But beneath the constant stream of public company news, the investable universe of publicly traded companies in the U.S. continues to shrink and grow older – declining by almost 50% over the last 25 years, from 8,090 in 1996 to 4,266 in 2019.1

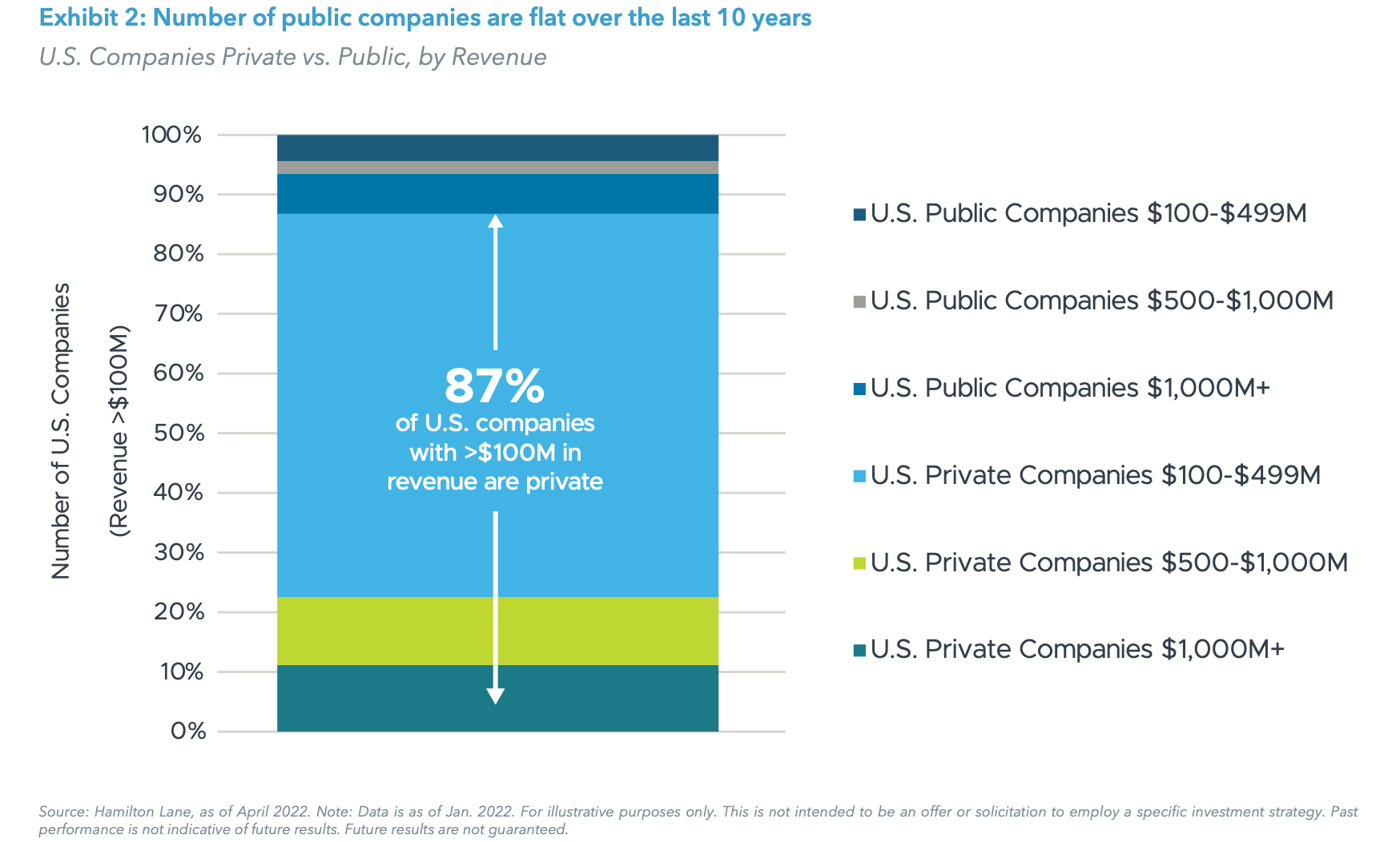

Moreover, only 13.8% (2,829) of U.S. companies with annual revenues greater than $100 million are public, leaving public investors closed off from more than 18,000 private companies that operate at that scale.2

