For most of the first quarter, investors were concerned about the low level of volatility, as measured by the VIX Index. However, equities corrected given sticky inflation, repricing of Fed policy expectations, and a sharp move higher in yields, shifting the focus from a soft-landing to a no-landing view – similar to what we saw in Q3 2023. Now, with equity markets roughly 5% off their highs, the question becomes – is this the start of a worse correction or should this dip be bought?

We believe investors with too much cash (relative to strategic allocations) should gradually buy this dip. We are encouraged by the technical setup that is now much cleaner for investors versus in the start of April. The upside move in yields is likely exhausted in the near term as: 1) yields more accurately reflect the growth and policy environment; 2) there is potential for this week’s core Personal Consumption Expenditures (PCE) to ease inflation concerns; and 3) the earnings season is beating estimates. We go into further detail on these developments below.

Market technicals are cleaner now vs. the start of the month, although some concerns remain

Given the strong market performance to start the year, equity markets were clearly in overbought territory, as the 14-day relative strength index (RSI) was above 70 in January and February. However, the RSI is now approaching oversold levels, or a reading less than 30, which is its lowest reading since the market low in October 2023. In addition, we also see an increasing share of stocks have reached oversold levels. Indeed, 12% of the S&P 500 now have an RSI that is less than 30, again the highest reading since the market low last fall.1

The percentage of S&P 500 Index members making new one-month lows would also suggest that markets are now oversold. After the stronger than expected retails sales reading, we saw new one-month lows spike to 56%, which was the highest reading since the regional bank crisis last spring.2 This is a critical level as historically, we get readings of 50-60% when equity markets start to trough.3

