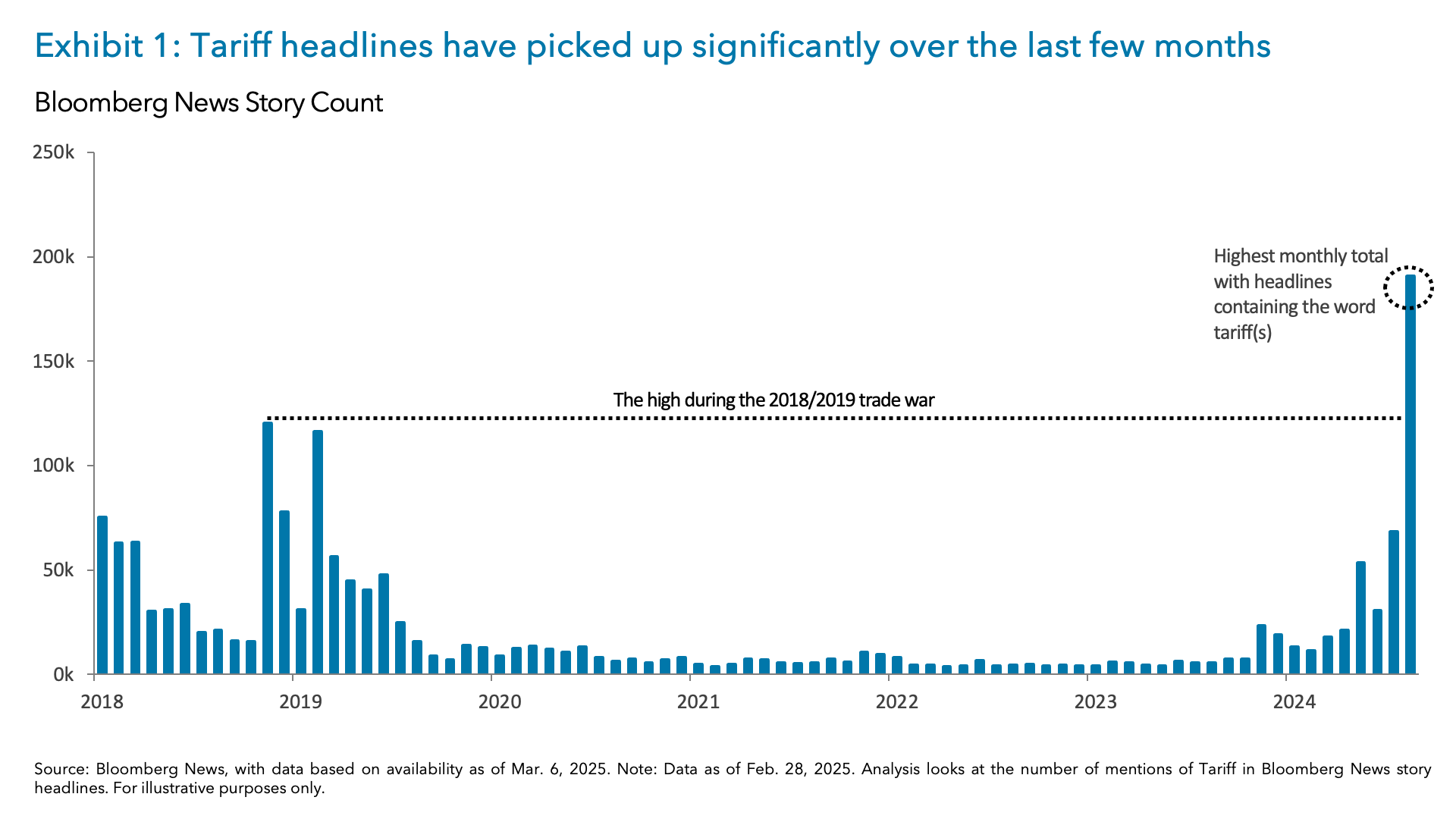

Investors sometimes categorize markets as being risk-on/risk-off. However, since the start of the year, it seems like markets have been trading on tariffs-on, tariffs-off. The number of tariff(s) mentions on Bloomberg News headlines reached a record high in February – surpassing levels during the last trade war, as seen in Exhibit 1.1 We also see this with U.S. companies, as more than half of the S&P 500 companies (259 of them) have cited the term tariff(s) on their Q4 earnings call – the highest total in the last 10-years.2

However, the latest round of market weakness has not been driven by tariff headlines alone, market participants have started to worry about the potential for a “growth scare” and even a recession. Indeed, we have seen softness in economic data, specifically survey-based data to start the year.

