Key Takeaways

Capital markets activity, trade policy, and visibility to the U.S. Federal Reserve policy path were the overarching inputs that went into our rating analysis. Still, the second quarter of 2025 ended with more momentum than it started with. Overall, we’re optimistic about the deal environment, reflected in positive views for middle-market buyout, venture, and event-driven strategies. On the credit side, we remain Neutral on credit hedge fund strategies and Positive on private credit despite some spread compression on new deals.

PRIVATE EQUITY

Exit activity manages through the macro noise

We remain confident in a pickup in exit activity, although the pace and the timing of a sustained improvement has been affected from the U.S. tariff announcements in April 2025. Still, IPO and M&A activity picked up throughout the second quarter of 2025 providing a healthy backdrop for middle market and late-stage venture strategies.

Private Credit is showing signs of a crowded market.

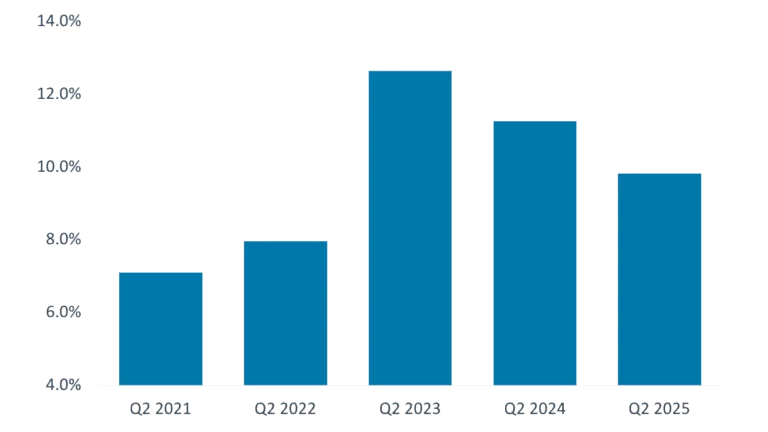

Private credit performance remains resilient. Although, we’ve seen some softening from our view at the start of 2025 — particularly spread compression on new deals and signs of competition and difficulty in deploying capital, we believe lenders should still be able to achieve gross yields of about 10%. This is a premium to most high yield and investment grade yields, and a reason we remain Positive.

New issue all-in yield composition

Yield of newly issued sponsored first-lien yields

Source: Cliffwater LLC as of June 2025. Past performance is not indicative of future results. Future results are not guaranteed.

REAL ASSETS

The Resiliency Of Infrastructure Is Seen In Sustainable Positive Returns

Private infrastructure posted double-digit annual returns over three, five, ten and fifteen-year periods. Tariff and tariff speculation could have negative and positive impacts on infrastructure but growing public deficits, digital transformation, energy transition and advancing energy independence are longer term structural shifts that provide tailwinds for the space.

Hedge Funds

Versatility Shines

We continue to favor multi-strategy as opportunistic trading in global interest rates and quantitative strategies helped overcome a challenging period for long/short equity allocations.

Explanation of iCapital’s Ratings Framework

iCapital’s basis for assigning ratings is the research team’s view of how the investment strategy will perform over the next three years relative to its respective category. For this purpose, the “category” is the asset class associated with investment strategies for which the research team provides coverage. For example, a rating for Growth Equity is relative to other strategies within the Private Equity category.

Strategy ratings are reevaluated at least semiannually with an emphasis on whether the outlook is materially different to affect how the investment strategy may perform over the next three years relative to its category.

Strategy Ratings:

- Positive: Investment strategies expected to outperform the category over the next three years.

- Neutral: Investment strategies expected to perform in line with the category over the next three years.

- Negative: Investment strategies expected to underperform the category over the next three years.

We use a three-year time horizon as it is roughly the average holding period for a private market asset. For Hedge Funds, we use the same strategy rating method but consider a 12-to-24-month performance outlook because of the higher mix of liquid assets that a typical hedge fund may own.

