With the Super Bowl right around the corner, we thought it would be fitting to focus on the growing role of private equity in sports.

For a long time, owning a professional sports team was seen as a personal venture or a generational investment and private equity and other institutional capital was largely on the sidelines. Indeed, when you think of the iconic teams and their owners, you picture names like Jerry Jones of the Dallas Cowboys or the Steinbrenner family of the Yankees – not private equity firms.

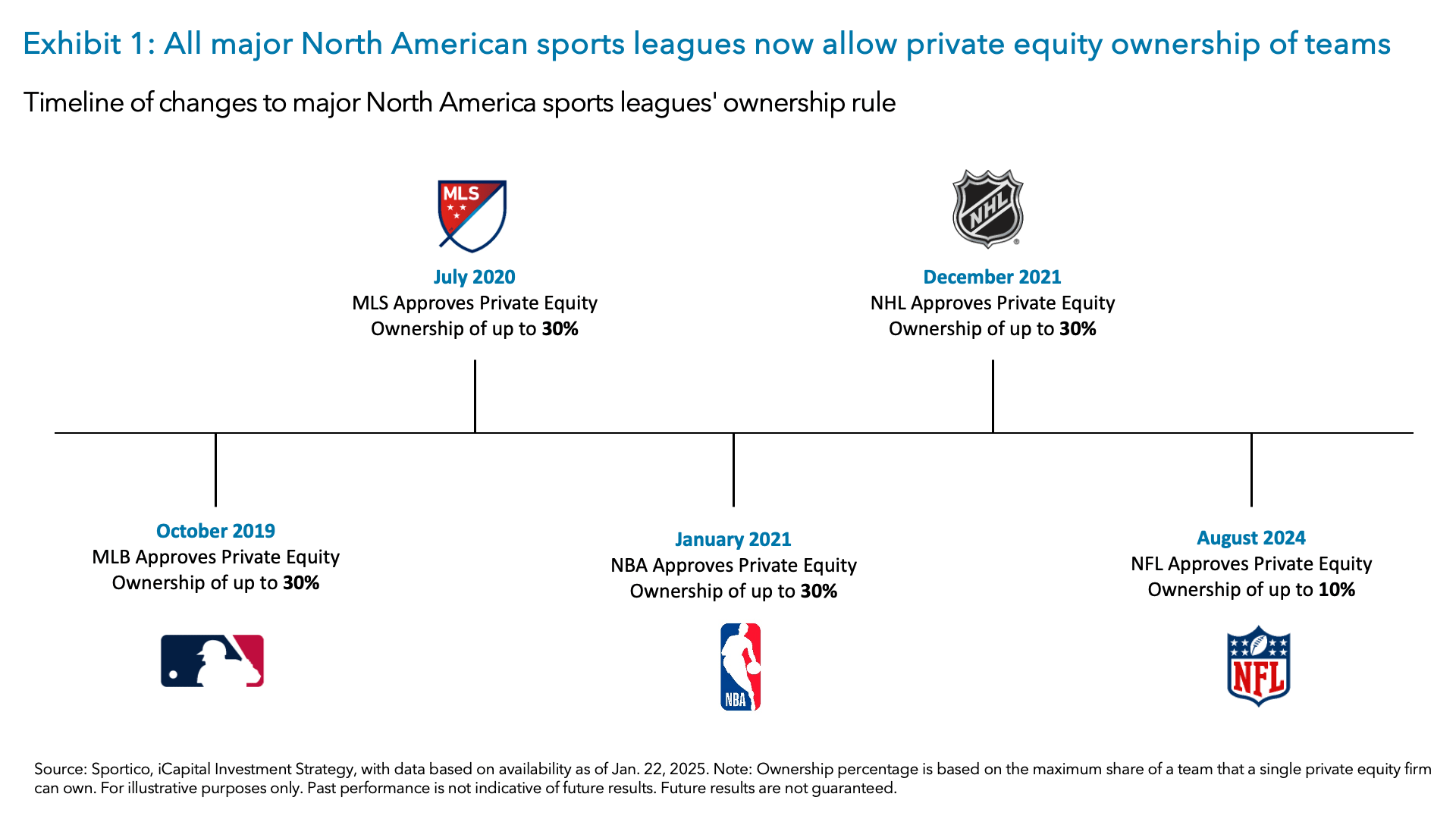

But today, that is all changing. Private equity firms are making their way onto the playing field as major sports leagues relax ownership rules and existing owners look to partially cash out. Just last year, the NFL gave the green light for select approved private equity funds to buy up to a 10% stake in teams1, joining several other major sports leagues that have opened their doors to institutional capital in the past five years (Exhibit 1).