With tariff headlines and weak economic data weighing on equity markets – equities are now oversold on a relative strength index (RSI) – we think today’s levels could provide an attractive entry point given the unwind we have already seen. However, our approach would be selective and gradual as markets will continue to grapple with tariff headlines over the coming months. Currently, we favor U.S. domestic high quality defensive sectors over cyclical sectors, and high-income generating assets, such as private credit and private real estate.

Survey data has increased concerns of a “growth scare”

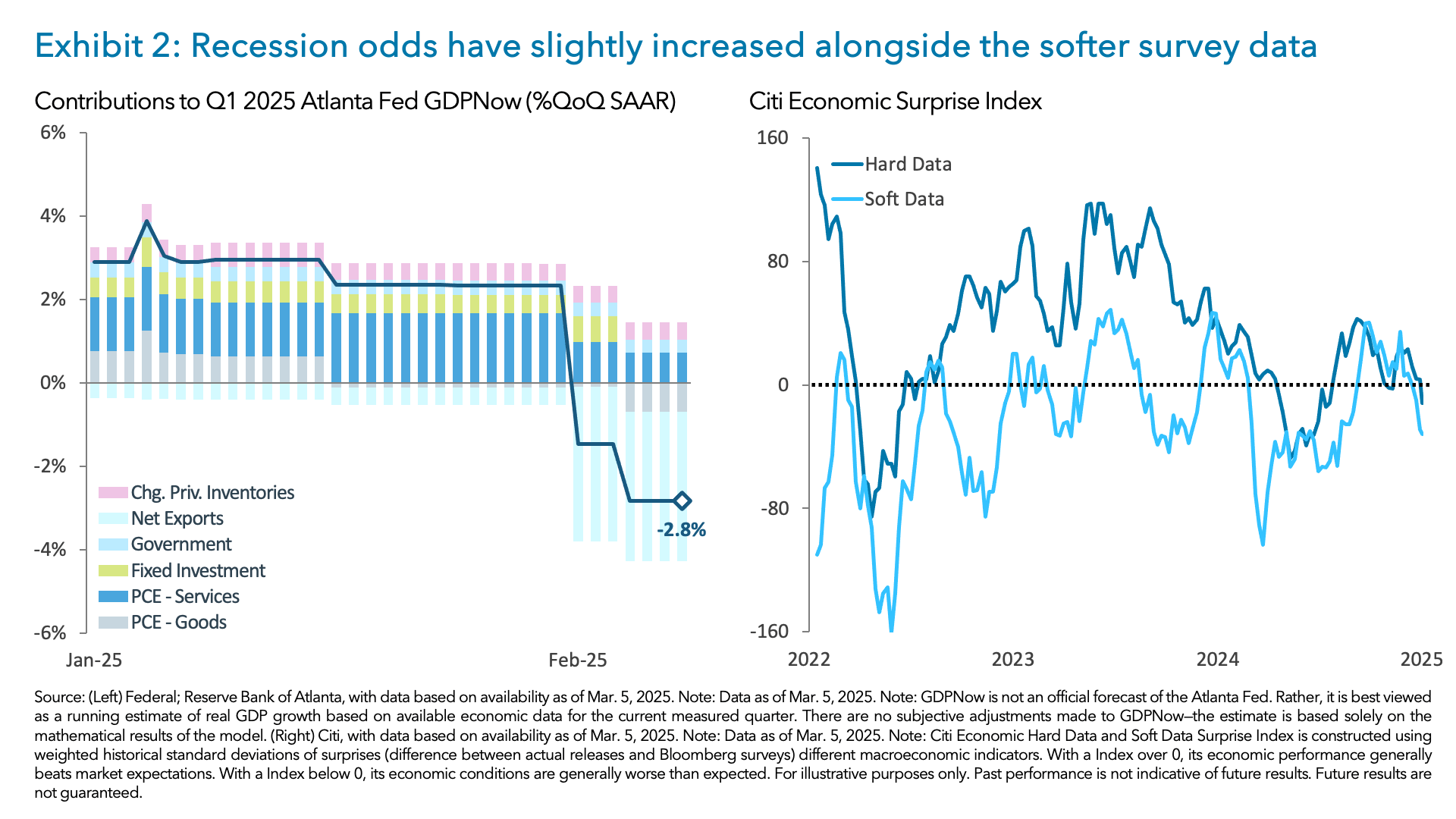

Economic data has weakened since the start of the year, as highlighted by the Citi economic surprise index falling into negative territory.3 The data disappointments thus far have largely been driven by soft (or survey-based) data. So far, year-to-date (YTD) soft data economic surprises have seen a larger decline than hard data, as seen in Exhibit 2.4 Soft data seems to be impacted by the spike in uncertainty as President Trump has announced and implemented various tariffs, and as a result economic policy and trade uncertainty indices are at multi-decade highs.5 In addition, the fears of a “growth scare” – and even a recession – rose when the Atlanta GDPNOW model started projecting negative growth for the quarter – the first time since COVID.6

