KEY TAKEAWAYS

• Private infrastructure funds generate returns from a mix of cash income and capital appreciation, depending upon the specific strategy, and may provide useful diversification as part of a fixed income and/or real assets allocation.

• The outlook for infrastructure is compelling relative to other asset classes in inflationary environments and periods of market volatility, given inflation hedging attributes and historically limited correlation to stocks and bonds.

• Long-term, unmet demand for infrastructure persists, due to significant planned investment from the public sector centered around rectifying historical underfunding, and efforts to mitigate climate change.

Private infrastructure funds aim to provide investors with stable, consistent income with the potential for capital appreciation, and may play a constructive role for investors looking to enhance their fixed income or real asset allocation. This is particularly true in market environments with high inflation, rising interest rates, and tightening monetary policy.

Infrastructure is one of the few asset classes with characteristics that allow it to not only mitigate the effects of inflation, but also to potentially benefit from increases in prices and interest rates.1 Investors may want to consider infrastructure as a diversified source of return for their portfolio, with attractive inflation protection and structural downside protection characteristics.

In this primer we will discuss:

- The definition of infrastructure and its characteristics as an investment

- The different types of private infrastructure investments and their risk and return characteristics

- The demand drivers for infrastructure in the United States and globally

- Infrastructure’s positive environmental, social, and governance (ESG) impact

- Infrastructure’s role in an investor’s portfolio

What is infrastructure?

Infrastructure is broadly defined as the basic physical and organizational structures and facilities (buildings, roads, and power supplies) needed for the operation of a society or enterprise. Infrastructure supports nearly every aspect of daily life, and major subsectors include social infrastructure (schools and hospitals); utilities (gas and water systems); transportation (toll roads and airports); and energy infrastructure (power generation).

These assets are essential facilities on which economic productivity depends, which helps give infrastructure as an asset class some attractive characteristics, including:

- Stable long-term cash flows: Infrastructure assets generally provide consistent and reliable income streams that are governed by long-term contracts, typically with reputable counterparties or counterparties regulated by the government.2 These cash flows also generally include either explicit inflation protection (e.g., contracts with inflation-linked payments) or an implicit inflation hedge (i.e., prices that can be adjusted during the life of the investment to reflect inflation).3

- Limited downside: Infrastructure assets may be less exposed to economic slowdowns than traditional asset classes, due to reliable long-term contracted cash flows. In addition, because they provide basic sustainable services essential to the functioning of the economy, demand is generally relatively inelastic, creating high barriers for new entrants as there are limited needs for new providers. A further barrier is strong regulation of many infrastructure assets, which can make it difficult to penetrate mature markets. Finally, due to the typical size of these assets and the high level of regulation, replacement costs are often prohibitively high, offering monopolistic benefits and further reducing risk for investors.

