If there is one thing that 2023 is likely to be most remembered for, it is Artificial Intelligence (AI). Or the year in which AI went mainstream and became accessible and visible to the everyday consumer, thanks to the launch of OpenAI’s ChatGPT and Google’s Bard. In fact, ChatGPT has been the fastest application to surpass 100 million users, taking a mere two months compared with apps like Instagram and Spotify which took 30 and 55 months, respectively.1

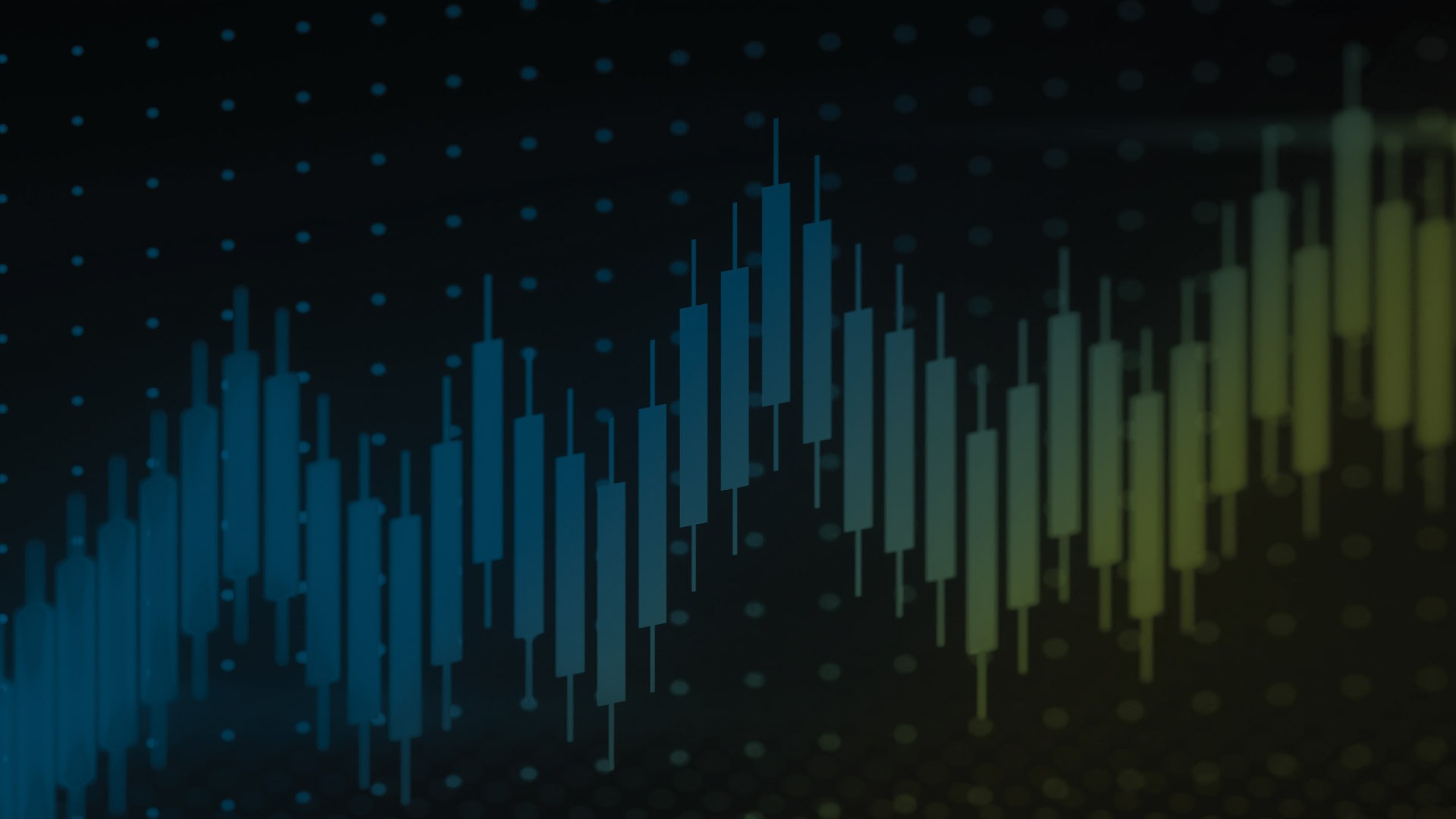

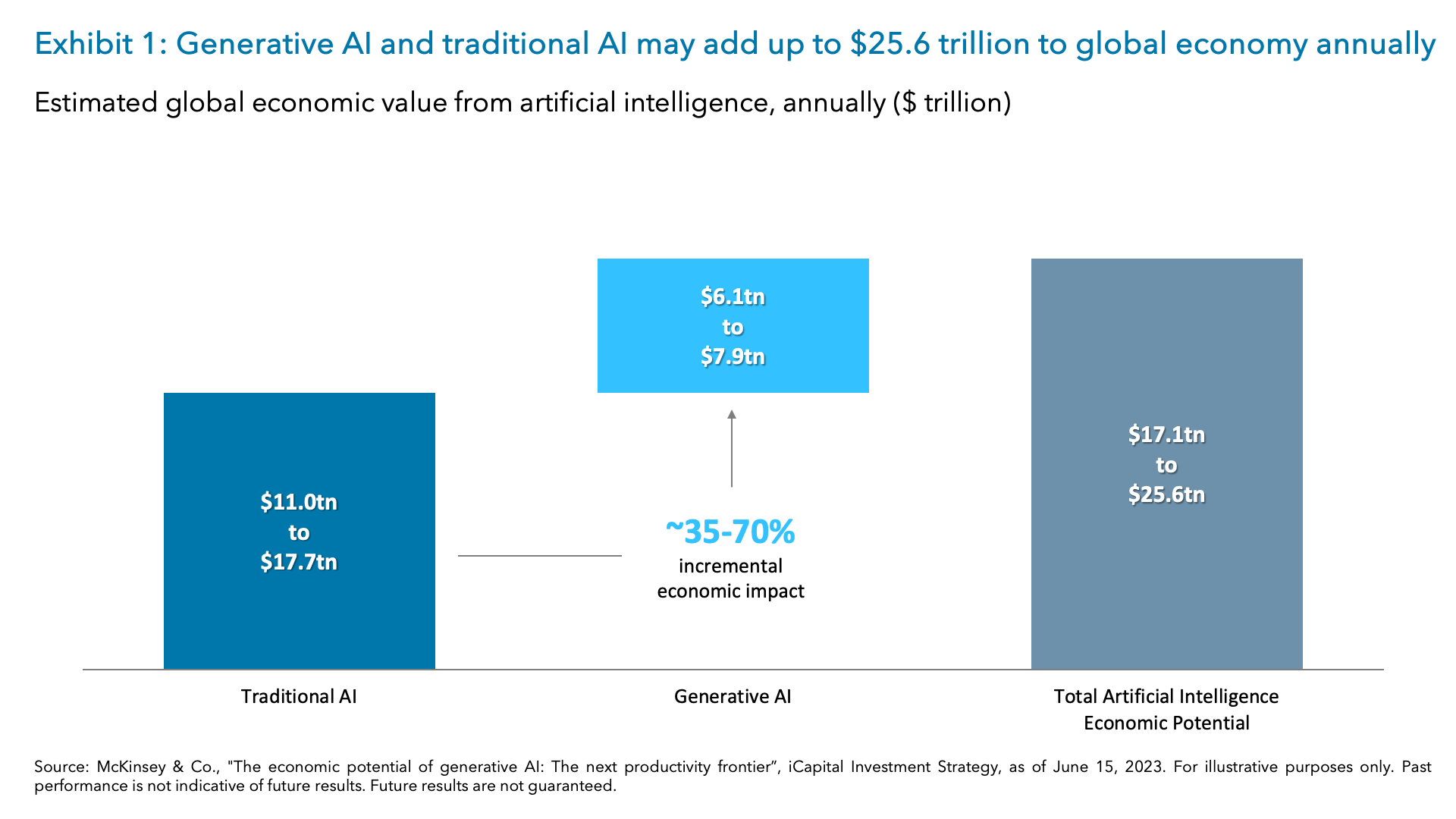

However, ChatGPT is just the tip of the iceberg. Though estimates vary, AI is expected to add between $17.1 trillion to $25.6 trillion annually in global economic value, with generative AI accounting for nearly 35% of that (between $6.1 trillion and $7.9 trillion annually) (Exhibit 1).2 With its ability to transform processes, enhance productivity, and meet evolving consumer and business needs, AI is undoubtedly one of the most far-reaching commercial opportunities today.

Consequently, AI is an important investment opportunity. In this week’s commentary we explore the investment implications of AI. Which sectors are set to benefit the most from the rush to adopt AI? How large is the opportunity set? And the key question – with everyone seemingly in agreement on the massive potential of AI and AI beneficiaries’ stocks having vastly outperformed this year, is it all already in the price?

Despite this outperformance, our view is that the full multi-year potential of AI is yet to be fully priced into beneficiary stocks. We explore the reasons for that and other investment implications of AI in the commentary below.

The rush to adopt AI is driving a sizable increase in projected industry revenues

There is a sense of fear of missing out (FOMO) when it comes to AI, and it’s playing out in IT managers’ spending intentions. IT managers globally realize the critical importance of embedding AI into their processes or risk being left behind their competitors who already do or will. While AI, specifically generative AI, is not yet significantly impacting overall IT spending levels, companies are beginning to incorporate AI through existing IT spending.3 Not surprisingly, 47% of companies recently surveyed by CNBC said AI is their top spending area in technology over the next 12 months, with 63% saying their companies are accelerating spending on AI.4 These adoption intentions in turn will require a substantial investment from corporations for years to come.

