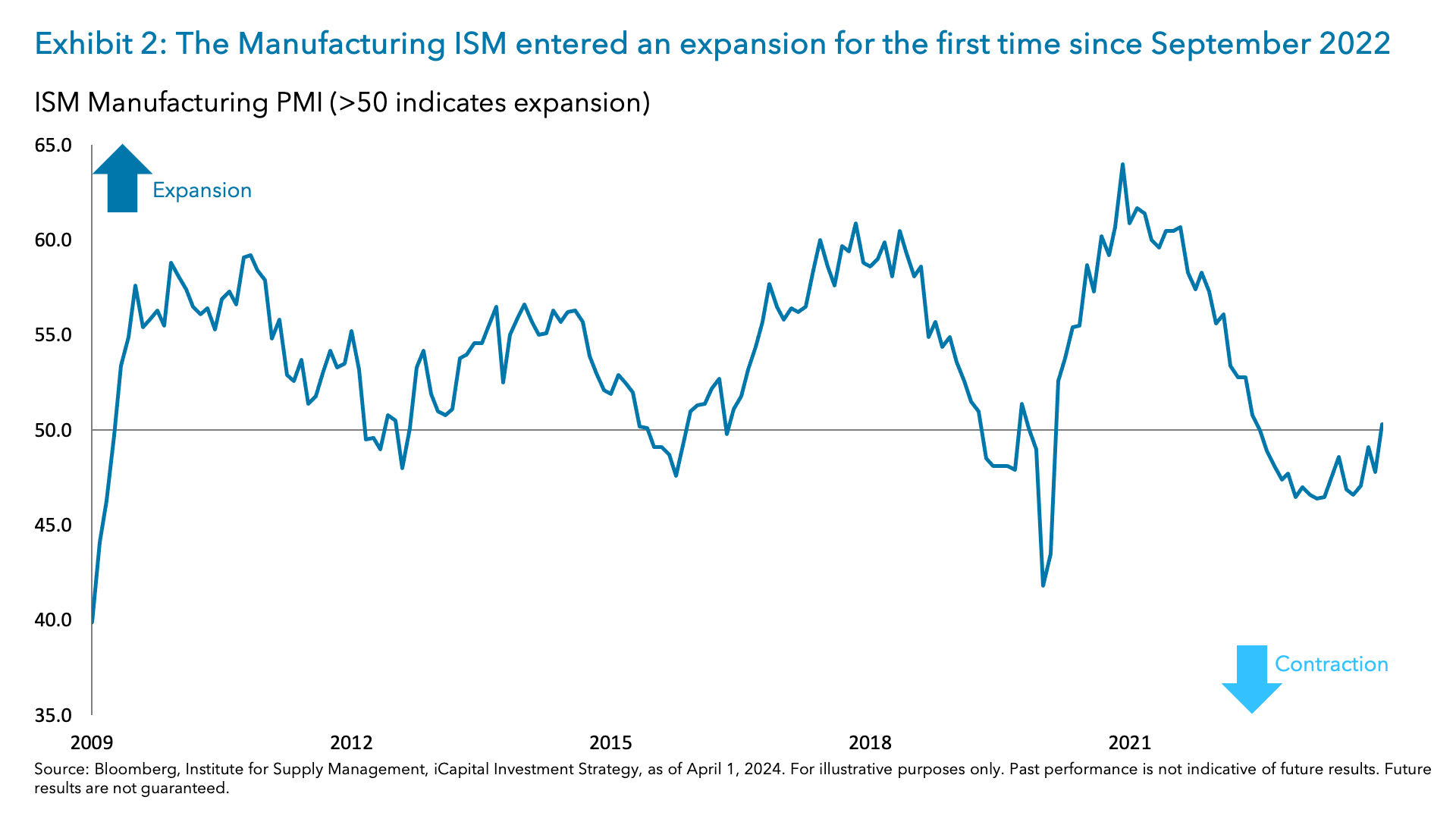

In the U.S., the Institute for Supply Management (ISM) manufacturing PMI entered expansion territory for the first time since September 2022. Notably, production increased by 6.2 points—the largest (month-over-month) MoM increase since the middle of 2020. But new orders and new export orders also ticked higher.6

