The Federal Reserve (Fed) taper is all but imminent this afternoon. Everyone knows it, which is why it shouldn’t produce a big market reaction. Instead, the markets’ attention is likely to turn immediately to what’s next.

Assuming the Fed winds down its asset purchases in mid-2022, when is the rate hike coming? In this week’s commentary, we discuss why the Fed might take a more dovish stance in 2022 than what the markets are currently pricing in and how investors should consider positioning portfolios today and longer term.

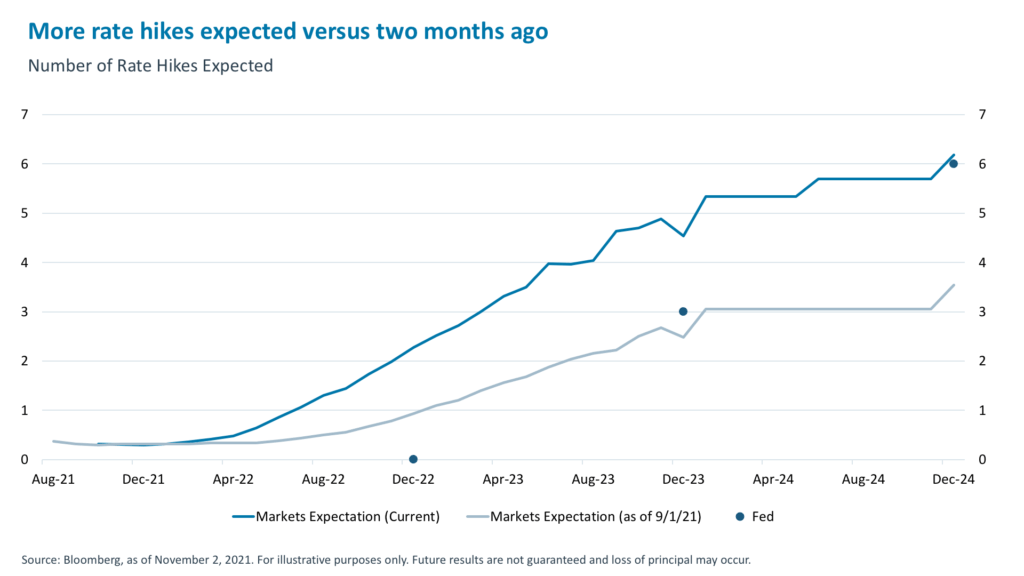

Markets are looking for a rate hike almost six months sooner than the Fed

The Fed fund futures markets are currently pricing in the first rate hike to occur by June of 2022 – right around the same time the Fed is expected to finish its bond purchases. This is much sooner than what we experienced during the last tightening cycle. October 2014 marked the last time the Fed stopped quantitative easing purchases, but back then, the Federal Open Market Committee waited over a year – until December 2015 – to hike rates. 1

Also, the futures markets’ pricing is more aggressive than what we saw in early September when the first rate hike was priced in for the fall of 2022. This is in contrast to the Fed’s own dot plot, which pencils in the first hike for 2023.2 So what’s caused this repricing since September and divergence from the Fed’s own expectations?

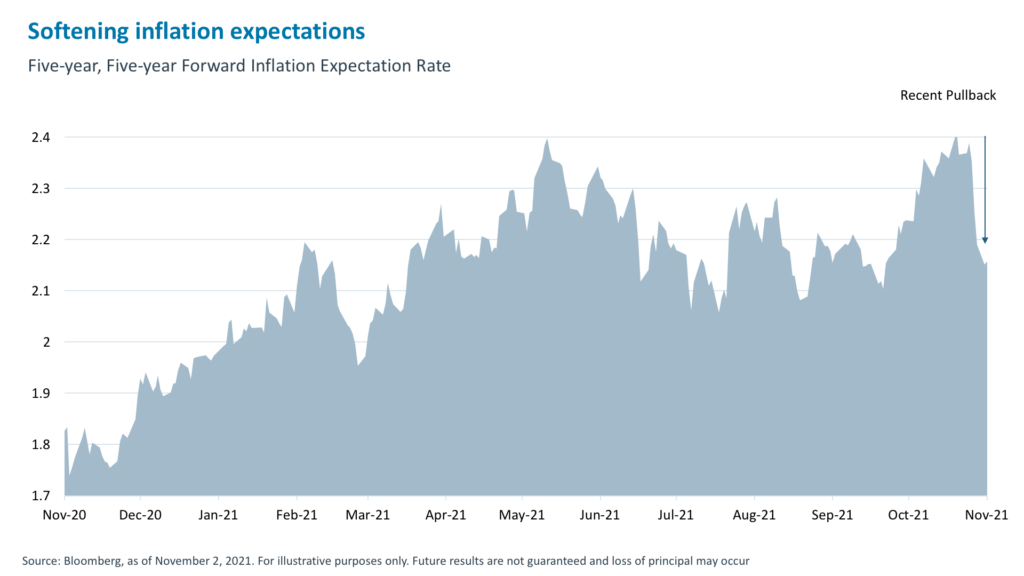

Inflation expectations are high but recently pulled back

The biggest driver of aggressive Fed fund futures market pricing has been the evolving market perception that inflation is anything but transitory. Indeed, forward inflation expectations rose sharply between September and late October, increasing from 2.14% to 2.4%.3 The markets assumed – and some Fed officials have intimated – that this higher inflation expectation could trigger the Fed to initiate rate hikes soon after tapering begins. This is especially the case since the rolling three-year average inflation should reach 2.4% by June 2022.4 Is this enough to constitute inflation that is “on track to moderately exceed two percent for some time” and would therefore trigger rate hikes? Perhaps, but a lot could happen between now and June.

