Key Takeaways

- Growth is reflating: The U.S. economy continues to run above trend, supported by manufacturing momentum, strong fiscal stimulus, ongoing AI investment, and expected payback from the shutdown.

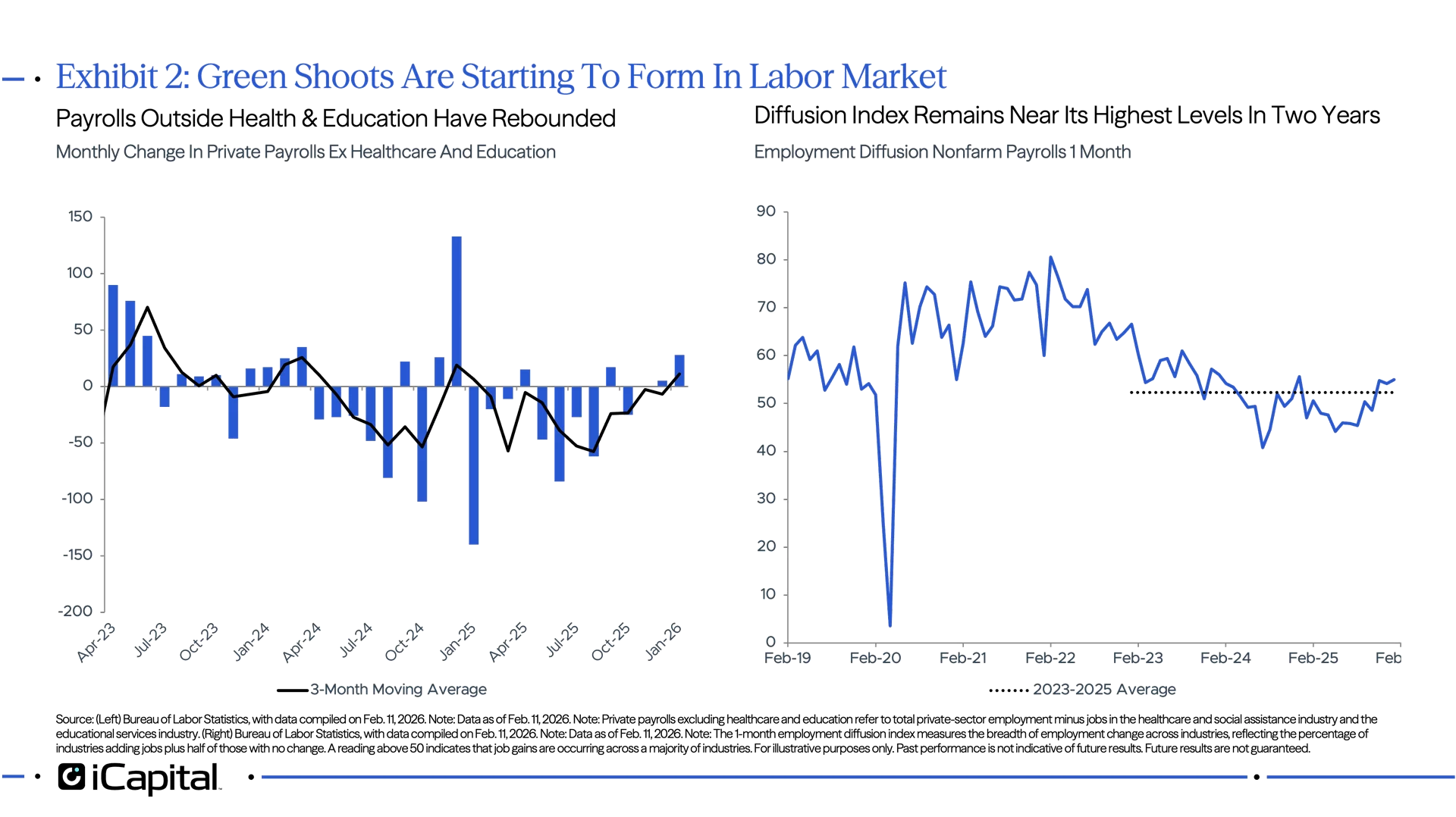

- Labor-market “green shoots” are forming: Despite mixed signals earlier in the month, payrolls are coming in above trend and the breadth of those labor gains is starting to improve – suggesting stabilization.