The recovery in manufacturing activity has also been notable in China. The NBS Manufacturing PMI, or their official measure, surpassed 50 for the first time since September 2023, and is now at the highest level since China’s reopening in early 2023.7

It’s also important to note that the recovery in the global manufacturing PMI has been supported by improvements in all three PMI sectors. Indeed, capital goods, consumer goods and intermediate goods all have output readings that are above 50. However, the consumer goods sector has been the primary driver of recent strength. This aligns with our view of the consumer, which we cover in our February Market Pulse. Within the latest U.S. ISM report, growth was evident in food and beverage products, metals, chemicals and transportation equipment industries.8

Three factors could help sustain the manufacturing recovery

We believe there are three keys factors that should continue to support the manufacturing activity going forward.

1. New Orders: Both globally and domestically we have seen a recovery in new orders—a leading subcomponent for the PMI and ISM. For the February print, global new orders surpassed 50 for the first time since June 2022—which marked the end to the longest contraction for the subcomponent.9 In addition, the ISM new orders subcomponent returned to an expansion in March, with a reading of 51.4—in line with the highest levels since the early summer of 2022.10 Fundamentally, consumer resiliency in the U.S. and recovering consumer globally should support consumer goods manufacturing. But demand is otherwise broad-based: 12 industries reported growth in new orders, significantly more than the two industries that reported a decline.11 In fact, a chemical product firm noted, “Performance continues to defy projections of a downturn in activity. Demand remains strong, and the pipeline for orders is robust.”12

