Private asset-based lending (ABL) is no longer living in the shadow of direct lending. It’s growing in popularity as asset managers look to expand to underserved and high-yielding credit opportunities and as investors search for diverse portfolio income.

Yet, many individual investors have limited or no allocation to ABL because it’s not easy to understand. In contrast to direct lending, where the ability of a borrower to pay interest is the most crucial factor, ABL includes loans backed by a wide variety of assets, each with different risk and return characteristics. Now, with more private credit managers introducing dedicated ABL strategies, becoming familiar with how the assets work could be the swing factor for adoption. Understanding the different sub-sectors, cash flow schedules, structural protections, and risks will help investors remove the barriers to adoption and gain comfort with the complexities of the opportunity.

Covering the Basics: Direct Lending vs. ABL

At $32 trillion, the ABL opportunity far surpasses $9 trillion in private credit.1 ABL touches the far corners of the credit world, providing funding across the economy from residential mortgages to aviation leases. In contrast, private credit, mainly in the form of direct lending, is concentrated on corporate middle market lending.

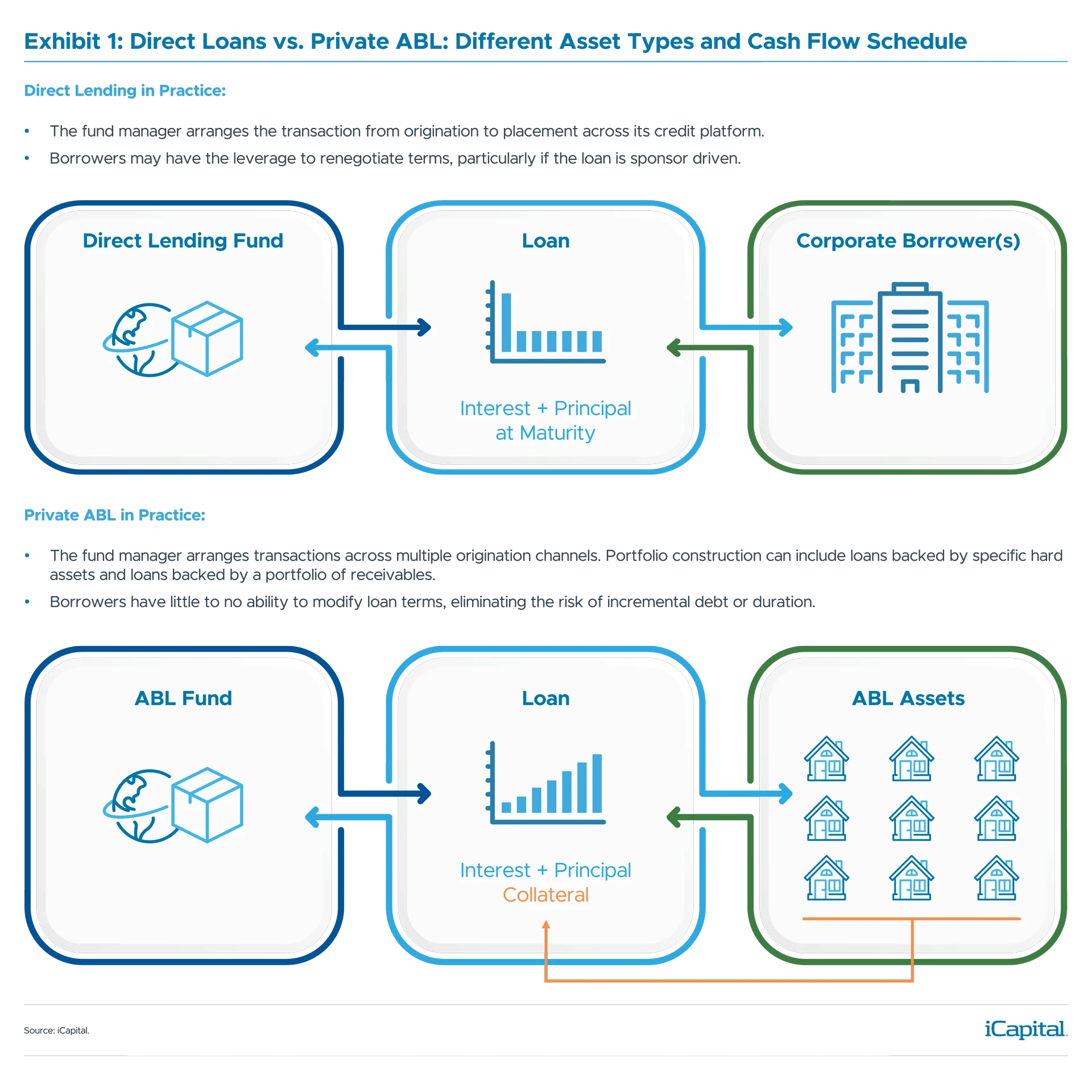

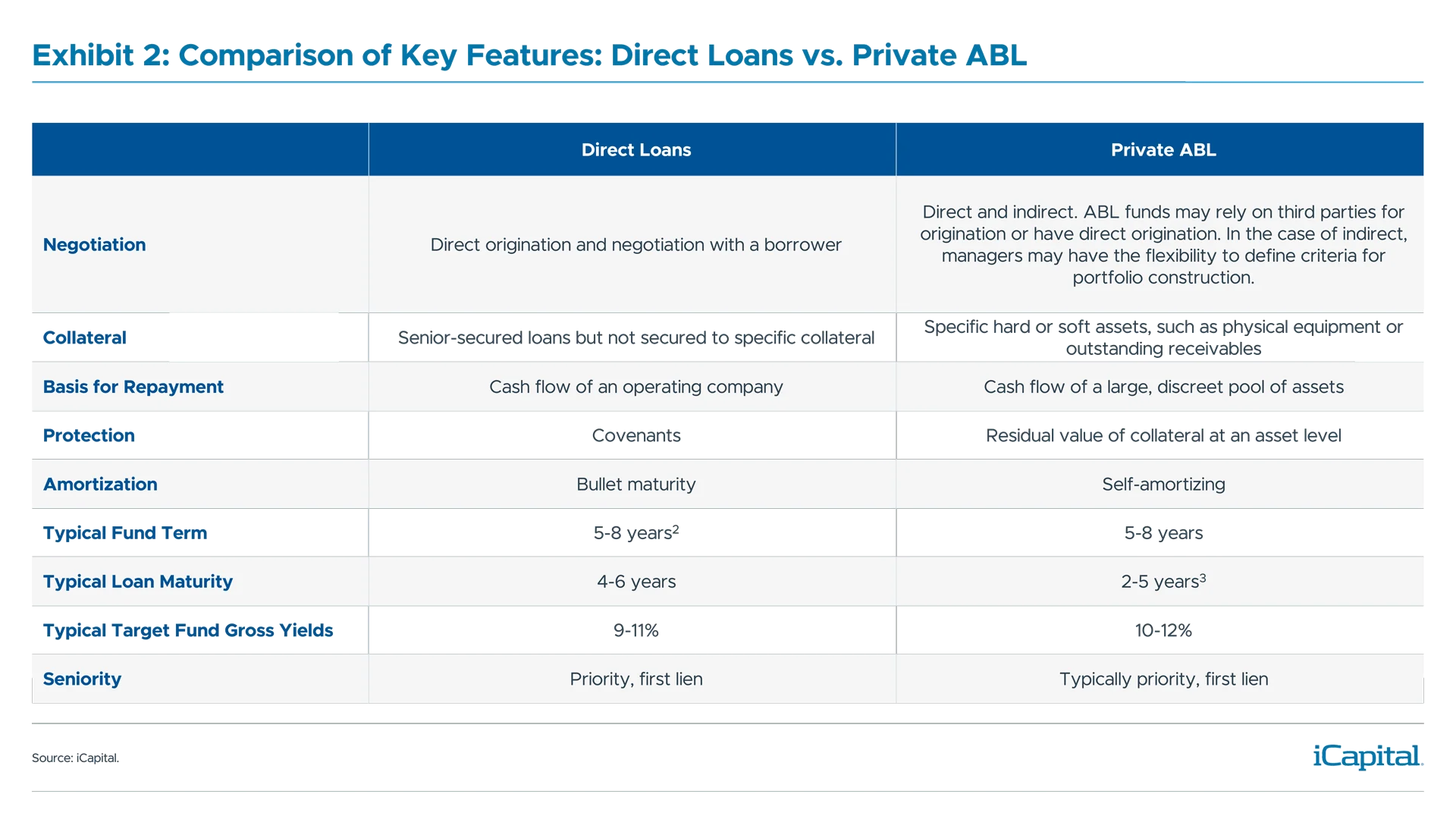

Direct lending is also considered more straightforward because an individual company borrows the capital and is responsible for interest and principal repayment. ABL is different. It’s based on a collection of diverse assets serving as collateral. It can take the form of financing a set of cash flow-producing assets, such as auto loans or business receivables, or it can be a loan against a specific hard asset, such as real estate. Simply put, direct lending amounts to corporate risk; ABL to asset risk.

