Since the start of 2023, semiconductor stocks have been on a tear, with the Philadelphia Stock Exchange Semiconductor Index, a proxy for the semiconductor industry, surging +87%, surpassing the S&P 500’s gain of +32% by nearly threefold.1 And despite industry revenues falling -8.2% in 2023 compared to record levels in 2022, the semiconductor index actually posted its highest annual return in 2023 since 2009 (Exhibit 1).2 Still even with this notable move higher, we think a combination of near-term cyclical drivers and longer-term secular trends could continue to support semiconductor stocks.

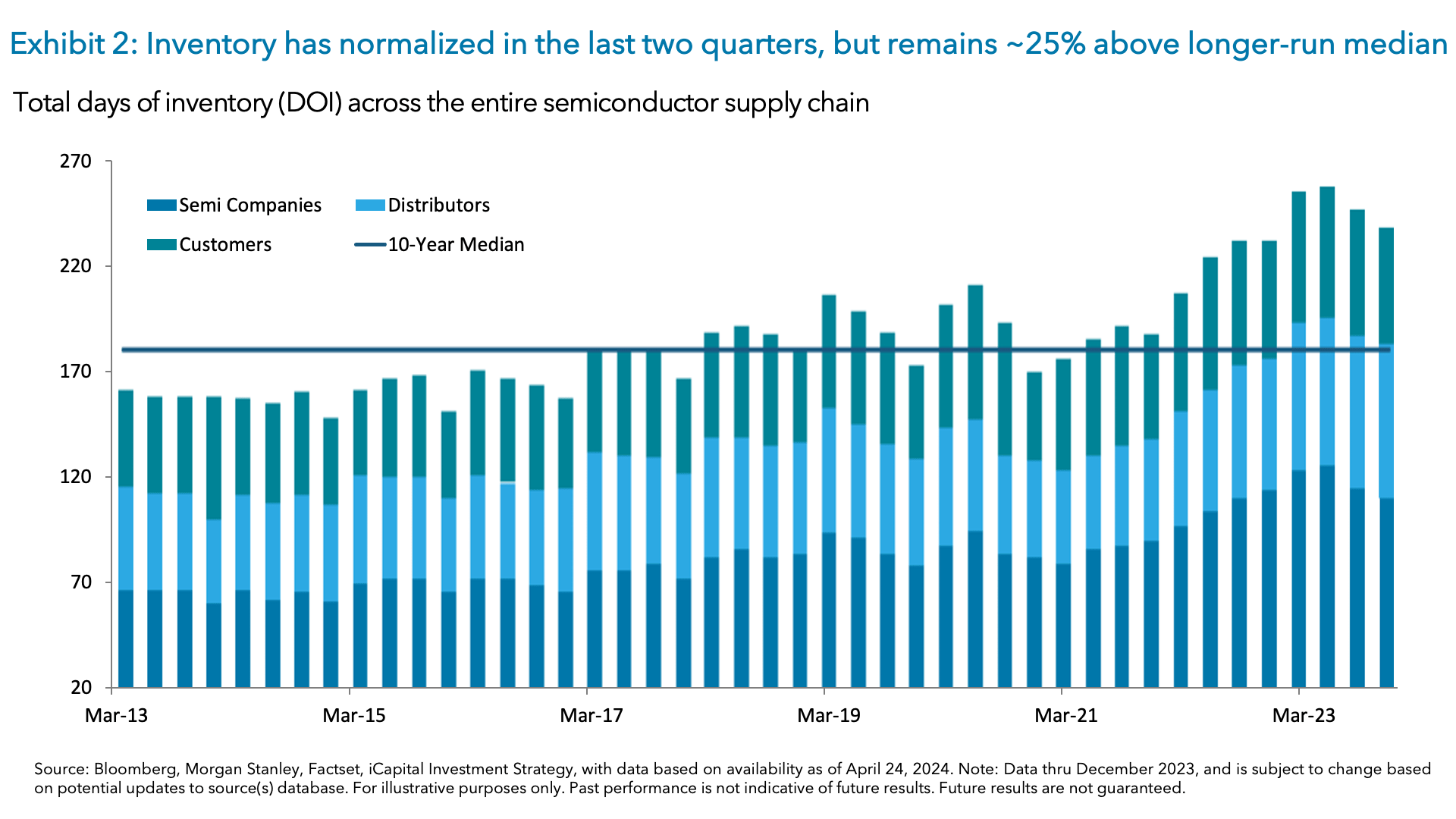

From a cyclical perspective, inventory levels – which have been elevated post pandemic re-stocking – have come into better balance in recent quarters.3 Total inventory days across producers/manufacturers, distributors, and customers, have collectively declined by 20 days since Q2 2023 though, inventory still remains 58 days, or ~25%, above the longer-run median (Exhibit 2).4

