After the slew of macro data last week (the week of July 28), investors are asking themselves whether the Federal Reserve (Fed) should have cut interest rates in July? Though economic data seems to have cooled, especially labor data, growth has largely remained resilient. Indeed, the Atlanta GDPNow model is still projecting 2% growth for Q3, and economic surprises have remained positive.1

Even as the labor report is giving way to a growth scare and tariffs are back in the headlines, we still see a few reasons why the Fed can cut rates. Specifically, the economy does not need restrictive policy and services disinflation will likely offset price increases from tariffs. As a result, we think every Federal Open Market Committee (FOMC) meeting will be “live” this fall. Indeed, markets are pricing in a 91% chance of a Fed cut in September.2 This backdrop should start to favor interest rate sensitive and defensive asset classes, specifically small and medium-sized businesses (where GPs tend to operate), commercial real estate, macro hedge funds and defensive sectors such as utilities, real estate and to a lesser degree consumer staples.

A Soft Jobs Report Renews Fears of a Growth Scare

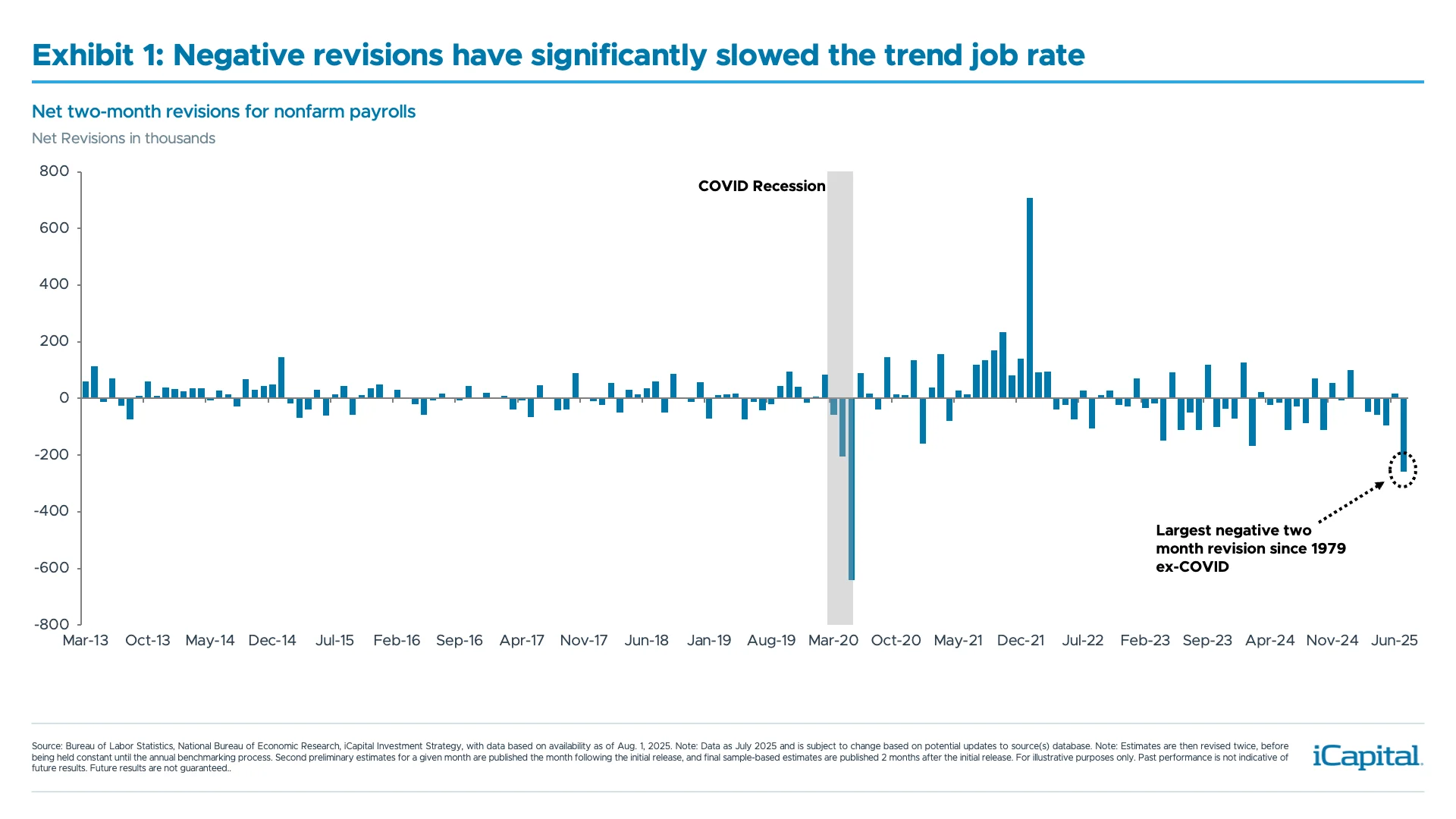

The July employment report highlighted a labor market that was starting to slow. Not only did the headline figure miss consensus estimates, but the two-month net downward revision of 258,000 jobs was the largest negative reading since 1979.3 This brought the three-month average job rate to 35,000 – the slowest rate since the pandemic.4 While the U-3 unemployment rate has remained steady – the unrounded figure did move slightly higher – the U-6 measure, which includes marginally attached workers moved up to 7.9%, up from 7.7% the prior reading.5 Given the importance Chair Powell has placed on the unemployment rate, we think Fed officials may start paying more attention to the U-6 reading, which is more reflective of labor supply that is likely holding down the U-3 measure.

But this scare is not just limited to labor data, the recent Institute for Supply Management (ISM) data for the month of July came in weaker than expected. This was especially notable in manufacturing data, which remained in contraction. Looking at the comments from the surveyed firms, tariffs remain a clear focal point as five out of 12 industry groups noted how tariffs were weighing on demand.6

But this scare is not just limited to labor data, the recent Institute for Supply Management (ISM) data for the month of July came in weaker than expected. This was especially notable in manufacturing data, which remained in contraction. Looking at the comments from the surveyed firms, tariffs remain a clear focal point as five out of 12 industry groups noted how tariffs were weighing on demand.6

