Key Takeaways

- Record issuance: 2024 saw structured investment sales volumes on iCapital reach an unprecedented $84.5 billion, marking a 42% year-over-year increase.1

- Favorable market dynamics: Strong equity performance and a favorable rate environment drove demand for growth-oriented and principal protected structures.

- Widespread participation: Increased activity across wealth channels highlighted the growing acceptance of structured investments as integral to the core portfolio.

- Strategy innovation: The emergence of new strategies and the re-emergence of some old ones catered to evolving investor preferences.

- Technological advancements: Platforms like iCapital supported improved client engagement and education efforts and drove new efficiencies.

With tailwinds from strong equity markets and relatively high interest rates, the U.S. structured investment market had a banner year marked by broadening participation across the various wealth management channels, innovative new strategies, and tech-driven enhancements to core portfolio positioning efforts. In fact, in 2024, structured investment (SI) sales volumes on the iCapital platform totaled a record $84.5 billion, a 42% increase year-over-year (YoY) with participation rising across all the major wealth management channels, including independent broker-dealers, private banks, and the RIA channel.1

Market Dynamics & SI Growth Trends

Another strong year for equities

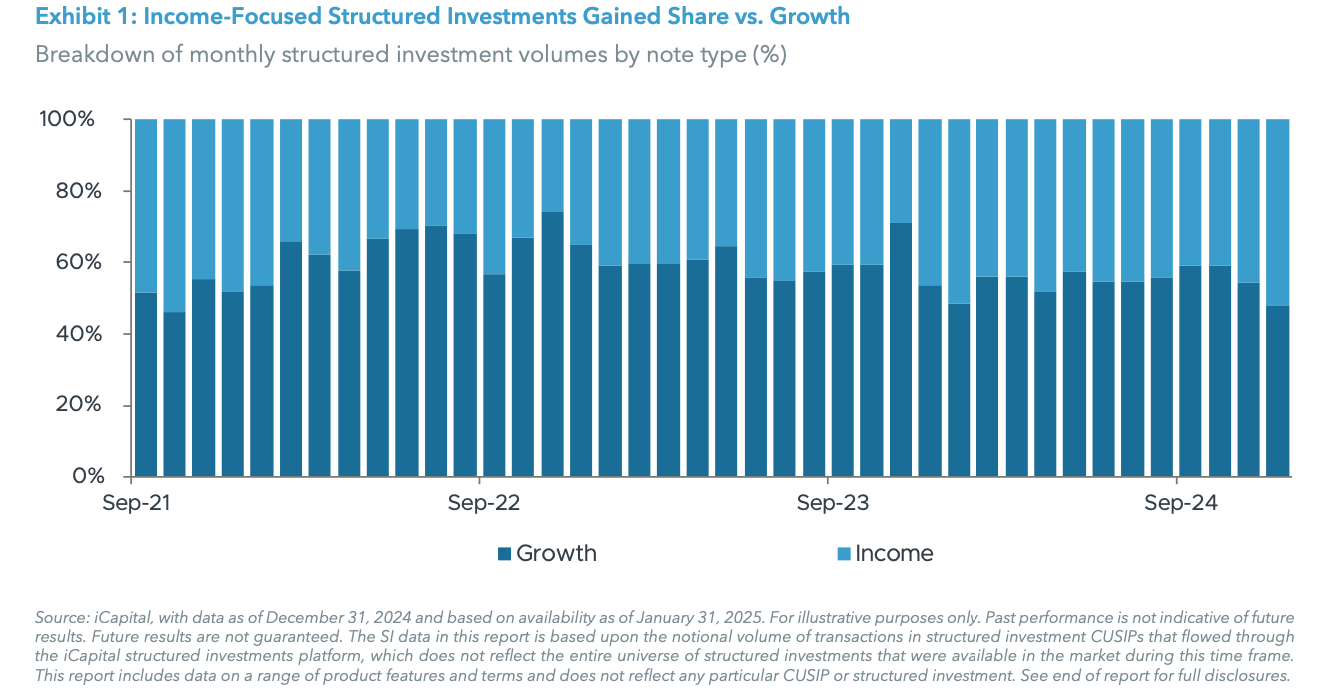

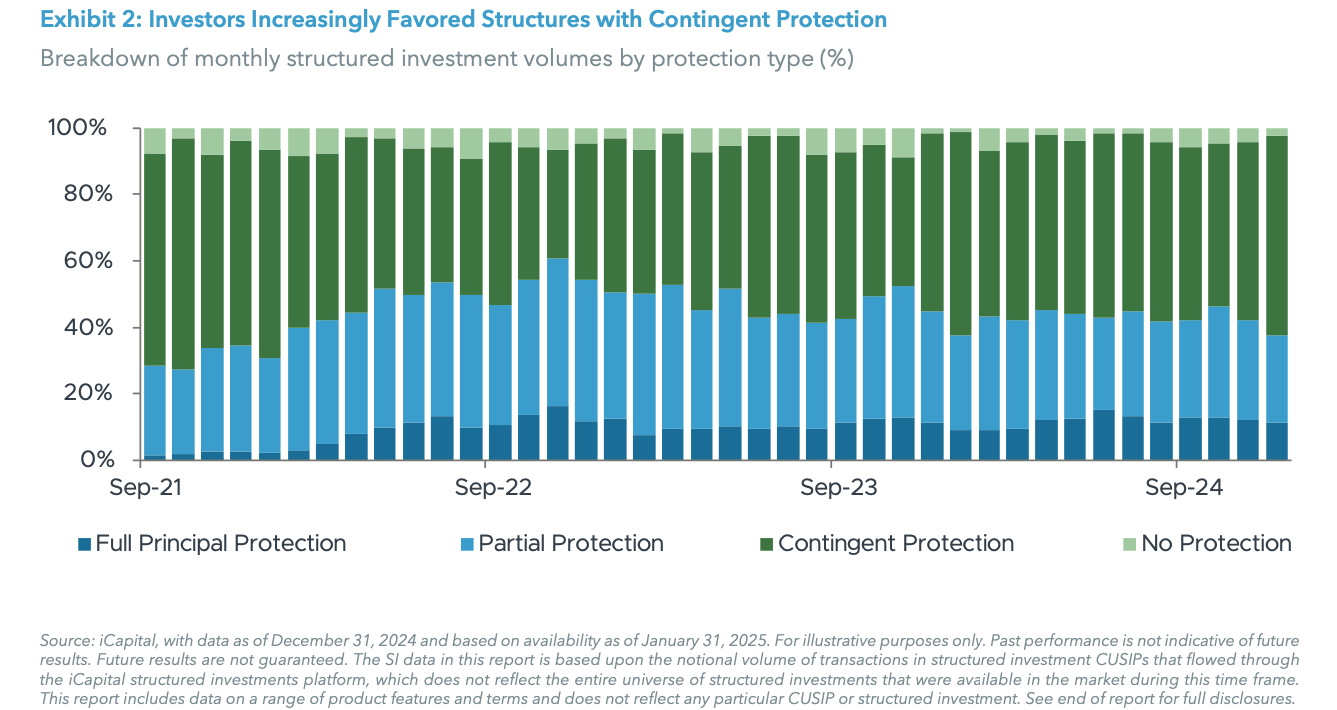

Structured investments are not only linked to market returns; their issuance and product development are also closely related to prevailing market conditions. The S&P 500 achieved returns of 20%+ for the second consecutive year,2 and this led many investors to seek continued equity market exposure—but often with