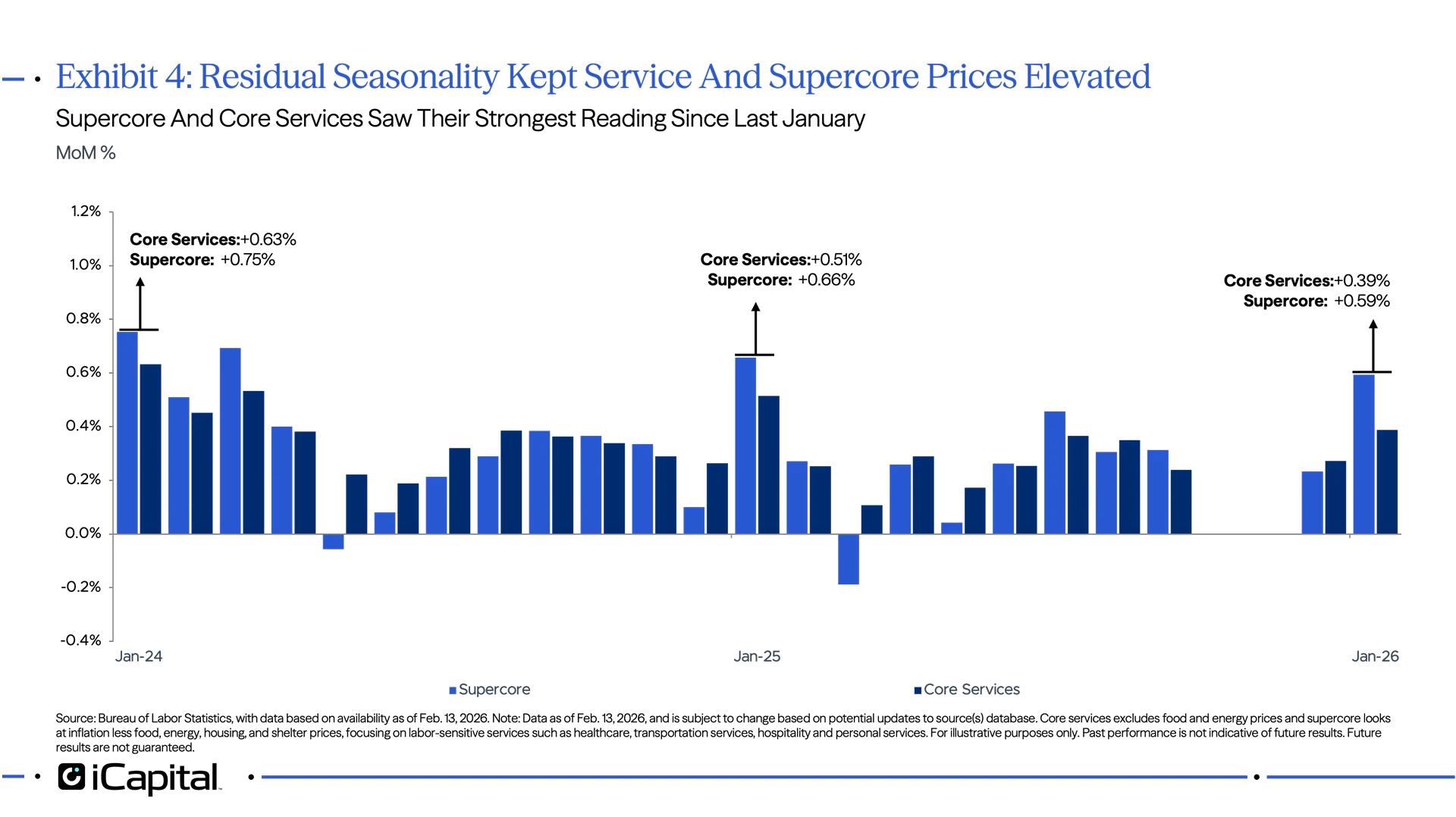

- Inflation remains above target: Despite CPI coming in line with expectations, core services and supercore posted their strongest readings since last January, indicating some residual seasonality.

