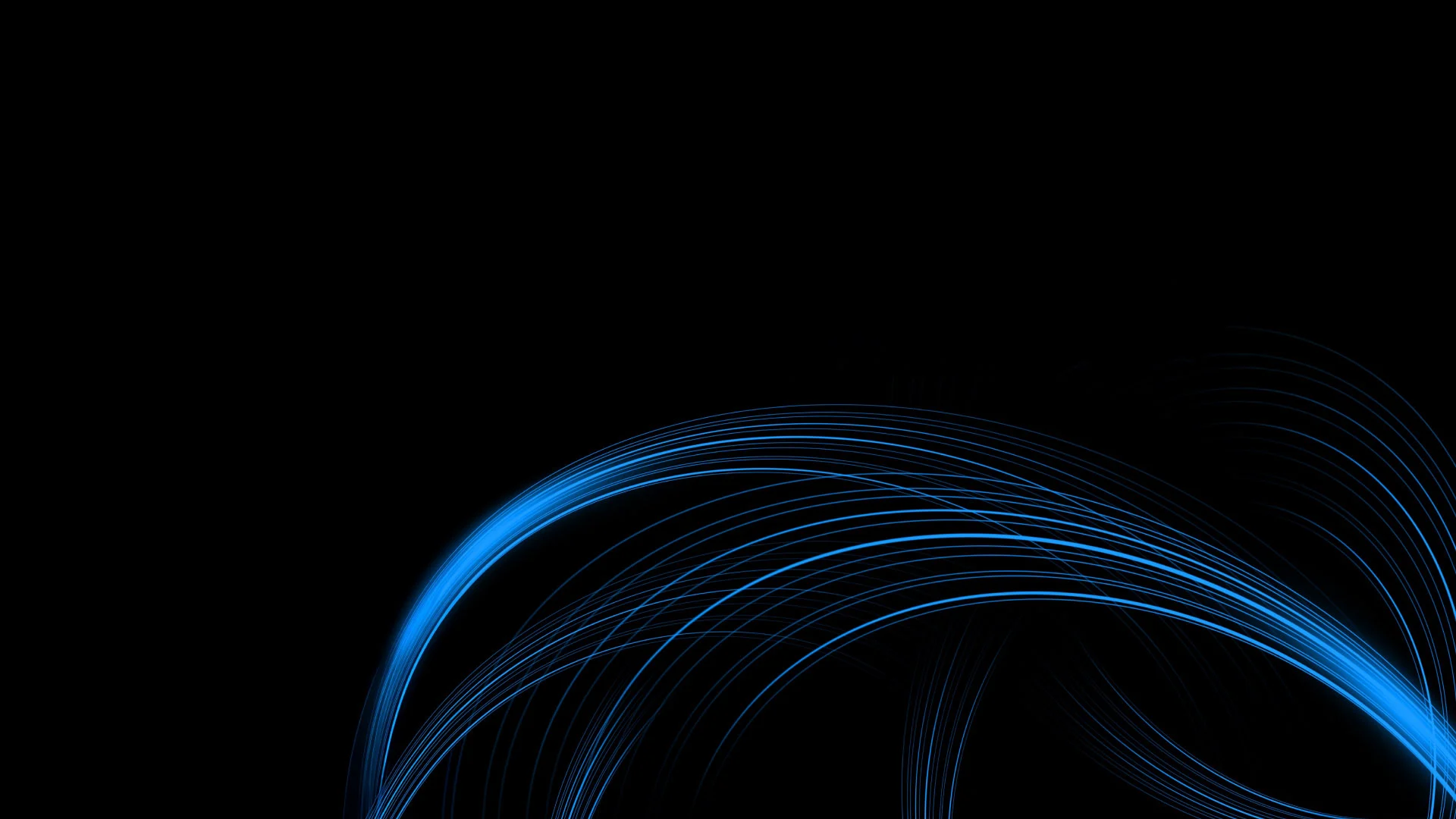

Despite another supersized 75 bps rate hike, the U.S. Federal Reserve (Fed) delivered something for markets and consumers to cheer about. For markets, we got the first hint of a slower pace of rate hikes ahead – Fed Chair Powell explicitly stated that it, “Will likely be appropriate to slow the pace of increases,” at some point.1 And for consumers, we got plenty of reassurance that, despite a slowdown and an expectation of below potential GDP growth, we are not in a recession given labor market strength with constrained supply. Note that over the last 20 years we have seen many quarters of below potential GDP growth, but few of them were truly recessionary (See Exhibit 1).2

This re-assurance was needed in retrospect given today’s GDP print came in at -0.9%.3 Despite the negative headline number, our take is that the details of the report reveal exactly what the Fed wanted to see – a contraction in goods and