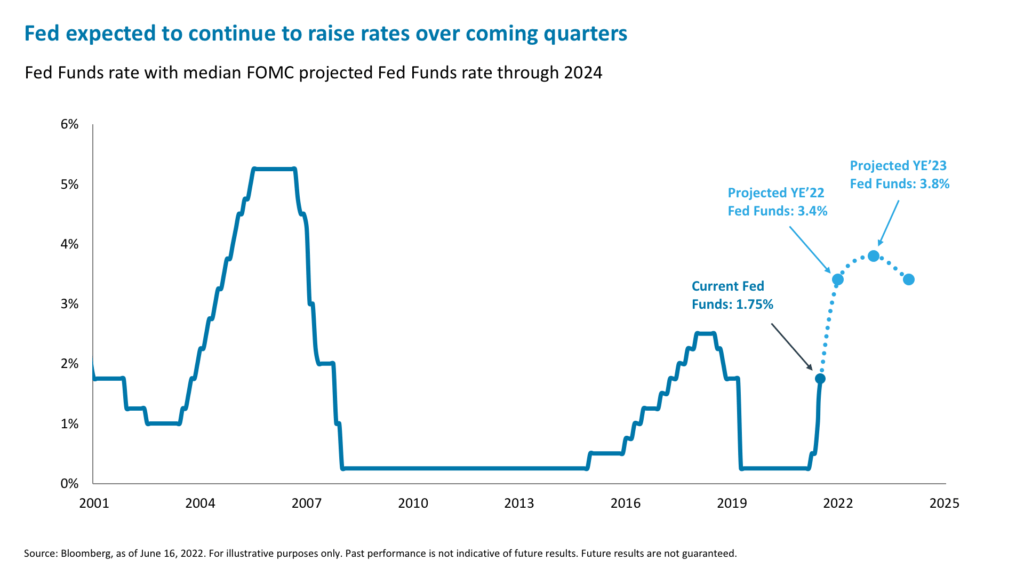

The U.S. Federal Reserve’s June meeting was hawkish, but not a hawkish surprise for the markets, as an aggressive path of interest rate increases was already priced in.

By moving aggressively the Fed is restoring some credibility—with inflation this high, rates are far too low and need to be raised quickly. Especially while the economy is still strong and there is a window in which it can act decisively.

Importantly, the Fed seems to have updated the markets on its reaction function—its focus is on fighting headline Consumer Price Index (CPI) inflation (rather than just focusing on the core, which is declining) because this measure seems to be driving consumer expectations. That is why it is important it acts firmly to slow inflation because higher expectations could become entrenched. If inflation (headline or not) comes in hotter than expected, expect more decisive hikes.

All of this is not a consolation for the markets per se, but it at least goes some way towards restoring the Fed’s credibility and highlights its resolve in fighting inflation.

Will rate hikes tip us into recession?

All of which begs the question, is more decisive Fed action on inflation going to tip the U.S. economy into recession?

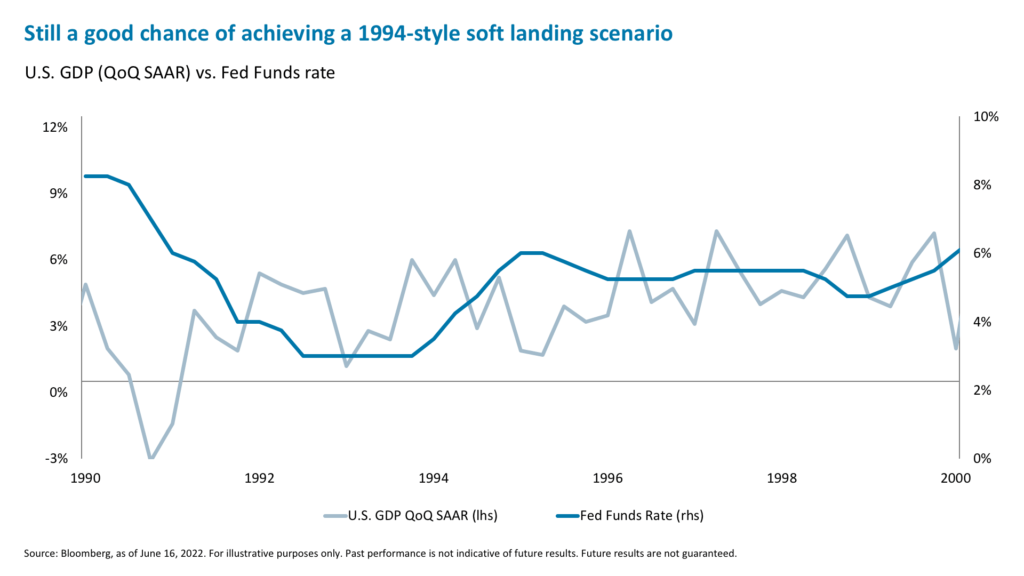

Last week we wrote that there is a wider path to a softer landing. Certainly, the inflation data appears to present a challenge to this conclusion, and markets are under pressure as they process surging implied recession probabilities following the 75bp rate hike.2