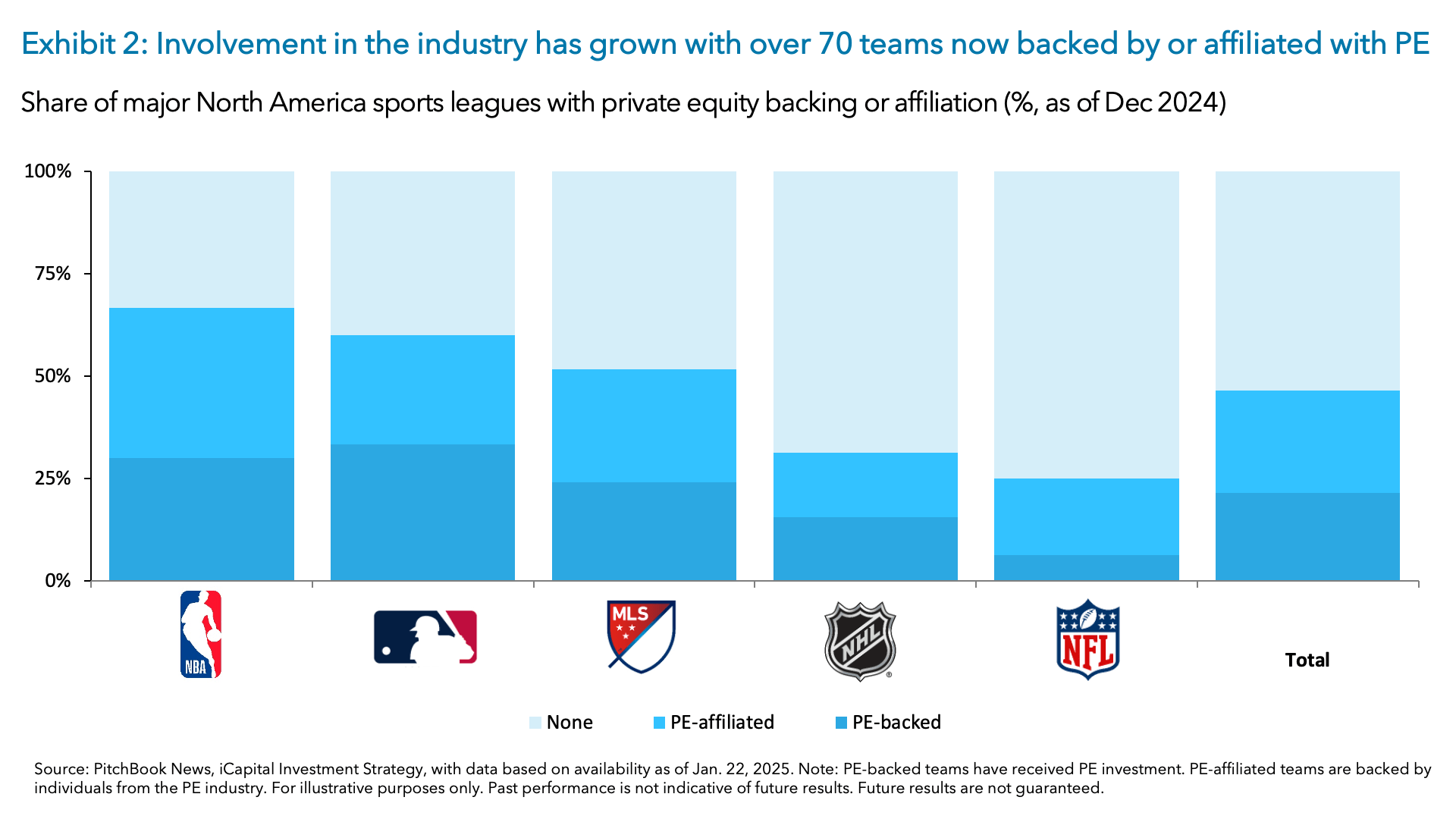

These rule changes have sparked a wave of private equity activity. Today, 71 major North American sports teams, collectively valued at over $205 billion, are now either backed by or affiliated with private equity (Exhibit 2).2 And the opportunity is still vast. Of the currently 153 teams across the NFL, NBA, MLB, NHL, and MLS, 82, or more than half, still do not have private equity involvement.3 And when you factor in growing areas like women’s sports, college sports, eSports, and even various international leagues, the potential for private equity to make an impact is sizable.

So why is private equity so eager to get in the game?