structures demand while the supply side catches up. Also, a slowdown in inventory growth was needed given the build-up over prior quarters and could ultimately help ease prices. Meanwhile, U.S. consumption expanded 1% and the GDP print would have been positive if it were not for private inventories contracting.4 All in, this is still consistent with the Fed’s desire for and trajectory of a soft landing.

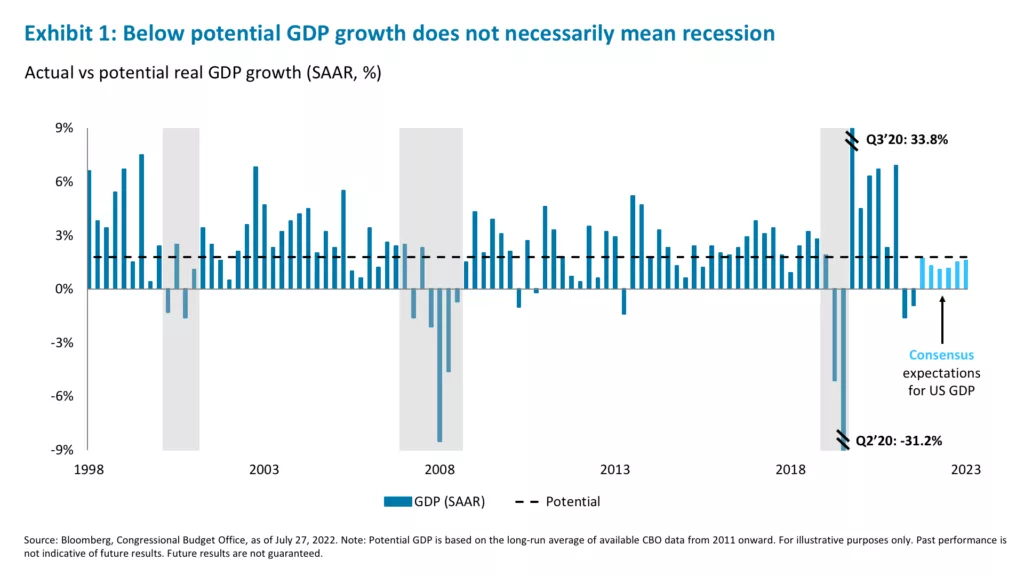

Our key takeaway from this Fed meeting is that markets could perform better in the second half of the year given the expected shift from supersized rate hikes to a more “normal” pace. Indeed, historical data suggests that equities have held up better during slower rate hiking cycles than fast ones (See Exhibit 2).5 Of course, upside inflation surprises could force the Fed to still be more aggressive than they anticipate, but we see three factors that should give them reasons to step down the pace of rate hikes.

