HIGHLIGHTS

• In 2023, structured investment (SI) sales volumes on the iCapital platform totaled a record $59 billion, a 17% increase year-over-year (YoY).1

• Structured investments offering full principal protection increased 15% in volume YoY in 2023, following a more than 470% surge in sales from 2021 to 2022.2

• Growth-oriented solutions outpaced their income-oriented counterparts, accounting for nearly 60% of total structured investments volume.3

• Fee-based offerings continued to gain market share relative to their brokerage counterparts, increasing to 45% in 2023 versus 41% in 2022.4

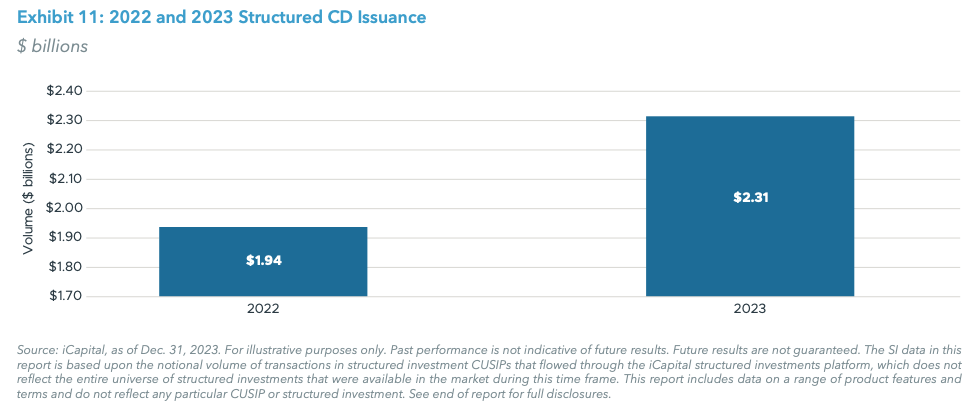

• Structured CD volume increased 18% in 2023 from 2022 levels, indicating continued investor appetite for principal protected solutions with FDIC insurance.5

• 2023 saw increased volumes in structured investments linked to a broad range of quantitative investment strategies (QIS), in both principal protected and principal at risk structures.

STRUCTURED INVESTMENTS ON iCAPITAL PLATFORM

In 2023, our platform saw a diverse variety of structured investment issuances, showcasing the many solutions available in the market. Over 50 wealth management firms contributed to our effort to measure investor activity over 2023.

