Buffered notes, a type of structured investment, are designed to offer a unique approach to generating alpha during periods of low to moderate growth.

How Do Buffered Notes Work?

Buffered notes can give investors an opportunity for leveraged exposure to the upside of the underlier, typically an index, ETF, or stock—up to a stated cap. These notes offer protection on the downside that come in the form of a buffer.

A buffer is a form of protection of an investor’s principal. The buffer absorbs a fixed percentage of the underlier’s decline, after which the investor participates in the decline in the underlier.

In exchange, investors are exposed to the credit risk of the issuer and must be willing to hold their investment for a fixed term, to the maturity of the note.

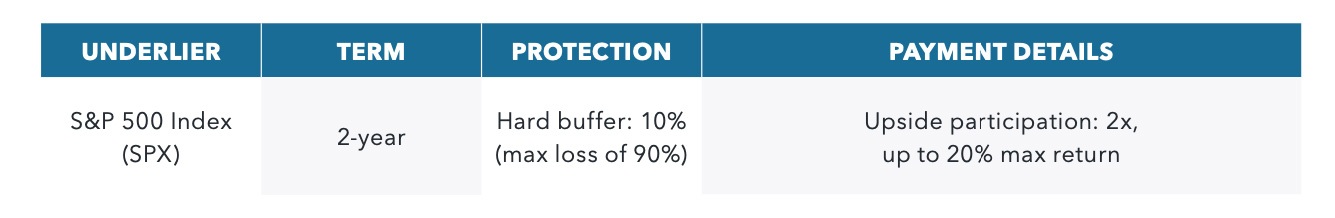

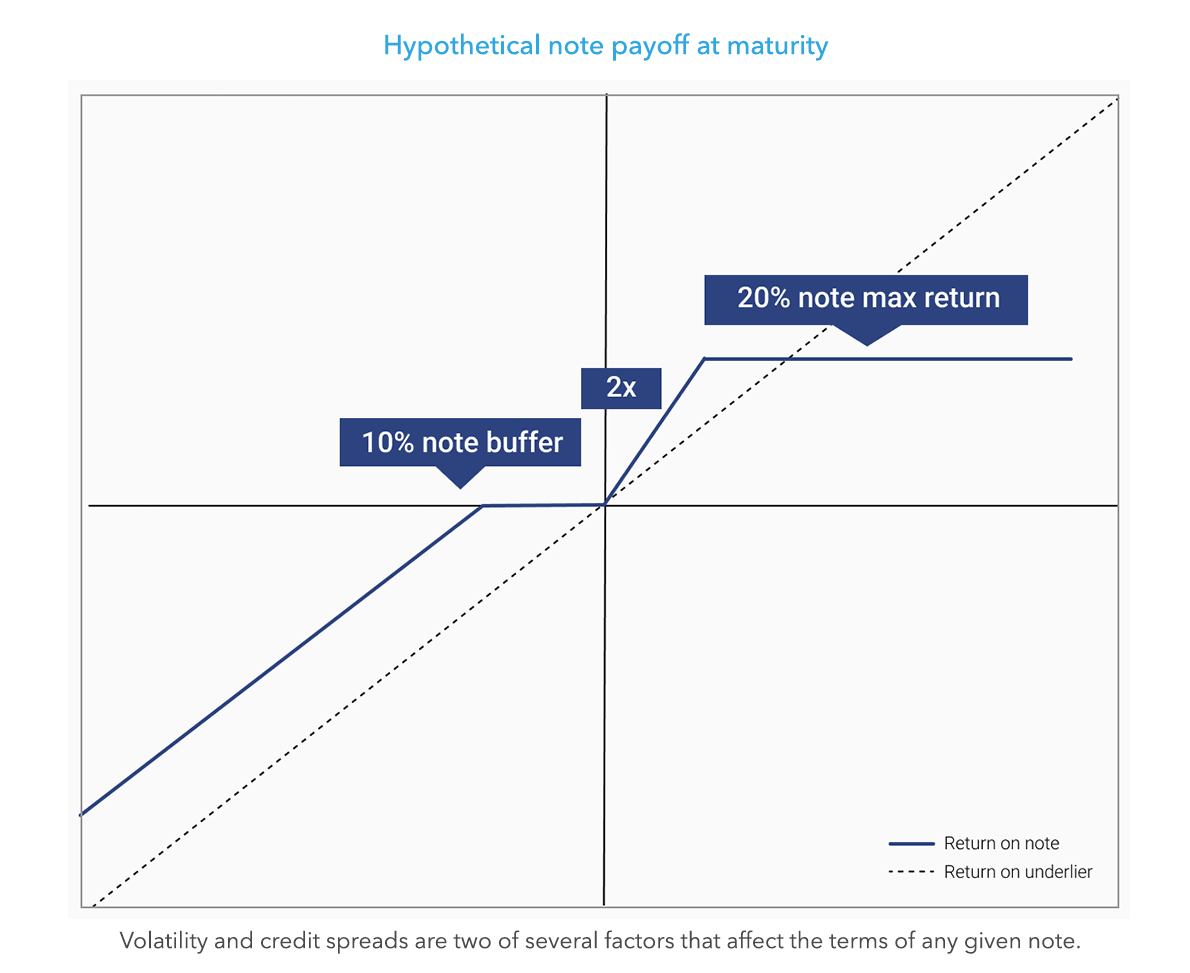

Let’s consider a hypothetical note with the following specifications:

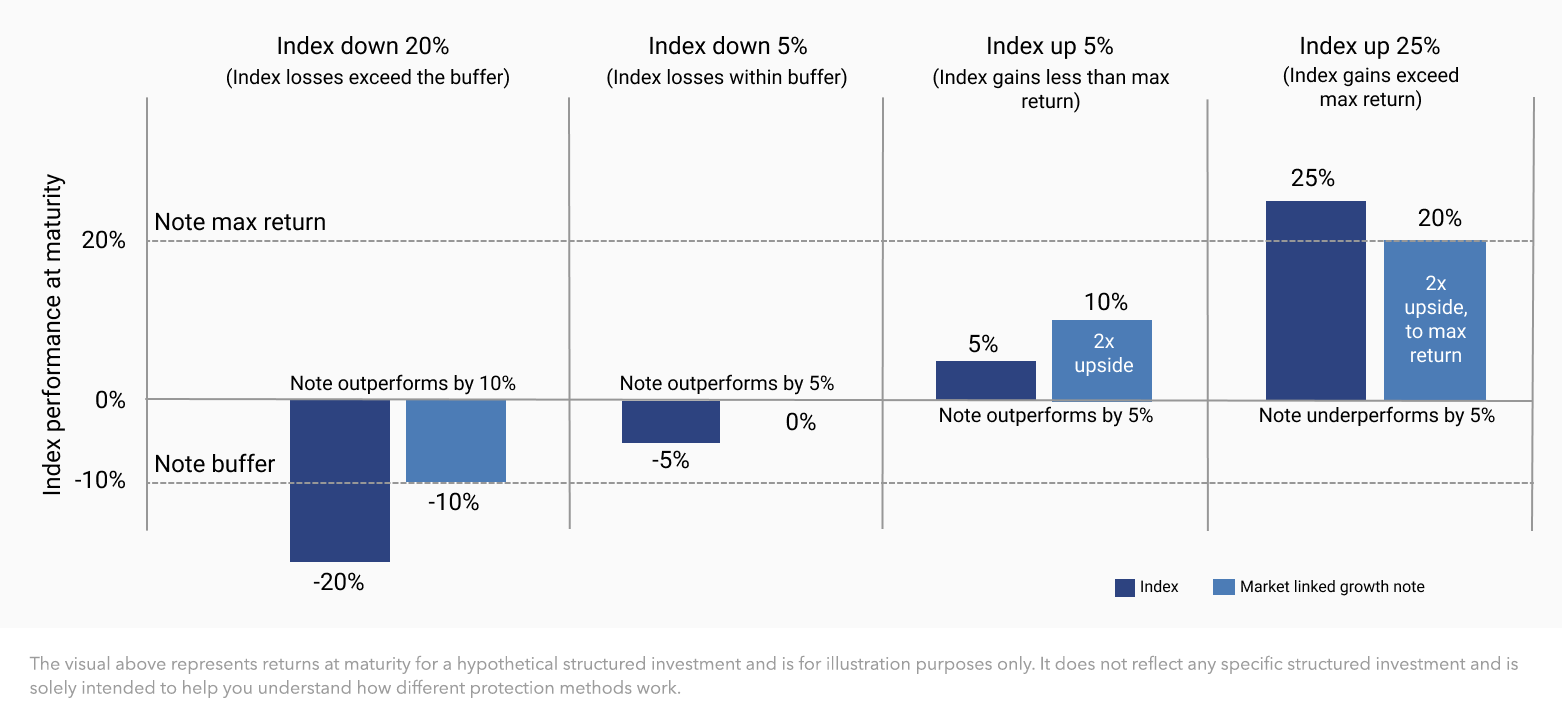

Over a two year term, this hypothetical note provides upside participation of 2x the performance of the underlier, SPX, up to a 20% max return. It also has a 10% hard buffer, which absorbs a fixed percentage of decline in the index and, after that, losses are one-to-one with the underlier.

If SPX is down by 10% or less at maturity, the note holder receives principal back. However, if SPX is down by more than 10% at maturity, the note would be exposed to losses in excess of a 10% decline in SPX, outperforming the index by 10%.

How Do Buffered Notes Perform?

Let’s look at four different market scenarios and outcomes for this hypothetical note.

Benefits

- Enhanced upside: Some buffered notes deliver more than 1x participation in gains of the underlying index, up to a stated cap. The leverage generates outperformance during low to moderate growth environments.

