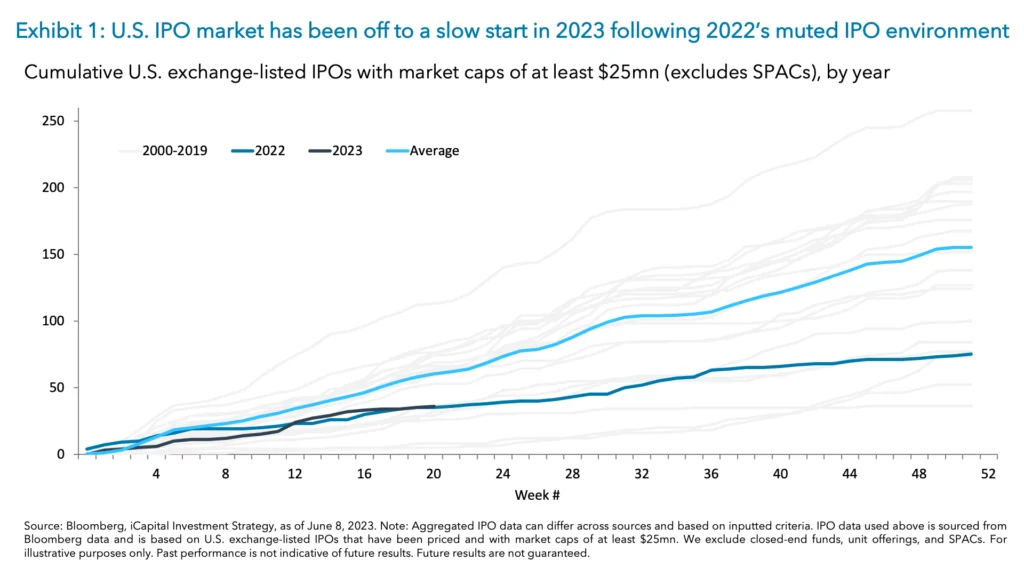

The U.S. IPO market found itself in a state of drought during the first five months of this year, following in the footsteps of last year’s weak deal-making environment. Weighed down by a challenging geopolitical backdrop, ongoing economic uncertainty, and market instabilities, the macro environment has been less conducive to new IPOs. As a result, only 36 companies have gone public since the beginning of the year.1 For context, IPO activity reached multi-decade highs in 2021 totaling 394 deals before stalling in 2022 to just 75 deals – roughly 50% below the 2000 to 2019 annual average of 155 (Exhibit 1).2

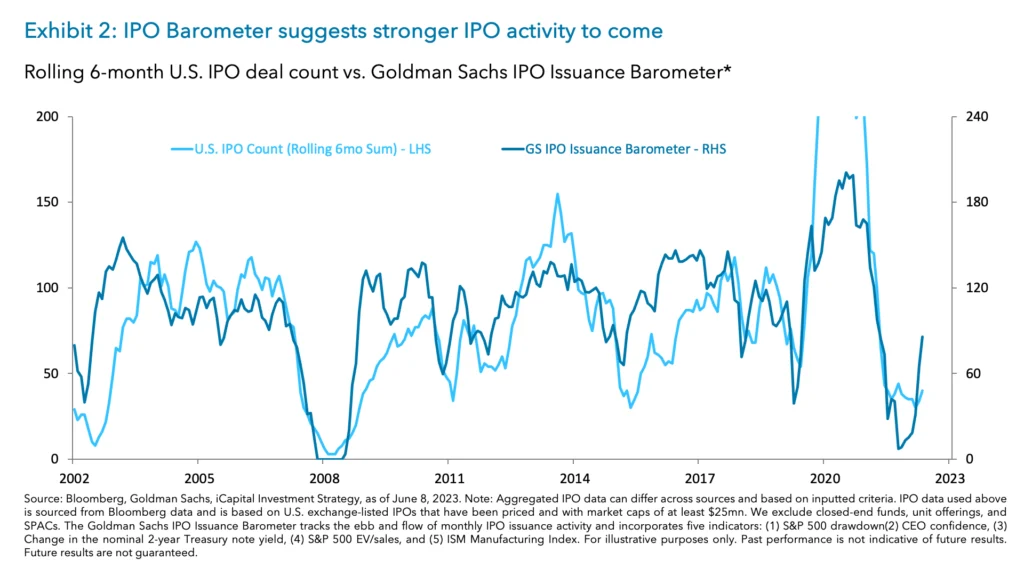

However, as we edge closer to the second half of this year, green shoots are beginning to emerge, with the macro picture turning incrementally more constructive. Inflation has begun leveling off, regional banking disruptions have largely faded, the growth outlook has improved, and recession risks have eased. As the market continues to normalize and confidence picks up, the IPO landscape should improve, and deal volumes should rise (Exhibit 2).