Related Articles

iCapital 2025 Market Outlook

Alternatives Decoded – Q4 2024

1. Pitchbook, Q1 2025 US PE Breakdown, April 11, 2025.

2. Dow Jones, iCapital Alternatives Decoded, with data based on availability as of Apr. 30, 2025. Note: Data as of December 2024 and is subject to change based on potential updates to source(s) database. Public infrastructure proxied by Dow Jones Brookfield Global Infrastructure Composite Index. For illustrative purposes only. Past performance is not indicative of future results. Future results are not guaranteed.

3. Source: CBOE, S&P Dow Jones, iCapital Alternatives Decoded, with data based on availability as of Mar. 31, 2025. Note: Data through June 2025 and is subject to change based on potential updates to source(s) database. CBOE S&P 500 Dispersion index measures the expected dispersion in the S&P 500 over the next 30 calendar days.

IMPORTANT INFORMATION

The material herein has been provided to you for informational purposes only by Institutional Capital Network, Inc. (“iCapital Network”) or one of its affiliates (iCapital Network together with its affiliates, “iCapital”). This material is the property of iCapital and may not be shared without the written permission of iCapital. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of iCapital.

This material is provided for informational purposes only and is not intended as, and may not be relied on in any manner as, legal, tax or investment advice, a recommendation, or as an offer or solicitation to buy or sell any security, financial product or instrument, or otherwise to participate in any particular trading strategy. This material does not intend to address the financial objectives, situation, or specific needs of any individual investor. You should consult your personal accounting, tax, and legal advisors to understand the implications of any investment specific to your personal financial situation.

ALTERNATIVE INVESTMENTS ARE CONSIDERED COMPLEX PRODUCTS AND MAY NOT BE SUITABLE FOR ALL INVESTORS. Prospective investors should be aware that an investment in an alternative investment is speculative and involves a high degree of risk. Alternative investments often engage in leveraging and other speculative investment practices that may increase the risk of investment loss; can be highly illiquid; may not be required to provide periodic pricing or valuation information to investors; may involve complex tax structures and delays in distributing important tax information; are not subject to the same regulatory requirements as mutual funds; and often charge high fees. There is no guarantee that an alternative investment will implement its investment strategy and/or achieve its objectives, generate profits, or avoid loss. An investment should only be considered by sophisticated investors who can afford to lose all or a substantial amount of their investment.

iCapital Markets LLC operates a platform that makes available financial products to financial professionals. In operating this platform, iCapital Markets LLC generally earns revenue based on the volume of transactions that take place in these products and would benefit from an increase in sales for these products.

The information contained herein is an opinion only, as of the date indicated, and should not be relied upon as the only important information available. Any prediction, projection, or forecast on the economy, stock market, bond market, or the economic trends of the markets is not necessarily indicative of the future or likely performance. The information contained herein is subject to change, incomplete, and may include information and/or data obtained from third-party sources that iCapital believes, but does not guarantee, to be accurate. iCapital considers this third-party data reliable, but does not represent that it is accurate, complete and/or up to date, and it should not be relied on as such. iCapital makes no representation as to the accuracy or completeness of this material and accepts no liability for losses arising from the use of the material presented. No representation or warranty is made by iCapital as to the reasonableness or completeness of such forward-looking statements or to any other financial information contained herein.

Securities products and services are offered by iCapital Markets, an SEC-registered broker-dealer, member FINRA and SIPC, and an affiliate of iCapital, Inc. and Institutional Capital Network, Inc. These registrations and memberships in no way imply that the SEC, FINRA, or SIPC have endorsed any of the entities, products, or services discussed herein. Annuities and insurance services are provided by iCapital Annuities and Insurance Services LLC, an affiliate of iCapital, Inc. “iCapital” and “iCapital Network” are registered trademarks of Institutional Capital Network, Inc. Additional information is available upon request.

©2025 Institutional Capital Network, Inc. All Rights Reserved.