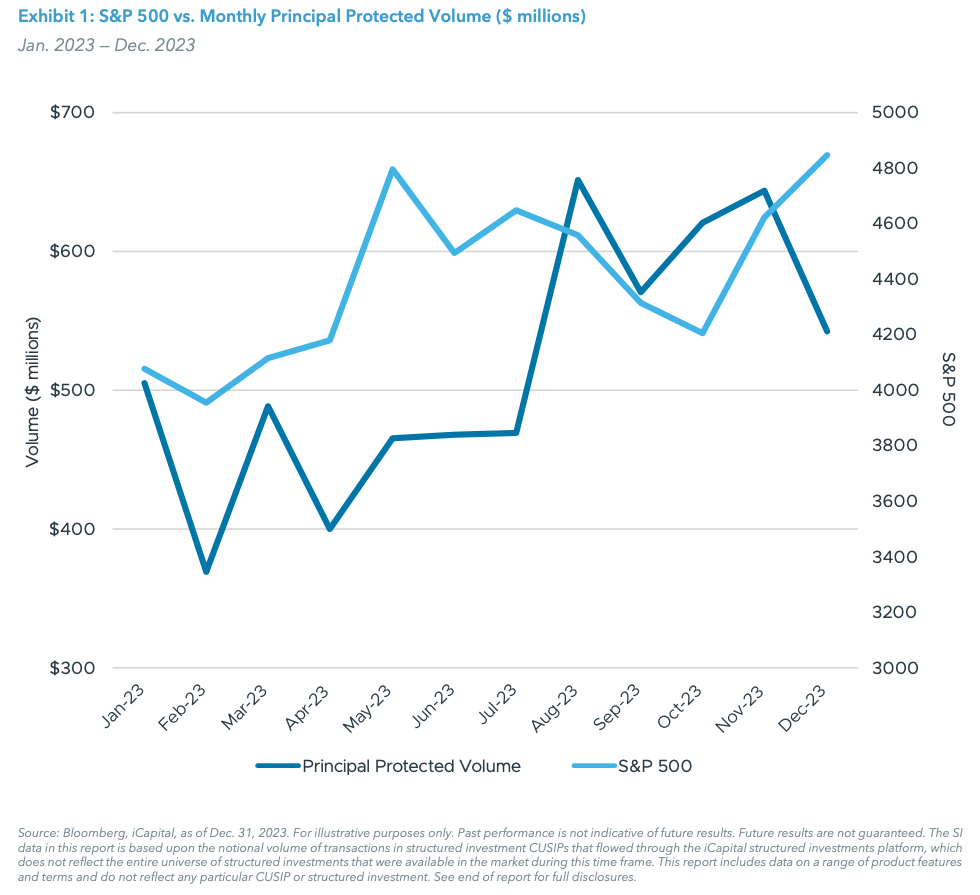

S&P 500 AND PRINCIPAL PROTECTED SALES

Despite the S&P 500 posting a 24% gain in 20236, sales in structured investments offering full principal protection finished the year stronger than they began. From 2022 to 2023, principal protected sales increased more than 15%, underscoring sustained investor interest in protection following a more than 470% surge in principal protected sales from 2021 to 2022.7 This elevated level of interest in principal protected structured notes and CDs is largely due to the continued favorable conditions in the interest rate environment over the past two years, allowing issuers to offer attractive upside potential while maintaining full principal protection.

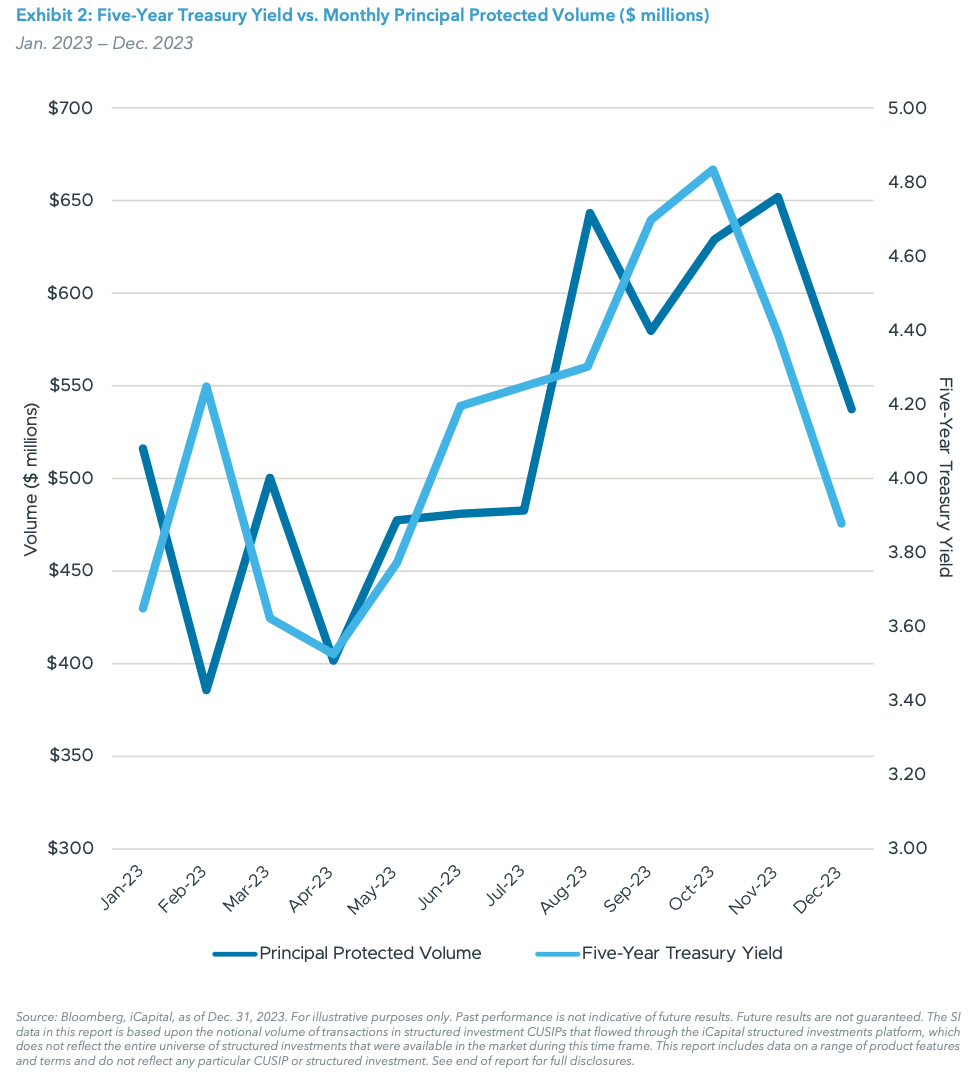

FIVE-YEAR TREASURY YIELD AND PRINCIPAL PROTECTED SALES

Throughout 2023, we witnessed a high degree of correlation between the movement in prevailing interest rates and the sales in principal protected products, again underscoring the direct impact broader market factors have on issuance of certain products in the marketplace for structured investments.