Managing an ABL fund also requires specialized capabilities, often with domain expertise in certain sectors. Determining the value of collateral that underlies the assets is a key part of risk management. While all lenders are involved with assessing collateral values, ABL collateral is tied to cash flows associated with a specific asset or pool of assets. Generally speaking, objective and conservative collateral valuation can protect against downside risk. But there are other complexities, such as having to recover the collateral in the case of defaults.

Managing an ABL fund also requires specialized capabilities, often with domain expertise in certain sectors. Determining the value of collateral that underlies the assets is a key part of risk management. While all lenders are involved with assessing collateral values, ABL collateral is tied to cash flows associated with a specific asset or pool of assets. Generally speaking, objective and conservative collateral valuation can protect against downside risk. But there are other complexities, such as having to recover the collateral in the case of defaults.

For the most part, collateral tends to rise in value and can be an inflation hedge. But some sub-sectors like auto financing may see a decline in collateral value as vehicles tend to depreciate. In practice, a fund manager will estimate the collateral value of a pool of assets, lend a percentage of this value, and seek equity investors to finance the shortfall.

Asset-based strategies have the potential to offer greater risk-adjusted returns compared to direct lending. Each investment’s collateral backing provides downside protection. In addition, ABL loans are often made at a discount to collateral value and have a self-amortizing asset – meaning principle is returned over the life of the investment rather than waiting for a realization event. These factors can result in greater returns for the same amount of risk relative to other credit investments.