The implications of this trend are profound. Fewer startups are going public due to the availability of private capital, and those that do tend to be larger and more mature – having exited their hyper-growth phase long before an IPO.3 In the technology sector, one study found that the average age of a newly listed company rose from five years in 2000 to 15 years in 2022.4

A prime example: In 2021, there was a spike in the number of IPOs in the U.S., with some 1,035 companies going public.5 At the time of IPO in 2021, the average company was 11 years old and valued at $4.3 billion, versus an average age of six years old and average valuation of only $700 million in 2020.5 Despite the fact that most of these companies were already well past their hyper-growth phase and were slowing down, these companies attracted extremely high valuations by public investors chasing growth at all costs. Today, 43% or 448 of those stocks, many of which are in the technology sector, have fallen since their public debut; moreover, 26% or 269 of those companies are now down by more than 50%.7

Corporates are staying private longer and, by the time they go public (if they do at all), most of their growth and value creation are behind them, reaped by a relatively small number of private investors. One could argue that venture capital and private equity firms often extract the most value out of their portfolio companies before they consider taking them public; and that the best small companies are increasingly opting to sell to private equity firms or strategic acquirers rather than exit via the public markets. Moreover, the majority of the stocks that have disappeared from the public arena are small cap, which tend to exhibit stronger growth profiles than larger, more mature businesses, making it even more difficult to find growth in the public markets.

