What are Fixed Income Investments with Principal Protection?

Fixed income investments with principal protection, including rate-linked investments, can provide income to investors on a periodic basis, either at a fixed or a floating rate, often while offering full principal protection.

Fixed income investments with principal protection are generally buy-and-hold products when used to generate periodic income, and investors must be willing to hold their investment until maturity. Investors should always read and understand the offering document before investing—in it they will find clearly defined terms, fees, and risks, including issuer credit risk, any limits on upside participation, potential for loss, and limited liquidity.

![]()

PAYMENT TYPE

Fixed income investments with principal protection offer coupon payments (paid monthly, quarterly, semi- annually, or annually), either at a fixed or floating rate. The floating rate is calculated based on a reference rate (such as SOFR) plus a spread. Additional coupon features may also be included.

![]()

PROTECTION

Generally, these products offer full principal protection. Certificates of deposits (CDs) offer FDIC insurance (up to applicable limits), while notes are subject to the credit risk of the issuer.

![]()

TERM

Investment terms range from one-month for CDs and one-year for notes/bonds, to 30-year investments. Terms may be fixed or issuer callable, with the possibility of early redemption at the issuer’s discretion.

![]()

UNDERLIER

The underlier is the reference rate. For floating rate investments, the reference rate is typically a publicly available rate, such as SOFR. For fixed rate investments, there is no reference rate, just a fixed coupon.

How Do They Work?