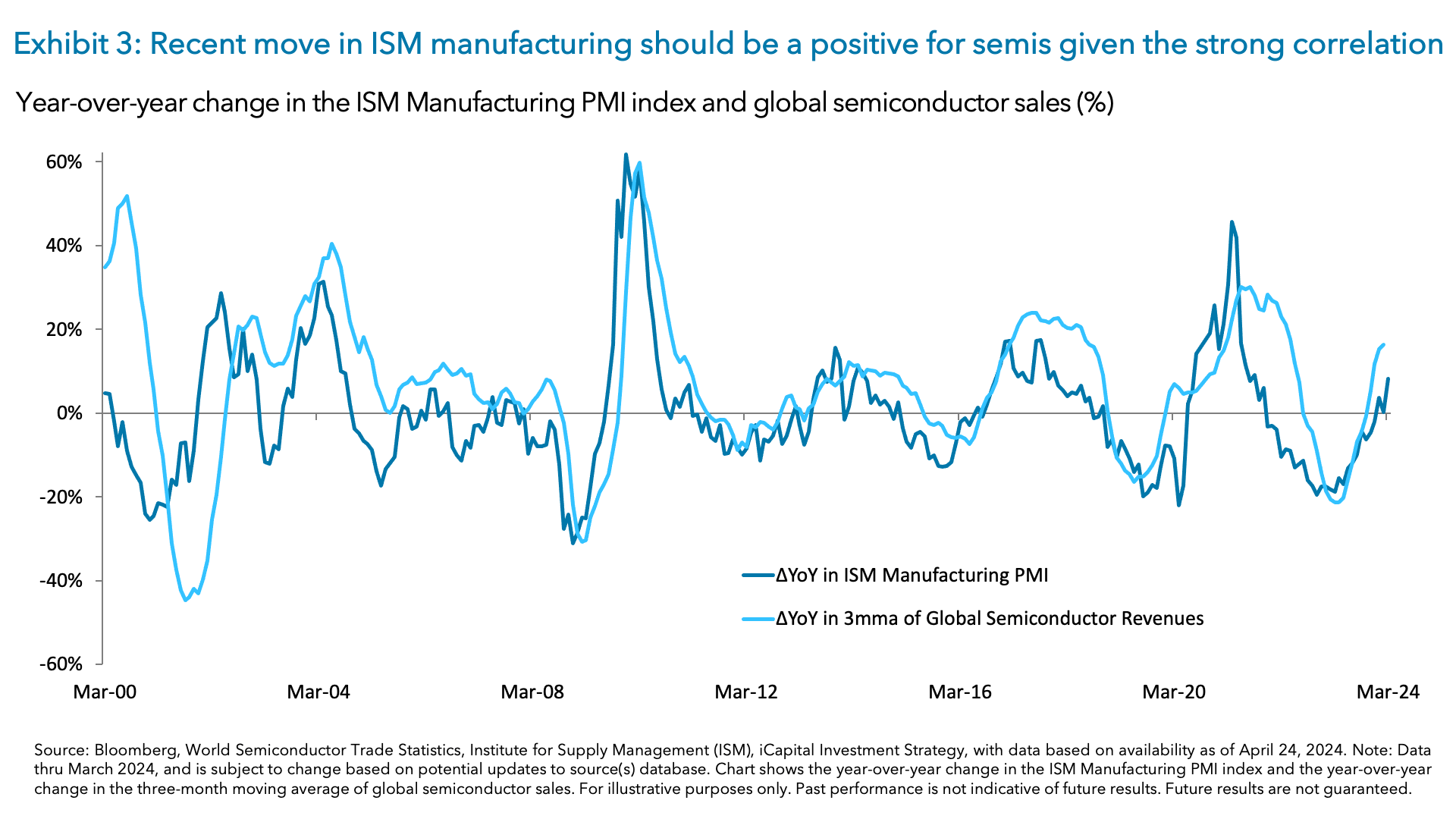

We may still be in a period of structurally higher inventory – although we remember all too well the shortages during the pandemic global supply chain disruptions – but signs point to further normalization as chip demand enters an upcycle. Semiconductor demand tends to be highly correlated with manufacturing surveys, and with the ISM manufacturing recently entering into an expansion, this should be a positive for chips (Exhibit 3).5 Despite the revenue decline in 2023 as we noted, growth of 6-8% is expected in 2024 as inventories further decline and shipments further match demand.6

Now from a secular perspective, the industry is also benefiting from a number of multi-year themes. For example, demand for AI compute, data centers, 5G connectivity, electric vehicle adoption and autonomous driving are all significant future growth drivers for the industry. Beyond this year, industry revenues are now forecasted to double by 2030, reaching around $1.1 trillion, driven by robust growth in the automotive, data storage, and industrial electronics end-markets. These markets are expected to make up ~40% of the overall revenue mix by 2030, up from around 25% in 2020.7