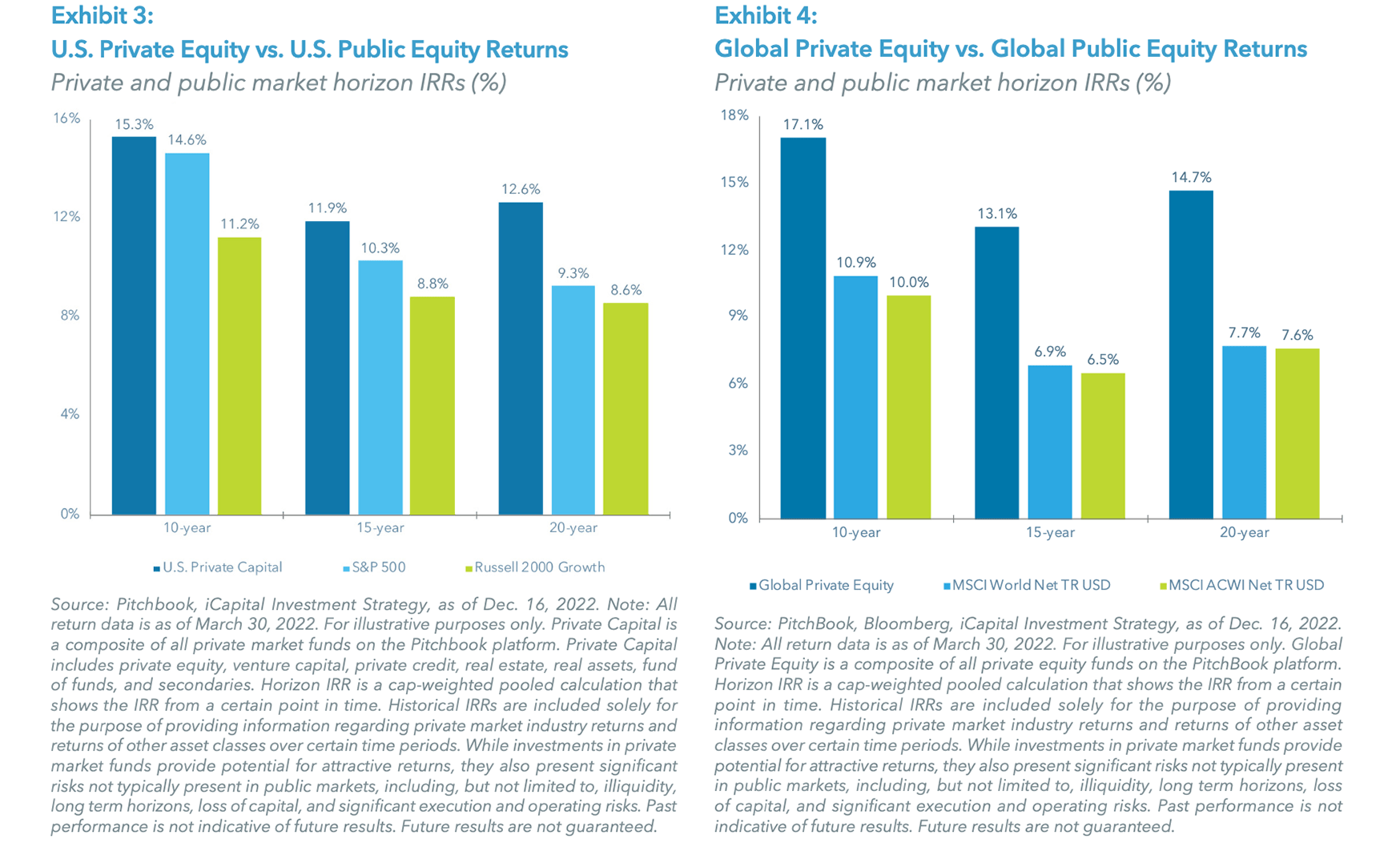

The fact is that most of today’s economic growth is taking place outside of the public markets – beyond the reach of most investors. To access growth opportunities in their portfolios going forward, eligible investors should consider allocating to the private marketplace, which offers diversification and the longer-term fundamental growth opportunities that used to be available in the public markets. As shown in Exhibits 3 and 4, private equity has historically outperformed public equity markets across multiple time periods, both in the U.S. and globally.

Given the historical outperformance of private equity, it’s no surprise that 93% of the institutional investors surveyed in 2023 by Preqin said they were planning to either maintain or increase their long-term allocations to private equity, while 86% reported that the performance of their private equity investments met or exceeded their expectations over the prior 12 months.8

So, what does the private market actually look like? It is massive, compared to the public market.

Here are some stats for the U.S.:

- There are seven million private U.S. companies.9

- The top 246 private companies alone have combined revenues of approximately $1.9 trillion and employ four million people.10

- There are nearly 200,000 middle market businesses, which represent one-third of private sector GDP and employ approximately 48 million people, totaling more than $10 trillion in annual revenue.11 About 91% of these companies are private.12

And yet the vast majority of eligible investors have little to no exposure to this market. Instead, they are invested in crowded passive public strategies, with an estimated $5.75 trillion dollars indexed to the S&P 500 alone.13 By comparison, the entire U.S. private equity industry, which invests in tens of thousands of companies, had only $4.6 trillion in assets under management, including dry powder, at the end of 2022.14

What’s holding back eligible individual investors from allocating to the private markets? The two main obstacles are the lack of liquidity and the lack of access to high- quality fund managers. However, there’s an important paradigm shift underway.

LIQUIDITY

If you accept that the traditional 60/40 portfolio built around daily liquidity is a suboptimal strategy for individuals with long-term financial objectives, then you need to question whether continued avoidance of illiquid investments is prudent. Think of it this way: particularly in low-growth environments, it makes little sense to have an entire portfolio invested in just the sliver of Exhibit 2 that represents publicly traded companies.

Another point worth considering is that the illiquid nature of private market investments has the inherent benefit of eliminating panic selling (when investor unload their stocks at a low point, rather than evaluating fundamentals). Almost every market crash involves panic selling, and the simple truth is that most people aren’t hardwired to keep their emotions in check when they see their portfolio take a big hit. By investing in private equity funds, the investor is placing the decision of when to sell in the hands of a professional manager and is essentially forced to adhere to a “buy and hold” discipline. One of the most overlooked factors in how private equity fund managers create value is simply in their ability to time their exit to a period where they can command a premium and attract an acceptable multiple.

So why are private equity fund managers better at timing the sales of their portfolio companies? Because high- performing managers spend a tremendous amount of time with the executives operating their companies and are economically aligned with them. Together, they work closely to execute a three to five year strategic plan to create value and exit at an opportune time.