a level of downside protection built in to guard against potential market corrections. Issuance of growth-oriented structures was up 26% YoY, and over 72% of the growth-oriented structures issued on the iCapital platform had either buffered or contingent protection features.1 Fully principal protected notes and FDIC-insured market linked certificates of deposit (MLCDs) accounted for nearly 20% of issuance in growth-oriented structures.1 This heavy use of protection by investors is in line with historical trends in a market that has long been used to achieve risk-managed exposure to equities. On the income note side, issuance was up 58% YoY, as investors continued to find opportunities for yield enhancement versus fixed income, with stocks largely on the rise.1

Steady, relatively high rates

This demand for protection was also fueled by an interest rate environment conducive to many SI strategies. Off interest rate lows in 2020, rates across the curve remained elevated in 2023 and 2024. As noted in a recent iCapital Alternatives Decoded issue regarding the influence of market dynamics on product economics, “As interest rates increase, an issuer’s funding may reflect more favorable bond terms. This allows for a greater amount of principal to be used towards the options package, ultimately improving the terms of the structured investment…” We saw sustained demand for two interest rate sensitive structures, in particular.

Principal protected notes: On platform, issuance of principal protected notes was up 33% YoY.1 Most offerings were linked to broad-based equity indices or a basket of equity indices, with an average term of 46 months.1 These notes are designed to satisfy clients that demand the most principal protection and accept issuer credit risk. They also provide some equity market exposure over the medium to long term.