Here are four key variables we are monitoring to gauge the state of the IPO market over the coming quarters:

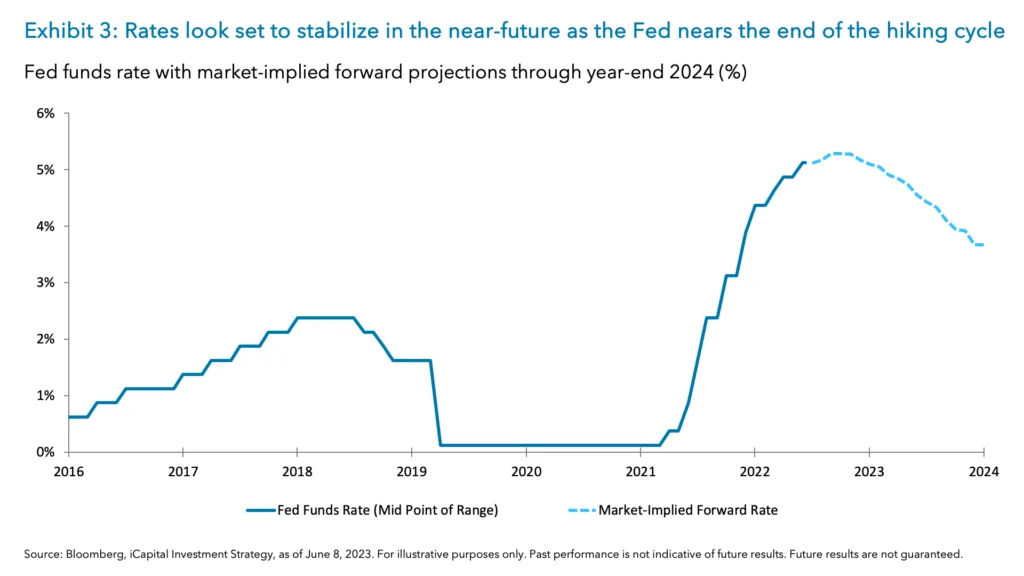

1. Clarity from the Federal Reserve:

The Federal Reserve is expected to pause its rate hiking cycle when it meets this week, and will provide us with an updated assessment on the future path of the economy and monetary policy. In early May, Chair Jerome Powell showed openness to a June pause saying, “our policy rate may not need to rise as much as it would have otherwise to achieve our goals.”3 Improving inflation dynamics and a slight cooldown in the labor market support the case for the June pause. However, with the labor market still tight and the potential for inflation to reignite, the Fed may use this June pause as a “skip” or a temporary pause to allow them to better gauge the incoming data before deciding whether to conclude the rate hiking cycle. Either way, the Fed is likely to move materially slower than before and the chances of more than one 25 basis point hike is unlikely. Beyond these next couple of meetings however, the Fed will likely shift towards more stable rates, which will be a net positive for capital markets over the coming quarters as it will provide companies seeking to go public with more predictable financing conditions and potentially lower costs of capital. It could also boost confidence in the cost of leverage and valuations, and in turn support a stronger IPO market.