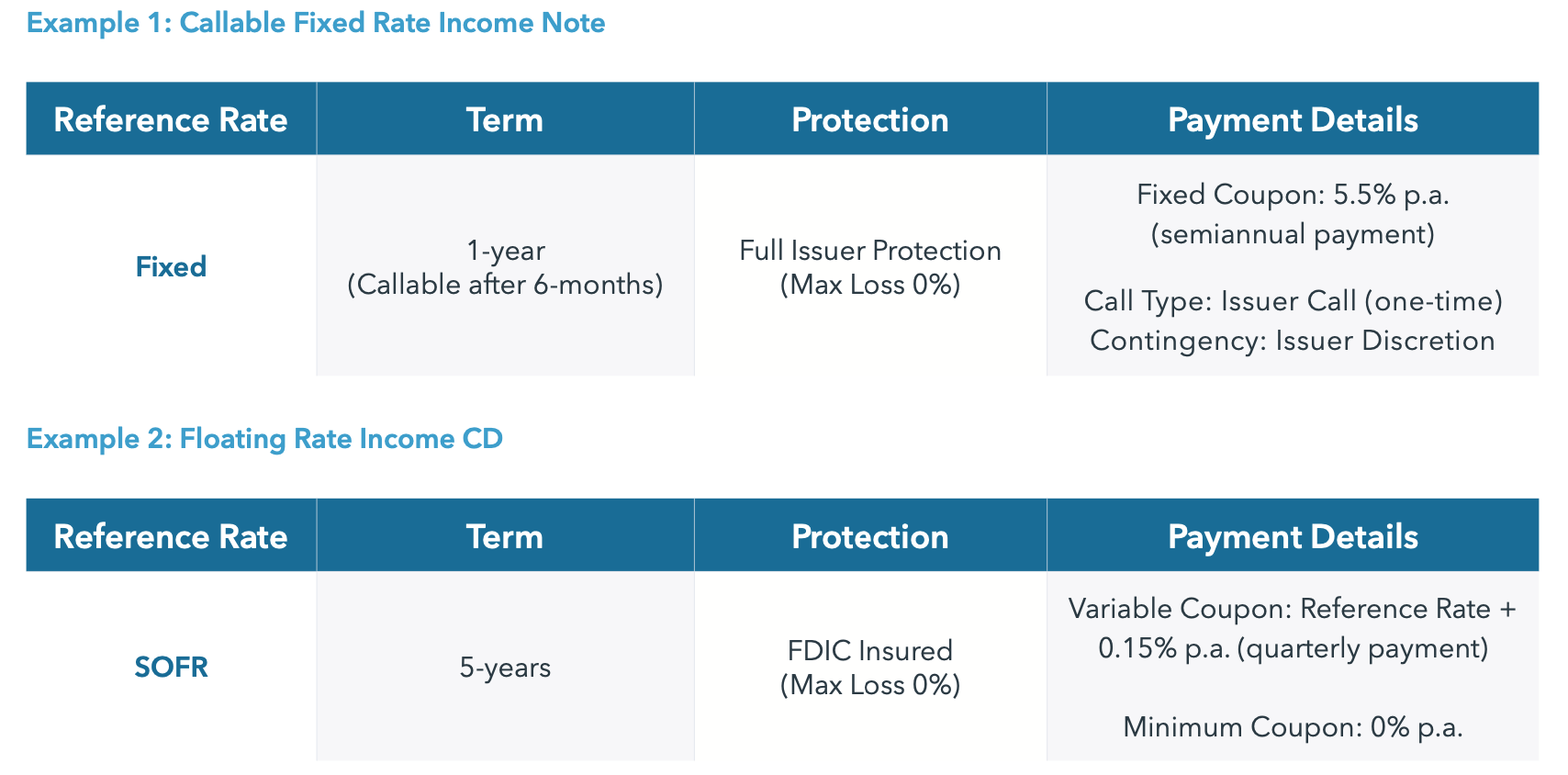

Let’s take a look at two hypothetical examples to further understand how the features of fixed income investments with principal protection work.

This callable fixed rate income note pays a semiannual coupon of 5.5% per annum. This note also offers full issuer protection, which means that the principal amount will be returned at maturity, subject to the credit risk of the issuer.

It has a one-year term, but it is callable at the issuer’s discretion, which means that on the call observation date the issuer may choose to redeem it prior to the scheduled maturity date after six months. If the note is called, investors will receive full principal back as well as any final coupon payment, and will no longer be invested in the market. If it is not called by the issuer, it will not be redeemed until the scheduled maturity date. In exchange for the issuer being able to determine whether to exercise the callability feature, which introduces additional uncertainty and risk to investors, issuer callable investments may offer higher potential returns than non- callable investments.

This floating rate income CD pays a variable coupon, which means that the coupon payment amount is calculated based on the reference rate. It pays a quarterly coupon of SOFR plus a spread of 0.15% per annum. It also is FDIC insured, which means that the principal amount is guaranteed to be returned at maturity and is insured by the FDIC, up to the applicable limit, which is typically $250,000 per depositor. Any amount of a CD that exceeds the applicable FDIC insurance limits, as well as any amounts payable under the CDs that are not insured by FDIC insurance, are subject to the creditworthiness of the issuer.

It has a five-year fixed term, which means that it cannot be redeemed prior to maturity. Investors must hold the CD until maturity in order to receive the protection described above.

When to Consider Fixed Income Investments with Principal Protection

For investors looking to generate portfolio income to meet their investment objectives, a diversified portfolio of fixed income investments with principal protection, including rate-linked investments, may be a welcome consideration. As with all fixed income investments, investors must be comfortable with the credit risk of the issuer and potential liquidity risk. Take note of the following key benefits and considerations:

Benefits

- Income Potential: Fixed income investments with principal protection offer a variety of coupon structures that can help meet income objectives, and issuer callable investments may offer higher potential returns than non-callable investments. While certain fixed income investments offer fixed rate coupon payments, others offer floating rate coupon payments that may not be guaranteed.

- Downside Protection: Fixed income investments with principal protection typically offer full protection. CDs offer FDIC insurance (up to applicable limits), while notes/bonds are subject to the credit risk of the issuer.

- Flexibility of Design: Fixed income investments with principal protection are available from a variety of issuers, and with varying tenors, coupon structures, and reference rates, offering income solutions that can be shaped to meet specific investor needs. Investors can typically invest in amounts as low as $1,000.

Considerations

- Credit Risk: Investors who hold fixed income investments with principal protection are exposed to the credit risk of the issuer and must be comfortable with the issuer’s creditworthiness for the life of the investment. CDs (including rate- linked CDs) are insured by the FDIC, up to the applicable limit. Any amount of a CD that exceeds the applicable FDIC insurance limits, as well as any amounts payable under the CDs that are not insured by FDIC insurance, are subject to the creditworthiness of the issuer.

