Defining Foreign Exchange

The foreign exchange market, also known as the Forex Market or simply FX, is the global market for trading currencies. At its most basic level, FX trading involves the buying and selling of currencies with the goal of either generating a profit or reducing risk in a portfolio. Each individual trade involves a pair of currencies and an exchange rate, which is the price at which one currency will be exchanged for the other.

Foreign Exchange Trading Instruments

Spot

Spot transactions involve the purchase or sale of a currency for instant delivery on a specified date.

Forwards

A negotiated contract between two parties to exchange a pair of currencies at an agreed upon rate at a specific time in the future.

Futures

A standardized contract between two parties to exchange a pair of currencies at a specific rate and time in the future.

Swaps

A negotiated transaction where two parties exchange principal and interest payments in different currencies for a specified period.

Options

A standardized contract that gives the buyer the right to exchange a certain currency at a specific exchange rate on or before a certain date.

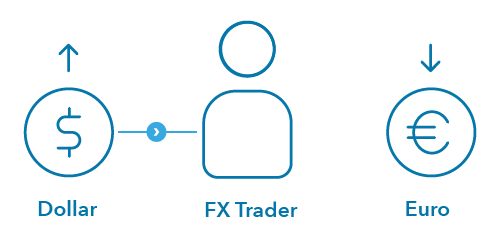

Hypothetical FX Trade

An FX trader believes the U.S. economy is going to grow faster than consensus expectations and that the Federal Reserve will raise interest rates to counter the resulting inflation. Meanwhile, economic activity in the eurozone is likely to meet or fall below expectations. With these assumptions, an FX trader buys the U.S. dollar against the Euro, anticipating that better-than-expected growth and the potential for higher interest rates will lift the value of the U.S. dollar relative to the Euro.

BENEFITS

![]() Hedge or reduce short-term and/or unwanted portfolio exposures.

Hedge or reduce short-term and/or unwanted portfolio exposures.

![]() Diversify current portfolio exposures.

Diversify current portfolio exposures.

![]() Create exposure to a different asset class for the potential to enhance returns.

Create exposure to a different asset class for the potential to enhance returns.

KEY RISK CONSIDERATIONS

Key risk considerations may include, but are not limited to, the following:

![]() Loss of capital: The loss of capital may be greater than the amount initially invested.

Loss of capital: The loss of capital may be greater than the amount initially invested.

![]() Complex securities: FX instruments require specialized knowledge or expertise given the complexity involved and the number of factors affecting a trade.

Complex securities: FX instruments require specialized knowledge or expertise given the complexity involved and the number of factors affecting a trade.

![]() Country risk: The general structure and stability of the issuing country will impact the underlying exchange rate.

Country risk: The general structure and stability of the issuing country will impact the underlying exchange rate.

![]() Counterparty risk: The probability that one party in a transaction defaults or does not fulfill their contractual obligation.

Counterparty risk: The probability that one party in a transaction defaults or does not fulfill their contractual obligation.

Please contact your financial professional or wealth management platform to learn more.

IMPORTANT INFORMATION

The material herein has been provided to you for informational purposes only by Institutional Capital Network, Inc. (“iCapital Network”) or one of its affiliates (iCapital Network together with its affiliates, “iCapital”). This material is the property of iCapital and may not be shared without the written permission of iCapital. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of iCapital.

This material is provided for informational purposes only and is not intended as, and may not be relied on in any manner as, legal, tax or investment advice, a recommendation, or as an offer or solicitation to buy or sell any security, financial product or instrument, or otherwise to participate in any particular trading strategy. This material does not intend to address the financial objectives, situation, or specific needs of any individual investor. You should consult your personal accounting, tax and legal advisors to understand the implications of any investment specific to your personal financial situation.

ALTERNATIVE INVESTMENTS ARE CONSIDERED COMPLEX PRODUCTS AND MAY NOT BE SUITABLE FOR ALL INVESTORS. Prospective investors should be aware that an investment in an alternative investment is speculative and involves a high degree of risk. Alternative Investments often engage in leveraging and other speculative investment practices that may increase the risk of investment loss; can be highly illiquid; may not be required to provide periodic pricing or valuation information to investors; may involve complex tax structures and delays in distributing important tax information; are not subject to the same regulatory requirements as mutual funds; and often charge high fees. There is no guarantee that an alternative investment will implement its investment strategy and/or achieve its objectives, generate profits, or avoid loss. An investment should only be considered by sophisticated investors who can afford to lose all or a substantial amount of their investment.

iCapital Markets LLC operates a platform that makes available financial products to financial professionals. In operating this platform, iCapital Markets LLC generally earns revenue based on the volume of transactions that take place in these products and would benefit by an increase in sales for these products.

The information contained herein is an opinion only, as of the date indicated, and should not be relied upon as the only important information available. Any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets is not necessarily indicative of the future or likely performance. The information contained herein is subject to change, incomplete, and may include information and/or data obtained from third party sources that iCapital believes, but does not guarantee, to be accurate. iCapital considers this third-party data reliable, but does not represent that it is accurate, complete and/or up to date, and it should not be relied on as such. iCapital makes no representation as to the accuracy or completeness of this material and accepts no liability for losses arising from the use of the material presented. No representation or warranty is made by iCapital as to the reasonableness or completeness of such forward-looking statements or to any other financial information contained herein.

Securities products and services are offered by iCapital Markets, an SEC-registered broker-dealer, member FINRA and SIPC, and an affiliate of iCapital, Inc. and Institutional Capital Network, Inc. These registrations and memberships in no way imply that the SEC, FINRA, or SIPC have endorsed any of the entities, products, or services discussed herein. Annuities and insurance services are provided by iCapital Annuities and Insurance Services LLC, an affiliate of iCapital, Inc. “iCapital” and “iCapital Network” are registered trademarks of Institutional Capital Network, Inc. Additional information is available upon request.

©2024 Institutional Capital Network, Inc. All Rights Reserved. | 2024.01