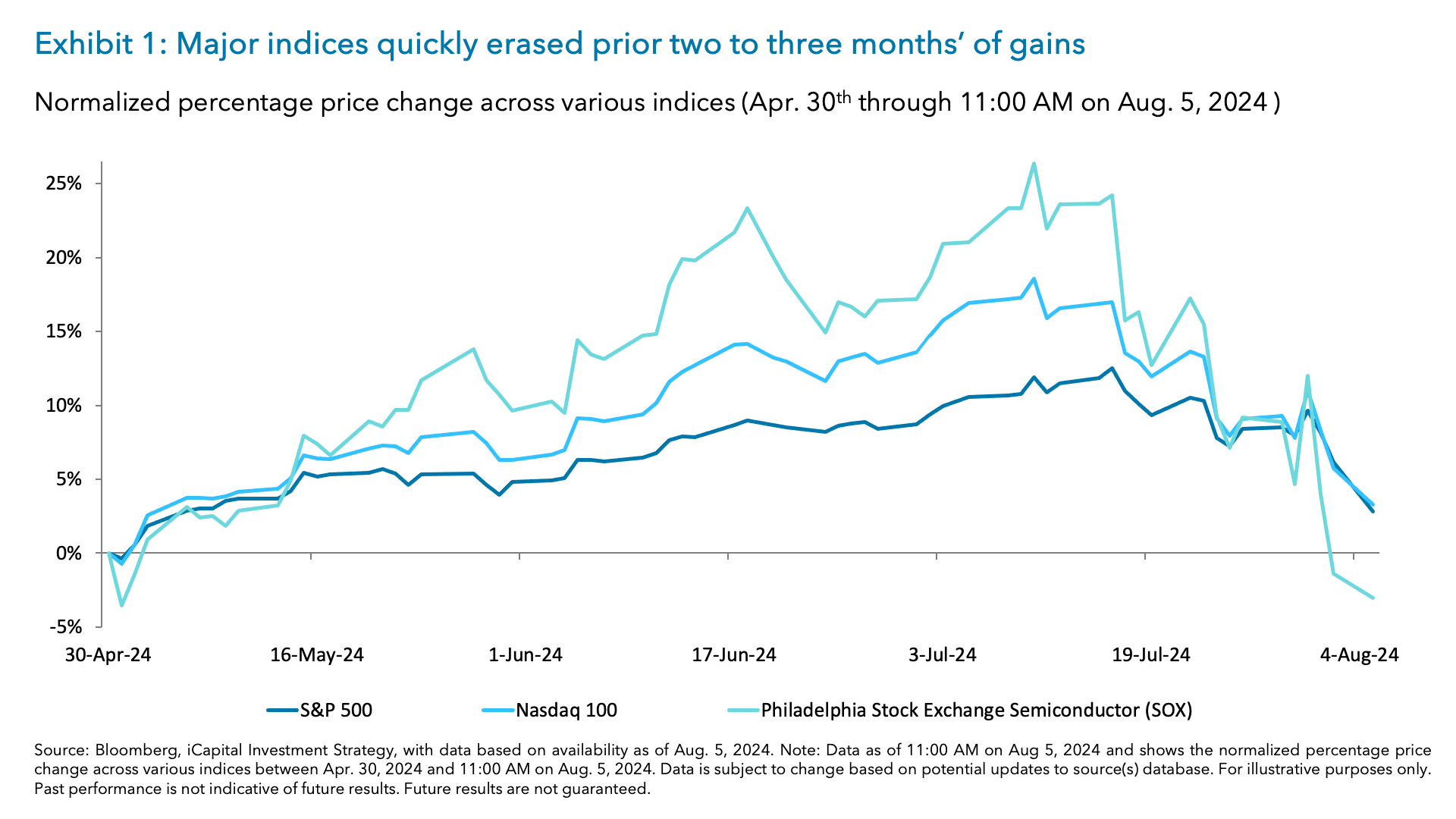

Still, today’s -3.4% plunge on the Nasdaq 100 through 11:00 AM on August 5 (which comes on top of the -12.4% sell-off in Japan’s Nikkei Index in Asia hours this morning) is starting to feel like an overreaction.1 The VIX, a measure of implied volatility, surged to a high of 65.7 percentage points in pre-market trading this morning which is the highest since April 2020.2 And today’s market move brings the recent pullback to -8.7% for the Nasdaq 100 and -13.9% for the S&P 500 from their 52-week highs.3