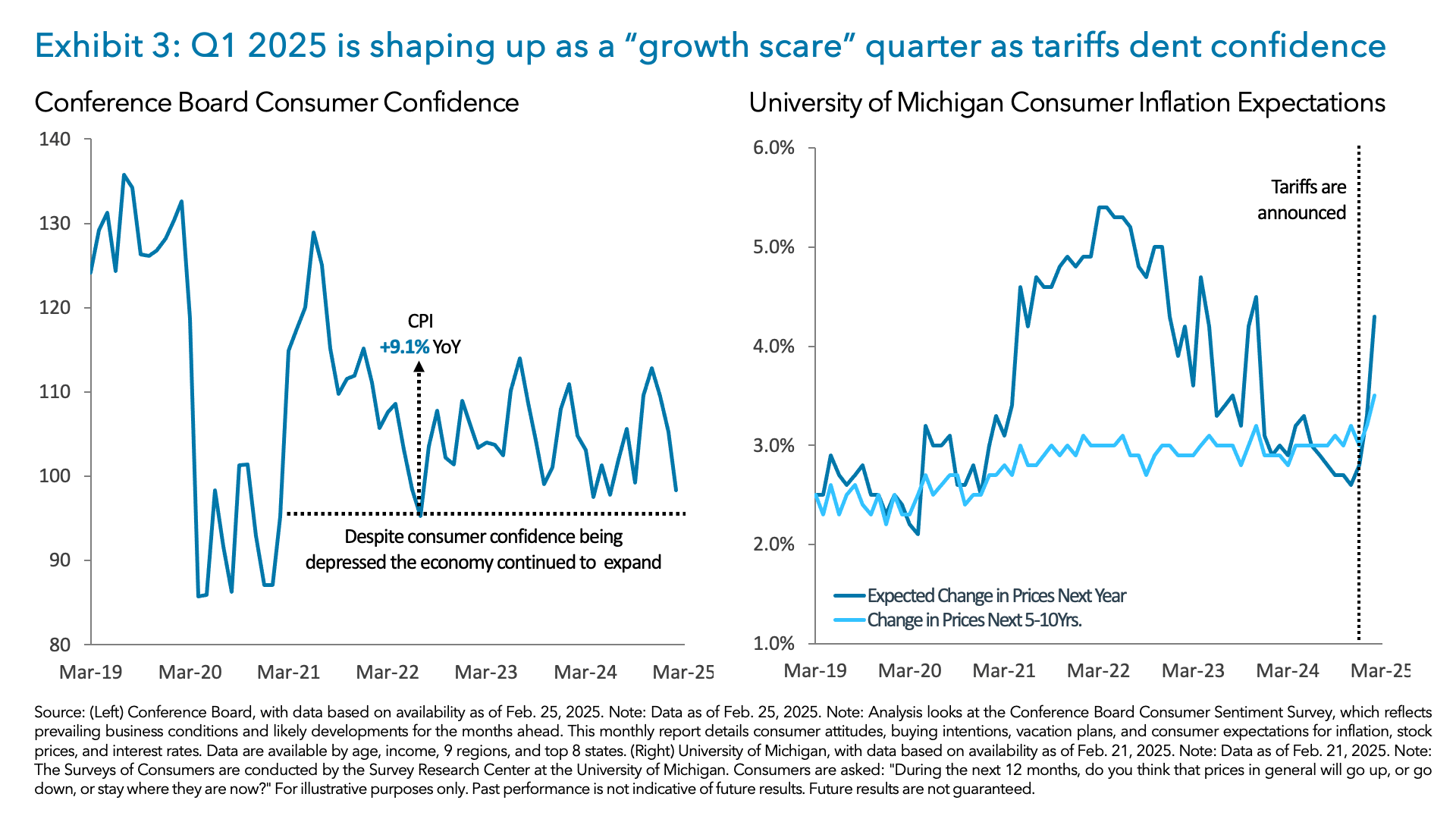

Despite this weakness, we still do not see elevated recession odds. First, despite consumer confidence falling to the lowest level since 2022, and remaining depressed for much of 2023 and 2024, the economy continued to expand, and the consumer continued to spend, as seen in Exhibit 3.7 Second, even with the sharp increase in inflation expectations, because of tariffs and items such as the cost of eggs, actual inflation continues to trend lower. Both core consumer (CPI) and producer price index (PPI) came in below expectations this week.8 Finally, once you strip out non-monetary gold imports – which accounted for 60% of the goods deficit widening – the Atlanta GDPNow model would project 0.4% growth for the first quarter.9

Markets have already started to factor in rising uncertainty and growth fears

Given the trade uncertainty and fears of a “growth scare”, equity markets have weakened over the last few weeks – the S&P 500 is down roughly -10% from its high and is officially in correction territory.10 However, there is even more pain under the surface, as the median stock is down almost -20% from its one-year high.11