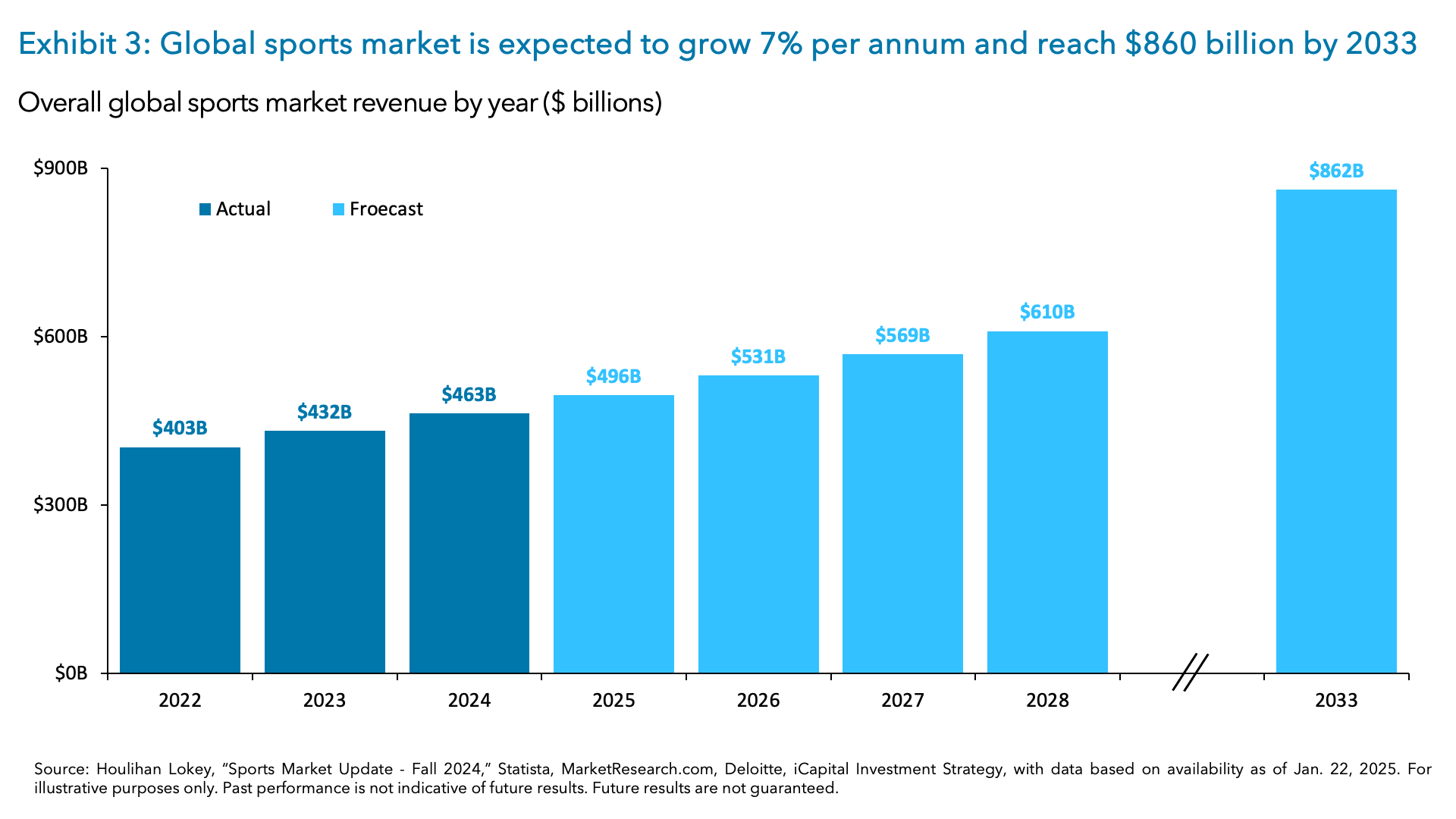

Well, for starters, the global sports market is massive, connecting nearly 8 billion people worldwide. And it’s not just about owning a sports team directly – it extends into media rights, merchandising, real estate, and even sports betting. Today, the global sports market is worth more than $460 billion annually and is expected to nearly double to $860 billion within the next decade (Exhibit 3).4