- Fed on hold, but balance sheet in focus: With the Fed likely on hold through H1, attention is shifting to their balance sheet strategy. While Kevin Warsh would prefer a smaller balance sheet, we think there are limits to desired reductions.

- Investment implications: A reflating backdrop favors select cyclicals – particularly banks and industrials – while private credit remains attractive relative to other asset classes with base rates likely to remain stable.

Across the US economy, there are signs that growth is seemingly “reflating” and coming in above expectations. But the question is how long can this last?

We have conviction that GDP should continue to grow above trend (2%) through the first half of the year. Although above trend growth should continue for much of 2026, sustaining further upside surprises will be challenging given how stretched economic surprises are relative to history.

An improving labor market should be supportive of growth and ultimately help close its gap with GDP – a divergence we touched on in our 2026 Outlook. But, above trend growth could keep inflation running above the Fed’s target, as evidenced by a hot supercore reading in the latest CPI report.

This environment of a reflating economy should be supportive of select cyclicals including banks and industrials. In addition, with the Fed on hold, this should keep base rates around current levels. Therefore, if spreads remain unchanged, the yield in private credit should remain an attractive alternative compared to other asset classes, specifically those of public credit markets and the S&P 500, where we see mid-to-high single-digit returns in 2026.

Reflating, but for how long?

