Last weekend I was at a pumpkin patch with my daughter. The good news: There were plenty of pumpkins to pick. The bad news: Hayrides were cancelled because of – what else – labor shortages, according to a hand-written sign.

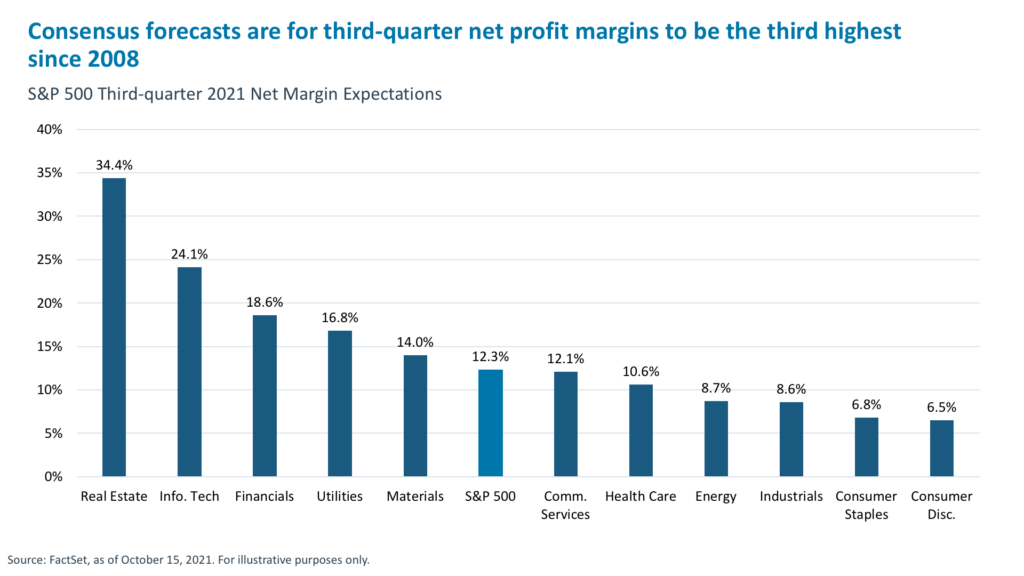

By now, we know the story. The world is short of everything, and everything takes too long to ship. A big question for the markets – amid a busy week of earnings reports in which consensus expectations are for the third-highest quarterly profit margin since 2008 – is will supply chain issues severely squeeze margins?1 The bigger question (including for all of us consumers) is when will supply challenges and shortages abate?

In this week’s commentary, we highlight three key charts to watch for possible signs of bottlenecks easing: container shipping costs, truck driver shortages, and factory closings in Southeast Asia. It looks to us that all three are peaking, although it may take several more quarters to unclog the logjam globally. In the investment implications section, we also discuss how investors should be positioned in the meantime.