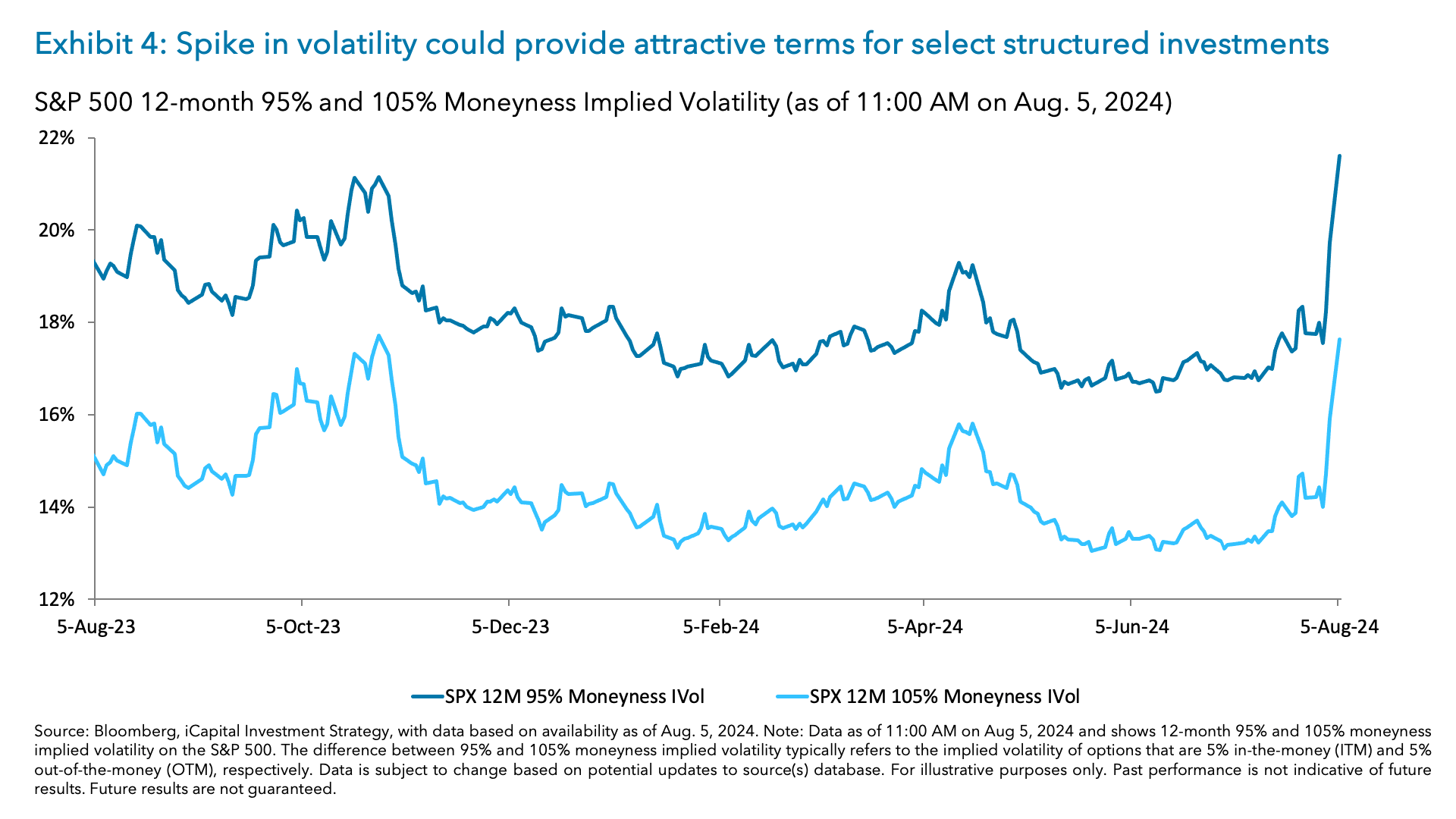

And while we reiterate the defensive positioning which typically works well in the months after rate cuts, we would be taking advantage of the pullback and a surge in volatility to begin adding to AI semiconductors, real estate and banks, as well as the broader S&P 500 and Nasdaq, using structured investments.

Defensive core for a slowing economy

This economy is slowing, and the markets are clearly in the mood to price in a recession, which argues for defensive positioning for the core of the portfolio.