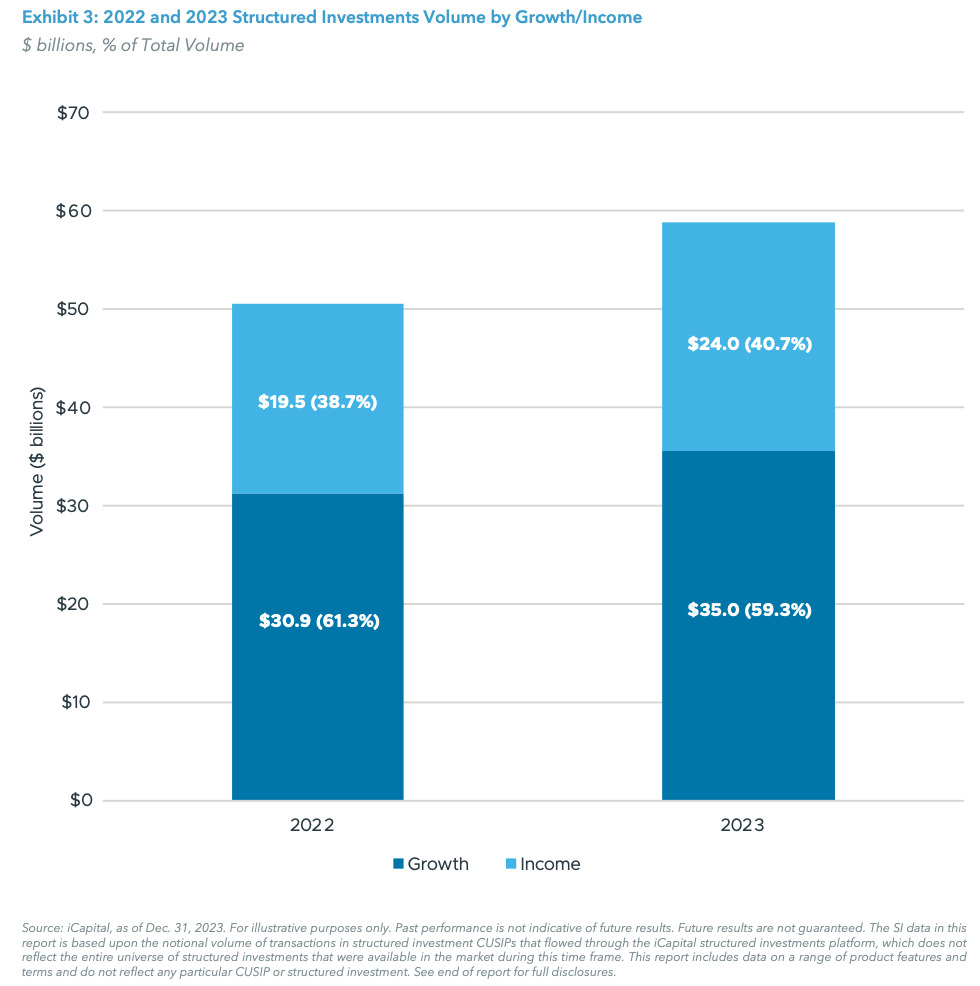

GROWTH VS. INCOME BREAKDOWN

Growth-oriented solutions accounted for nearly 60% of the $59 billion total structured investment volumes on the iCapital platform in 2023, increasing over 17% from the prior year. Income-oriented solutions increased by 23% YoY, slightly increasing their market share. This is the second consecutive year growth-oriented product sales significantly outpaced those in income-oriented products. Much of the decreased demand in income-oriented products could be attributed to competing opportunities in other more traditional fixed income markets, such as Treasuries and brokered CDs. Should yields significantly decrease in 2024, we may see renewed interest in income-oriented offerings as investors return to the yield enhancement features of the product type.