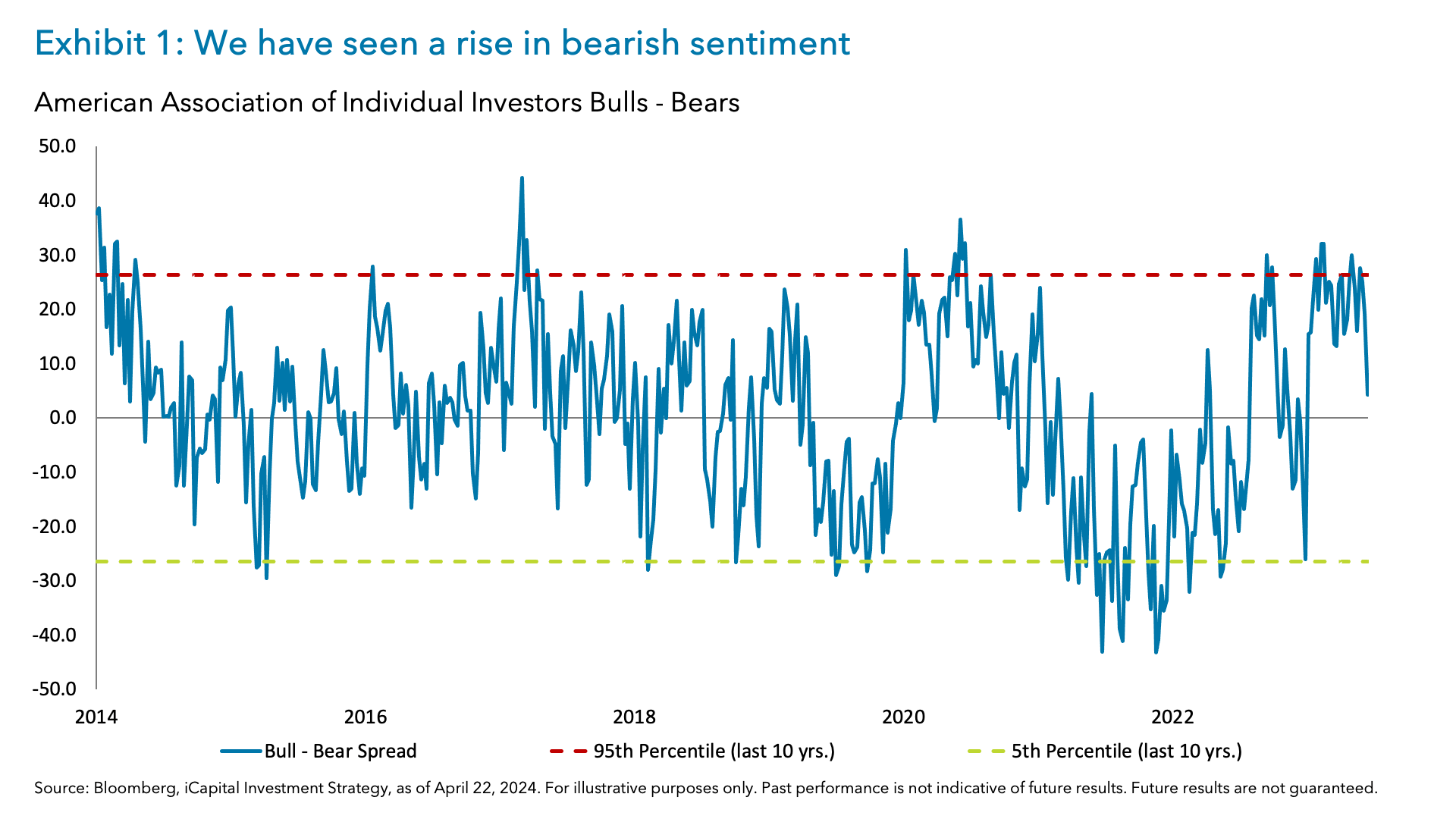

In addition to the cleaning up of market technicals, sentiment has also corrected. Indeed, when we look at the American Association of Individual Investors (AAII), bearish sentiment has ticked-up to the highest levels since November of last year.4 The spread between bullish and bearish sentiment has declined from 95th percentile over the last 10 years, and now stands at 4.30.5 If we see this spread fall below 0, which would indicate that there are more bears than bulls, it would be a sign that sentiment is getting overly pessimistic.

However, positioning for Commodity Trading Advisors (CTAs) and hedge funds still appears long with potentially more derisking to go, which could deepen the pullback. CTAs are near max long and therefore we could see continued deleveraging if the S&P 500 breaks below 4,900. This is why we would be buying this pullback gradually – while we await buybacks to come back and households to step in, counteracting any systematic selling pressure.

Upside move in yields more likely reflects the adjusted growth and policy environment

