While this is essential to your decision-making process, it is equally important to understand the operations and underlying economics of a fund – the associated fees and expenses charged by the fund, the fund manager and any third-party service providers, and how often can subscriptions or redemptions be made. These considerations may determine whether an investment is appropriate for an investor’s risk profile and investment objectives. The hedge fund world is complex and there is a lot to take into consideration.

Before making a hedge fund investment, investors and their advisors should consider four key questions:

1. Where does a hedge fund fit in your overall portfolio?

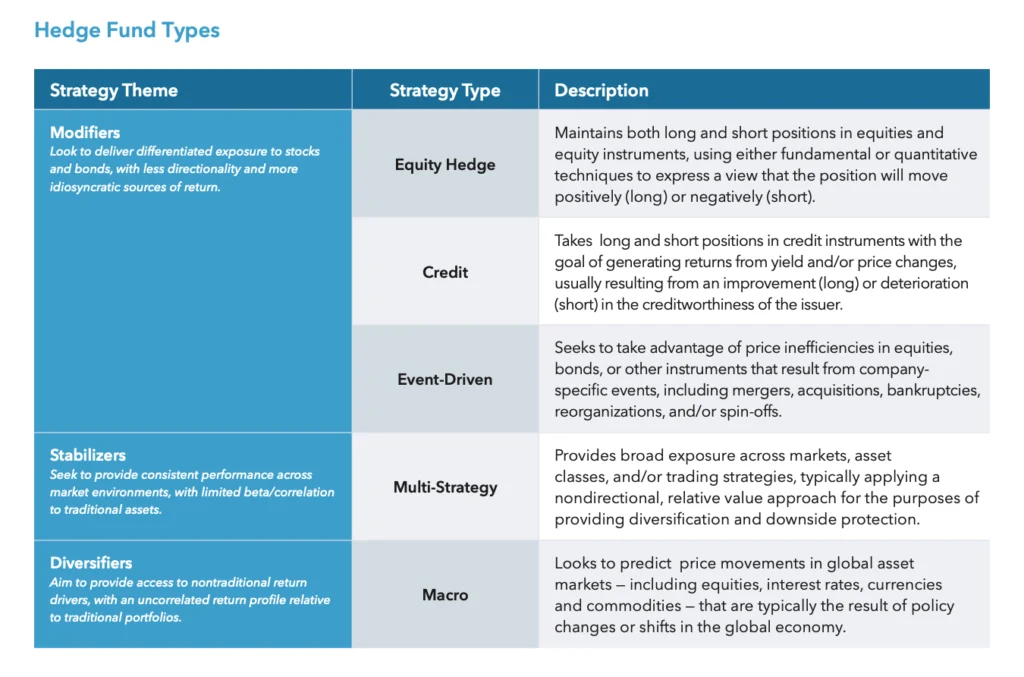

Hedge fund strategies extend across all markets, from equities and bonds, to commodities, currencies, credit, and derivatives. They can be guided by fundamental research, or they may be driven by quantitative methods, which explore not only the value of individual assets, but also make use of statistical analysis to exploit trading patterns, sectoral trends, or the rise and fall of volatility, for example. Hedge fund managers have developed a wide range of investment strategies that target an equally diverse range of investment objectives, including return enhancement, risk mitigation, and capital preservation. When considering an allocation to hedge funds, it is important to develop an understanding of the strategy objectives and investment styles to determine how hedge funds can complement your existing portfolio and align with your overall investment goals.

2. Are you comfortable with the manager’s investment process and operations after completing due diligence?

It is critical to understand a manager’s investment strategy, process, structure, and the underlying drivers of the fund’s returns. Within each strategy, different managers take on different amounts of risk to achieve their individual return targets, leading to a wide range of prospective risk/return profiles. An investor should analyze the fund’s track record from a quantitative standpoint, checking to see how returns compare to those of suitable benchmarks and the level of risk that was taken to achieve those returns. This includes an assessment of how the strategy would be expected to perform under various market scenarios.

Investment due diligence, however, is only half of the equation. A separate part of the due diligence process is operational due diligence, which analyzes the management firm’s operational procedures and compliance/regulatory framework. Hedge funds are much more complex than mutual funds or other publicly traded investment types, and they engage with a variety of third-party service providers in the execution of their investment strategy. Operational due diligence is a continual process of evaluating the operational aspects of a hedge fund and verifying what is conveyed in a fund’s offering documents, audited financials, and reference checks before, and while, invested. Investors are looking for any red flags that would indicate an unnecessary risk. If a hedge fund does not pass operational due diligence checks, an investor should not invest or, if already invested, seek to resolve the issue or withdraw from the fund.

3. What is the hedge fund’s liquidity profile?

In contrast to mutual funds or ETFs, hedge funds do not offer daily liquidity, but instead offer redemption terms that vary from fund to fund – some managers offer monthly or quarterly redemptions while others may require investments for a multiyear period. Investors must also give written notice of their intention to redeem, with notice periods typically ranging from 30 to 90 days in advance, allowing the manager to position the hedge fund’s portfolio to finance the redemption request.

