What Is Direct Lending?

Direct lending refers to privately negotiated loans or credit (oftentimes senior in the capital structure) made by non-bank lenders to privately-owned companies, many of which are backed by private equity sponsors looking to finance an acquisition. In most cases, lenders focus on middle market companies seeking a tailored financing solution that is not accessible to them in the public credit markets or through bank lenders, who are subject to strict regulations. It is estimated that there are approximately 200,000 middle market businesses in the United States, with annual revenues between $10 million and $1 billion.1

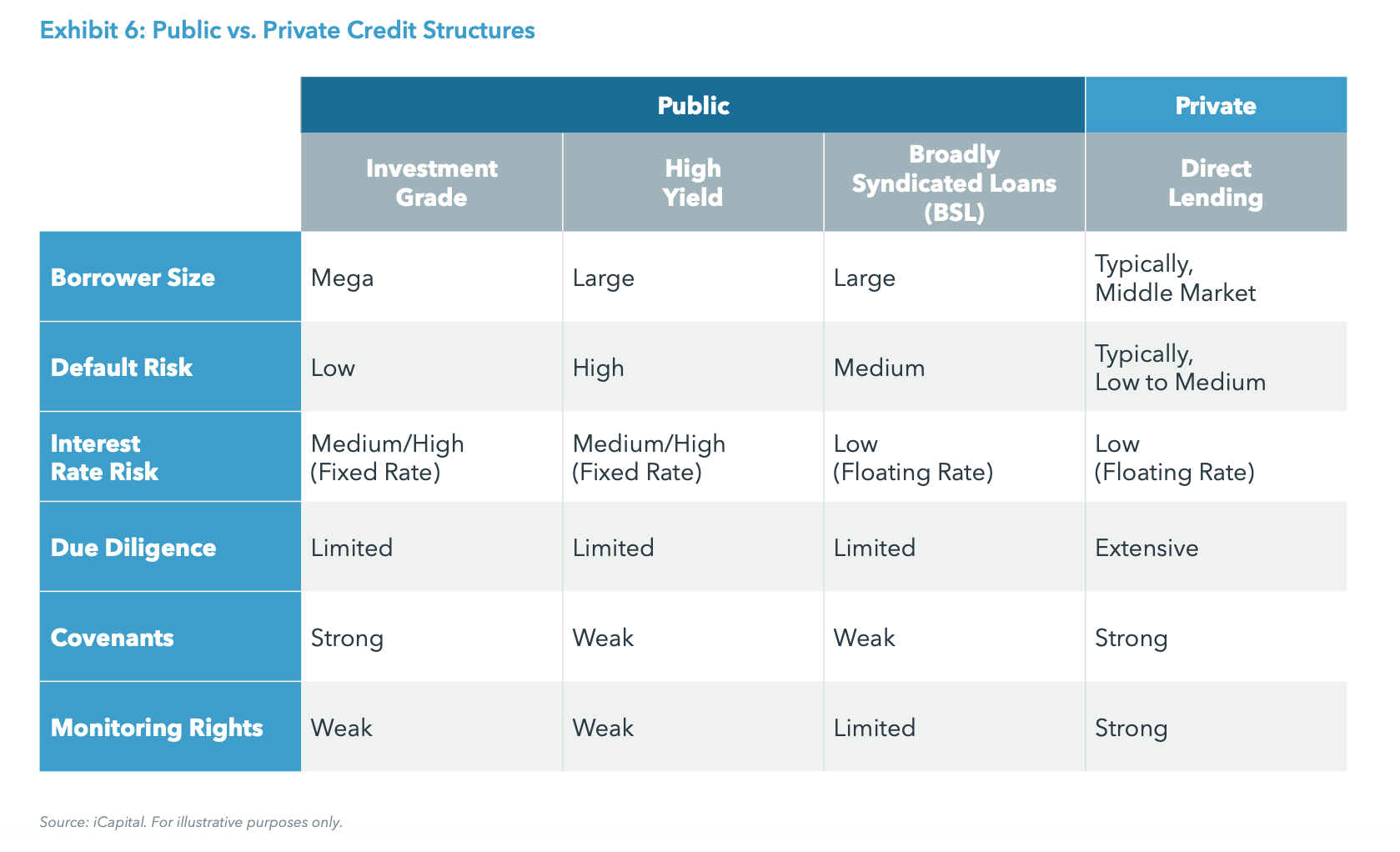

This type of lending is distinct from the traditional sources of debt capital for corporate borrowers, namely bank loans and broadly syndicated loans (BSL). Like syndicated leveraged loans (but unlike most high-yield bonds), these private loans typically feature interest payments at a spread above a floating reference rate and a floor on the minimum rate, reducing interest-rate risk for investors and providing protection in an inflationary environment. In addition, companies are increasingly seeking financing from private credit managers due to their ability to offer the speed of execution, flexibility, and certainty of closing that traditional banks often cannot match, particularly in challenging market conditions.