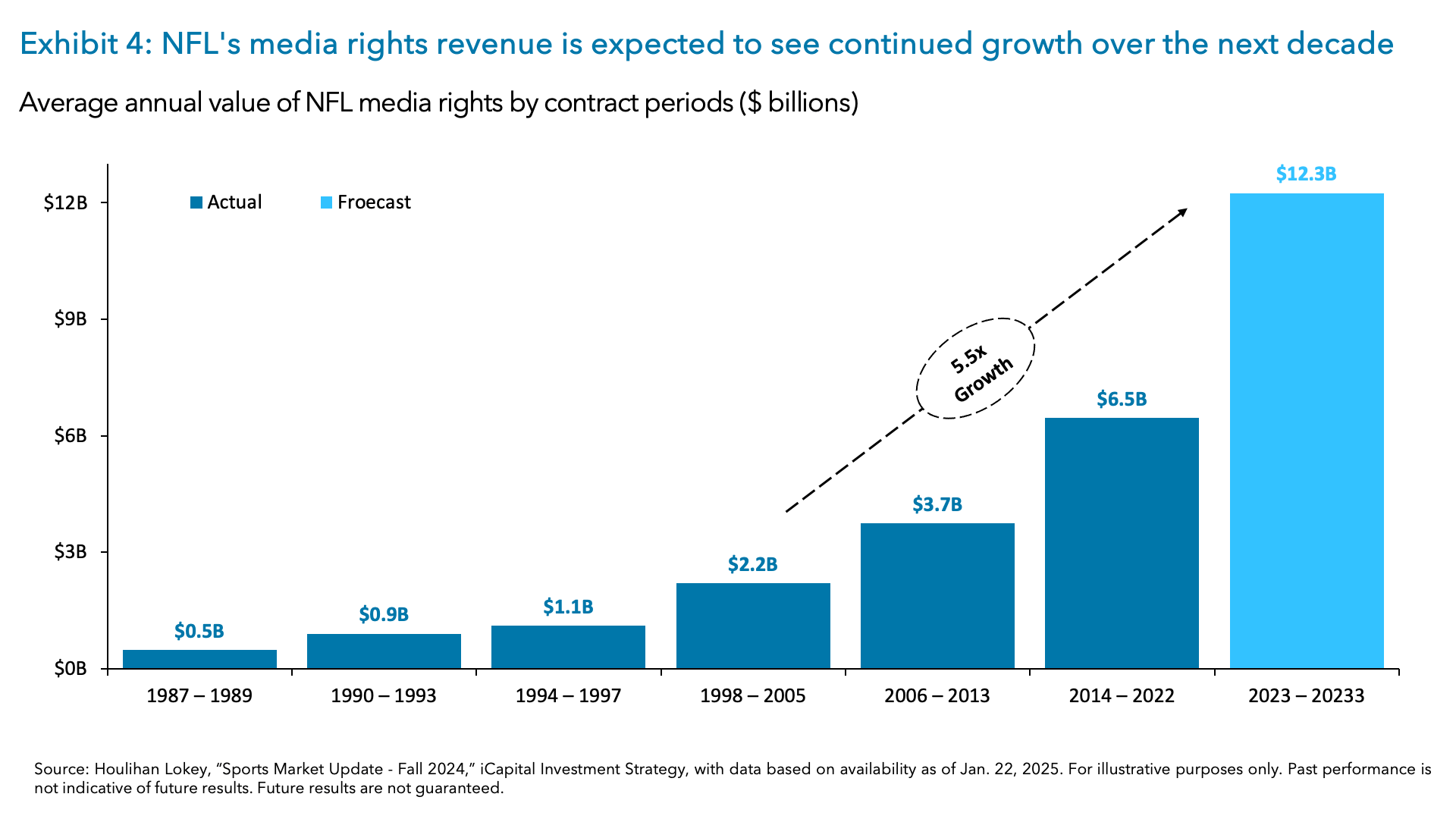

That’s a lot of growth potential and a big part of it is being fueled by media and streaming rights – especially as competition between Big Tech and legacy media heats up. Take the NFL for instance. Back in the late 90’s / early 2000’s (1998-2005), the average annual value of its media rights contract was around $2.2 billion. Today it’s $6.5 billion (Exhibit 4). And with the push for exclusive streaming rights from companies like Amazon and Netflix, that number is expected to jump to $12.3 billion over the coming decade – a nearly fivefold increase from the early 2000’s.5

And it’s not just the NFL cashing in. The NHL is expected to see its media rights revenue grow by 3.1x over the next decade, the MLS by 2.8x, and the NBA by 2.6x.6

What does this all mean?