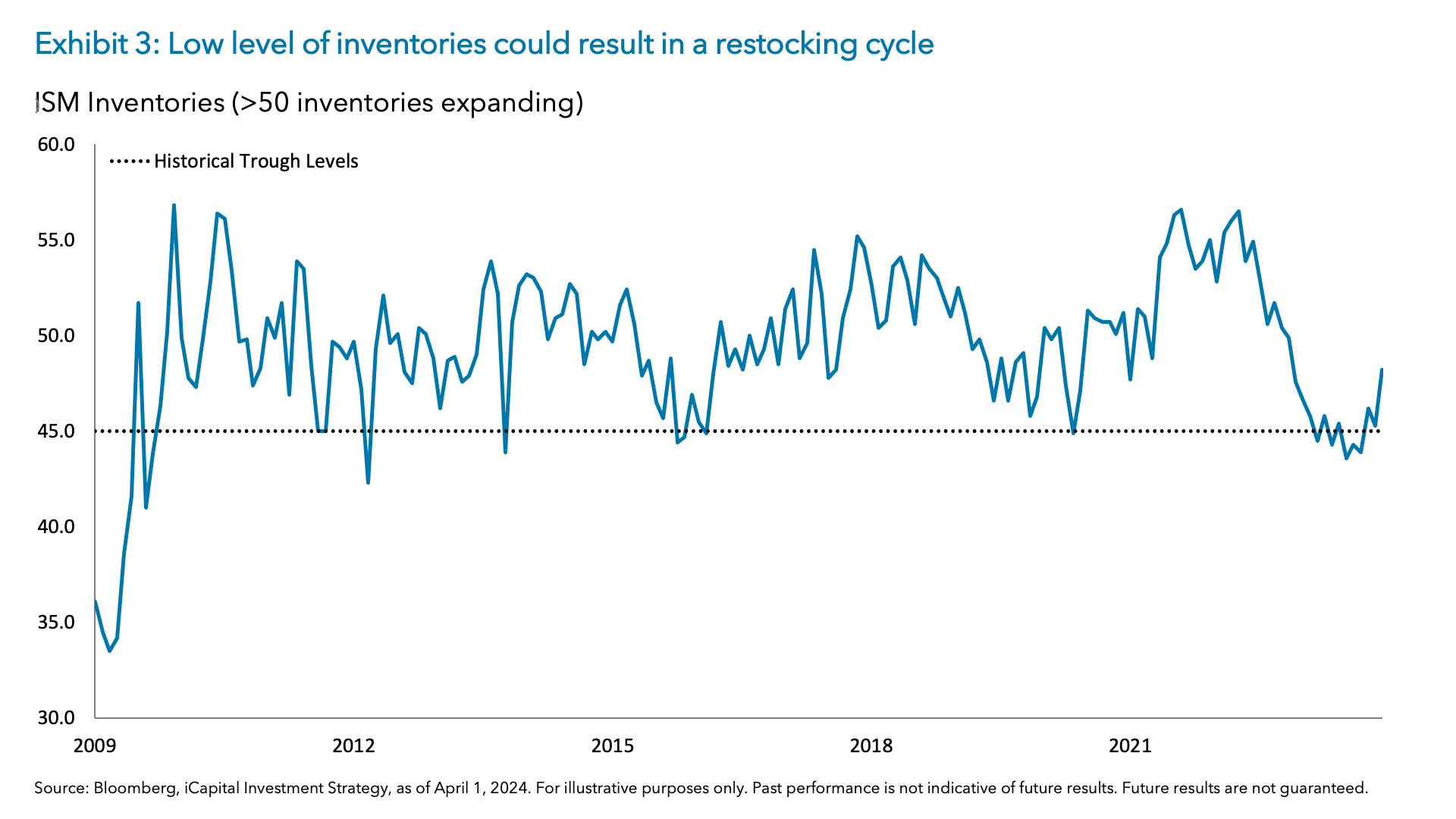

2. Inventories: Within the latest ISM report, customer inventories decreased, with the fall accelerating in the month of March. According to the Institute, we are approaching levels that were considered ‘too low’ for companies.13 This can be seen in Exhibit 3. The report acknowledged that the customer inventories declined substantially and are at levels which should be accommodative for future production. Panelist in the March release did note that they “continue to have a shortage of their products in inventory, which should be positive for future orders and production.”14 Thus, after quarters of de-stocking, a re-stocking cycle should be upon us.