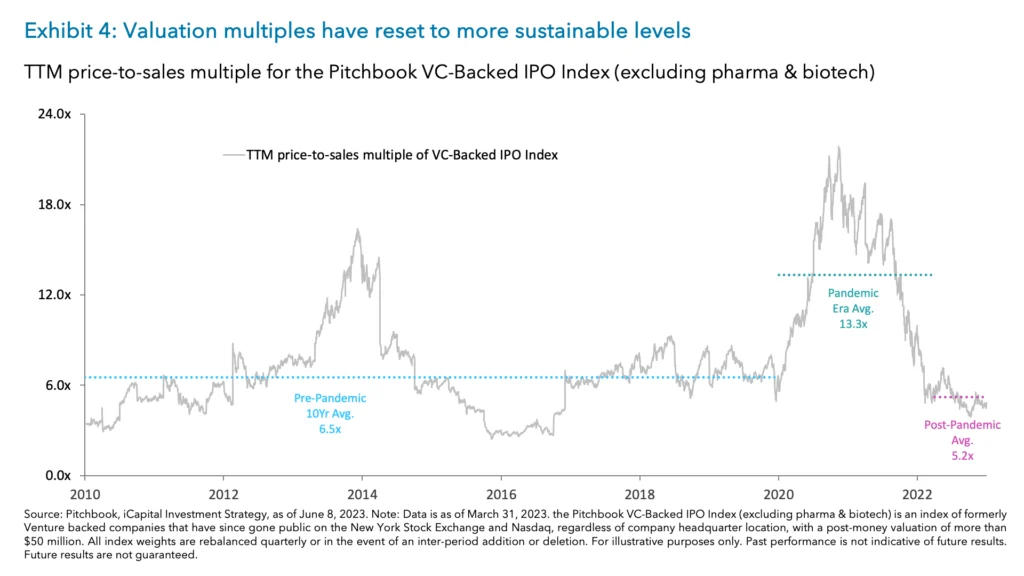

2. Valuations Stabilizing:

Valuations have come down materially from their pandemic-era peak but have since leveled off and are now showing signs of stabilization. As of the end of the first quarter, the Pitchbook Venture Capital Backed IPO Index, which tracks venture capital-backed companies that have since gone public, is trading at 4.8x trailing-twelve-month sales (TTM P/S) compared to early January lows of 3.9x.4 While valuations at 4.8x remain well below the pandemic era (the second quarter of 2020 through that of 2022) which averaged 13.3x, they have moved back toward the pre-pandemic historical average of 6.5x (Exhibit 4).5 And further stabilization of the tech sector in recent months has likely pushed multiples slightly higher. Looking ahead, the move in valuations from the pandemic peak back to historical averages indicates a shift towards more realistic and sustainable pricing levels. Given the current level of rates, the present level of valuations may be increasingly accepted as the new normal, so waiting to IPO in hopes of higher valuations due to rate cuts may not be worth it. And the recent stability in multiples could help increase confidence for companies expecting to go public.

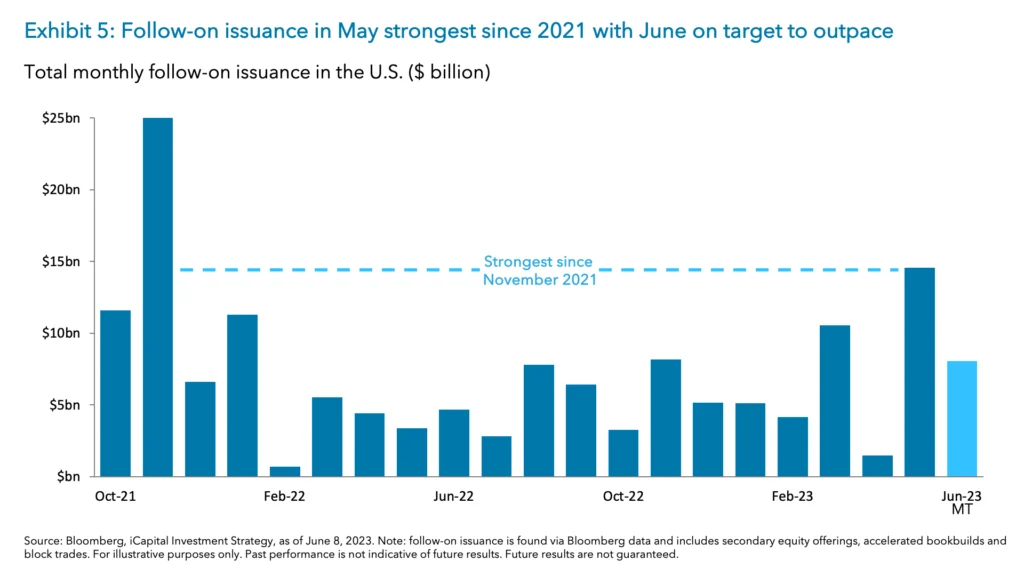

3. Strength in the follow-on market:

Historically, the follow-on market, which involves secondary equity offerings, accelerated bookbuilds and block trades, has served as a leading indicator for forthcoming IPO activity. When follow-on issuance is robust, it suggests that the market is not having a hard time absorbing additional supply and signals that the market is conducive (or becoming conducive) to raising capital. For the month of May, the U.S. follow-on market had its busiest month, from both an issuance and transaction perspective, since November 2021, raising roughly $14.6 billion across 58 transactions (Exhibit 5).6 And June is on pace to beat May’s strength with a total of $8.1 billion raised through just the first 8 days of the month.7 This takes the year-to-date issuance up to $43.9 billion across 209 transactions compared to $28.6 billion across 110 transactions for the same period in 2021.8 The recent strength in follow-ons might be a precursor to improved capital market conditions for IPOs over the coming quarters.

