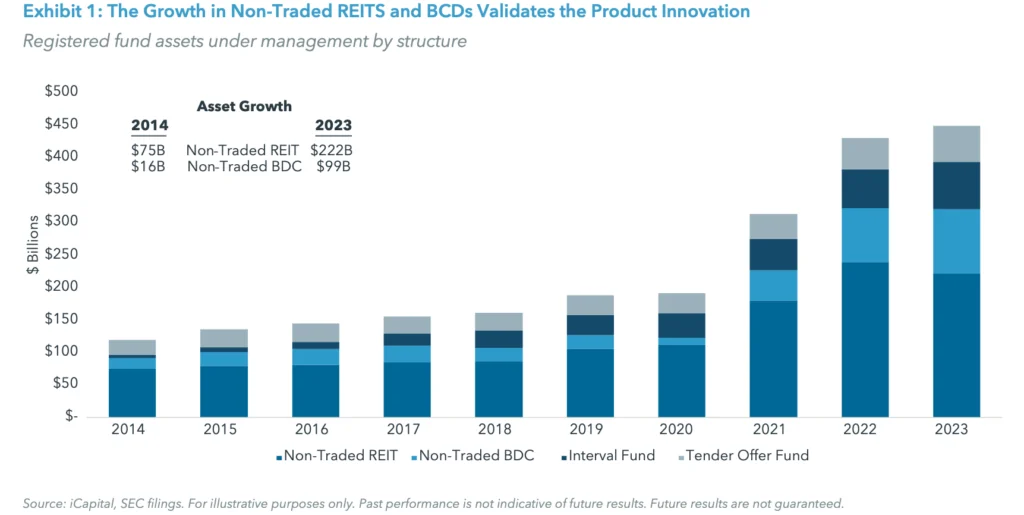

As more individual investors try to figure out how to add alternative investments to their portfolios, fund managers are innovating on simpler fund structures. One of the biggest product trends seen from these managers are evergreen funds. These fund structures are individual investor-friendly in that they typically offer periodic liquidity and are perpetually offered. From a niche product a decade ago, these funds now account for nearly $500 billion in assets and are on their way to becoming an important part of the alternative investment offerings into the wealth management channel.

Historically, alternative investments have been limited to the upper end of the wealth spectrum where only certain investors can commit to traditional, closed-end drawdown funds. Drawdown funds typically have a finite fundraising window, require a minimum commitment amount in the millions of dollars, make capital calls over multiple years, and generally have a fixed term of about a decade. These attributes require tolerance in withstanding the tendencies of a J-curve return and also create logistical hurdles from making sure an investor’s timing lines up with the fundraising window to managing cash flows for capital calls over multiple years, not to mention that these traditional GP-LP structures produce a K-1 for tax reporting, which can come months after the mid-April filing deadline.

Evergreen funds solve many of these challenges by offering mutual fund-like features: a continuous capital raising process (no fundraising window), lower minimums, upfront investments (no capital calls), and no defined start or end date. Additionally, they come with streamlined 1099 tax reporting for enhanced ease of use.

The most commonly used structures for exposure to core/ core plus real estate and middle market direct lending private credit are through non-traded real estate investment trusts (REITs) and non-traded business development corporations (BDCs).

INCOME-PRODUCING NON-TRADED REITS AND BDCS

The goal of these funds is straightforward – to provide investors with exposure to income producing private real estate or credit. In fact, both REITs and BDCs are required to distribute 90% of their net income. An added benefit to the income-producing nature of these underlying assets is how they provide added liquidity through redemptions, typically on a quarterly basis. As compared to traditional, closed-end drawdown funds that pursue similar strategies, we’ve observed that investors in BDCs may only be giving up approximately 1% of net returns in exchange for enhanced flexibility. On the real estate side, even funds targeting the upper end of the wealth spectrum for core and core plus strategies utilize an open-ended structure.

Proof of the benefits of these structures is seen in fund flows. Non-traded REITs and BDCs have taken hold in the wealth channel and now account for over $300 billion in assets under management, or roughly 70% of the space. Non-traded BDCs have seen some of the fastest growth, with a five-fold increase since 2019 to $100 billion in assets.

