As the United States kicks off September in earnest following the Labor Day holiday, investors will be focused on a few eventful months for monetary and fiscal policy. While we’ve been awaiting a Fed bond tapering announcement, last week’s weak jobs report all but assures that taper timing will be delayed until later in the year. Meanwhile, we believe fiscal policy, rather than monetary policy, is likely to be the dominant driver of market performance this fall.

In this week’s commentary, we take a closer look at what’s on the horizon for policy and how investors may want to position portfolios in the current environment.

Forward-looking Fed is looking for a stronger September and a taper in November

The Bureau of Labor and Statistics announced Friday that 235,000 jobs were created in August — well shy of the 720,000 number expected. I suspect, however, that September and beyond will see a big reversal of August’s employment weakness and pave the way for an eventual taper announcement in November. Indeed, in his speech at Jackson Hole, Fed Chair Powell noted that “conditions are favorable for continued labor market progress.” There are two conditions that should promote a stronger labor market this fall: expiring unemployment benefits and falling COVID cases.

1. Extended or topped-up unemployment benefits expired on September 6, affecting over 12 million workers. The now-expired benefits covered approximately 90% of a median worker’s prior compensation, and some of these workers may be more willing to accept a job in the coming weeks and months, especially as businesses still seek to hire amidst labor supply shortages (job openings are at record highs).

2. Daily case counts in hard-hit states like Florida, Mississippi, and Louisiana plunged in recent weeks. Case counts are also starting to decline in high-vaccination states like New York and California. We note that U.S. is approaching 40 million cumulative COVID cases (likely understated) and 206 million people – 62% of the population – having received at least one dose of the vaccine. Immunity no doubt is increasing, suggesting that future outbreaks could be shorter lived with lower caseloads and hospitalizations, leading to continued progress in the labor markets.

The Fed will have to wait until October to see if jobs data picks up in September as a result of these developments. With no scheduled press conference in October, the Fed will likely signal or announce tapering in November after reviewing two more months of data. In our view, the taper announcement should be well digested by the markets, for a few reasons:

The Fed will have to wait until October to see if jobs data picks up in September as a result of these developments. With no scheduled press conference in October, the Fed will likely signal or announce tapering in November after reviewing two more months of data. In our view, the taper announcement should be well digested by the markets, for a few reasons:

- Tapering should come as a surprise to no one, unlike in May 2013 when Fed Chair Ben Bernanke’s tapering comments shocked markets.

- The Fed will likely taper only after Delta cases subside and/or it becomes clear that the economy can navigate through the ups and downs of COVID.

- The Fed will still be adding to and holding over 18% of the supply of U.S. Treasuries, which will continue to exert downward pressure on rates.

- Finally, a tapering announcement will signal that the Fed is handing over the accommodative policy baton from monetary policy to fiscal policy.

Fiscal policy should be the dominant source of market volatility this fall

The $3.5 trillion U.S. budget reconciliation, infrastructure stimulus, and debt ceiling deadline are all on the agenda for September. With the details still largely to be determined, it’s too early to draw definitive conclusions about the impact of each policy. Still, September could provide investors with key details to answer the following questions:

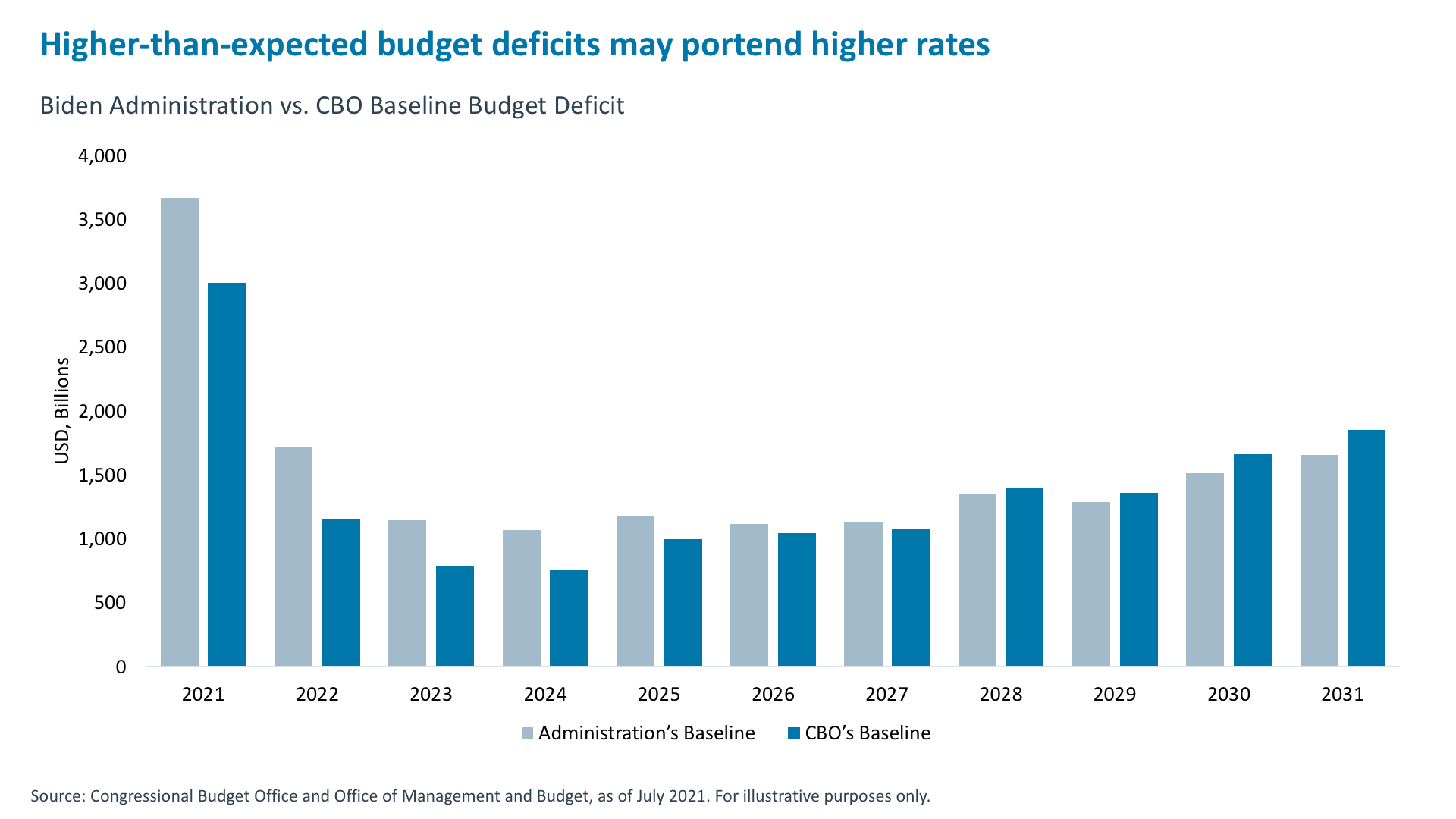

1. How much of all this extra spending will be offset with revenues, and/or how much will result in deficit spending? Under the recent Biden proposals, the projected budget deficits through 2024 are $414 billion larger on average per year than the Congressional Budget Office (CBO) budget baseline projection.1 If these deficits trajectory materializes under legislation passed later this fall, this could put upward pressure on rates.

2. How much will higher corporate tax rates impact S&P 500 earnings in 2022 and beyond? Most analysts have not yet estimated the impact of higher corporate and foreign taxes and any corresponding offset from spending on physical infrastructure and “human” infrastructure. Those that do estimate the impact, project that higher corporate taxes could shave off as much as $11 of $222 EPS estimates for 2022, or 5%,2 though some of it could be offset by higher government spending. This math and uncertainty around it is a potential source of volatility.

