Key Takeaways:

- Recent credit situations have raised fresh questions around the health of credit markets and whether there are more widespread systematic vulnerabilities.

- Private credit is interconnected with the banking system. US banks have $96 billion in loan commitments to private credit vehicles, mostly in the form of revolving credit lines.1

- The current risks to the financial system appear limited due to moderate leverage and long-term underlying capital commitments. Further, the utilization of bank credit lines by private credit vehicles has been stable and is a small part (4%) of bank exposure to non-bank lenders.2

- The market ultimately rests on the performance of underlying portfolio borrowers. Here, private credit underwriting standards have an information advantage, defaults are low, lenders have control in a workout situation, and above average equity subordination exists.

Private Direct Lending Is Rapidly Expanding

Recent credit events have raised questions about the growing interdependence between private credit and the broader financial system. The current risks appear limited due to moderate leverage and long-term underlying commitments in the form of capital lock-ups. Still, private credit has interdependencies with the banking system which makes evaluating overall systematic risk complex.

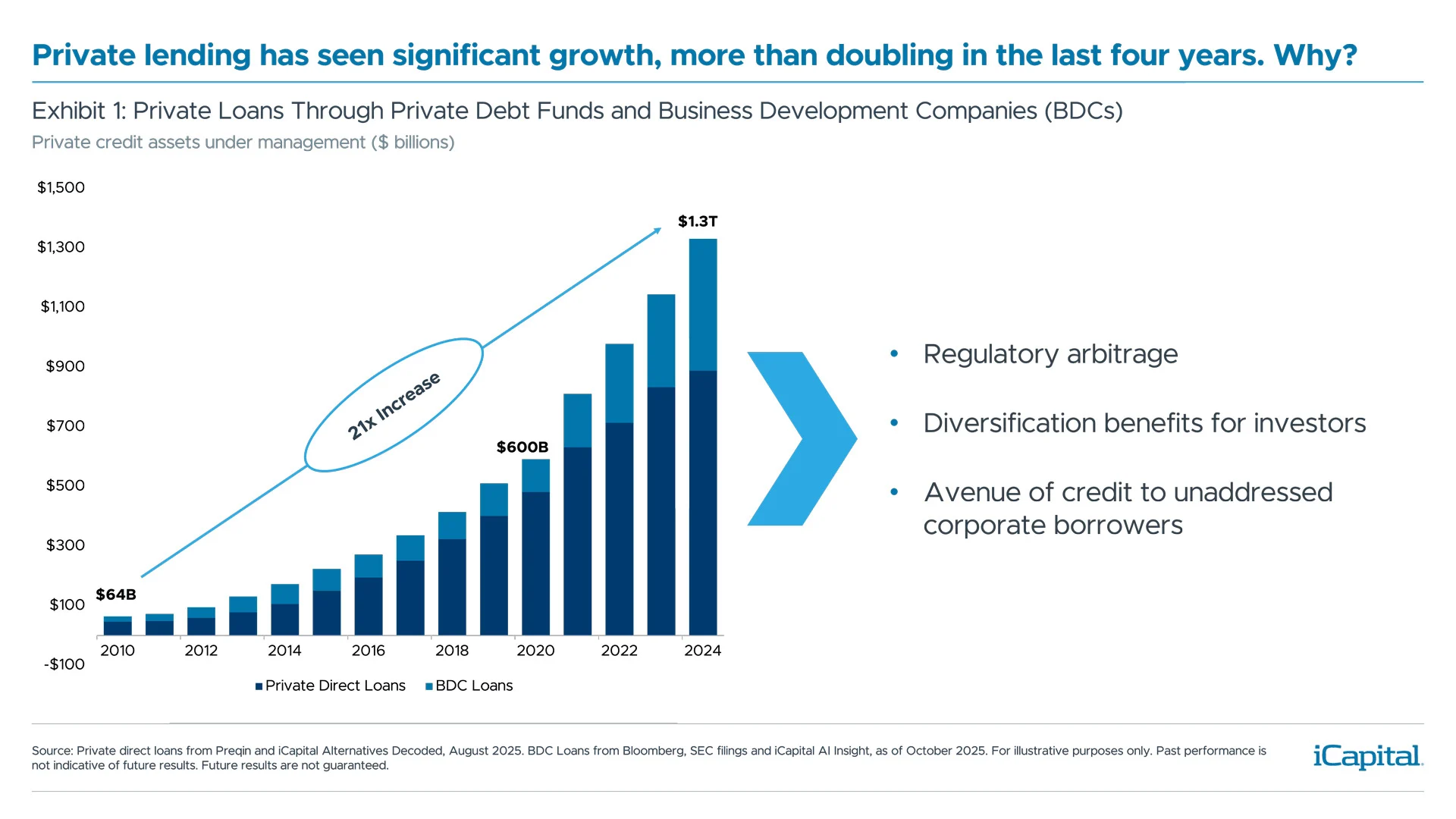

Private, or direct lending, is a huge market with dramatic growth over the last ten years reaching $1.3 trillion in assets at the end of 2024 (Exhibit 1). To put this in context, direct lending is now the same size as the amount of outstanding US high yield corporate bonds.3 Why has the market taken off? Three main reasons: regulatory arbitrage, a diversification benefit for investors, and a source of financing to corporate borrowers that might not otherwise be available.