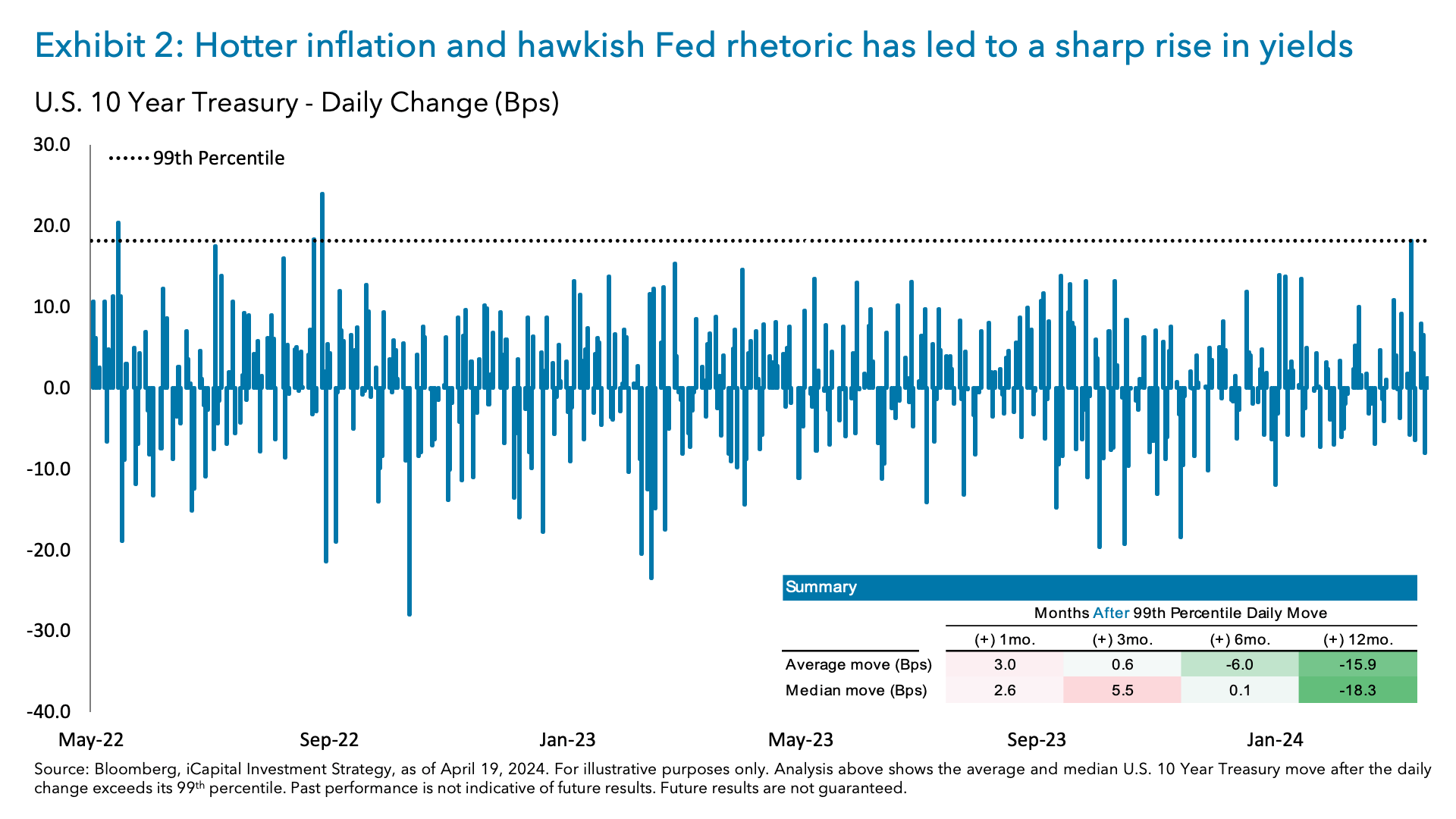

After the sharp move seen in yields, a consolidation or a peak in yields would be a positive for equities, similar to what we saw in the fall of 2023. After the March Consumer Price Index (CPI) print, we witnessed the U.S. 10 Year Treasury increase by 18bps, which is in the 99th percentile of all daily moves going back to 1990.6 Historically, after we see a move of this magnitude, rates tend to consolidate or even start to drift lower. Indeed, in the six months after this large of a move, the U.S. 10 Year Treasury yield typically declines by an average of 6bps. While not a large move by historical standards, this suggests that the sharp move higher in Treasuries may be behind us.

We also believe that yields could start to consolidate as the U.S. 10 Year Treasury is currently trading above fair value assumptions including rate cut, inflation, and growth expectations.

While markets were discounting almost seven rate cuts at the start of the year, now they are only expecting one and a half cuts for 2024 – more aligned with Fed forecasts. Indeed, if one Fed official were to raise their 2024 policy rate forecast, this would bring the median forecast to two rate cuts for this year. Even looking at growth forecasts for 2024, we have seen estimates get revised higher throughout the year. Starting the year, economists were forecasting GDP growth of 1.3% for 2024.7 Over the course of the year, these forecasts have risen by 1.1 percentage points (ppt) and now GDP is expected to grow by 2.4% in 2024.8

It appears that treasury yields are now two standard deviations higher than where these variables would suggest and this divergence from fair value is the greatest since October 2023, which was when yields peaked.9

This week’s core PCE could alleviate some inflation concerns

We think this week’s core PCE reading will be important in determining the Fed’s rate path for the remainder of the year, and if yields can ultimately stabilize around current levels. While there is much focus on CPI (it is released earlier in the month and has a 70% overlap with PCE), there is a wide divergence in the remaining 30% of the baskets that differ. These divergences have caused a wedge to open up between PCE and CPI, which could lead investors to place a greater importance on PCE readings going forward.