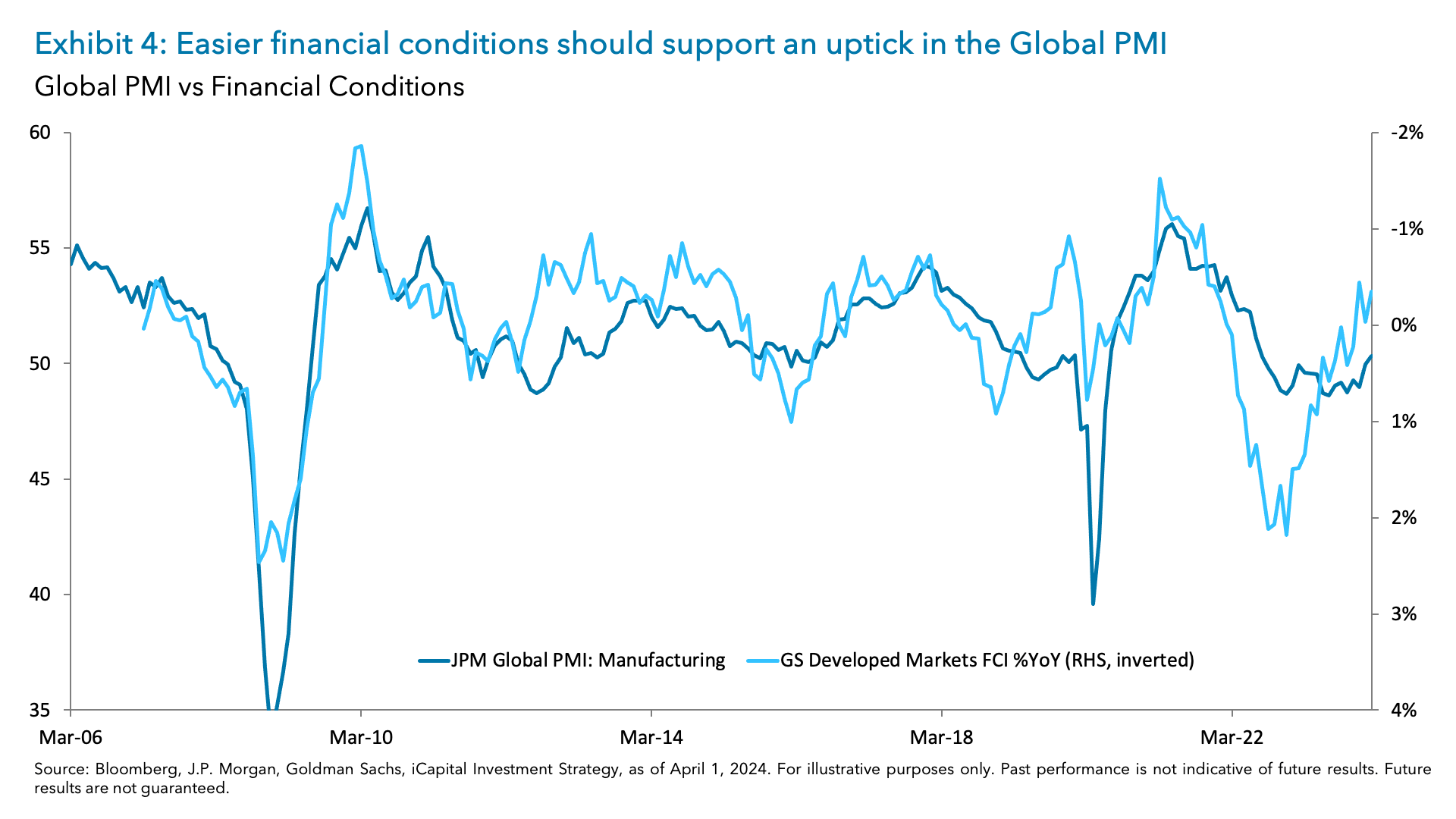

3. Easier financial conditions: Financial conditions play a critical role for manufacturing firms where commercial and industrial (C&I) loans stand at $2.8 trillion.15 Even before lending standards tightened during the Silicon Valley Bank crisis, standards for C&I lending were already tight. While these standards have started to ease somewhat, from a level perspective they are still restrictive and actual lending volumes have been negative. But notably, lending standards recently have started to loosen, and we believe if financial conditions continue to ease, this should further help C&I lending standards and could support further upside to manufacturing activity, as seen in Exhibit 4.16

Will an uptick in manufacturing drive inflation?

With the stronger than expected inflation readings to start the year, we have to ask—will better manufacturing activity lead to higher inflation? We have seen a notable increase in the prices paid subcomponent. Indeed, ISM prices paid jumped by 3.3 points to 55.8 in the March report.17 While prices paid came in above consensus expectations, this reading is still below the thirty-year average of 58.8.18 We find that when the ISM is below this level, headline CPI averages 0.16% on a MoM basis.19 However, once prices paid rise above 58.8, average MoM CPI inflation readings increase to 0.3%—in line with headline inflation readings in January and February. While a risk, if you extrapolate 0.3% MoM readings, headline CPI would decline, albeit at a slower rate, to 2.9% YoY by the June FOMC meeting.

It is also important to note that when you dissect the CPI basket across goods and services, services make up a much larger percentage of the basket: 62% versus 38%.20 When you break down goods further, durable goods only make up 12% of the total CPI basket.21 Even if an uptick in manufacturing does put upward pressure on goods inflation, it’s worth remembering that we’ve been experiencing goods deflation since mid-2023, so the starting point for an uptick is quite low. Therefore, any uptick in goods or manufacturing inflation may have a marginal impact on inflation, especially when compared to services. Fortunately, today’s reading of services prices paid showed an easing in that metric to the lowest level since March of 2020.

We expect cyclical sectors and regions to benefit from the manufacturing upturn

Why does this manufacturing upturn matter to investors? Despite the sector being a small part of the overall U.S. economy, it represents a larger share of earnings growth for the S&P 500. Indeed, goods and manufacturing represent 50% of S&P 500 earnings, despite only accounting for 20% of the U.S. economy.22 Therefore, with the post-COVID shift from goods to services, GDP was able to grow at an above-trend rate, despite the weakness we saw in S&P 500 earnings growth.23

With manufacturing growth now returning to an expansion, we think this can support earnings (outside of the Magnificent 7) later this year. The average manufacturing upturn is approximately nine months.24 And when the Global manufacturing PMI is above 50, the S&P 500 averages roughly 12% YoY earnings growth, which is more than the historical average of approximately 7.5%.25