This is perhaps the biggest difference between private equity and public equity — the importance of thinking and acting long-term. Private equity professionals spend far more time discussing strategy and long-term value creation with their management teams than board members of public companies, which are often afflicted by short-termism. In one survey of 500 public company executives, 70% of respondents said their companies would deprioritize or even ignore long-term growth strategies in order to meet short-term financial goals.15 These same respondents also noted that their companies delivered disappointing financial outcomes – they were half as likely to achieve organic revenue growth and 27% less likely to produce higher levels of Return on Invested Capital (ROIC).16

However, to benefit from these long-term strategies, investors must be willing and able to stay invested in a less liquid asset, which many investors have a difficult time embracing. In our 2023 iCapital Financial Advisor Survey, advisors cited lack of liquidity as the top barrier to using alternative investments in client portfolios.17

While investors tend to be conservative when considering illiquid assets, a BlackRock study found that an investor’s ability to take on liquidity risk may be higher than is typically assumed, depending on spending needs.18 The study concluded that institutional investors with high spending needs — up to 8% of the portfolio — can sustainably manage allocations up to 20% in private investments.19 For advisors and clients following the “4% Rule” – which is generally regarded as a conservative annual spending rate – reallocating 5-10% of a total portfolio to private equity should have a negligible impact on overall liquidity, while enhancing diversification and increasing return potential.