The wedge is particularly notable within the healthcare and auto insurance categories. While these two components were very strong in the CPI release, they were softer in Producer Price Index (PPI), which came out later in the week. Given PCE derives its health care and auto insurance measures from PPI, there is a chance that PCE data could alleviate some of the inflation fears that were stoked by the strong CPI reading.

Another reason why we believe markets will focus on PCE is because of the difference in the weighting of shelter/housing between the two inflation baskets. Indeed, shelter makes up almost 33% of the CPI basket, while only making up 16% of the PCE basket.10 While rents have remained sticky, rents appear to be trending in the right direction based off other rental measures and real-time data Last week, the U.S. Bureau of Labor Statistics (BLS) New Tenant Rent Index rose by 0.42% over the last four quarters, the slowest rate of growth since 2010.11 This highlights that rental inflation should come down in the second half of the year, as the BLS uses the same survey data in the new tenants rent index for the OER/Shelter categories of CPI.12

Currently, core PCE is expected to come in at 0.3% MoM, which is slightly softer than the 0.4% MoM increase we saw for CPI. As a result, the yearly rate for core PCE is expected to fall to 2.7% – a full percentage point lower than CPI.13

Given the more favorable trend of core services ex-shelter for PCE, we think the consensus estimates for core PCE to reach 2.5% YoY by year-end are achievable. While Fed Chair Powell in a recent speech acknowledged that “recent data showed a lack of further progress on inflation,” we believe core PCE getting to 2.5% could give the Fed enough confidence to cut rates later this year.

What if the Fed doesn’t cut rates at all this year? Earnings should still support equity markets.

Earnings should at least partially offset the compression in valuation due to higher rates. Despite the negative equity market reaction to the start of the reporting season, earnings have gotten off to a strong start. While only 14% of companies have reported earnings as of April 19th, roughly 74% of S&P 500 companies have reported earnings that came in better than expectations, which is in-line with its 10-year average.14 While earnings have only grown by 0.5% on a YoY basis, earnings have positively surprised by 7.8% so far this quarter – slightly higher than its 6.7% 10-year average.15