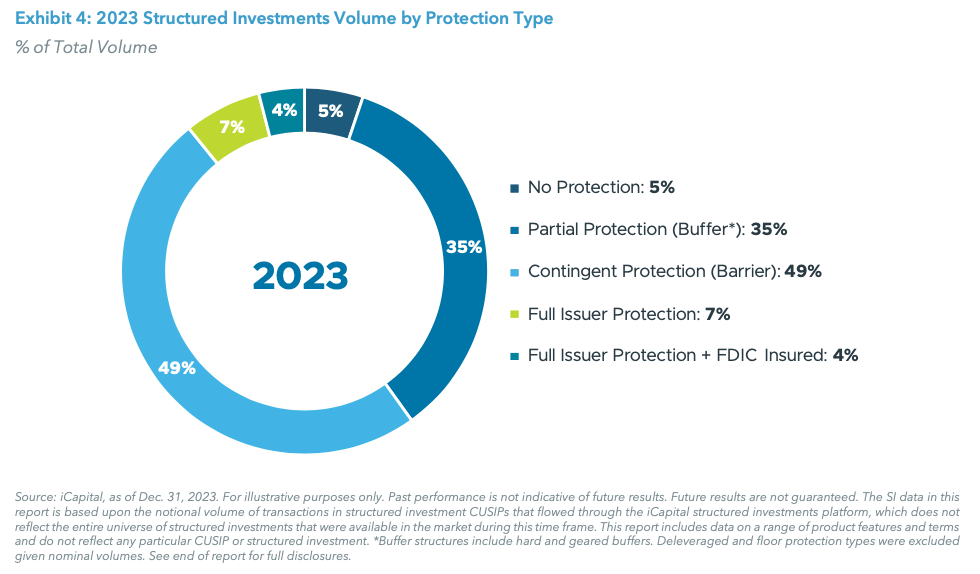

PROTECTION TYPE BREAKDOWN

A vast majority (95%) of structured investment volumes on the iCapital platform in 2023 had some form of principal protection, with contingent or partial protection accounting for 84% of all protection types. Among these structures, 90% with partial protection (buffer) were growth-oriented, while 73% with contingent protection (barrier) were income-oriented.

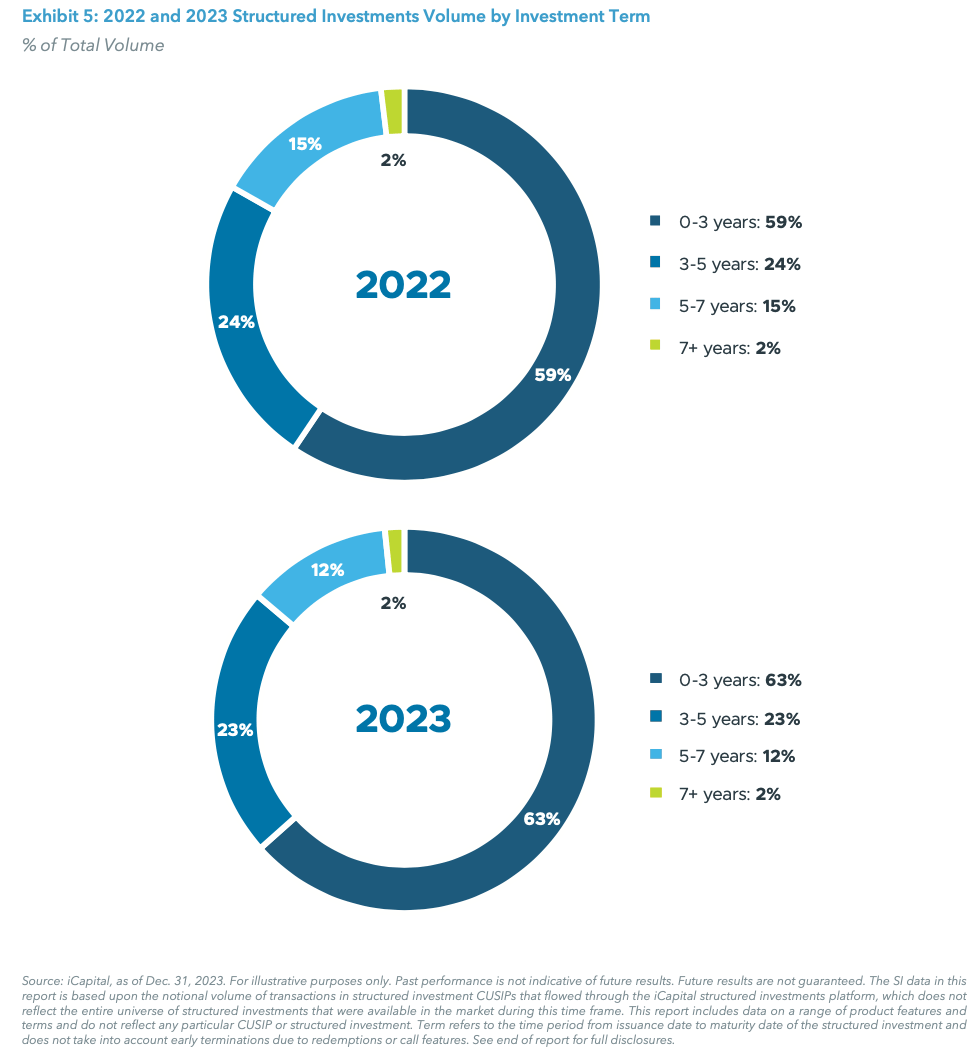

INVESTMENT TERM BREAKDOWN

Volumes across investment terms in 2023 remained relatively unchanged from the previous year, with a slight YoY increase in volume on structured investments with 0-3-year terms (from 59% in 2022 to 63% in 2023), and modest decreases in volume on structured investments with 3-5 and 5-7-year terms (from 24% and 15% in 2022 to 23% and 12% in 2023, respectively).