Asset-based strategies have the potential to offer greater risk-adjusted returns compared to direct lending. Each investment’s collateral backing provides downside protection. In addition, ABL loans are often made at a discount to collateral value and have a self-amortizing asset – meaning principle is returned over the life of the investment rather than waiting for a realization event. These factors can result in greater returns for the same amount of risk relative to other credit investments.

A wide variety of asset types – what am I getting into?

It’s clear there’s more to do in ABL. Of the $32 trillion opportunity, private credit managers likely have less than 5% under management.4 Why? Much of the growth in private credit so far has been in the form of direct lending where assets have increased eightfold over the last ten years.5 The opening in the market came after the global financial crisis when banks slowed their lending activities in response to rising capital requirements. Private direct lending managers stepped in to meet the needs of borrowers.

Now, private credit managers are looking to expand. The ABL opportunity is large and fragmented, and it also benefits from a retreat in bank lending.

In theory, ABL funds should be a logical choice for private wealth investors. The self-amortizing profile provides high current income while mitigating refinancing and duration risk. And the underlying collateral provides downside protection – as low direct lending loss rates are at roughly 100 basis points (bps), ABL is even lower, with average loss rates of 10 to 20 bps.6

These are some of the reasons that five of the top 30 private credit managers in the U.S. launched a dedicated ABL fund in 2024 alone.7

So how will the private wealth channel get comfortable with ABL? A first step is to address some of the concerns and complexities associated with the space.