Tariffs Are Still Expected to Weigh On Growth and Inflation

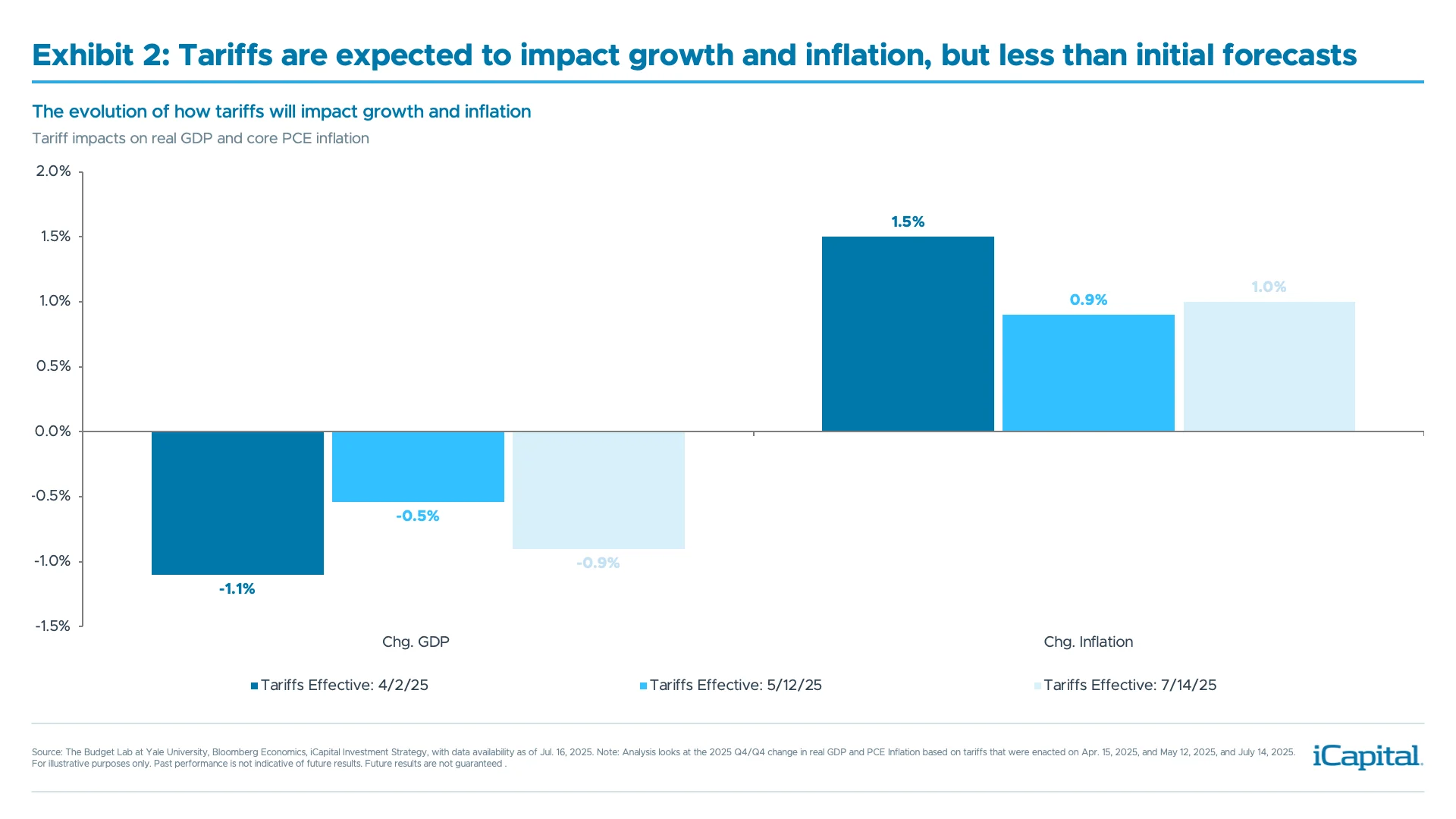

If economic data softening wasn’t enough on its own, tariffs and the trade war are once again front and center as we have moved past the August 1 deadline. While we have seen the administration make several deals with key trading partners, there are some countries – notably Brazil, India, Switzerland, and the Philippines – that are facing a higher rate than what was proposed on April 2.7 That said, the effective tariff rate is still projected to climb to levels not seen since the 1930s. Given this sharp increase, it will inevitably affect both growth and inflation, seen in Exhibit 2. However, the impact is expected to be less severe than the worst-case scenario projected on Liberation Day, yet more significant than when the administration announced a 90-day pause on reciprocal tariff rates.