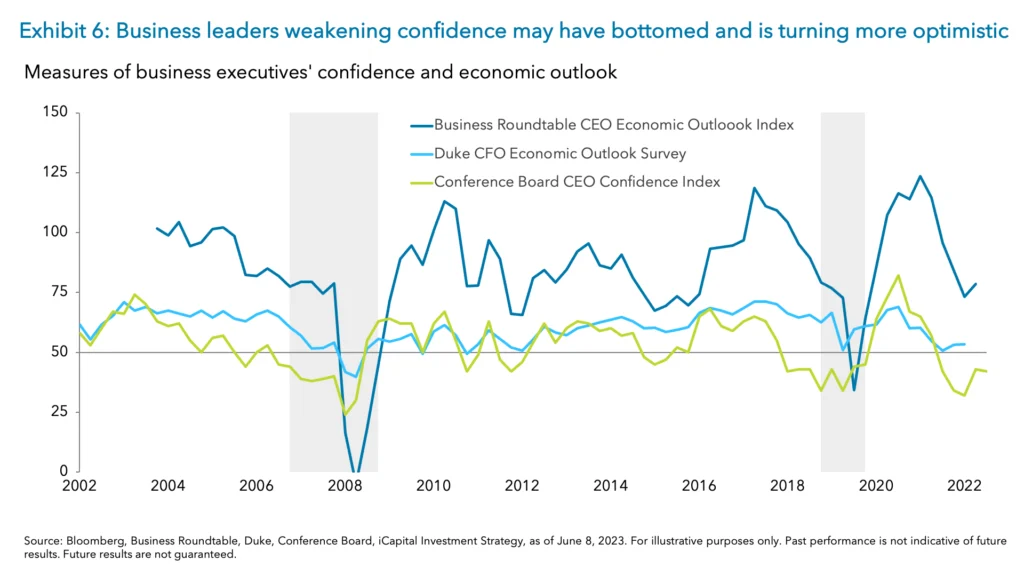

4. Sustained pick-up in business leaders’ confidence:

When CEOs and business leaders feel optimistic and confident about the economy and market conditions, they are more inclined to pursue IPOs as a means of raising capital and expanding their businesses. Looking ahead, the expectations for further clarity from the Fed and stabilizing growth expectations should provide executives with more confidence. In fact, recent measures of business leaders’ confidence and economic outlook suggest that the worst may now be behind us; these measures appeared to have bottomed in recent quarters (Exhibit 6). Historically, a bottoming in CEO confidence tends to suggest a pick-up in IPO deal activity over the next 12-months.9

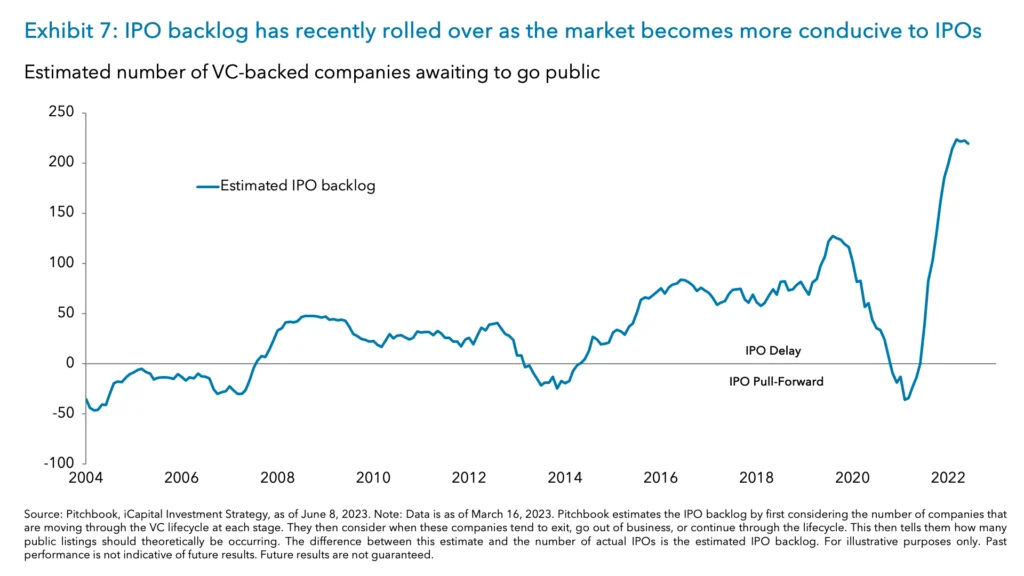

A record IPO backlog suggest public listings could pick up significantly if conditions are right

Once a company goes public there is a period of time, usually around 90-180 days, when insiders and some early investors may not sell their shares. So, when thinking through when to go public, a company will not want to IPO into a bad macro environment, which may be expected over the coming months, and risk a sell-off. However, if there is greater clarity on the expected growth, rate, and valuation environments, that should give more confidence for companies to go public.