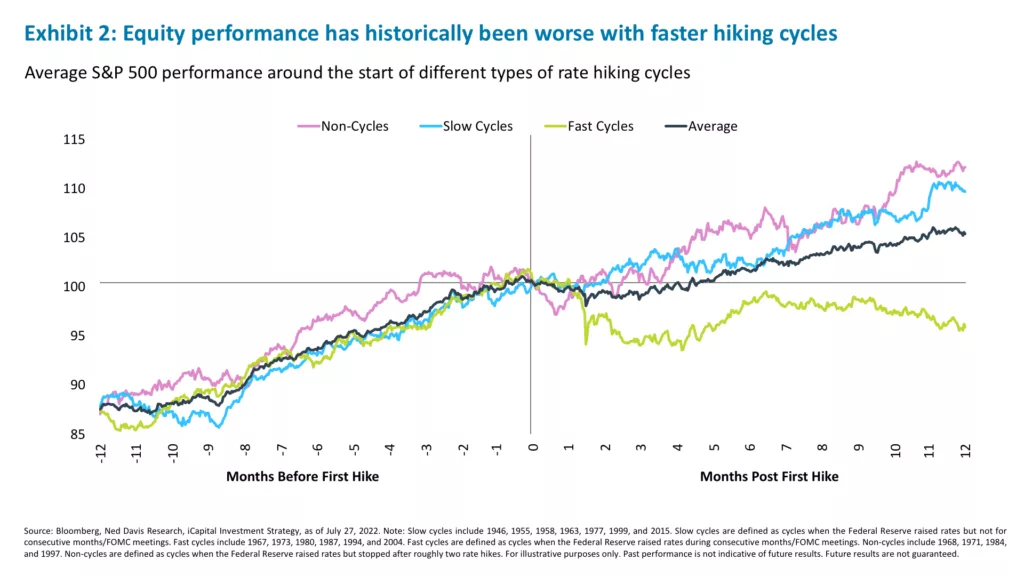

1) Financial conditions have already tightened substantially and act with a lag. The Goldman Sachs financial conditions index, which measures the weighted average of riskless interest rates, the exchange rate, equity valuations, and credit spreads, is back to 2019 levels (excluding the pandemic) and is actually now more in line with historical averages (See Exhibit 3).6 Keeping in mind that policy tightening takes time to weigh on the economy, we expect downward economic pressure in the coming quarters. Indeed, Mr. Powell explicitly stated that, “Their full effect has not been felt by the economy yet, so there’s probably some additional tightening – significant additional tightening – in the pipeline,” adding that it makes sense to, “See how it impacts the economy.”7 The Fed may therefore need to do less in the quarters ahead than in the last three months.