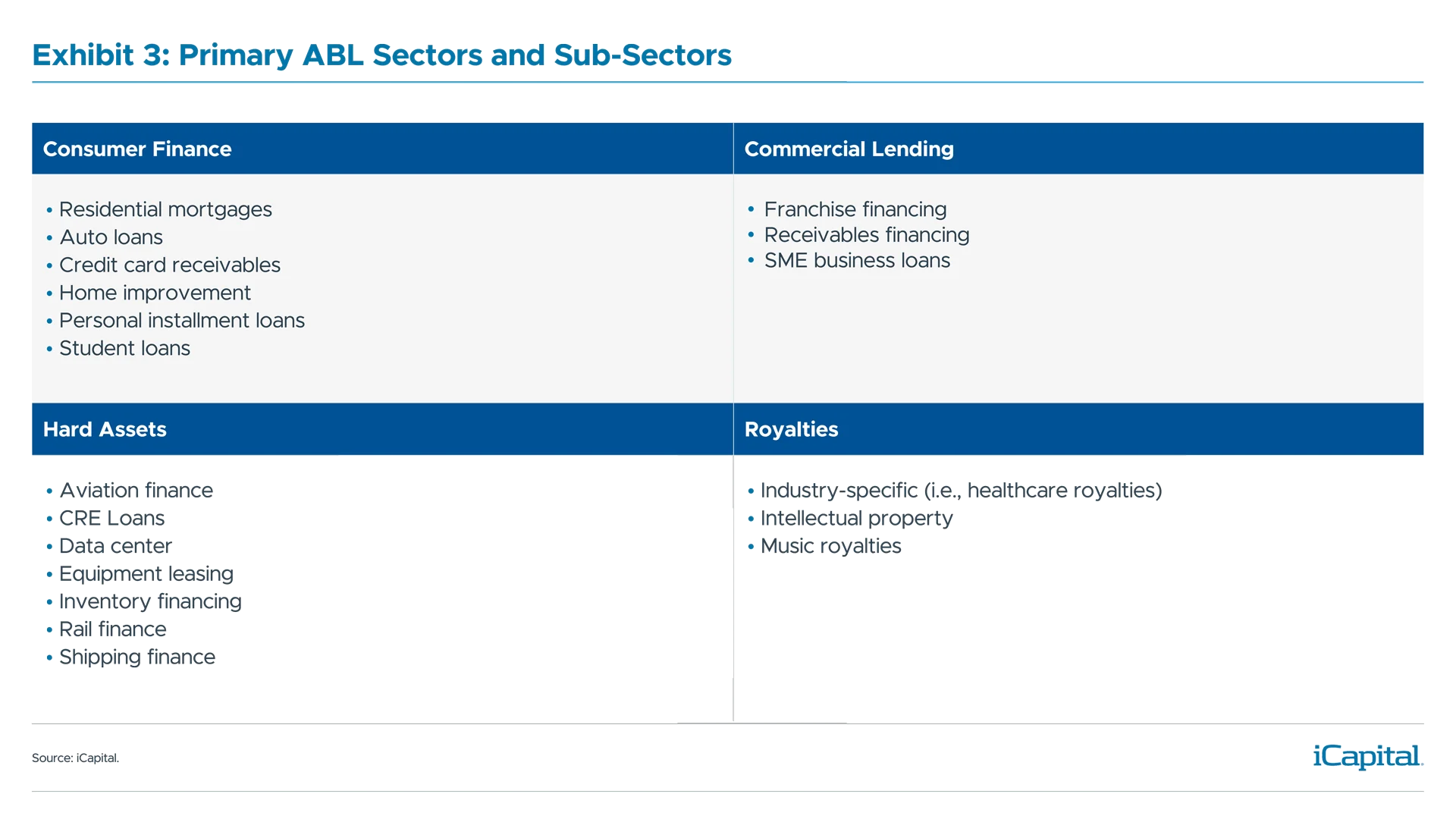

Concerns of sub- and near-prime assetsPrivate ABL fund managers have flexibility in specifying risk and return parameters based on pre-approved guidelines for asset selection. Meaning there’s a low likelihood that a fund will have elevated credit risk due to exposure to sub-prime assets. The subordinated equity layer also absorbs higher-risk assets first, in the event that assets come under stress. Inexperience with unfamiliar assetsAreas such as aviation finance, equipment leasing, and receivables financing are unfamiliar to many investors. This alone doesn’t mean these areas should be avoided, but it does mean the risks and investment processes should be explored and understood. Best-in-class fund managers have well-established credit platforms to evaluate, source, value, and manage many different types of assets. Most of these managers have specialized investment teams with expertise in target industry verticals. While individual sub-asset classes such as equipment or shipping finance can be considered niche, an ABL fund will often contain hundreds of loans to different borrowers in different geographic areas, providing the benefit of diversification. When looking at the aggregate ABL opportunity, residential mortgage, and commercial real estate are the largest sub-sectors. These areas are generally better understood, are more standardized, and face tight underwriting standards. For investors who seek exposure to some of these niche areas, the risks are different. In aviation finance, for example, fleet capacity, production and delivery measures, fuel prices, interest rates, and labor harmony are all factors that impact airline lease rates. Specialized investment teams are responsible for analysis and diligence and have years of sector experience. Fear of trying to follow a vast universeIdentifying and evaluating fundamentals and risk factors across a broad set of assets is daunting. Fortunately, fund managers take an active role throughout the life of an investment to limit the potential for losses. This includes specific origination requirements for borrowers, strong documentation, and robust servicing capabilities to ensure repayment while also granting real-time visibility into the performance of an asset, helping to ensure the borrower is financially healthy. For investors who like a hands-on approach, categorizing assets by sector is a starting point to identify performance and risk measures. We see the aggregate asset-based market in four categories, as seen in Exhibit 3.