Indeed, over the past 10 years, global corporate private investment in AI has totaled approximately $447.95 billion, with 48.5% of that (roughly $217.2 billion) raised in 2021 and 2022 (Exhibit 2).5 And global AI spending is forecast to grow rapidly and across all industries in the coming years. In 2023, AI spend is expected to be driven by banking, retail, and professional services, which collectively will account for roughly 37% of overall AI spend.6 Further, the International Data Corporation (IDC) forecasts that aggregate AI spending is likely to double from $154 billion in 2023 to $300 billion in 2026, growing at a compound annual growth rate (CAGR) of 27% over the 2022-2026 period.7 This is a multi-year boom and secular megatrend for AI technology suppliers to capitalize on.

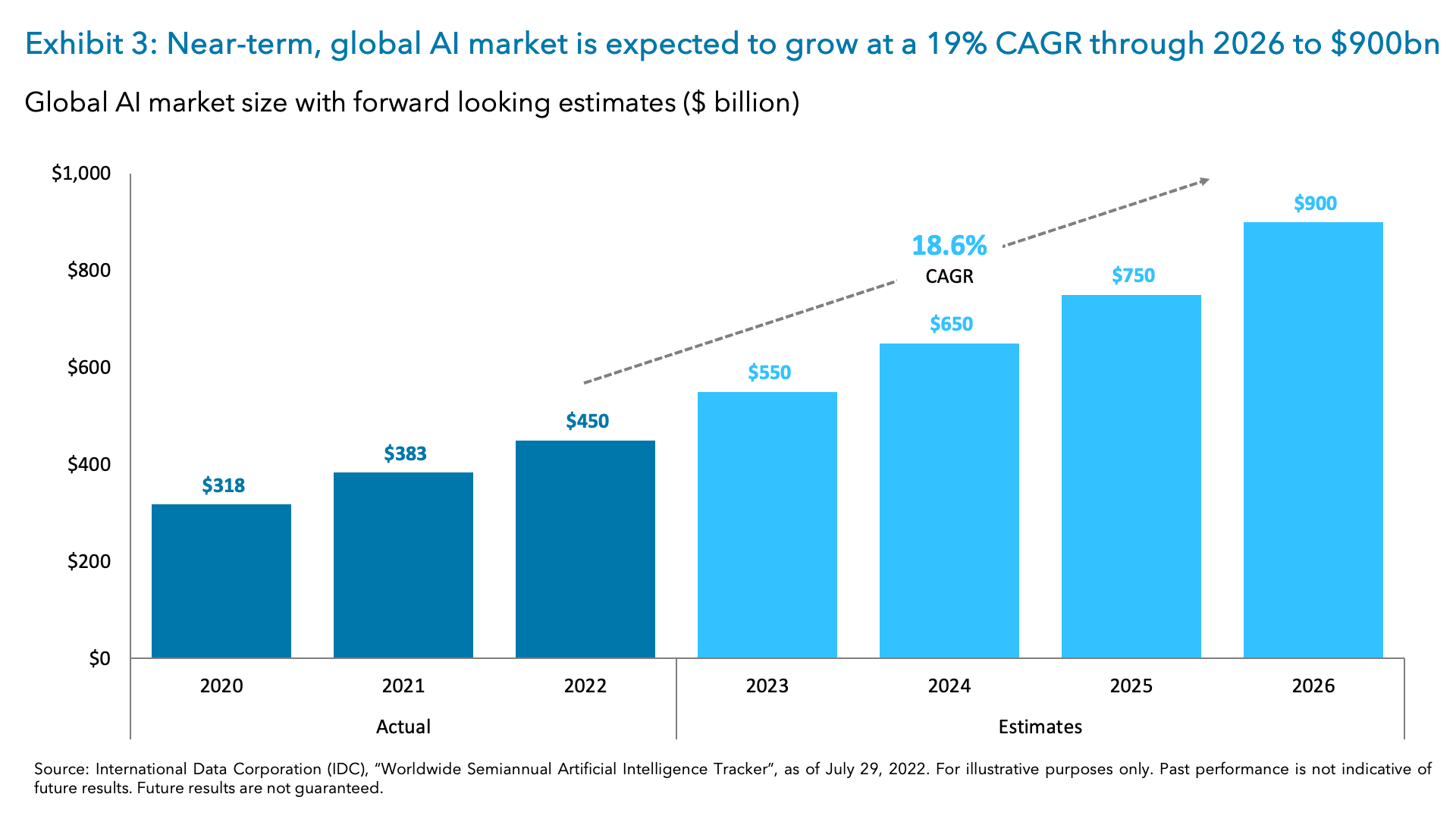

Indeed, Microsoft CEO Satya Nadella recently called next-generation AI an opportunity that can increase the partner ecosystem’s total addressable market (TAM) by over 50% down the line from $4 trillion to $6.5 trillion.8 And it’s not just one company’s forecast. In the near-term, the global AI-beneficiary TAM is forecast to double from $450 billion in revenues in 2022 to $900 billion in 2026, growing at a CAGR of 18.6% through 2026 (Exhibit 3).9 This TAM captures three major IT segments which are set to benefit from AI – hardware, software, and services.