The Growth Of Private Credit

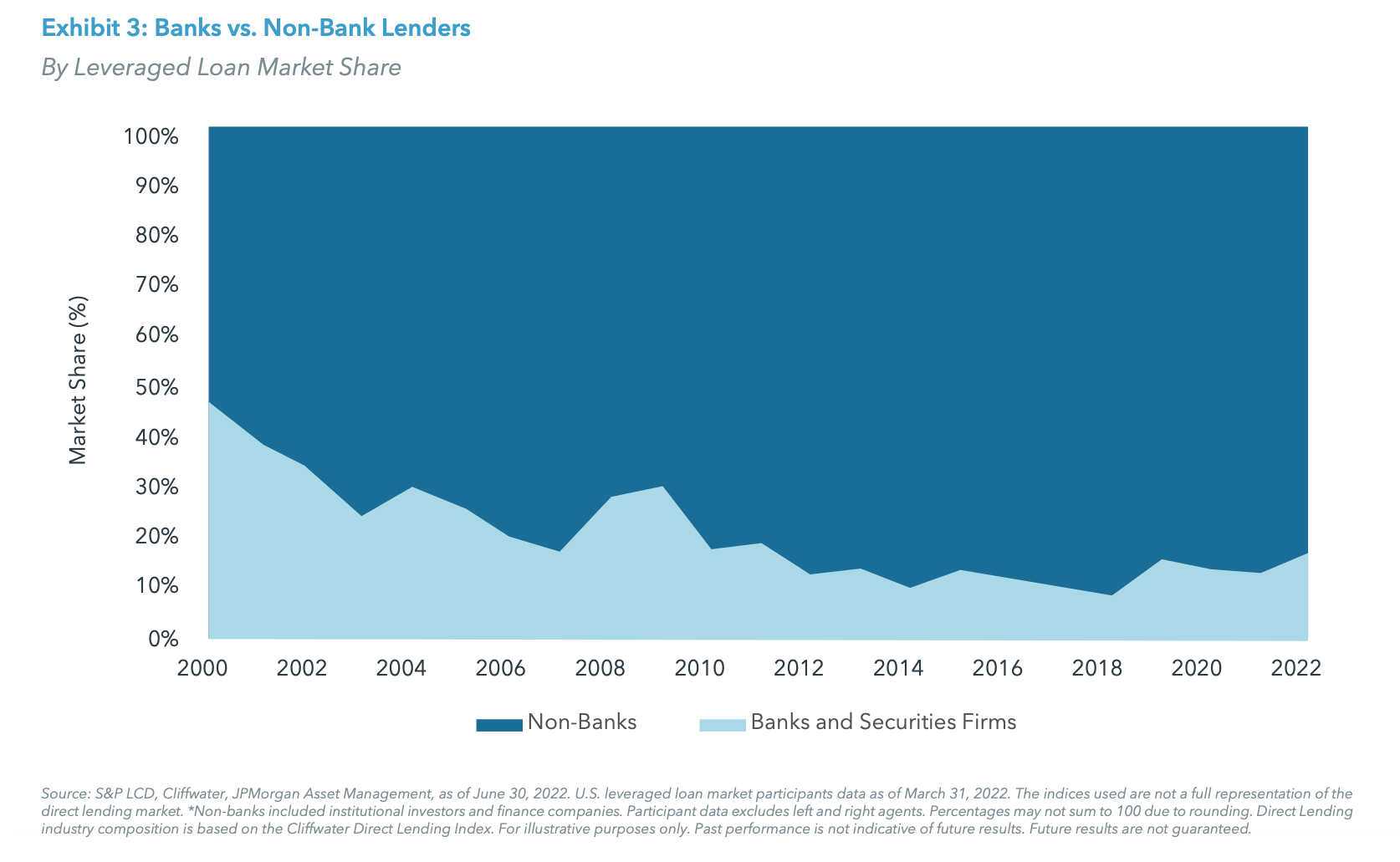

Bank participation in direct lending has dropped precipitously over the last two decades. This trend has primarily been driven by massive consolidation within the banking industry, in addition to tightened lending standards and a general shift to stricter regulatory requirements imposed on banks.

