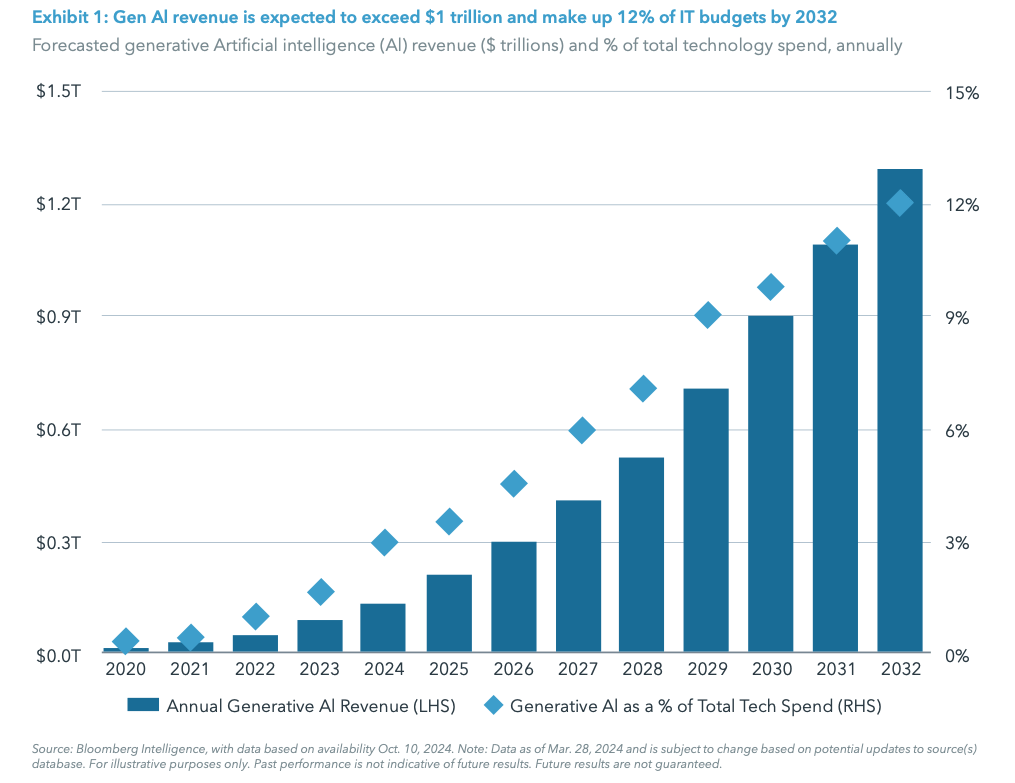

Seemingly overnight, the phrase Artificial Intelligence (AI) has become ubiquitous, and with it, so have AI- related investment opportunities. No longer solely a tech buzzword, AI has gone mainstream not just amongst investment managers, but throughout the business and consumer communities alike. In corporate America specifically, AI mentions started spiking in 2023 and have hit record highs in recent quarters.1 AI and its many subsets, including Generative AI (GenAI), Machine Learning, Natural Language Processing (NLP) and Neural Networks are swiftly evolving, and they have become the subject of considerable media attention and public focus. This is especially true since the launch of ChatGPT in November 2022, a Large Language Model (LLM) or type of AI designed to process and generate large amounts of text. At the same time, corporate spending on AI has grown rapidly and is expected to explode over the next decade – from an already meaningful baseline of $140B to $1.3T by 2032.2 From a corporate IT budget perspective, GenAI alone is expected to rise from 3% of budgets to 12% over the same period.3

The investment ramifications and opportunities accompanying the development of AI are perhaps rivaled only by the birth of the Internet in the 1980s. Much of the latest AI investment focus has been on the public markets, and the AI theme has been a disproportionate driver of recent market performance via companies such as Nvidia, a leading supplier of AI hardware. But like most investment themes, private markets are the first to capture and provide financing to new and powerful technological ideas. Almost all the major technology companies that went public in the past 20 years were first funded by venture capital (VC) investors who have captured a large share of the value created by these companies. Investing in the AI theme within the private markets requires careful analysis as investors need to decide how and where to get exposure – directly into AI focused companies through venture capital, or through investments that stand to benefit from the AI boom such as digital infrastructure.