1. Hardware is expected to account for roughly $40 billion of overall TAM, or about 4.5% of the estimated industry revenues, by 2026.10 Note that so far, the biggest outperformers among AI beneficiaries have been the chipmakers, like Nvidia.11 Understandably, hardware like graphics processing unit (GPU) semiconductors, which are required for compute-intensive AI training tasks, are the enabling technology and are the early-stage beneficiaries. Also, since this compute is predominately occurring in the cloud, hyperscalers like Microsoft, Amazon, and Tencent will need to boost their AI data center investments, which in turn benefits other chip providers. And these benefits are already visible today. For example, Broadcom’s management expects AI revenue to represent more than 25% of the company’s semiconductor revenue in the 2024 fiscal year, up from roughly 10% in the 2022 fiscal year and 15% today.12 Nvidia recently reported fiscal first quarter 2024 data center revenue of $4.28 billion and guided for fiscal second quarter data center revenue to come in at $11 billion, a step-function increase largely driven by proliferation of generative AI.13 Similarly, Marvell’s management said recently that they expect “AI revenue in fiscal 2024 to at least double from the prior year and continue to grow rapidly in the coming years.”14 Collectively, these chip providers are already seeing visible signs of a step up in AI data center investments.

2. Software is expected to represent approximately $790 billion of overall TAM, or roughly 88% of the estimated industry revenues, by 2026.15 AI-related software has and is expected to continue to make up the lion share of the overall revenue mix. After the necessary investments in data centers and compute are made and AI/machine learning (ML) models are trained, companies will focus on the inference stage of AI – which is applying the trained models to new use cases and building and scaling AI “killer apps.” From picks-and-shovels of AI and ML from some of the largest tech companies that will enable businesses and consumers to buy off-the-shelf and ready-to-use AI tools, to more niche software applications that cater to a specific industry vertical or workplace productivity category, there will not be a shortage of software companies developing AI-enabled, AI-powered products. These might include cybersecurity companies utilizing AI for threat detection, work productivity companies that enhance call center operations, conversational commerce/marketing platforms, and healthcare precision medicine companies, to name a few of the many more use cases.

3. IT Services sector is expected to account for about $70 billion of overall TAM, or 8% of the estimated industry revenues, by 2026.16 Finally, AI services is expected to see the strongest growth rates – north of 20% (2022-2026E CAGR) – as there will be an increased need for services to deploy AI solutions for intelligent automation.17

AI is a massive, multi-year public market opportunity that many analysts are modeling conservatively