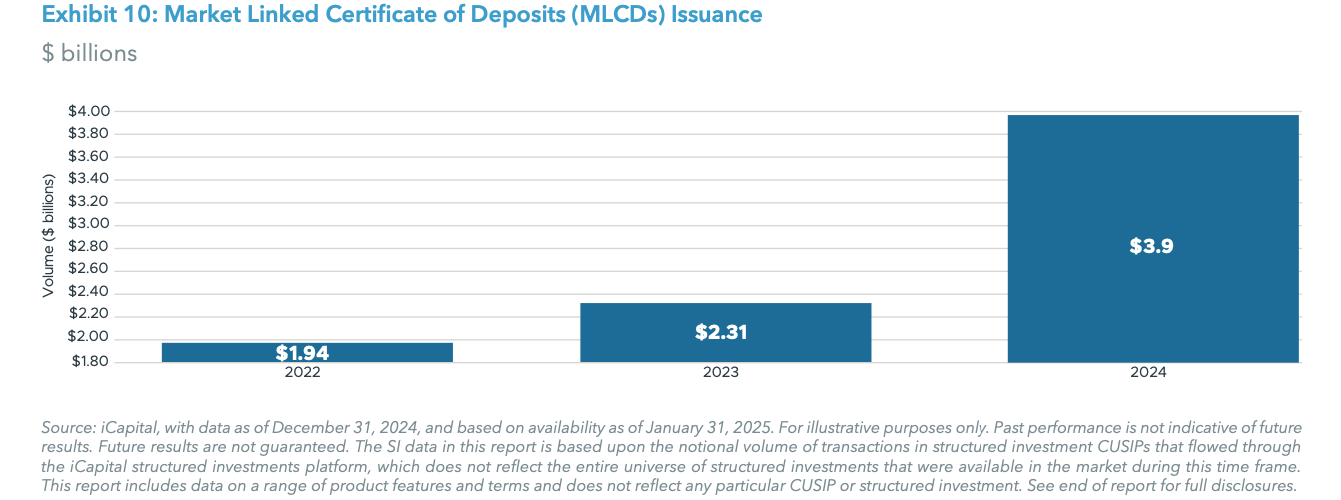

FDIC-insured market linked CDs (MLCDs): A product long challenged by persistently low interest rates from 2010 on has reemerged as a useful tool in helping conservative investors obtain a degree of equity exposure, with the peace of mind of full protection at maturity and FDIC insurance, up to applicable limits. MLCD issuance rose 70% YoY, surpassing $3.9 billion, with new issuers entering the market to capitalize on increased client demand.1 The average term on MLCDs of 35 months, while shorter than that of principal protected notes, would typically be associated with either reduced leverage or possibly capped upside, relative to notes of comparable term and depending on which underlier the product is tied to. This is due to differences in funding.1

