This week, the second largest property developer in China is widely expected to default on its bond obligations. The news triggered a 2.16% sell-off in the S&P 500 Index on Monday. We don’t believe the risks to U.S. stocks from China are systemic given limited financial ties and would buy this dip, even though, on the margin, slower growth in China could dampen market sentiment. Still, an issue of this magnitude in China, where real estate contributes substantially to GDP, could be systemic to China’s economy and precisely because of that should warrant a prompt policy response.

In this week’s commentary, we discuss Evergrande’s contagion risks to the broader China real estate market as well as why and how the government is likely to respond. We reiterate our view from last week that pro-cyclical policy support is likely to be stepped up and that we are buyers on the dip of China’s local A-shares.

Systemic concerns about Evergrande are warranted as the broader property sector is under pressure

It is difficult to overstate how important real estate is in China. A recent study estimated that it accounted for nearly 30% of economic output in 2019,1 with the residential property market roughly double the value of the U.S. residential market and seven times the value of China’s own stock markets.2 Real estate accounts for 40% of household assets in China and real estate and construction jobs represent approximately 17% of urban employment.3

On the debt side, China’s non-financial corporations’ credit-to-GDP ratio has surged to 159.2% as of the first quarter of 2021, 4 of which a significant share is in real estate. Even before Evergrande’s troubles, the percentage of credit defaults attributable to real estate was increasing, accounting for 30% of defaults in the first half of 2021.5

If the contagion from an Evergrande default spreads to other parts of the property market and triggers the negative feedback loops of higher financing costs, less credit access, lower development, sales and prices, increases in non-performing bank loans, and more, this would present a significant downside risk to growth, which already slowed markedly in China. It is estimated that even a mild slowdown would shave 1.4% off China’s GDP in 2022 via direct, indirect, and financial tightening effects. A more severe slowdown could reduce GDP growth by as much as 4.1%.6

Last year, China drew “three red lines” for property developers that scrutinized their liabilities-to-assets ratio, net gearing on total equity ratio, and net cash to short-term debt ratio. As of June 2021, 5% of property developers are not meeting three of these key thresholds, and another 11% are failing to meet two.7 There are for sure other property developers the markets will need to worry about but it’s not a majority.

The fear of these effects caused China property high-yield bond spreads to sharply widen to 1780 basis points, versus a 762 basis-point average since 2010: Evergrande accounts for 16% of China’s high-yield dollar bond market.8 And the Hang Seng Property Index fell sharply to a five-year low.9

Because of its systemic nature, we expect policy support for the property market to be stepped up (over time)

We believe, given the sharpness of the recent slowdown and with financial conditions tightening, the Chinese government will want to, and has room to, address this issue. The first step will likely be to “ringfence” Evergrande and arrange for its orderly restructuring – for example, the government may coordinate with banks to continue to provide liquidity and arrange for asset sales to developers with stronger balance sheets. The second step might be to implement measures to support the property market.

China’s housing market has always been policy-led: a constant tug of war between the local governments, housing developers, and even the homeowners that benefit from rising prices, and the regulators looking to contain systemic risk.

For the last couple of decades, the market has swung back and forth between those two forces as authorities try to strike a balance between managing risk and hurting economic growth.

Home prices have risen roughly six-fold over the past 15 years – generating huge household wealth, but also widening the gap between the haves and have-nots.10 Real estate is estimated to account for as much as 70% of China’s wealth inequality.11 This brings the sector into conflict with Beijing’s “Common Prosperity” drive and broader attempts to improve the quality of China’s growth.

Last year’s “three red lines” were paired in recent months with measures tightening mortgage approvals and raising rates for first-time buyers, as well as curbs on land sales and rental controls. The idea of a national property tax was (once again) raised in May.

Year-over-year housing mortgage loan growth has been in negative territory since June. In conjunction with the other tightening measures, this is hitting the property market hard. National residential sales volume dropped 17.6% year-over-year in August, while average price per square meter fell 2.5%.12

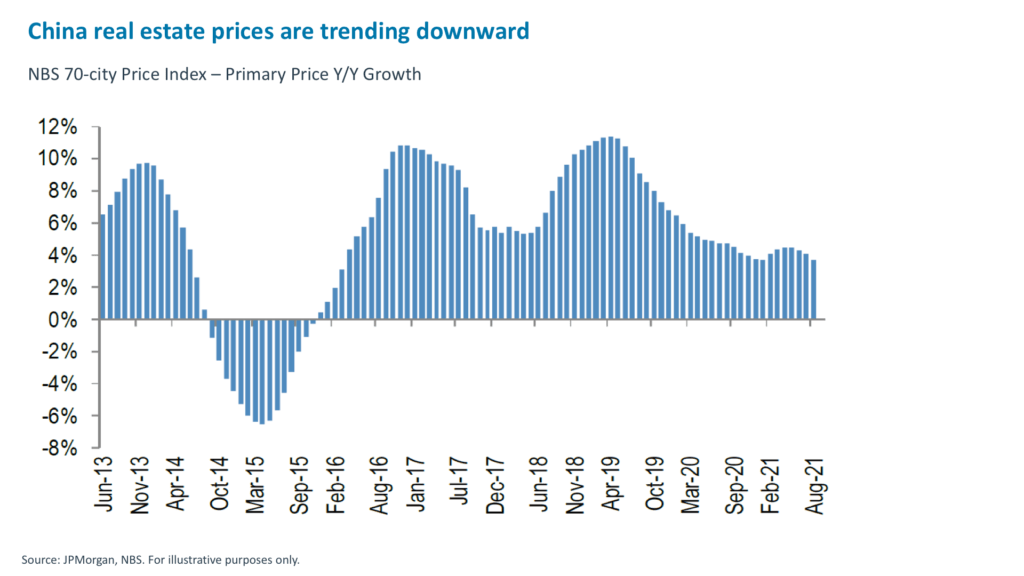

The narrower 70-city dataset from China’s National Bureau of Statistics offers a less dramatic impression of downward pressure, but shows that year-over-year price growth is on a downward path and is as low as it has been since 2016.

