What if you could gain market exposure, but limit your losses if the market goes down?

Or make an investment with the potential to generate higher coupon payments?

Structured investments can be designed for almost any market outlook or financial objective and can be used to:

![]() Manage investment risk

Manage investment risk

![]() Earn periodic income payments

Earn periodic income payments

![]() Diversify your portfolio

Diversify your portfolio

What is a Structured Investment?

A structured investment is a type of investment where returns are linked to the performance of a reference asset, or the underlier, which is typically an index, ETF, or stock.

![]() Index

Index

![]() ETF

ETF

![]() Stock

Stock

The two most common types of structured investments are:

Market Linked CD

Carries FDIC Insurance1

![]()

Market Linked Note

Carries Issuer Credit Risk

![]()

Depending on the type of structured investment, a level of principal protection can be selected that aligns with an investor’s goals and objectives.

Full Principal Protection

Partial Protection2

Contingent Protection3

No Protection

More Protection

Less Protection

The power of structured investments is in the flexibility of their design, offering solutions across the risk-return spectrum.

Choosing an Investment

Investing in structured investments begins with a review of objectives. Is the investor’s primary objective growth or income? What market exposure is sought?

![]() Risk-Managed Growth

Risk-Managed Growth

Opportunity to grow assets, typically with a single payment at maturity and optional protection features

![]() Enhanced Income

Enhanced Income

Potential to earn periodic coupons throughout the life of the investment, often while managing downside risk

With an objective in mind, an investment is based on four basic parameters:

![]() Payment Type

Payment Type

Single payment at maturity or periodic coupons

![]() Protection

Protection

100% principal protection or principal-at-risk in exchange for higher potential returns

![]() Term

Term

Fixed term, typically 2–5 years, or callable, with the possibility of early redemption

![]() Underlier

Underlier

Reference asset to which the investment returns are linked

Structured investments are buy-and-hold products and investors must be willing to hold their investment until maturity. Investors should always read and understand the offering document before investing — in it they will find clearly defined terms, fees, and risks, including issuer credit risk, any limits on upside participation, potential for loss, and limited liquidity.

How They Work

Let’s walk through two hypothetical examples:

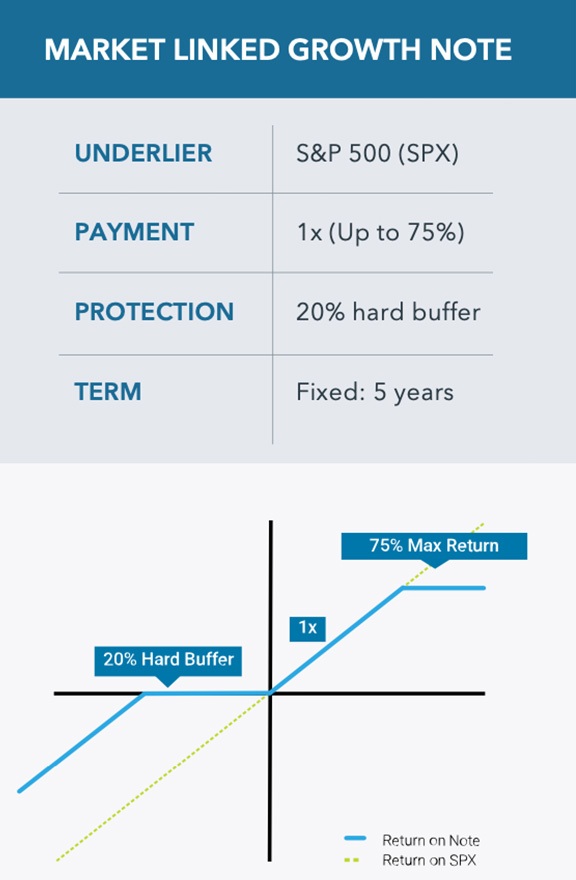

INVESTOR A:

- Seeking the growth potential of equities

- Concerned about downside risk

- Willing to make a 5-year investment

OBJECTIVE:

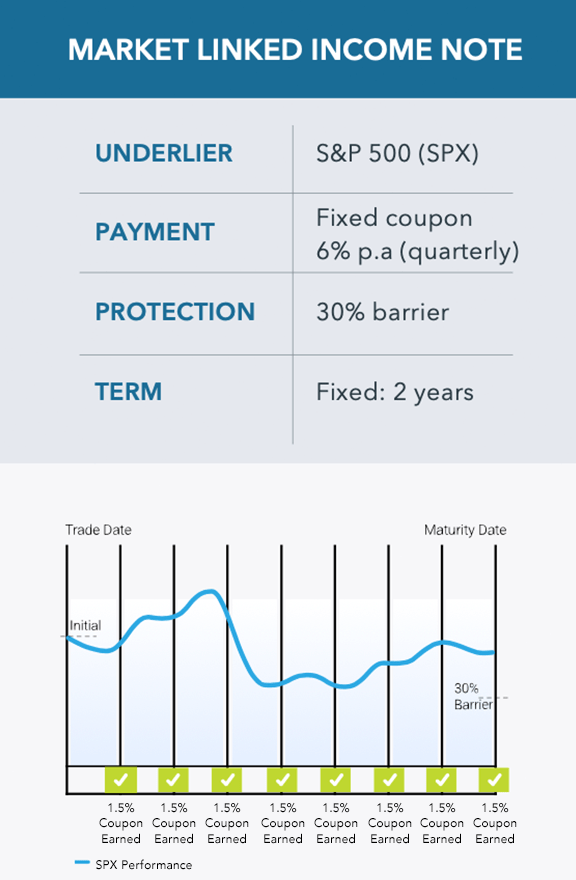

INVESTOR B:

- Seeking periodic income with higher yields

- Comfortable with equity risk

- Willing to make a 2-year investment

OBJECTIVE:

The example above illustrates a market linked growth note with upside participation, which means that at maturity investors would participate in the gains in the underlier. It offers 1x upside participation, up to a max return of 75%. At maturity, investors would receive a return that is one-to-one with the gains of the SPX on a price return basis, but not to exceed 75%. In other words, investor gains will be limited to the 75% max return.

The note also has a hard buffer to protect principal against a downturn in the underlier. The hard buffer would absorb the first 20% of losses in the SPX and after that, losses would be 1% for every 1% that the SPX has declined below 80% of its initial level.

Benefits: Equity upside potential with partial protection

The example above illustrates a market linked income note with a fixed coupon, which means that the coupon payments would be made each period, regardless of the performance of the underlier. It would pay a quarterly fixed coupon of 6% p.a., no matter the performance of the SPX.

This note also has a barrier to protect principal against a downturn in the underlier. At maturity, the barrier would absorb the first 30% of losses in the SPX and after that, the protection would disappear, and losses would be one-to-one from the underlier’s initial level.

Benefits: Higher coupons than two-year bond alternatives, although subject to downside risk

Why Now?

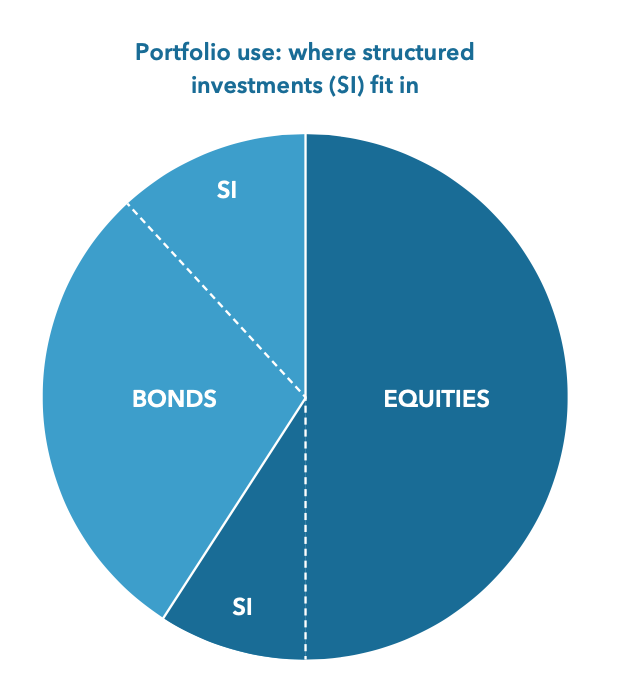

Structured investments can help address specific portfolio needs for a more tailored portfolio approach and are:

Strategic: They can provide strategies to manage today’s investing challenges, such as ongoing market volatility.

Flexible: Some offer full or partial principal protection at maturity, while others offer greater upside, but come with greater risk.

Diverse: They can be a core portfolio component as an alternative or complement to equity or fixed income holdings, for example.

Advancements in innovative technology and analytical tools have increased education and transparency. This has provided a clearer understanding of how these investments can be used within a diversified portfolio and created a stronger structured investment market than ever before.

Key Risks

Key risk considerations may include, but are not limited to, the following:

- Contingent Upside: Return and/or income payments are dependent on the performance of the underlier and not guaranteed, and may be either levered or limited depending on the terms of the structured investment.

