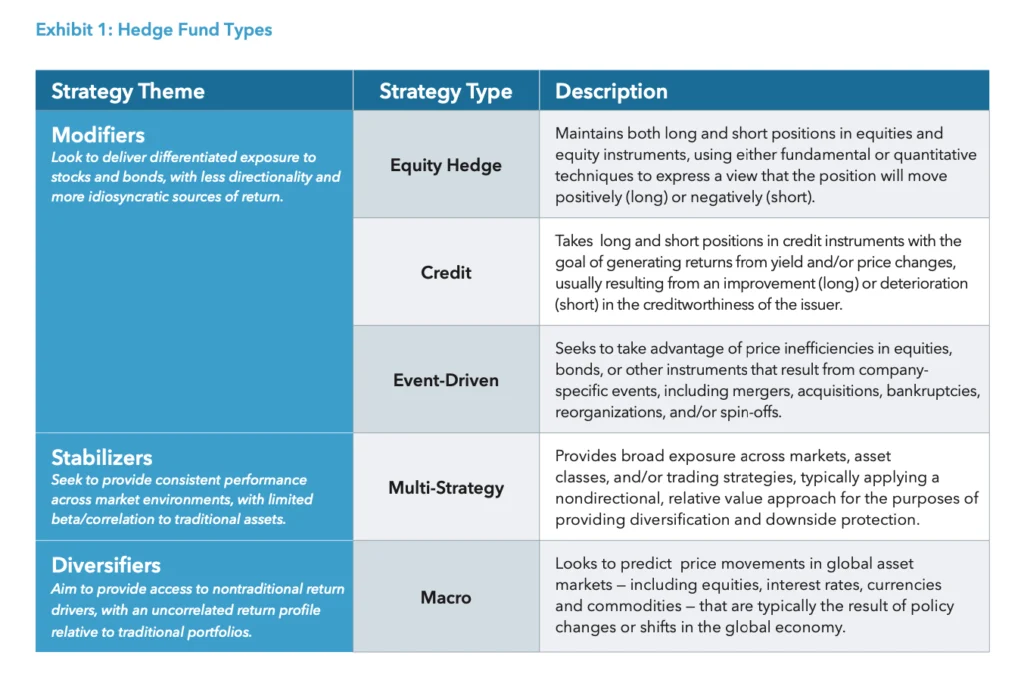

Market conditions ebb-and-flow over time, and various hedge fund strategies perform differently during changing market environments. In the same manner that value and growth stocks or domestic and international equities move in and out of favor, hedge fund strategies show similar tendencies, with each responding differently to economic and market conditions.

For investors and advisors considering an allocation to hedge funds, it is important to develop an understanding of the most common themes, strategies, and investment styles. Here we will delve into the three themes – modifiers, stabilizers, and diversifiers – and how five hedge fund strategy types fit within each theme, adding distinct value in client portfolios.

1. MODIFIERS

Modifiers aim to deliver differentiated exposure to stocks and bonds, with less directionality and more idiosyncratic sources of return. As such, these funds may be used to replace, or “modify,” traditional long only equity or fixed income exposure in a client’s portfolio. There are three main hedge fund strategy types that fit within the Modifier category: Equity Hedge, Credit, and Event-Driven.

Equity Hedge: Taking a fundamental or quantitative approach, the equity hedge strategy is characterized by the ability to take both long and short positions in individual stocks. At a basic level, portfolios are constructed by combining a core group of long positions in stocks that a manager believes will increase in value (move positively), with short positions in stocks they believe will decrease in value.

Strategies can be defined by market sensitivity, or the ratio of long to short exposure in a portfolio. Fund managers may operate with a long or short bias, or they may choose to shift their exposure opportunistically to position the portfolio in anticipation of changing market conditions. A strategy that seeks to maintain a balanced long and short ratio is said to be “market neutral.” An industry or regional focus, or the methods that fund managers use for stock selection, can further differentiate long/short equity strategies.