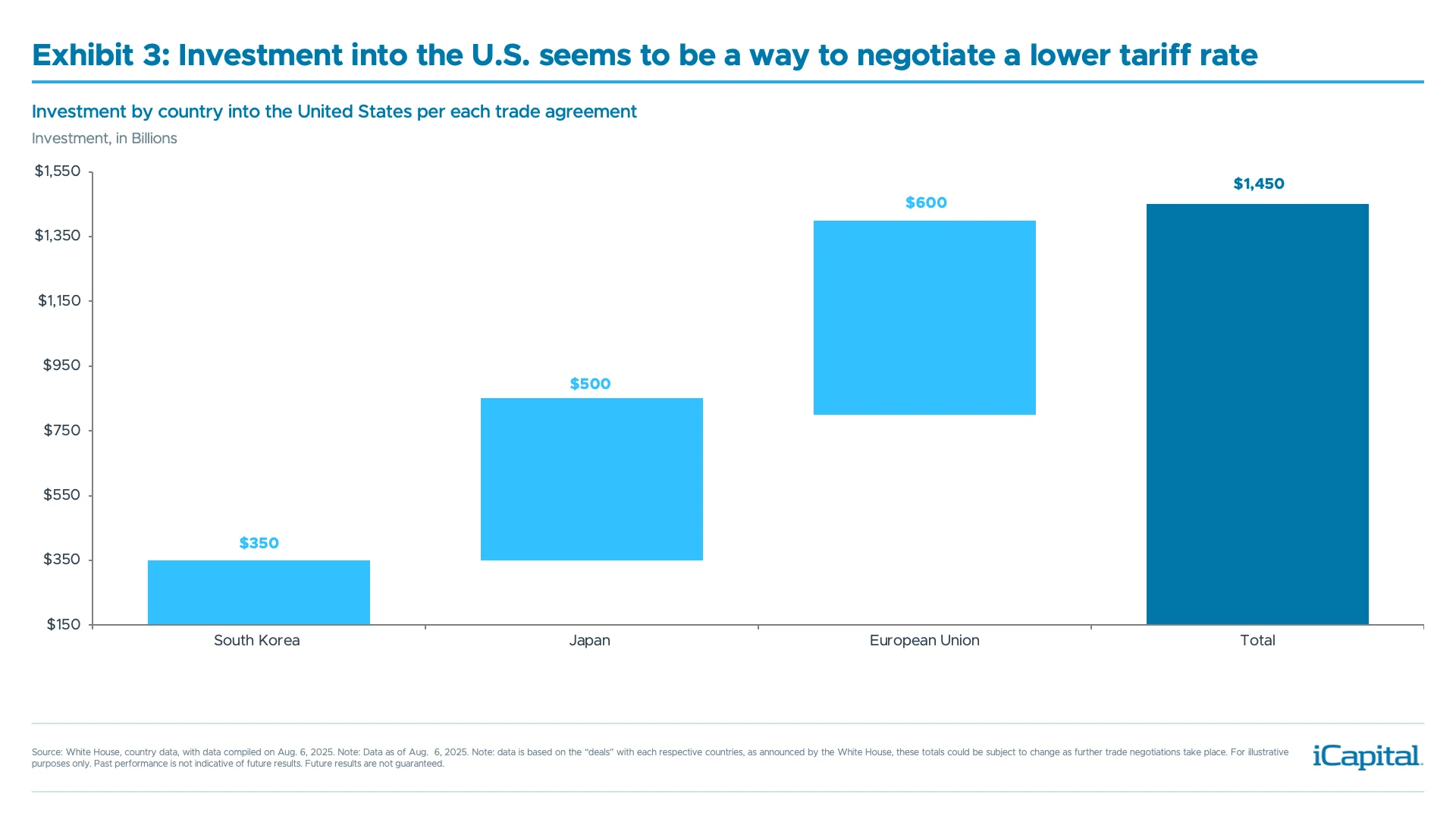

While the new proposed rate by the administration could weigh on the economy, we still believe they are focused on cutting deals with trading partners. However, negotiations remain a wildcard, as President Trump may threaten higher rates which has been seen over the last few months. But we believe these rates likely reflect a maximalist approach and could drop especially if countries are willing to invest in the U.S. Indeed, based on the deals that have been announced over the last few weeks, roughly $1.5 trillion is expected to be invested in the U.S, seen in Exhibit 3.8

While the new proposed rate by the administration could weigh on the economy, we still believe they are focused on cutting deals with trading partners. However, negotiations remain a wildcard, as President Trump may threaten higher rates which has been seen over the last few months. But we believe these rates likely reflect a maximalist approach and could drop especially if countries are willing to invest in the U.S. Indeed, based on the deals that have been announced over the last few weeks, roughly $1.5 trillion is expected to be invested in the U.S, seen in Exhibit 3.8

A Recession Should Be Avoided, For Now

A Recession Should Be Avoided, For Now

Growth estimates have clearly come in since the start of the year. When we wrote our 2025 Outlook, the U.S. economy was forecasted to expand by +2.1% in 2025 – slightly above trend.9 But given the risks from tariffs, growth is expected to come in closer to +1.5% this year – a pace we’d describe as a “muddle-through” environment.10 This shift from above- to below trend-growth could spark a renewed growth scare, similar to August 2024 when the unemployment rate briefly rose above a level to meet the definition of the Sahm Rule – historically coincident with recessions.