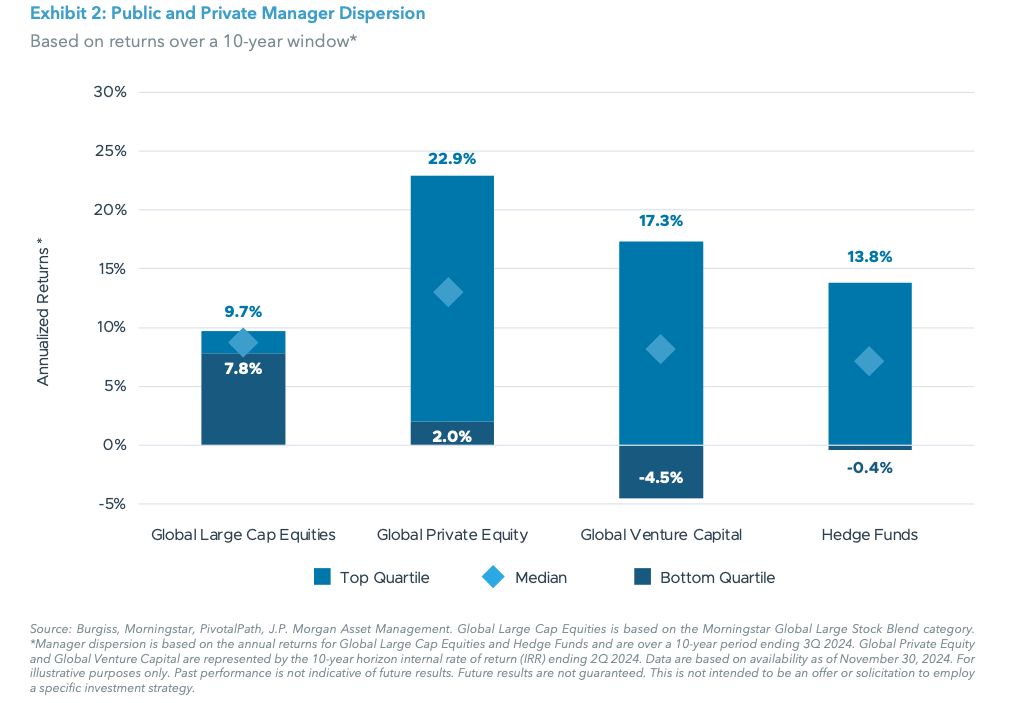

We believe AI represents the next growth area of the software service model. Whether it is a software delivery mechanism like the horizontally integrated OpenAI which was established in 2015 or vertically like Anduril, a leading AI-native technology and defense contractor founded in 2017, AI is a form of software. In the case of OpenAI, which generates 80% of its revenue from ChatGPT Plus, it is a Software as a Service (SaaS) model aimed at the consumer. Alternatively, Anthropic has a B2B enterprise model focused on businesses and API usage by developers and companies which provides 80% of its revenue.4 While it is possible given their early mover advantages, access to talent, and large pools of capital that the AI space could be dominated by a few players, we expect there will be many opportunities for new companies. Similar to the evolution of the software sector, there are going to be both horizontal and vertical application opportunities. Oftentimes, horizontal applications grab most of the attention in the early phase with vertical business models following as the sector matures, and AI investments have been following a similar trend. In the vertical AI software business models, there are countless opportunities in sectors such as HR, legal, finance, and marketing, among many others. Going forward, identifying and making sense of the many factors that will impact growth trajectories, including how long it will take for these companies to generate meaningful revenue, is where skilled venture capital investors are needed and can create significant value. However, because venture capital return dispersion is the highest between top and bottom quartile managers, manager selection is paramount.

Venture Capital

For investors looking to gain high-octane private markets exposure to the AI theme, venture capital is an excellent starting point. When beginning to evaluate venture capital opportunities, one way to proceed is to divide potential investments into two broad phases – early-stage and late-stage. The former, which encompasses start-up businesses that are either soon-to-reach product launch or are in the proof-of-concept phase can be broadly thought of as Seed and Series A investment rounds. The latter focuses on companies with products with a demonstrated product-market-fit that may be closer to an IPO/exit and are usually Series C, D and beyond. Early-stage investing typically comes with the highest upside potential, but also a higher failure rate given how early these companies are on their journey. Additionally, early-stage companies are often less valuation sensitive as they are valued on the basis of future prospects, while late-stage companies are more highly correlated to public markets.