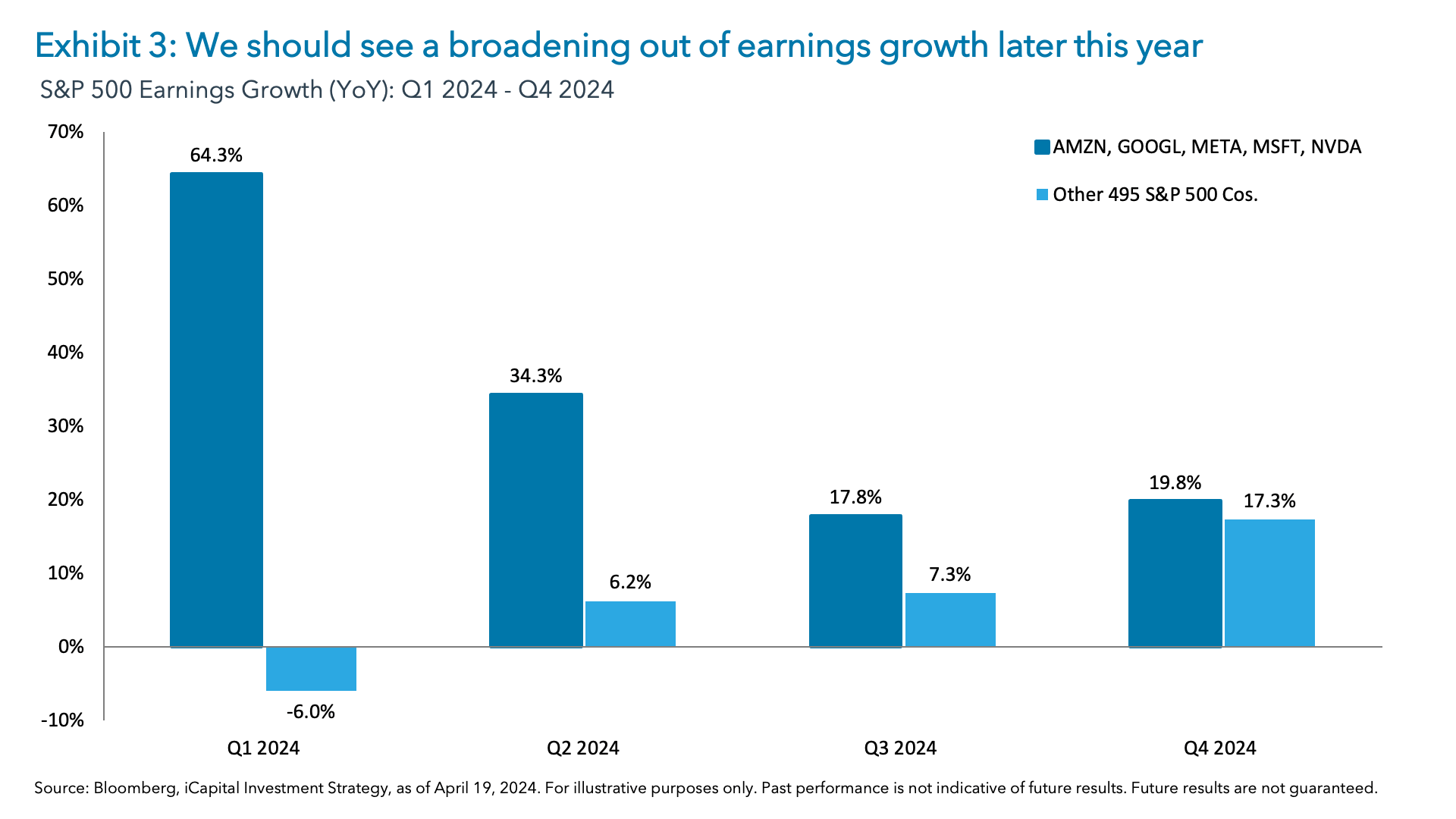

We believe the earnings picture should brighten later this year, as earnings growth is expected to broaden out. Indeed, earnings growth estimates for the 495 names in the S&P 500 are expected to catch-up to YoY earnings growth for the “Magnificent 5” later this year.16 We think broader earnings growth should be a positive for markets. Indeed, in our 2024 Outlook we discussed the market scenario without the rate cuts. We reiterated that even without rate cuts, we expect equity returns to be positive, but less so than before. A 19-20x multiple and $276 of 2025 EPS estimates still justifies the SPX at 5,200-5,500. This means that after the recent correction, the upside to 5,400-5,500 for the SPX by year-end has now improved to 8%.

We believe investors with too much cash can take advantage of this dip

Given the overall constructive fundamental view, appropriate repricing in rates, and a better technical backdrop than appeared at the start of the month, once we get through the peak of the corporate buyback blackout window, stocks should be supported – even if the Fed doesn’t cut rates.

But if the Fed stays on hold, aren’t money market rates still attractive? We note that as attractive as a 5.5% money market yield might seem on the surface, it is worth much less than that after accounting for taxes. Meanwhile, given the recent pullback, the upside potential for stocks has improved. Thus, we believe investors that are under allocated and under positioned relative to their strategic asset allocations should take advantage of this dip and add to their equity exposures.