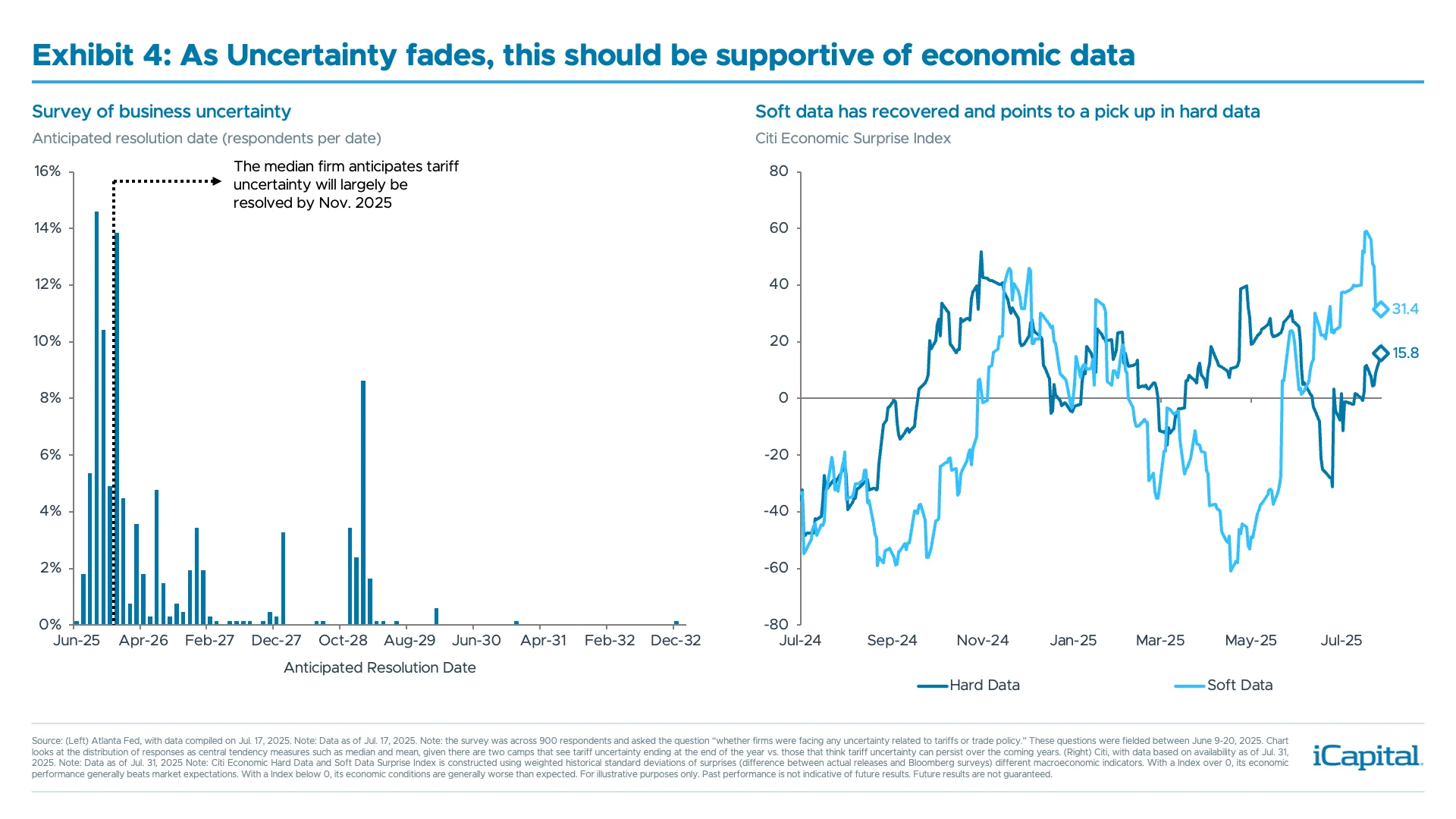

This past spring, hard data remained resilient, while soft data weakened. However, soft data has now recovered, as companies are growing more optimistic about the outlook. Indeed, according to a recent survey, the median firm expects trade uncertainty to abate by November 2025, seen in exhibit 4.11

We also believe that labor market data remains resilient, even despite the recent weakness. Currently, with initial jobless claims at 218,000 – still historically low levels – claims would need to rise by 130,000 before reaching an average level seen heading into a recession.12 Thus, indicating that while hiring has slowed, firing also remains low, as the labor market continues to come into balance.

We also believe that labor market data remains resilient, even despite the recent weakness. Currently, with initial jobless claims at 218,000 – still historically low levels – claims would need to rise by 130,000 before reaching an average level seen heading into a recession.12 Thus, indicating that while hiring has slowed, firing also remains low, as the labor market continues to come into balance.

The Two Reasons Why The Fed Will Likely Cut?

As the economic backdrop evolves, and appears to be slowing, we believe the Fed will likely restart its rate cutting cycle, which could occur as soon as the September FOMC meeting. Currently, we see two reasons why the Fed will cut rates.