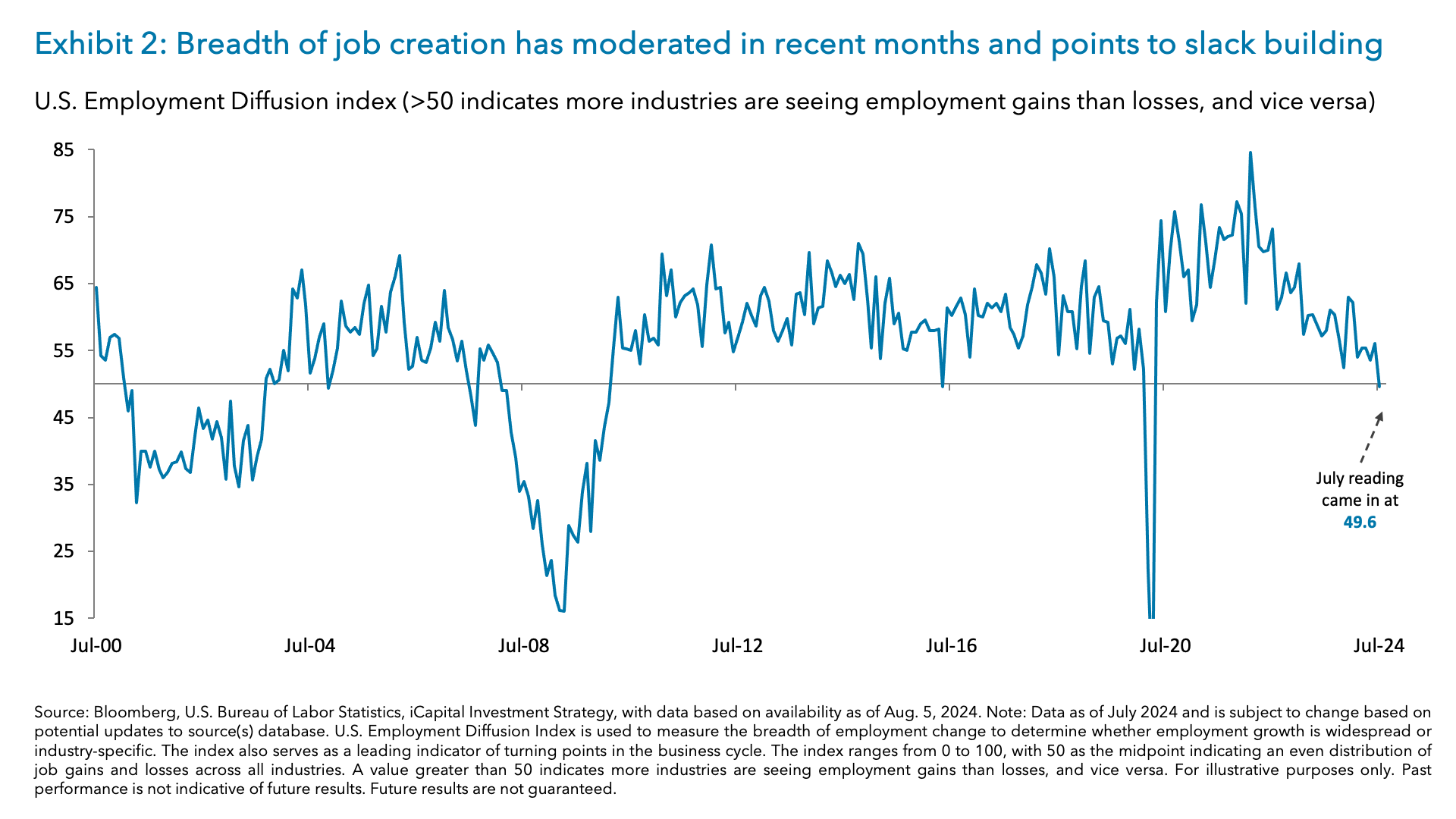

Yes, the July layoff data reflected temporary factors such as Hurricane Beryl that hit Texas, but over the past year, almost half of the increase in the unemployment came through layoffs.4 The category that is growing the most is the “job losers or on a permanent layoff”, which reached 35-36% of total unemployed recently, up from 30% of the overall a year ago.5 And yes, some of the rise in unemployment may also be due to immigration, but surveying a broad number of measures suggest that labor market slack is building. For instance, the job creation diffusion index is at 49.6, job openings have decreased by four million since their March 2022 high, initial jobless claims increased from less than 200k in January of 2024 to 249k most recently, and wage growth is much slower at 3.6%, barely above the 3.3% core CPI inflation.6

All of this risks a self-fulfilling prophecy of fewer jobs, lower wages, and less consumption and in turn, more layoffs. That said, a recession is not our base case. But the markets are laser focused on recession prediction indicators like the Sahm rule which was triggered after the last week’s unemployment rate increase to 4.3%.