1. Bloomberg, iCapital Investment Strategy, as of April 17, 2024.

2. Bloomberg, iCapital Investment Strategy, as of April 18, 2024.

3. Bloomberg, iCapital Investment Strategy, as of April 18, 2024.

4. Bloomberg, iCapital Investment Strategy, as of April 18, 2024.

5. Bloomberg, iCapital Investment Strategy, as of April 18, 2024.

6. Bloomberg, iCapital Investment Strategy, as of April 17, 2024.

7. Bloomberg, iCapital Investment Strategy as of April 22, 2024.

8. Bloomberg, iCapital Investment Strategy, as of April 22, 2024.

9. Bloomberg, J.P. Morgan, iCapital Investment Strategy, as of April 17, 2024.

10. Bureau of Economic Analysis, Bureau of Labor, as of April 22, 2024.

11. Bloomberg, iCapital Investment Strategy, as of April 22, 2024.

12. Bloomberg, iCapital Investment Strategy, as April 22, 2024.

13. Bloomberg, iCapital Investment Strategy, as of April 17, 2024.

14. FactSet, iCapital Investment Strategy, as of April 19, 2024.

15. FactSet, iCapital Investment Strategy, as of April 19, 2024.

16. FactSet, iCapital Investment Strategy, as of April 19, 2024.

INDEX DEFINITIONS

S&P 500: The S&P 500 is widely regarded as the best single gauge of large-cap U.S. equities. The index includes 500 of the top companies in leading industries of the U.S. economy and covers approximately 80% of available market capitalization.

VIX Index: is a calculation designed to produce a measure of constant, 30-day expected volatility of the U.S. stock market, derived from real-time, mid-quote prices of S&P 500 Index call and put options. On a global basis, it is one of the most recognized measures of volatility -- widely reported by financial media and closely followed by a variety of market participants as a daily market indicator.

IMPORTANT INFORMATION

The material herein has been provided to you for informational purposes only by Institutional Capital Network, Inc. (“iCapital Network”) or one of its affiliates (iCapital Network together with its affiliates, “iCapital”). This material is the property of iCapital and may not be shared without the written permission of iCapital. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of iCapital.

This material is provided for informational purposes only and is not intended as, and may not be relied on in any manner as, legal, tax or investment advice, a recommendation, or as an offer or solicitation to buy or sell any security, financial product or instrument, or otherwise to participate in any particular trading strategy. This material does not intend to address the financial objectives, situation, or specific needs of any individual investor. You should consult your personal accounting, tax and legal advisors to understand the implications of any investment specific to your personal financial situation. ALTERNATIVE INVESTMENTS ARE CONSIDERED COMPLEX PRODUCTS AND MAY NOT BE SUITABLE FOR ALL INVESTORS. Prospective investors should be aware that an investment in an alternative investment is speculative and involves a high degree of risk. Alternative Investments often engage in leveraging and other speculative investment practices that may increase the risk of investment loss; can be highly illiquid; may not be required to provide periodic pricing or valuation information to investors; may involve complex tax structures and delays in distributing important tax information; are not subject to the same regulatory requirements as mutual funds; and often charge high fees. There is no guarantee that an alternative investment will implement its investment strategy and/or achieve its objectives, generate profits, or avoid loss. An investment should only be considered by sophisticated investors who can afford to lose all or a substantial amount of their investment. iCapital Markets LLC operates a platform that makes available financial products to financial professionals. In operating this platform, iCapital Markets LLC generally earns revenue based on the volume of transactions that take place in these products and would benefit by an increase in sales for these products.

The information contained herein is an opinion only, as of the date indicated, and should not be relied upon as the only important information available. Any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets is not necessarily indicative of the future or likely performance. The information contained herein is subject to change, incomplete, and may include information and/or data obtained from third party sources that iCapital believes, but does not guarantee, to be accurate. iCapital considers this third-party data reliable, but does not represent that it is accurate, complete and/or up to date, and it should not be relied on as such. iCapital makes no representation as to the accuracy or completeness of this material and accepts no liability for losses arising from the use of the material presented. No representation or warranty is made by iCapital as to the reasonableness or completeness of such forward-looking statements or to any other financial information contained herein. Securities products and services are offered by iCapital Markets, an SEC-registered broker-dealer, member FINRA and SIPC, and an affiliate of iCapital, Inc. and Institutional Capital Network, Inc. These registrations and memberships in no way imply that the SEC, FINRA, or SIPC have endorsed any of the entities, products, or services discussed herein. Annuities and insurance services are provided by iCapital Annuities and Insurance Services LLC, an affiliate of iCapital, Inc. “iCapital” and “iCapital Network” are registered trademarks of Institutional Capital Network, Inc. Additional information is available upon request.k©2024 Institutional Capital Network, Inc. All Rights Reserved. | 2024.01