- The economy does not need a restrictive policy. While we have seen economic data slow recently, we are not in the camp that we will see an economic contraction – we largely think this is a “muddle through” economy. But given the softness in data, we do not think this is a reason for the Federal Reserve to keep its policy rate above neutral – thereby restricting economic growth.

- Risks to the Dual Mandate: As Fed Chair Powell discussed at the last FOMC meeting, there are risks to both sides of the Dual Mandate. Specifically, Fed Governors Waller and Bowman acknowledged the risks to labor market data – highlighted by the July nonfarm payrolls report. While there are still upside risks to inflation, especially as tariffs could put upward pressure on core goods ex car prices, the disinflation from core services may help offset the price increases from tariffs. Given core services represent a large percentage of the basket, 76.7% vs. 23.3%, inflation could still return to the Fed’s target even as tariff increases make their way through the economy.13 Indeed, if we look at the three-month and six-month annualized rates for supercore CPI, the stickiest parts of the inflation basket, are around the Fed’s 2% target.14 Therefore the long awaited service disinflation may be finally starting to take shape.

Given the recent weakness in data, there is now a debate on whether the Fed should cut rates by 25 basis points (bps) or 50 bps at the September meeting. However, we think it is more important to focus on the destination. Given the two factors above, we believe the Fed will want to lower rates to a neutral setting. Based on the median estimate of the Fed’s long-run dot, 3%, they could cut rates by 150 bps before returning to a neutral policy setting – an ample amount to support growth.

