This profile of fixed annuities is one in a series created to increase awareness of annuities by providing market color, friendly tips, and interesting stats at a glance.

A deferred annuity is a long-term, tax-deferred investment issued by an insurance company and purchased through a qualified professional.

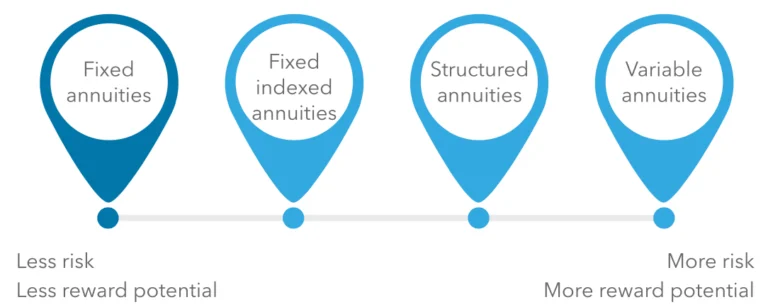

There are four main types:

Fixed annuities

Fixed annuities preserve retirement assets by providing both a guaranteed annual return and full protection of principal.

Did you know?

Banks are not the only option when an investor is seeking returns and wants full protection. Insurance companies have had a product comparable to a Certificate of Deposit (CD) for decades. Like CDs, fixed annuities provide both:

- Full protection of an investor’s premium.

- A specified, guaranteed return.

Tax fact: Keep more to earn more

With a fixed annuity, interest in an investor’s contract grows tax-deferred and annual tax savings stay in the account to earn interest. This can grow savings faster until money is withdrawn. Contrast that to a CD, where earned interest is taxable every year.

Because fixed annuities generally have longer holding periods than CDs, insurance companies generally offer higher annual interest rates than a typical bank CD.

Investors should work with a qualified professional to find the right fixed annuity for their financial needs.

Given the equity market’s pullback in 2022, many investors are looking for a reasonable return on retirement savings they are not willing to put at risk.

Friendly tip: Shop around

Just like some banks offer higher interest rates on savings than other banks, fixed annuity rates can differ widely from one insurance company to another. In addition, like CDs, fixed annuities come in a wide range of rate guarantee periods.

Interesting fact

Fixed annuity sales in the first half of 2023 were up 64% versus the first half of 2022, representing the highest six-month period in fixed annuity sales to date.1 Fixed annuities benefit from high interest rate environments, with insurance companies able to offer more attractive rates.

Know that fixed annuities:

- May not provide returns that keep pace with inflation.

- Are not FDIC insured like CDs, and guarantees under a fixed annuity contract are backed by the issuing insurance company and subject to its claims paying ability.

- Are considered a long-term investment, typically carrying penalties (such as a surrender charge) if money is withdrawn during the stated surrender period.

- Come with an additional 10% federal tax penalty for withdrawals prior to age 591⁄2.

Securities products and services may be offered by iCapital Markets LLC, a registered broker/dealer, member FINRA and SIPC, and an affiliate of iCapital. Annuities and insurance services provided by iCapital Annuities and Insurance Services LLC, an affiliate of iCapital, Inc. iCapital and iCapital Network are registered trademarks of Institutional Capital Network, Inc. Please see the disclaimer at the end of this document for more information.

Please contact your financial professional to learn more.

ENDNOTES

1. Record-High Sales of Registered Index-Linked and Fixed Indexed Annuities Drive Overall Sales Growth in the Second Quarter 2023, LIMRA, July 25, 2023.

IMPORTANT INFORMATION

The material herein has been provided to you for informational purposes only by Institutional Capital Network, Inc. (“iCapital Network”) or one of its affiliates (iCapital Network together with its affiliates, “iCapital”). This material is the property of iCapital and may not be shared without the written permission of iCapital. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of iCapital.

This material is provided for informational purposes only and is not intended as, and may not be relied on in any manner as, legal, tax or investment advice, a recommendation, or as an offer or solicitation to buy or sell any security, financial product or instrument, or otherwise to participate in any particular trading strategy. This material does not intend to address the financial objectives, situation, or specific needs of any individual investor. You should consult your personal accounting, tax and legal advisors to understand the implications of any investment specific to your personal financial situation.

ANNUITIES ARE CONSIDERED COMPLEX PRODUCTS AND MAY NOT BE SUITABLE FOR ALL INVESTORS. The information is not intended as investment advice and is not a recommendation about managing or investing retirement savings. Actual annuity contracts may differ materially from the general overview provided. Prior to making any decision with respect to an annuity contract, purchasers must review, as applicable, the offering document, the disclosure document, and the buyer’s guide which contain detailed and additional information about the annuity. Any annuity contract is subject in its entirety is to the terms and conditions imposed by the carrier under the contract. Withdrawals or surrenders may be subject to surrender charges, and/or market value adjustments, which can reduce the owner’s contract value or the actual withdrawal amount received. Withdrawals and distributions of taxable amounts are subject to ordinary income tax and, if made prior to age 591⁄2, may be subject to an additional 10% federal income tax penalty. Annuities are not FDIC-insured. All references to guarantees arising under an annuity contract are subject to the financial strength and claims-paying ability of the carrier.

iCapital Markets LLC operates a platform that makes available financial products to financial professionals. In operating this platform, iCapital Markets LLC generally earns revenue based on the volume of transactions that take place in these products and would benefit by an increase in sales for these products.

The information contained herein is an opinion only, as of the date indicated, and should not be relied upon as the only important information available. Any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets is not necessarily indicative of the future or likely performance. The information contained herein is subject to change, incomplete, and may include information and/or data obtained from third party sources that iCapital believes, but does not guarantee, to be accurate. iCapital considers this third-party data reliable, but does not represent that it is accurate, complete and/or up to date, and it should not be relied on as such. iCapital makes no representation as to the accuracy or completeness of this material and accepts no liability for losses arising from the use of the material presented. No representation or warranty is made by iCapital as to the reasonableness or completeness of such forward-looking statements or to any other financial information contained herein.

Securities products and services are offered by iCapital Markets, an SEC-registered broker-dealer, member FINRA and SIPC, and an affiliate of iCapital, Inc. and Institutional Capital Network, Inc. These registrations and memberships in no way imply that the SEC, FINRA, or SIPC have endorsed any of the entities, products, or services discussed herein. Annuities and insurance services are provided by iCapital Annuities and Insurance Services LLC, an affiliate of iCapital, Inc. “iCapital” and “iCapital Network” are registered trademarks of Institutional Capital Network, Inc. Additional information is available upon request.

© 2024 Institutional Capital Network, Inc. All Rights Reserved. | 2024.01