- Liquidity Risk: Fixed income investments with principal protection are generally buy-and-hold investments when used to generate periodic income, which means that investors must be comfortable holding the investment until maturity in order to receive principal protection, and there is no guaranteed secondary market. Changes in interest rates and credit conditions will affect the market value and secondary liquidity, and any secondary market sale may result in investors receiving a price lower than the initial purchase price.

- Fees: Fees and costs are typically embedded in the price of a new issue fixed income investment with principal protection. The price an investor may receive if sold before maturity may be negatively impacted by the embedded fees and costs.

- Call Feature: Callable fixed income investments with principal protection can be called before maturity based on issuer discretion. It is possible the trade does not last for the full length of the stated term. This introduces reinvestment risk to the extent a trade is called early and similar alternatives are not available.

- Other Risks: Fixed income investments with principal protection are subject to interest rate risk, inflation risk, and market risk. Investors should also understand the unique set of risks of the reference rate, if any.

Securities products and services may be offered through iCapital Markets, LLC a registered broker/dealer, member FINRA and SIPC, and an affiliate of Institutional Capital Network, Inc. (“iCapital”). Please see the disclaimer at the end of this document for more information.

IMPORTANT INFORMATION

The material herein has been provided to you for informational purposes only by Institutional Capital Network, Inc. (“iCapital Network”) or one of its affiliates (iCapital Network together with its affiliates, “iCapital”). This material is the property of iCapital and may not be shared without the written permission of iCapital. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of iCapital.

This material is provided for informational purposes only and is not intended as, and may not be relied on in any manner as, legal, tax or investment advice, a recommendation, or as an offer or solicitation to buy or sell any security, financial product or instrument, or otherwise to participate in any particular trading strategy. This material does not intend to address the financial objectives, situation, or specific needs of any individual investor. You should consult your personal accounting, tax and legal advisors to understand the implications of any investment specific to your personal financial situation.

STRUCTURED INVESTMENTS ARE CONSIDERED COMPLEX PRODUCTS AND MAY NOT BE SUITABLE FOR ALL INVESTORS. Please note that there is no public secondary market for structured investments. Although the issuer may from time to time make a market in certain structured investments, the issuer does not have any obligation to do so and market making may be discontinued at any time. Accordingly, an investor must be prepared to hold such investments until maturity. Any or all payments are subject to the creditworthiness of the issuer. Before investing in any product, an investor should review the prospectus or other offering documents, which contain important information, including the product’s investment objectives or goals, its strategies for achieving those goals, the principal risks of investing in the product, the product’s fees and expenses, and its past performance.

iCapital Markets LLC operates a platform that makes available financial products to financial professionals. In operating this platform, iCapital Markets LLC generally earns revenue based on the volume of transactions that take place in these products and would benefit by an increase in sales for these products.

The information contained herein is an opinion only, as of the date indicated, and should not be relied upon as the only important information available. Any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets is not necessarily indicative of the future or likely performance. The information contained herein is subject to change, incomplete, and may include information and/or data obtained from third party sources that iCapital believes, but does not guarantee, to be accurate. iCapital considers this third-party data reliable, but does not represent that it is accurate, complete and/or up to date, and it should not be relied on as such. iCapital makes no representation as to the accuracy or completeness of this material and accepts no liability for losses arising from the use of the material presented. No representation or warranty is made by iCapital as to the reasonableness or completeness of such forward-looking statements or to any other financial information contained herein.

Securities products and services are offered by iCapital Markets, an SEC-registered broker-dealer, member FINRA and SIPC, and an affiliate of iCapital, Inc. and Institutional Capital Network, Inc. These registrations and memberships in no way imply that the SEC, FINRA, or SIPC have endorsed any of the entities, products, or services discussed herein. Annuities and insurance services are provided by iCapital Annuities and Insurance Services LLC, an affiliate of iCapital, Inc. “iCapital” and “iCapital Network” are registered trademarks of Institutional Capital Network, Inc. Additional information is available upon request.

© 2024 Institutional Capital Network, Inc. All Rights Reserved. | 2024.01