With these cyclical and secular forces at play, we anticipate further upside for stocks in the chip space. However, valuations for many of these semiconductor names are relatively high. The forward earnings ratio on the Philadelphia Stock Exchange Semiconductor index is currently in the 93rd percentile over a five-year lookback with the median name showing a forward earnings ratio that’s in the 89th percentile (Exhibit 5).8

Given that valuations are stretched and a number of potential concerns, (geopolitics, elections, delayed rate hikes, divergent fortunes of various semiconductor companies given the varying impact of the AI cycle), we would look to structured investments to gain exposure in a more risk managed way. For example, investors may want to use structures with downside protection or buffers to better manage those concerns, while still participating in the upside. And current options market dynamics can help enable this opportunity. Or, investors may wish to narrow down the list of semiconductor beneficiaries by opting for a custom index versus a broad ETF, and these indices are increasingly available.

1. Bloomberg, iCapital Investment Strategy, as of April 24, 2024. Note: Return period is Dec. 31, 2022 thru April 16, 2024.

2. Bloomberg, World Semiconductor Trade Statistics, iCapital Investment Strategy, as of April 24, 2024.

3. Morgan Stanley, “Semiconductor Inventory Tracker” as of March 18, 2024.

4. Morgan Stanley, “Semiconductor Inventory Tracker” as of March 18, 2024.

5. Bloomberg, iCapital Investment Strategy, as of April 24, 2024.

6. JPMorgan Research, as of April 1, 2024.

7. Gartner, William Blair, McKinsey, iCapital Investment Strategy, as of March 2023.

8. Bloomberg, iCapital Investment Strategy, as of April 24, 2024.

INDEX DEFINITIONS

The Philadelphia Stock Exchange Semiconductor IndexSM is a modified market capitalization-weighted index composed of companies primarily involved in the design, distribution, manufacture, and sale of semiconductors.

S&P 500: The S&P 500 is widely regarded as the best single gauge of large-cap U.S. equities. The index includes 500 of the top companies in leading industries of the U.S. economy and covers approximately 80% of available market capitalization.

IMPORTANT INFORMATION

The material herein has been provided to you for informational purposes only by Institutional Capital Network, Inc. (“iCapital Network”) or one of its affiliates (iCapital Network together with its affiliates, “iCapital”). This material is the property of iCapital and may not be shared without the written permission of iCapital. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of iCapital.

This material is provided for informational purposes only and is not intended as, and may not be relied on in any manner as, legal, tax or investment advice, a recommendation, or as an offer or solicitation to buy or sell any security, financial product or instrument, or otherwise to participate in any particular trading strategy. This material does not intend to address the financial objectives, situation, or specific needs of any individual investor. You should consult your personal accounting, tax and legal advisors to understand the implications of any investment specific to your personal financial situation. ALTERNATIVE INVESTMENTS ARE CONSIDERED COMPLEX PRODUCTS AND MAY NOT BE SUITABLE FOR ALL INVESTORS. Prospective investors should be aware that an investment in an alternative investment is speculative and involves a high degree of risk. Alternative Investments often engage in leveraging and other speculative investment practices that may increase the risk of investment loss; can be highly illiquid; may not be required to provide periodic pricing or valuation information to investors; may involve complex tax structures and delays in distributing important tax information; are not subject to the same regulatory requirements as mutual funds; and often charge high fees. There is no guarantee that an alternative investment will implement its investment strategy and/or achieve its objectives, generate profits, or avoid loss. An investment should only be considered by sophisticated investors who can afford to lose all or a substantial amount of their investment. iCapital Markets LLC operates a platform that makes available financial products to financial professionals. In operating this platform, iCapital Markets LLC generally earns revenue based on the volume of transactions that take place in these products and would benefit by an increase in sales for these products.

The information contained herein is an opinion only, as of the date indicated, and should not be relied upon as the only important information available. Any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets is not necessarily indicative of the future or likely performance. The information contained herein is subject to change, incomplete, and may include information and/or data obtained from third party sources that iCapital believes, but does not guarantee, to be accurate. iCapital considers this third-party data reliable, but does not represent that it is accurate, complete and/or up to date, and it should not be relied on as such. iCapital makes no representation as to the accuracy or completeness of this material and accepts no liability for losses arising from the use of the material presented. No representation or warranty is made by iCapital as to the reasonableness or completeness of such forward-looking statements or to any other financial information contained herein. Securities products and services are offered by iCapital Markets, an SEC-registered broker-dealer, member FINRA and SIPC, and an affiliate of iCapital, Inc. and Institutional Capital Network, Inc. These registrations and memberships in no way imply that the SEC, FINRA, or SIPC have endorsed any of the entities, products, or services discussed herein. Annuities and insurance services are provided by iCapital Annuities and Insurance Services LLC, an affiliate of iCapital, Inc. “iCapital” and “iCapital Network” are registered trademarks of Institutional Capital Network, Inc. Additional information is available upon request.k©2024 Institutional Capital Network, Inc. All Rights Reserved. | 2024.01