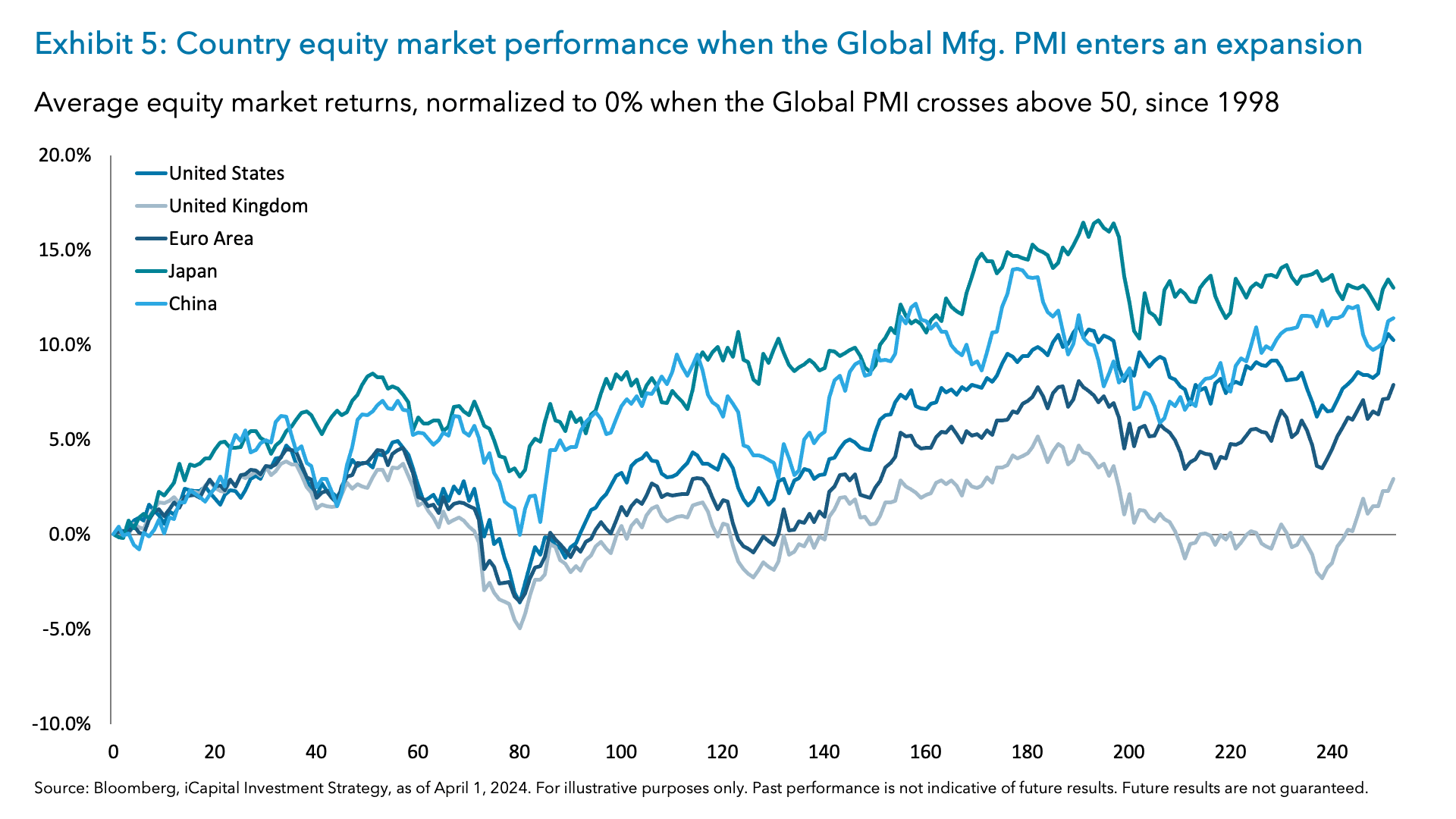

From a return perspective, we find that in the 12 months after the JPM global PMI first enters an expansion, equities historically posted strong returns. For example, since 1998 U.S. stocks average a 10.3% return in the 12-month period after manufacturing returns to expansion, but countries such as Japan and China typically outperform the U.S. as seen in Exhibit 5.26 We believe that the current backdrop of improving earnings revision ratios should further support the potential for outperformance of Japanese and U.S. equities, with their revisions being the highest out of the major countries/regions.27