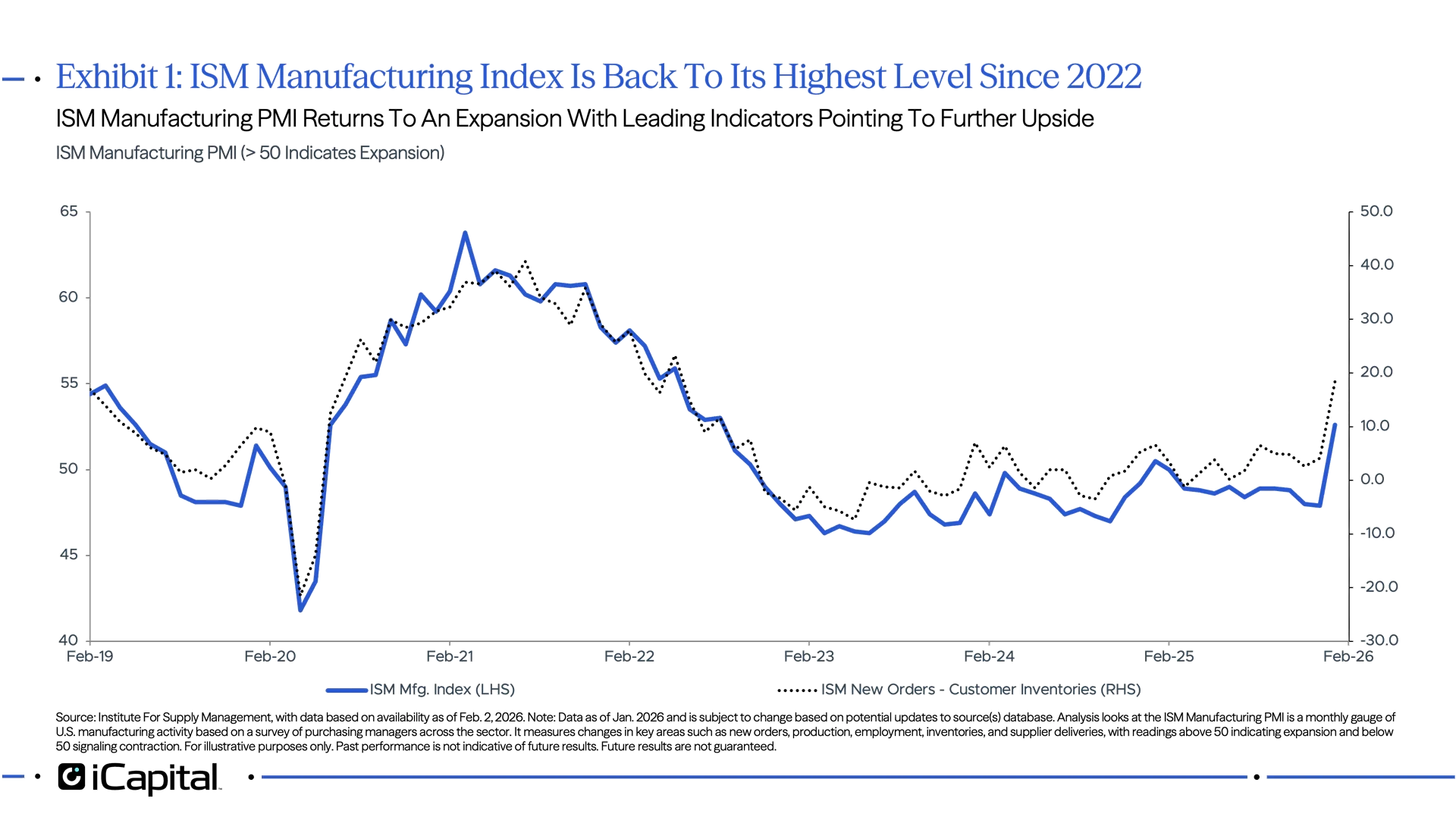

The U.S. economy has been growing at an above trend rate since the beginning of 2023, but there are signs of a re-acceleration in growth or what we would deem “reflating.” The clearest sign of this is the latest ISM manufacturing reading, which entered an expansion and is at its highest level since August 2022.1 Leading indicators of the index – new orders less inventories – would also suggest there is upside to this reading as customer inventories have fallen to their lowest level since 2022 (see exhibit 1).2 Given this, firms may need to boost production to meet demand (via new orders) or rebuild depleted inventories.

Given how recent data is evolving, the Atlanta GDPNow model is still projecting well above trend growth of 3.7% for Q4 ’25 – 1.4 percentage points (pp) higher than the consensus estimate.3 But there are three factors that should support above trend growth in the first half of year.

- Fiscal policy support: The One Big Beautiful Bill Act (OBBBA) is expected to boost growth by 0.9-1.2 pp in 2026, in addition to boosting disposable income by 0.6 pp.4 The peak boost from the bill is expected to be 0.6 pp occurring in Q2, supported by investment incentives, new spending, and enhancements of the Tax Cut and Jobs Act (TCJA).5

- Continued AI spending: Hyperscalers continue to increase their CAPEX forecasts, with 2026 estimates at $659 bn, a 60% increase year-over-year (YoY).6 Last year – through Q3 – it is estimated that AI contributed ~25% of total GDP growth.7 We think this trend can continue based on historical technology cycles.

- Payback from government shutdown: The government shutdown is projected to subtract 0.8-1.15 pp from growth in Q4 – likely one of the reasons why the Atlanta Fed GDPNow could be overstating growth.8 However, a payback is expected in Q1 ’26, with forecasts indicating it could boost growth by 1-1.3 pp.9

One thing we are mindful of is how elevated economic surprises have become. Indeed, the Citi Economic Surprise Index recently reached its 90th percentile and the Bloomberg Economic Surprise Index reached its 80th percentile.10 Given the mean reverting nature of these time series, it could become more challenging for data to come in above expectations, as consensus forecasts will likely rise from here.