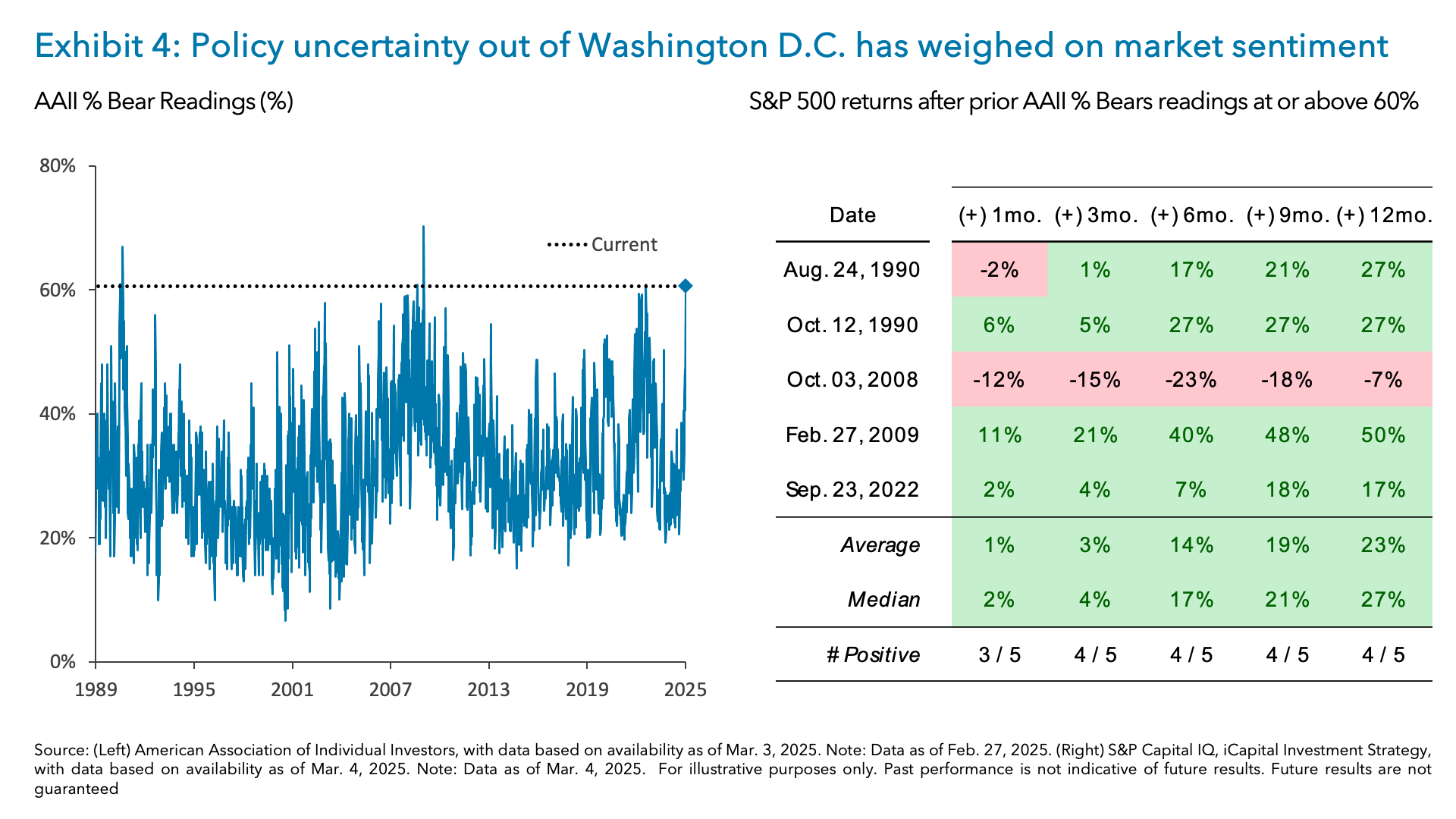

While the sell-off continues, the S&P 500 now appears to be oversold. Indeed, the S&P 500 is currently below 30 on a relative strength index – the first time since October 2023.12 At the same time, we have also witnessed a large positioning unwind and a jump in bearish sentiment. In fact, based on prime book data, Monday (3/10) represented one of the largest single day de-grossings for hedge funds – a 3.8 standard deviation move.13 In addition, the Association of American Individual Investors (AAII) Bears rose to 60.60% – the 6th highest reading in the survey’s history. Historically when we have seen readings above 60%, future returns for equity markets tend to be positive, as seen in Exhibit 4.14

Given this set-up, we think the bar for a positive surprise has been reset lower. This is one of the reasons why we believe today’s levels present an attractive entry point for equities. However, we still need positive catalysts to support markets.

The three positive surprises that could start to support markets

While markets now appear to be oversold on a technical, positioning and sentiment basis, we are looking for possible catalysts that could positively surprise markets. Indeed, Fed rate cuts, better-than-expected economic data and trade deals/agreements could start to support markets from here.

1. The Fed returns to rate cuts. One of the reasons why markets performed well last year was because of the Fed embarking on a rate-cutting cycle. While the Fed has paused their rate cutting cycle, we think next week’s FOMC meeting could be an important catalyst for markets, as we will get an updated dot plot, showing how many times the Fed expects to cut rates this year.

Rate cuts were an important catalyst during the first trade war, as when the Fed started cutting rates in July 2019 – markets started pricing in rate cuts in March 2019 – it helped support equity markets and economic data. After the Fed cut rates in July 2019, the S&P 500 was 9.34% higher into year-end.15

2. Positive data surprises. With economic surprises remaining in negative territory, we think any better-than-expected data could start to support markets, with the upcoming retail sales report likely being an important data point. Growth concerns in the U.S. started after we received a weak January retail sales report, and weaker than expected guidance from large store retailers. If February retail sales show a recovery in spending, then market participants may be more comfortable with the narrative that January data was impacted by cold weather and start to write down the risks of a recession.