- Downside Exposure: Structured investments can offer full, partial, or no protection of principal. Depending on the terms of the structured investment, an investor may have downside exposure.

- Fees: Fees and costs are usually embedded in the price of the structured investment. The price an investor may receive if sold before maturity may be negatively impacted by the embedded fees and costs.

- Liquidity Risk: Structured investments are buy-and-hold investments, which means that investors must hold the note until maturity in order to receive the specified investment return and protection. While issuing firms or dealers may be willing to buy back a structured investment before maturity, they may do so at a discount to statement value and are under no legal obligation to provide liquidity.

- Credit Risk: Similar to corporate bonds, structured investment holders are exposed to the credit risk of the issuer and must be comfortable with the issuer’s creditworthiness throughout the life of the trade.

- Underlier Risk: Investors should understand the unique set of risks of the structured investment underlier.

Securities products and services may be offered through iCapital Markets, LLC a registered broker/dealer, member FINRA and SIPC, and an affiliate of Institutional Capital Network, Inc. (“iCapital”). Please see the disclaimer at the end of this document for more information.

1. Market Linked Certificates of Deposit (“CDs”) are insured by the Federal Deposit Insurance Corporation, or FDIC, a U.S. Government Agency that provides deposit insurance backed by the full faith and credit of the United States Government up to applicable limits. Market Linked Notes are not FDIC insured.

2. Partial Protection: A type of principal protection offered on some structured investments, where the protection that investors receive at maturity does not protect the full principal amount invested.

3. Contingent Protection: A type of principal protection offered on some structured investments, where the protection that investors receive at maturity is contingent upon the Underlier being at or above a specified level at maturity.

IMPORTANT INFORMATION

The material herein has been provided to you for informational purposes only by Institutional Capital Network, Inc. (“iCapital Network”) or one of its affiliates (iCapital Network together with its affiliates, “iCapital”). This material is the property of iCapital and may not be shared without the written permission of iCapital. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of iCapital.

This material is provided for informational purposes only and is not intended as, and may not be relied on in any manner as, legal, tax or investment advice, a recommendation, or as an offer or solicitation to buy or sell any security, financial product or instrument, or otherwise to participate in any particular trading strategy. This material does not intend to address the financial objectives, situation, or specific needs of any individual investor. You should consult your personal accounting, tax and legal advisors to understand the implications of any investment specific to your personal financial situation.

STRUCTURED INVESTMENTS ARE CONSIDERED COMPLEX PRODUCTS AND MAY NOT BE SUITABLE FOR ALL INVESTORS. Please note that there is no public secondary market for structured investments. Although the issuer may from time to time make a market in certain structured investments, the issuer does not have any obligation to do so and market making may be discontinued at any time. Accordingly, an investor must be prepared to hold such investments until maturity. Any or all payments are subject to the creditworthiness of the issuer. Before investing in any product, an investor should review the prospectus or other offering documents, which contain important information, including the product’s investment objectives or goals, its strategies for achieving those goals, the principal risks of investing in the product, the product’s fees and expenses, and its past performance.

iCapital Markets LLC operates a platform that makes available financial products to financial professionals. In operating this platform, iCapital Markets LLC generally earns revenue based on the volume of transactions that take place in these products and would benefit by an increase in sales for these products.

The information contained herein is an opinion only, as of the date indicated, and should not be relied upon as the only important information available. Any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets is not necessarily indicative of the future or likely performance. The information contained herein is subject to change, incomplete, and may include information and/or data obtained from third party sources that iCapital believes, but does not guarantee, to be accurate. iCapital considers this third-party data reliable, but does not represent that it is accurate, complete and/or up to date, and it should not be relied on as such. iCapital makes no representation as to the accuracy or completeness of this material and accepts no liability for losses arising from the use of the material presented. No representation or warranty is made by iCapital as to the reasonableness or completeness of such forward- looking statements or to any other financial information contained herein.

Securities products and services are offered by iCapital Markets, an SEC- registered broker-dealer, member FINRA and SIPC, and an affiliate of iCapital, Inc. and Institutional Capital Network, Inc. These registrations and memberships in no way imply that the SEC, FINRA, or SIPC have endorsed any of the entities, products, or services discussed herein. Annuities and insurance services are provided by iCapital Annuities and Insurance Services LLC, an affiliate of iCapital, Inc. “iCapital” and “iCapital Network” are registered trademarks of Institutional Capital Network, Inc. Additional information is available upon request.

© 2024 Institutional Capital Network, Inc. All Rights Reserved. | 2024.01