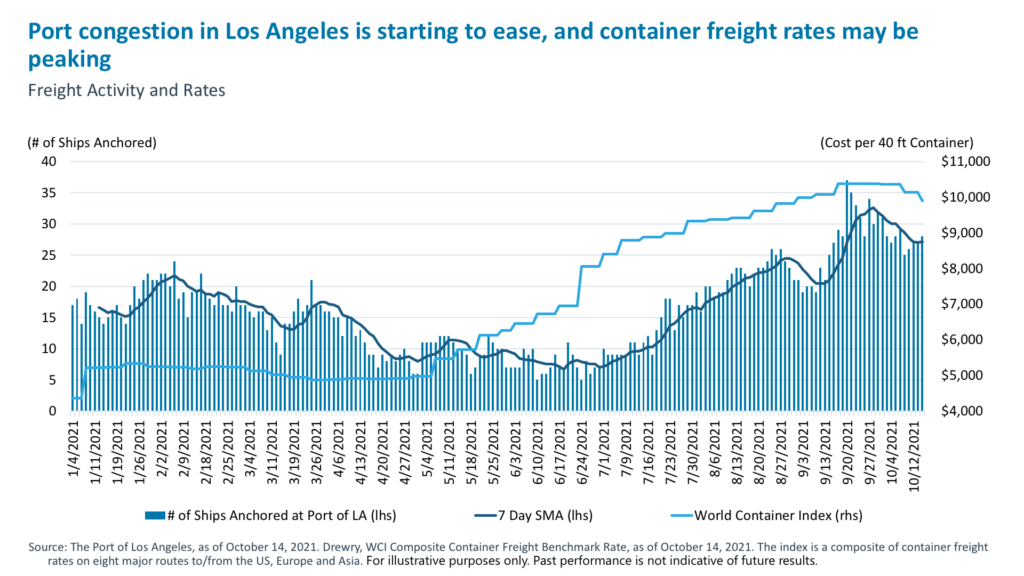

Container shipping costs could be subsiding

For the first time since the end of September, the spot freight rate for a 40-foot container fell below $10,000.2 The weekly data showed three consecutive week-over-week declines for the first time since March 2021. This could be due to several factors.

First, the peak shipping season to stock retailers’ shelves for the holiday shopping season appears to be behind us. Indeed, it seems that peak season has been front-loaded this year to July – September versus September – October, historically.3

Second, wait times at sea and at ports – which could be peaking – are partly to blame for high shipping rates because they tie up containers and leave them in short supply. The latest data suggest that the number of ships at anchor is starting to decline, and the number of days at anchor, which has more than doubled to nine days on average today from four days in the spring/early summer, could also be peaking, as seen in the Freight Activity and Rates chart. 4

There is one caveat: This chart examines the spot rates for bookings within a week. In practice, however, many customers sign longer-term agreements, and 2022 contract rates are expected to increase by 6%.5 Still, spot rates are expected to decline in 2022,6 and the potential peaking in port congestion could be an early sign that the containership logjam may be easing – good news for consumers.

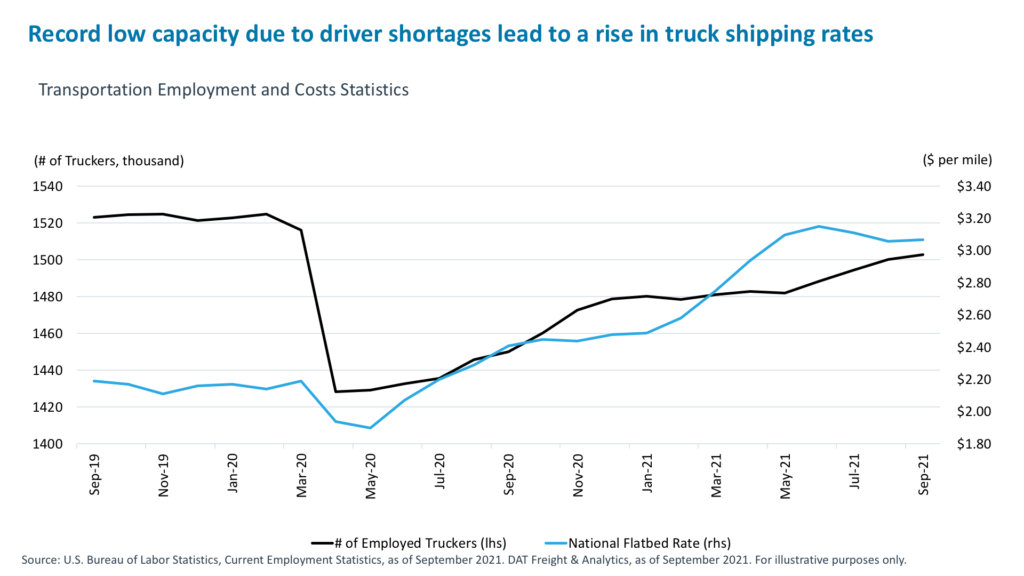

Truck driver shortages could be improving cyclically; still challenged structurally

The key reasons for container ships being stuck at ports and nearly 30% of container boxes sitting at terminal yards for more than five days (versus the two-day norm)7 are shortages of port workers and truck operators. For example, the number of truck transportation employees is still 2% below pre-pandemic levels, while demand for trucking services is running near all-time highs, and the number of truck driver job openings is at roughly 231,000.8 Consistent with that, the American Trucking Association estimates a driver shortage of 239,000 by early 2022.9

Still, the good news is transportation workers are increasingly coming back, incentivized by higher pay. Indeed, average hourly earnings in the transportation and warehousing sector rose 6% year over year versus 4.6% for all private workers.10 And that’s exactly what it will take – continued pay increases to attract workers to a sector that was experiencing a shortage even before the pandemic.

