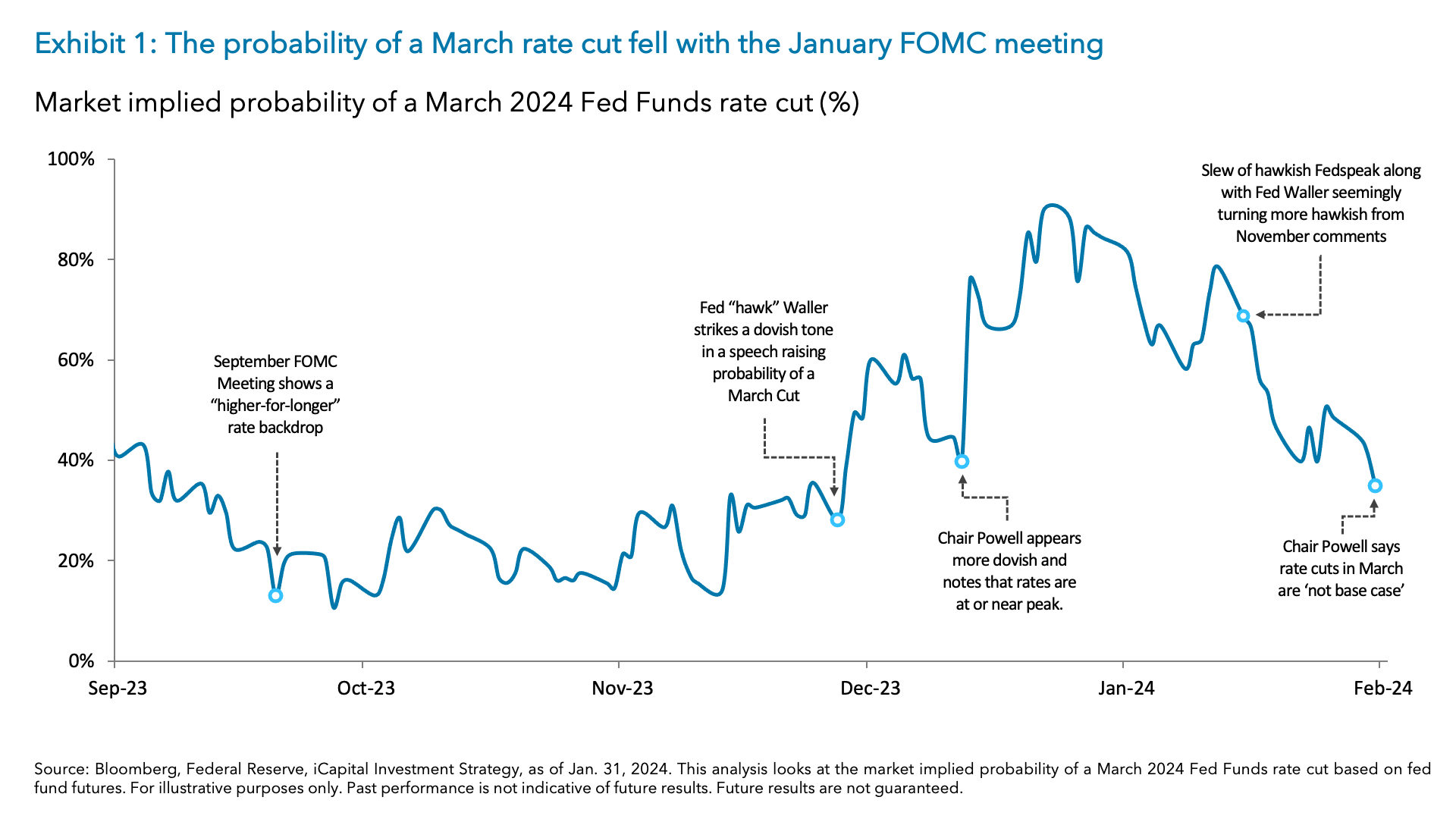

Over the past week, markets were keenly focused on macroeconomic events from the Federal Reserve (the “Fed”) and the U.S. Treasury (the “Treasury”) amidst a flurry of mega-cap earnings. At the January Federal Open Market Committee (FOMC) meeting, the Fed kept rates unchanged, as expected, removing its hiking bias and struck a more neutral tone.1 At the presser, Fed Chair Powell pushed back against a March rate cut, and subsequently, the odds fell to ~35% after being north of 70% following the December FOMC meeting (Exhibit 1).2 However, given the backdrop of resilient growth and inflation trending toward target, we expect the Fed will still cut at some point between March and June. In addition we received the Treasury’s quarterly refunding announcement. Within the statement, it updated its quarterly borrowing estimates below market expectations, and refined its quarterly auction sale outlook higher, in-line with consensus. Importantly, it noted that additional increases have likely concluded.3

Considering the Fed’s rate easing bias, quantitative tightening (QT) tapering potentially starting in the spring or summer, and better-than-expected Treasury supply forecasts, yields likely remain capped with equities support amidst a soft-landing realization. We continue to like our top ideas outlined in our 2024 U.S. and International Market Outlooks.

Federal Reserve on hold but likely for just a bit longer

Three key points emerged from the January FOMC meeting:

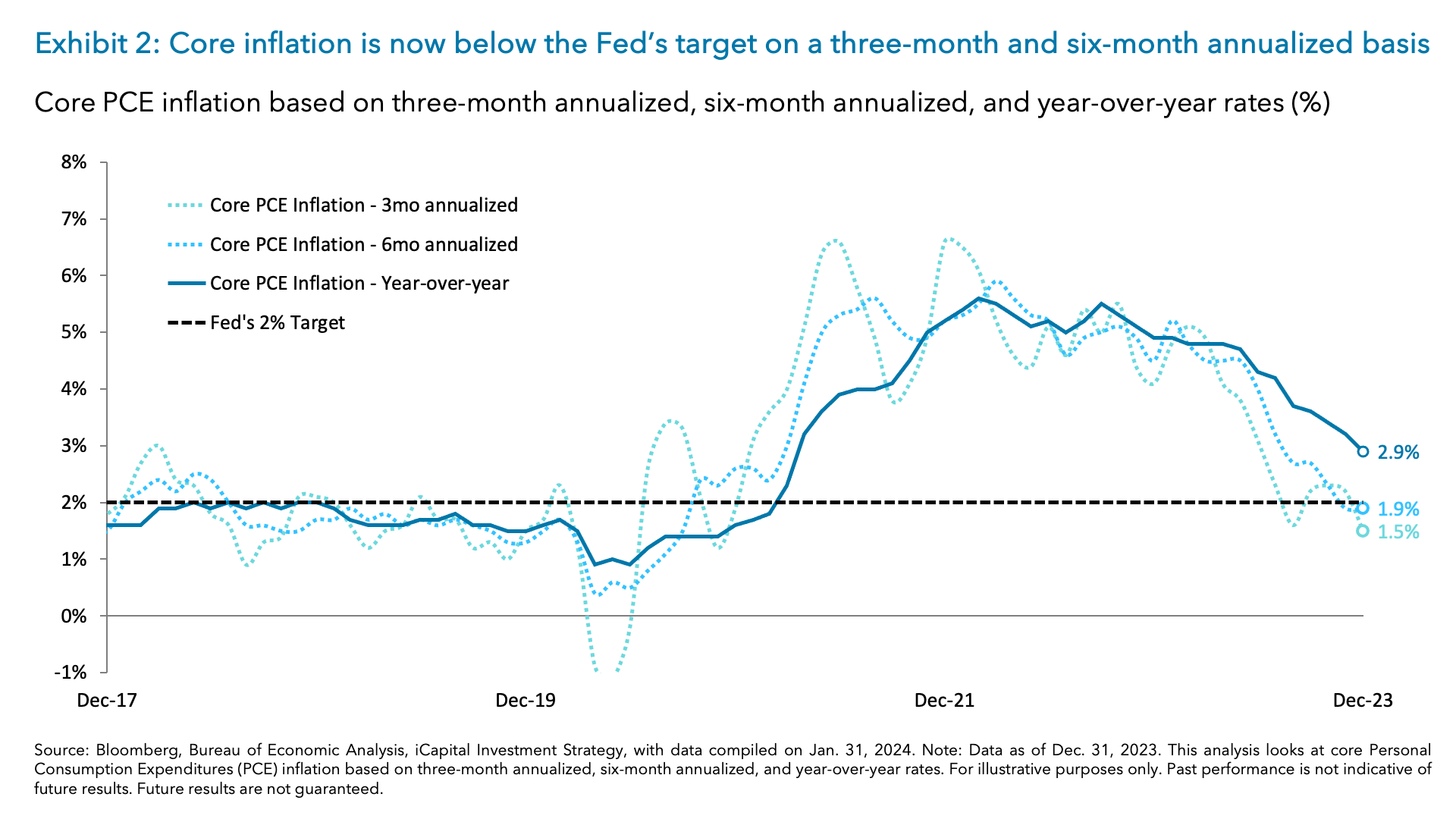

1. The Fed dropped its tightening bias and explicitly mentioned conditions for reducing its target range. Specifically, the Fed removed “the extent of any additional policy firming” from the policy statement and included that “the Committee does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward two percent”.4 This suggests that it is now a matter of when the Fed will cut rates, given its acknowledgement of how the risks to both employment and inflation are “moving into better balance”.5 Indeed, year-over-year (YoY) core PCE inflation is now below 3% for the first time since April 2021 and is below 2% on a three-month and six-month annualized basis (Exhibit 2).6

2. Powell pushed back against a March rate cut. During the presser, Powell reiterated the word “confidence” and notably said that he was not sure the committee would “gain enough confidence” on inflation to start cutting rates at its March meeting.7 However, we will receive a number of key data points between now and then – including key inflation reads on Feb. 13, Feb. 29, and Mar. 12.8 Indeed, if core PCE inflation runs at or below +0.2% month-over-month over the next five months, that would imply an annualized rate of +2.1% or less by May.9 This should continue to support the odds of the Fed beginning to cut rates at some point between the March and June meeting.

3. Powell acknowledged that the committee had a conversation around slowing the pace of QT at its January meeting. Coming into the January meeting, there were questions of whether the Fed would address the run-off of their balance sheet, or QT. The Fed did not change the QT portion of its statement but Powell noted they would have a more in-depth conversation on the topic at the March meeting.10 This aligns with market expectations that the Fed could start to slow the pace of QT from $60 billion to $30-$45 billion at some point this spring/summer.11 Greater Fed demand for Treasuries should be help restrict any moves higher in yields.

A better-than-expected refunding announcement is a net positive for yields

We also received an update from the Treasury regarding its quarterly refunding plans and marketable borrowing estimates for the February to April 2024 quarter (fiscal first quarter 2024), which, on net, was viewed positively by markets. Treasury borrowing estimates of $760 billion and $202 billion for the first and second quarters, respectively, came in lower than consensus and the Treasury’s previous forecast.12 This was due to higher cash balances and the expectation for a marginally better near-term fiscal picture