How Private Credit is Connected to the Banking System

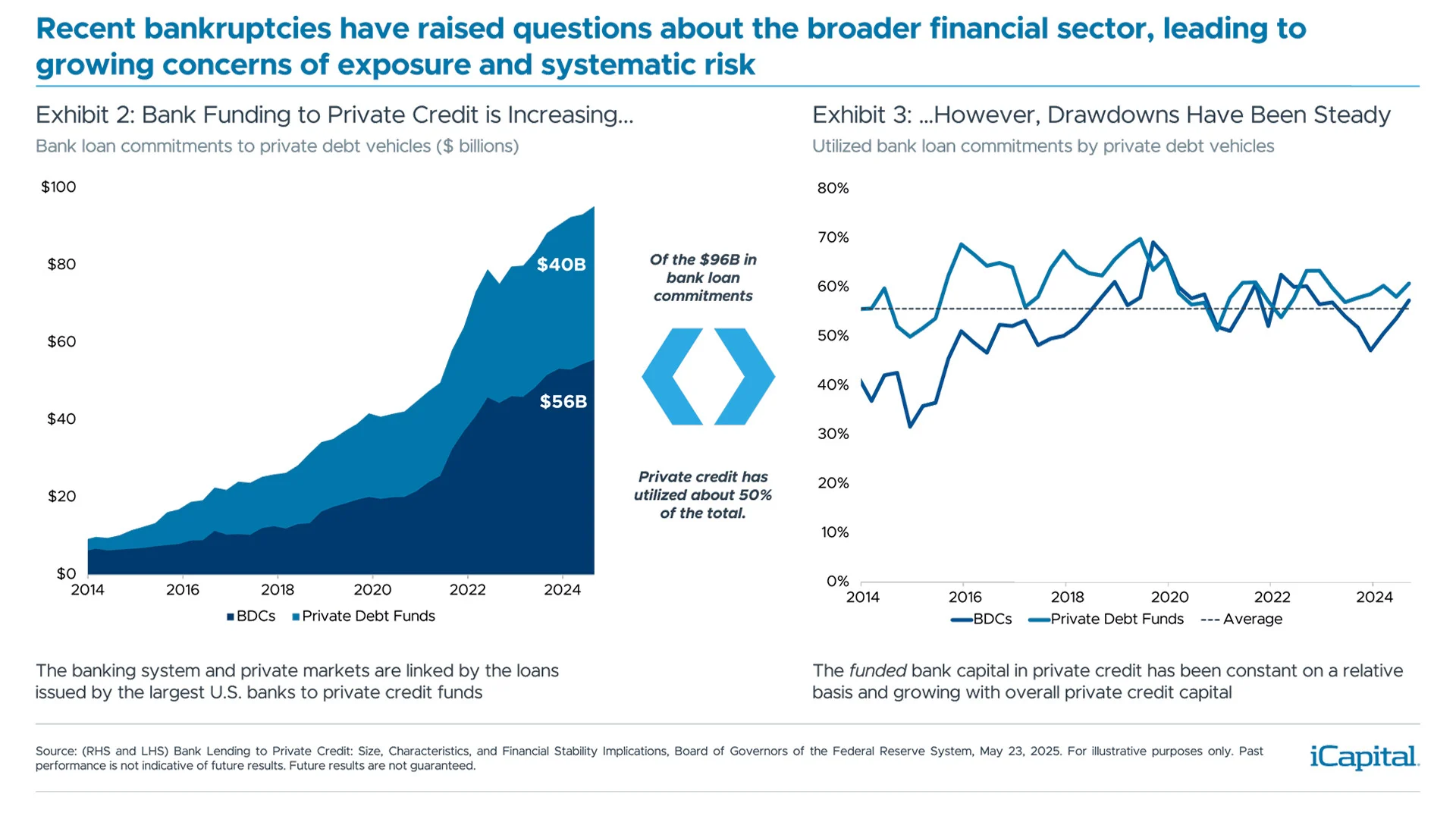

The rapid emergence of private credit has shifted traditional bank services such as corporate lending outside of the banking system. But the line is blurred. While the actual lending is taking place outside of the banking system, not all the risk and credit exposure is isolated there. Why? Many private credit vehicles borrow from banks to make investments and add leverage. Consequently, the health of private credit firms has implications for the overall financial system.

As seen in Exhibit 2, US banks have $96 billion in loan commitments to private credit vehicles, mostly in the form of revolving credit lines. The utilization rate on both term and revolving credit lines is 59%, indicating there is plenty of unutilized bank capital, or dry powder, available (Exhibit 3).