What about residual value?Given that ABL loans are measured against collateral – and in some cases, the complexity and cost of possessing those assets – conservative valuation can minimize risk. As mentioned, the tangible value of collateral offers downside protection in which the fund manager plays a vital role with specialized ability to value the underlying asset properly. Managers also focus on the fungibility of an asset, meaning they determine the ease with which an asset can be sold in case of a default. The combination of determining the residual value and having the ability to realize that value is key in asset-based lending. Most funds also add a margin of error to account for residual value risk. A fund may loan 80-90% of the value of receivables; 50-70% of the collateral value of inventory; and less than 50% for equipment financing. These discounts enable a fund to manage for the cost of collateral recovery, potential changes in collateral value, and credit risk. Where does ABL fit into an investor’s portfolio?One of the key determinants for selecting the right ABL allocation is diversification. A fixed income allocation composed of public bonds will be concentrated in corporate debt. A mix of public and private credit will introduce middle-market exposure and higher yields but will still be tied to corporate lending. In contrast, an ABL allocation enables investors to complement their fixed income holdings but with substantially greater diversification. Most ABL funds specify target allocations in areas such as transportation, residential, commercial, and consumer assets, which diversify risk away from corporate debt. In looking at a private ABL composite, the return profile shows a low-to-moderate correlation to other credit assets that are associated with ABL (Exhibit 4). One reason is that the assets underlying ABL portfolios are not subject to the same volatility and daily market trading as other assets.

|

A potential to generate attractive risk-adjusted returns

A growing, but still limited, number of ABL funds implies there are opportunities to benefit from the inefficiencies of each underlying sector. This also introduces unique return drivers that are uncorrelated to the market.