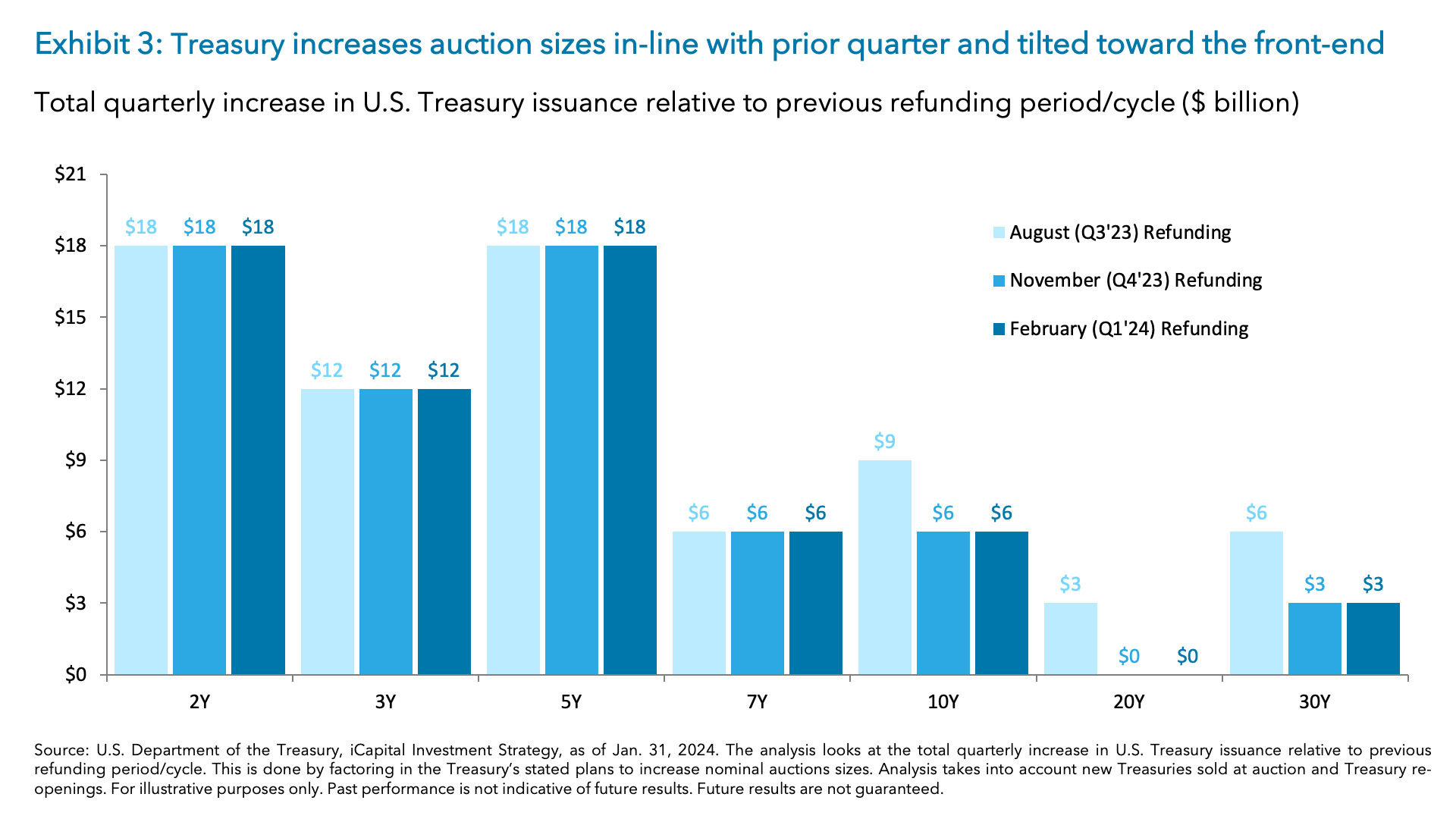

The Treasury also announced increases to its quarterly refunding auction estimates, which were in-line with the prior quarter’s increase, and noted that it does not expect further increases “for at least the next several quarters.”13 Across the key tenors – three, 10 and 30-year Treasuries – the Treasury sees upcoming February auctions sizes increasing to $121 billion from $112 billion at the November auction, with most of the heavy lifting throughout the quarter continuing to be done at the front-end of the curve (Exhibit 3).14

If the Fed begins slowing QT around the May meeting, as the market currently expects, that could result in the Treasury needing to finance $150 billion less in 2024.15 This would be marginally supportive to the supply picture which is currently expected to increase by roughly $800 billion in 2024 to $1.8 trillion.16 However, the Treasury is still going to have to contend with growing fiscal deficits over the medium- to longer-term which may keep auctions sizes and supply needs elevated.

What does all of this mean for markets?

The good news for now is that with rates stabilizing and central banks clearly showing signs of easing, demand for Treasuries should further return to help absorb the increases in supply. Together, these factors should ease upward pressures on yields across the curve. Capped yields and the continued soft landing narrative realization should, in turn, support equities. All in, the latest round of macro data adds support to our thesis where we continue to see broadening opportunities. Please see our 2024 Market Outlook for our top ideas.

