Retirement is a relatively new reality. Previous generations didn’t often plan to live 20–30 years without a paycheck.

Today we do.

Annuities can be designed to help clients pursue financial security and address retirement planning needs, including:

Having enough money for a lifetime

Having enough money for a lifetime

Paying for rising healthcare and living costs

Paying for rising healthcare and living costs

Supplementing income from Social Security and pensions

Supplementing income from Social Security and pensions

What Is an Annuity?

An annuity is a long-term, tax-deferred investment issued by an insurance company that can be tailored to meet unique needs. It has two distinct phases:

Accumulation Phase

Accumulation Phase

Distribution Phase

Distribution Phase

1. The principal earns interest.

2. That interest earns interest.

3. The money you would have otherwise paid in taxes earns interest.

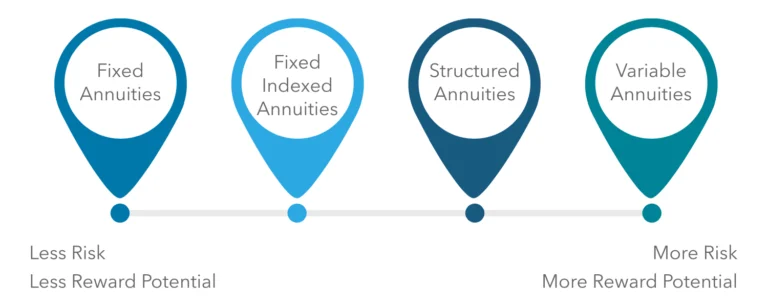

There are several types of annuities to choose from—all of which offer different levels of upside potential and downside protection.

1. Annuitization, where the account value is converted into a series of periodic income payments;

OR

2. Adding an income benefit to your annuity contract, usually for a fee, which allows you to take systematic withdrawals for life regardless of the account value.

Investors should carefully review an annuity contract’s offering document, disclosure document, and buyer’s guide for contract details, including risks, fees, and charges. This helps ensure that the annuity aligns with their needs and goals.

Choices

Fixed Annuities

- A guaranteed annual rate of return.

- Full principal protection.

Fixed Indexed Annuities (FIA)

- More growth potential than fixed annuities.

- Returns based on the performance of an index.

- Full principal protection.

Structured Annuities

- Typically offer greater upside potential than FIAs.

- Returns based on the performance of an index.

- Partial protection against market losses.

Variable Annuities

- Participation in an underlying portfolio of selected funds.

- Subject to full market risk.

| Fixed annuity | Fixed indexed annuity | Structured annuity | Variable annuity | |

|---|---|---|---|---|

| Tax-deferred growth | ||||

| Protection against market losses | Full | Full | Partial | |

| Guaranteed interest rate | ||||

| Uncapped growth potential | ||||

| Upside based on an index/indices | ||||

| Upside based on investment funds (e.g., mutual funds) |

This overview is intended as general background information, for educational purposes only, and should not be used as a primary basis to make a decision to purchase an annuity contract. This material does not reflect a specific annuity contract and no person should consider investing in an instrument on the basis of this overview. Actual annuity contracts may differ materially from the general overview provided.

| Fixed annuity | |

|---|---|

| Tax-deferred growth | |

| Protection against market losses | Full |

| Guaranteed interest rate | |

| Uncapped growth potential | |

| Upside based on an index/indeces | |

| Upside based on investment funds (e.g., mutual funds) |

This overview is intended as general background information, for educational purposes only, and should not be used as a primary basis to make a decision to purchase an annuity contract. This material does not reflect a specific annuity contract and no person should consider investing in an instrument on the basis of this overview. Actual annuity contracts may differ materially from the general overview provided.

| Fixed indexed annuity | |

|---|---|

| Tax-deferred growth | |

| Protection against market losses | Full |

| Guaranteed interest rate | |

| Uncapped growth potential | |

| Upside based on an index/indices | |

| Upside based on investment funds (e.g., mutual funds) |

This overview is intended as general background information, for educational purposes only, and should not be used as a primary basis to make a decision to purchase an annuity contract. This material does not reflect a specific annuity contract and no person should consider investing in an instrument on the basis of this overview. Actual annuity contracts may differ materially from the general overview provided.

| Structured annuity | |

|---|---|

| Tax-deferred growth | |

| Protection against market losses | Partial |

| Guaranteed interest rate | |

| Uncapped growth potential | |

| Upside based on an index/indices | |

| Upside based on investment funds (e.g., mutual funds) |

This overview is intended as general background information, for educational purposes only, and should not be used as a primary basis to make a decision to purchase an annuity contract. This material does not reflect a specific annuity contract and no person should consider investing in an instrument on the basis of this overview. Actual annuity contracts may differ materially from the general overview provided.

| Variable annuity | |

|---|---|

| Tax-deferred growth | |

| Protection against market losses | |

| Guaranteed interest rate | |

| Uncapped growth potential | |

| Upside based on an index/indices | |

| Upside based on investment funds (e.g., mutual funds) |

This overview is intended as general background information, for educational purposes only, and should not be used as a primary basis to make a decision to purchase an annuity contract. This material does not reflect a specific annuity contract and no person should consider investing in an instrument on the basis of this overview. Actual annuity contracts may differ materially from the general overview provided.