Call velocity

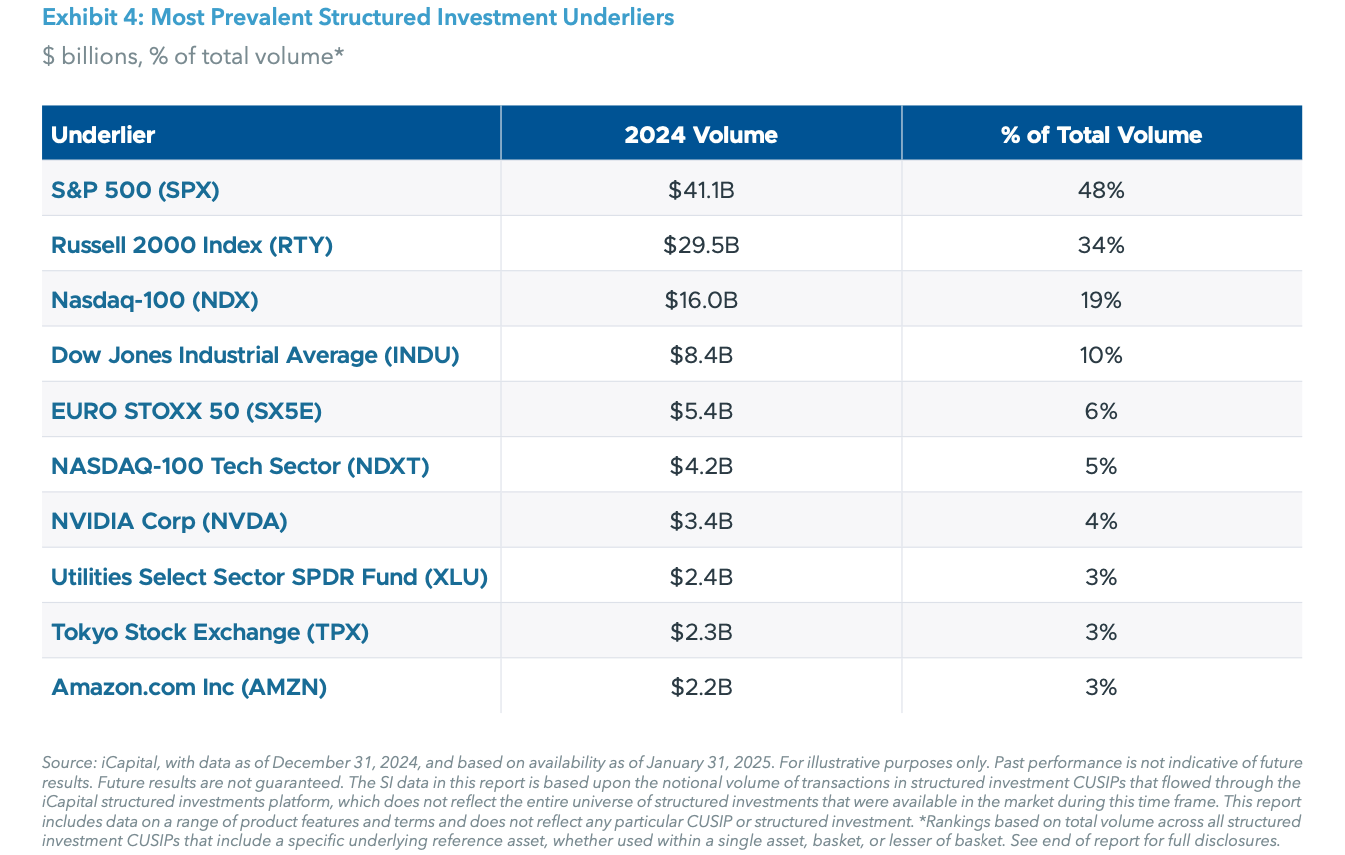

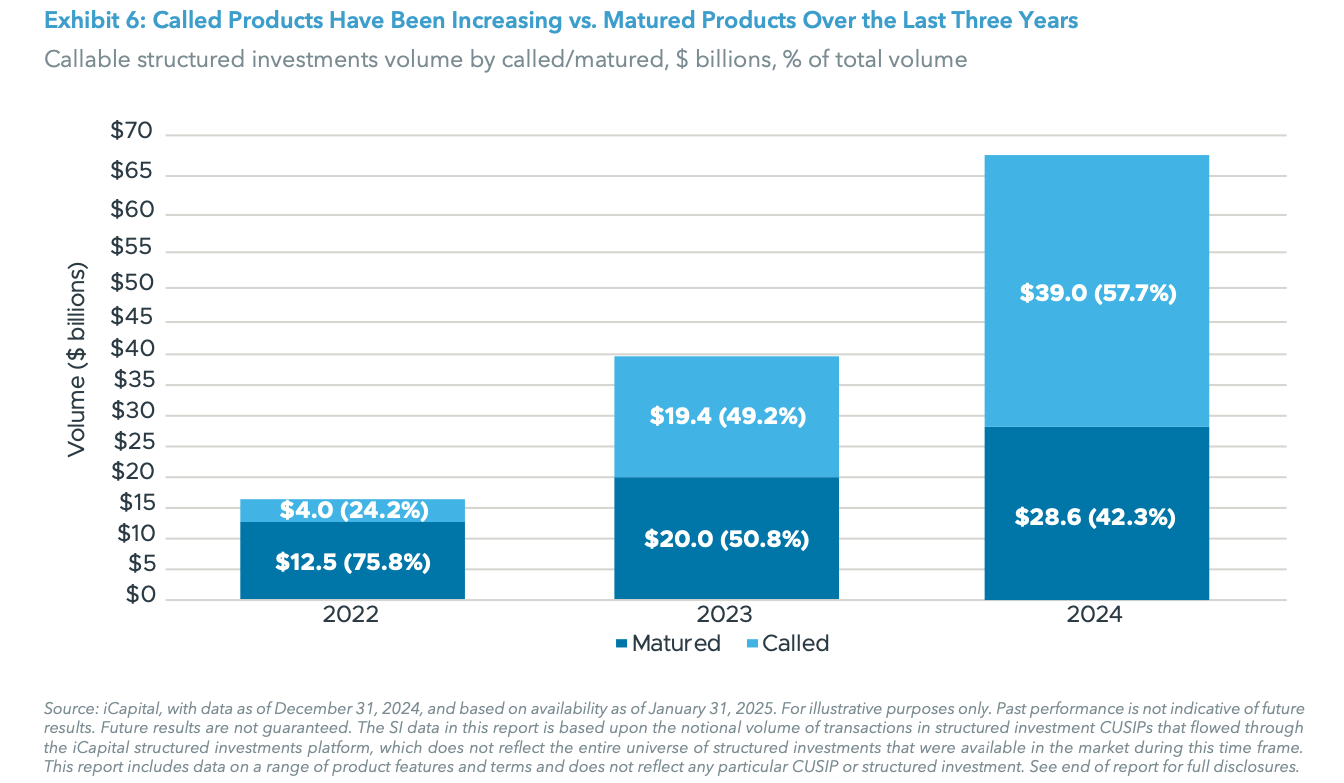

A third market dynamic most certainly fueling growth in SI issuance came from within the SI market itself—call volumes. As equity markets rose, numerous callable structures were indeed called, and many investors reinvested in new notes. On platform, we saw nearly $39 billion in called structures, or 73% of the total outstanding callable population.1