ACCESS

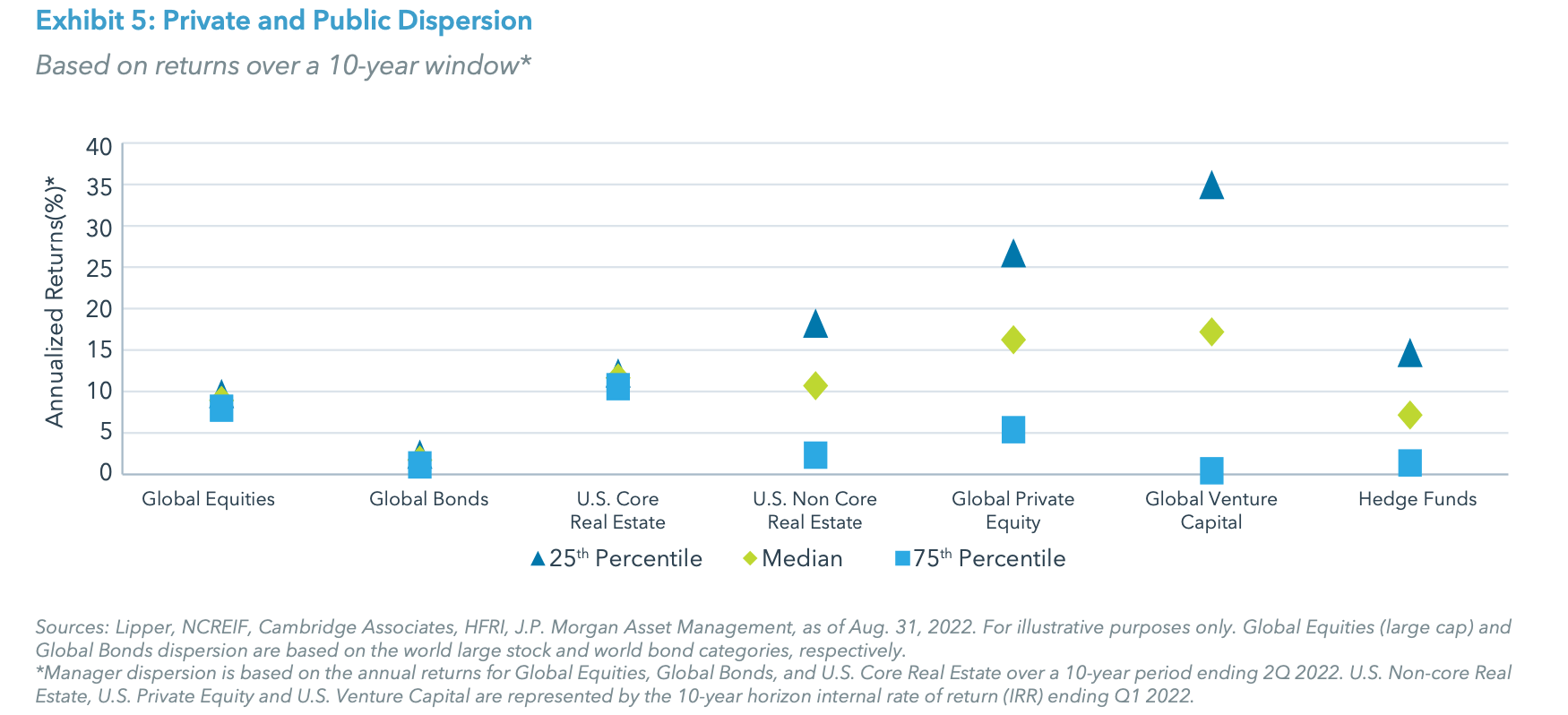

Of course, suggesting that an investor consider a less liquid asset class assumes that they have adequate information and access to experienced private company managers. Access is key in the private markets, where the return dispersion is massive relative to stocks and bonds. The spread between top-quartile and bottom-quartile managers has been over 2,100 basis points over the last decade (see Exhibit 5).

Harry Markowitz, Nobel Prize winner and the father of Modern Portfolio Theory, summed up the uneven playing field in an interview with Barron’s: “Whether you’re passive or active, as a basic principle, depends on how much information you have … Warren Buffet and David Swensen, the CIO of Yale University’s endowment, get offers that I don’t get and I bet you don’t get. They get information I don’t have, and they have staff which they have personally trained that can evaluate that information.”20 Mr. Markowitz, who passed away this past June at age 95, was correct up until relatively recently. Thankfully, this dynamic is changing to the benefit of the individual investor.

To be sure, private markets are not nearly as accessible or transparent as public markets – historically, individual investors have lacked the access to information and due diligence resources to properly evaluate opportunities to invest in specific private companies. Thus, for the vast majority of individuals, entrusting capital to professional private equity managers with the experience and resources necessary to properly select, manage, and exit private investments is the preferred way of gaining private market exposure.

Today, there are a number of platforms that are leveraging technology to provide eligible investors with access to quality private market funds at low minimums and streamline the associated reporting and administration for individual investors and their advisors. Some of these platforms also provide fully transparent, institutional-quality due diligence, a service that has historically only been available to institutional investors and large family offices.

While some may question why top-tier private fund managers are pursuing individual investor capital, the answer becomes clear when taking into account the size of the opportunity set. Individual investors held roughly half of global wealth ($140–150T) in 2022, with a nearly equal amount being held and managed by institutional investors ($135–145T).21 For individual investors, however, alternative investment strategies account for a very small percentage of their investable assets (estimated at less than 5%).22 This presents a significant opportunity for fund managers, who are increasingly taking advantage of semi-liquid, evergreen structures and also leveraging technology-enabled platforms to aggregate individual investor commitments into feeder funds at lower minimums, while effectively only dealing with a single entity, just as they would a typical institutional investor.

CONCLUSION

With investors seeking uncorrelated sources of return to mitigate risk in a traditional stock/bond portfolio, the need to incorporate a diverse range of quality private asset exposures into a portfolio is greater than ever in today’s increasingly volatile market environment. Investors should consider integrating private strategies that operate in less efficient markets, exhibiting more growth and more opportunities to generate alpha. And to do this effectively, investors and their advisors must adjust their mindset from seeing alternatives as a bolt-on exposure to seeing them as core holdings in a portfolio, with growth and income allocations across both public and private assets. Today, the full toolkit is available, and financial professionals can implement a meaningful allocation to the private capital markets with high-quality managers and an ease-of-use that was not possible a decade ago.

ENDNOTES

1. The World Bank, as of May 10, 2023.

2. Hamilton Lane, “Private Market Investing: Staying Private Longer Leads to Opportunity,” April 14, 2022.

3. Ewens, Michael and Joan Farre-Mensa, “The Deregulation of the Private Equity Markets and the Decline in IPO,” The Review of Financial Studies, Volume 33, Issue 12, Dec. 2020.

4. University of Florida, Warrington College of Business, Initial Public Offerings: Updated Statistics, as of Sept. 12, 2023.

5. Stock Analysis, All 2021 IPOs; prices reflect intraday trading, as of Sept. 21, 2023.

6. University of Florida, Warrington College of Business, Initial Public Offerings: Updated Statistics, as of Sept. 12, 2023; Bloomberg, as of Oct. 2021.