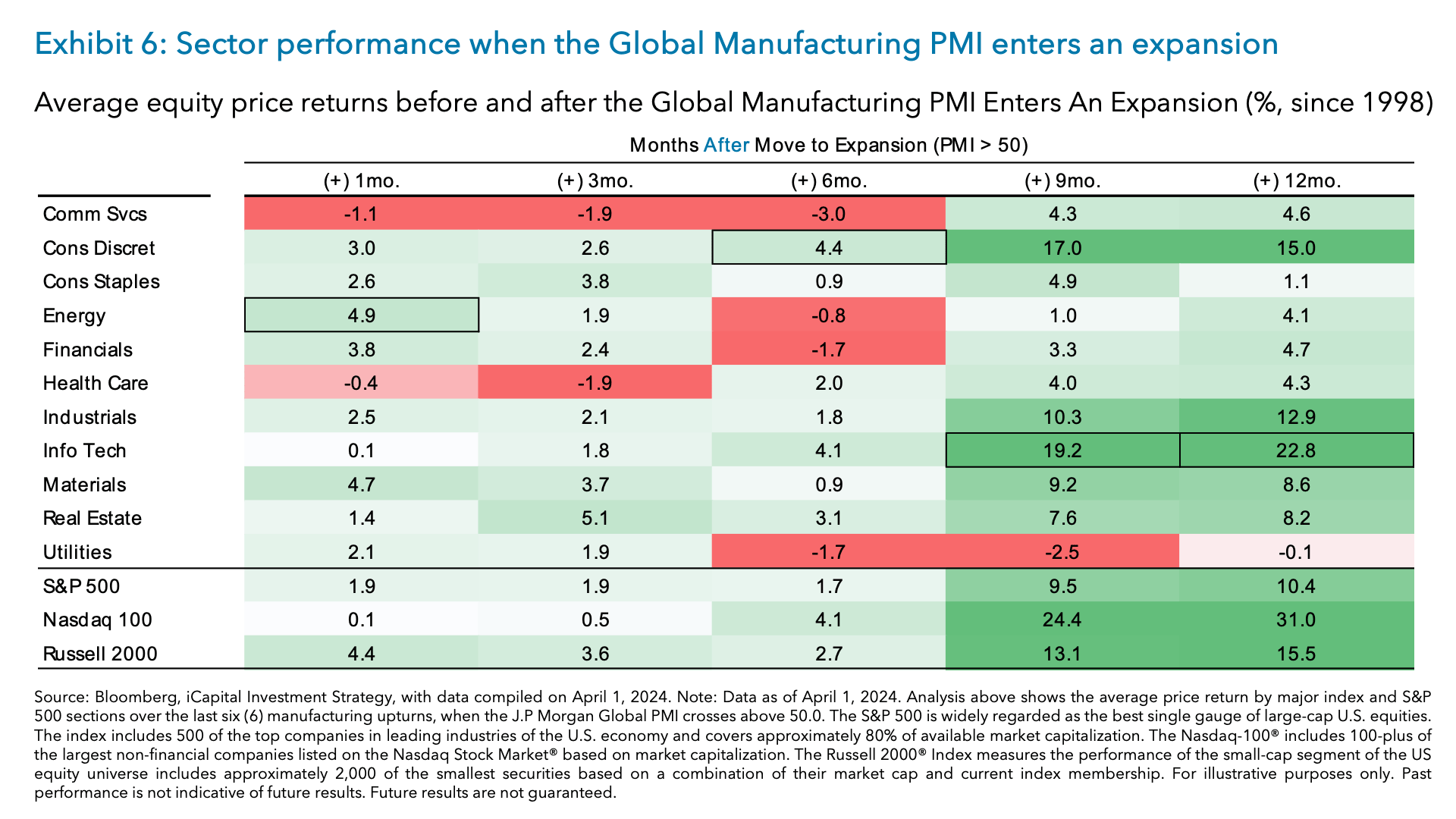

From a sector perspective, we find that cyclical sectors tend to be relative outperformers once the PMI crosses above 50. Indeed, technology, consumer discretionary, industrials and materials are historically the top performers when the PMI enters an expansion seen in Exhibit 6.28 Specifically within the technology sector, we find that semiconductors have historically performed well when the PMI crosses above 50, as the industry delivered an average 47% return in the 12-months following.29

Finally, from a size perspective, we find that small caps historically outperform large cap equities when the global manufacturing PMI rises above 50. Indeed, since 1998 the Russell 2000 on average outperformed the S&P 500 by 5% over the next 12 months.30 While small caps should benefit from a continued pick-up in economic activity, any potential uptick in rates could weigh on their outperformance, as 40% of the debt on their balance sheet is short-term or floating.31 In addition, a delay of rate cuts could also impact the potential outperformance of small cap as roughly a third of the Russell 2000 is unprofitable.32 We therefore, for now, prefer positioning for a manufacturing uptick in sector and country beneficiaries.