Resilient Data and Fed Cuts May Keep Any Market Sell-Offs Limited

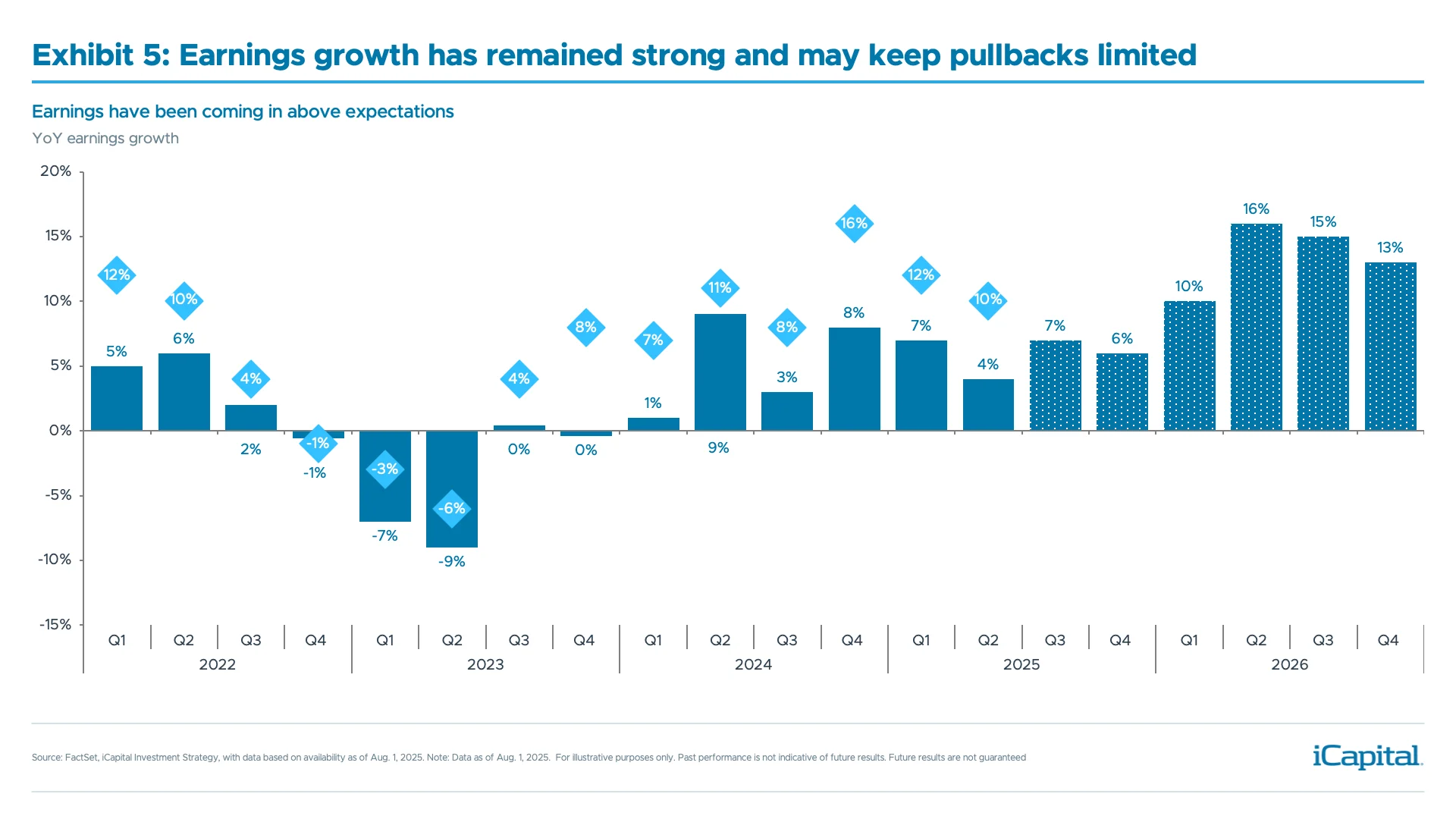

Another reason why we think any pullbacks will be limited is because of the strong earnings results in the Q2 2025 reporting season. Currently, 82% of companies have reported a positive earnings per share (EPS) surprise, which is above the five and 10-year average of 78% and 75%, respectively.15 Earnings have also exceeded estimates by roughly 8 percentage points, bringing the blended year-over-year (YoY) growth rate to 10.3%.16 This trend may continue as earnings revisions are also turning positive, as analysts have revised their Q3 2025 estimates higher17 and breadth of earnings revisions have also recovered to 8% – the highest level since August 2023.18

The other item market participants are focused on this quarter are margins. Given tariffs will likely lead to an increase in cost of goods sold (COGS) – 40% of the S&P 500 COGS are generated overseas19 – margins were expected to slightly contract this quarter. However, margins have remained resilient as they remained at 12.7%, the same level as last quarter, and above the 5-year average of 11.8%.20 This is likely because of the strategies management teams are utilizing to mitigate cost increases coming from tariffs. Indeed, 27% of firms this reporting season noted that the profit headwind they expected from tariffs had declined.21 Suggesting that companies may be able to offset the tariff pressure on margins.