Labor green shoots continue to emerge

With the stronger than expected nonfarm payrolls (NFP) report, we believe the labor market is starting to show signs of green shoots. Despite some continued softness across data in January, the following suggests a stabilization is under way:

- ADP: Most of the hiring that took place in January was the result of small and mid-size businesses – a shift from the concentration in large businesses last year. Given that small and mid-size businesses represent 46% of total employment, this represents a healthy development.11

- Challenger: Despite the large spike, about 50% of the increase in Challenger job cuts was driven by last year’s Amazon and UPS announcements.12 Given this, and the fact we are not above levels seen last October, we think these spikes are likely more idiosyncratic compared to a broader uptick in layoffs.

- Claims: Last week, jobless claims rose by 22k, the largest weekly increase since the beginning of December – which itself was the largest increase since 2020.13 Despite the large increase and the rise in claims since the start of the year, they still appear to be broadly in line with levels seen over the last few years (2023-2025).

- NFP: Despite the benchmark revisions – which were isolated to late 2024 and early 2025 – the latest NFP report was solid. Both headline and private payrolls came in above expectations, and the unemployment rate fell to 4.3% despite the increase in the labor force participation rate.14

Even with the negative headlines, breadth in labor gains appear to be improving. First, the month‑over‑month (MoM) employment diffusion index remains near its highest level of the past two years and above its two‑year average.15 Second, private payrolls ex healthcare and education (these groups saw the largest gains in 2025), have been recovering throughout the second half of the year – suggesting some broadening in employment gains (see Exhibit 2).16