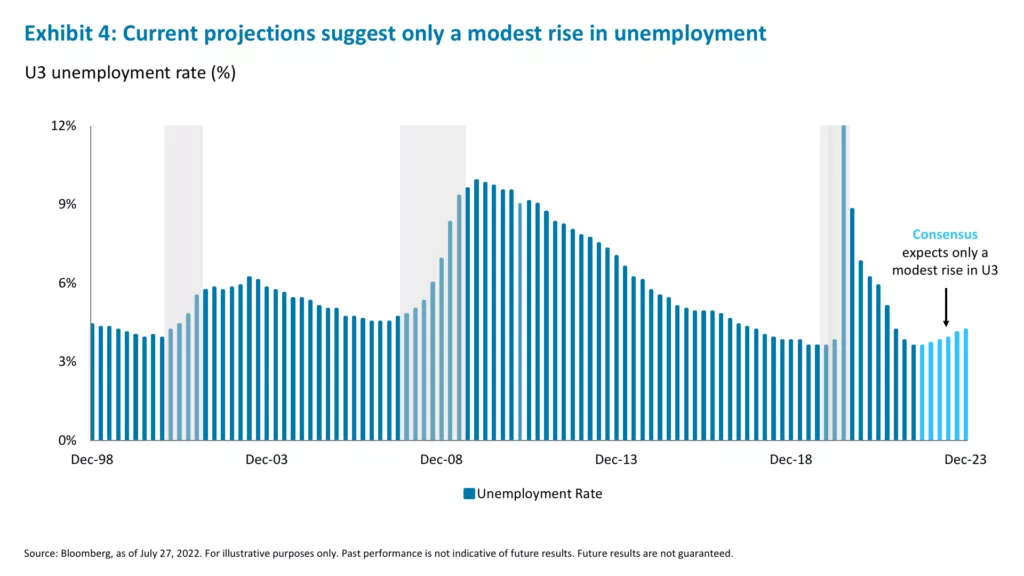

2) Lower inflation expectations and slower economic data could reduce need to tighten. While the June headline inflation print showed no signs of cooling, at 9.1%, consumer expectations of inflation fell in lockstep with commodities and gasoline prices.8 This should alleviate some of the Fed’s fears that inflation is becoming entrenched in the consumer psyche. Additionally, a moderation in growth should help rein in inflation. For example, the U.S. ISM Manufacturing Index fell from 56 in May to 53 in June, and is expected to come in at 52.3 for July.9 Meanwhile, while jobs growth remains robust, the rise in jobless claims is noteworthy – climbing from 166,000 in mid-March to 251,000 in the latest print.10 JOLTs job openings metric has also begun to roll over – falling from 11.85 million openings in March to an expected 10.98 million in June.11 These are an early sign of labor market softening and bear watching, but this is at present a welcome development through the Fed’s eyes – “The labor market has such a large amount of surplus demand that you could see that demand come down in a way that didn’t translate into a big increase in unemployment.”12 Importantly, this reinforces the idea that there is a path to Mr. Powell’s soft-ish landing, where the economy slows but the unemployment rate does not rise much, which is what current forecasts suggest (See Exhibit 4).

3) After yesterday’s 75 bps rate hike, the fed funds rate target range is now 2.25-2.5%, approaching the Fed’s definition of neutral or longer-run level of interest rates.13 This is a big milestone for the Fed as they have tried to expeditiously move to neutral. Now that we are there or thereabouts, and given that the economy is already facing below potential GDP performance and rates are still expected to rise into “moderately restrictive” territory (3.25%-3.5% by the end of 2023), there is a stronger case for taking it a little slower in the months ahead.14

The bottom line for investors is that a more “normal” path of rate increases ahead could mean a less treacherous second half of 2022, as we wrote in our mid-year outlook.