While inflation expectations are elevated, they have declined meaningfully recently, easing pressure on the Fed.5 There are a few reasons for this. First, we expect supply chain bottleneck to begin to abate, and already, container shipping rates are falling.6 Additionally, while oil is surging for now, it could come off its highs in the spring of 2022, when the balance is forecast to flip from a deficit to a surplus as production recovers. Targeted lockdowns in China driven by a fresh round of COVID outbreaks may also dent China’s oil demand once again.

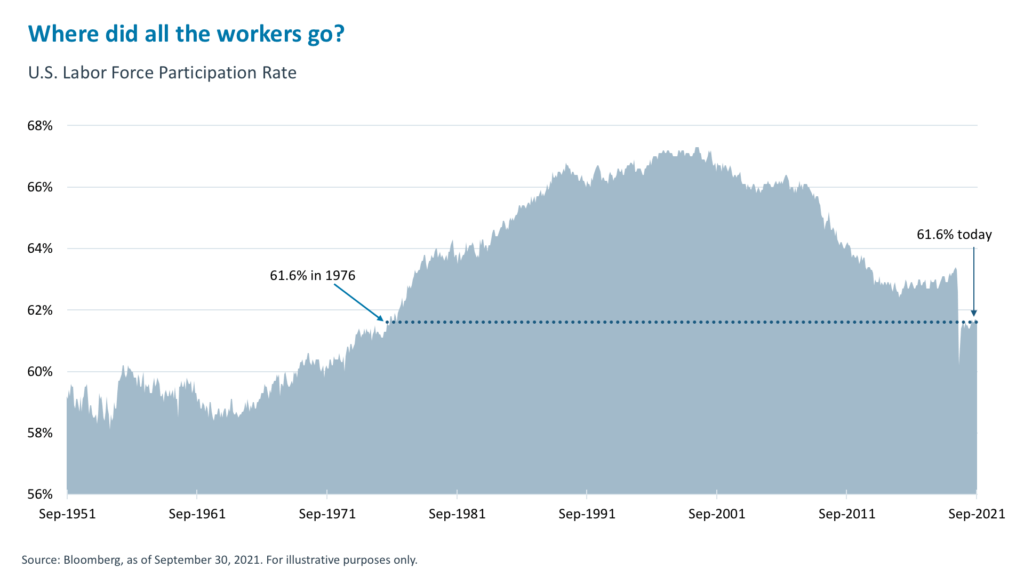

Labor force participation is at its lowest point in 45 years

Aside from inflation, the deciding factor in the Fed’s decision to hike rates will be achieving maximum employment, and that could take longer than the headline unemployment rate might suggest. This further supports the case for the Fed to be more dovish on rate hikes.

The Fed expects the unemployment rate (currently at 4.8%) to drop to 3.8% by the end of 2022, just a touch above the 3.5% low that we hit pre-pandemic.7 While this might sound good on the surface, two other measures will be equally important to get a true gauge of our distance from maximum employment. The first is U-6 unemployment, which counts those who are employed part-time but wish they were full-time and those who are marginally attached to the labor force. The U-6 rate today is 8.5% versus the pre-pandemic low of 6.8%.8

Second, the labor participation rate, a ratio of the employed to those in the labor force seeking employment, will also be heavily scrutinized. At 61.6% today, this ratio is at its lowest point in 45 years! Demographic trends and early retirements are partly to blame for this number, but the participation rate for workers aged 24 to 54 years is also 1.3% below pre-pandemic levels (81.6% versus 82.9% in December 2019).9 The Fed may want to see this ratio tick higher to ensure that we are as close to maximum employment as possible before it begins rate hikes.

Additionally, the Biden Administration’s Build Back Better plan aims to bring one million parents back into the labor force through expanded access to childcare options.10 If the bill passes, however, it might take some time for this cohort to find jobs.

