The news of DeepSeek took the world by storm over the weekend and into Monday morning, with internet stocks reacting sharply lower in the U.S. and sharply higher in China. The key question for U.S. investors is whether the era of U.S. Big Tech supremacy in AI is over. We don’t believe so and view today’s early price action as a market overreaction. In this brief commentary, we outline the reasons for this view.

1. The efficiency revelations stemming from reports that DeepSeek is able to outperform western models such as ChatGPT while significantly reducing the cost and time of training may in the end have a positive impact on the likes of Microsoft, OpenAI, META, Amazon and others. Assuming the efficiency reports are correct, these U.S. companies may explore introducing these efficiencies to their models, especially considering DeepSeek is open-source. Indeed, in a recent CNBC interview, the Perplexity AI CEO noted that companies could leverage DeepSeek’s R1 model for their own AI language models.1 However, there is also analyst talk that DeepSeek’s model is a derivative model that relies on larger foundation models, such as Meta’s open-source Llama models – so it doesn’t actually replace it2.

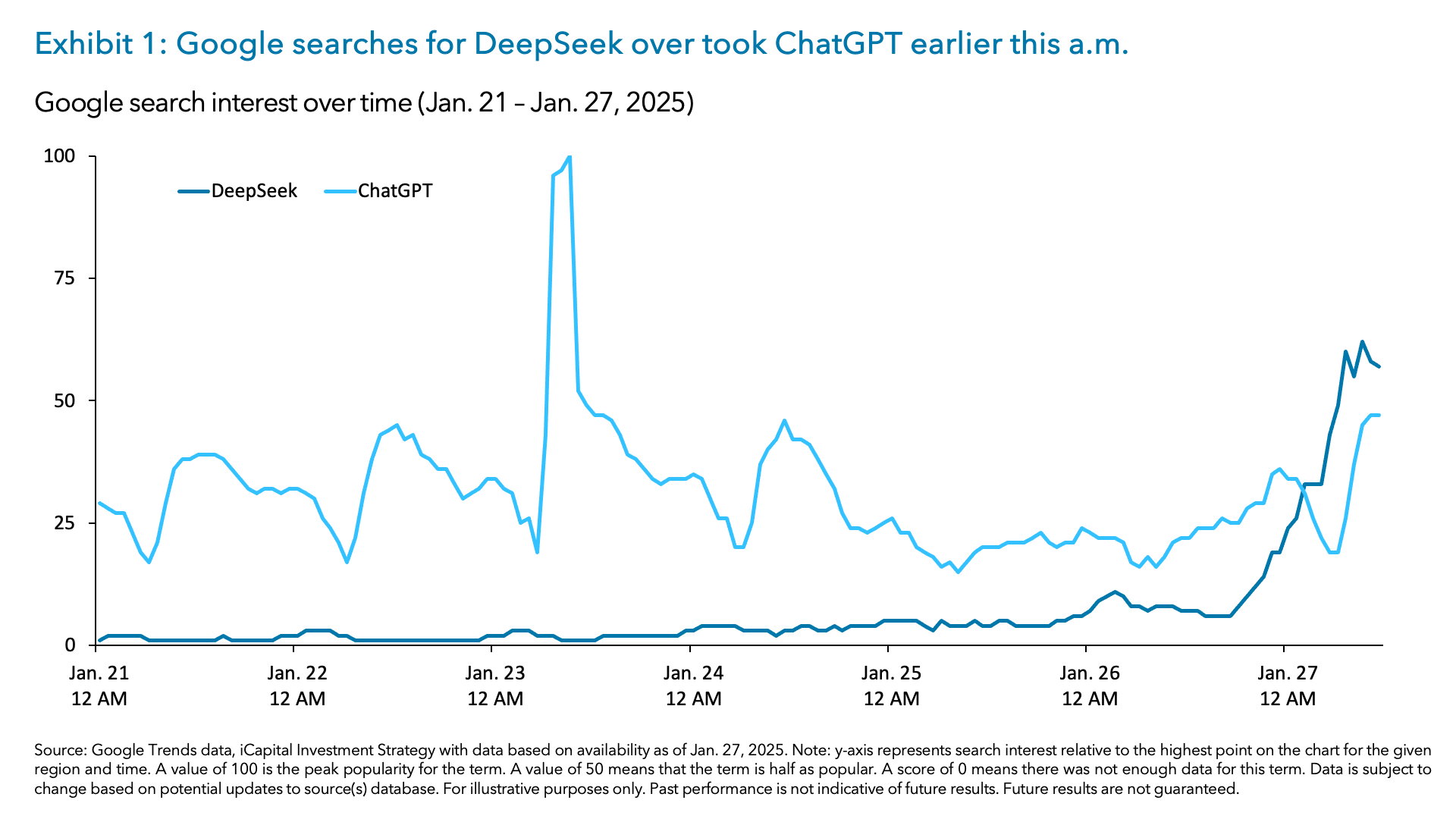

2. DeepSeek is not a true substitute for ChatGPT given the data privacy and security concerns associated with a China-based app in the era of heightened geopolitical and tech vigilance between the U.S. and China. Despite the DeepSeek app climbing to the #1 download under the free app section on the Apple App Store early Monday morning, the app itself restricted its use to Chinese numbers only. Additionally, even without this step, given the scrutiny around TikTok for similar privacy and security reasons, we would not be surprised by potential Trump administration moves to try to block its use.

3. Growing AI competition from China (which should not be at all a surprise as the country has long prioritized AI development) may actually increase the focus on domestic U.S. AI investment. This should support robust AI capex benefiting a range of semiconductor, power producer and data center companies. Plus, analysts note that AI semiconductor demand is also coming from a variety of foundational and derivative models, as well as cloud, enterprise and sovereign AI customers. Additionally, we still expect increased demand for semiconductors from the buildout of physical AI. Thus, the demand for compute still seems broad and robust, even if hyperscalers may learn to train AI more efficiently.

