Build beyond the box

Architect allows advisors to more easily analyze and integrate alternatives and structured investments, which can offer enhanced return and income opportunities to create potentially better outcomes for clients.

Your portfolio

design studio

Architect is a real-time scratchpad to build portfolios that incorporate the offerings from your unique iCapital product menu.

-

Easily explore new asset allocations

-

Incorporate alternatives and structured investments directly into client portfolios

-

Position combinations of alternatives and structured investments as a holistic solution

Powerful analytics. Unparalleled user experience.

Architect is designed from the ground up to bring clarity to the alternatives and structured investment process, through rich and intuitive analytics that visualize underlying risk and return drivers.

-

Portfolio growth simulation with and without alternatives and structured investments

-

Historical performance modeling

-

Risk factor analysis

Enhanced client

engagement

Architect's tools and analytics can help strengthen investment expertise, provide differentiated results, and improve client conversations that will set your practice apart from the competition.

-

Elevate and differentiate your investment expertise

-

Better align with client objectives

-

Empower informed decision making

FAQs

What is Architect?

Why should I use Architect?

How can Architect help me grow my business?

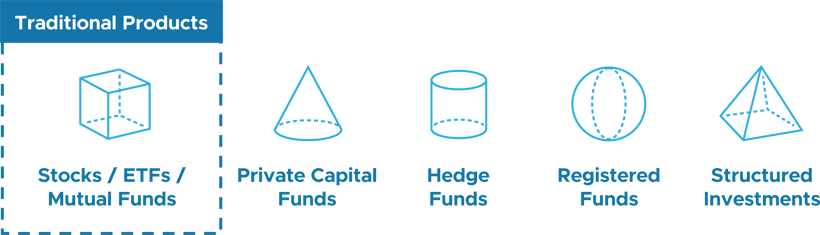

Which assets can be evaluated using Architect?

What type of analytics can I access with Architect?

How is Architect different from other portfolio analytical tools?

Why is it important to have a tool that analyzes alternatives and structured investments?

What are Spectrum Scores and why do they matter?

- Protection — ability to protect an investor from downside;

- Upside — opportunity for returns;

- Liquidity — ability to easily convert assets into cash;

- Simplicity — an analysis on the simplicity or complexity of the asset’s structure, features, and the investment strategies;

- History — an evaluation of how much time series data we have on the assets in the portfolio.

This framework empowers advisors to evaluate portfolios relative to client preferences and produce an alignment score – a measurement of goodness of portfolio fit. This approach is more nuanced and all-encompassing than competitive approaches, which typically seek to match a client risk tolerance based on just risk and return.

How do I start analyzing portfolios?

Trailing 12 months, through February 29, 2024.

Unique financial professionals who have visited an iCapital platform in the past 12 months ending February 29, 2024.