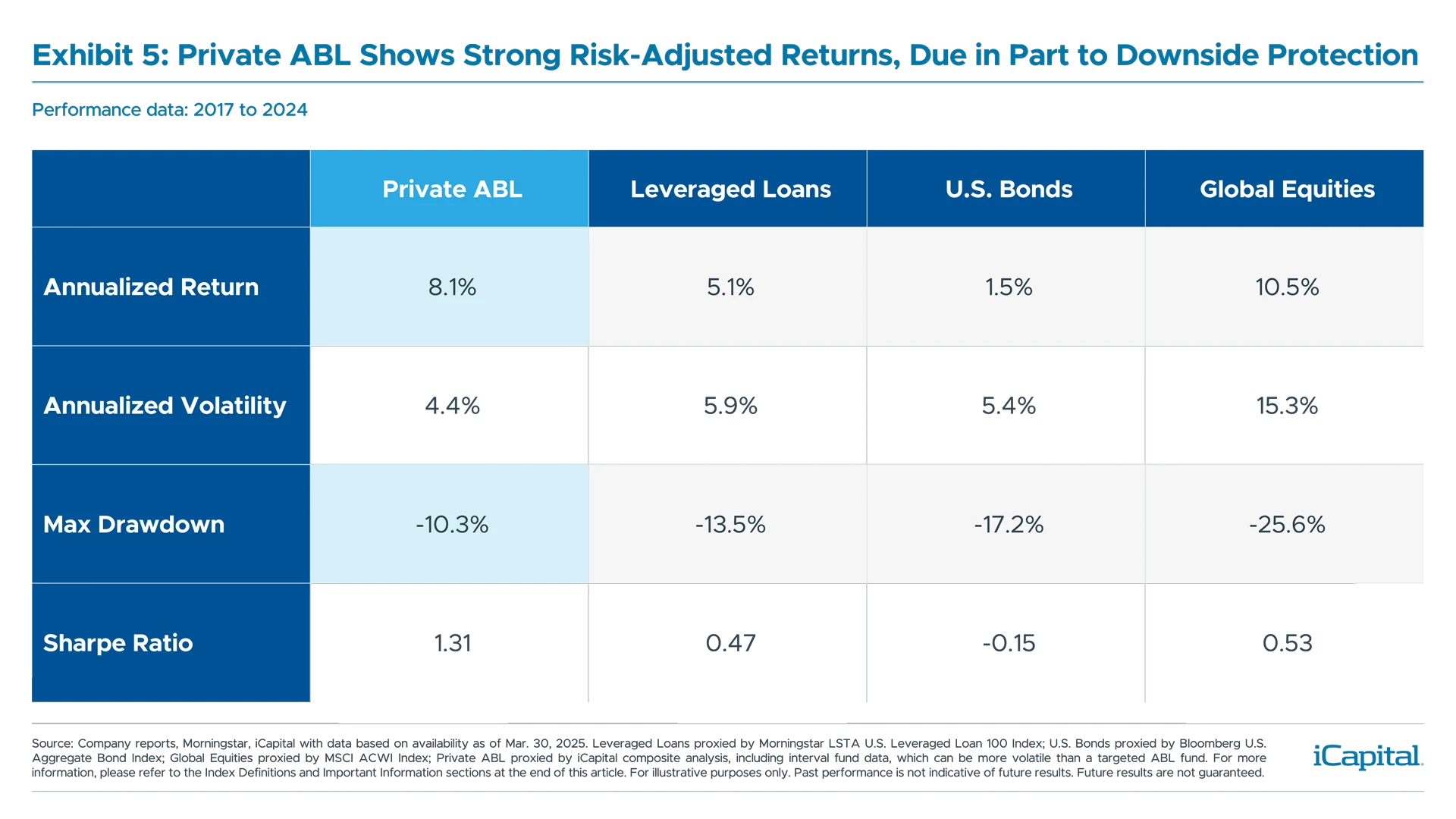

Over the last seven years, private ABL has outperformed other credit comparables, including leveraged loans and U.S. bonds. A fraction of the volatility and minimal drawdowns resulted in a higher Sharpe Ratio, or an ability to offer greater returns for the same level of risk.

As the popularity of ABL funds increases and funds move beyond the early stage of their lifecycle, we expect returns to improve and move closer to the 10-12% target returns seen in Exhibit 2.

As the popularity of ABL funds increases and funds move beyond the early stage of their lifecycle, we expect returns to improve and move closer to the 10-12% target returns seen in Exhibit 2.

Final takeaways

Including an asset-based allocation in a portfolio can strengthen risk-adjusted returns and complement existing fixed income and private credit holdings. Investors can contemplate the combination of factors – diversification within a fixed income allocation, low market correlations, downside protections, and stable income – when learning more about ABL strategies and when considering an allocation within their portfolio.

1. Marathon Asset Management, data as of Q1 2025. Private credit assets include direct lending, leveraged loans, distressed and structured credit.

2. Direct lending strategies may also be offered through business development companies (“BDCs”) and interval fund structures.

3.Depending on the type, loan durations vary from a few months to several years.

4. Marathon Asset Management, data as of Q1 2025, KKR, Integer Advisors, iCapital as of October 2022.

5. Preqin, iCapital Alternatives Decoded 1Q 2025 release.

6. Marathon Asset Management for ABL loss rates, data as of Q1 2025. Cliffwater for direct loan loss rates, data as of December 2024.