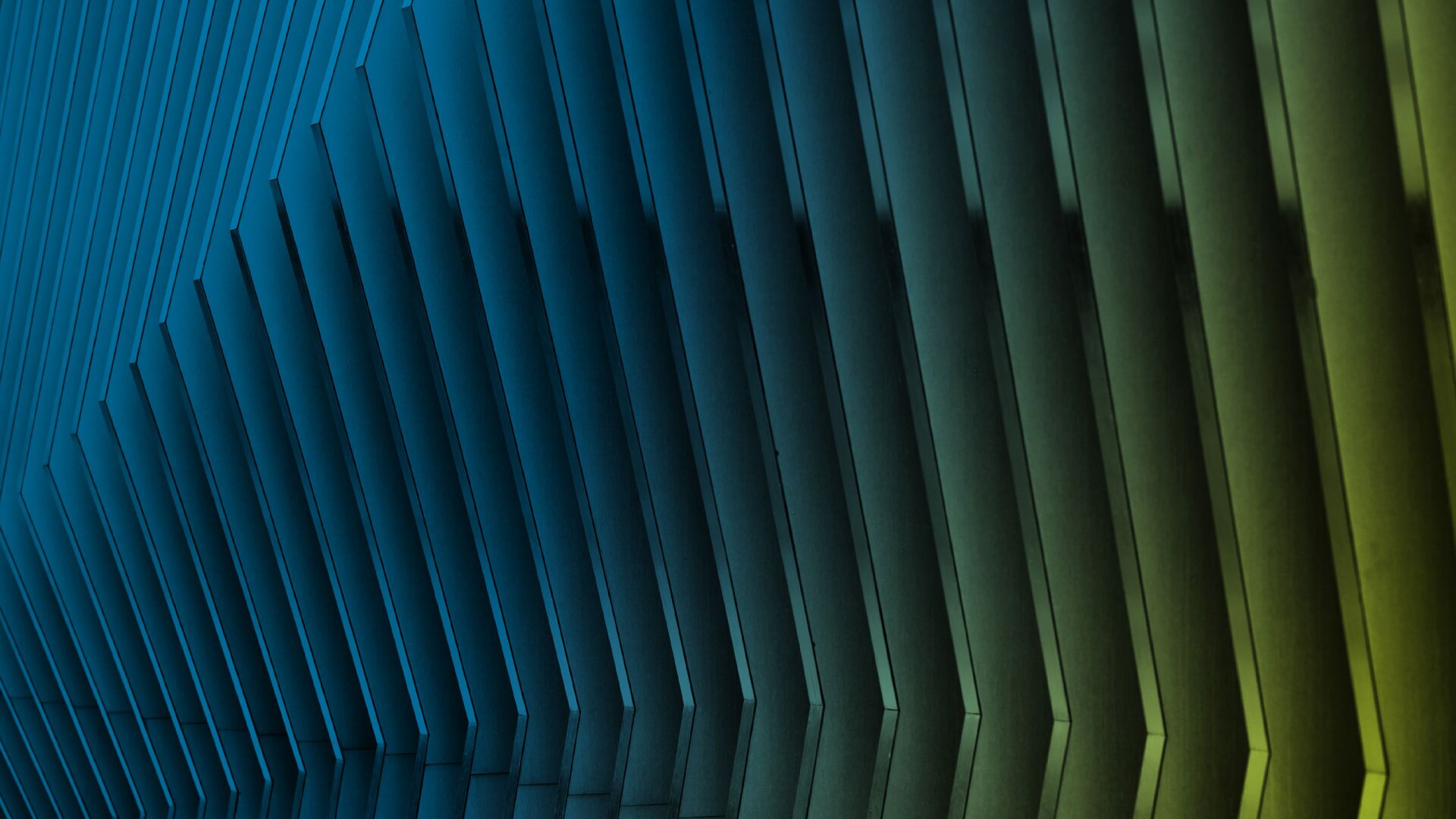

Classifying infrastructure investments

Infrastructure investments are typically categorized across several dimensions, including sector and risk/return profile. These broadly used categories can help investors tailor their infrastructure exposure. Another primary classifier for infrastructure investments is the phase of an investment, which strongly impacts the risk/return profile. The two standard phases are referred to as greenfield (new construction) and brownfield (already operating on a standalone basis or undergoing expansion). The risk and return of a project are also affected by geography. For example, whether the investment is in a developed or an emerging market.

The longer-term private infrastructure opportunity set

In the developed markets, infrastructure has been chronically underfunded for decades.4 Solving this issue will require significant investment, which presents a huge opportunity for private infrastructure funds.