This shortage was further exacerbated by the spread of COVID-19 with two million more workers retiring during the pandemic than forecasted.11 And for the truck transportation sector specifically, the median age for drivers of private fleets is 15 years older than that of all U.S. workers.12 It is likely that the retirement rate in trucking was higher than other industries.

Net-net, we expect worker availability to continue to improve, but trucking rates are likely to stay elevated amid robust demand and ongoing trucker shortages that will require higher pay. It’s no wonder that Tesla and the private equity community are increasingly investing in autonomous long-haul transport.

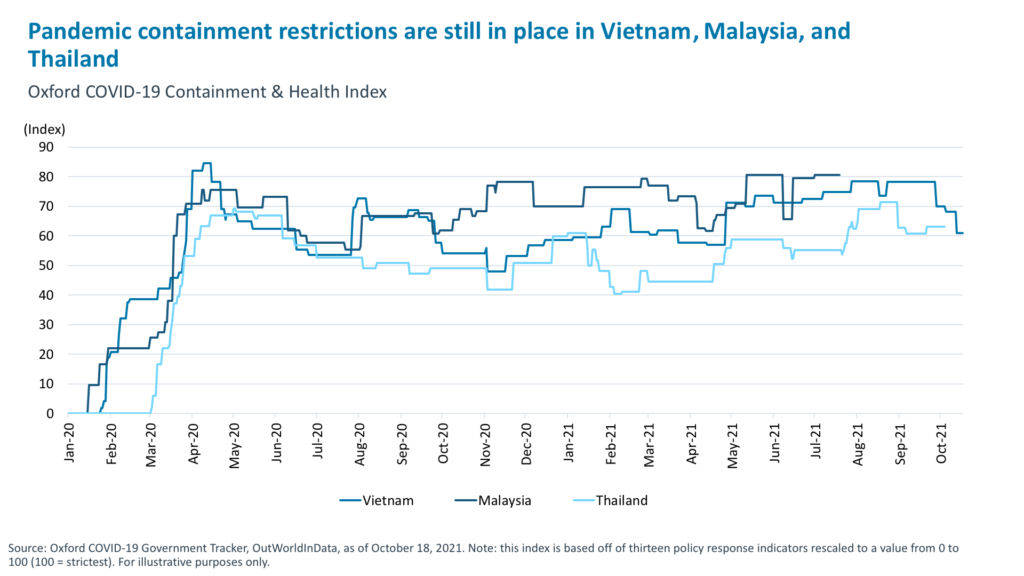

Factories should be reopening in Southeast Asia

China, Taiwan, Vietnam, Malaysia, and Thailand are among the top manufacturing destinations globally. Until recently, COVID cases were surging in these countries. High cases and low vaccination rates resulted in strict lockdowns including factory closures.13 Even now, Oxford’s containment and health index, which measures both lockdown restrictions and testing and contract tracing, indicates that Vietnam, Malaysia, and Thailand have yet to ease restrictions.14

Cases, however, are now coming down and vaccination rates are rising in these countries. For example, the first-dose vaccination rate in Malaysia is now close to 70%, while in Vietnam it is near 30% but ramping up quickly. With these improvements, we expect that restrictions could soon begin to ease, and with that, manufacturing shortages should too.

Sectors to avoid and to consider

The phrase “supply chain” has exploded in popularity recently and may end up being among the most searched terms in 2021, according to Google Trends.15 And while there are tentative positive signs of global supply chain issues easing (as we discussed previously), we should expect them to take time to fully resolve.