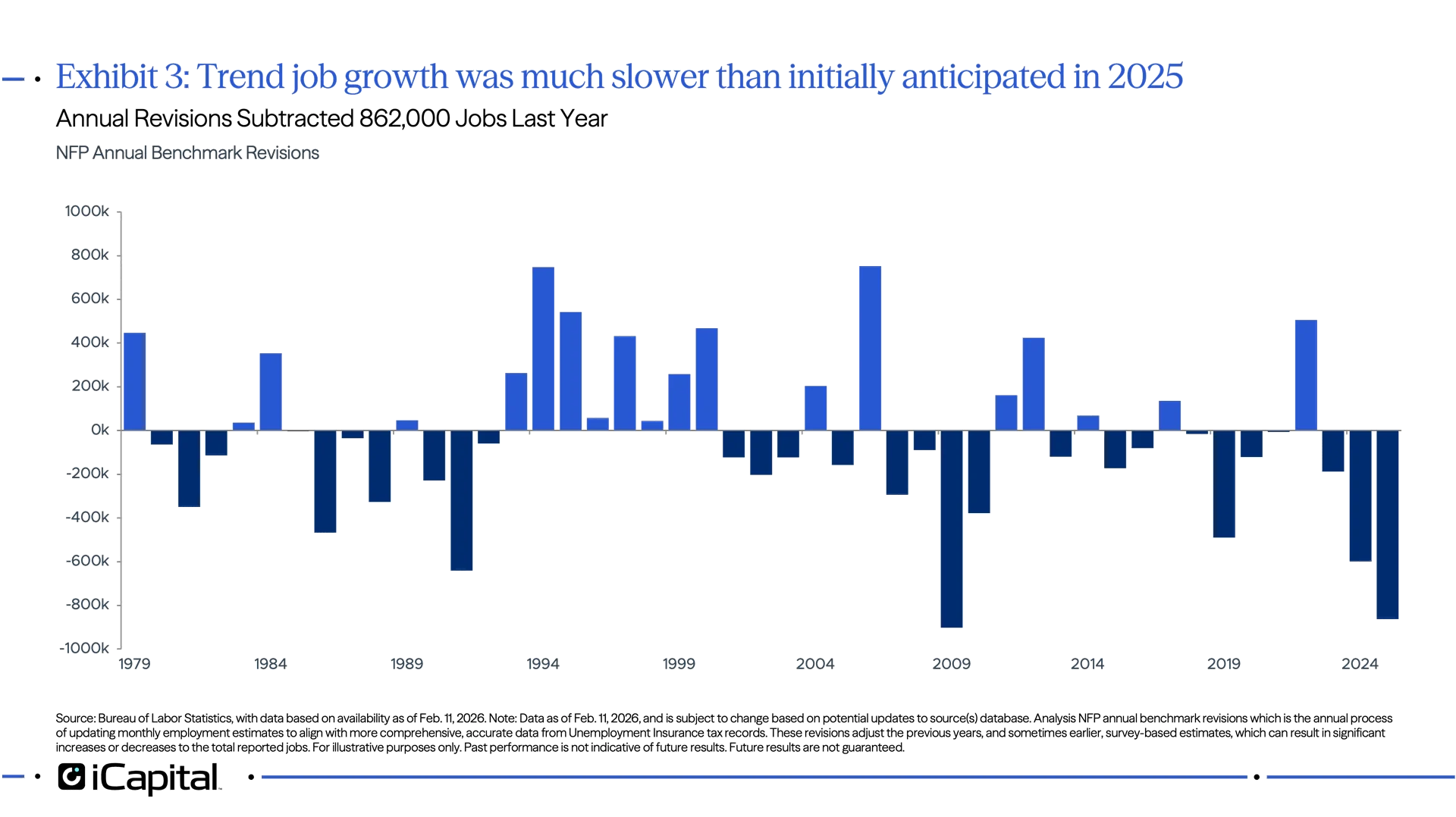

Despite the green shoots that are starting to appear, we still recognize that labor markets are in a peculiar balance as evidenced by some of the weaker data released earlier in the month. Specifically, ADP reported 22k new jobs in January, well below the consensus estimate of 45k.17 Challenger job‑cut announcements saw their largest January increase since 2009, and initial jobless claims have risen by 27K so far this year.18 Finally, the benchmark revisions showed that there were 862k fewer jobs created in 2025 – bringing the average monthly gain to 15k, down from the prior of 49k (see Exhibit 3).19

While the divergence between labor and GDP appears to be closing, the labor‑market recovery warrants close attention, as it remains in a peculiar balance – particularly with Chair Powell noting that job growth may be overstated by roughly 60K per month.20

Residual seasonality

This environment should also keep inflation running above target. While the latest CPI report was broadly in line with consensus expectations and shelter prices showed further signs of disinflating – rising just 0.22% MoM, below the 2025 average of 0.29%21 – underlying details were somewhat less reassuring.

Core service prices rose 0.39% MoM, the strongest reading since last January.22 In addition, the supercore measure rose 0.593% MoM, which is also the highest since last January.23 Both prints suggest some residual seasonality, even if it is less pronounced than what we saw a year ago (see Exhibit 4).  Given the government shutdown, we think inflation may run firmer this spring, as the BLS’ treatment of October–November rents sets up a mechanical payback in coming months.

Given the government shutdown, we think inflation may run firmer this spring, as the BLS’ treatment of October–November rents sets up a mechanical payback in coming months.

Fed on hold, but attention shifts to the balance sheet

With the labor markets stabilizing and inflation still running above target, the Fed appears to be on hold for the first half of 2026. Despite this, with President Trump’s pick of Kevin Warsh as the next Federal Reserve Chairman, there has been a lot of focus on the Fed’s balance sheet and the strategy going forward – placing renewed focus on the recent steepening of the yield curve.

Warsh has long been considered a balance sheet “hawk” and could look to reduce the Fed’s assets to “offset” any rate cuts to the policy rate. In essence, it would allow the Fed to cut rates while trying to keep a lid on loose financial conditions. This view was also echoed by Stephen Miran who recently stated that he was also supportive of a smaller balance sheet.

However, we think there are limitations to how small the balance sheet can get, especially since the balance sheet has shrunk from $9 trillion to $6.6 trillion from 2022-2025.24 These limitations include:

- Currency in circulation: From 2007 to today, currency in circulation has grown from 5.5% to 8% of GDP.25 As this trend persists, it will require a larger balance sheet – especially relative to pre-GFC levels.