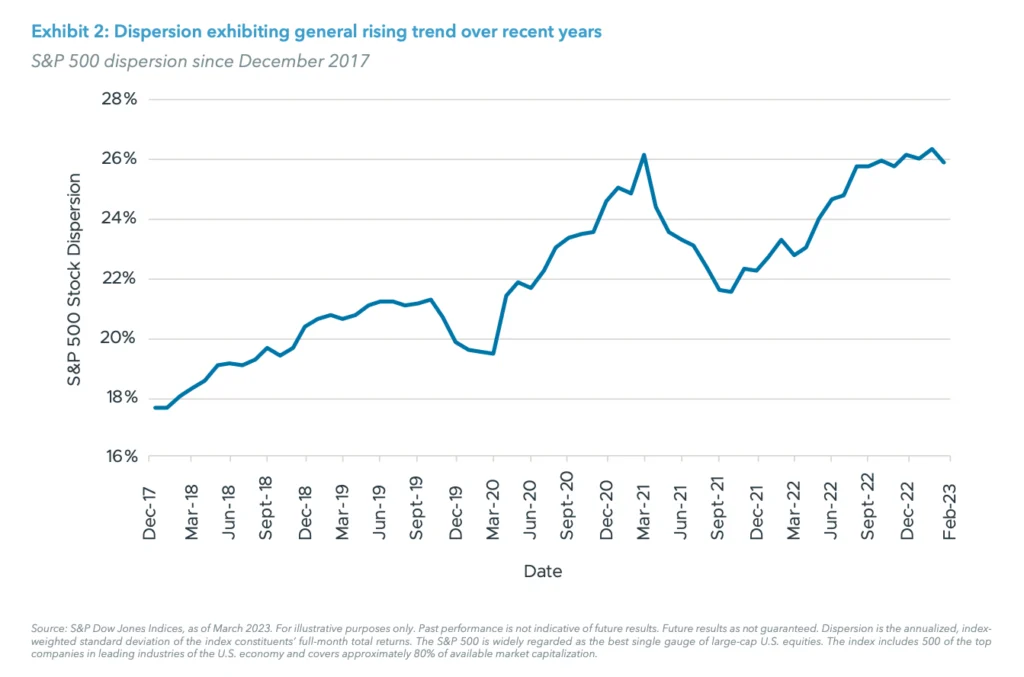

Historically, the most advantageous environment for equity hedge has been characterized by low correlations between different individual companies’ share prices, or higher dispersion, which generates greater opportunity on both the long and short sides of a manager’s portfolio. Recent trends in equity dispersion signal an improving backdrop for equity hedge strategies.

Credit: Credit strategies share a similar trading approach with other modifying strategies, but they apply them exclusively to the broad range of instruments available in global credit markets. Modifying credit strategies typically focus on investment grade and high yield corporate credit, with exposure to structured credit, municipal bonds, collateralized loans, and asset-backed and mortgage- backed securities, with the goal of delivering differentiating returns for investors.

Consequently, there are numerous investment styles possible under the rubric of credit strategies. A fund can take long and short positions in different credit instruments — long a corporate bond and short a high yield index, for example — to express a view that a company’s credit will perform better than the index. Or a fund could go long and short credit instruments of the same company with different durations in what is known as a cap structure trade — long a company’s 1-year bond and short its 10- year bond, for example — which expresses a view on the company’s short-term solvency as compared to its long- term creditworthiness.