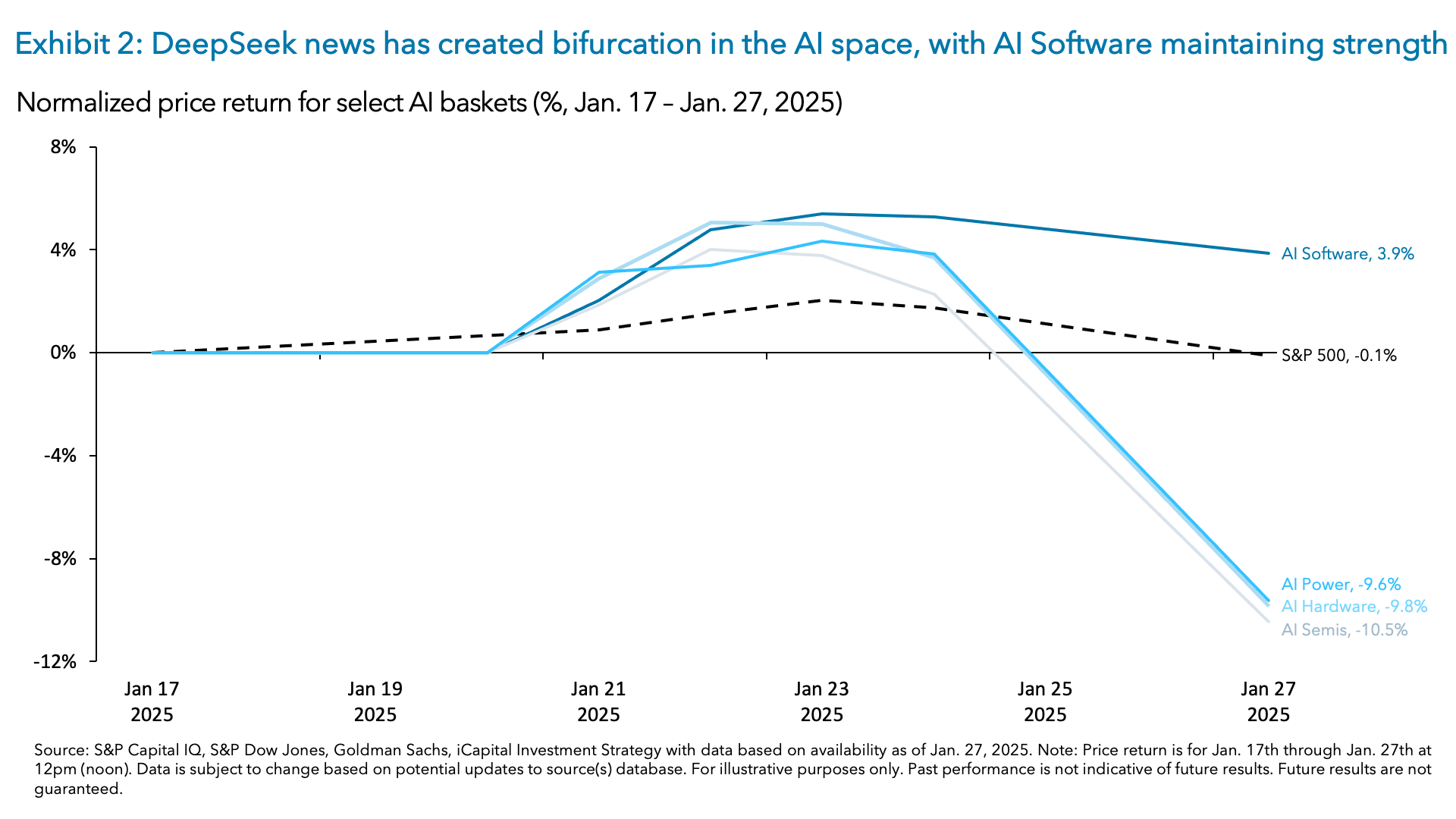

4. U.S. domestically focused software companies should continue to roll out AI capabilities, beyond the broadly publicized available agents like ChatGPT. If there is anything to be learned from the DeepSeek open-source model, they may be able to do it more efficiently/cheaper. Investors seem to agree as the Goldman Sachs AI Software basket traded much better than other AI beneficiary baskets throughout the day.3

5. Big tech earnings reports are front and center this week, potentially alleviating the DeepSeek concerns. Microsoft and Meta report on Wednesday and Apple on Thursday. Together, the Mag 74 stocks are forecast to report +21.7% Q4 ’24 EPS growth and analysts expect ongoing 17% – 24% quarterly year-over-year earnings growth through 20255. We will be looking for constructive commentary confirming expected solid demand for AI products despite the launch of DeepSeek. Additionally, we will be paying close attention to any commentary on less semiconductor content needed for AI capex, and/or any talk of lower unit prices on these chips.

Investment Implications

The tech ecosystem is clearly adjusting to a potential new reality – that U.S. Big Tech will not be the only provider of cutting-edge AI capabilities. But for the reasons outlined above and given protectionist stances on AI in both U.S. and China, our early takeaway is that there is room for both U.S. and China-based AI products to grow and co-exist, and they do not immediately replace one another.

We remain favorable on U.S. Big Tech into earnings this week; we continue to favor AI software and AI power companies given their domestic focus and especially now on the pullback; and we remain vigilant on AI semiconductors but see a potential opportunity to add, assuming we hear constructive commentary on semiconductor capex from hyperscalers this week.