1. Bloomberg, Federal Reserve, iCapital Investment Strategy, as of Jan. 31, 2024.

2. Bloomberg, iCapital Investment Strategy, as of Jan. 31, 2024.

3. Bloomberg, U.S. Treasury, iCapital Investment Strategy, as of Jan. 31, 2024.

4. Federal Reserve, Federal Open Market Committee Policy Statement, iCapital Investment Strategy, as of Jan. 31, 2024.

5. Federal Reserve, Federal Open Market Committee Policy Statement, iCapital Investment Strategy, as of Jan. 31, 2024.

6. Bloomberg, iCapital Investment Strategy, as of Jan. 31, 2024.

7. Federal Reserve, Federal Open Market Committee Policy Statement and Meeting, iCapital Investment Strategy, as of Jan. 31, 2024.

8. Bloomberg, iCapital Investment Strategy, as of Jan. 31, 2024

9. Bloomberg, iCapital Investment Strategy, as of Jan. 31, 2024

10. Federal Reserve, Federal Open Market Committee Policy Statement and Meeting, iCapital Investment Strategy, as of Jan. 31, 2024.

11. Bank of America, Goldman Sachs, iCapital Investment Strategy, as of Jan. 8, 2024.

12. Bloomberg, U.S. Treasury, iCapital Investment Strategy, as of Jan. 29, 2024. Note: Consensus expectations is based on the average forecast across Goldman Sachs, Morgan Stanley, JPMorgan, Bank of America, and Bloomberg Intelligence.

13. Bloomberg, U.S. Treasury, iCapital Investment Strategy, as of Jan. 31, 2024.

14. Bloomberg, U.S. Treasury, iCapital Investment Strategy, as of Jan. 31, 2024.

15. Goldman Sachs, iCapital Investment Strategy, as of Jan. 12, 2024.

16. Goldman Sachs, iCapital Investment Strategy, as of Jan. 19, 2024.

IMPORTANT INFORMATION:

The material herein has been provided to you for informational purposes only by Institutional Capital Network, Inc. (“iCapital Network”) or one of its affiliates (iCapital Network together with its affiliates, “iCapital”). This material is the property of iCapital and may not be shared without the written permission of iCapital. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of iCapital.

This material is provided for informational purposes only and is not intended as, and may not be relied on in any manner as, legal, tax or investment advice, a recommendation, or as an offer or solicitation to buy or sell any security, financial product or instrument, or otherwise to participate in any particular trading strategy. This material does not intend to address the financial objectives, situation, or specific needs of any individual investor. You should consult your personal accounting, tax and legal advisors to understand the implications of any investment specific to your personal financial situation.

iCapital Markets LLC operates a platform that makes available financial products to financial professionals. In operating this platform, iCapital Markets LLC generally earns revenue based on the volume of transactions that take place in these products and would benefit by an increase in sales for these products.

The information contained herein is an opinion only, as of the date indicated, and should not be relied upon as the only important information available. Any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets is not necessarily indicative of the future or likely performance. The information contained herein is subject to change, incomplete, and may include information and/or data obtained from third party sources that iCapital believes, but does not guarantee, to be accurate. iCapital considers this third-party data reliable, but does not represent that it is accurate, complete and/or up to date, and it should not be relied on as such. iCapital makes no representation as to the accuracy or completeness of this material and accepts no liability for losses arising from the use of the material presented. No representation or warranty is made by iCapital as to the reasonableness or completeness of such forward-looking statements or to any other financial information contained herein.

Securities products and services are offered by iCapital Markets, an SEC-registered broker-dealer, member FINRA and SIPC, and an affiliate of iCapital, Inc. and Institutional Capital Network, Inc. These registrations and memberships in no way imply that the SEC, FINRA, or SIPC have endorsed any of the entities, products, or services discussed herein. Annuities and insurance services are provided by iCapital Annuities and Insurance Services LLC, an affiliate of iCapital, Inc. “iCapital” and “iCapital Network” are registered trademarks of Institutional Capital Network, Inc. Additional information is available upon request.

© 2024 Institutional Capital Network, Inc. All Rights Reserved.