The other item market participants are focused on this quarter are margins. Given tariffs will likely lead to an increase in cost of goods sold (COGS) – 40% of the S&P 500 COGS are generated overseas19 – margins were expected to slightly contract this quarter. However, margins have remained resilient as they remained at 12.7%, the same level as last quarter, and above the 5-year average of 11.8%.20 This is likely because of the strategies management teams are utilizing to mitigate cost increases coming from tariffs. Indeed, 27% of firms this reporting season noted that the profit headwind they expected from tariffs had declined.21 Suggesting that companies may be able to offset the tariff pressure on margins.

Resilient data, coming Fed rate cuts and strong earnings should help provide a floor under markets and likely keep any selloffs limited, especially as we enter a seasonally weak period in the calendar.

Coming Rate Cuts and Resilient Data Should Favor Interest Rate Sensitive Asset Classes

The September FOMC meeting will likely be a “live” meeting as there is a 91% chance of a rate cut.22 With front-end rates already moving lower, this will likely start to benefit interest rate sensitive asset classes in both private and public markets.

Alternatives

Commercial Real Estate: While parts of CRE – particularly the office sector – remain pressured, the broader asset class stands to benefit from policy easing. Assuming long-term rates remain relatively stable, lower short-end yields should drive cap rate compression over the coming quarters, supporting valuations across sectors where fundamentals and NOI remain healthy.

Lower rates are also particularly impactful this cycle due to the growing share of floating-rate CRE debt. Today, 22% of CMBS loans are floating, up from just 5% between 2004 and 2014, meaning the passthrough from Fed cuts could be faster and more powerful than in past cycles. That said, lower funding costs could ease refinancing pressures, improve financing conditions for high-quality assets, and encourage new capital deployment from GPs who have been waiting on the sideline.

Middle Market Private Equity: The middle market is the backbone of the U.S. economy accounting for over two thirds of all U.S. companies.23 These small and medium-sized businesses tend to be more rate-sensitive and thus stand to benefit from coming rate cuts – especially if the economy remains on solid footing. Indeed, if the Fed delivers two cuts before year-end, average interest coverage ratios could rise from 1.84x to 1.95x for these companies – a modest but meaningful improvement.24 This would likely feed through into earnings, potentially boosting them by 6%, and in turn support returns for both GP and LPs.25

Beyond the earnings uplift, if broader macro uncertainty continues to subside in the months ahead – as suggested by the Atlanta Fed Survey – this should lead to an improvement in capital market activity. Middle market companies are well positioned to benefit from this rebound, especially as they continue to trade at slightly cheaper valuations than large buyout. Their relative value, combined with improving financing conditions, could draw increased investor interest in the back half of the year.

Macro Hedge Funds: The two factors that are typically most detrimental for risk assets, market uncertainty and volatility, often drive positive performance for macro hedge funds. Looking ahead, the uncertain impact from tariffs and shifts in monetary and fiscal policy, and the potentially volatile effects on asset classes from equities and credit to global rates, currencies and commodities, portends a favorable backdrop for certain strategies to deliver uncorrelated returns for clients.

Public Markets

Focus on Income and Defensives

As we have discussed in our 2025 Mid-Year Outlook and in Is It Time to Rotate Your Portfolio Positioning?, we started favoring cyclicals such as Financials and Industrials given that economic data had remained resilient and the policies out of the Trump administration were serving as an additional tailwind for these sectors. With growth appearing to cool, markets are starting to worry about a potential growth scare. This would likely favor rotating back into defensives but would do so from an overweight position to cyclicals or from cash. Defensive sectors tend to outperform after Fed rate cuts but will also likely benefit from any drop in rates given their attractive dividend yields. Indeed, the S&P utilities and real estate sectors have a dividend yield of 2.69% and 3.41%, respectively, which is more than the S&P 500 at 1.22%.26

INDEX DEFINITIONS

S&P 500 Index: The S&P 500 is widely regarded as the best single gauge of large-cap U.S. equities. The index includes 500 of the top companies in leading industries of the U.S. economy and covers approximately 80% of available market capitalization.

S&P 500 Real Estate Index: The S&P Real Estate Sector Index, part of the S&P 500, measures the performance of companies classified in the Global Industry Classification Standard (GICS) Real Estate sector, including real estate management and development, and REITs (excluding mortgage REITs).

S&P 500 Utilities Index: Standard and Poor's 500 Utilities Index is a capitalization-weighted index that tracks the performance of utility companies within the S&P 500, providing a view of energy, water, and electric service providers.

ENDNOTES

- Atlanta Fed, as of Aug. 4, 2024.

- Bloomberg, as of Aug. 5, 2024.

- Bureau of Labor Statistics, as of Aug. 1, 2025. Note: this excludes readings during the COVID pandemic.