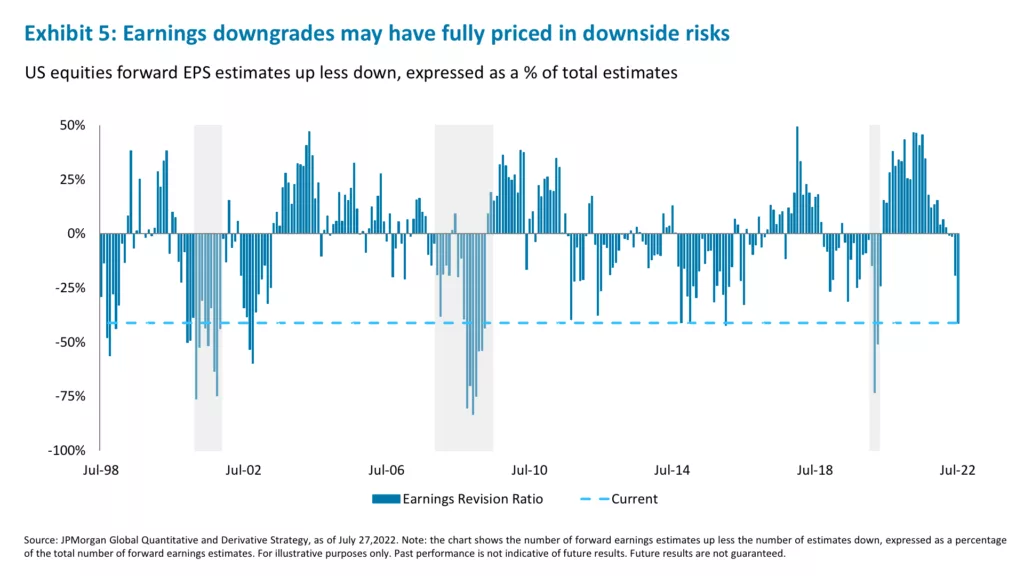

We are definitely still facing a slowdown and will likely see several quarters of below potential GDP growth but, as we saw in Exhibit 1, that does not necessary spell a recession. Additionally, the U.S. net earnings revisions ratio may have fallen to -40% (See Exhibit 5), but this is no worse than in several other periods of downgrades in which recession was avoided, while corporate profits in the current reporting quarter are holding up better than expected.15 As a result, barring a full-blown recession, we think consensus estimates have already largely priced in earnings downgrades in this cycle, with downside risks better priced in than just a few months ago.16

The Fed’s first hint at slower rate increases ahead is a welcome sign for markets, and it may give the current rally legs, especially if our base case of a slowdown rather than a recession holds and given a starting point of depressed valuations and extremely light positioning. We have advocated for adding selectively to energy, financials, and technology holdings, and we maintain that position.

1. FOMC Press Conference, as of July 27, 2022.

2. Bloomberg, as of July 27, 2022.

3. Bloomberg, as of July 28, 202

4. Bloomberg, as of July 28, 202

5. Bloomberg, Ned Davis Research, iCapital Investment Strategy, as of July 27, 2022.

6. Bloomberg, Goldman Sachs, iCaptial, as of July 27, 2022

7. FOMC Press Conference, as of July 27, 2022.

8. Bloomberg, as of July 27, 2022.

9. Bloomberg, as of July 27, 2022.

10. Bloomberg, as of July 27, 2022.

11. Bloomberg, as of July 27, 2022.

12. FOMC Press Conference, as of July 27, 2022.

13. Bloomberg, Federal Reserve, as of July 27, 2022.

14. Bloomberg, iCapital, as of July 27, 2022.

15. iCapital, JPMorgan Global Quantitative and Derivative Strategy, as of July 27, 2022.

16. Ibid.

IMPORTANT INFORMATION

The material herein has been provided to you for informational purposes only by iCapital, Inc. (“iCapital”). This material is the property of iCapital and may not be shared without the written permission of iCapital. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of iCapital.

This material is provided for informational purposes only and is not intended as, and may not be relied on in any manner as, legal, tax or investment advice, a recommendation, or as an offer to sell, a solicitation of an offer to purchase or a recommendation of any interest in any fund or security. You should consult your personal accounting, tax and legal advisors to understand the implications of any investment specific to your personal financial situation. This material does not intend to address the financial objectives, situation or specific needs of any individual investor. Alternative investments are complex, speculative investment vehicles and are not suitable for all investors.

The information contained herein is an opinion only, as of the date indicated, and should not be relied upon as the only important information available. Any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets is not necessarily indicative of the future or likely performance. The information contained herein is subject to change, incomplete, and may include information and/or data obtained from third party sources that iCapital believes, but does not guarantee, to be accurate. iCapital considers this third-party data reliable, but does not represent that it is accurate, complete and/or up to date, and it should not be relied on as such. iCapital makes no representation as to the accuracy or completeness of this material and accepts no liability for losses arising from the use of the material presented. No representation or warranty is made by iCapital as to the reasonableness or completeness of such forward-looking statements or to any other financial information contained herein.

Securities products and services are offered by iCapital Markets, an SEC-registered broker-dealer, member FINRA and SIPC, and an affiliate of iCapital, Inc. and Institutional Capital Network, Inc. These registrations and memberships in no way imply that the SEC, FINRA, or SIPC have endorsed any of the entities, products, or services discussed herein. Annuities and insurance services are provided by iCapital Annuities and Insurance Services LLC, an affiliate of iCapital, Inc. “iCapital” and “iCapital Network” are registered trademarks of Institutional Capital Network, Inc. Additional information is available upon request.

© 2023 Institutional Capital Network, Inc. All Rights Reserved.