Portion in the U.S. Independent Wealth Channel2

as of 5/31/2025

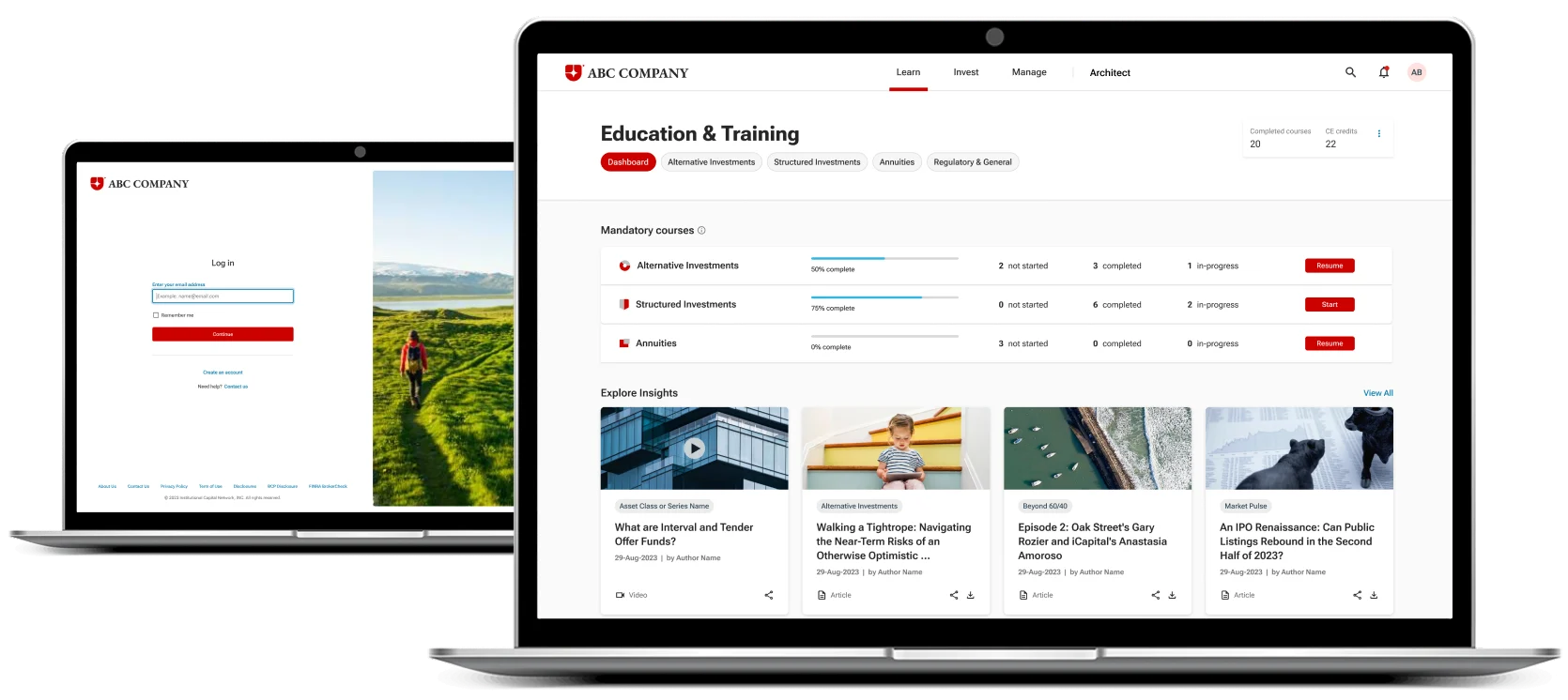

Your Brand, Your Platform

Powered by Our Technology

Configure Your Platform to Reflect Your Brand Identity

Build the features, functionality, and user experience of the platform with customizable colors, workflows, and URLs that align with your brand.

Build a Tailored

Investment Offering

Create a custom menu that fits your firm’s needs, combining funds sourced by your team, bespoke funds, direct investments, and iCapital-sponsored strategies—all unified on one adaptable platform.

Portfolio Construction

and Analytics

Equip advisors to easily explore new asset allocations, simulate portfolio growth with alternatives and structured investments, and leverage analytics to help deliver the best client outcomes.

Optimize Every Stage of the Investment Lifecycle

Leverage a fully digital platform that allows you to streamline workflows, improve productivity, and easily scale processes as your business grows.

Simplify Advisor

and Client Reporting

Seamlessly integrate into downstream reporting systems, allowing for simplified decision-making for advisors and transparency for clients.

Enhance Supervisory

Oversight

Manage your investment offerings with full visibility into approved products, an integrated learning management system, and insight into all firmwide investment activity — ensuring compliance with firmwide programs and risk mitigation.

Build a Platform that Fully Integrates with Your Firm’s Technology Stack

Create a platform that blends seamlessly with your existing workflows and tools. Customize investment offerings, streamline client onboarding, and assess suitability across portfolios. Equip your advisors with advanced analytics and educational resources to enhance client outcomes

For illustrative purposes only.

Related Posts

Contact Us

Speak with our Independent Wealth Enterprise Team about using iCapital’s award winning5 platform to help grow your business.

Submit an inquiry form

and an iCapital representative will contact you.

1. Represents inception to date (2013 through July 2024) client subscription volumes across alternatives, structured investments, and annuities.

2. Represents inception to date (2013 through July 2024) client subscription volumes for the “Independent Wealth Channel” across alternatives and structured investments. “Independent Wealth Channel” includes Independent U.S. Wealth Management, which is defined as Independent Investment Advisers and Independent Broker Dealers in the U.S. and excludes International Firms, Private Banks, and Wirehouses.

3. Testimonial may not be representative of the experience of other customers. Testimonial is not a guarantee of future performance or success.

4. Testimonial AUM numbers as of 07/31/24.

5. View detailed description of the awards and selection criteria here.

iCapital and its affiliates provide various services through a number of affiliated entities – please refer to Certain iCapital Entities for a full list of entities. iCapital entities are collectively referred to as “iCapital”, and they all are affiliated with iCapital, Inc. and Institutional Capital Network, Inc.

This website is for informational purposes only. This website is the property of iCapital and may not be shared, reproduced in any form, or referred to in any other publication, without express written permission of iCapital.

This website and any information included on it are not intended, and may not be relied on in any manner, as legal, tax or investment advice, a recommendation, or as an offer to sell, a solicitation of an offer to purchase or a recommendation of any interest in any fund or security. Financial products, including investment funds and structured investments, are complex and may be speculative and are not suitable for all investors. You should consult your personal accounting, tax and legal advisors to understand the implications of any investment specific to your personal financial situation. This website and the information contained on it is not intended to, and does not, address the financial objectives, situation or specific needs of any specific investor.

iCapital and iCapital Network are registered trademarks of Institutional Capital Network, Inc.

©2024 Institutional Capital Network, Inc. All Rights Reserved.

Robert Picard

Robert Picard Haig Ariyan

Haig Ariyan

Li Ma

Li Ma

Tony Nguyen

Tony Nguyen