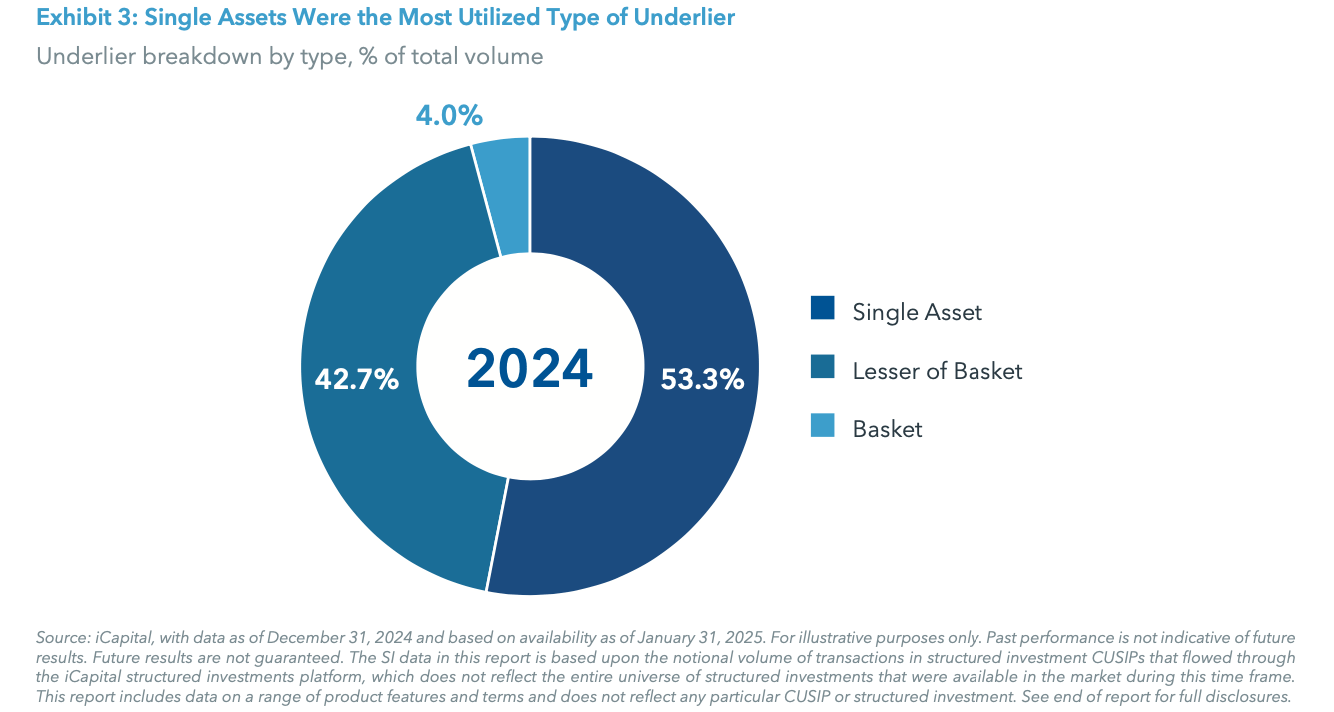

The average duration of callable products that triggered during 2024 was 12 months.1 Notably, the popular worst- of autocallable structures often featured the Russell 2000 Index (RTY) as a basket underlier, and were likely call candidates. This trend was driven by the Russell recovery of 2024, which saw the RTY up over 36% from October 2023 levels.3 In fact, of the nearly $39 billion in called structures, that Index was an underlier in $21.4B of them.1

Adoption and tech on the rise

While growth in SI issuance was fueled by favorable market dynamics, there is more to the story. The SI industry is growing across all segments, with broker-dealer and RIA volumes both hitting all-time highs, up +48% YoY and 45% YoY, respectively.1 Overall usage of the platform hit exciting highs as well, as measured by monthly active users (MAUs). In 2024, we saw broker-dealer MAUs +10% YoY, private bank MAUs +23% YoY, and RIA MAUs +27%.1

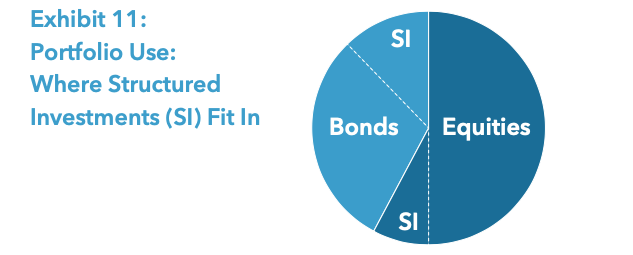

Why are we seeing growing adoption and participation? Financial professionals and their clients are increasingly viewing structured investments as a more integral part of asset allocation strategies, serving alongside traditional long only assets. This approach is facilitated by tech platforms like iCapital, which support existing wealth management firms in enhancing advisor adoption, while also empowering new wealth management firms to launch the business line.

More on this important point about technology advancements after a review of 2024 highlights from the iCapital platform, including the year’s top trends.