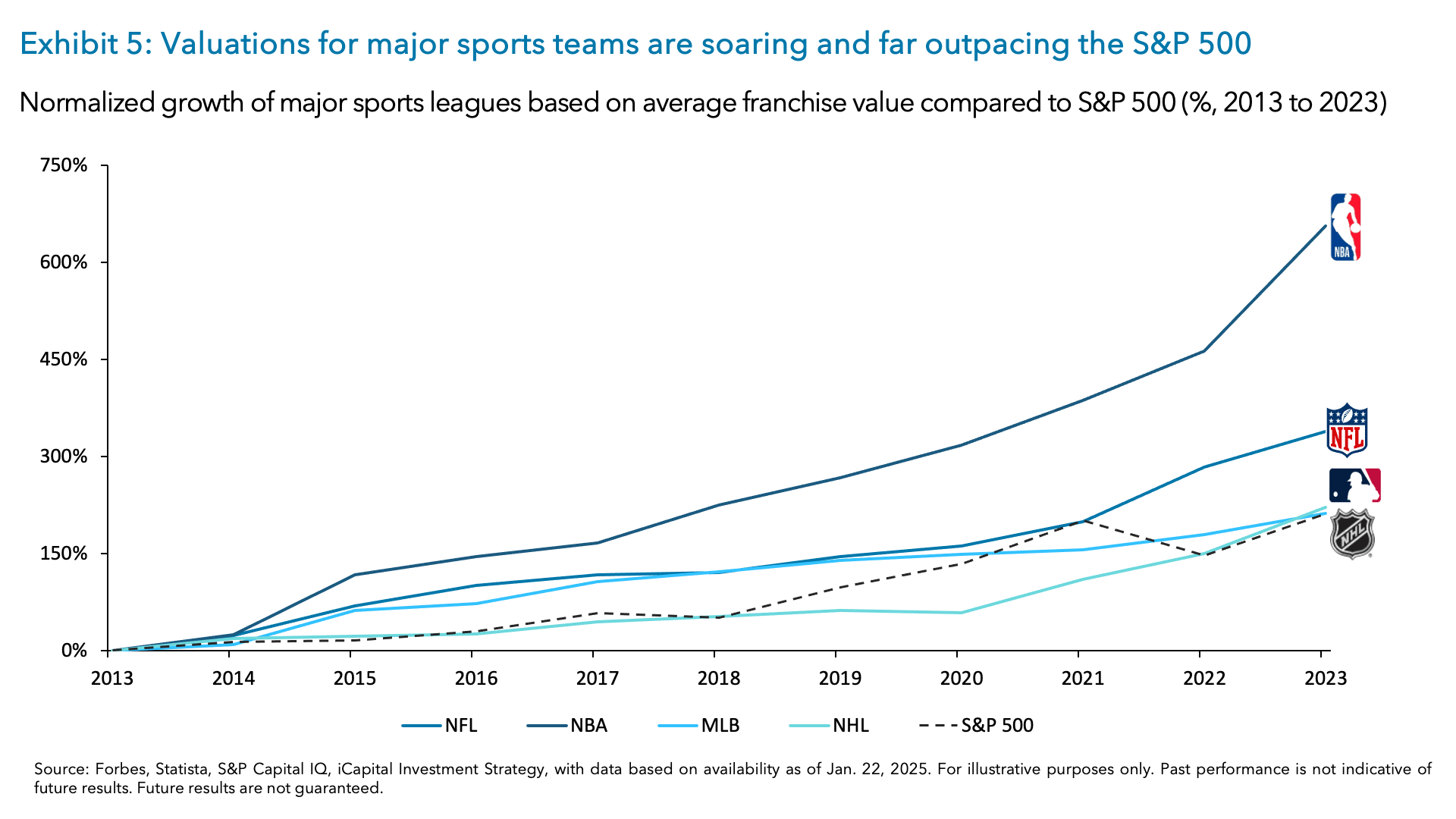

Well, bigger media right fees translate to larger revenue and profit sharing amongst the teams and their related businesses, ultimately pushing up valuations. Indeed, valuations for major sports teams are soaring (Exhibit 5). In the NBA and NFL, average franchise values have increased by a staggering +650% and +300% over the past ten years.7 For context, the S&P 500 has only risen by about +200% during this time.8

Across the major North American sports leagues (MLB, NBA, NFL, NHL), franchise values have compounded at +14.4% annually for the past 20 years, easily outpacing the S&P 500’s +10.7% growth.9 Private equity firms are seeing this continued growth and want in on the action.

The Future of PE in Sports

As private equity steps up to the plate, there is significant potential for these teams and the underlying assets to continue appreciating. Unlike traditional owners who might view a team as personal or generational investments, private equity sees these assets as operating businesses with untapped potential. PE firms are focusing on things like increasing operational efficiencies, consolidating and commercializing assets, and finding new ways to grow revenues through things like cutting-edge technologies to enhance fan engagement.

Surprisingly, this model isn’t new for private equity. In 2022, Sixth Street Partners invested €360 million to renovate Real Madrid’s stadium, boosting projected annual revenues from $168 million to $447-$491 million.10 Similarly, when CVC acquired Formula One in 2006, it restructured the business, expanded the race calendar, and secured lucrative media deals, ultimately increasing F1’s enterprise value to $8 billion before its 2016 sale to Liberty Media.11