- Downside protection: Buffered notes can offer risk mitigation with a hard buffer.

Considerations

- Credit risk: Structured investment holders are exposed to the credit risk of the issuer and must be comfortable with the issuer’s creditworthiness throughout the life of the trade.

- Time to Maturity: Structured investments are buy-and-hold investments, which means that investors must hold the note until maturity in order to receive any investment returns or principal, and there is no guaranteed secondary market. Issuing firms or dealers may be willing to buy back a structured investment before maturity but may do so at a discount to statement value and are under no legal obligation to provide liquidity.

- Price return: Holders of a structured note do not receive any dividends paid by the underlier, while a direct holder of the underlier itself may be entitled to dividends.

Who Should Consider Buffered Notes?

Investors with equity exposure as part of their asset allocation, who are willing to add credit risk to their portfolio and sacrifice some near-term liquidity, may want to consider allocating a portion of that exposure to buffered notes.

Let’s say an investor has a 60% allocation to equities, and within that allocation are mutual funds, ETFs, and stocks. By taking a third of that equity allocation—or 20% of the entire portfolio—and reallocating it to buffered notes, the overall equity portfolio would now have features that help position it for certain market conditions.

In this reallocated portfolio, the 40% allocated to equities that remains invested in uncapped traditional investments would give the investor full upside and downside exposure. The portfolio would outperform the buffered notes if the markets outperform the cap, while the 20% invested in buffered notes would outperform during down to moderately-up environments.

Informed Investing

Structured investments come in a wide variety with different terms and conditions. There’s one for almost any market outlook or investment goal, giving investors the chance to stay in the market and choose how much protection they need to feel comfortable.

When considering any structured investment, investors should understand the type of protection it offers, if any, as well as its pay-out potential, by carefully reviewing the offering documents before investing.

Securities products and services may be offered through iCapital Markets, LLC a registered broker/dealer, member FINRA and SIPC, and an affiliate of Institutional Capital Network, Inc. (“iCapital”). Please see the disclaimer at the end of this document for more information.

Please contact your financial professional or a fund manager to learn more.

IMPORTANT INFORMATION

The material herein has been provided to you for informational purposes only by Institutional Capital Network, Inc. (“iCapital Network”) or one of its affiliates (iCapital Network together with its affiliates, “iCapital”). This material is the property of iCapital and may not be shared without the written permission of iCapital. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of iCapital.

This material is provided for informational purposes only and is not intended as, and may not be relied on in any manner as, legal, tax or investment advice, a recommendation, or as an offer or solicitation to buy or sell any security, financial product or instrument, or otherwise to participate in any particular trading strategy. This material does not intend to address the financial objectives, situation, or specific needs of any individual investor. You should consult your personal accounting, tax and legal advisors to understand the implications of any investment specific to your personal financial situation.

STRUCTURED INVESTMENTS ARE CONSIDERED COMPLEX PRODUCTS AND MAY NOT BE SUITABLE FOR ALL INVESTORS. Please note that there is no public secondary market for structured investments. Although the issuer may from time to time make a market in certain structured investments, the issuer does not have any obligation to do so and market making may be discontinued at any time. Accordingly, an investor must be prepared to hold such investments until maturity. Any or all payments are subject to the creditworthiness of the issuer. Before investing in any product, an investor should review the prospectus or other offering documents, which contain important information, including the product’s investment objectives or goals, its strategies for achieving those goals, the principal risks of investing in the product, the product’s fees and expenses, and its past performance.

iCapital Markets LLC operates a platform that makes available financial products to financial professionals. In operating this platform, iCapital Markets LLC generally earns revenue based on the volume of transactions that take place in these products and would benefit by an increase in sales for these products.

The information contained herein is an opinion only, as of the date indicated, and should not be relied upon as the only important information available. Any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets is not necessarily indicative of the future or likely performance. The information contained herein is subject to change, incomplete, and may include information and/or data obtained from third party sources that iCapital believes, but does not guarantee, to be accurate. iCapital considers this third-party data reliable, but does not represent that it is accurate, complete and/or up to date, and it should not be relied on as such. iCapital makes no representation as to the accuracy or completeness of this material and accepts no liability for losses arising from the use of the material presented. No representation or warranty is made by iCapital as to the reasonableness or completeness of such forward-looking statements or to any other financial information contained herein.

Securities products and services are offered by iCapital Markets, an SEC-registered broker-dealer, member FINRA and SIPC, and an affiliate of iCapital, Inc. and Institutional Capital Network, Inc. These registrations and memberships in no way imply that the SEC, FINRA, or SIPC have endorsed any of the entities, products, or services discussed herein. Annuities and insurance services are provided by iCapital Annuities and Insurance Services LLC, an affiliate of iCapital, Inc. “iCapital” and “iCapital Network” are registered trademarks of Institutional Capital Network, Inc. Additional information is available upon request.

© 2024 Institutional Capital Network, Inc. All Rights Reserved. | 2024.01