Thankfully, we have begun to get that clarity as the macro backdrop continues to gradually stabilize. And as such the IPO market is better positioned for a potential pick-up in the back half of this year. The chart below suggests that given the estimated IPO backlog, the market can pick up relatively quickly. Right now, there are an estimated 219 VC-backed startups that are ready to go public but are currently waiting to do so (Exhibit 7).10 However, this number has recently started to decline as the number of VC-backed public listings have slowly ticked higher. The pent-up demand and readiness of these companies to go public should help clear this backlog and spur IPO activity as the macro picture normalizes further.

The extent to which these companies come to market will also likely be based on the ability for bellwether unicorns – startups valued at north of $1 billion – to price well. Johnson & Johnson recently took its consumer business Kenvue public, which was the largest IPO since Rivian in November of 2021.11 And SoftBank is still targeting a listing for its semiconductor business ARM later this year. Reddit, Discord, and Instacart are also among other notable offerings planned for the latter part of the year.12 That said, if the Fed pauses, valuations stabilize, growth outlook and CEO confidence evolve as expected above, we suspect many other companies will be willing to go public as well.

1. Bloomberg, iCapital Investment Strategy, as of June 8, 2023. Note: Aggregated IPO data can differ across sources and based on inputted criteria. IPO data used in this commentary is sourced from Bloomberg data and is based on U.S. exchange-listed IPOs that have been priced and with market caps of at least $25mn. We exclude closed-end funds, unit offerings, and SPACs.

2. Bloomberg, iCapital Investment Strategy, as of June 8, 2023.

3. Thomas Laubach Research Conference, Bloomberg, iCapital Investment Strategy, as of May 19, 2023.

4. Pitchbook, iCapital Investment Strategy, as of March 31, 2023.

5. Pitchbook, iCapital Investment Strategy, as of March 31, 2023.

6. Bloomberg, iCapital Investment Strategy, as of June 8, 2023. Note: follow-on issuance is found via Bloomberg data and includes secondary equity offerings, accelerated bookbuilds and block trades.

7. Bloomberg, iCapital Investment Strategy, as of June 8, 2023.

8. Bloomberg, iCapital Investment Strategy, as of June 8, 2023.

9. Bloomberg, iCapital Investment Strategy, as of June 8, 2023.

10. Pitchbook, iCapital Investment Strategy, as of June 8, 2023.

11. Bloomberg, iCapital Investment Strategy, as of June 8, 2023.

12. Bloomberg, iCapital Investment Strategy, as of May 10, 2023.

IMPORTANT INFORMATION

The material herein has been provided to you for informational purposes only by iCapital, Inc. (“iCapital”). This material is the property of iCapital and may not be shared without the written permission of iCapital. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of iCapital.

This material is provided for informational purposes only and is not intended as, and may not be relied on in any manner as, legal, tax or investment advice, a recommendation, or as an offer to sell, a solicitation of an offer to purchase or a recommendation of any interest in any fund or security. You should consult your personal accounting, tax and legal advisors to understand the implications of any investment specific to your personal financial situation. This material does not intend to address the financial objectives, situation or specific needs of any individual investor. Alternative investments are complex, speculative investment vehicles and are not suitable for all investors.

The information contained herein is an opinion only, as of the date indicated, and should not be relied upon as the only important information available. Any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets is not necessarily indicative of the future or likely performance. The information contained herein is subject to change, incomplete, and may include information and/or data obtained from third party sources that iCapital believes, but does not guarantee, to be accurate. iCapital considers this third-party data reliable, but does not represent that it is accurate, complete and/or up to date, and it should not be relied on as such. iCapital makes no representation as to the accuracy or completeness of this material and accepts no liability for losses arising from the use of the material presented. No representation or warranty is made by iCapital as to the reasonableness or completeness of such forward-looking statements or to any other financial information contained herein.

Securities products and services are offered by iCapital Markets, an SEC-registered broker-dealer, member FINRA and SIPC, and an affiliate of iCapital, Inc. and Institutional Capital Network, Inc. These registrations and memberships in no way imply that the SEC, FINRA, or SIPC have endorsed any of the entities, products, or services discussed herein. Annuities and insurance services are provided by iCapital Annuities and Insurance Services LLC, an affiliate of iCapital, Inc. “iCapital” and “iCapital Network” are registered trademarks of Institutional Capital Network, Inc. Additional information is available upon request.

© 2023 Institutional Capital Network, Inc. All Rights Reserved.