2024 SI Platform Overview

Macro Trends

Top On-Platform Trends

Financial Products:

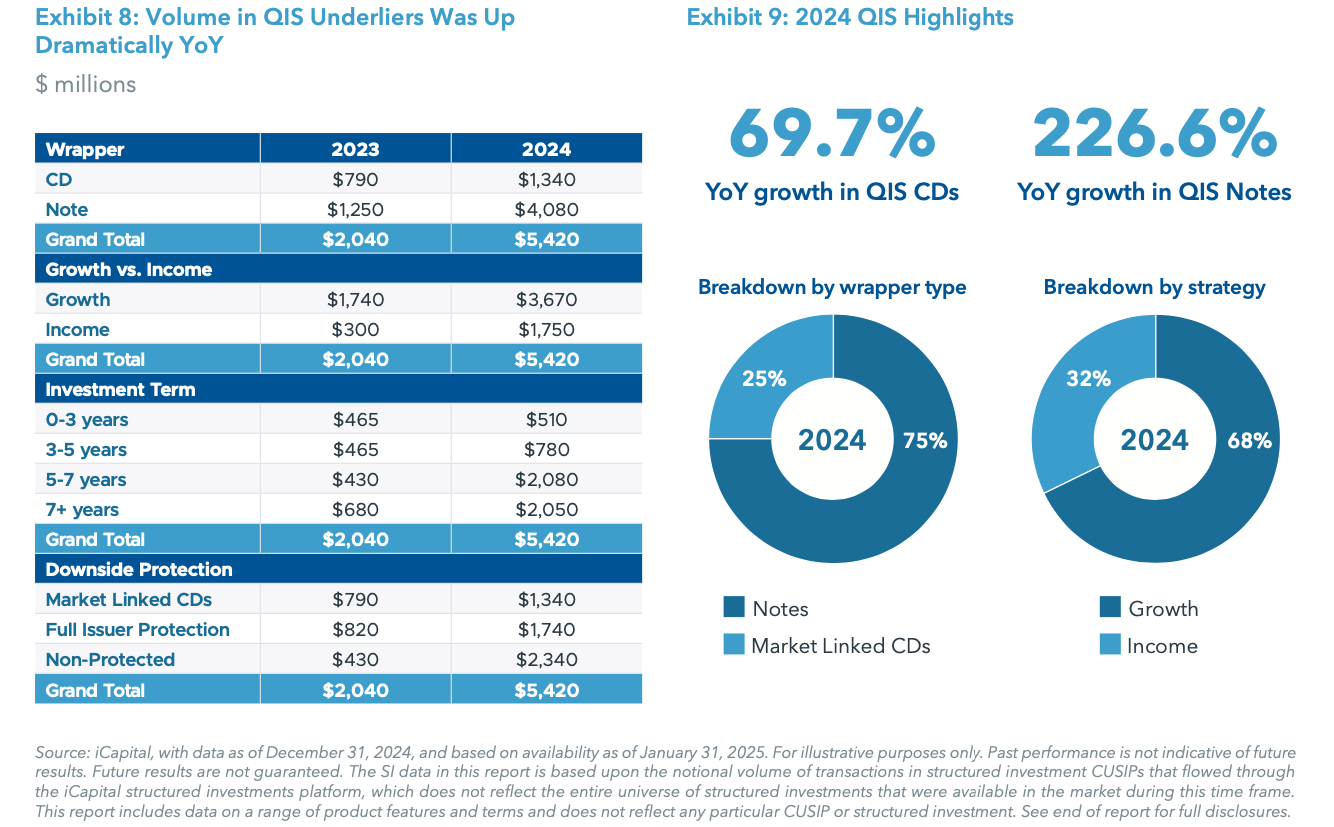

Index innovation with Quantitative Investment Strategies (QIS) underliers: Whether issuers were building QIS underliers in-house or looking to third-party index providers, issuance in these non-traditional indices was on the rise. QIS are rules based, systematic indices that provide exposure to different themes or algorithmic strategies to express a view on the market. Total issuance linked to QIS more than doubled YoY. Most of these investments were longer dated, with 76% of notional issuance in 5+ year structures.1 The top 4 themes were:

1. High Volatility – These strategies typically aim to capitalize on the significant price movements and dynamic nature of certain sectors of stocks by employing a volatility-based or momentum capturing approach. These indices seek to enhance returns through active management of risk and exposure, often using decrements and managed futures to optimize performance in high- volatility environments.

2. Low Volatility – These strategies are often designed to provide exposure to broad-based equities while managing risk through a volatility control mechanism. These indices aim to balance the potential for returns with a focus on limiting downside risk.

3. Low Volatility/Thematic – Investment strategies that typically aim to provide balanced exposure to various asset classes and/or capitalize on momentum in markets while also leveraging volatility control mechanisms to achieve objectives. These indices are most often designed to enhance performance through strategic rebalancing based on market conditions.

4. Thematic – These innovative indices are designed to provide exposure to a certain segment or theme in the markets such as U.S. blue-chips, the autonomous economy, or AI. They aim to provide investors seeking long-term growth potential with a balanced approach to managing risk and capitalizing on themed opportunities.

Because QIS can be complex, we have deepened our support of QIS distribution via training initiatives that help outline the methodology, innovation, and value to investors that these indices may provide.