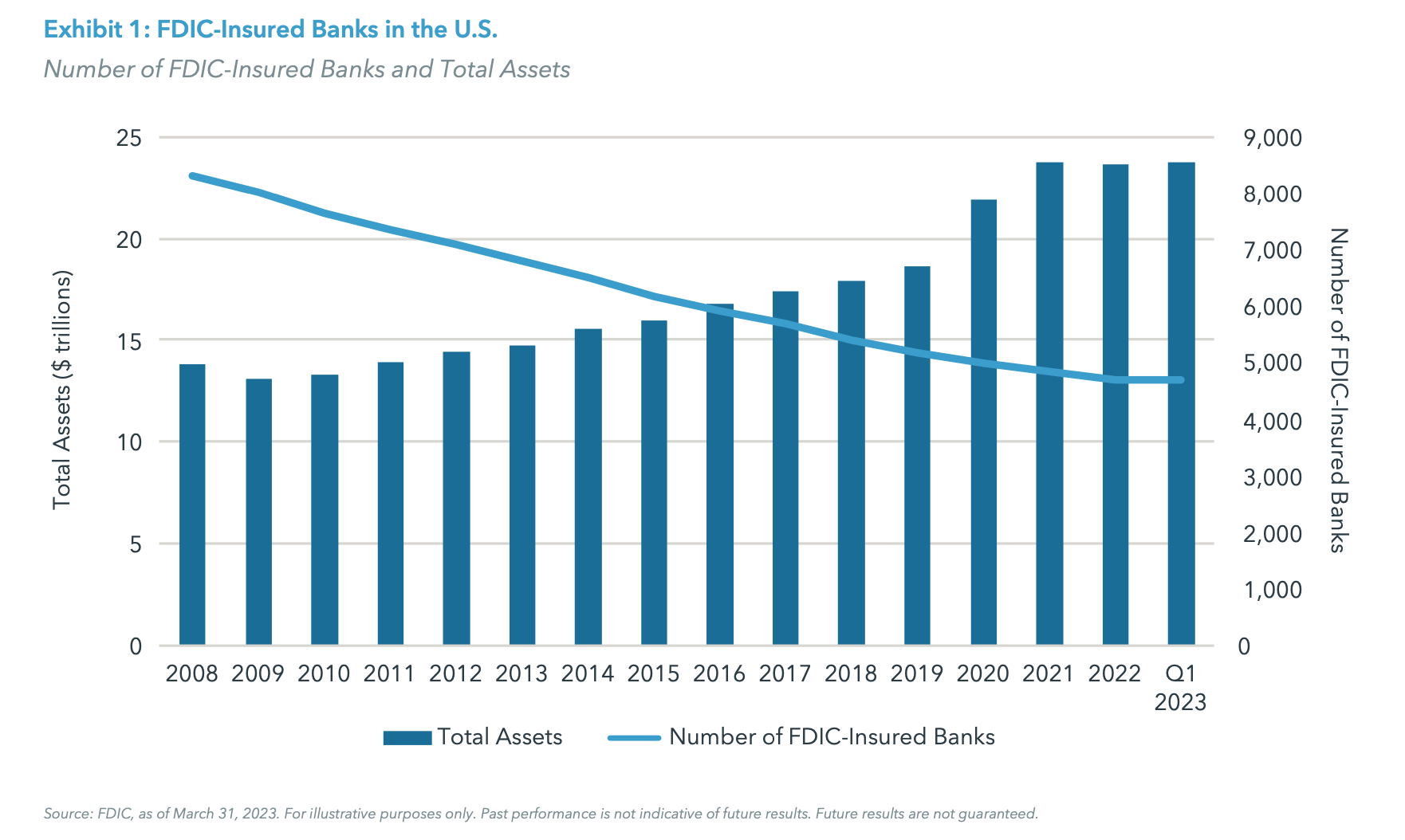

The number of FDIC-insured banks in the U.S. has fallen from over 8,000 in 2008 to approximately 4,700 in 2023, while total assets has increased from $13.8 trillion to $23.7 trillion, respectively (see Exhibit 1).2 As the number of independent regional and community banks declined dramatically, bank lending to small and medium-sized businesses also dropped precipitously.

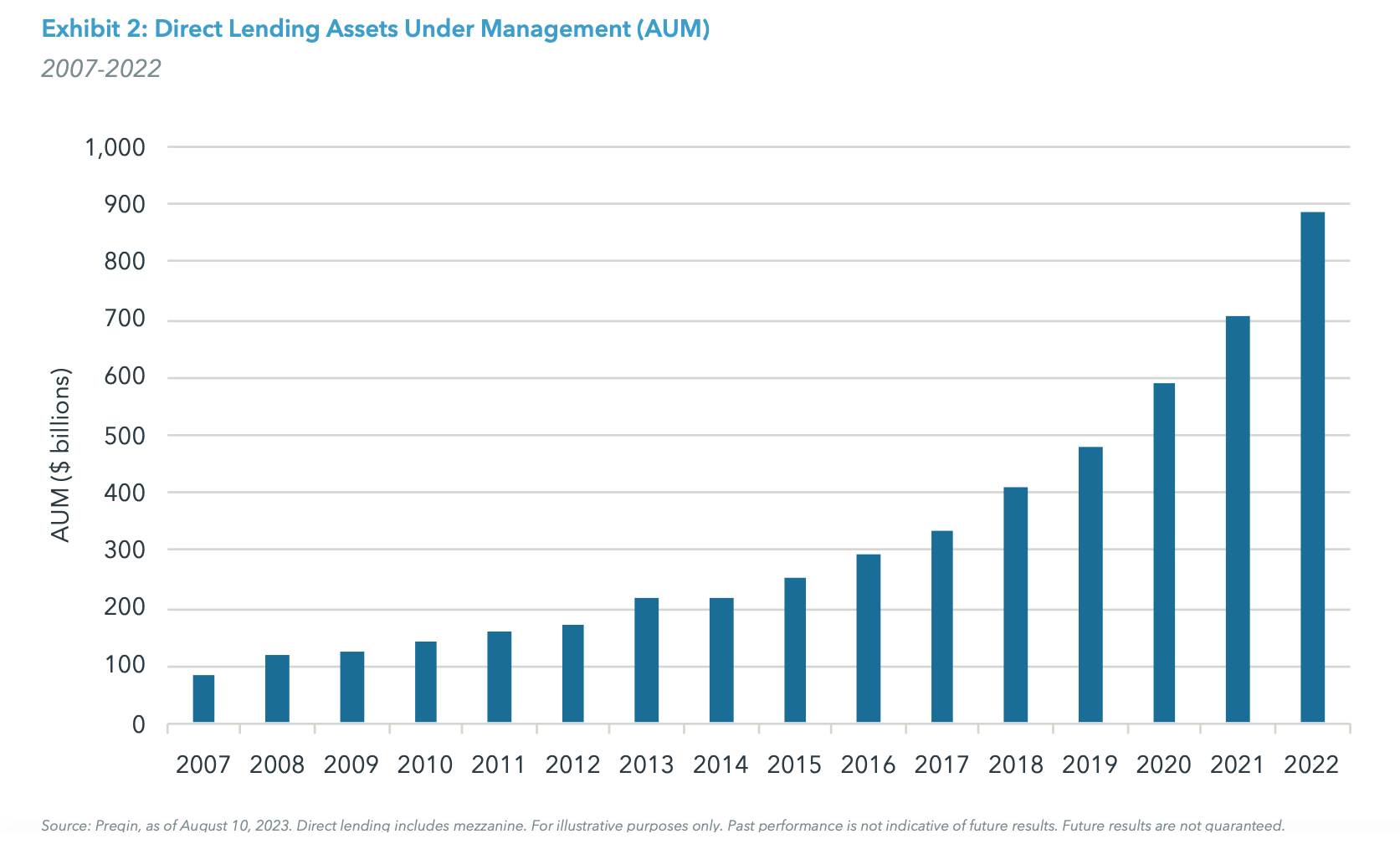

The surge of interest in private credit can be traced back to 2010 with the industry-wide retrenchment of banks following the Global Financial Crisis (GFC). Regulatory changes created a massive financing gap, particularly in the middle market. The regulatory changes also limited access to the public credit markets to all but the largest companies, with higher minimums for public debt issuance and stricter reserve requirements. In the U.S., regulations such as the Dodd-Frank Act increased the minimum amount banks were required to hold in liquid assets, leaving banks less inclined to underwrite smaller, less-liquid credit. In the European Union, regulatory changes such as Basel III led to a $2 trillion decline in bank lending.3