Adding to beneficiaries of the manufacturing uptick, even if the Fed doesn’t cut rates as expected

Higher yields and robust economic data, including in manufacturing, combined with somewhat hawkish Fed commentary questioning whether disinflation progress has stalled have weighed on markets so far in April. And although we don’t expect an uptick in manufacturing to drive an uptick in overall inflation, the markets are starting to ask: “What if the Fed doesn’t cut rates this year?” Our answer – even if the Fed does hold off on cutting rates, we expect that equities could still move higher, albeit less so than if rate cuts were on the table.

The buoyant economy activity (especially now with the manufacturing upturn) should support earnings growth, upward revisions and ultimately markets. This positive is likely to be partially offset by the pressure on multiples if high(er) rates persist, which is why we could see more capped returns.

Importantly, the “broadening out” could turn out to be less broad if the Fed delays rate cuts by too much. The rate sensitive sectors like real estate, housing, small caps and unprofitable tech would likely lag. However, cyclical sectors and industries like Industrials, Semiconductors and Financials should benefit from this resilient economy and an uptick in manufacturing growth should benefit their topline growth, helping offset the move higher in rates. We would therefore be adding exposure to these cyclicals, at the expense of the defensives, even if the Fed doesn’t cut rates as expected.

1. Bloomberg, iCapital Investment Strategy, as of April 1, 2024.

2. Bloomberg, iCapital Investment Strategy, as of April 1, 2024.

3. Bloomberg, iCapital Investment Strategy, as of April 1, 2024. Note: Analysis based off unrounded PMI numbers.

4. J.P. Morgan, iCapital Investment Strategy, as of April 1, 2024.

5. Bloomberg, iCapital Investment Strategy, as of April 1, 2024.

6. Bloomberg, Institute for Supply Management, iCapital Investment Strategy, as of April 1, 2024.

7. Bloomberg, iCapital Investment Strategy, as of April 1, 2024.

8. Institute for Supply Management, iCapital Investment Strategy, as of April 1, 2024.

9. J.P. Morgan, iCapital Investment Strategy, as of April 1, 2024.

10. Bloomberg, iCapital Investment Strategy, as of April 1, 2024.

11. Institute for Supply Management, iCapital Investment Strategy, as of April 1, 2024.

12. Institute for Supply Management, iCapital Investment Strategy, as of April 1, 2024.

13. Institute for Supply Management, iCapital Investment Strategy, as of April 1, 2024.

14. Institute for Supply Management, iCapital Investment Strategy, as of April 1, 2024.

15. Federal Reserve, iCapital Investment Strategy, as of April 2, 2024.

16. Bloomberg, iCapital Investment Strategy, as of April 1, 2024.

17. Bloomberg, iCapital Investment Strategy, as of April 2, 2024.

18. Bloomberg, iCapital Investment Strategy, as of April 2, 2024.

19. Bloomberg, iCapital Investment Strategy, as of April 2, 2024.

20. Bloomberg, iCapital Investment Strategy, as of April 1, 2024.

21. Bloomberg, iCapital Investment Strategy, as of April 1, 2024.

22. Bloomberg, iCapital Investment Strategy, as of April 1, 2024.

23. Bloomberg, iCapital Investment Strategy, as of April 1, 2024.

24. Bloomberg, J.P. Morgan, iCapital Investment Strategy, as of April 2, 2024.

25. Bloomberg, J.P. Morgan, iCapital Investment Strategy, as of April 1, 2024.

26. J.P. Morgan, iCapital Investment Strategy, as of April 1, 2024.

27. Bloomberg, Bank of America, iCapital Investment Strategy, as of April 1, 2024.

28. Bloomberg, J.P. Morgan, iCapital Investment Strategy, as of April 1, 2024.

29. Bloomberg, iCapital Investment Strategy, as of April 1, 2024.

30. Bloomberg, iCapital Investment Strategy, as of April 2, 2024.

31. Bank of America, iCapital Investment Strategy, as of April 2, 2024.

32. Bank of America, iCapital Investment Strategy, as of April 2, 2024.

INDEX DEFINITIONS

S&P 500: The S&P 500 is widely regarded as the best single gauge of large-cap U.S. equities. The index includes 500 of the top companies in leading industries of the U.S. economy and covers approximately 80% of available market capitalization.