AI-related investments are already taking a front seat in the venture capital space – in the first nine months of 2024, AI accounted for approximately 36% of the total U.S. deal value and 27% of the US deal count.5 There has also been a boom in the number of AI-related venture capital headlines, especially with respect to GenAI, which has seen a 271% increase in funding YoY. Much of the fundraising has been concentrated in a few names, as 63% of the fundraising YoY went to just five companies,6 and some of the valuations have been eyepopping. More recently, Anduril is in talks to double its valuation to more than $28 billion in a new funding round that may raise upwards of $2.5 billion.7

Importantly, even though the AI headline explosion is a relatively recent phenomenon, venture capital investors have been investing in AI focused companies for many years. And, while the recent fundraising is concentrated among a few GenAI companies, there are numerous investment opportunities outside of GenAI. In fact, the majority of deals have actually been focused on software companies8 – a core area where VC’s have been active for decades. For example, established CRM software businesses such as Salesforce and Hubspot have been actively making investments in AI-enabled solutions, both through in-house development as well as bolt-on acquisitions. Also, a number of AI-powered software apps in both the B2B and direct-to-consumer space have come to market, including names such as Character.AI (a consumer chatbot app founded in 2021), Perplexity (a general-purpose search app launched in 2022), and Runway (an image and video editing software company founded in 2018). So, while for many investors, AI is seemingly everywhere for the first time, early investors are already profiting from AI investments made years ago.

Digital Infrastructure

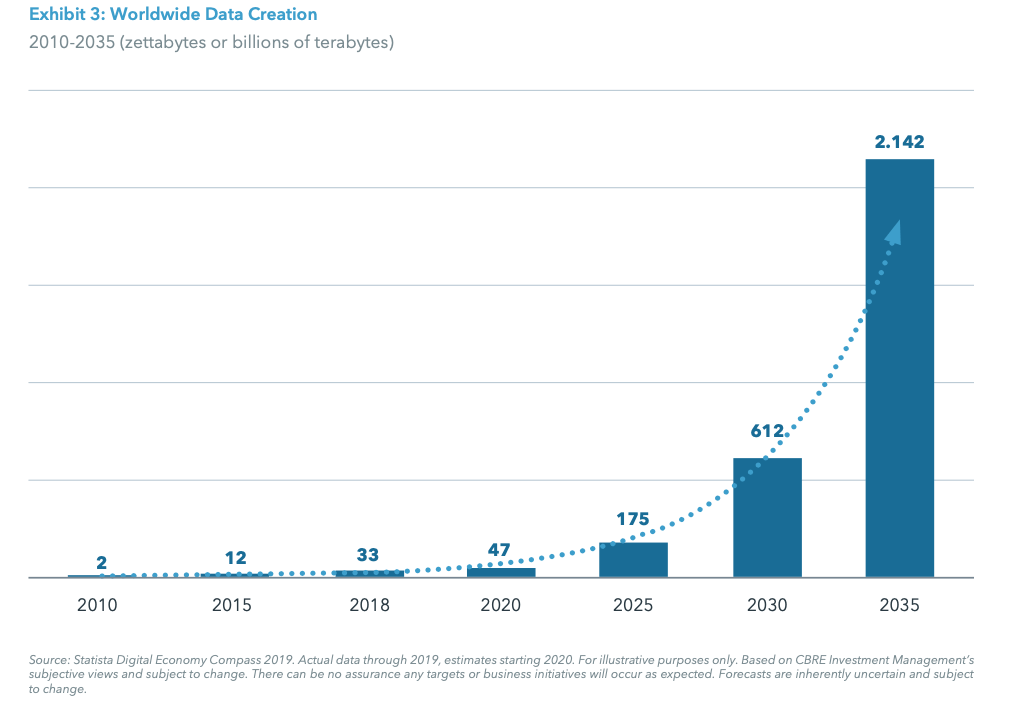

Investing in digital infrastructure is another way to capitalize on the growing AI opportunity. Digital infrastructure encompasses investments in areas ranging from fiber optics, cell towers, and wireless communication to data centers and the energy used to power them. Data centers are a critical support underlying the growth of global digitalization and are highly specialized facilities that houses servers and data storage devices used to process vast amounts of data. With exponential data growth, the demand for data centers is projected to increase dramatically.

Investors with an interest in digital infrastructure can access a variety of funds, including dedicated funds focused exclusively on digital infrastructure that have raised $44 billion over the last decade9 as well as more diversified generalist funds. Many infrastructure-focused investment managers have identified digitalization as a forward-looking theme to complement other investments. Much like traditional infrastructure strategies, investment managers can target core and core plus investments, or they can take a more opportunistic approach in developing infrastructure assets depending on the investment’s positioning on the risk/reward spectrum. Core and core plus investments deliver regulated and contracted cash flows and are generally in more mature, cash-yielding assets located within developed countries while opportunistic investments are generally newer assets in the development and/ or construction stage, potentially in emerging markets. These assets generate less initial cash flow but have the potential for long-run capital appreciation.