Taking a step back, it is important to define what we mean by a recession. One definition is simply several quarters of slowing economic growth. If that is the case, then we are almost certainly experiencing a recession already, with more to come: GDP growth is forecast to be resilient at around 2.7% in the second and third quarters, but dip to 1.5% in the fourth quarter of the year.3

However, the most common definition of a recession is two quarters of negative GDP growth, typically triggered by a shock of some kind. For a full-fledged recessionary crisis to occur, something usually needs to “break” beyond just a slowdown in consumption, and what has typically triggered deep recessions are significant imbalances or excesses that need to unwind.

For example, in the mortgage debt crisis in 2008, consumers, corporates, and banks were all stretched and credit quality was questionable.4 That is not the case today – all are in strong financial shape.5

Could the crypto crash be the imbalance that triggers a correction? Parts of the crypto ecosystem are definitely breaking. Many speculative alt coins and businesses built on lending around crypto are being revealed as clearly unsustainable amid the market turmoil.

At first glance, however, it does not appear systemically significant, accounting for just a small fragment of the markets: roughly 27 million people or just 8.3% of the U.S. population hold crypto assets.6 In contrast, at the onset of the Global Financial Crisis, the mortgage market totaled $9.3 trillion in mortgage debt, including 63% of the U.S. population, while banks had large derivative exposure.7 For those that hold crypto, losses are severe but linkages to the core financial system are limited. This should mitigate the fallout for now, but we will examine this in more detail next week.

Bottom line, we do expect an economic slowdown in the second half of 2022 and in to 2023. But given the lack of imbalances and a sharp reset in valuations, there is still a chance we achieve the same outcome as in 1994: higher rates, slower growth, but no outright GDP contraction recession.

Equity multiples still not screaming buy

In this environment, where for the Fed and everyone else it is incredibly hard to predict which way the inflation data will break, it is difficult to make any decisive short-term calls for equities. One thing is clear—while inflation remains high, Fed actions will continue to depress multiples on equities and move stocks lower.

We might be around fair value for current market conditions, but if we are wrong and we are heading for a true recession, then we have yet to hit the bottom in equities. Market fair value would then be at recessionary levels (13.5x), which would imply a level of roughly 3,200 on the S&P 500, or another 15% down from today.8 While stocks have corrected meaningfully (pricing in 85% implied recession probabilities on the S&P 500), we are not yet at levels that scream buy.9 To get decisively bullish we would need to be on the other side of the growth slowdown. We are not.

Irrespective of the extent of the slowdown, investors should be preparing their portfolios with the worst-case scenario in mind.

Things to do in the face of a slowdown

Hopefully investors have already reduced exposure to unprofitable tech and narrowed down their positions to only their highest conviction stocks or indices. At current levels, we would not be meaningfully increasing equity allocations until we have seen more evidence of inflation slowing, the economic slowdown bottoming out, and importantly, the Fed shifting its hawkish tone. Until then, in this challenging market environment where little is certain, we recommend the following ideas:

1. Focus on stability and income (get paid while you wait): Consider short-term Treasuries and municipal bonds, given two-year durations trading at around 3.1%.10

2. Replace high beta exposure: Rotate out of riskier high beta stocks into lower-beta high-yield bonds and/or replace them with structures with downside protection, such as structured notes. Similarly, if adding new positions, do so with downside protection.

3. Have staying power & dry powder: Think about maintaining enough dry powder/liquidity to capitalize on opportunities when things do really get to “dirt cheap” levels. For example, we continue to like financial stocks, especially if the Fed delivers more rate hikes.

Elsewhere, for investors who can afford a little illiquidity, investing in alternatives can have advantages during a downturn.