Banks in the U.S. have further tightened their lending standards over the past year in response to the regional bank crisis. Over 50% of respondents to the Federal Reserve’s Opinion Survey on Bank Lending Practices reported a tightening of lending standards to large and middle market firms seeking commercial and industrial loans in the second quarter of 2023, up from 45% in the first quarter of 2023.4 This is in stark contrast from the first quarter of 2022, when only 6% of respondents noted tighter lending standards.5

As traditional bank lenders have receded from the middle market, private direct lending has stepped in to fill the void. As shown in Exhibit 3, over the last 20 years, non-bank lenders accounted for 79% of the leveraged loan market on average.6

Significant Supply-Demand Imbalance

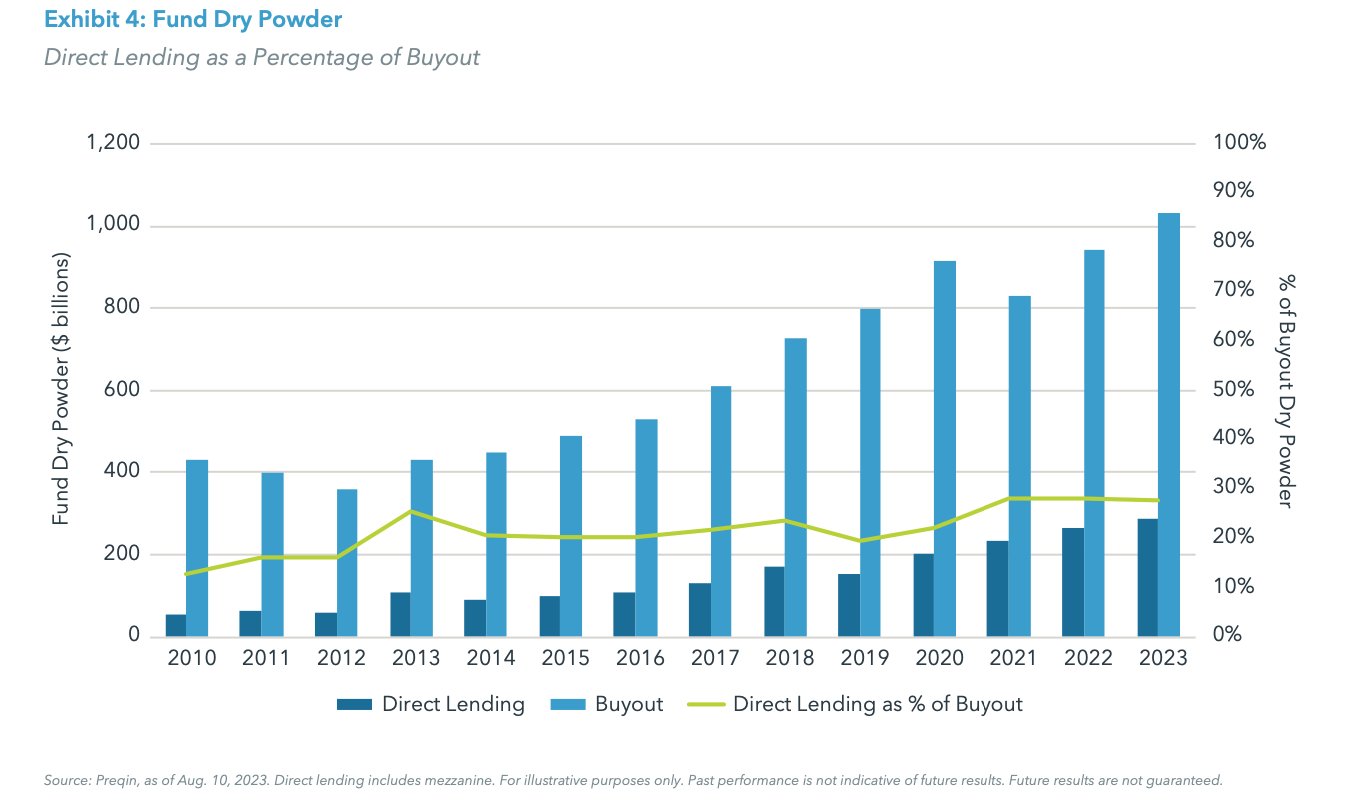

As of August 7, 2023, there was an estimated $286 billion in direct lending dry powder (or uninvested capital) held globally by direct lending firms.7 At the same time, private equity firms have continued to raise capital, with an estimated $1 trillion in dry powder held by buyout funds.8 Since today’s buyout managers are typically financing their deals with 50% equity and 50% debt, the implied total amount of debt financing they will require over the next five years (which is the investment period of a private equity firm) to fund their deals should be around $1 trillion. Spread across five years (the period during which the private equity dry powder will be invested), this would suggest a need of about $200 billion per year of debt financing, yet the entire amount of direct lending financing currently stands at $286 billion. Exhibit 4 shows direct lending dry powder as a percentage of the overall buyout dry powder, which has remained at roughly 28% since 2021.9 This significant supply-demand imbalance creates an appealing environment for middle market lending.

The Case For Private Credit

Downside Protection

The market demand for financing creates an attractive environment for direct lenders, allowing private credit managers to be more selective. Experienced and disciplined private credit managers are typically able to achieve strong downside protection because the privately negotiated nature of their transactions permits them to conduct extensive due diligence on potential borrowers and to secure covenants. This process allows a lender to better assess the credit quality of a company by more thoroughly evaluating critical factors such as its cash flow profile, quality of revenue, competitive positioning within its industry, and the strength of its management team. This diligence process is extensive and can take several weeks, providing the lender with greater access and control over terms and structure.