Bank Loans Are One Source of Leverage for Private Credit

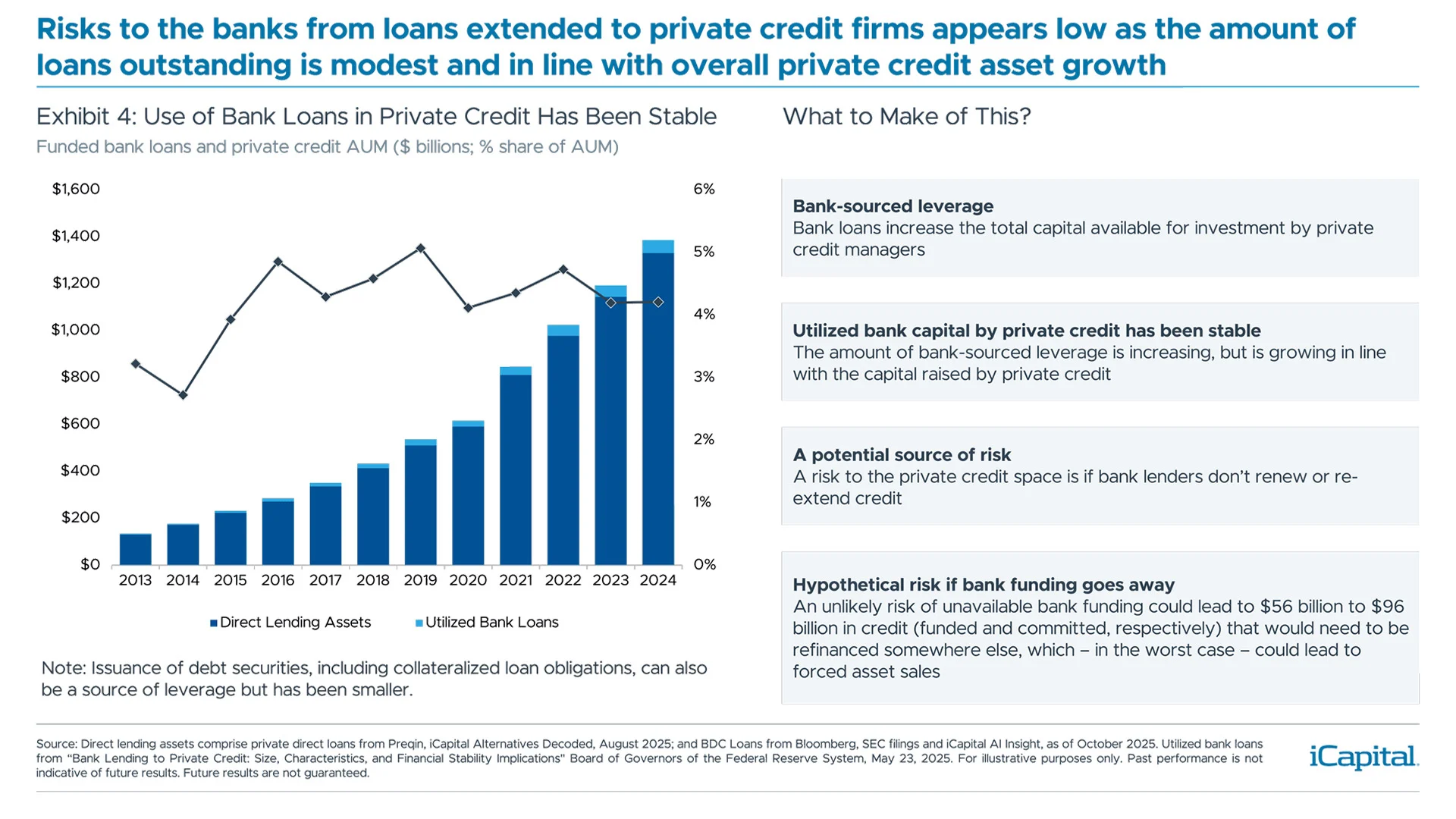

The immediate risks to the banking system appear low. While bank loans to private credit have grown, the growth has been in line with the overall growth in private credit. Meaning, the ratio of bank loans to direct lending has been stable over the last ten years.