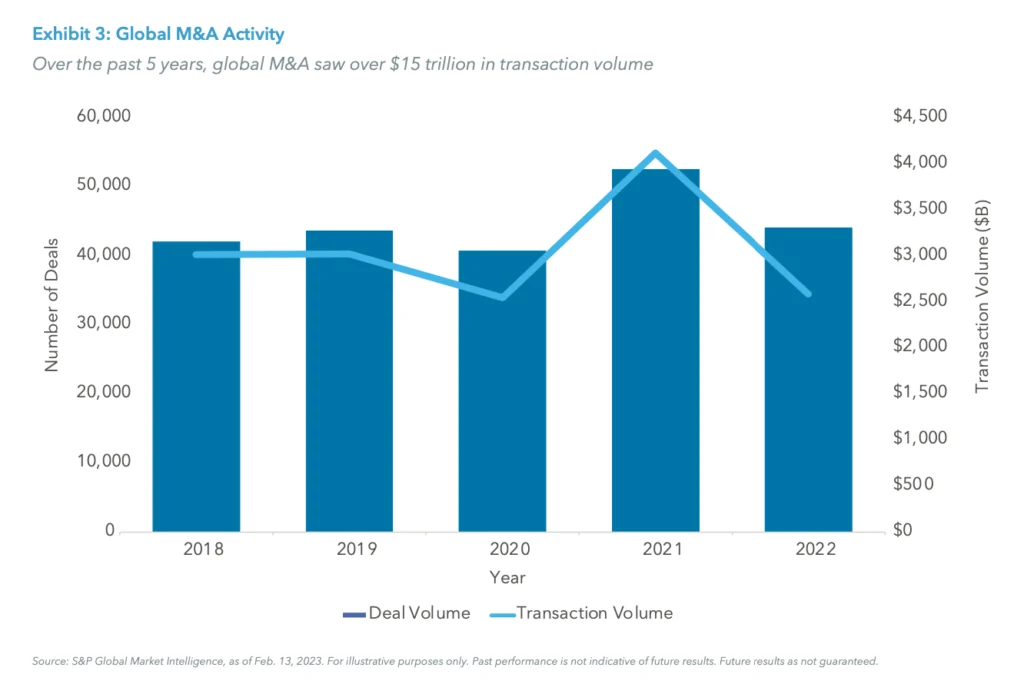

Event-Driven: Event-driven strategies are designed to take advantage of price movements in securities affected by corporate actions such as merger and acquisition (M&A) deals, spin-offs, restructurings, or bankruptcies. There are numerous types of event-driven sub-strategies, typically defined by the events they target. These sub-strategies are highly dependent on corporate events and activities and may provide higher returns during periods when companies seek out specific ways to increase shareholder capital, as opposed to simply benefitting from the “rising tide” of equity markets drifting higher over time.

Merger arbitrage is a common investment style within the event-driven strategy category. With this investment style, managers seek to take advantage of price movements in the stocks of an acquirer and target companies when a merger is announced. Until a merger is completed, there is usually a difference between the takeover bid price and the current stock price of the takeover candidate, reflecting the risk that the merger may not happen as proposed. Merger arbitrage trades seek to capture and realize this pricing arbitrage.

Other investment styles in the event-driven category include debt restructurings, balance sheet recapitalizations, corporate spin-offs, and shareholder activism, and involve entering a position either in response to, or in anticipation of, potential corporate events. Shareholder activism positions occur when fund managers accumulate large shareholdings in order to influence company management and encourage the desired outcome. For instance, an activist manager who owns over 5% of a target company may publicly advocate for changes, such as the replacement of company management or divesting a non-core division and will often seek representation on the company’s board of directors.

2. STABILIZERS

The purpose of stabilizers is to provide consistent performance across market environments, with limited beta1 and modest correlation to traditional assets. These funds typically have an absolute return focus, making them a potentially attractive complement to a client’s stock and bond investments.

Multi-Strategy: Multi-strategy funds can allocate capital dynamically across strategies, asset classes, sectors, and geographies. They may use a single portfolio manager approach or may deploy capital across an array of portfolio management teams within the fund. When executed well, this approach is designed to generate consistent returns with low volatility, regardless of overall market conditions.

Many funds within this strategy type employ a relative value investment style, which is a form of arbitrage that focuses on perceived mispricing between related instruments and relies less on market direction to generate returns. This investment style involves the use of spread trades — going long a security perceived to be undervalued, while shorting another security perceived to be overvalued — in order to capture performance as both securities return to their “fair value.” Relative value can be applied to any type of related securities, including stocks, bonds, futures, options, currencies, and commodities.

3. DIVERSIFIERS

Diversifiers seek to provide access to nontraditional return drivers, with an uncorrelated return profile relative to traditional portfolios. They often do so by investing across a broader range of asset classes on a global basis, and by shifting exposures long or short depending on the market environment.

Macro: Macro strategies seek to benefit from observations and predictions based on broad economic activity, political outcomes, and differing macroeconomic policies employed by countries around the globe. As a result, fund managers typically have a wide latitude to structure trades using virtually any trading strategy or financial instrument in any market around the world.

Macro hedge funds may be directional in nature, looking to capture positive (long) or negative (short) moves in asset prices, or may take a market neutral approach which focuses on spreads and arbitrage opportunities. Strategies may involve trading instruments directly influenced by interest rates and exchange rates, or indirectly by broad macroeconomic indicators such as inflation, unemployment, industrial production, foreign trade, and liquidity flows.

