The experience of investing in China in 2021 can be summed up with a single word: uncertainty. Stepped up regulatory pressure on a wide array of companies ranging from communication services to after-school tutoring to gaming to ride-hailing services left the Hang Seng Index down -4% year to date, versus +14% for the MSCI All-Country World Index. Economic activity in China has also disappointed this year and key economic indicators for August, such as fixed asset investment and retail sales, will come out later today and are expected to point to a continued slowdown. And finally, just last Friday, the Biden administration suggested that it might pick up former President Trump’s playbook and use trade and sanctions to pressure China to change its industrial subsidies policy.

This uncertainty has prompted investors to reduce their allocations to China. For example, hedge fund allocations to Chinese equities pulled back to mid-2019 levels and global fund manager surveys suggest shorting China is the third most crowded trade.1 We believe that ongoing regulatory scrutiny will continue to weigh on certain sectors and companies in the government’s crosshairs. However, we also think China is likely to pivot to more accommodative economic policy that should lift cyclicals, many of which align well with China’s longer-term economic priorities. In this week’s commentary, we dig into how investors can consider adjusting their China allocations.

Cheap and unloved, but we are not (yet) tempted by China big tech valuations

Last week, reports suggested that China may suspend approval of new video games. This week started with the news that China will break up Alipay and separate Ant’s loan businesses. As a result of these and many prior developments, China’s big tech stocks are down close to 20% on average year to date. The regulatory scrutiny is not new, but it’s still ongoing and in our view, should be expected to continue as China focuses on principles of “common prosperity.”

As part of this process, China is prioritizing the “quality” of its growth versus its former growth-at-all-costs approach. Today, the growth needs to be more inclusive and address imbalances between regions, rural and urban areas, and income and wealth inequality. The government is prioritizing the social good and well-being of the total population against practices that might be monopolistic or questionable (how many hours of video games should minors really play?); present data privacy concerns, especially if data can be inadvertently accessed from outside of the country; or otherwise create social inequality or put society at risk.

Some argue that the risks of this regulation are increasingly being reflected in share prices. For example, consensus earnings for China offshore stocks have been revised lower by 27% year to date2 and the ratio of the MSCI China Information Technology price-to-earnings multiple to that of the S&P 500 Information Technology Index is 0.89 versus a 10-year average of 1.33.3

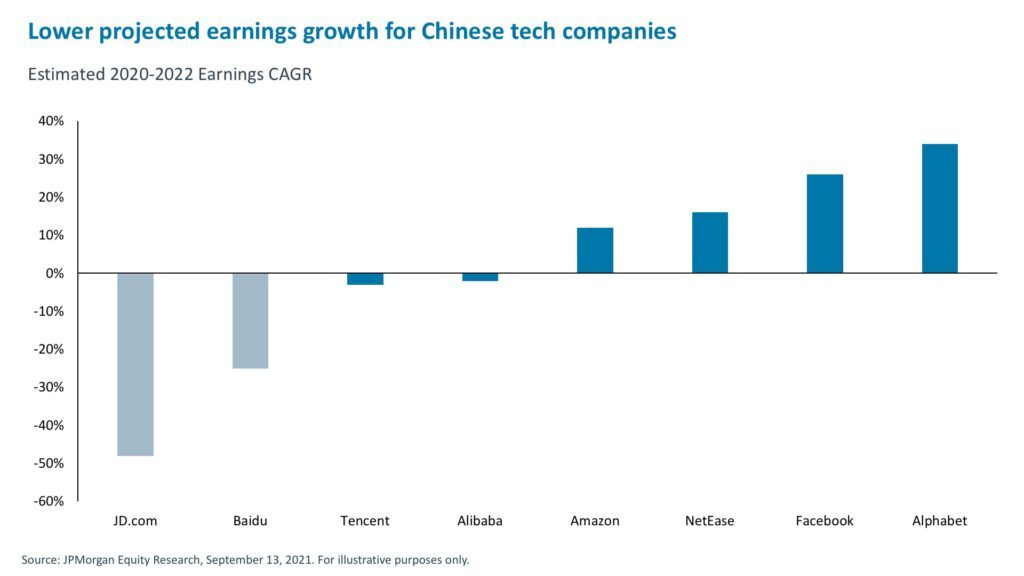

But as tempting as it is to buy this dip in select China big-tech names, it seems that the era of hyper growth for these companies has given way to era of regulation-managed growth. This ongoing scrutiny will come with costs, including downward pressure on earnings, some from fines (we view these as manageable) and some from fundamental business changes such as profitability and monetization. Already, the 2020-2022 projected EPS CAGRs for China internet companies are substantially weaker than for their U.S. internet peers.