Thus, the markets are now prone to overreact to any “slowness” as a potential harbinger of recessionary “weakness” given the Sahm rule and the 25 months of yield curve inversion – until today.7 Further, earnings revisions have recently flipped into negative territory for U.S. equities.8

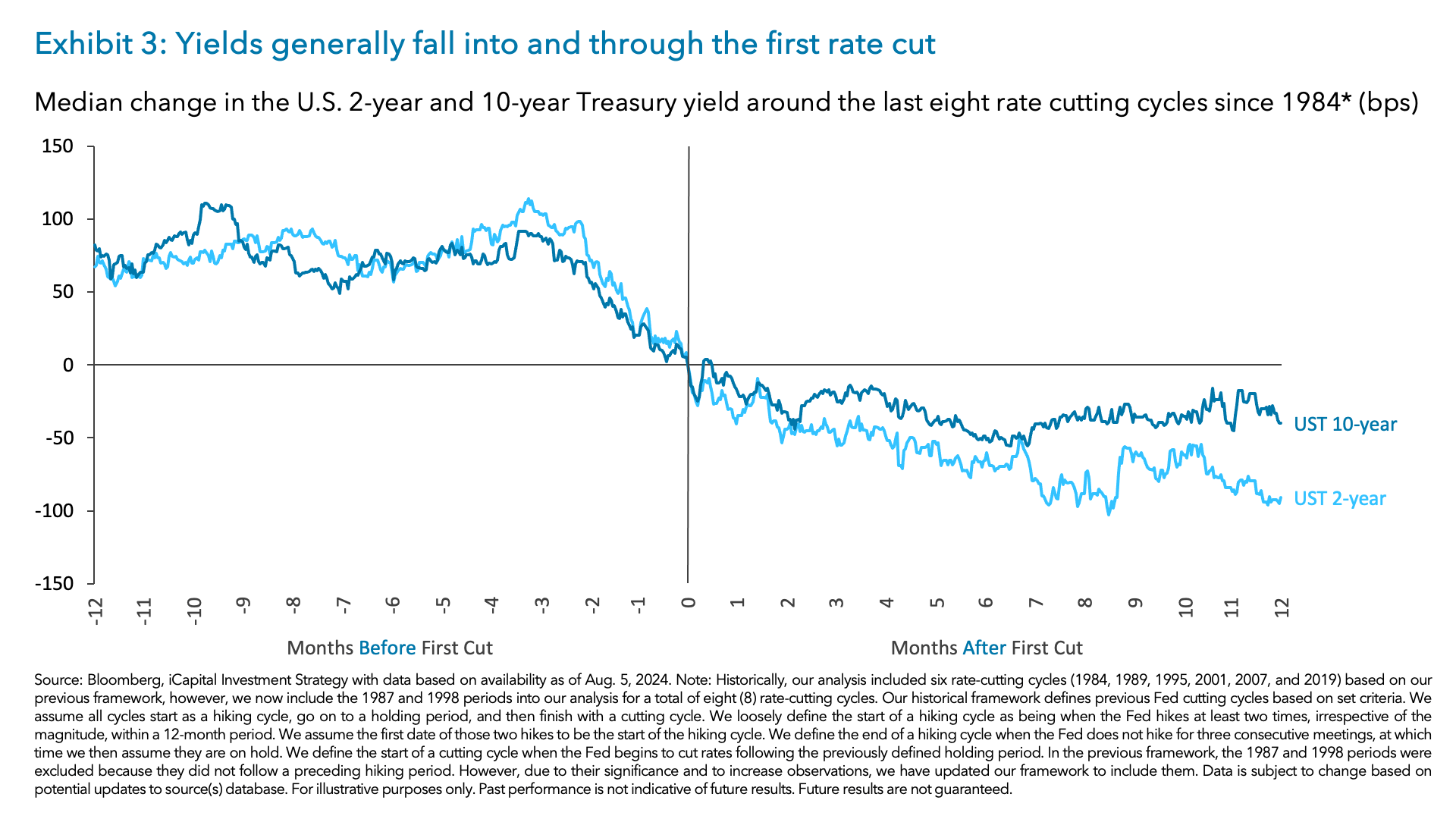

This is why we reiterate our focus on “defensive” strategies for the core of the portfolios, such as municipal bonds, utilities, real estate, and we expand that list to include infrastructure. But is it too late to make defensive changes in portfolios? We don’t think so, as yields tend to move lower after the cut (mentioned in our 2024 Outlook Report) and defensives outperformed, as we highlighted here.