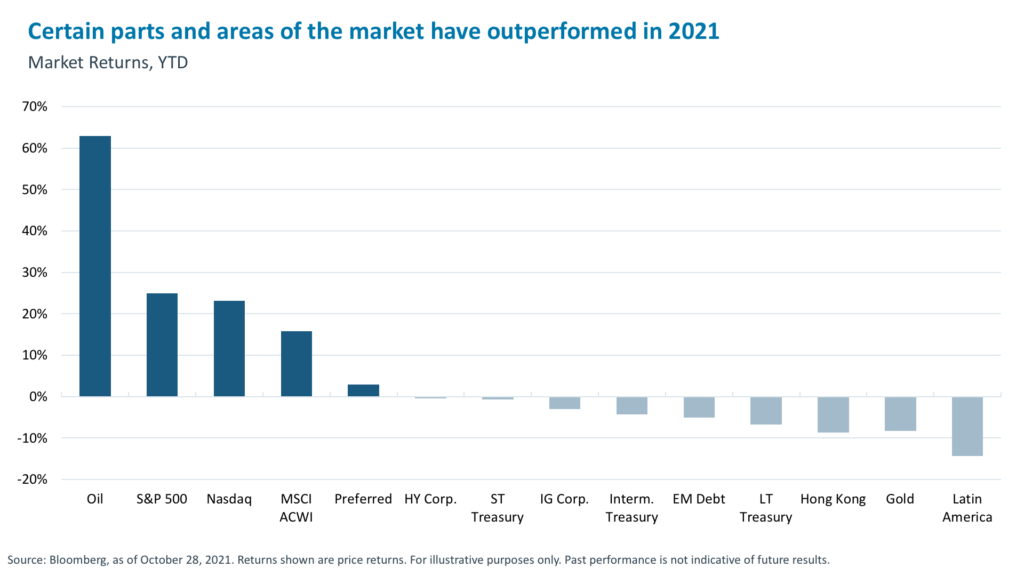

Investment implications

The Fed meeting today (and especially the one scheduled for December) should shed some light on their likely reaction to higher-than-expected inflation and progress on unemployment. Our current view is that the Fed may want to put some distance between the end of tapering and the beginning of rate liftoff. If they do, this should prompt a lower two-year yield, higher 10-year yields, a steeper yield curve and, likely, outperformance from cyclical assets. The market overall should react positively to the fact the tightening cycle is not imminent. Still, faster or slower, rate-hiking cycles in the past caused rate-sensitive short-term fixed income to underperform, while equities fared well, including growth equities.11 This is why “the tale of two cities” performance of 2021 that saw equities hit record highs while fixed income languished (as seen in the chart below) could be repeated in 2022, except with more muted stock market performance likely.

The bottom line for investors: Don’t fear the taper, but if a more dovish Fed causes a rally in short-term fixed income, consider using that rally to prepare your fixed income portfolio for the upcoming rate-hiking cycle. We think private credit is one of the better places to be in a solid-growth and rising-rate environment.

1. Federal Reserve Bank of New York, Markets & Policy Implementation.

2. Bloomberg, as of November 2, 2021.

3. Bloomberg, as of November 2, 2021.

4. Federal Reserve, Summary of Economic Projections, September 2021.

5. Bloomberg, as of November 2, 2021.

6. Bloomberg, Drewry WCI Composite Container Freight Benchmark Rate, as of October 28, 2021.

7. Federal Reserve, Summary of Economic Projections, September 2021.

8. U.S. Bureau of Labor Statistics, Current Employment Statistics, September 2021.

9. Bloomberg, as of October 2021.

10. The White House, FACT SHEET: The American Families Plan, April 28, 2021.

11. Bloomberg, as of October 2021.

IMPORTANT INFORMATION

The material herein has been provided to you for informational purposes only by iCapital, Inc. (“iCapital”). This material is the property of iCapital and may not be shared without the written permission of iCapital. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of iCapital.

This material is provided for informational purposes only and is not intended as, and may not be relied on in any manner as, legal, tax or investment advice, a recommendation, or as an offer to sell, a solicitation of an offer to purchase or a recommendation of any interest in any fund or security. You should consult your personal accounting, tax and legal advisors to understand the implications of any investment specific to your personal financial situation. This material does not intend to address the financial objectives, situation or specific needs of any individual investor. Alternative investments are complex, speculative investment vehicles and are not suitable for all investors.

The information contained herein is an opinion only, as of the date indicated, and should not be relied upon as the only important information available. Any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets is not necessarily indicative of the future or likely performance. The information contained herein is subject to change, incomplete, and may include information and/or data obtained from third party sources that iCapital believes, but does not guarantee, to be accurate. iCapital considers this third-party data reliable, but does not represent that it is accurate, complete and/or up to date, and it should not be relied on as such. iCapital makes no representation as to the accuracy or completeness of this material and accepts no liability for losses arising from the use of the material presented. No representation or warranty is made by iCapital as to the reasonableness or completeness of such forward-looking statements or to any other financial information contained herein.

Securities products and services are offered by iCapital Markets, an SEC-registered broker-dealer, member FINRA and SIPC, and an affiliate of iCapital, Inc. and Institutional Capital Network, Inc. These registrations and memberships in no way imply that the SEC, FINRA, or SIPC have endorsed any of the entities, products, or services discussed herein. Annuities and insurance services are provided by iCapital Annuities and Insurance Services LLC, an affiliate of iCapital, Inc. “iCapital” and “iCapital Network” are registered trademarks of Institutional Capital Network, Inc. Additional information is available upon request.

© 2023 Institutional Capital Network, Inc. All Rights Reserved.