Many of the larger macro hedge funds use a systematic investment style approach, employing sophisticated computer-driven trading programs to analyze and profit from recognized price trends in either direction (rising or falling) across asset classes and markets.

Alternatively, macro hedge funds can also use a discretionary investment style, relying primarily on human-based analysis to drive trade selection and portfolio construction.

Conclusion

Hedge funds offer an opportunity to realize excess absolute or risk-adjusted returns, and engage in investments with substantial geographical, sectoral, asset class, and strategic diversification. These features enhance the manager’s ability to navigate a wide range of market conditions and pursue performance above the market average.

Hedge funds are designed to provide multiple benefits in client portfolios. They can modify existing stock and bond exposure by accessing differentiated return sources. They can stabilize the risk-adjusted performance of the overall portfolio by investing in multiple, uncorrelated strategies with returns that are independent of market direction. And they can diversify a traditional asset allocation by introducing funds that often thrive during periods of increased market volatility and macroeconomic uncertainty. Understanding what each strategy is meant to provide is crucial in constructing robust portfolios that can deliver the desired results across changing market conditions.

ENDNOTES

1. Beta describes the activity of an investment’s returns as it responds to swings in the market.

IMPORTANT INFORMATION

The material herein has been provided to you for informational purposes only by Institutional Capital Network, Inc. (“iCapital Network”) or one of its affiliates (iCapital Network together with its affiliates, “iCapital”). This material is the property of iCapital and may not be shared without the written permission of iCapital. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of iCapital.

This material is provided for informational purposes only and is not intended as, and may not be relied on in any manner as, legal, tax or investment advice, a recommendation, or as an offer or solicitation to buy or sell any security, financial product or instrument, or otherwise to participate in any particular trading strategy. This material does not intend to address the financial objectives, situation, or specific needs of any individual investor. You should consult your personal accounting, tax and legal advisors to understand the implications of any investment specific to your personal financial situation.

ALTERNATIVE INVESTMENTS ARE CONSIDERED COMPLEX PRODUCTS AND MAY NOT BE SUITABLE FOR ALL INVESTORS. Prospective investors should be aware that an investment in an alternative investment is speculative and involves a high degree of risk. Alternative Investments often engage in leveraging and other speculative investment practices that may increase the risk of investment loss; can be highly illiquid; may not be required to provide periodic pricing or valuation information to investors; may involve complex tax structures and delays in distributing important tax information; are not subject to the same regulatory requirements as mutual funds; and often charge high fees. There is no guarantee that an alternative investment will implement its investment strategy and/or achieve its objectives, generate profits, or avoid loss. An investment should only be considered by sophisticated investors who can afford to lose all or a substantial amount of their investment.

iCapital Markets LLC operates a platform that makes available financial products to financial professionals. In operating this platform, iCapital Markets LLC generally earns revenue based on the volume of transactions that take place in these products and would benefit by an increase in sales for these products.

The information contained herein is an opinion only, as of the date indicated, and should not be relied upon as the only important information available. Any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets is not necessarily indicative of the future or likely performance. The information contained herein is subject to change, incomplete, and may include information and/or data obtained from third party sources that iCapital believes, but does not guarantee, to be accurate. iCapital considers this third-party data reliable, but does not represent that it is accurate, complete and/or up to date, and it should not be relied on as such. iCapital makes no representation as to the accuracy or completeness of this material and accepts no liability for losses arising from the use of the material presented. No representation or warranty is made by iCapital as to the reasonableness or completeness of such forward-looking statements or to any other financial information contained herein.

Securities products and services are offered by iCapital Markets, an SEC-registered broker-dealer, member FINRA and SIPC, and an affiliate of iCapital, Inc. and Institutional Capital Network, Inc. These registrations and memberships in no way imply that the SEC, FINRA, or SIPC have endorsed any of the entities, products, or services discussed herein. Annuities and insurance services are provided by iCapital Annuities and Insurance Services LLC, an affiliate of iCapital, Inc. “iCapital” and “iCapital Network” are registered trademarks of Institutional Capital Network, Inc. Additional information is available upon request.

©2024 Institutional Capital Network, Inc. All Rights Reserved. | 2024.01