Don’t get me wrong – there might well be a trading opportunity in China tech shares again, especially when concrete regulations and/or actions are issued and fines are paid, but I think a better path forward until then is to focus on sectors that are well aligned with China’s strategic priorities and pro-cyclical policies.

Investing alongside China’s strategic priorities and pro-cyclical policies

China’s key strategic priorities are well outlined in its latest Five-Year Plan. These priorities drive the development of policies that tend to deliver tangible results and often provide opportunities for investors. For example, China aims to be the leader in next-generation technology including artificial intelligence (AI), robotics/automation, 5G, and semiconductors. The country is already the world’s largest market for robotics. That market is set to grow at an impressive 26% CAGR from 2019 – 2023.4 Local companies supply 39% of domestic robotics markets but the goal is for domestic production to reach 70% by 2025.5

China also put a major focus on decarbonization of the economy as it committed to become carbon neutral by 2060 and see peak emissions by 2030. The country has enacted targeted policies to support development of electric vehicles (EVs) and renewable energy to achieve that objective. It also leads the world in EV adoption, with EVs accounting for 20% of cars sold in August 2021, a number projected to rise to 35% by 2025.6

Given these longer-term objectives, it also makes sense to direct cyclical stimulus toward these strategically important sectors. Not all stimulus will be targeted, but the broad pro-cyclical push should help the technology, industrials, materials, and financials sectors.

Indeed, with China likely to report August data that points to continued weakness, its policy stance will have to turn more accommodative. China’s GDP growth has slowed notably this year – from an 18.3% year-over-year growth rate in the first quarter to a forecasted 5.6% rate for the third quarter.7 August PMI readings fell to their lowest levels since March 2020 and are in contraction territory as Delta variant outbreaks caused mobility restrictions and shutdowns.

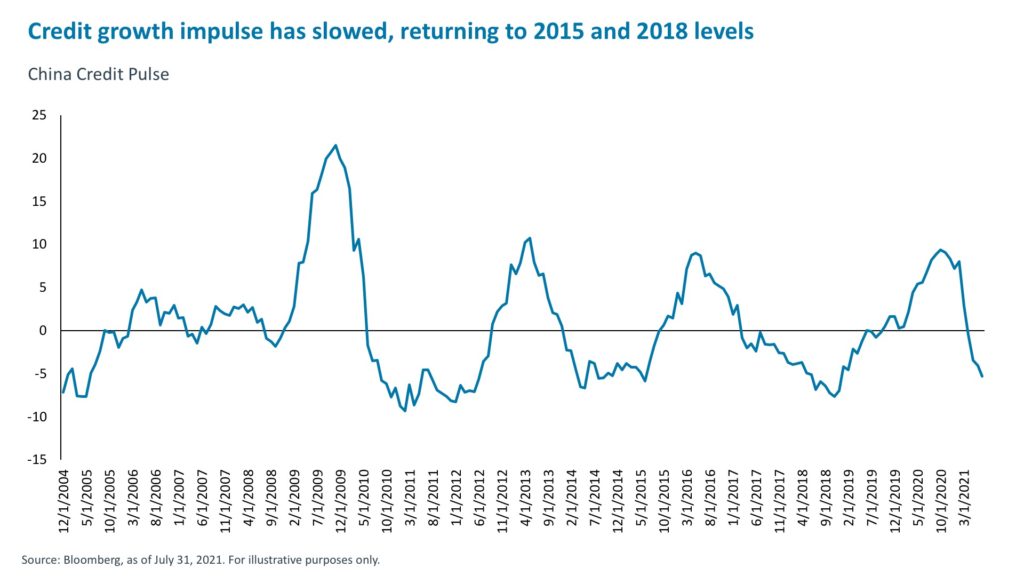

This comes on the heels of slowing credit growth and policy that has been turning more restrictive since 2020. Given the recent economic weakness, we expect policy to become more accommodative in the coming months. Specifically, we are looking for stronger total social financing measures and already saw government loans stepped up in August. More reserve ratio requirement (RRR) cuts to boost bank lending are also likely on the way. These measures should support an uptick in infrastructure and manufacturing fixed asset investment, both of which have been particularly weak.