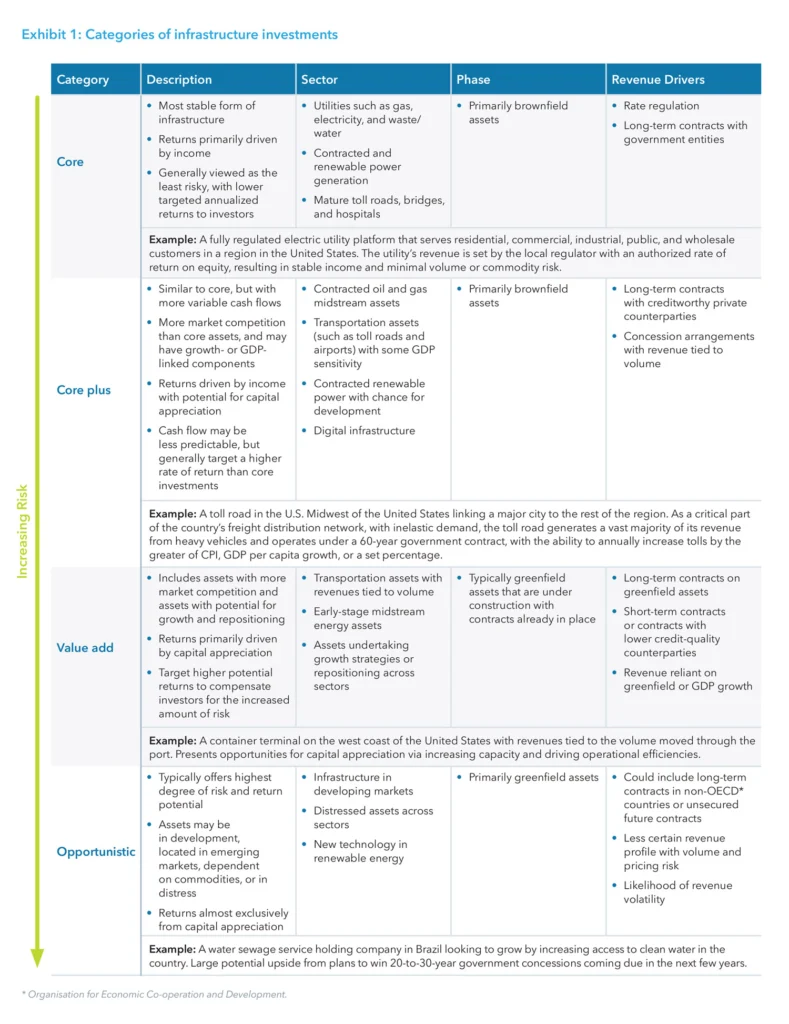

According to the American Society of Civil Engineers, the total investment needs for U.S. infrastructure for the years 2020 through 2029 total $5.94 trillion, with a current funding gap of $2.5 trillion.5 Exhibit 2 breaks down these infrastructure funding needs. There are particularly notable gaps in funding for surface transportation, water services, electricity, and airports.

Thankfully, there seems to be wide recognition of the scale of the problem, spurring action from federal, state, and local governments. The Infrastructure Investment and Jobs Act (IIJA, or more commonly just “the Infrastructure Bill”) included $1.2 trillion in infrastructure spending, $550 billion of which is new federal spending to be allocated over the next five years. The IIJA investments, ranging from clean energy to broadband, can have a significant impact on the future of infrastructure in the United States. On the local front, 37 states have raised their gasoline tax since 2010 to fund critical transportation investments, and 98% of local infrastructure ballot initiatives passed in November 2020.6 These improvements were made by elected officials from both sides of the aisle and with strong voter support.7

Further, the effort to address climate change globally is resulting in an outsized market opportunity in renewable energy. As consensus grows that carbon emissions must decrease across all sectors of the world economy, governments continue to commit to decarbonization targets. More than 130 of the countries that signed the landmark Paris Agreement – as well as numerous cities and companies – have set or are considering a target of reducing emissions to net zero by mid-century.8

These commitments, along with more favorable economics (the cost of renewable energy has dropped to a level where it has become profitable without subsidies) create a sizeable opportunity for infrastructure investors.9 Goldman Sachs has estimated that as much as $16 trillion of total investment will be required by 2030 to limit global warming to 2°C.10 As the renewables sector continues to mature and attract private capital, there should be ample opportunities for private investors to acquire and/or develop cash flow- generating, operational renewable assets.