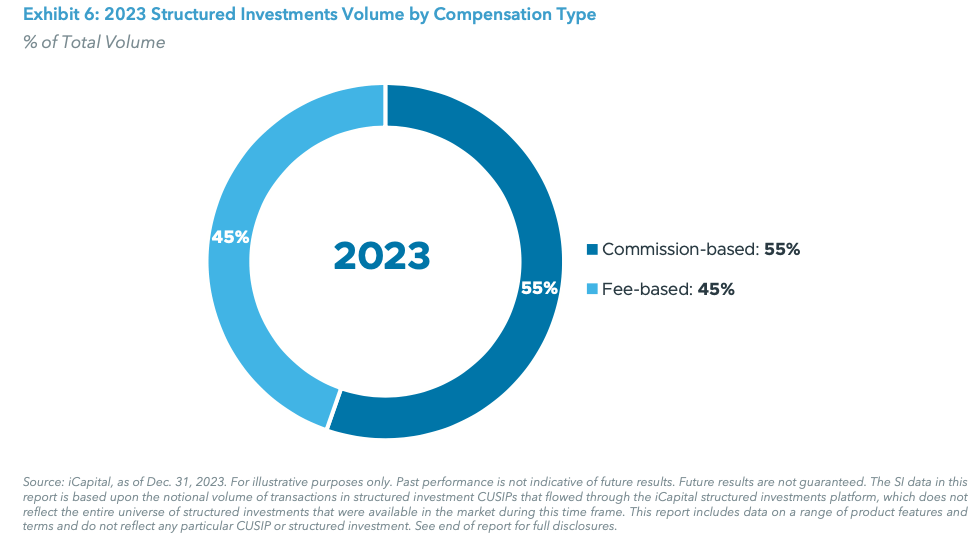

COMPENSATION TYPE BREAKDOWN

Volumes of fee-based solutions versus commission-based solutions continued to trend towards parity. As seen last year, fee-based volumes continue to capture market share, climbing to 45%, up from 41% in 2022, while commission-based volumes declined from 59% to 55%.8