7. Preqin, “Investor Outlook H2 2024.”

INDEX DEFINITIONS

Bloomberg U.S. Aggregate Bond Index: A broad base, market capitalization-weighted bond market index. The index includes Treasury securities, government agency bonds, mortgage-backed bonds, corporate bonds, and several foreign bonds traded in the United States.

Morningstar LSTA U.S. Leveraged Loan 100 Index: The Morningstar LSTA US Leveraged Loan 100 Index is designed to measure the performance of the 100 largest facilities in the US leveraged loan market. Index constituents are market-value weighted, subject to a single loan facility weight cap of 2%.

MSCI ACWI Index: MSCI’s flagship global equity index is designed to represent the performance of the full opportunity set of large- and mid-cap companies from developed and emerging markets around the world.

Private ABL Composite: iCapital analysis of six private ABL and alternative lending funds. Due to the scarcity of private ABL fund and fund data, iCapital calculated return, volatility and correlation data from fund and company reports to represent a composite.

IMPORTANT INFORMATION

The material herein has been provided to you for informational purposes only by Institutional Capital Network, Inc. (“iCapital Network”) or one of its affiliates (iCapital Network together with its affiliates, “iCapital”). This material is the property of iCapital and may not be shared without the written permission of iCapital. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of iCapital.

This material is provided for informational purposes only and is not intended as, and may not be relied on in any manner as, legal, tax or investment advice, a recommendation, or as an offer or solicitation to buy or sell any security, financial product or instrument, or otherwise to participate in any particular trading strategy. This material does not intend to address the financial objectives, situation, or specific needs of any individual investor. You should consult your personal accounting, tax, and legal advisors to understand the implications of any investment specific to your personal financial situation.

ALTERNATIVE INVESTMENTS ARE CONSIDERED COMPLEX PRODUCTS AND MAY NOT BE SUITABLE FOR ALL INVESTORS. Prospective investors should be aware that an investment in an alternative investment is speculative and involves a high degree of risk. Alternative investments often engage in leveraging and other speculative investment practices that may increase the risk of investment loss; can be highly illiquid; may not be required to provide periodic pricing or valuation information to investors; may involve complex tax structures and delays in distributing important tax information; are not subject to the same regulatory requirements as mutual funds; and often charge high fees. There is no guarantee that an alternative investment will implement its investment strategy and/or achieve its objectives, generate profits, or avoid loss. An investment should only be considered by sophisticated investors who can afford to lose all or a substantial amount of their investment.

iCapital Markets LLC operates a platform that makes available financial products to financial professionals. In operating this platform, iCapital Markets LLC generally earns revenue based on the volume of transactions that take place in these products and would benefit from an increase in sales for these products.

The information contained herein is an opinion only, as of the date indicated, and should not be relied upon as the only important information available. Any prediction, projection, or forecast on the economy, stock market, bond market, or the economic trends of the markets is not necessarily indicative of the future or likely performance. The information contained herein is subject to change, incomplete, and may include information and/or data obtained from third-party sources that iCapital believes, but does not guarantee, to be accurate. iCapital considers this third-party data reliable, but does not represent that it is accurate, complete and/or up to date, and it should not be relied on as such. iCapital makes no representation as to the accuracy or completeness of this material and accepts no liability for losses arising from the use of the material presented. No representation or warranty is made by iCapital as to the reasonableness or completeness of such forward-looking statements or to any other financial information contained herein.

Securities products and services are offered by iCapital Markets, an SEC-registered broker-dealer, member FINRA and SIPC, and an affiliate of iCapital, Inc. and Institutional Capital Network, Inc. These registrations and memberships in no way imply that the SEC, FINRA, or SIPC have endorsed any of the entities, products, or services discussed herein. Annuities and insurance services are provided by iCapital Annuities and Insurance Services LLC, an affiliate of iCapital, Inc. “iCapital” and “iCapital Network” are registered trademarks of Institutional Capital Network, Inc. Additional information is available upon request.

©2025 Institutional Capital Network, Inc. All Rights Reserved.