Infrastructure’s positive ESG impact

Infrastructure as an asset class involves investments representing critical elements that support people’s lives and communities, and consideration of environmental, social, and governance (ESG) factors directly impact the operation of infrastructure assets. While each infrastructure project will differ, some common ESG considerations include: the environmental impacts on ecosystems and biodiversity; community engagement and inclusive decision making; and climate change mitigation and adaptation.11

Further, infrastructure is at the core of the transition to a low-carbon economy through the development of renewable energy, such as wind and solar power. Driven by a supportive regulatory backdrop and declining cost curves for wind and solar power, the U.S. Energy Information administration expects that the share of renewables in the U.S. electricity generation mix will double from 21% in 2020 to 42% in 2050.12 Private infrastructure investments will be a critical component in achieving further decarbonization in the economy.

Infrastructure’s role in a portfolio

Infrastructure assets can offer much to an investor’s portfolio, including yield, diversification, the potential for capital appreciation, and the ability to mitigate, and even benefit from, inflation.

Yield: Infrastructure assets can provide consistent and reliable income streams, which are often governed by long-term contracts with reputable counterparties or counterparties regulated by the government.13 Income varies with the risk profile of the investment, but infrastructure investments can generate yields in the high single digits for core infrastructure, with core-plus and value-add investments producing less yield but greater capital appreciation.14

Diversification: Infrastructure’s drivers of returns are broadly diversified from the broader economy and other asset classes.15 Infrastructure asset performance is relatively insulated from broader market movements, with returns largely determined by contractual cash flows and backed by government bodies. Since 2008, global core infrastructure returns have a -0.1 correlation to global bonds and equities, and only a 0.3 correlation to U.S. real estate.16

Capital appreciation: Throughout the life of an infrastructure asset, the managers that own and operate it can add value. Owners can optimize operations, cut costs, and/or look to increase revenue by expanding into different regions or adding product lines. Capital appreciation is most typical in value-add and opportunistic infrastructure strategies.

Inflation protection: Infrastructure investments offer protection in an inflationary environment in several ways and can even benefit from inflation.17 Due to inelastic demand and limited competition, even in an inflationary environment, an increase in consumer prices does not generally impact the use of infrastructure assets.18 In addition, as mentioned earlier, many infrastructure assets are contractually linked to inflation through regulations, contracts, or government concessions.19 An inflationary environment may also limit competition, as infrastructure assets are typically large projects with costly new-construction expenses that increase in lockstep with supplies and labor, increasing replacement cost.