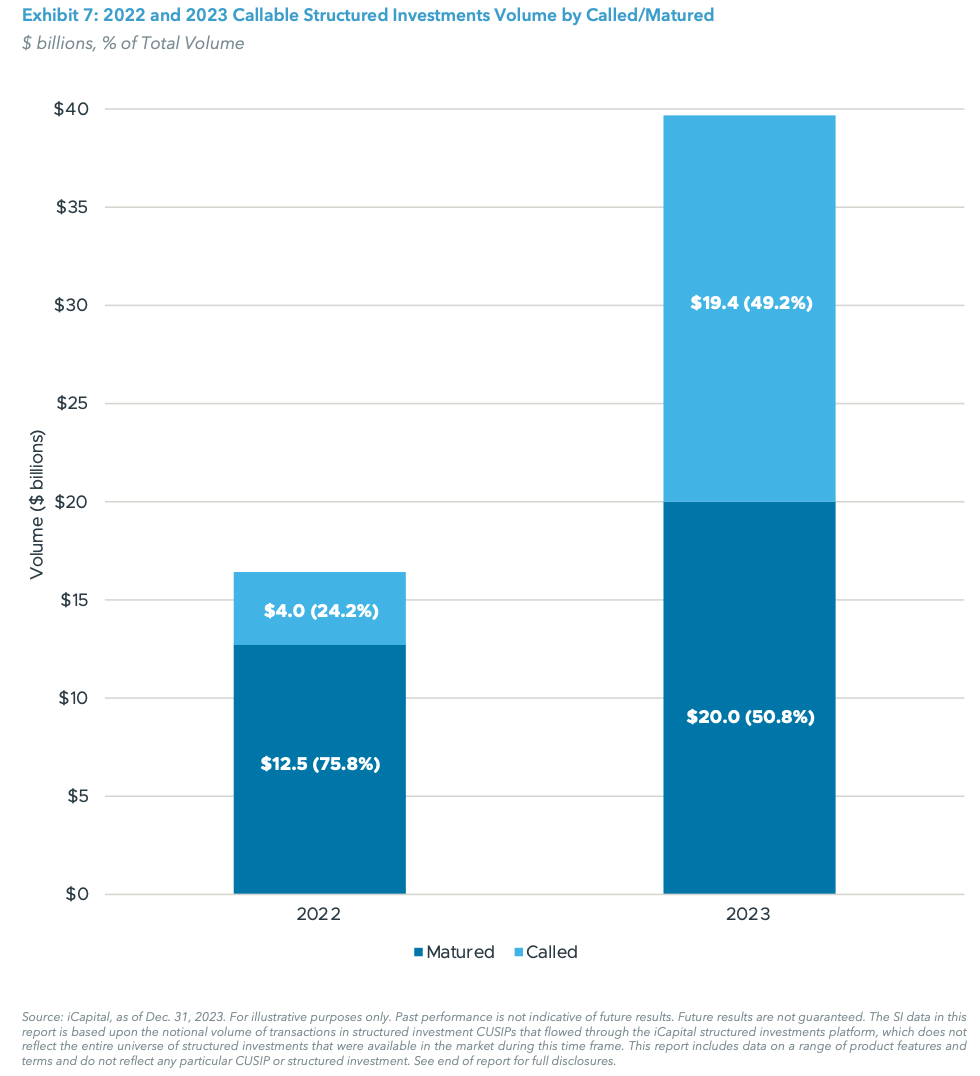

CALLED VS. MATURED BREAKDOWN

The total notional of structured investments on the iCapital platform that were called or matured in 2023, increased by 139% from 2022. The majority of this increase was fueled by products being called, which surged 385%, from $4 billion in 2022 to $19.4 billion in 2023, driven by the rebounding equities market.