What does this mean for corporate margins in the meantime? By and large, companies should be able to sustain margins as they are raising prices to make up for higher costs and wages. For example, net 44% of small businesses plan to raise prices in the next three months, while net 26% expect to increase compensation during the same period.16 Consumers are benefitting from wage increases, which help overcome inflation. This virtuous cycle is driving prices higher but is preserving (for now) companies’ margins and consumers’ purchasing power.

However, we should expect significant divergence in sector profit-margin results. In our view, we would avoid sectors with thin profit margins where low revenue per worker and high logistics and rising wage costs could further squeeze companies. The consumer staples and consumer discretionary sectors fall into this category. We prefer sectors that are less impacted by global supply chain disruptions, have high pricing power and higher revenue per employee, and that should continue to deliver near-record margins. These include real estate, financials, communication services, and parts of information technology, like semiconductors.

1. FactSet Earnings Insight, October 15, 2021.

2. Bloomberg, Drewry WCI Composite Container Freight Benchmark Rate, as of October 14, 2021.

3. Bank of America Transportation Research, October 2021, Bloomberg.

4. The Port of Los Angeles, as of October 14, 2021.

5. Drewry, as of October 14, 2021.

6. Drewry, as of October 14, 2021.

7. Bank of America Shipping Research, October 15, 2021.

8. Bureau of Labor Statistics, Occupational Outlook Handbook, October 2021.

9. American Trucking Associations, ATAs Driver Shortage Report, July 2019.

10. Bureau of Labor Statistics, October 8, 2021.

11. U.S. Census Bureau and Bureau of Labor Statistics, Current Population Survey data, July 2021.

12. American Trucking Associations, ATAs Driver Shortage Report, July 2019.

13. Reuters, “How COVID-19 in Southeast Asia is threatening global supply chains,” October 6, 2021.

14. University of Oxford, COVID-19 Government Response Tracker, as of October 18, 2021.

15. Google Trends, as of October 18,2021.

16. National Federation of Independent Business Small Business Economic Trends, August 2021.

IMPORTANT INFORMATION

The material herein has been provided to you for informational purposes only by iCapital, Inc. (“iCapital”). This material is the property of iCapital and may not be shared without the written permission of iCapital. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of iCapital.

This material is provided for informational purposes only and is not intended as, and may not be relied on in any manner as, legal, tax or investment advice, a recommendation, or as an offer to sell, a solicitation of an offer to purchase or a recommendation of any interest in any fund or security. You should consult your personal accounting, tax and legal advisors to understand the implications of any investment specific to your personal financial situation. This material does not intend to address the financial objectives, situation or specific needs of any individual investor. Alternative investments are complex, speculative investment vehicles and are not suitable for all investors.

The information contained herein is an opinion only, as of the date indicated, and should not be relied upon as the only important information available. Any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets is not necessarily indicative of the future or likely performance. The information contained herein is subject to change, incomplete, and may include information and/or data obtained from third party sources that iCapital believes, but does not guarantee, to be accurate. iCapital considers this third-party data reliable, but does not represent that it is accurate, complete and/or up to date, and it should not be relied on as such. iCapital makes no representation as to the accuracy or completeness of this material and accepts no liability for losses arising from the use of the material presented. No representation or warranty is made by iCapital as to the reasonableness or completeness of such forward-looking statements or to any other financial information contained herein.

Securities products and services are offered by iCapital Markets, an SEC-registered broker-dealer, member FINRA and SIPC, and an affiliate of iCapital, Inc. and Institutional Capital Network, Inc. These registrations and memberships in no way imply that the SEC, FINRA, or SIPC have endorsed any of the entities, products, or services discussed herein. Annuities and insurance services are provided by iCapital Annuities and Insurance Services LLC, an affiliate of iCapital, Inc. “iCapital” and “iCapital Network” are registered trademarks of Institutional Capital Network, Inc. Additional information is available upon request.

© 2023 Institutional Capital Network, Inc. All Rights Reserved.