Asset allocation

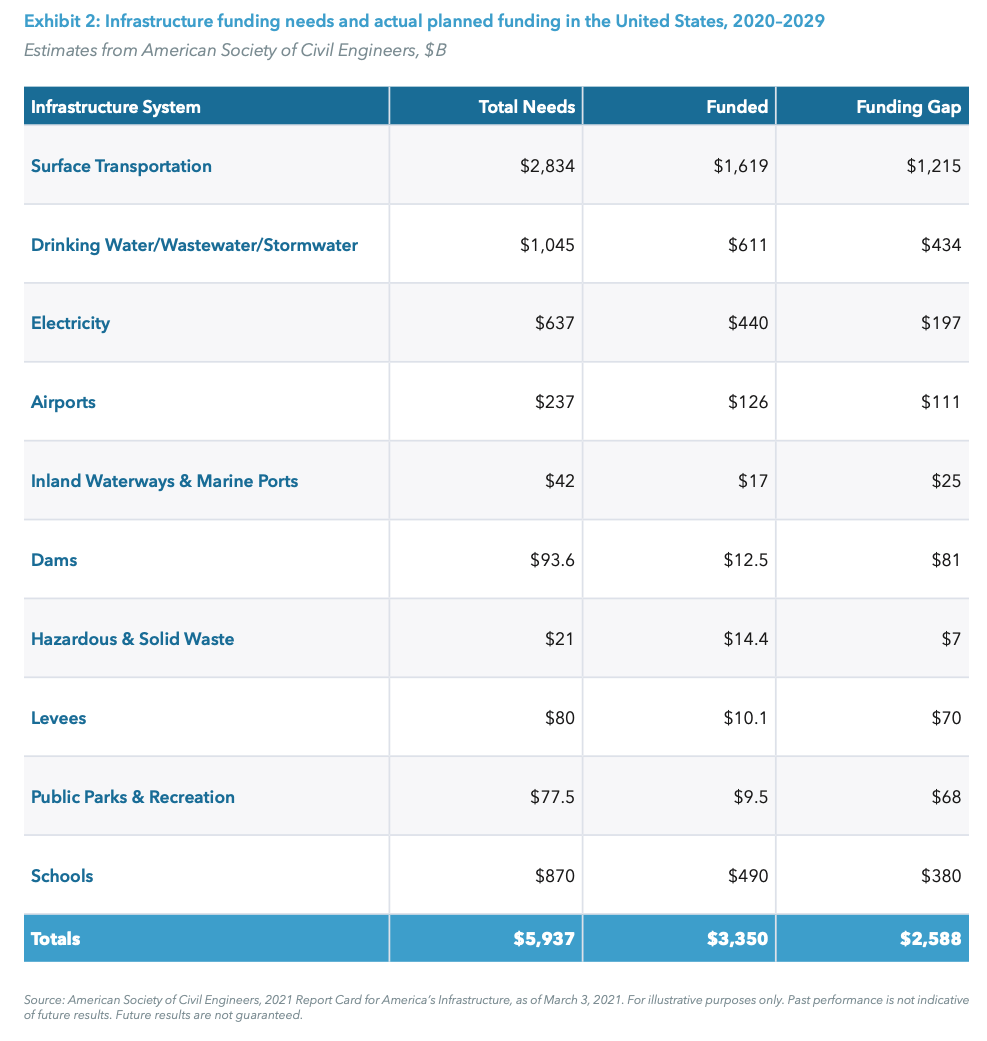

A growing number of investors have turned to private infrastructure as a solution to enhance the risk/return profile of their portfolio (See Exhibit 3). At its current pace, 2022 fundraising is set to exceed a record-breaking 2021.20 According to Preqin, institutional investors have a median target allocation for infrastructure of 5 percent in North America, although they remain below their targets and plan to grow commitments going forward.21

The opportunity in infrastructure looks compelling on a long-term basis, given the scale of planned public infrastructure investment, and in the shorter term, given high levels of inflation and rising interest rates. The current income generation, downside protection characteristics, and inflation protection features associated with infrastructure investments make them a natural fit to include in an investor’s fixed income and/or real asset allocation. Infrastructure investments can produce meaningful portfolio diversification benefits, due to their low correlation to fixed income and equity markets,22 with the potential for longer-term capital appreciation.

END NOTES

1. Source: “Infrastructure as an inflation hedge – look no further?”, CBRE, March 2022.

2. Ibid.

3. Source: “Infrastructure Investing in an Inflationary Environment,” Pathway Capital Management, February 2022.

4. Source: American Society of Civil Engineers, 2021 Report Card for America’s Infrastructure, March 3, 2021.

5. Ibid.

6. Ibid.

7. Ibid.

8. Source: “For a livable climate: Net-zero commitments must be backed by credible action,” United Nations, as of Feb. 28, 2023.

9. Source: “Infrastructure Investing: Why Now?”, Brookfield, July 14, 2021.

10. Source: “Carbonomics: The Green Engine of Economic Recovery,” Goldman Sachs Equity Research, June 2020.

11. Source: “ESG in Infrastructure,” Global Infrastructure Hub, August 16, 2022.

12. “EIA Projects Renewables Share of U.S. Electricity Generation Mix Will Double By 2050,” U.S. Energy Information Administration, February 8, 2021.