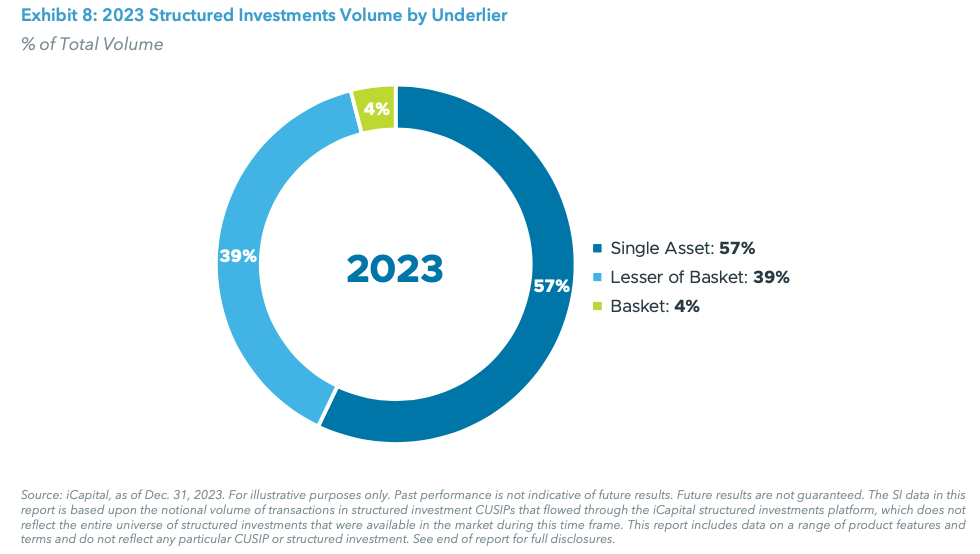

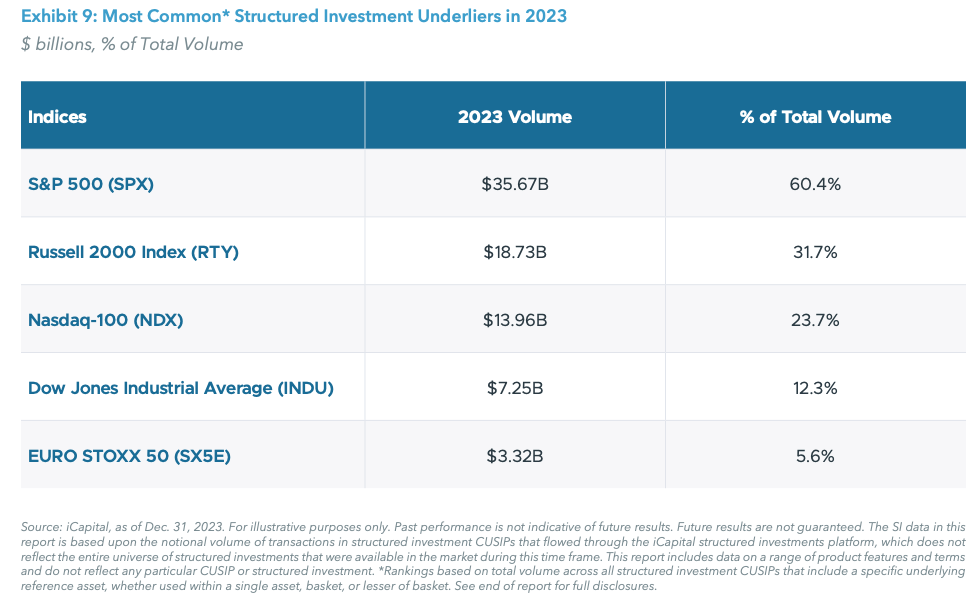

UNDERLIER BREAKDOWN

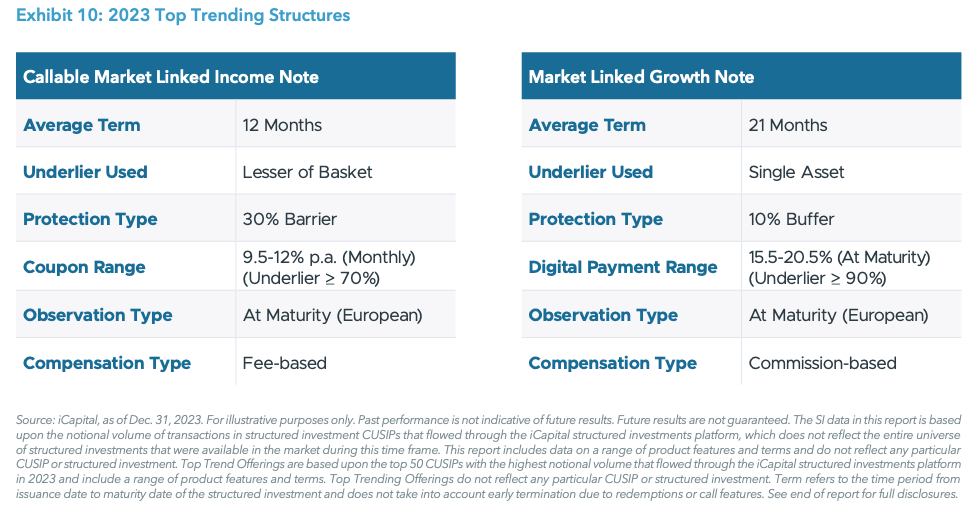

TOP TRENDING

STRUCTURED CERTIFICATE OF DEPOSITS (CDs)

Investor appetite for principal protected solutions with FDIC insurance continues to be strong, with sales on the iCapital platform exceeding $2.3 billion for 2023, up over 18% YoY. Most of the sales in equity-linked CDs during the year were in growth-oriented structures tied to either broad-based market indices (e.g., S&P 500) (comprising approximately 66% of structured CD volume) or an index based on one of the many different quantitative investment strategies (QIS) found in the market today (comprising 34% of structured CD volume).9 QIS indices are rules based, systematic indices that provide exposure to different themes or algorithmic strategies to express a view on the market.

LOOKING FORWARD

As investors seek new ways to diversify portfolios and mitigate risk, the appetite for alternative investments, including structured investments, only continues to grow. There is an opportunity to leverage the unique attributes of structured investments to navigate market volatility and economic uncertainty. Structured investments not only provide investors with the ability to mitigate risk, but also provide the opportunity to participate in market moves.

All eyes will be on the Fed as the market awaits the first rate cut in 2024. Anticipating a potential swing back into an interest rate cutting cycle, the market can expect renewed interest in income-oriented products, as well as increased demand for various QIS index strategies within principal protected and principal at-risk structures. In addition, a continued equity market rally could trigger a new wave of call observations, specifically for structured investments with “lesser of” underliers tied to the Russell 2000.

However, regardless of the timing of rate cuts, there should continue to be a strong demand for structured investments and an increase in adoption as a core product within client portfolios. As such, one can expect fee-based structured investments to continue to gain market share versus their commission-based counterparts. Furthermore, as the market continues to see growth in the adoption of the asset class, new issuers will likely engage in structured note origination, as well as existing issuers expanding their product shelf to include CDs.

ENDNOTES

1. iCapital, as of Dec. 31, 2023. The SI data in this report is based upon the notional volume of transactions in structured investment CUSIPs that flowed through the iCapital structured investments platform, which does not reflect the entire universe of structured investments that were available in the market during this time frame.

2. iCapital, as of Dec. 31, 2023. The SI data in this report is based upon the notional volume of transactions in structured investment CUSIPs that flowed through the iCapital structured investments platform, which does not reflect the entire universe of structured investments that were available in the market during this time frame.