Conclusion

The official birthday of the Internet is January 1st, 1983.10 Since then, the size of the global digital economy has exploded and is projected to reach $16.5 trillion by 2028.11 AI builds on the success of the Internet and like the Industrial Revolution is projected to dramatically reshape the global economy in the coming decades. To profit from this generational opportunity, investors will need to access top-tier managers with the ability to identify superior companies, appropriately evaluate a variety of risk/return considerations and invest in the best indirect and direct opportunities. We believe choice will continue to improve, and the coming year will see an increasing number of pure play AI offerings along with funds such as AI infrastructure which invest in areas set to benefit from AI’s explosive growth. Furthermore, the AI revolution is not just a U.S. phenomenon. European and APAC markets are becoming progressively more sophisticated, and we expect the opportunity set to become more global in nature. Much like the many U.S. and international companies that have contributed to the development and adoption of the Internet, there will be a wide array of companies certain to benefit from the widespread adoption of AI.

Endnotes

1. AI mentions rise in S&P 500 earnings calls, Goldman says | Reuters.

2. Bloomberg Intelligence, as of Mar. 26, 2024.

3. Ibid.

4. Consumer vs. Enterprise: How OpenAI and Anthropic Are Shaping the Future of AI | by Noah Lee Savage | Medium.

5. Pitchbook Venture Monitor, Q3 2024.

6. “The State of the SaaS Capital Markets: Mid-Year Review” – July 2025, Sapphire.

7. Anduril in Talks for Over $28 Billion Valuation in New Funding| by Lizette Chapman| Bloomberg.

8. “The State of the SaaS Capital Markets: Mid-Year Review” – July 2025, Sapphire.

9. Source: Pitchbook: Infrastructure Investors Capitalize on the Digital Revolution. As of July 2024.

10. A Brief History of the Internet.

11. Global Digital Economy Forecast, 2023 To 2028 | Forrester.

Important Information

The material herein has been provided to you for informational purposes only by Institutional Capital Network, Inc. (“iCapital Network”) or one of its affiliates (iCapital Network together with its affiliates, “iCapital”). This material is the property of iCapital and may not be shared without the written permission of iCapital. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of iCapital.

This material is provided for informational purposes only and is not intended as, and may not be relied on in any manner as, legal, tax or investment advice, a recommendation, or as an offer or solicitation to buy or sell any security, financial product or instrument, or otherwise to participate in any particular trading strategy. This material does not intend to address the financial objectives, situation, or specific needs of any individual investor. You should consult your personal accounting, tax, and legal advisors to understand the implications of any investment specific to your personal financial situation.

ALTERNATIVE INVESTMENTS ARE CONSIDERED COMPLEX PRODUCTS AND MAY NOT BE SUITABLE FOR ALL INVESTORS. Prospective investors should be aware that an investment in an alternative investment is speculative and involves a high degree of risk. Alternative investments often engage in leveraging and other speculative investment practices that may increase the risk of investment loss; can be highly illiquid; may not be required to provide periodic pricing or valuation information to investors; may involve complex tax structures and delays in distributing important tax information; are not subject to the same regulatory requirements as mutual funds; and often charge high fees. There is no guarantee that an alternative investment will implement its investment strategy and/or achieve its objectives, generate profits, or avoid loss. An investment should only be considered by sophisticated investors who can afford to lose all or a substantial amount of their investment.

iCapital Markets LLC operates a platform that makes available financial products to financial professionals. In operating this platform, iCapital Markets LLC generally earns revenue based on the volume of transactions that take place in these products and would benefit from an increase in sales for these products.

The information contained herein is an opinion only, as of the date indicated, and should not be relied upon as the only important information available. Any prediction, projection, or forecast on the economy, stock market, bond market, or the economic trends of the markets is not necessarily indicative of the future or likely performance. The information contained herein is subject to change, incomplete, and may include information and/or data obtained from third-party sources that iCapital believes, but does not guarantee, to be accurate. iCapital considers this third- party data reliable, but does not represent that it is accurate, complete and/or up to date, and it should not be relied on as such. iCapital makes no representation as to the accuracy or completeness of this material and accepts no liability for losses arising from the use of the material presented. No representation or warranty is made by iCapital as to the reasonableness or completeness of such forward-looking statements or to any other financial information contained herein.

Securities products and services are offered by iCapital Markets, an SEC-registered broker-dealer, member FINRA and SIPC, and an affiliate of iCapital, Inc. and Institutional Capital Network, Inc. These registrations and memberships in no way imply that the SEC, FINRA, or SIPC have endorsed any of the entities, products, or services discussed herein. Annuities and insurance services are provided by iCapital Annuities and Insurance Services LLC, an affiliate of iCapital, Inc. “iCapital” and “iCapital Network” are registered trademarks of Institutional Capital Network, Inc. Additional information is available upon request.

©2025 Institutional Capital Network, Inc. All Rights Reserved.