Many private credit managers have been able to take advantage of their due diligence findings and their direct negotiating position by including covenants into their loan agreements. These covenants are conditions imposed by the lender to help protect against potential downside. Loan covenants can be affirmative (positive), which requires a borrower to fulfill a specific obligation; restrictive (negative), which is intended to prevent a borrower from taking a specific action without the lender’s approval; or financial, which requires the borrower to maintain specified financial performance on an ongoing basis (maintenance covenant) or ensure certain thresholds are met if an action is taken, for example, issuing debt (incurrence covenant). These covenants, in addition to proactive monitoring of a borrower’s financial performance, allow lenders to identify potential issues early on and to work with management teams to address those issues before they hinder the company’s ability to pay off its interest and debt obligations.

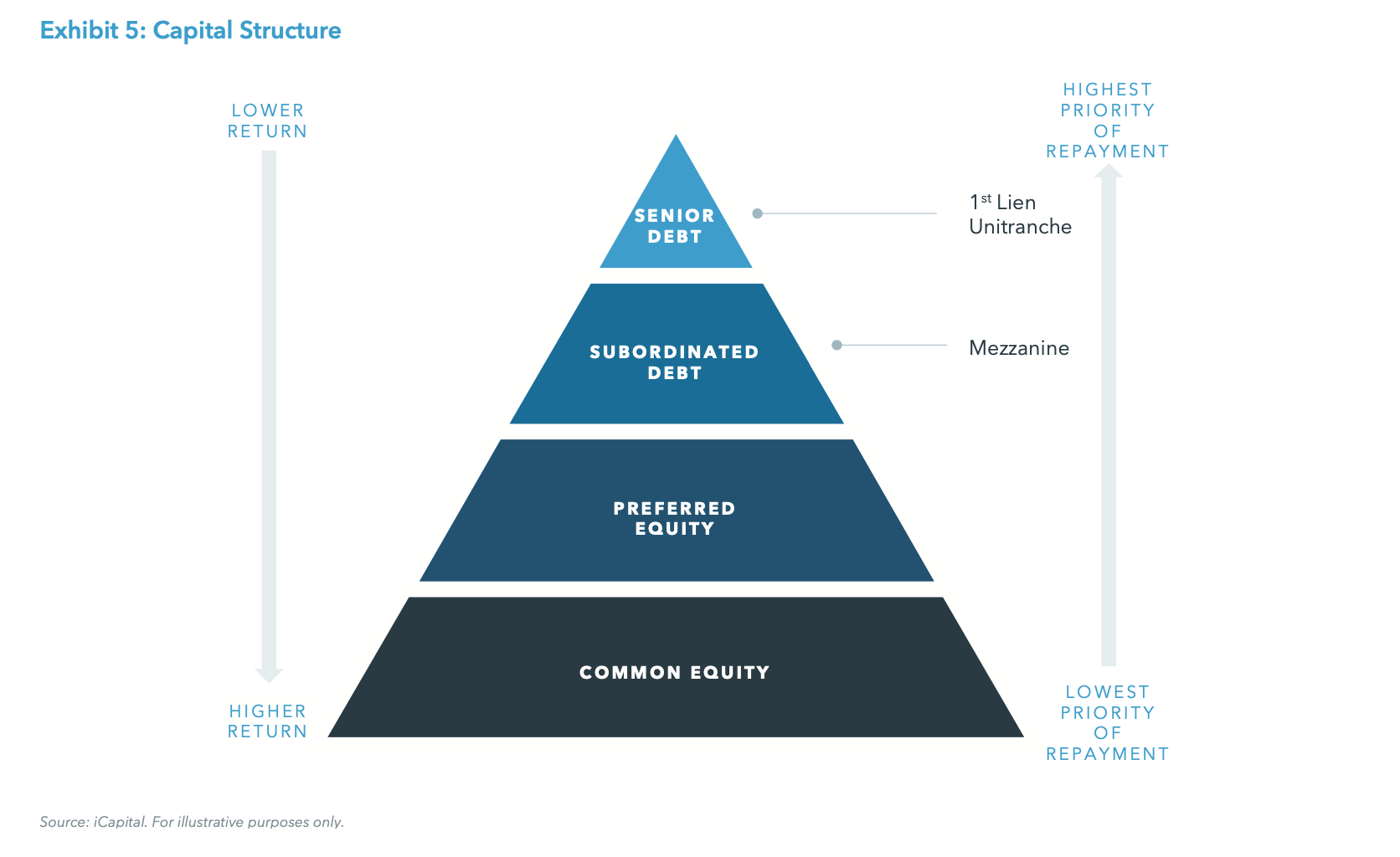

In addition, most direct lenders invest in senior secured and unitranche debt (which combines a company’s first and second lien debt into a single security). These lenders are therefore positioned at the top of the capital structure and have a priority claim against a company’s assets in the event of a default, as shown in Exhibit 5.

The public market for non-investment grade corporate debt also represents a markedly different risk-return profile. While direct lending typically focuses on middle market companies with $25-70 million in EBITDA, broadly syndicated loans (BSL) are generally made available to larger companies with greater than $150-200 million in EBITDA. Banks originate these loans and then distribute to mutual funds and collateralized loan obligations (CLOs) for a fee, rarely maintaining the underlying loan on their balance sheet due to capital reserve requirements. Therefore, rather than conducting due diligence on the fundamental credit quality of the borrower, banks are incentivized to focus on the quantity they are able to sell in the liquid BSL market. In contrast to direct, BSL buyers typically only have a week or two to conduct due diligence and rely on materials provided by the borrower’s underwriter.