3. Reaching trade agreement(s). Markets have been hypersensitive to the number of trade headlines we have received over the last few months. While some tariffs have been implemented, markets will be focused on the reciprocal tariff announcement on April 2nd. With investigations and comment periods to take place after this announcement, there is the potential for deals to be struck ahead of the actual tariffs being implemented. As a matter of fact, we have already seen countries take steps to lower tariff rates on certain U.S. goods. If we start to receive positive headlines on this front, this could support markets, like 2019 – positive trade headlines came in Sept. 2019 with the ultimate Phase One trade deal signed in January 2020.

How to position for this environment? Entry levels appear attractive, but we would be selective and gradual in our approach

As we take stock of the market sell-off, given the increase in pessimism, the unwind of equity positioning and with the S&P 500 being oversold, we think today’s equity levels present an attractive entry point for investors. However, given the uncertainty pertaining to both trade policy and economic data, we favor defensive sectors and high-income generating assets.

While we deal with the medium-term tariff overhang, we think there are certain areas within markets that investors could favor. Indeed, we favor defensives over cyclicals in this environment. We believe utilities and real estate could be relative outperformers, given their consistent earnings stream, reasonable dividend yields, and their cheap relative valuations – both of their forward price-to-earnings ratios vs. the S&P 500 are well below their 10-year averages.16 Defensive sectors should continue to benefit from the drop in interest rates. Indeed, since rates peaked on January 14th, utilities and real estate have outperformed the S&P 500 by 6.52 ppt and 7.5 ppt, respectively.17 These sectors should also benefit from having a more domestic focus, which should somewhat isolate them from any further tariff threats.