Bank Exposure is Growing, But is Still Limited

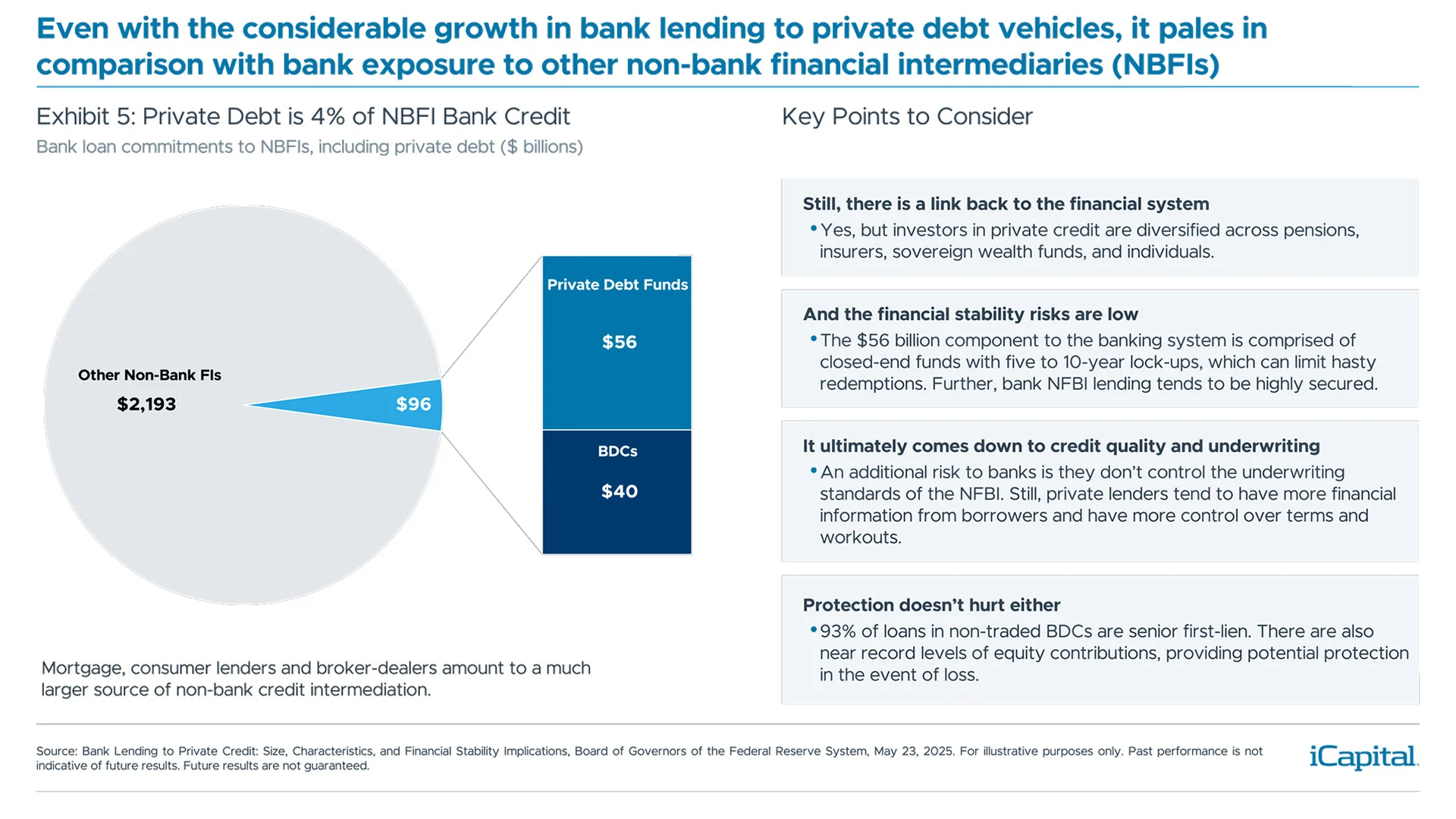

It’s also important to put the size of private credit in context when discussing potential systematic concerns. The total amount of bank loan commitments to private credit vehicles represents 4% of total bank loans to non-bank financial intermediaries (NBFIs) as seen in Exhibit 5. Further, bank lending to NBFIs tends to be highly secured – providing another layer of protection.