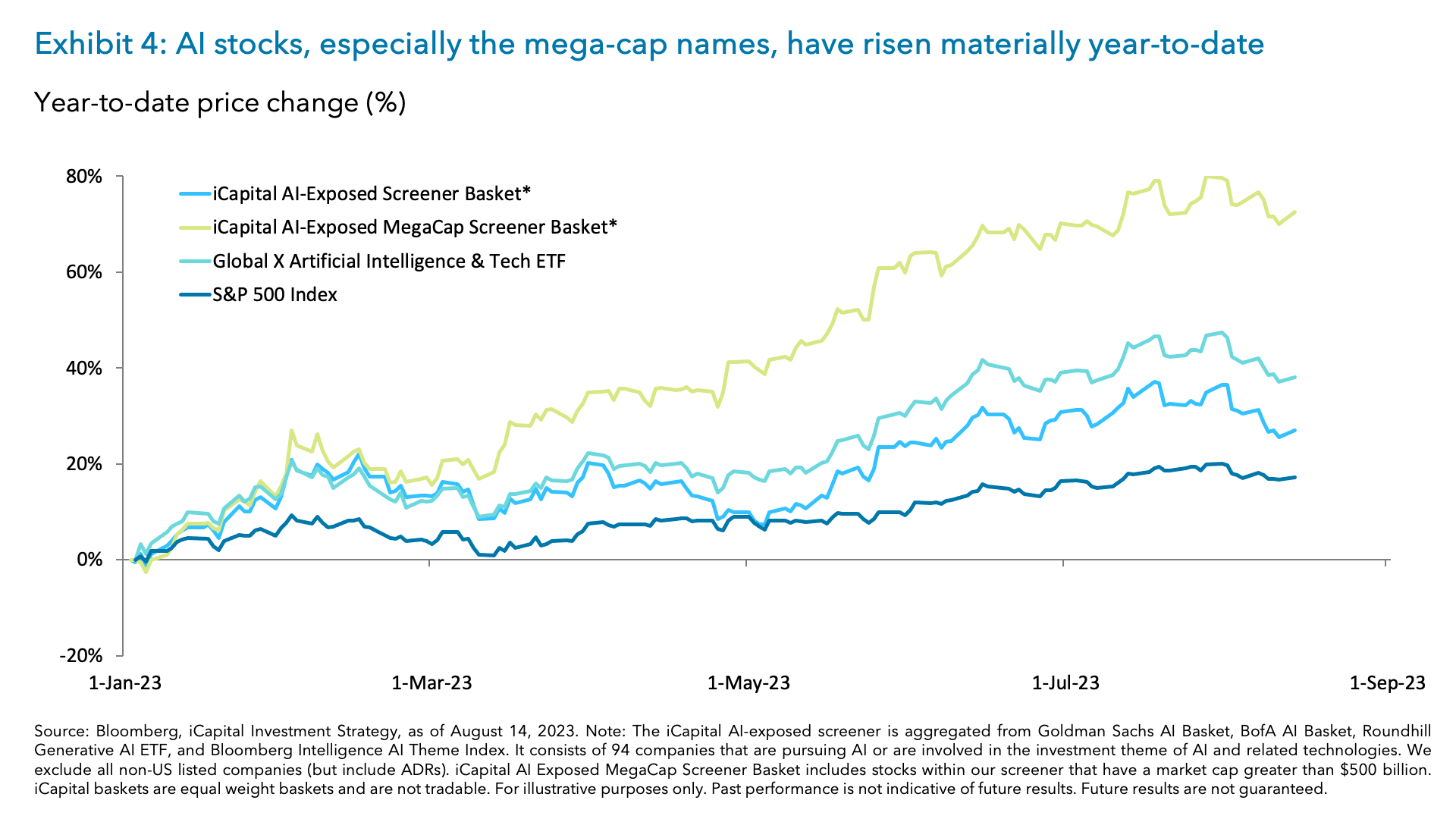

As impressive as some of these forecasts are, they are well known. This begs the question – how much of this expected growth in AI TAM is already priced into the stocks? The inflows into AI and AI-related ETFs have been robust, with $1.3 billion in net inflows over the last 12 months compared to net outflows of -$6.2 billion across all other thematic ETFs.18 Still, aggregate flows in AI-related ETFs only make up 0.4% of overall U.S.-listed ETF flows over the past year.19 Instead, investors have been participating with AI through individual names. As a result, AI stocks, especially the mega-cap names, have surged.20 Across our AI-exposed stock screener, which consists of 94 companies that are pursuing AI or are involved in the investment theme of AI and related technologies, the median company is up 27% year-to-date while the median mega-cap company is up 56%.21 This compares to the S&P 500 year-to-date return of 16% (Exhibit 4).22 As AI-exposed stocks have risen, so too have their valuations. Valuations for these AI-exposed names have expanded from a median 4.0x forward sales at the start of 2023 to a median 6.0x forward sales in mid-July before falling to 5.2x today.23 Interestingly, while there has been a sharp move in valuations since the start of the year, the median company’s valuation currently ranks in the 60th percentile on a five-year lookback.24