- Treasury General Account: Although the TGA held steady at around $5 billion per day in 2007, its current size of roughly $960 billion – also representing a substantial increase relative to pre‑GFC levels.26

Since 2007, these two factors have accounted for roughly half of the increase in the Fed’s balance sheet.27 Given the likely limitations to balance sheet reductions, it will be important to monitor funding spreads in case the shrinkage in the balance sheet leads to funding stresses – similar to what we saw last fall and in 2019. This is precisely why the Fed began purchasing $40 billion in Treasury securities in December, a move that signals an improving liquidity environment even if the pace ultimately moderates as funding pressures ease.

Investment implications: Favor select cyclicals

With the economy reflating and growth expected to remain above trend (at least through H1), green shoots starting to appear in the labor market and a Fed on hold – this environment should favor cyclicals.

While cyclicals have outperformed defensives by roughly 16% since the beginning of September, we think it is important to be selective in our approach.28 Indeed, while the financial sector is down 5.7% on a year-to-date basis, the KBW Bank Index is up 1.32%.29 Meaning that not all cyclicals are created equal. Therefore, we would continue to favor banks, which benefit from deregulation tailwinds, a steeper yield curve and a pick-up in capital market activity. We also continue to favor industrials, which should benefit from the pick-up in manufacturing activity seen since the start of the year.

The current environment also has important implications for private markets. With the Fed on hold, base rates should remain around current levels. Given the floating rate nature of the private credit asset class, we think this will ultimately be supportive, especially when high yield and leverage loan spreads remain at multi-decade tights. In addition, we also said we see a year of mid-to-high single digit returns in equity markets, so with private credit yields at ~10% this should be attractive relative to a number of different asset classes.30

Despite the headlines around defaults and concerns around the exposure to software (discussed here), we think it is important to focus on managers that have a long and proven track record, and with loan books that are diversified and have exposure to sectors that should benefit from the real economy.

- Institute for Supply Management, as of Feb. 12, 2026.

- Institute for Supply Management, as of Feb. 12, 2026.

- Federal Reserve Bank of Atlanta, Bloomberg, as of Feb. 13, 2026.

- Tax Foundation, RBC, Goldmans Sachs, Bank of America, as of Feb. 4, 2026.

- Goldman Sachs, as of Oct. 17, 2025. Note: New spending includes border, defense and etc.

- Company data (Meta, Microsoft, Amazon, Alphabet and Oracle), as of Feb. 12, 2026.

- Bureau of Economic Analysis, as of Sep. 30, 2025.

- EY Partheon, Goldman Sachs as of Nov. 7, 2025.

- Bank of America, as of Feb. 4, 2026.

- Bloomberg Economics, Citi, as of Feb. 12, 2026.

- Bureau of Labor Statistics, as of December 17, 2025.

- Challenger, Gray & Christmas, as of Feb. 5, 2026.

- Department of Labor, as of Feb. 12, 2026.

- Bureau of Labor Statistics, as of Feb. 11, 2026.

- Bureau of Labor Statistics, as of February 11, 2026.

- Bureau of Labor Statistics, as of February 11, 2026.

- ADP, as of Feb. 4, 2026.

- Department of Labor as of Feb. 5, 2026.

- Bureau of Labor Statistics, as of Feb. 12, 2026

- Federal Reserve, as of Jan. 28, 2026.

- Bureau of Labor Statistics, as of Feb. 13, 2026.

- Bureau of Labor Statistics, as of Feb. 13, 2026.

- Bureau of Labor Statistics, as of Feb. 13, 2026.

- Federal Reserve, as of Feb. 12, 2026.

- Federal Reserve: Demystifying the Federal Reserve's Balance Sheet Governor Christopher Waller, as of Jul. 10, 2025.

- S. Treasury, as of Feb. 10, 2026

- Federal Reserve: Demystifying the Federal Reserve's Balance Sheet Governor Christopher Waller, as of Jul. 10, 2025.

- Bloomberg, as of Feb. 12, 2026.