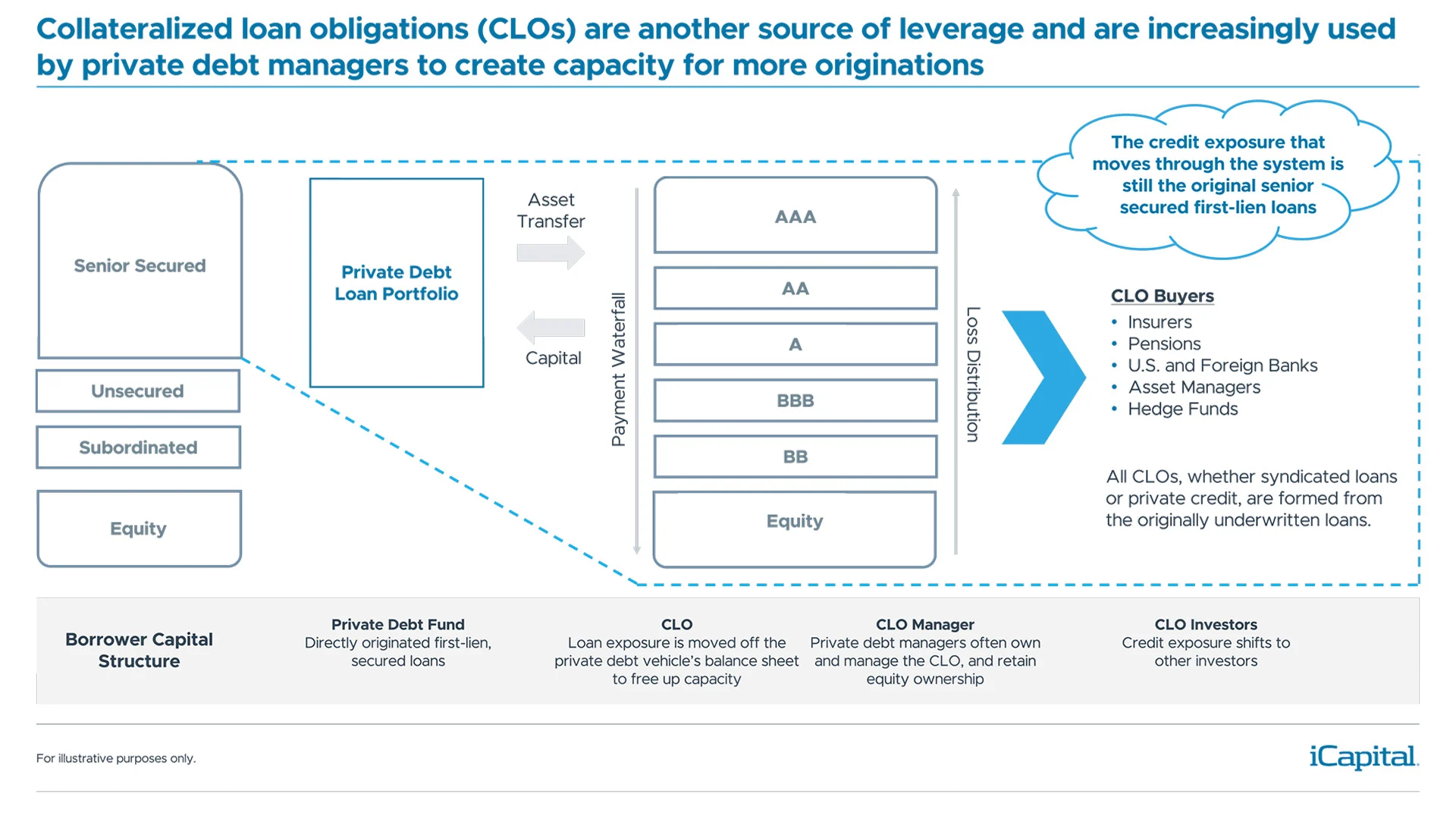

Secondary Exposure and CLOs in Private Credit

Are there other hidden areas of exposure? There can also be secondary exposure through securitizations such as collateralized loan obligation (CLOs). Several private credit managers and BDCs utilize CLOs as a financing mechanism, or another source of capital for leverage. Importantly, all CLOs – whether comprised of broadly syndicated or private credit loans – are formed from the originally underwritten loans. In the case of private lending, this is mostly first lien, senior secured loans.