S&P 500 Equal-Weighted Index: The equal-weight version of the widely-used S&P 500. The index includes the same constituents as the capitalization weighted S&P 500, but each company in the S&P 500 EWI is allocated a fixed weight - or 0.2% of the index total at each quarterly rebalance.

Russell 2000: An index that measures the performance of the small-cap segment of the U.S. equity universe. The Russell 2000 Index is a subset of the Russell 3000 Index representing approximately 7% of the total market capitalization of that index, as of the most recent annual reconstitution. It includes approximately 2,000 of the smallest securities based on a combination of their market cap and current index membership.

Nasdaq-100: The companies in the Nasdaq-100 includes 100-plus of the largest domestic and international non-financial companies listed on the Nasdaq Stock Market based on market capitalization.

IMPORTANT INFORMATION

The material herein has been provided to you for informational purposes only by Institutional Capital Network, Inc. (“iCapital Network”) or one of its affiliates (iCapital Network together with its affiliates, “iCapital”). This material is the property of iCapital and may not be shared without the written permission of iCapital. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of iCapital.

This material is provided for informational purposes only and is not intended as, and may not be relied on in any manner as, legal, tax or investment advice, a recommendation, or as an offer or solicitation to buy or sell any security, financial product or instrument, or otherwise to participate in any particular trading strategy. This material does not intend to address the financial objectives, situation, or specific needs of any individual investor. You should consult your personal accounting, tax and legal advisors to understand the implications of any investment specific to your personal financial situation. ALTERNATIVE INVESTMENTS ARE CONSIDERED COMPLEX PRODUCTS AND MAY NOT BE SUITABLE FOR ALL INVESTORS. Prospective investors should be aware that an investment in an alternative investment is speculative and involves a high degree of risk. Alternative Investments often engage in leveraging and other speculative investment practices that may increase the risk of investment loss; can be highly illiquid; may not be required to provide periodic pricing or valuation information to investors; may involve complex tax structures and delays in distributing important tax information; are not subject to the same regulatory requirements as mutual funds; and often charge high fees. There is no guarantee that an alternative investment will implement its investment strategy and/or achieve its objectives, generate profits, or avoid loss. An investment should only be considered by sophisticated investors who can afford to lose all or a substantial amount of their investment. iCapital Markets LLC operates a platform that makes available financial products to financial professionals. In operating this platform, iCapital Markets LLC generally earns revenue based on the volume of transactions that take place in these products and would benefit by an increase in sales for these products.

The information contained herein is an opinion only, as of the date indicated, and should not be relied upon as the only important information available. Any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets is not necessarily indicative of the future or likely performance. The information contained herein is subject to change, incomplete, and may include information and/or data obtained from third party sources that iCapital believes, but does not guarantee, to be accurate. iCapital considers this third-party data reliable, but does not represent that it is accurate, complete and/or up to date, and it should not be relied on as such. iCapital makes no representation as to the accuracy or completeness of this material and accepts no liability for losses arising from the use of the material presented. No representation or warranty is made by iCapital as to the reasonableness or completeness of such forward-looking statements or to any other financial information contained herein.nSecurities products and services are offered by iCapital Markets, an SEC-registered broker-dealer, member FINRA and SIPC, and an affiliate of iCapital, Inc. and Institutional Capital Network, Inc. These registrations and memberships in no way imply that the SEC, FINRA, or SIPC have endorsed any of the entities, products, or services discussed herein. Annuities and insurance services are provided by iCapital Annuities and Insurance Services LLC, an affiliate of iCapital, Inc. “iCapital” and “iCapital Network” are registered trademarks of Institutional Capital Network, Inc. Additional information is available upon request.

©2024 Institutional Capital Network, Inc. All Rights Reserved. | 2024.01