- Bloomberg, as of Feb. 12, 2026.

- iCapital Alternatives Decoded, as of Jun. 2025.

INDEX DEFINITIONS

Bloomberg Economic Surprise Index: The Bloomberg Economic Surprise Index is a quantitative, weighted measure that tracks how much economic data releases deviate from the median forecasts of economists. A positive reading indicates data is exceeding expectations, while a negative reading shows data is missing expectations. It acts as a sentiment indicator, highlighting whether economic conditions are accelerating or slowing compared to consensus estimates.

Citi Economic Surprise Index: The Citigroup Economic Surprise Index (CESI) is a daily, objective, and quantitative measure of how economic data releases compare to market expectations over a rolling three-month window. It calculates the sum of the difference between actual economic data and consensus forecasts, often expressed as weighted historical standard deviations.

KBW Bank Index: is a benchmark stock index that tracks the performance of 24 leading U.S. banking stocks, including large national money‑center banks, major regional banks, and thrift institutions.

IMPORTANT INFORMATION

The material herein has been provided to you for informational purposes only by Institutional Capital Network, Inc. (“iCapital Network”) or one of its affiliates (iCapital Network together with its affiliates, “iCapital”). This material is the property of iCapital and may not be shared without the written permission of iCapital. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of iCapital.

This material is provided for informational purposes only and is not intended as, and may not be relied on in any manner as, legal, tax or investment advice, a recommendation, or as an offer or solicitation to buy or sell any security, financial product or instrument, or otherwise to participate in any particular trading strategy. This material does not intend to address the financial objectives, situation, or specific needs of any individual investor. You should consult your personal accounting, tax and legal advisors to understand the implications of any investment specific to your personal financial situation.

ALTERNATIVE INVESTMENTS ARE CONSIDERED COMPLEX PRODUCTS AND MAY NOT BE SUITABLE FOR ALL INVESTORS. Prospective investors should be aware that an investment in an alternative investment is speculative and involves a high degree of risk. Alternative Investments often engage in leveraging and other speculative investment practices that may increase the risk of investment loss; can be highly illiquid; may not be required to provide periodic pricing or valuation information to investors; may involve complex tax structures and delays in distributing important tax information; are not subject to the same regulatory requirements as mutual funds; and often charge high fees. There is no guarantee that an alternative investment will implement its investment strategy and/or achieve its objectives, generate profits, or avoid loss. An investment should only be considered by sophisticated investors who can afford to lose all or a substantial amount of their investment.

iCapital Markets LLC operates a platform that makes available financial products to financial professionals. In operating this platform, iCapital Markets LLC generally earns revenue based on the volume of transactions that take place in these products and would benefit from an increase in sales for these products.

The information contained herein is an opinion only, as of the date indicated, and should not be relied upon as the only important information available. Any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets is not necessarily indicative of the future or likely performance. The information contained herein is subject to change, incomplete, and may include information and/or data obtained from third party sources that iCapital believes, but does not guarantee, to be accurate. iCapital considers this third-party data reliable, but does not represent that it is accurate, complete and/or up to date, and it should not be relied on as such. iCapital makes no representation as to the accuracy or completeness of this material and accepts no liability for losses arising from the use of the material presented. No representation or warranty is made by iCapital as to the reasonableness or completeness of such forward-looking statements or to any other financial information contained herein.

Securities products and services are offered by iCapital Markets LLC, an SEC-registered broker-dealer, member FINRA and SIPC, and an affiliate of iCapital, Inc. and Institutional Capital Network, Inc. These registrations and memberships in no way imply that the SEC, FINRA, or SIPC have endorsed any of the entities, products, or services discussed herein. Annuities and insurance services are provided by iCapital Annuities and Insurance Services LLC, an affiliate of iCapital, Inc. “iCapital” and “iCapital Network” are registered trademarks of Institutional Capital Network, Inc. Additional information is available upon request.

©2026 Institutional Capital Network, Inc. All Rights Reserved.