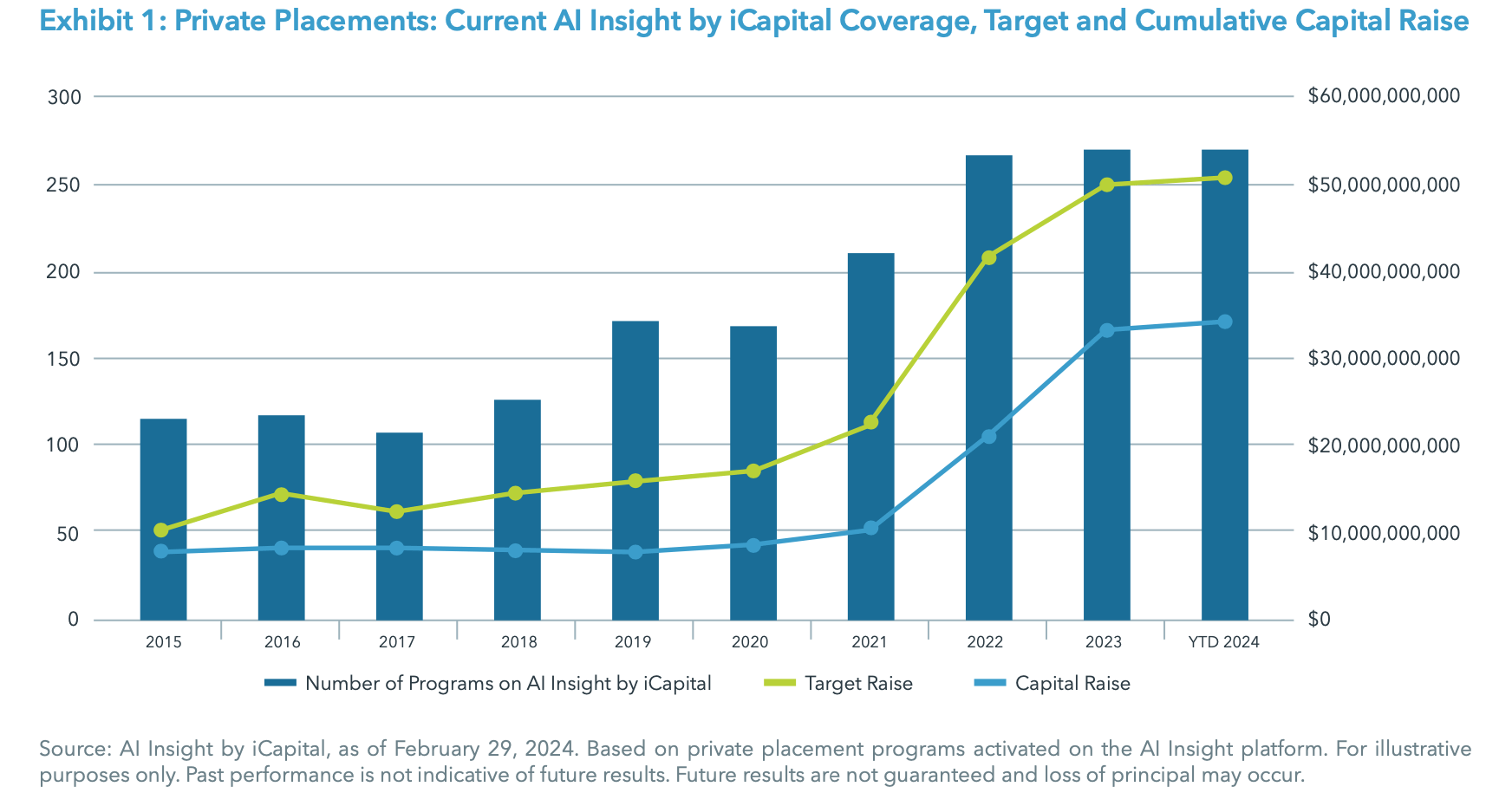

- As of March 1, AI Insight by iCapital covers 272 private placements currently raising capital, with an aggregate target raise of $50.9 billion and an aggregate reported raise of $34.6 billion or 68% of target.1

- The average size of funds currently raising capital is $187 million. Funds range in size from $3.5 million for a specified industrial 1031 exchange to a recently increased $15 billion AUM diversified private equity and debt fund.1

- Real estate-related funds, including 1031s, Opportunity Zone Funds, and non-1031 real estate LLCs, LPs, and private REITs represent 71% of the total number of funds and 48% of aggregate target. The percentage of target continues to trend down as larger private equity and hedge funds have been added along with the slowdown in real estate. Additionally, private equity’s share of the target raise is likely much higher because, despite the closing of the large private equity fund, there are 13 funds that do not report a target or capital raise, as they are seeking instead to raise a percentage of a larger, institutional fund rather than a specific dollar amount.1

- In terms of coverage by general objective, income has been and remains the largest component at 55% of funds, while growth and growth and income follow at 24% and 19%, respectively.1

- 60% of private placements we cover use the 506(b) exemption, 33% use 506(c), and 7% have not yet filed their Form D with the SEC.1

- Twelve private placements closed to new investors in February and 31 have closed year-to-date, having been on the platform for an average of 378 days. The 26 funds that reported a raise at close raised 90% of target, on average.1

- According to Pitchbook, overall private capital fundraising was down 20% in 2023 from 2022, with much dispersion in activity ranging from 47% less capital closed on for venture capital and 41% less for real estate, to 65% more for secondaries funds. Fewer funds closed overall, down 48% from 2022. However, Pitchbook noted that capital raise numbers for private markets is on a lag as funds are finalizing closings, and that most likely the end result will show that last year was roughly the same as 2022 – down from the peak in 2021 and more in-line with pre-pandemic fund flows. Another trend noted was the “denominator effect” is no longer an issue limiting investment in private market funds, which bodes well for fundraising going forward. Strong public market returns, and private market write-downs have balanced out private market weightings in portfolios.2