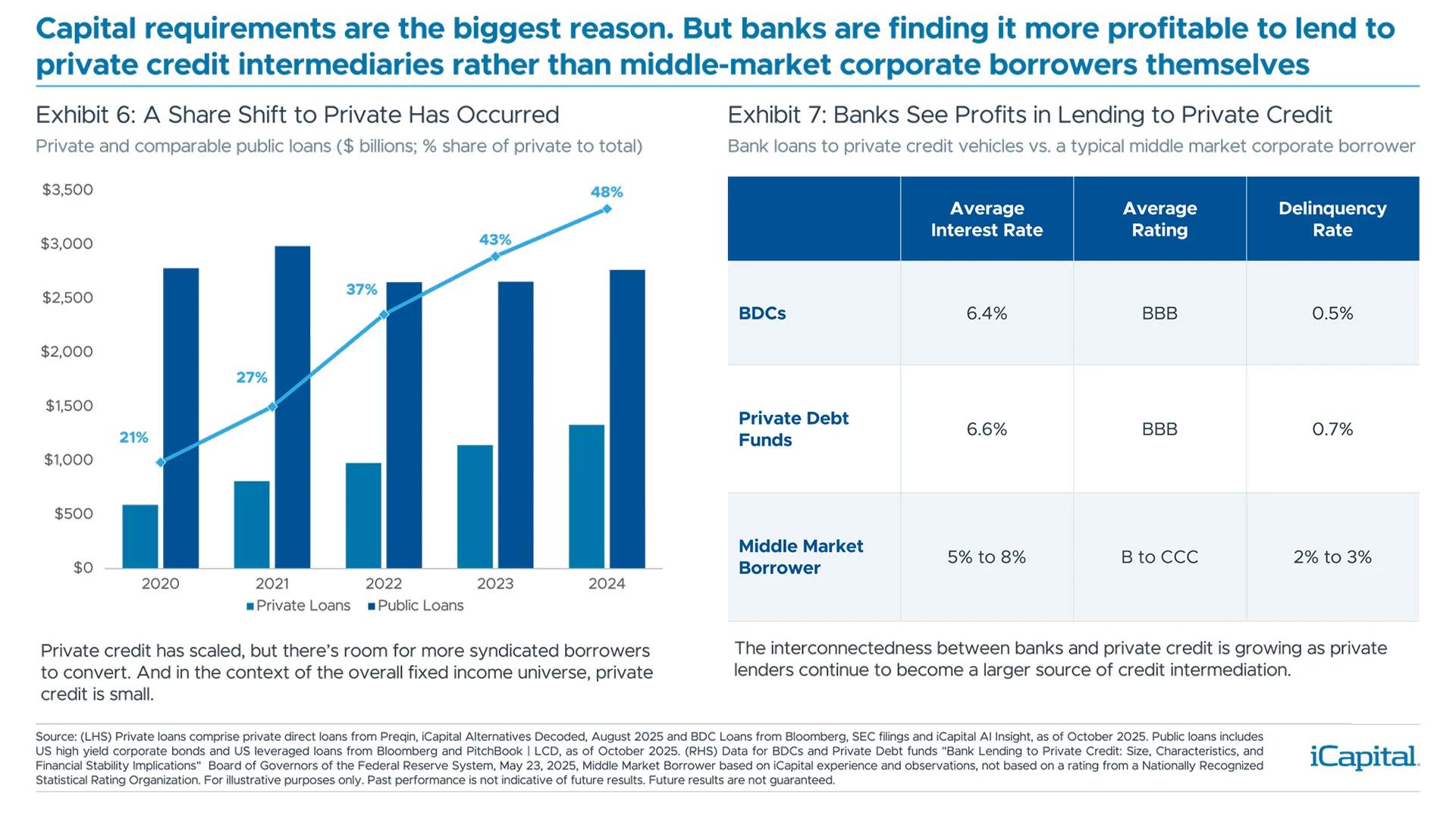

Competitors and Partners

Why are the banks in the business of lending to credit intermediaries? In the case of private credit, capital requirements are the biggest reason. It can simply be costly for many banks to lend to middle-market borrowers due to the cost of regulatory capital requirements. However, banks are finding it profitable to lend to private credit intermediaries themselves. Exposure here generates a decent spread and faces low delinquency rates (Exhibit 7).