And more recently, private equity has been investing heavily into data analytics and artificial intelligence (AI) to enhance various aspects of sports operations. For instance, in 2024, Gemini Sports Analytics secured significant funding to develop advanced AI-driven platforms aimed at optimizing player performance and strategic decision-making.12

As we look ahead, private equity is not just investing in sports – they are actively reshaping the industry.

For more on Private Equity’s involvement in the sports industry, check out our latest episode of Beyond 60/40 where we sit down with Marc Lasry, Co-Founder, CEO, & Chairman of Avenue Capital Group.

1. National Football League, as of Aug. 27, 2024.

2. PitchBook, as of Jan. 22, 2025. Note: PE-backed teams have received PE investment. PE-affiliated teams are backed by individuals from the PE industry.

3. PitchBook, iCapital Investment Strategy, as of Jan. 22, 2025.

4. Houlihan Lokey, “Sports Market Update - Fall 2024,” as of Sept. 7, 2024.

5. Houlihan Lokey, “Sports Market Update - Fall 2024,” as of Sept. 7, 2024.

6. Houlihan Lokey, “Sports Market Update - Fall 2024,” as of Sept. 7, 2024.

7. Forbes, Sportico, Statista, as of Jan. 22, 2025.

8. S&P Capital IQ, iCapital Investment Strategy, as of Jan. 22, 2025. Note: S&P 500 return based on 2014-2023.

9. Arctos, U. Michigan Ross, iCapital Investment Strategy, as of Jan. 22, 2025. Note: Franchise values based on the Ross-Arctos Sports Franchise Index as of Sept. 2024.