7. Stock Analysis, All 2021 IPOs; prices reflect intraday trading, as of Sept. 21, 2023.

8. Preqin Investor Outlook: Alternative Assets, H2 2023, Aug. 22, 2023.

9. Kaiser Family Foundation, “Number of Private Sector Firms, by Size,” 2021.

10. Forbes, “Americas Largest Private Companies,” Dec. 1, 2022.

11. The National Center for the Middle Market: Q2 2022 Middle Market Indicator.

12. Privately owned excludes publicly listed companies and companies that have public filing obligations.

13. S&P Global, “S&P Dow Jones Indices Annual Survey of Assets,” Dec. 31, 2022. 14. Preqin, as of Sept. 12, 2023.

15. McKinsey, “How executives can help sustain value creation for the long term,” July 22, 2021.

16. McKinsey, “How executives can help sustain value creation for the long term,” July 22, 2021.

17. iCapital, 2023 iCapital Financial Advisor Survey, August 17, 2023.

18. Blackrock Investment Institute, The Core Role of Private Markets in Modern Portfolios, March 2019.

19. Blackrock Investment Institute, The Core Role of Private Markets in Modern Portfolios, March 2019.

20. Barrons, “The Father of Portfolio Theory Bets on Rebuilding,” Feb. 3, 2018.

21. Bain & Company, Global Private Equity Report 2023, as of Feb. 27, 2023.

22. Bain & Company, Global Private Equity Report 2023, as of Feb. 27, 2023. Excludes ultra-high-net-worth and family offices.

IMPORTANT INFORMATION

The material herein has been provided to you for informational purposes only by Institutional Capital Network, Inc. (“iCapital Network”) or one of its affiliates (iCapital Network together with its affiliates, “iCapital”). This material is the property of iCapital and may not be shared without the written permission of iCapital. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of iCapital.

This material is provided for informational purposes only and is not intended as, and may not be relied on in any manner as, legal, tax or investment advice, a recommendation, or as an offer or solicitation to buy or sell any security, financial product or instrument, or otherwise to participate in any particular trading strategy. This material does not intend to address the financial objectives, situation, or specific needs of any individual investor. You should consult your personal accounting, tax and legal advisors to understand the implications of any investment specific to your personal financial situation.

ALTERNATIVE INVESTMENTS ARE CONSIDERED COMPLEX PRODUCTS AND MAY NOT BE SUITABLE FOR ALL INVESTORS. Prospective investors should be aware that an investment in an alternative investment is speculative and involves a high degree of risk. Alternative Investments often engage in leveraging and other speculative investment practices that may increase the risk of investment loss; can be highly illiquid; may not be required to provide periodic pricing or valuation information to investors; may involve complex tax structures and delays in distributing important tax information; are not subject to the same regulatory requirements as mutual funds; and often charge high fees. There is no guarantee that an alternative investment will implement its investment strategy and/or achieve its objectives, generate profits, or avoid loss. An investment should only be considered by sophisticated investors who can afford to lose all or a substantial amount of their investment.

iCapital Markets LLC operates a platform that makes available financial products to financial professionals. In operating this platform, iCapital Markets LLC generally earns revenue based on the volume of transactions that take place in these products and would benefit by an increase in sales for these products.

The information contained herein is an opinion only, as of the date indicated, and should not be relied upon as the only important information available. Any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets is not necessarily indicative of the future or likely performance. The information contained herein is subject to change, incomplete, and may include information and/or data obtained from third party sources that iCapital believes, but does not guarantee, to be accurate. iCapital considers this third-party data reliable, but does not represent that it is accurate, complete and/or up to date, and it should not be relied on as such. iCapital makes no representation as to the accuracy or completeness of this material and accepts no liability for losses arising from the use of the material presented. No representation or warranty is made by iCapital as to the reasonableness or completeness of such forward-looking statements or to any other financial information contained herein.

Securities products and services are offered by iCapital Markets, an SEC-registered broker-dealer, member FINRA and SIPC, and an affiliate of iCapital, Inc. and Institutional Capital Network, Inc. These registrations and memberships in no way imply that the SEC, FINRA, or SIPC have endorsed any of the entities, products, or services discussed herein. Annuities and insurance services are provided by iCapital Annuities and Insurance Services LLC, an affiliate of iCapital, Inc. “iCapital” and “iCapital Network” are registered trademarks of Institutional Capital Network, Inc. Additional information is available upon request.

©2024 Institutional Capital Network, Inc. All Rights Reserved. | 2024.01