Opportunity to gradually buy the dip

That said, the markets are now technically oversold, and the price action feels like a tantrum, whether you look at the S&P 500, the Nasdaq 100, the Philadelphia Stock Exchange Semiconductor Index (SOX), the Nikkei 225, the Magnificent 7 or the Russell 2000.9 Long bullish positioning in Tech has been reigned in, as hedge funds saw their largest net selling in six weeks, with Tech being the most sold sector, CTAs likely sold $11.1bn last week and retail flows have slowed.10 Finally, we are now mostly out of the buyback blackout window and the largest buyers may be in the market soon.

Therefore, we are now on watch for a positive catalyst in the coming days or weeks, which can emerge and break the cycle of recession fears. Here are some potential catalysts that we are monitoring:

- Realization that while the economy is slowing, a recession is not a certainty. Even the author of the Sahm rule, recently wrote that this time might be different and the signal from the rule is less accurate, given the rise in immigration flows.11

- The Fed has plenty of flexibility to “save the economy” given the 525 bps of rate cutting potential. By cutting interest rates decisively in the coming months, the committee can deliver a quick boost to pockets of the economy that need it most – consumer, small businesses, real estate.

- Acknowledgement that even while rate cuts haven’t arrived just yet, yields are already much lower and this is already providing some relief to those with floating rate loans, as well as banks assets held on the balance sheets which should be benefitting from positive mark-to-market valuations given much lower yields.

- Constructive labor market data points which are still possible post the Beryl-induced temporary layoffs. Indeed, according to the Bureau of Labor of Statistics, 436,000 workers were unable to work because severe weather.12 This is up from 59,000 last month and far more than the historical average of 117,062.13

- Speeches by Fed officials between now and Jackson Hole on August 22-24 hint that either the Fed is preparing for a supersized rate cut or a rate cutting cycle now that the labor market has weakened.

- The rest of the semiconductors reporting seasons could still show very robust demand for AI chips given overall hyperscaler capex is forecast to grow 39% this year and 11% in 2025.14

While waiting for these catalysts to unfold, amidst earnings revisions that could drift lower, we are sticking with the defensive core. But we would use the oversold conditions and the spike in volatility to gradually add on pullbacks to AI semiconductors, real estate and banks, as well as the broader SPX and Nasdaq indices, using structured investments.

As we highlighted here iCapital Market Pulse: Market Consolidation and the Great Rotation – iCapital, equities – assuming no recession – moved higher six months after the rate cut. And the surge in implied call and put volatility is providing for attractive terms on income focused structured investments and/or those with downside buffers or barriers.

1. Bloomberg, iCapital Investment Strategy, as of Aug. 5, 2024. Note: Data as of 11:00 AM on Aug. 5, 2024.

2. Bloomberg, iCapital Investment Strategy, as of Aug. 5, 2024.

3. Bloomberg, iCapital Investment Strategy, as of Aug. 5, 2024. Note: Data as of 11:00 AM on Aug. 5, 2024. Bloomberg, iCapital 4. Investment Strategy, as of Aug. 5th, 2024.

5. Bureau of Labor Statistics, as of Aug. 2, 2024.

6. Bureau of Labor Statistics, Department of Labor, Bloomberg, as of Aug. 5, 2024.

7. Bloomberg, iCapital Investment Strategy, as of Aug. 5, 2024. Note curve initially inverted in March 2022, but then uninverted a few days later. The inversion became persistent in July 2022.

8. JPMorgan Earnings Revisions Landscape, as of July 25, 2024.

9. Magnificent 7 comprises Apple, Microsoft, Google parent Alphabet, Amazon, Nvidia, Meta Platforms and Tesla.

10. Goldman Sachs, as of Aug. 2, 2024.

11. Stay-At-Home-Macro (Sahm), as of July 26, 2024.

12. Bureau of Labor Statistics, Bloomberg as of Aug. 2, 2024.

13. Bureau of Labor Statistics, Bloomberg, iCapital Investment Strategy as of Aug. 5, 2024.

14. Bank of America, as of July 18, 2024.

INDEX DEFINITIONS

Nasdaq Composite Index: A market capitalization-weighted index of more than 2,500 stocks listed on the Nasdaq stock exchange. It is a broad index that is heavily weighted toward the important technology sector. The index is composed of both domestic and international companies.