10. Sixth Street, as of May 19, 2022.

11. Forbes, “How CVC Has Made $8.2 Billion From Formula One Auto Racing”, as of Apr. 15, 2014

12. SportsPro, as of Apr. 17, 2024.

INDEX DEFINITIONS

Ross-Arctos Sports Franchise Index: The Ross-Arctos Sports Franchise Index seeks to provide a real-time, data-driven gauge of aggregate franchise valuation growth for the largest North American leagues (NFL, NBA, MLB, and NHL). The quarterly private asset index covers more than 60 years of North American franchise transactions.

S&P 500 Index: The S&P 500 is widely regarded as the best single gauge of large-cap U.S. equities. The index includes 500 of the top companies in leading industries of the U.S. economy and covers approximately 80% of available market capitalization.

IMPORTANT INFORMATION

The material herein has been provided to you for informational purposes only by Institutional Capital Network, Inc. (“iCapital Network”) or one of its affiliates (iCapital Network together with its affiliates, “iCapital”). This material is the property of iCapital and may not be shared without the written permission of iCapital. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of iCapital.

This material is provided for informational purposes only and is not intended as, and may not be relied on in any manner as, legal, tax or investment advice, a recommendation, or as an offer or solicitation to buy or sell any security, financial product or instrument, or otherwise to participate in any particular trading strategy. This material does not intend to address the financial objectives, situation, or specific needs of any individual investor. You should consult your personal accounting, tax and legal advisors to understand the implications of any investment specific to your personal financial situation.

ALTERNATIVE INVESTMENTS ARE CONSIDERED COMPLEX PRODUCTS AND MAY NOT BE SUITABLE FOR ALL INVESTORS. Prospective investors should be aware that an investment in an alternative investment is speculative and involves a high degree of risk. Alternative Investments often engage in leveraging and other speculative investment practices that may increase the risk of investment loss; can be highly illiquid; may not be required to provide periodic pricing or valuation information to investors; may involve complex tax structures and delays in distributing important tax information; are not subject to the same regulatory requirements as mutual funds; and often charge high fees. There is no guarantee that an alternative investment will implement its investment strategy and/or achieve its objectives, generate profits, or avoid loss. An investment should only be considered by sophisticated investors who can afford to lose all or a substantial amount of their investment.

iCapital Markets LLC operates a platform that makes available financial products to financial professionals. In operating this platform, iCapital Markets LLC generally earns revenue based on the volume of transactions that take place in these products and would benefit by an increase in sales for these products.

The information contained herein is an opinion only, as of the date indicated, and should not be relied upon as the only important information available. Any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets is not necessarily indicative of the future or likely performance. The information contained herein is subject to change, incomplete, and may include information and/or data obtained from third party sources that iCapital believes, but does not guarantee, to be accurate. iCapital considers this third-party data reliable, but does not represent that it is accurate, complete and/or up to date, and it should not be relied on as such. iCapital makes no representation as to the accuracy or completeness of this material and accepts no liability for losses arising from the use of the material presented. No representation or warranty is made by iCapital as to the reasonableness or completeness of such forward-looking statements or to any other financial information contained herein.

Securities products and services are offered by iCapital Markets, an SEC-registered broker-dealer, member FINRA and SIPC, and an affiliate of iCapital, Inc. and Institutional Capital Network, Inc. These registrations and memberships in no way imply that the SEC, FINRA, or SIPC have endorsed any of the entities, products, or services discussed herein. Annuities and insurance services are provided by iCapital Annuities and Insurance Services LLC, an affiliate of iCapital, Inc. “iCapital” and “iCapital Network” are registered trademarks of Institutional Capital Network, Inc. Additional information is available upon request.

©2025 Institutional Capital Network, Inc. All Rights Reserved.