Implications for Public and Private Market Investors

Episodes of policy easing historically helped support valuations of China’s equities, most recently in the first half of 2020. For investors in China’s public markets, we favor opportunities in cyclical sectors that are likely to be supported with additional policy easing, are removed from the epicenter of regulatory scrutiny, and are well aligned with strategic priorities of de-carbonization and tech and healthcare innovation.

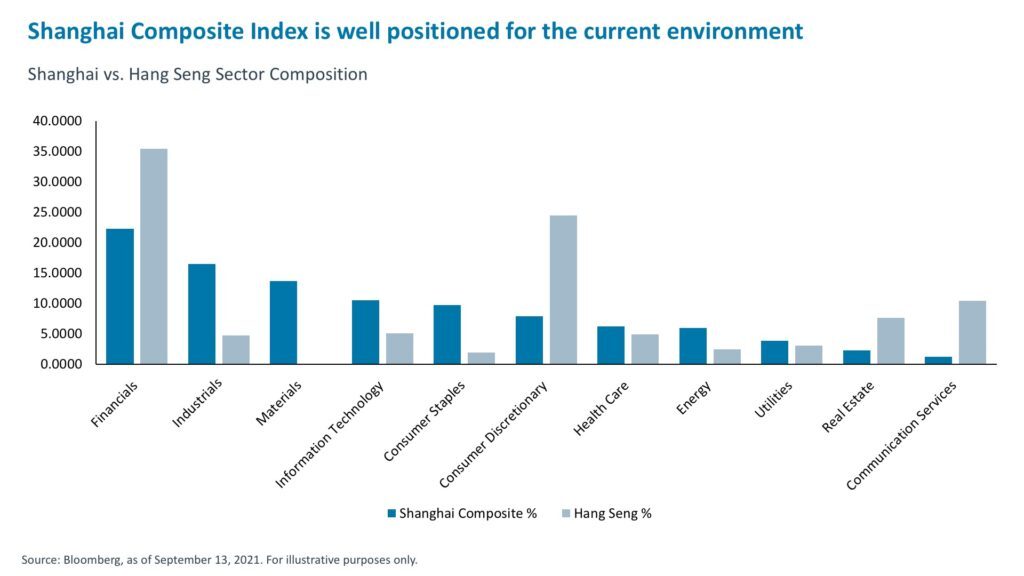

On an index level, this outlook suggests investors should shift exposure to more domestically focused local A-shares. For example, the Shanghai Composite Index has markedly outperformed the Hang Seng Index, returning + 6.62% versus -3.76%, respectively, year to date.8 This is a result of the Shanghai’s composition, which avoids the sensitive communication services and parts of consumer discretionary sectors and instead captures cyclical exposure in financials, industrials, materials, and info tech. Given the anticipated pro-cyclical policy pivot, which should support infrastructure and manufacturing fixed asset investment, these sectors should continue to benefit.