The Nasdaq-100: The companies in the Nasdaq-100 includes 100-plus of the largest domestic and international non-financial companies listed on the Nasdaq Stock Market based on market capitalization.

The Nikkei 225: The Nikkei 225 is a price-weighted equity index, which consists of 225 stocks in the Prime Market of the Tokyo Stock Exchange.

Russell 2000: An index that measures the performance of the small-cap segment of the U.S. equity universe. The Russell 2000 Index is a subset of the Russell 3000 Index representing approximately 7% of the total market capitalization of that index, as of the most recent annual reconstitution. It includes approximately 2,000 of the smallest securities based on a combination of their market cap and current index membership.

S&P 500: The S&P 500 is widely regarded as the best single gauge of large-cap U.S. equities. The index includes 500 of the top companies in leading industries of the U.S. economy and covers approximately 80% of available market capitalization.

Philadelphia Stock Exchange Semiconductor Index (SOX): The Philadelphia Stock Exchange Semiconductor Index (SOX) is a modified market capitalization-weighted index composed of companies primarily involved in the design, distribution, manufacture, and sale of semiconductors.

The Cboe VIX: The VIX Index is a financial benchmark designed to be an up-to-the-minute market estimate of expected volatility of the S&P 500 Index, and is calculated by using the midpoint of real-time S&P 500® Index (SPX) option bid/ask quotes.

IMPORTANT INFORMATION

The material herein has been provided to you for informational purposes only by Institutional Capital Network, Inc. (“iCapital Network”) or one of its affiliates (iCapital Network together with its affiliates, “iCapital”). This material is the property of iCapital and may not be shared without the written permission of iCapital. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of iCapital.

This material is provided for informational purposes only and is not intended as, and may not be relied on in any manner as, legal, tax or investment advice, a recommendation, or as an offer or solicitation to buy or sell any security, financial product or instrument, or otherwise to participate in any particular trading strategy. This material does not intend to address the financial objectives, situation, or specific needs of any individual investor. You should consult your personal accounting, tax and legal advisors to understand the implications of any investment specific to your personal financial situation.

ALTERNATIVE INVESTMENTS ARE CONSIDERED COMPLEX PRODUCTS AND MAY NOT BE SUITABLE FOR ALL INVESTORS. Prospective investors should be aware that an investment in an alternative investment is speculative and involves a high degree of risk. Alternative Investments often engage in leveraging and other speculative investment practices that may increase the risk of investment loss; can be highly illiquid; may not be required to provide periodic pricing or valuation information to investors; may involve complex tax structures and delays in distributing important tax information; are not subject to the same regulatory requirements as mutual funds; and often charge high fees. There is no guarantee that an alternative investment will implement its investment strategy and/or achieve its objectives, generate profits, or avoid loss. An investment should only be considered by sophisticated investors who can afford to lose all or a substantial amount of their investment.

iCapital Markets LLC operates a platform that makes available financial products to financial professionals. In operating this platform, iCapital Markets LLC generally earns revenue based on the volume of transactions that take place in these products and would benefit by an increase in sales for these products.

The information contained herein is an opinion only, as of the date indicated, and should not be relied upon as the only important information available. Any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets is not necessarily indicative of the future or likely performance. The information contained herein is subject to change, incomplete, and may include information and/or data obtained from third party sources that iCapital believes, but does not guarantee, to be accurate. iCapital considers this third-party data reliable, but does not represent that it is accurate, complete and/or up to date, and it should not be relied on as such. iCapital makes no representation as to the accuracy or completeness of this material and accepts no liability for losses arising from the use of the material presented. No representation or warranty is made by iCapital as to the reasonableness or completeness of such forward-looking statements or to any other financial information contained herein.

Securities products and services are offered by iCapital Markets, an SEC-registered broker-dealer, member FINRA and SIPC, and an affiliate of iCapital, Inc. and Institutional Capital Network, Inc. These registrations and memberships in no way imply that the SEC, FINRA, or SIPC have endorsed any of the entities, products, or services discussed herein. Annuities and insurance services are provided by iCapital Annuities and Insurance Services LLC, an affiliate of iCapital, Inc. “iCapital” and “iCapital Network” are registered trademarks of Institutional Capital Network, Inc. Additional information is available upon request.

©2024 Institutional Capital Network, Inc. All Rights Reserved.