Even with individual investor-friendly attributes, the liquidity of these funds is considered semi-liquid, as it’s limited and at the discretion of the manager. Most funds offer quarterly liquidity of up to 5% of net asset value (NAV); if this 5% threshold is exceeded, then investors may be rationed back on a pro rata basis until their request is fulfilled. This is designed to offer investors opportunities to cash out while also protecting other investors in the fund who do not wish to redeem. Said another way, these funds are intended to be longer term investments with a quarterly redemption option that is intended to prevent a “run on the fund.”

The ability for these funds to meet redemption requests ultimately will prove their merit — in validating that the products work as designed. Following an up and down 2021 – 2024 period in public market equity and real estate valuations, several non-traded REITs that saw a rush in redemption requests were able to fulfil all requests while others are still working through a backlog. There’s always the possibility that a fund can’t meet all investor redemption requests, especially when they come in waves. In such cases, these fund structures could face a mismatch in assets and liabilities. But to date, we’ve observed that a majority of funds are performing as expected.

Continued product innovation with evergreen products is helping investors gain exposure to the private markets in a simpler structure relative to drawdown funds. As time goes on, we may even start to observe certain institutional investors utilizing evergreen funds for parts of their private real estate and credit exposure, which would further validate the evolution and democratization of the market.

IMPORTANT INFORMATION

The material herein has been provided to you for informational purposes only by Institutional Capital Network, Inc. (“iCapital Network”) or one of its affiliates (iCapital Network together with its affiliates, “iCapital”). This material is the property of iCapital and may not be shared without the written permission of iCapital. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of iCapital.

This material is provided for informational purposes only and is not intended as, and may not be relied on in any manner as, legal, tax or investment advice, a recommendation, or as an offer or solicitation to buy or sell any security, financial product or instrument, or otherwise to participate in any particular trading strategy. This material does not intend to address the financial objectives, situation, or specific needs of any individual investor. You should consult your personal accounting, tax, and legal advisors to understand the implications of any investment specific to your personal financial situation.

ALTERNATIVE INVESTMENTS ARE CONSIDERED COMPLEX PRODUCTS AND MAY NOT BE SUITABLE FOR ALL INVESTORS. Prospective investors should be aware that an investment in an alternative investment is speculative and involves a high degree of risk. Alternative Investments often engage in leveraging and other speculative investment practices that may increase the risk of investment loss; can be highly illiquid; may not be required to provide periodic pricing or valuation information to investors; may involve complex tax structures and delays in distributing important tax information; are not subject to the same regulatory requirements as mutual funds; and often charge high fees. There is no guarantee that an alternative investment will implement its investment strategy and/or achieve its objectives, generate profits, or avoid loss. An investment should only be considered by sophisticated investors who can afford to lose all or a substantial amount of their investment.

iCapital Markets LLC operates a platform that makes available financial products to financial professionals. In operating this platform, iCapital Markets LLC generally earns revenue based on the volume of transactions that take place in these products and would benefit from an increase in sales for these products.

The information contained herein is an opinion only, as of the date indicated, and should not be relied upon as the only important information available. Any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets is not necessarily indicative of the future or likely performance. The information contained herein is subject to change, incomplete, and may include information and/or data obtained from third party sources that iCapital believes, but does not guarantee, to be accurate. iCapital considers this third-party data reliable, but does not represent that it is accurate, complete and/or up to date, and it should not be relied on as such. iCapital makes no representation as to the accuracy or completeness of this material and accepts no liability for losses arising from the use of the material presented. No representation or warranty is made by iCapital as to the reasonableness or completeness of such forward-looking statements or to any other financial information contained herein.

Securities products and services are offered by iCapital Markets, an SEC-registered broker-dealer, member FINRA and SIPC, and an affiliate of iCapital, Inc. and Institutional Capital Network, Inc. These registrations and memberships in no way imply that the SEC, FINRA, or SIPC have endorsed any of the entities, products, or services discussed herein. Annuities and insurance services are provided by iCapital Annuities and Insurance Services LLC, an affiliate of iCapital, Inc. “iCapital” and “iCapital Network” are registered trademarks of Institutional Capital Network, Inc. Additional information is available upon request.

©2024 Institutional Capital Network, Inc. All Rights Reserved.