In addition, most hedge funds have “lock-up periods,” a length of time starting on the date of the initial investment, during which the investor cannot redeem, even upon request. The length of the lock-up period is typically one year but will vary by fund. In some cases, there may be a “hard lock,” with no redemption possible, while in other cases the investor may be able to withdraw funds early after paying a penalty (“soft lock”). Even after a lock-up has expired, withdrawals may be subject to a “gate” or redemption limit that constrains the amount of investor capital that can be withdrawn from the fund at any one time. The main purpose of gates is to prevent large scale, sudden withdrawals that could require the fund to liquidate large amounts of securities at fire-sale prices. Gates also help to align the fund’s liquidity with the characteristics of the underlying asset and/or trading strategy.

For investors considering an allocation to hedge funds, redemption windows, lock-up periods, and gate provisions are all crucial factors in determining if the redemption terms suit their liquidity needs.

4. Are you comfortable with the hedge fund’s fee structure?

Hedge funds charge management fees to cover their operating costs, including staff salaries, investment infrastructure, and general business expenses. The management fee typically ranges between 1–2% of assets under management, with newer or lower performing funds sometimes charging less, and high performing, high demand funds occasionally charging more. In addition to the management fee, hedge fund managers typically charge an incentive, or performance fee, which works to align their interests with those of investors. The standard hedge fund incentive fee has traditionally been 15–20% of fund profits, although like management fees, hedge fund managers may charge more or less, depending on the level of demand for their funds.

The purpose of the incentive fee is to motivate the hedge fund manager to generate profits for investors and to increase the fund’s net asset value (NAV). Incentive fees are charged on net capital appreciation, or the growth of the fund’s NAV.

While the fee structure may seem onerous, there are also several common protections for investors. High water marks stipulate that incentive fees can only be charged for any performance above an investor’s highest NAV in the fund (the high water mark). In other words, the high water mark ensures that a fund manager does not receive incentive fees for gains that merely recover previous losses. An additional protection sometimes offered in relation to the incentive fee is a hurdle rate, or a minimum level of return that must be generated in a certain period before any performance fee can be taken. Hurdle rates are much less common in hedge funds than high water marks, although funds with a hurdle rate also typically have a high water mark.

Fund expense fees are other fees incurred in the process of operating the fund and may include legal, audit, and administrative fees. In addition, certain, but not all hedge funds, may charge an additional layer of costs known as pass through fees. Pass through fees are often utilized by “platform” firms which employ multiple portfolio management teams who make investments on behalf of the fund. Pass through fees are used to cover payouts to these portfolio management teams, who receive a portion of profits they generate for the fund, and to cover other expenses incurred by the teams.

Investors considering an allocation to hedge funds should keep in mind that hedge fund performance should always be assessed net of fees, and that these fees generally should be viewed in relation to the level and quality of money management that is being provided.

IMPORTANT INFORMATION

The material herein has been provided to you for informational purposes only by Institutional Capital Network, Inc. (“iCapital Network”) or one of its affiliates (iCapital Network together with its affiliates, “iCapital”). This material is the property of iCapital and may not be shared without the written permission of iCapital. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of iCapital.

This material is provided for informational purposes only and is not intended as, and may not be relied on in any manner as, legal, tax or investment advice, a recommendation, or as an offer or solicitation to buy or sell any security, financial product or instrument, or otherwise to participate in any particular trading strategy. This material does not intend to address the financial objectives, situation, or specific needs of any individual investor. You should consult your personal accounting, tax and legal advisors to understand the implications of any investment specific to your personal financial situation.

ALTERNATIVE INVESTMENTS ARE CONSIDERED COMPLEX PRODUCTS AND MAY NOT BE SUITABLE FOR ALL INVESTORS. Prospective investors should be aware that an investment in an alternative investment is speculative and involves a high degree of risk. Alternative Investments often engage in leveraging and other speculative investment practices that may increase the risk of investment loss; can be highly illiquid; may not be required to provide periodic pricing or valuation information to investors; may involve complex tax structures and delays in distributing important tax information; are not subject to the same regulatory requirements as mutual funds; and often charge high fees. There is no guarantee that an alternative investment will implement its investment strategy and/or achieve its objectives, generate profits, or avoid loss. An investment should only be considered by sophisticated investors who can afford to lose all or a substantial amount of their investment.

iCapital Markets LLC operates a platform that makes available financial products to financial professionals. In operating this platform, iCapital Markets LLC generally earns revenue based on the volume of transactions that take place in these products and would benefit by an increase in sales for these products.

The information contained herein is an opinion only, as of the date indicated, and should not be relied upon as the only important information available. Any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets is not necessarily indicative of the future or likely performance. The information contained herein is subject to change, incomplete, and may include information and/or data obtained from third party sources that iCapital believes, but does not guarantee, to be accurate. iCapital considers this third-party data reliable, but does not represent that it is accurate, complete and/or up to date, and it should not be relied on as such. iCapital makes no representation as to the accuracy or completeness of this material and accepts no liability for losses arising from the use of the material presented. No representation or warranty is made by iCapital as to the reasonableness or completeness of such forward-looking statements or to any other financial information contained herein.

Securities products and services are offered by iCapital Markets, an SEC-registered broker-dealer, member FINRA and SIPC, and an affiliate of iCapital, Inc. and Institutional Capital Network, Inc. These registrations and memberships in no way imply that the SEC, FINRA, or SIPC have endorsed any of the entities, products, or services discussed herein. Annuities and insurance services are provided by iCapital Annuities and Insurance Services LLC, an affiliate of iCapital, Inc. “iCapital” and “iCapital Network” are registered trademarks of Institutional Capital Network, Inc. Additional information is available upon request.

©2024 Institutional Capital Network, Inc. All Rights Reserved. | 2024.01