The Return of Market Linked CDs: Investor appetite for principal protected solutions with FDIC insurance was strong, and we saw issuers unlocking CD shelves in response to demand (and because it was now feasible to structure them again). Sales on the iCapital platform exceeded $3.9 billion for 2024, up 70% YoY.1 Sales in MLCDs during the year were in growth- oriented structures tied to either broad market indices (comprising 66% of market linked CD volume) or QIS underliers (34% of market linked CD volume).1

Rate-Linked Ready

iCapital expanded its product offering to include a robust selection of new issue fixed income products, such as callable fixed rate income notes, callable step-up notes, floating rate notes, and fixed-to-floating rate notes.

Now, wealth management firms can seamlessly integrate a unique set of securities into existing workflows and provide their advisors with a diversified structured investment offering across equity and fixed income products from one centralized location. This comprehensive approach ensures that advisors are better equipped to service their clients in an ever- evolving investment landscape.

Enhanced Engagement Through Education and Technology

Doubling down on client education & support: Expanding investor education is paramount to continued adoption in the market. This is why we’ve helped firms convert trainings that are used to educate advisors and support staff on structured investments to create client- friendly versions of those trainings that can be shared directly with end investors.

Doubling down on client education & support: Expanding investor education is paramount to continued adoption in the market. This is why we’ve helped firms convert trainings that are used to educate advisors and support staff on structured investments to create client- friendly versions of those trainings that can be shared directly with end investors.

Improved client experience: Thanks to integrated, automated technology, advisors can provide clients with detailed information about the performance and progress of their structured investments. This includes information on the investment’s value, returns and/or lifecycle events, and changes to its underlying asset or market conditions. With easy access to this information, clients gain clarity and a real-time view of how their investments are performing.

At the core: Perhaps one of the greatest successes of the 2024 structured investment landscape was not equity performance or issuance highs, but rather increased momentum in the core portfolio movement. That is, the notion that structured investments should be viewed not as one-off trades but as core holdings within an asset allocation and positioned as such.

Rates Reimagined

Legacy distribution models for new issue fixed income offerings such as corporate notes are often manual, fragmented, and lack the necessary capabilities to help advisors efficiently manage lifecycle events such as coupons, calls, and maturities. With new issue note products on iCapital, the ecosystem is enhanced through:

- A scalable technology solution designed specifically for retail

- Deep connectivity with issuers, wholesalers, and distribution partners

- Improved product representation to enhance advisor understanding

- Robust lifecycle management capabilities

“By leveraging these educational materials, firms equip advisors with the information they need to have better conversations with their clients, which can lead to investors ultimately making more informed decisions. We’ve been happy to help wealth management firms convert educational tools for end-client use, spreading awareness and encouraging more knowledgeable market participants.”

– Andrew Kuefler

Head of Structured Investment Strategy & Growth, iCapital

One such tech tool that promotes this approach is iCapital Architect, an award-winning4 portfolio analytics tool that enables advisors to create and analyze outcome-oriented portfolios for their clients while incorporating structured investments (and alternatives). Use of this tool continued to gain momentum as Architect served both power users and less experienced advisors who were looking to build allocations to structured investments and alternatives for the first time. Architect’s analytics can illuminate the benefits (and potential drawbacks) of investing in structured investments, enabling better informed, data-driven client dialogues.

Expectations for Continued Growth

After what was truly a banner year for structured investments, certain circumstances in 2025 could potentially impact flows, such as rate declines or an equity market sell-off. Call volume was a driver of sustained growth and poses a potential risk to notional amounts in 2025, depending on the market. We expect advisors to continue gravitating toward principal and partial-principal protected structures to lock in attractive pricing before potential rate declines. We — along with our annuities counterparts — expect advisors and their baby boomer investors to continue gravitating toward wealth preservation with principal and partial-principal protected structures.