- Preqin reported that fundraising concentration to the largest managers has increased over the last decade but has leveled out overall other than less mature categories. The Gini co-efficient, which measures the dispersion of managers and funds raised over time with 0 being perfect equality and 1 being perfect inequality, has increased from 0.67 in 2004 to 0.81 in 2023. The report suggests that the more mature markets such as private equity have reached equilibrium with this concentration, while less mature markets such as private debt and real estate may continue to see increases in concentration. In these markets, the large, institutional early movers will represent a disproportionate amount of the market while it is maturing.3

- According to Pitchbook, private equity exhibited a 0.77 correlation to the S&P 500 from 2000 to year-end 2023. Interestingly, secondaries provided the lowest correlation at 0.23, along with the lowest correlation to other traditional asset classes. This was lower than the correlation of real estate or private debt strategies, which were reported at 0.30 and 0.43.4

- iCapital recently published an Investment & Market Strategy report, Trading Places: Mapping the Impact of Alts in a Traditional Portfolio, highlighting the benefits of adding alternatives to an investment portfolio. Historical analysis shows that adding a 20% allocation to a diversified set of alternatives, including private equity, private debt, real estate and hedge funds, lifted returns by 100 basis points over the last 16 years while reducing volatility. The analysis showed improvements in returns in 98.6% of modeled scenarios, with the portfolio including alternatives outperforming most strongly during weaker markets. This makes sense given the lower correlations and strengthens the case for an allocation going forward.

- iCapital also recently published a new Market Pulse: Signs Point to an Improving Equity Exit Environment. While private equity deal activity has been sluggish the last two years, increasing hold periods to well above long- term averages, recent activity and valuations suggest that a turnaround is upon us. Exit activity was down again in Q4 2023, but the rate of decline eased from prior quarters and the trend is positive. Another positive signal from this report is the volume of US leveraged finance activity, which skyrocketed in January and was more than 2.5 times the amount of activity last January. This means companies are positioning for increased activity. Additionally, the public markets have repriced, up 39% from their lows, and public market valuations are higher, often a leading indicator for private market valuations.

1. AI Insight by iCapital, as of Feb. 29, 2024. The data in this report is based upon the private placements on the AI Insight by iCapital platform, which does not reflect the entire universe of private placements available in the market. For informational purposes only.

2. Pitchbook, Global Private Market Fundraising Report, March 5, 2024.

3. Preqin, The Concentration of Private Capital, Feb. 5, 2024.

4. PitchBook, Q1 2024 Quantitative Perspectives: U.S. Market Insights, Feb. 9, 2024.

IMPORTANT INFORMATION

The material herein has been provided to you for informational purposes only by Institutional Capital Network, Inc. (“iCapital Network”) or one of its affiliates (iCapital Network together with its affiliates, “iCapital”). This material is the property of iCapital and may not be shared without the written permission of iCapital. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of iCapital. This material is provided for informational purposes only and is not intended as, and may not be relied on in any manner as, legal, tax or investment advice, a recommendation, or as an offer or solicitation to buy or sell any security, financial product or instrument, or otherwise to participate in any particular trading strategy. This material does not intend to address the financial objectives, situation, or specific needs of any individual investor. You should consult your personal accounting, tax and legal advisors to understand the implications of any investment specific to your personal financial situation.

ALTERNATIVE INVESTMENTS ARE CONSIDERED COMPLEX PRODUCTS AND MAY NOT BE SUITABLE FOR ALL INVESTORS. Prospective investors should be aware that an investment in an alternative investment is speculative and involves a high degree of risk. Alternative Investments often engage in leveraging and other speculative investment practices that may increase the risk of investment loss; can be highly illiquid; may not be required to provide periodic pricing or valuation information to investors; may involve complex tax structures and delays in distributing important tax information; are not subject to the same regulatory requirements as mutual funds; and often charge high fees. There is no guarantee that an alternative investment will implement its investment strategy and/or achieve its objectives, generate profits, or avoid loss. An investment should only be considered by sophisticated investors who can afford to lose all or a substantial amount of their investment.

iCapital Markets LLC operates a platform that makes available financial products to financial professionals. In operating this platform, iCapital Markets LLC generally earns revenue based on the volume of transactions that take place in these products and would benefit by an increase in sales for these products.

The information contained herein is an opinion only, as of the date indicated, and should not be relied upon as the only important information available. Any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets is not necessarily indicative of the future or likely performance. The information contained herein is subject to change, incomplete, and may include information and/or data obtained from third party sources that iCapital believes, but does not guarantee, to be accurate. iCapital considers this third-party data reliable, but does not represent that it is accurate, complete and/or up to date, and it should not be relied on as such. iCapital makes no representation as to the accuracy or completeness of this material and accepts no liability for losses arising from the use of the material presented. No representation or warranty is made by iCapital as to the reasonableness or completeness of such forward- looking statements or to any other financial information contained herein.

Securities products and services are offered by iCapital Markets, an SEC-registered broker- dealer, member FINRA and SIPC, and an affiliate of iCapital, Inc. and Institutional Capital Network, Inc. These registrations and memberships in no way imply that the SEC, FINRA, or SIPC have endorsed any of the entities, products, or services discussed herein. Annuities and insurance services are provided by iCapital Annuities and Insurance Services LLC, an affiliate of iCapital, Inc. “iCapital” and “iCapital Network” are registered trademarks of Institutional Capital Network, Inc. Additional information is available upon request.

©2024 Institutional Capital Network, Inc. All Rights Reserved.