13. Source: “Infrastructure: Opportunity for yield and diversification,” Nuveen, Summer 2018.

14. Ibid.

15. Ibid.

16. Source: “Guide to Alternatives 1Q 2022,” JP Morgan, Data based on quarterly returns from June 30, 2008 to February 28, 2022.

17. Source: “Infrastructure Investing in an Inflationary Environment,” Pathway Capital Management, February 2022. 18. Ibid.

19. Ibid.

20. Source: PitchBook, as of May 20, 2022.

21. Source: “Here’s Another Reason Why Infrastructure Funds Are Raising Record Amounts of Money,” Preqin, Institutional Investor, August 23, 2022.

22. Source: “Guide to Alternatives 1Q 2022,” JP Morgan. Data based on quarterly returns from June 30, 2008 to August 31, 2022.

IMPORTANT INFORMATION

The material herein has been provided to you for informational purposes only by Institutional Capital Network, Inc. (“iCapital Network”) or one of its affiliates (iCapital Network together with its affiliates, “iCapital”). This material is the property of iCapital and may not be shared without the written permission of iCapital. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of iCapital.

This material is provided for informational purposes only and is not intended as, and may not be relied on in any manner as, legal, tax or investment advice, a recommendation, or as an offer or solicitation to buy or sell any security, financial product or instrument, or otherwise to participate in any particular trading strategy. This material does not intend to address the financial objectives, situation, or specific needs of any individual investor. You should consult your personal accounting, tax and legal advisors to understand the implications of any investment specific to your personal financial situation.

ALTERNATIVE INVESTMENTS ARE CONSIDERED COMPLEX PRODUCTS AND MAY NOT BE SUITABLE FOR ALL INVESTORS. Prospective investors should be aware that an investment in an alternative investment is speculative and involves a high degree of risk. Alternative Investments often engage in leveraging and other speculative investment practices that may increase the risk of investment loss; can be highly illiquid; may not be required to provide periodic pricing or valuation information to investors; may involve complex tax structures and delays in distributing important tax information; are not subject to the same regulatory requirements as mutual funds; and often charge high fees. There is no guarantee that an alternative investment will implement its investment strategy and/or achieve its objectives, generate profits, or avoid loss. An investment should only be considered by sophisticated investors who can afford to lose all or a substantial amount of their investment.

iCapital Markets LLC operates a platform that makes available financial products to financial professionals. In operating this platform, iCapital Markets LLC generally earns revenue based on the volume of transactions that take place in these products and would benefit by an increase in sales for these products.

The information contained herein is an opinion only, as of the date indicated, and should not be relied upon as the only important information available. Any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets is not necessarily indicative of the future or likely performance. The information contained herein is subject to change, incomplete, and may include information and/or data obtained from third party sources that iCapital believes, but does not guarantee, to be accurate. iCapital considers this third-party data reliable, but does not represent that it is accurate, complete and/or up to date, and it should not be relied on as such. iCapital makes no representation as to the accuracy or completeness of this material and accepts no liability for losses arising from the use of the material presented. No representation or warranty is made by iCapital as to the reasonableness or completeness of such forward-looking statements or to any other financial information contained herein.

Securities products and services are offered by iCapital Markets, an SEC-registered broker-dealer, member FINRA and SIPC, and an affiliate of iCapital, Inc. and Institutional Capital Network, Inc. These registrations and memberships in no way imply that the SEC, FINRA, or SIPC have endorsed any of the entities, products, or services discussed herein. Annuities and insurance services are provided by iCapital Annuities and Insurance Services LLC, an affiliate of iCapital, Inc. “iCapital” and “iCapital Network” are registered trademarks of Institutional Capital Network, Inc. Additional information is available upon request.

©2024 Institutional Capital Network, Inc. All Rights Reserved. | 2024.01