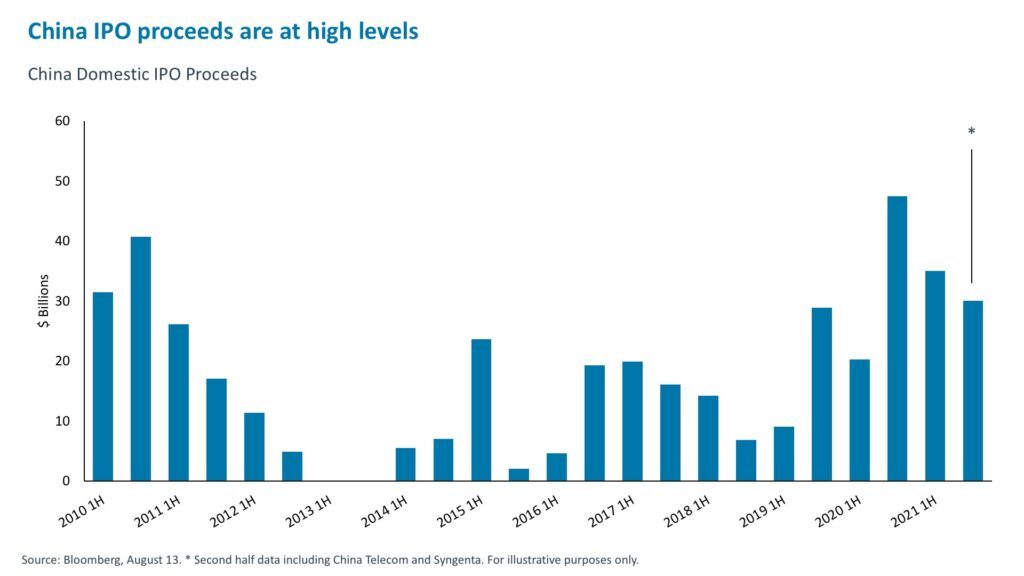

For private markets investors, the recent regulatory scrutiny suggests that opportunities to exit to the public markets may be more limited or at least uncertain for select sectors and companies, particularly those looking to list on non-Chinese indices. This could pressure multiples. Like public market investors, however, private equity fund managers are likely to re-position to account for this environment that emphasizes “common prosperity.”

In the meantime, venture capital exit activity this year is still on pace to surpass 2020’s volume, even amid the heightened regulatory scrutiny.9 Over the longer-term, the need to finance the new economy is significant and local market investor participation is rising. While exits to foreign exchanges might be a source of uncertainty, Shanghai, Shenzhen, or Hong Kong-based exchanges are likely to see more listings.

1. Bank of America, Global Fund Manager Survey, August 17, 2021.

2. Goldman Sachs, China Strategy, August 25, 2021.

3. Bloomberg, as of September 13, 2021.

4. IDC, China Robotics Market Forecast, March 2020.

5. South China Morning Post, February 20, 2021.

6. CAAM, JPMorgan Asia Pacific Equity Research, September 13, 2021.

7. Bloomberg, as of September 13, 2021.

8. Bloomberg, as of September 13, 2021.

9. Pitchbook, Greater China Venture Report, H1 2021.

IMPORTANT INFORMATION

The material herein has been provided to you for informational purposes only by iCapital, Inc. (“iCapital”). This material is the property of iCapital and may not be shared without the written permission of iCapital. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of iCapital.

This material is provided for informational purposes only and is not intended as, and may not be relied on in any manner as, legal, tax or investment advice, a recommendation, or as an offer to sell, a solicitation of an offer to purchase or a recommendation of any interest in any fund or security. You should consult your personal accounting, tax and legal advisors to understand the implications of any investment specific to your personal financial situation. This material does not intend to address the financial objectives, situation or specific needs of any individual investor. Alternative investments are complex, speculative investment vehicles and are not suitable for all investors.

The information contained herein is an opinion only, as of the date indicated, and should not be relied upon as the only important information available. Any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets is not necessarily indicative of the future or likely performance. The information contained herein is subject to change, incomplete, and may include information and/or data obtained from third party sources that iCapital believes, but does not guarantee, to be accurate. iCapital considers this third-party data reliable, but does not represent that it is accurate, complete and/or up to date, and it should not be relied on as such. iCapital makes no representation as to the accuracy or completeness of this material and accepts no liability for losses arising from the use of the material presented. No representation or warranty is made by iCapital as to the reasonableness or completeness of such forward-looking statements or to any other financial information contained herein.

Securities products and services are offered by iCapital Markets, an SEC-registered broker-dealer, member FINRA and SIPC, and an affiliate of iCapital, Inc. and Institutional Capital Network, Inc. These registrations and memberships in no way imply that the SEC, FINRA, or SIPC have endorsed any of the entities, products, or services discussed herein. Annuities and insurance services are provided by iCapital Annuities and Insurance Services LLC, an affiliate of iCapital, Inc. “iCapital” and “iCapital Network” are registered trademarks of Institutional Capital Network, Inc. Additional information is available upon request.

© 2023 Institutional Capital Network, Inc. All Rights Reserved.