1. How China’s new AI model DeepSeek is threatening U.S. dominance, as of Jan. 24, 2025.

2. BofA Global Research, as of Jan. 27, 2025.

3. Goldman Sachs, as of Jan. 27, 2025.

4. Mag 7 stocks include: Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, Tesla.

5. FactSet Earnings Insights, as of Jan. 17, 2025.

INDEX DEFINITIONS

Goldman AI Hardware Basket: designed to represent the 3 of the 4 main components of data centers: (1) the facility itself; (2) the industrial equipment, including the mechanical, electrical; (3) the IT hardware.

Goldman Sachs Power Up America Basket: composed of unregulated energy producers and related industries that benefit from the rising demand of power.

Goldman Sachs AI Semiconductor Basket: composed of semiconductors names with the potential for AI to drive incremental earnings, and excluding analog semiconductors.

Goldman Sachs AI Software Basket: composed of software names with the potential for AI to drive incremental earnings, which include infrastructure, platform and security layers of the stack.

S&P 500 Index: The S&P 500 is widely regarded as the best single gauge of large-cap U.S. equities. The index includes 500 of the top companies in leading industries of the U.S. economy and covers approximately 80% of available market capitalization.

IMPORTANT INFORMATION

The material herein has been provided to you for informational purposes only by Institutional Capital Network, Inc. (“iCapital Network”) or one of its affiliates (iCapital Network together with its affiliates, “iCapital”). This material is the property of iCapital and may not be shared without the written permission of iCapital. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of iCapital.

This material is provided for informational purposes only and is not intended as, and may not be relied on in any manner as, legal, tax or investment advice, a recommendation, or as an offer or solicitation to buy or sell any security, financial product or instrument, or otherwise to participate in any particular trading strategy. This material does not intend to address the financial objectives, situation, or specific needs of any individual investor. You should consult your personal accounting, tax and legal advisors to understand the implications of any investment specific to your personal financial situation.

ALTERNATIVE INVESTMENTS ARE CONSIDERED COMPLEX PRODUCTS AND MAY NOT BE SUITABLE FOR ALL INVESTORS. Prospective investors should be aware that an investment in an alternative investment is speculative and involves a high degree of risk. Alternative Investments often engage in leveraging and other speculative investment practices that may increase the risk of investment loss; can be highly illiquid; may not be required to provide periodic pricing or valuation information to investors; may involve complex tax structures and delays in distributing important tax information; are not subject to the same regulatory requirements as mutual funds; and often charge high fees. There is no guarantee that an alternative investment will implement its investment strategy and/or achieve its objectives, generate profits, or avoid loss. An investment should only be considered by sophisticated investors who can afford to lose all or a substantial amount of their investment.

iCapital Markets LLC operates a platform that makes available financial products to financial professionals. In operating this platform, iCapital Markets LLC generally earns revenue based on the volume of transactions that take place in these products and would benefit by an increase in sales for these products.

The information contained herein is an opinion only, as of the date indicated, and should not be relied upon as the only important information available. Any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets is not necessarily indicative of the future or likely performance. The information contained herein is subject to change, incomplete, and may include information and/or data obtained from third party sources that iCapital believes, but does not guarantee, to be accurate. iCapital considers this third-party data reliable, but does not represent that it is accurate, complete and/or up to date, and it should not be relied on as such. iCapital makes no representation as to the accuracy or completeness of this material and accepts no liability for losses arising from the use of the material presented. No representation or warranty is made by iCapital as to the reasonableness or completeness of such forward-looking statements or to any other financial information contained herein.

Securities products and services are offered by iCapital Markets, an SEC-registered broker-dealer, member FINRA and SIPC, and an affiliate of iCapital, Inc. and Institutional Capital Network, Inc. These registrations and memberships in no way imply that the SEC, FINRA, or SIPC have endorsed any of the entities, products, or services discussed herein. Annuities and insurance services are provided by iCapital Annuities and Insurance Services LLC, an affiliate of iCapital, Inc. “iCapital” and “iCapital Network” are registered trademarks of Institutional Capital Network, Inc. Additional information is available upon request.

©2025 Institutional Capital Network, Inc. All Rights Reserved.