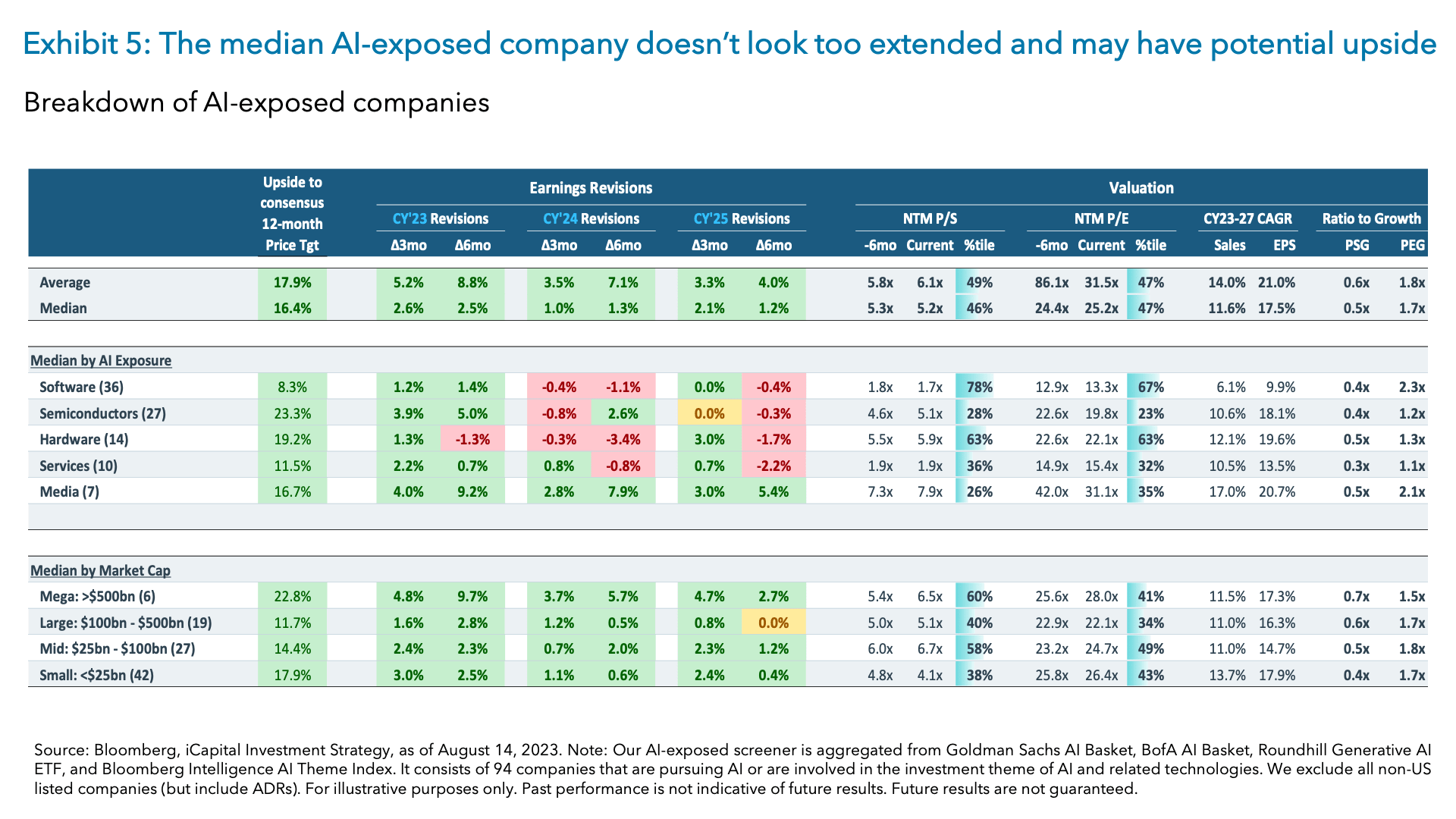

Judging from these developments, it’s easy to say that a lot has been priced in. But looking under the hood and separating talk from action, what stands out is that earnings estimates revisions for AI-related stocks have been fairly modest, with the notable exception of Nvidia. For example, while Nvidia’s earnings per share (EPS) estimates for the 2023, 2024, and 2025 calendar years have been revised higher by 77%, 95%, and 97%, respectively, over the past six months, the median AI-exposed stock saw a modest 2.5%, 1.3%, and 1.2% revision, respectively, during that same period.25

In our view, the reason for this is that companies tend to issue guidance that is relatively short-term on revenues that are visible within the next few quarters and that’s what analysts tend to pencil in. This implies that the true multi-year potential is not yet in the models, price targets, or the stock price.

However, if the upcoming reality confirms the optimistic TAM forecasts above and the rapid customer take-up of AI, we believe upward revisions to current earnings estimates are likely.

This in turn means that current forward price-to-earnings (P/E) ratios may fall as earnings are revised higher. And speaking of the P/E ratio, adjusting it for 5-year forward consensus expected annual earnings growth, which well outpaces the S&P 500 even before any further upwards revisions, the price-to-earnings-to-growth (PEG ratio) stands at 1.7x for median AI-exposed stock.26 That is not relatively expensive. And finally, if EPS upwards revisions do materialize, analyst price targets are likely to drift higher. Bottom line, current analyst price targets seem to imply a floor but not a ceiling, for these AI beneficiary stocks.