3. iCapital, as of Dec. 31, 2023. The SI data in this report is based upon the notional volume of transactions in structured investment CUSIPs that flowed through the iCapital structured investments platform, which does not reflect the entire universe of structured investments that were available in the market during this time frame.

4. iCapital, as of Dec. 31, 2023. The SI data in this report is based upon the notional volume of transactions in structured investment CUSIPs that flowed through the iCapital structured investments platform, which does not reflect the entire universe of structured investments that were available in the market during this time frame.

5. iCapital, as of Dec. 31, 2023. The SI data in this report is based upon the notional volume of transactions in structured investment CUSIPs that flowed through the iCapital structured investments platform, which does not reflect the entire universe of structured investments that were available in the market during this time frame.

6. Bloomberg, as of Dec. 31, 2023.

7. iCapital, as of Dec. 31, 2023. The SI data in this report is based upon the notional volume of transactions in structured investment CUSIPs that flowed through the iCapital structured investments platform, which does not reflect the entire universe of structured investments that were available in the market during this time frame.

8. iCapital, as of Dec. 31, 2023. The SI data in this report is based upon the notional volume of transactions in structured investment CUSIPs that flowed through the iCapital structured investments platform, which does not reflect the entire universe of structured investments that were available in the market during this time frame.

9. iCapital, as of Dec. 31, 2023. The SI data in this report is based upon the notional volume of transactions in structured investment CUSIPs that flowed through the iCapital structured investments platform, which does not reflect the entire universe of structured investments that were available in the market during this time frame.

IMPORTANT INFORMATION

The material herein has been provided to you for informational purposes only by Institutional Capital Network, Inc. (“iCapital Network”) or one of its affiliates (iCapital Network together with its affiliates, “iCapital”). This material is the property of iCapital and may not be shared without the written permission of iCapital. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of iCapital.

This material is provided for informational purposes only and is not intended as, and may not be relied on in any manner as, legal, tax or investment advice, a recommendation, or as an offer or solicitation to buy or sell any security, financial product or instrument, or otherwise to participate in any particular trading strategy. This material does not intend to address the financial objectives, situation, or specific needs of any individual investor. You should consult your personal accounting, tax and legal advisors to understand the implications of any investment specific to your personal financial situation.

The structured investments data in this report is based upon the notional volume of transactions in structured investment CUSIPs that flowed through the iCapital structured investments platform, which does not reflect the entire universe of structured investments that were available in the market during this time frame. Actual structured investments may differ materially from the general overview provided. Past performance of any products should not be taken as an indication or guarantee of future performance, and no representation or warranty, expressed or implied is made regarding future performance.

STRUCTURED INVESTMENTS ARE CONSIDERED COMPLEX PRODUCTS AND MAY NOT BE SUITABLE FOR ALL INVESTORS. Please note that there is no public secondary market for structured investments. Although the issuer may from time to time make a market in certain structured investments, the issuer does not have any obligation to do so and market making may be discontinued at any time. Accordingly, an investor must be prepared to hold such investments until maturity. Any or all payments are subject to the creditworthiness of the issuer. Before investing in any product, an investor should review the prospectus or other offering documents, which contain important information, including the product’s investment objectives or goals, its strategies for achieving those goals, the principal risks of investing in the product, the product’s fees and expenses, and its past performance.

iCapital Markets LLC operates a platform that makes available financial products to financial professionals. In operating this platform, iCapital Markets LLC generally earns revenue based on the volume of transactions that take place in these products and would benefit by an increase in sales for these products.

The information contained herein is an opinion only, as of the date indicated, and should not be relied upon as the only important information available. Any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets is not necessarily indicative of the future or likely performance. The information contained herein is subject to change, incomplete, and may include information and/or data obtained from third party sources that iCapital believes, but does not guarantee, to be accurate. iCapital considers this third-party data reliable, but does not represent that it is accurate, complete and/or up to date, and it should not be relied on as such. iCapital makes no representation as to the accuracy or completeness of this material and accepts no liability for losses arising from the use of the material presented. No representation or warranty is made by iCapital as to the reasonableness or completeness of such forward-looking statements or to any other financial information contained herein.

Securities products and services are offered by iCapital Markets, an SEC-registered broker-dealer, member FINRA and SIPC, and an affiliate of iCapital, Inc. and Institutional Capital Network, Inc. These registrations and memberships in no way imply that the SEC, FINRA, or SIPC have endorsed any of the entities, products, or services discussed herein. Annuities and insurance services are provided by iCapital Annuities and Insurance Services LLC, an affiliate of iCapital, Inc. “iCapital” and “iCapital Network” are registered trademarks of Institutional Capital Network, Inc. Additional information is available upon request.

© 2024 Institutional Capital Network, Inc. All Rights Reserved.