Calculating how long the current squeeze will last is complicated by multiple factors.

On the one hand, Xi Jinping’s very public determination to clamp down on leverage and unaffordable housing suggest that the government may maintain a strict policy course. Leaders have publicly committed to policy tightening, emboldening regulators to apply greater pressure on the sector. The party declared property was not a short-term economic stimulus tool in 2019 and reiterated that stance in July of this year.

On the other hand, the dangers of contagion hitting the broader financial system are far greater than during other property market dips, given the scale of the developer most visibly in trouble, coupled with the ongoing economic drag and uncertainty caused by the continuing COVID-19 pandemic.

All of which complicates predicting the timing of any broader policy shift. It is, however, likely that the measures we outlined above to deal with Evergrande would precede any measures to loosen property policy given Beijing’s very publicly stated goals and some runway before price growth falls into negative territory in major cities. Furthermore, it is reasonable to assume that any such measures – as has been typical – would start at the local, rather than national, level.

Not ready to buy property developers yet, but we’d be adding to pro-cyclical China A-shares

Given the uncertainty about how long it might take to see a material easing in China’s real estate sector and the risk presented by several more highly levered developers, buying China property high-yield bonds might be premature for now. However, as we wrote last week, we expect policy to turn more accommodative in the coming months, and the case for that has strengthened given very sluggish consumer demand and now tightening financial conditions in the property market. To position for this policy pivot, we are in favor of buying the dip in pro-cyclically exposed China A-shares.

1. Kenneth Rogoff, Yuanchen Yang, “Peak China Housing,” Aug 2020. https://www.nber.org/system/files/working_papers/w27697/w27697.pdf

2. Goldman Sachs. https://seekingalpha.com/article/4456013-china-sector-analysis-real-estate

3. Sources: Bloomberg. https://www.bloomberg.com/news/articles/2021-09-16/china-s-nightmare-evergrande-scenario-is-an-uncontrolled-crash. Kenneth Rogoff, Yuanchen Yang, “Peak China Housing,” Aug 2020. https://www.nber.org/system/files/working_papers/w27697/w27697.pdf

4. BIS, as of Q1 2021.

5. Bloomberg.

6. Wind, Haver Analytics, World Input-Output Database (2015), Goldman Sachs Global Investment Research.

7. Goldman Sachs Research, September 2, 2021.

8. Bloomberg, “Market Contagion Tests Xi’s Resolve on Evergrande, Property Curbs.” https://www.bloomberg.com/news/articles/2021-09-20/market-contagion-tests-xi-resolve-on-evergrande-property-curbs

9. South China Morning Post. https://www.scmp.com/business/companies/article/3149371/hong-kong-stocks-sink-tech-china-evergrande-fallout-without

10. Bloomberg. https://www.bloomberg.com/news/articles/2020-10-08/what-china-s-three-red-lines-mean-for-property-firms-quicktake

11. Guanghua Wan, Chen Wang, Yu Wu, “What Drove Housing Wealth Inequality in China?” 2021.

https://onlinelibrary.wiley.com/doi/epdf/10.1111/cwe.12361

12. NBS, CREIS, J.P. Morgan.

IMPORTANT INFORMATION

The material herein has been provided to you for informational purposes only by iCapital, Inc. (“iCapital”). This material is the property of iCapital and may not be shared without the written permission of iCapital. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of iCapital.

This material is provided for informational purposes only and is not intended as, and may not be relied on in any manner as, legal, tax or investment advice, a recommendation, or as an offer to sell, a solicitation of an offer to purchase or a recommendation of any interest in any fund or security. You should consult your personal accounting, tax and legal advisors to understand the implications of any investment specific to your personal financial situation. This material does not intend to address the financial objectives, situation or specific needs of any individual investor. Alternative investments are complex, speculative investment vehicles and are not suitable for all investors.

The information contained herein is an opinion only, as of the date indicated, and should not be relied upon as the only important information available. Any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets is not necessarily indicative of the future or likely performance. The information contained herein is subject to change, incomplete, and may include information and/or data obtained from third party sources that iCapital believes, but does not guarantee, to be accurate. iCapital considers this third-party data reliable, but does not represent that it is accurate, complete and/or up to date, and it should not be relied on as such. iCapital makes no representation as to the accuracy or completeness of this material and accepts no liability for losses arising from the use of the material presented. No representation or warranty is made by iCapital as to the reasonableness or completeness of such forward-looking statements or to any other financial information contained herein.

Securities products and services are offered by iCapital Markets, an SEC-registered broker-dealer, member FINRA and SIPC, and an affiliate of iCapital, Inc. and Institutional Capital Network, Inc. These registrations and memberships in no way imply that the SEC, FINRA, or SIPC have endorsed any of the entities, products, or services discussed herein. Annuities and insurance services are provided by iCapital Annuities and Insurance Services LLC, an affiliate of iCapital, Inc. “iCapital” and “iCapital Network” are registered trademarks of Institutional Capital Network, Inc. Additional information is available upon request.

© 2023 Institutional Capital Network, Inc. All Rights Reserved.