Private markets are incubating the next batch of AI leaders

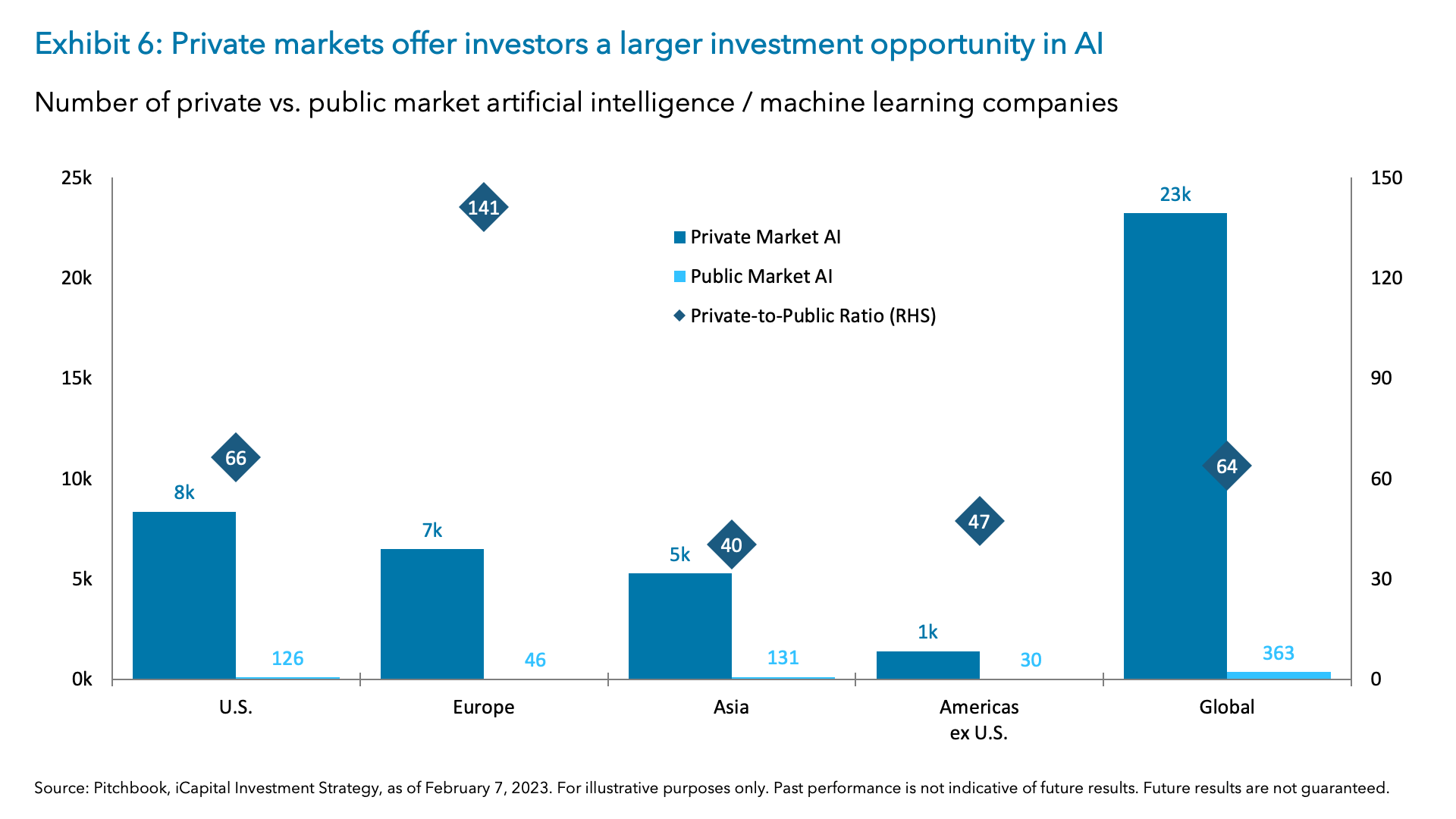

In addition to the public market, we see significant opportunities to gain exposure to AI through the private market. For example, AI company funding accounted for 69% of the top 20 venture capital (VC) software deals this year.27 And while the AI story has taken the public market by storm just this year, this has long been a theme in private markets, with venture capital funds backing and scaling AI companies for the last 10 years. VC funds have consistently invested in AI companies since 2014, ramping up their investments significantly in 2018.28 As a result, there are 23,000 private AI companies globally today compared with 363 public AI companies, or roughly 64 private AI companies for every 1 public AI company (Exhibit 6), offering investors a broader opportunity set for AI exposure.29 Looking ahead, this number will likely only grow as general partners (GPs) and limited partners (LPs) take on greater interest in AI as the future of technology. At the same time, tech incumbents will increasingly look to gain a competitive advantage in the AI race by securing crucial technologies and skilled talent which can be found in the private markets.

“Not-yet-fully-priced-in” dynamic is an opportunity for long-term investors

So what’s next? After the surge in the first half of the year, sentiment around AI has begun leveling off. Google Trends suggests that web searches for AI actually peaked in April 2023, as did ChatGPT site visits, and there has been a notable decline since July 2023.30 At the same time, the median AI-exposed stock is now down -7.5% since the start of August 2023.31 This pullback, however, is not surprising and is even welcomed. This is because the increased AI spending levels that management teams have guided for and expect over the near-term, along with analyst upward revisions to quarterly earnings estimates, have now been priced-in by the market. So these stocks were fully valued when incorporating the near-term fundamentals, but we note that as a result of the recent pullback, the upside to 12-month analyst consensus price targets for the median AI-exposed stocks now stands at 16%.32 Moreover, longer-term, analysts appear to be modeling the true multi-year potential of AI conservatively and will likely have to mark-to-market their beyond this year estimates as adoption ramps up. We see this “not-yet-fully-priced-in” dynamic as an opportunity for long-term investors – to buy the dips in AI-related stocks while also considering private equity and VC managers that are funding the next generation of AI beneficiary companies.

1. UBS, iCapital Investment Strategy, as of June 12, 2023.

2. McKinsey & Co., “The Economic Potential of Generative AI,” as of June 14, 2023.

3. Gartner, “Worldwide IT Spending Forecast,” as of July 19, 2023.

4. CNBC Technology Executive Council, as of June 23, 2023.

5. NextBase Quid, Stanford University, 2023 AI Index Report, as of April 3, 2023. Includes corporations’ overall investment in private AI companies but excludes investments via minority stake, M&A, and public offerings.