Moreover, the BSL market is relatively liquid with larger pools of capital. This market efficiency has generally led to loan terms favoring the borrower, with fewer protections for the lender in the form of financial covenants. Investors in BSL are often “term takers” — meaning they have little ability to negotiate terms or covenants. In fact, the vast majority of BSLs are covenant-lite, meaning they do not include maintenance covenants that are embedded in direct lending agreements. While BSLs are senior in the capital structure, the lack of protective covenants have contributed to higher default rates and lower recovery rates versus direct lending to middle market companies, where lenders are able to respond to deteriorating conditions before bankruptcy is required.10

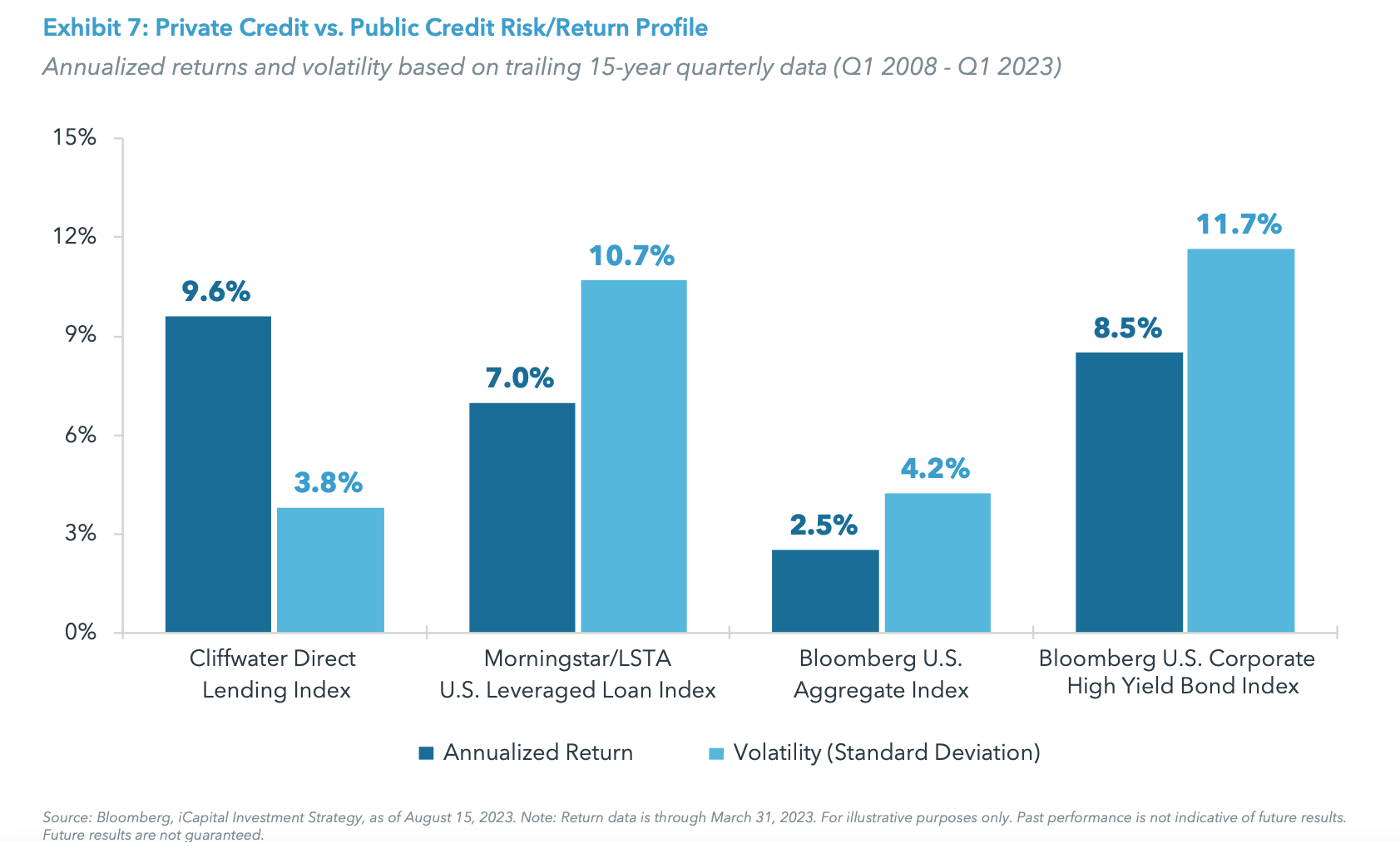

Enhanced Yield – Illiquidity Premium

Private credit has generated higher yields than most other fixed income strategies, including public high yield and broadly syndicated loans.11 Naturally, investors demand a premium over more liquid fixed income investments to justify the inability to trade private credit. As shown in Exhibit 7, private credit has outperformed leveraged loans by 260 bps and high yield by 110 bps over the past 15 years.12 Moreover, private credit experienced significantly less volatility over this time frame.13 Notably, the past 18 months has seen a shift from a low interest rate environment to the Fed’s rate hiking cycle beginning in March of 2022, demonstrating the benefit of direct lending’s floating reference rate.