- Bureau of Labor Statistics, as of Aug. 1, 2025.

- Bureau of Labor Statistics, as of Aug. 1, 2025.

- Institute for Supply Management, as of Aug. 1, 2025.

- New York Times, as of Aug. 4, 2025.

- New York Times, as of Aug. 4, 2025. Note: reflects the country announcements with trade deals. This includes Japan, South Korea and the European Union.

- Bloomberg, as of Dec. 18, 2024.

- Bloomberg, as of Aug. 4, 2025.

- Federal Reserve of Atlanta, as of Jul.17, 2025.

- Department of Labor, iCapital Investment Strategy, as of Aug. 4, 2025.

- Bureau of Labor Statistics, as of Aug. 1, 2025.

- Bloomberg Index Services, as of Aug. 4, 2025.

- FactSet, as of Aug. 1, 2025.

- FactSet, as of Aug. 1, 2025.

- FactSet, as of Aug. 1, 2025.

- J.P. Morgan, as of Jul. 11, 2025.

- Bloomberg Intelligence, as of Apr. 7, 2025.

- FactSet, as of Aug. 1, 2025.

- Goldman Sachs, as of Aug. 1, 2025.

- CME Group, as of Aug. 4, 2025.

- S&P Capital IQ, iCapital Alternatives Decoded, as of February 2023. Note: Analysis reflects U.S. private and public companies with revenues over $100 million. Based on depth of data availability, middle market is defined here as being companies with $100–$499 million in revenue.

- iCapital Investment Strategy Analysis, Pitchbook | LCD, as of Aug. 5, 2025.

- iCapital Investment Strategy Analysis, Pitchbook | LCD, as of Aug. 5, 2025.

- S&P Capital IQ, as of Aug. 4, 2025.

IMPORTANT INFORMATION

The material herein has been provided to you for informational purposes only by Institutional Capital Network, Inc. (“iCapital Network”) or one of its affiliates (iCapital Network together with its affiliates, “iCapital”). This material is the property of iCapital and may not be shared without the written permission of iCapital. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of iCapital.

This material is provided for informational purposes only and is not intended as, and may not be relied on in any manner as, legal, tax or investment advice, a recommendation, or as an offer or solicitation to buy or sell any security, financial product or instrument, or otherwise to participate in any particular trading strategy. This material does not intend to address the financial objectives, situation, or specific needs of any individual investor. You should consult your personal accounting, tax and legal advisors to understand the implications of any investment specific to your personal financial situation.

ALTERNATIVE INVESTMENTS ARE CONSIDERED COMPLEX PRODUCTS AND MAY NOT BE SUITABLE FOR ALL INVESTORS. Prospective investors should be aware that an investment in an alternative investment is speculative and involves a high degree of risk. Alternative Investments often engage in leveraging and other speculative investment practices that may increase the risk of investment loss; can be highly illiquid; may not be required to provide periodic pricing or valuation information to investors; may involve complex tax structures and delays in distributing important tax information; are not subject to the same regulatory requirements as mutual funds; and often charge high fees. There is no guarantee that an alternative investment will implement its investment strategy and/or achieve its objectives, generate profits, or avoid loss. An investment should only be considered by sophisticated investors who can afford to lose all or a substantial amount of their investment.

iCapital Markets LLC operates a platform that makes available financial products to financial professionals. In operating this platform, iCapital Markets LLC generally earns revenue based on the volume of transactions that take place in these products and would benefit by an increase in sales for these products.

The information contained herein is an opinion only, as of the date indicated, and should not be relied upon as the only important information available. Any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets is not necessarily indicative of the future or likely performance. The information contained herein is subject to change, incomplete, and may include information and/or data obtained from third party sources that iCapital believes, but does not guarantee, to be accurate. iCapital considers this third-party data reliable, but does not represent that it is accurate, complete and/or up to date, and it should not be relied on as such. iCapital makes no representation as to the accuracy or completeness of this material and accepts no liability for losses arising from the use of the material presented. No representation or warranty is made by iCapital as to the reasonableness or completeness of such forward-looking statements or to any other financial information contained herein.

Securities products and services are offered by iCapital Markets, an SEC-registered broker-dealer, member FINRA and SIPC, and an affiliate of iCapital, Inc. and Institutional Capital Network, Inc. These registrations and memberships in no way imply that the SEC, FINRA, or SIPC have endorsed any of the entities, products, or services discussed herein. Annuities and insurance services are provided by iCapital Annuities and Insurance Services LLC, an affiliate of iCapital, Inc. “iCapital” and “iCapital Network” are registered trademarks of Institutional Capital Network, Inc. Additional information is available upon request.

©2025 Institutional Capital Network, Inc. All Rights Reserved.