6. International Data Corporation (IDC), “Worldwide Artificial Intelligence Spending Guide,” as of March 7, 2023.

7. International Data Corporation (IDC), “Worldwide Artificial Intelligence Spending Guide,” as of March 7, 2023.

8. Microsoft, “Microsoft Inspire 2023 Conference,” as of July 18, 2023.

9. International Data Corporation (IDC), “Worldwide Semiannual Artificial Intelligence Tracker,” as of July 29, 2022.

10. International Data Corporation (IDC), “Worldwide Semiannual Artificial Intelligence Tracker,” as of July 29, 2022.

11. Bloomberg, iCapital Investment Strategy, as of August 14, 2023.

12. Broadcom, Q2 2023 Broadcom Earnings Conference Call, as of June 1, 2023.

13. Nvidia, Q1 2024 NVIDIA Earnings Conference Call, as of May 24, 2023.

14. Marvell Technology, First Quarter of Fiscal Year 2024 Financial Results Release, as of May 25, 2023.

15. International Data Corporation (IDC), “Worldwide Semiannual Artificial Intelligence Tracker,” as of July 29, 2022.

16. Source: International Data Corporation (IDC), “Worldwide Semiannual Artificial Intelligence Tracker,” as of July 29, 2022.

17. International Data Corporation (IDC), “Worldwide Semiannual Artificial Intelligence Tracker,” as of July 29, 2022.

18. Goldman Sachs, iCapital Investment Strategy, as of August 1, 2023.

19. Goldman Sachs, iCapital Investment Strategy, as of August 1, 2023.

20. Bloomberg, iCapital Investment Strategy, as of August 14, 2023. Note: Our AI-exposed screener is aggregated from Goldman Sachs AI Basket, BofA AI Basket, Roundhill Generative AI ETF, and Bloomberg Intelligence AI Theme Index. It consists of 94 companies that are pursuing AI or are involved in the investment theme of AI and related technologies. We exclude all non-US listed companies (but include ADRs).

21. Bloomberg, iCapital Investment Strategy, as of August 14, 2023. Note: Our AI-exposed screener is aggregated from Goldman Sachs AI Basket, BofA AI Basket, Roundhill Generative AI ETF, and Bloomberg Intelligence AI Theme Index. It consists of 94 companies that are pursuing AI or are involved in the investment theme of AI and related technologies. We exclude all non-US listed companies (but include ADRs).

22. Bloomberg, iCapital Investment Strategy, as of August 14, 2023.

23. Bloomberg, iCapital Investment Strategy, as of August 14, 2023. Note: Forward sales is defined as price to next-12-month sales.

24. Bloomberg, iCapital Investment Strategy, as of August 14, 2023.

25. Bloomberg, iCapital Investment Strategy, as of August 14, 2023.

26. Bloomberg, iCapital Investment Strategy, as of August 14, 2023. Note: Price-to-Earnings-to-Growth (PEG) is NTM Price-to-Earnings divided by the 5-year forward consensus expected annual earnings growth.

27. Pitchbook, iCapital Investment Strategy, as of August 14, 2023.

28. Pitchbook, iCapital Investment Strategy, as of August 14, 2023.

29. Pitchbook, iCapital Investment Strategy, as of February 7, 2023.

30. Google Trends, iCapital Investment Strategy, as of August 14, 2023.

31. Bloomberg, iCapital Investment Strategy, as of August 14, 2023.

32. Bloomberg, iCapital Investment Strategy, as of August 14, 2023.

IMPORTANT INFORMATION

The material herein has been provided to you for informational purposes only by iCapital, Inc. (“iCapital”). This material is the property of iCapital and may not be shared without the written permission of iCapital. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of iCapital.

This material is provided for informational purposes only and is not intended as, and may not be relied on in any manner as, legal, tax or investment advice, a recommendation, or as an offer to sell, a solicitation of an offer to purchase or a recommendation of any interest in any fund or security. You should consult your personal accounting, tax and legal advisors to understand the implications of any investment specific to your personal financial situation. This material does not intend to address the financial objectives, situation or specific needs of any individual investor. Alternative investments are complex, speculative investment vehicles and are not suitable for all investors.

The information contained herein is an opinion only, as of the date indicated, and should not be relied upon as the only important information available. Any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets is not necessarily indicative of the future or likely performance. The information contained herein is subject to change, incomplete, and may include information and/or data obtained from third party sources that iCapital believes, but does not guarantee, to be accurate. iCapital considers this third-party data reliable, but does not represent that it is accurate, complete and/or up to date, and it should not be relied on as such. iCapital makes no representation as to the accuracy or completeness of this material and accepts no liability for losses arising from the use of the material presented. No representation or warranty is made by iCapital as to the reasonableness or completeness of such forward-looking statements or to any other financial information contained herein.

Securities products and services are offered by iCapital Markets, an SEC-registered broker-dealer, member FINRA and SIPC, and an affiliate of iCapital, Inc. and Institutional Capital Network, Inc. These registrations and memberships in no way imply that the SEC, FINRA, or SIPC have endorsed any of the entities, products, or services discussed herein. Annuities and insurance services are provided by iCapital Annuities and Insurance Services LLC, an affiliate of iCapital, Inc. “iCapital” and “iCapital Network” are registered trademarks of Institutional Capital Network, Inc. Additional information is available upon request.

© 2023 Institutional Capital Network, Inc. All Rights Reserved.