3. Who will be the winners and losers under various fiscal reforms? As is oftentimes the case, large pieces of legislation create winners and losers as they boost spending for some and raise taxes for others.

a. Potential losers: The tech sector, which tends to have higher proportion of foreign revenues. The sector could be hurt by higher headline corporate tax rates (going from 21% to 25%) and increases in the GILTI (global intangible low-taxed income) tax, which could double under the current Biden proposals3.

b. Potential winners: The clean energy space. Addressing climate change is a top priority for the Biden administration and its $3.5 trillion “investment plan” calls for hundreds of billions in credits and spending to support that priority. Any expansion of wind, solar, electric vehicle, and battery investment credits, as well as direct spending provisions, would benefit the clean energy space.

How might the markets react to this mix of policy and how should investors position?

September is known to have more downside risks than other months and this summer offered equity investors a picture-perfect rally, so a pullback can’t be ruled out, especially as fiscal policy creates uncertainty. But looking toward year-end, many factors should support markets: continued strong earnings; declining COVID cases and rising vaccination rates, including booster shots and possible approvals of vaccines for younger children, corporate cash fueling record buybacks, the offsetting of tax hikes with stimulus spending, and rising disposable incomes for select segments of the population if the “human” infrastructure stimulus passes.

Even as equity markets may continue to rise, however, I expect there will be a large degree of repositioning underneath the surface. Specially, we like opportunities in re-opening stocks like energy; clean energy stocks that could benefit from Biden stimulus; cryptocurrencies as a longer-term strategic allocation and as a hedge against too-loose monetary/too-lax fiscal policy while also offering optionality on tech innovation; and private credit on an (underappreciated) potential for higher rates if too much fiscal stimulus results in too much deficit spending or leads to higher inflation and, in turn, a more hawkish-on-rates Fed.

As seasons change and we adjust our routines to back-to-school and back-to-work, preparing portfolios for potential rotations as policy takes center stage should also be top-of-mind for investors this fall.

1. Congressional Budget Office, An Analysis of Certain Proposals in the President’s 2022 Budget, July 2021.

2. Goldman Sachs, as of August 2021.

3. Tax Foundation, Piling on the GILTI Verdicts, July 15, 2021. https://taxfoundation.org/biden-gilti-proposal/

IMPORTANT INFORMATION

The material herein has been provided to you for informational purposes only by iCapital, Inc. (“iCapital”). This material is the property of iCapital and may not be shared without the written permission of iCapital. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of iCapital.

This material is provided for informational purposes only and is not intended as, and may not be relied on in any manner as, legal, tax or investment advice, a recommendation, or as an offer to sell, a solicitation of an offer to purchase or a recommendation of any interest in any fund or security. You should consult your personal accounting, tax and legal advisors to understand the implications of any investment specific to your personal financial situation. This material does not intend to address the financial objectives, situation or specific needs of any individual investor. Alternative investments are complex, speculative investment vehicles and are not suitable for all investors.

The information contained herein is an opinion only, as of the date indicated, and should not be relied upon as the only important information available. Any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets is not necessarily indicative of the future or likely performance. The information contained herein is subject to change, incomplete, and may include information and/or data obtained from third party sources that iCapital believes, but does not guarantee, to be accurate. iCapital considers this third-party data reliable, but does not represent that it is accurate, complete and/or up to date, and it should not be relied on as such. iCapital makes no representation as to the accuracy or completeness of this material and accepts no liability for losses arising from the use of the material presented. No representation or warranty is made by iCapital as to the reasonableness or completeness of such forward-looking statements or to any other financial information contained herein.

Securities products and services are offered by iCapital Markets, an SEC-registered broker-dealer, member FINRA and SIPC, and an affiliate of iCapital, Inc. and Institutional Capital Network, Inc. These registrations and memberships in no way imply that the SEC, FINRA, or SIPC have endorsed any of the entities, products, or services discussed herein. Annuities and insurance services are provided by iCapital Annuities and Insurance Services LLC, an affiliate of iCapital, Inc. “iCapital” and “iCapital Network” are registered trademarks of Institutional Capital Network, Inc. Additional information is available upon request.

© 2023 Institutional Capital Network, Inc. All Rights Reserved.