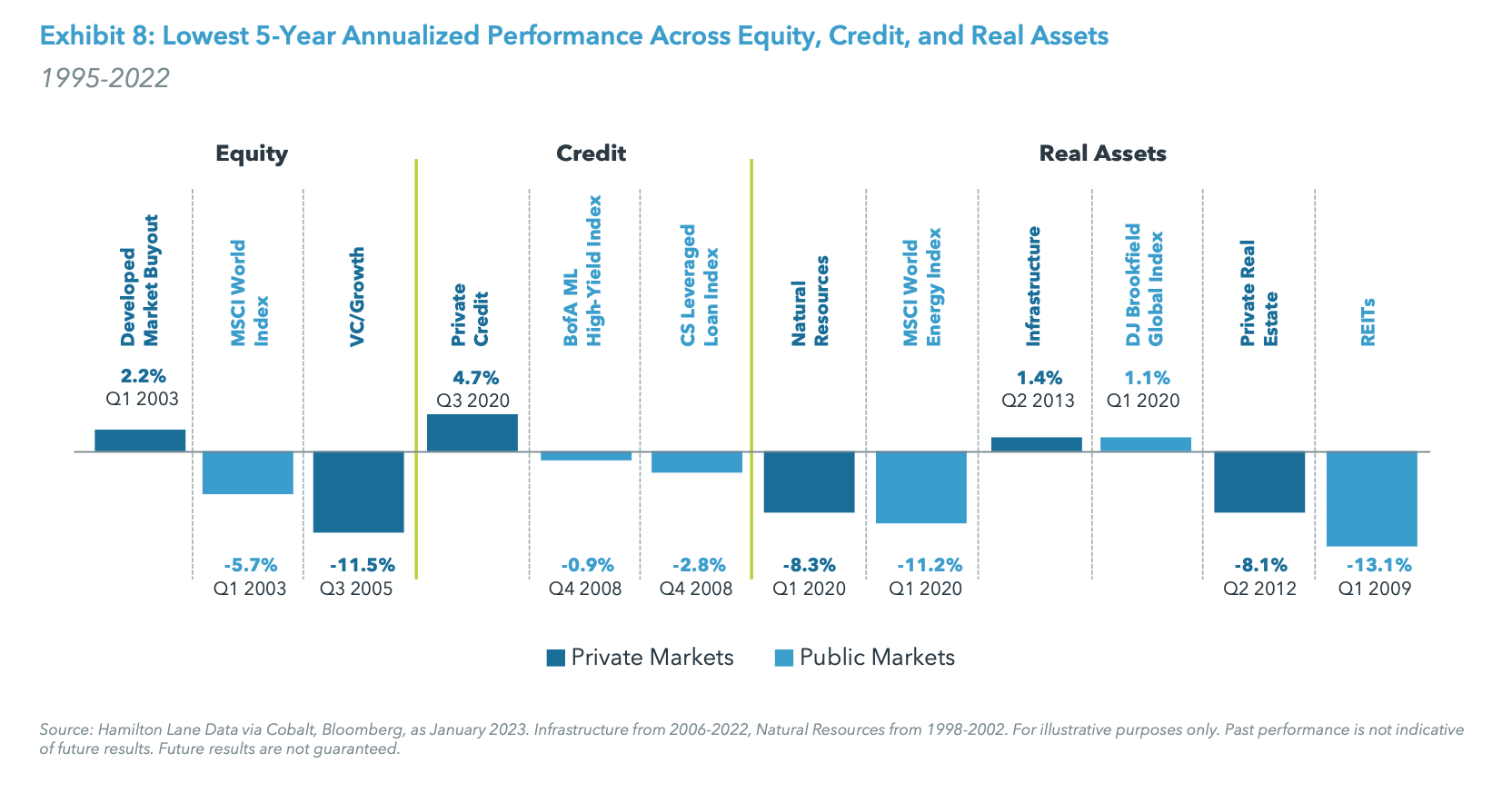

While private credit’s floating rate structure generally insulates lenders from duration risk, rising interest rates and high inflation environments can prove challenging to their portfolio companies, which face potentially slowing or even contracting growth and reduced cash flow as economic activity softens, potentially leading to higher defaults. However, historical data suggests that private credit downside protections and access to greater lender information may help mitigate this risk. In analyzing the lowest five-year annualized performance by asset class over the past 25+ years, we can see that private credit generated the best results with a 4.7% positive annualized return during its worst five-year stretch (as shown in Exhibit 8). Only three other asset classes in this analysis conducted by Hamilton Lane delivered positive performance (two of these also being an alternative investment strategy) during their worst five-year period.14

The return on private credit is also comparable to the public equity market, however private credit offers significantly more downside protection.15 As shown in Exhibit 9, direct lending has outperformed the Russell 2000 Total Return Index over one, three, five, and 10-year periods, consistently offering a 7.2% or greater return, while the Russell 2000 experienced negative returns in two of those periods.16 Over the 15-year period, direct lending’s return was only 70 bps lower than that of the Russell 2000; however, we would argue on a risk-adjusted basis, direct lending has outperformed across all periods.17 While not guaranteed, of course, this outperformance is indicative of the downside protection potential in private credit, often achieved with thorough upfront due diligence and the ability to rely on covenants to protect against principal loss.

Importance Of Manager Selection To Mitigate Risk

It is important to note that while the overall features of the private credit market make it an attractive opportunity, it is crucial for investors to select managers who are highly disciplined and well-equipped to execute the strategy properly. Given that many direct lenders rely on transactions backed by private equity sponsors to drive the majority of their deal flow, experienced managers who have developed deep sponsor relationships have a considerable competitive advantage over newer entrants.

Further, direct lenders do not compete only on price, but also on the certainty of closing and the speed of approving a loan. Thus, experienced managers who have strong networks and sector expertise, as well as greater scale and deeper resources, are often able to win deals without being the lowest priced option. By providing borrowers with assurance that their financing will close on time at the negotiated yield, which is appealing in today’s volatile and competitive markets, such managers can often command a premium for their loans.

Conclusion

From a portfolio perspective, a private credit allocation can provide enhanced income potential through originating loans to mid-sized companies that come with a higher interest rate spread over public credit markets, diversification benefits through lower volatility and lower correlation to broader bond and loan indices, and exposure to private companies that is not available in the public credit markets.

ENDNOTES

1. National Center for the Middle Market, Middle Market Indicator, as of June 2023.

2. FDIC Statistics as a Glance, as of March 31, 2023.

3. Blackrock, Private Credit: Evolution and Opportunity in Direct Lending, as of April 2022.

4. Board of Governors of the Federal Reserve System, Senior Loan Officer Opinion Survey on Bank Lending Practices, as of July 31, 2023. Large and middle market firms defined by annual sales of $50 million or more. Excludes loans or credit lines to be used to finance mergers and acquisitions.

5. Board of Governors of the Federal Reserve System, Senior Loan Officer Opinion Survey on Bank Lending Practices, as of May 9, 2022. Large and middle market firms defined by annual sales of $50 million or more. Excludes loans or credit lines to be used to finance mergers and acquisitions.