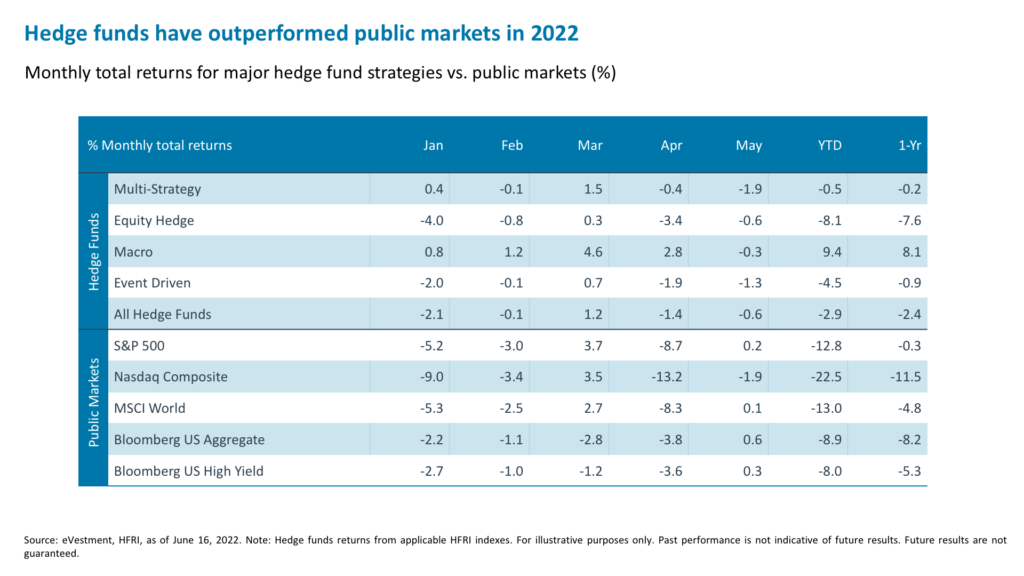

1. Hedge funds: All fund categories have outperformed the public markets, but certain strategies have even generated positive returns, such as macro funds.11

2. Private credit: While data lags, private lending is typically much less volatile than the high yield and leveraged loans space and benefits from floating rate spreads above interest rates.12

3. Private equity: Though it will certainly be impacted by the stock market valuation reset, private equity has historically been less volatile than public markets,13 and investors who allocate new cash during a downturn tend to see better returns than if they allocate at market peaks.14

Things not to do in the face of a slowdown

We would avoid consumer discretionary stocks as spending on discretionary items is squeezed. Consumers cannot really cut back on food and gasoline, so will cut elsewhere. We would also steer clear of stocks associated with housing and autos as demand is being and will be hit hard by sharply rising rates. Finally, broad semiconductor exposure is unlikely to pay off given that the overall sector is so sensitive to moves in global GDP, so we would stick with selective stock trades in this sector.

1. Bloomberg, iCapital Investment Strategy, as of June 15, 2022.

2. Bloomberg, FOMC Statement, as of June 15, 2022.

3. Bloomberg, as of June 15, 2022.

4. Bloomberg, iCapital Investment Strategy, as of June 15, 2022.

5. Bloomberg, iCapital Investment Strategy, as of June 15, 2022.

6. TripleA, as of June 15, 2022.

7. Bloomberg, Federal Reserve, BIS, as of June 15, 2022.

8. Bloomberg, iCapital Investment Strategy, as of June 15, 2022.

9. JPMorgan, as of June 16, 2022

10. Bloomberg, as of June 16, 2022.

11. HFRI, eVestment, as of June 16, 2022.

12. WealthManagement.com, “Adding Private Credit to a Client’s Portfolio,” April 20, 2021.

13. Cambridge Associates, “US Private Equity Index and Selected Benchmark Statistics”, as of March 2019.

14. PitchBook, as of May 10, 2022.

IMPORTANT INFORMATION

The material herein has been provided to you for informational purposes only by iCapital, Inc. (“iCapital”). This material is the property of iCapital and may not be shared without the written permission of iCapital. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of iCapital.

This material is provided for informational purposes only and is not intended as, and may not be relied on in any manner as, legal, tax or investment advice, a recommendation, or as an offer to sell, a solicitation of an offer to purchase or a recommendation of any interest in any fund or security. You should consult your personal accounting, tax and legal advisors to understand the implications of any investment specific to your personal financial situation. This material does not intend to address the financial objectives, situation or specific needs of any individual investor. Alternative investments are complex, speculative investment vehicles and are not suitable for all investors.

The information contained herein is an opinion only, as of the date indicated, and should not be relied upon as the only important information available. Any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets is not necessarily indicative of the future or likely performance. The information contained herein is subject to change, incomplete, and may include information and/or data obtained from third party sources that iCapital believes, but does not guarantee, to be accurate. iCapital considers this third-party data reliable, but does not represent that it is accurate, complete and/or up to date, and it should not be relied on as such. iCapital makes no representation as to the accuracy or completeness of this material and accepts no liability for losses arising from the use of the material presented. No representation or warranty is made by iCapital as to the reasonableness or completeness of such forward-looking statements or to any other financial information contained herein.

Securities products and services are offered by iCapital Markets, an SEC-registered broker-dealer, member FINRA and SIPC, and an affiliate of iCapital, Inc. and Institutional Capital Network, Inc. These registrations and memberships in no way imply that the SEC, FINRA, or SIPC have endorsed any of the entities, products, or services discussed herein. Annuities and insurance services are provided by iCapital Annuities and Insurance Services LLC, an affiliate of iCapital, Inc. “iCapital” and “iCapital Network” are registered trademarks of Institutional Capital Network, Inc. Additional information is available upon request.

© 2023 Institutional Capital Network, Inc. All Rights Reserved.