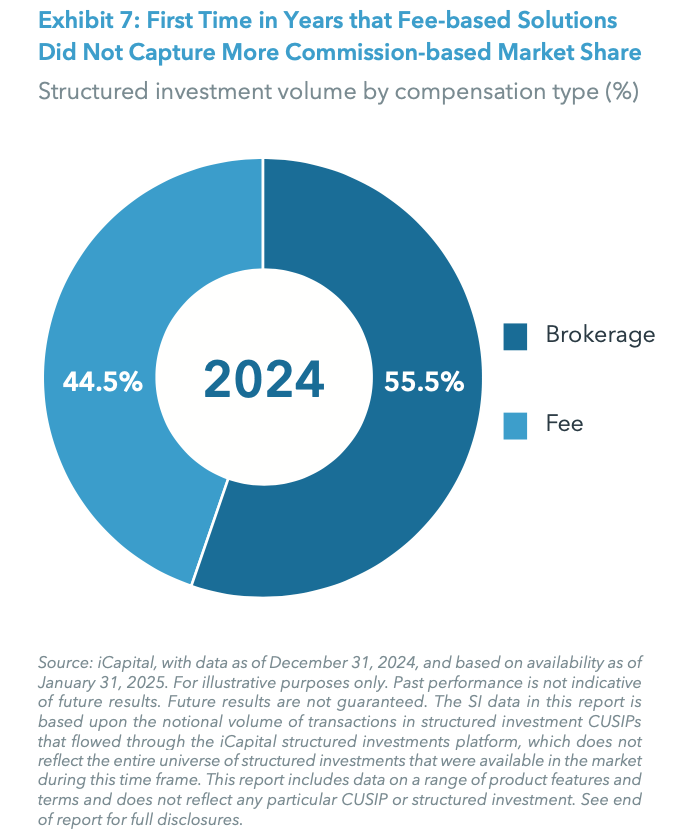

Most excitingly, we expect continued growth out of this market because we see increasing product use within the large and historically less SI-engaged advisory channel. What was once primarily viewed as a brokerage-like product is increasingly being built within core portfolio delivery (SI as a hedged equity sleeve, for example) and being implemented by a greater number of increasingly educated advisors and clients.

We are thrilled that technology plays an important role in this expanded use of structured investments, powering education, portfolio analytics, efficiencies and more, and we look forward to the continued use of evolving technology in pursuing structured investment opportunities in 2025 and beyond.

1. Source: iCapital, with data as of December 31, 2024, and based on availability as of January 31, 2025. The SI data in this report is based upon the notional volume of transactions in structured investment CUSIPs that flowed through the iCapital structured investments platform, which does not reflect the entire universe of structured investments that were available in the market during this time frame.

2. Source: Bloomberg, iCapital, as of December 31, 2024.

3. Source: Bloomberg, iCapital, as of December 31, 2024.

4. Source: 2024 WealthManagement.com Industry Award – “Best Alternative Investment Platform” & 2024 BISA “Technology Innovation Award”

IMPORTANT INFORMATION

The material herein has been provided to you for informational purposes only by Institutional Capital Network, Inc. (“iCapital Network”) or one of its affiliates (iCapital Network together with its affiliates, “iCapital”). This material is the property of iCapital and may not be shared without the written permission of iCapital. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of iCapital.

This material is provided for informational purposes only and is not intended as, and may not be relied on in any manner as, legal, tax or investment advice, a recommendation, or as an offer or solicitation to buy or sell any security, financial product or instrument, or otherwise to participate in any particular trading strategy. This material does not intend to address the financial objectives, situation, or specific needs of any individual investor. You should consult your personal accounting, tax and legal advisors to understand the implications of any investment specific to your personal financial situation.

The structured investments data in this report is based upon the notional volume of transactions in structured investment CUSIPs that flowed through the iCapital structured investments platform, which does not reflect the entire universe of structured investments that were available in the market during this time frame. Actual structured investments may differ materially from the general overview provided. Past performance of any products should not be taken as an indication or guarantee of future performance, and no representation or warranty, expressed or implied is made regarding future performance.

STRUCTURED INVESTMENTS ARE CONSIDERED COMPLEX PRODUCTS AND MAY NOT BE SUITABLE FOR ALL INVESTORS. Please note that there is no public secondary market for structured investments. Although the issuer may from time to time make a market in certain structured investments, the issuer does not have any obligation to do so, and market making may be discontinued at any time. Accordingly, an investor must be prepared to hold such investments until maturity. Any or all payments are subject to the creditworthiness of the issuer. Before investing in any product, an investor should review the prospectus or other offering documents, which contain important information, including the product’s investment objectives or goals, its strategies for achieving those goals, the principal risks of investing in the product, the product’s fees and expenses, and its past performance.

iCapital Markets LLC operates a platform that makes available financial products to financial professionals. In operating this platform, iCapital Markets LLC generally earns revenue based on the volume of transactions that take place in these products and would benefit by an increase in sales for these products.

The information contained herein is an opinion only, as of the date indicated, and should not be relied upon as the only important information available. Any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets is not necessarily indicative of the future or likely performance. The information contained herein is subject to change, incomplete, and may include information and/or data obtained from third-party sources that iCapital believes, but does not guarantee, to be accurate. iCapital considers this third-party data reliable, but does not represent that it is accurate, complete and/or up to date, and it should not be relied on as such. iCapital makes no representation as to the accuracy or completeness of this material and accepts no liability for losses arising from the use of the material presented. No representation or warranty is made by iCapital as to the reasonableness or completeness of such forward-looking statements or to any other financial information contained herein.

Securities products and services are offered by iCapital Markets, an SEC-registered broker-dealer, member FINRA and SIPC, and an affiliate of iCapital, Inc. and Institutional Capital Network, Inc. These registrations and memberships in no way imply that the SEC, FINRA, or SIPC have endorsed any of the entities, products, or services discussed herein. Annuities and insurance services are provided by iCapital Annuities and Insurance Services LLC, an affiliate of iCapital, Inc. “iCapital” and “iCapital Network” are registered trademarks of Institutional Capital Network, Inc. Additional information is available upon request.

© 2025 Institutional Capital Network, Inc. All Rights Reserved.