6. Source: S&P LCD, Cliffwater, JPMorgan Asset Management, as of June 30, 2022.

7. Preqin, as of August 7, 2023.

8. Preqin, as of August 7, 2023.

9. Preqin, as of August 7, 2023.

10. S&P Global Ratings, S&P Global Market Intelligence’s Credit Pro & Ratings Research, Credit Trends: U.S. Recovery Study: Post-Default Recoveries Improve in 2021 As Challenges Remain, Dec. 15, 2021.

11. Bloomberg, iCapital Investment Strategy, as of August 15, 2023. Note: Return data is through March 31, 2023.

12. Bloomberg, iCapital Investment Strategy, as of August 15, 2023. Note: Return data is through March 31, 2023.

13. Bloomberg, iCapital Investment Strategy, as of August 15, 2023. Note: Return data is through March 31, 2023.

14. Hamilton Lane, 2023 Market Overview, as of January 2023.

15. Bloomberg, iCapital Investment Strategy, as of August 15, 2023. Note: Return data is through March 31, 2023.

16. Bloomberg, iCapital Investment Strategy, as of August 15, 2023. Note: Return data is through March 31, 2023.

17. Bloomberg, iCapital Investment Strategy, as of August 15, 2023. Note: Return data is through March 31, 2023.

INDEX DEFINITIONS

Cliffwater Direct Lending Index (CDLI): An asset-weighted index of over 11,000 directly originated middle market loans totaling $264B. It seeks to measure the unlevered, gross of fee performance of U.S. middle market corporate loans, as represented by the asset-weighted performance of the underlying assets of Business Development Companies (BDCs), including both exchange-traded and unlisted BDCs, subject to certain eligibility requirements.

Morningstar/LSTA U.S. Leveraged Loan Index: Designed to deliver comprehensive, precise coverage of the US leveraged loan market. Underpinned by PitchBook and LCD data, the index serves as the market standard for the US leveraged loan asset class and tracks the performance of more than 1,400 USD denominated loans.

Bloomberg U.S. Aggregate Bond Index: A broad base, market capitalization-weighted bond market index. The index includes Treasury securities, government agency bonds, mortgage-backed bonds, corporate bonds, and several foreign bonds traded in the United States.

Bloomberg U.S. Corporate High Yield Bond Index: Measures the USD-denominated, high yield, fixed-rate corporate bond market. Securities are classified as high yield if the middle rating of Moody’s, Fitch and S&P is Ba1/BB+/BB+ or below. Bonds from issuers with an emerging markets country of risk, based on Bloomberg EM country definition, are excluded.

Russell 2000® Index: Measures the performance of the small-cap segment of the U.S. equity universe. The Russell 2000 Index is a subset of the Russell 3000® Index representing approximately 7% of the total market capitalization of that index, as of the most recent reconsitution. It includes approximately 2,000 of the smallest securities based on a combination of their market cap and current index membership. The Russell 2000 is constructed to provide a comprehensive and unbiased small- cap barometer and is completely reconstituted annually to ensure larger stocks do not distort the performance and characteristics of the true small-cap opportunity set.

IMPORTANT INFORMATION

The material herein has been provided to you for informational purposes only by Institutional Capital Network, Inc. (“iCapital Network”) or one of its affiliates (iCapital Network together with its affiliates, “iCapital”). This material is the property of iCapital and may not be shared without the written permission of iCapital. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of iCapital.

This material is provided for informational purposes only and is not intended as, and may not be relied on in any manner as, legal, tax or investment advice, a recommendation, or as an offer or solicitation to buy or sell any security, financial product or instrument, or otherwise to participate in any particular trading strategy. This material does not intend to address the financial objectives, situation, or specific needs of any individual investor. You should consult your personal accounting, tax and legal advisors to understand the implications of any investment specific to your personal financial situation.

ALTERNATIVE INVESTMENTS ARE CONSIDERED COMPLEX PRODUCTS AND MAY NOT BE SUITABLE FOR ALL INVESTORS. Prospective investors should be aware that an investment in an alternative investment is speculative and involves a high degree of risk. Alternative Investments often engage in leveraging and other speculative investment practices that may increase the risk of investment loss; can be highly illiquid; may not be required to provide periodic pricing or valuation information to investors; may involve complex tax structures and delays in distributing important tax information; are not subject to the same regulatory requirements as mutual funds; and often charge high fees. There is no guarantee that an alternative investment will implement its investment strategy and/or achieve its objectives, generate profits, or avoid loss. An investment should only be considered by sophisticated investors who can afford to lose all or a substantial amount of their investment.

iCapital Markets LLC operates a platform that makes available financial products to financial professionals. In operating this platform, iCapital Markets LLC generally earns revenue based on the volume of transactions that take place in these products and would benefit by an increase in sales for these products.

The information contained herein is an opinion only, as of the date indicated, and should not be relied upon as the only important information available. Any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets is not necessarily indicative of the future or likely performance. The information contained herein is subject to change, incomplete, and may include information and/or data obtained from third party sources that iCapital believes, but does not guarantee, to be accurate. iCapital considers this third-party data reliable, but does not represent that it is accurate, complete and/or up to date, and it should not be relied on as such. iCapital makes no representation as to the accuracy or completeness of this material and accepts no liability for losses arising from the use of the material presented. No representation or warranty is made by iCapital as to the reasonableness or completeness of such forward-looking statements or to any other financial information contained herein.

Securities products and services are offered by iCapital Markets, an SEC-registered broker-dealer, member FINRA and SIPC, and an affiliate of iCapital, Inc. and Institutional Capital Network, Inc. These registrations and memberships in no way imply that the SEC, FINRA, or SIPC have endorsed any of the entities, products, or services discussed herein. Annuities and insurance services are provided by iCapital Annuities and Insurance Services LLC, an affiliate of iCapital, Inc. “iCapital” and “iCapital Network” are registered trademarks of Institutional Capital Network, Inc. Additional information is available upon request.

©2024 Institutional Capital Network, Inc. All Rights Reserved. | 2024.01