Moving Parts But it Comes Down to Credit Health

While private lenders have a reliance on bank funding – which is an opening back to the banking system – bank commitments are manageable, and utilization has been stable. The risk emanating from private credit appears limited as long-term lock-ups, a diversified investor base and manageable leverage mitigate undue volatility or forced sales. Direct lenders and BDCs also tend to have minimal exposure to off-balance sheet financing.

At the end of the day, the market rests on the performance of underlying portfolio borrowers. Here, private credit underwriting standards have an information advantage, defaults are low, lenders have control in a workout situation, and above average equity subordination exists.

- Bank Lending to Private Credit: Size, Characteristics, and Financial Stability Implications, Board of Governors of the Federal Reserve System, May 23, 2025.

- Bank Lending to Private Credit: Size, Characteristics, and Financial Stability Implications, Board of Governors of the Federal Reserve System, May 23, 2025

- Derived from Exhibit 6. Private loan AUM of $1.33T compares to US high yield corporate bond outstanding of $1.35T in 2024. Public loan data in Exhibit 6 also includes $1.42T in US leveraged loans outstanding.

IMPORTANT INFORMATION

The material herein has been provided to you for informational purposes only by Institutional Capital Network, Inc. (“iCapital Network”) or one of its affiliates (iCapital Network together with its affiliates, “iCapital”). This material is the property of iCapital and may not be shared without the written permission of iCapital. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of iCapital.

This material is provided for informational purposes only and is not intended as, and may not be relied on in any manner as, legal, tax or investment advice, a recommendation, or as an offer or solicitation to buy or sell any security, financial product or instrument, or otherwise to participate in any particular trading strategy. This material does not intend to address the financial objectives, situation, or specific needs of any individual investor. You should consult your personal accounting, tax and legal advisors to understand the implications of any investment specific to your personal financial situation.

ALTERNATIVE INVESTMENTS ARE CONSIDERED COMPLEX PRODUCTS AND MAY NOT BE SUITABLE FOR ALL INVESTORS. Prospective investors should be aware that an investment in an alternative investment is speculative and involves a high degree of risk. Alternative Investments often engage in leveraging and other speculative investment practices that may increase the risk of investment loss; can be highly illiquid; may not be required to provide periodic pricing or valuation information to investors; may involve complex tax structures and delays in distributing important tax information; are not subject to the same regulatory requirements as mutual funds; and often charge high fees. There is no guarantee that an alternative investment will implement its investment strategy and/or achieve its objectives, generate profits, or avoid loss. An investment should only be considered by sophisticated investors who can afford to lose all or a substantial amount of their investment.

iCapital Markets LLC operates a platform that makes available financial products to financial professionals. In operating this platform, iCapital Markets LLC generally earns revenue based on the volume of transactions that take place in these products and would benefit by an increase in sales for these products.

The information contained herein is an opinion only, as of the date indicated, and should not be relied upon as the only important information available. Any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets is not necessarily indicative of the future or likely performance. The information contained herein is subject to change, incomplete, and may include information and/or data obtained from third party sources that iCapital believes, but does not guarantee, to be accurate. iCapital considers this third-party data reliable, but does not represent that it is accurate, complete and/or up to date. iCapital makes no representation as to the accuracy or completeness of this material and accepts no liability for losses arising from the use of the material presented. No representation or warranty is made by iCapital as to the reasonableness or completeness of such forward-looking statements or to any other financial information contained herein.

Securities products and services are offered by iCapital Markets LLC, an SEC-registered broker-dealer, member FINRA and SIPC, and an affiliate of iCapital, Inc. and Institutional Capital Network, Inc. These registrations and memberships in no way imply that the SEC, FINRA, or SIPC have endorsed any of the entities, products, or services discussed herein. Annuities and insurance services are provided by iCapital Annuities and Insurance Services LLC, an affiliate of iCapital, Inc. “iCapital” and “iCapital Network” are registered trademarks of Institutional Capital Network, Inc. Additional information is available upon request.

©2025 Institutional Capital Network, Inc. All Rights Reserved.