With any annuity, there are key benefits and considerations, such as:

![]()

Optional features may be useful to add to an annuity contract, but are also potentially subject to fees, requirements, and other limitations. Examples include:

- Guaranteed lifetime withdrawal benefit – A benefit that is designed to generate a specific level of guaranteed lifetime income without annuitizing.

- Death benefit – A benefit that is designed to generate a payment to a designated beneficiary in the event of the annuitant’s death prior to the annuitization date.

![]()

Annuities are not FDIC insured.* All references to guarantees arising under the annuity contract, including optional benefits, are subject to the claims-paying ability of the carrier.

With structured and variable annuities, principal is subject to market risk, which may be significant.

![]()

Early withdrawals or surrender during the surrender charge period may trigger surrender charges, fees, or tax penalties, and may be subject to negative adjustments, which can reduce the account value or the actual withdrawal amount. For this reason, an investor should be prepared and able to hold an annuity through the full length of the surrender charge period.

Withdrawals and distributions of taxable amounts are subject to ordinary income tax and, if made prior to age 591⁄2, may be subject to an additional 10% federal income tax penalty.

Why now?

Annuities offer choice and personalization that may help in forging a path towards financial security in retirement. They can provide:

![]() Tax-deferred growth

Tax-deferred growth

![]() Options to protect principal*

Options to protect principal*

![]() Guaranteed income

Guaranteed income

![]() Death benefit protection for heirs

Death benefit protection for heirs

![]() Tax-efficient legacy planning

Tax-efficient legacy planning

Securities products and services may be offered by iCapital Markets LLC, a registered broker/dealer, member FINRA and SIPC, and an affiliate of iCapital. Annuities and insurance services provided by iCapital Annuities and Insurance Services LLC, an affiliate of iCapital, Inc. iCapital and iCapital Network are registered trademarks of Institutional Capital Network, Inc. Please see the disclaimer at the end of this document for more information.

Please contact your financial professional to learn more.

ENDNOTES

*Variable annuities are subject to market risk and do not provide any form of principal protection. All guarantees and protections are subject to the claims-paying ability of the issuing insurance company.

IMPORTANT INFORMATION

The material herein has been provided to you for informational purposes only by Institutional Capital Network, Inc. (“iCapital Network”) or one of its affiliates (iCapital Network together with its affiliates, “iCapital”). This material is the property of iCapital and may not be shared without the written permission of iCapital. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of iCapital.

This material is provided for informational purposes only and is not intended as, and may not be relied on in any manner as, legal, tax or investment advice, a recommendation, or as an offer or solicitation to buy or sell any security, financial product or instrument, or otherwise to participate in any particular trading strategy. This material does not intend to address the financial objectives, situation, or specific needs of any individual investor. You should consult your personal accounting, tax and legal advisors to understand the implications of any investment specific to your personal financial situation.

ANNUITIES ARE CONSIDERED COMPLEX PRODUCTS AND MAY NOT BE SUITABLE FOR ALL INVESTORS. The information is not intended as investment advice and is not a recommendation about managing or investing retirement savings. Actual annuity contracts may differ materially from the general overview provided. Prior to making any decision with respect to an annuity contract, purchasers must review, as applicable, the offering document, the disclosure document, and the buyer’s guide which contain detailed and additional information about the annuity. Any annuity contract is subject in its entirety is to the terms and conditions imposed by the carrier under the contract. Withdrawals or surrenders may be subject to surrender charges, and/or market value adjustments, which can reduce the owner’s contract value or the actual withdrawal amount received. Withdrawals and distributions of taxable amounts are subject to ordinary income tax and, if made prior to age 591⁄2, may be subject to an additional 10% federal income tax penalty. Annuities are not FDIC-insured. All references to guarantees arising under an annuity contract are subject to the financial strength and claims-paying ability of the carrier.

iCapital Markets LLC operates a platform that makes available financial products to financial professionals. In operating this platform, iCapital Markets LLC generally earns revenue based on the volume of transactions that take place in these products and would benefit by an increase in sales for these products.

The information contained herein is an opinion only, as of the date indicated, and should not be relied upon as the only important information available. Any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets is not necessarily indicative of the future or likely performance. The information contained herein is subject to change, incomplete, and may include information and/or data obtained from third party sources that iCapital believes, but does not guarantee, to be accurate. iCapital considers this third-party data reliable, but does not represent that it is accurate, complete and/or up to date, and it should not be relied on as such. iCapital makes no representation as to the accuracy or completeness of this material and accepts no liability for losses arising from the use of the material presented. No representation or warranty is made by iCapital as to the reasonableness or completeness of such forward-looking statements or to any other financial information contained herein.

Securities products and services are offered by iCapital Markets, an SEC-registered broker-dealer, member FINRA and SIPC, and an affiliate of iCapital, Inc. and Institutional Capital Network, Inc. These registrations and memberships in no way imply that the SEC, FINRA, or SIPC have endorsed any of the entities, products, or services discussed herein. Annuities and insurance services are provided by iCapital Annuities and Insurance Services LLC, an affiliate of iCapital, Inc. “iCapital” and “iCapital Network” are registered trademarks of Institutional Capital Network, Inc. Additional information is available upon request.

© 2024 Institutional Capital Network, Inc. All Rights Reserved. | 2024.01