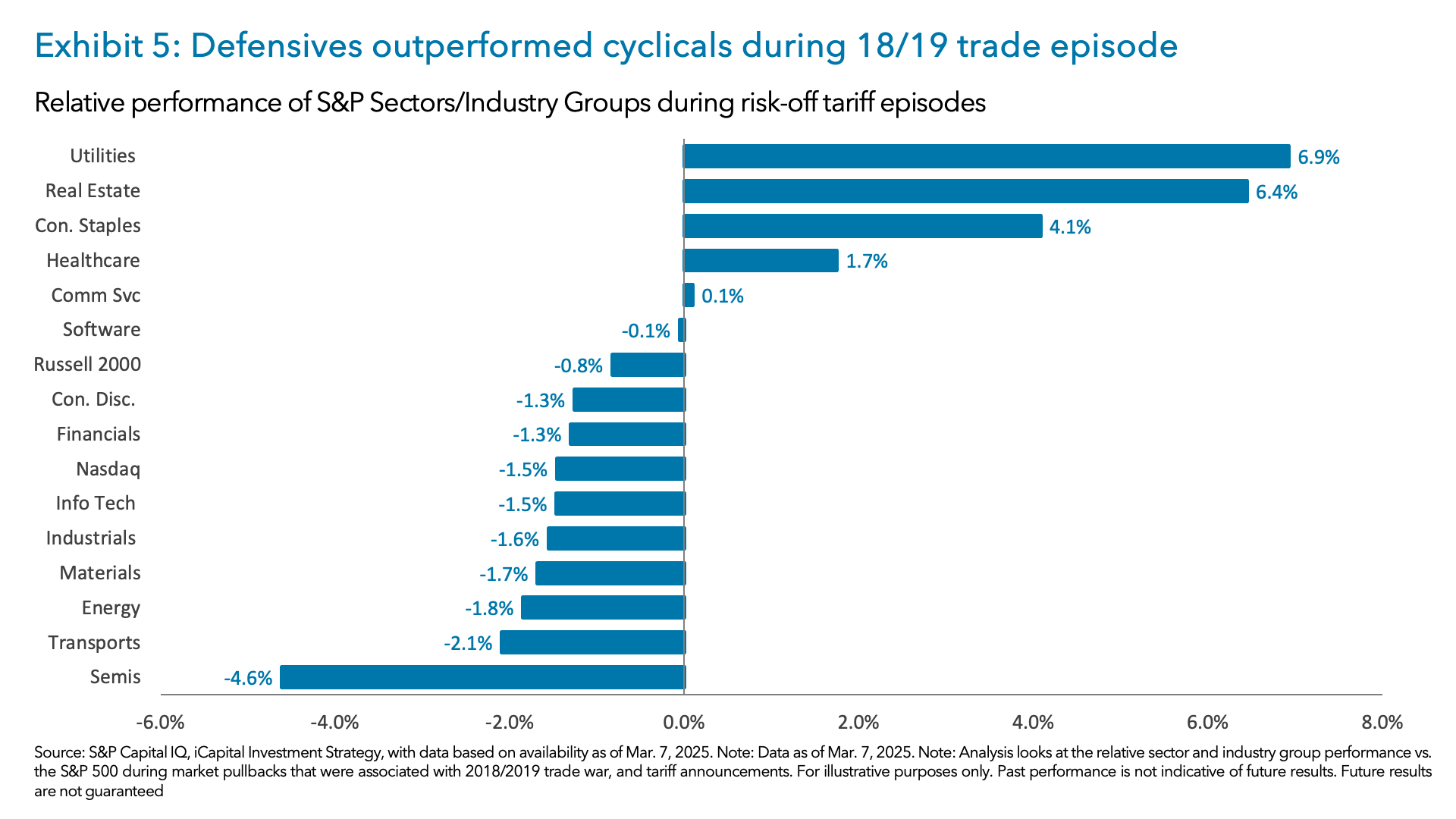

As we saw in the last trade war, tariffs weighed on manufacturing activity – the safeguard tariffs implemented in January 2018 coincided with the peak in the Institute for Supply Management (ISM) manufacturing purchasing managers’ index (PMI).18 Therefore, there is the potential for manufacturing activity to weaken from today’s levels. Given the high correlation that cyclicals have with manufacturing activity in the U.S., this could weigh on the earnings revisions for these sectors and ultimately their performance, as seen in Exhibit 5.

Today’s environment should also favor high-income asset classes. With the 10yr. Treasury yield now 54 bps off of its January 14th, 2025 high, we think investors will be looking towards other asset classes to help maintain income within their portfolios.19

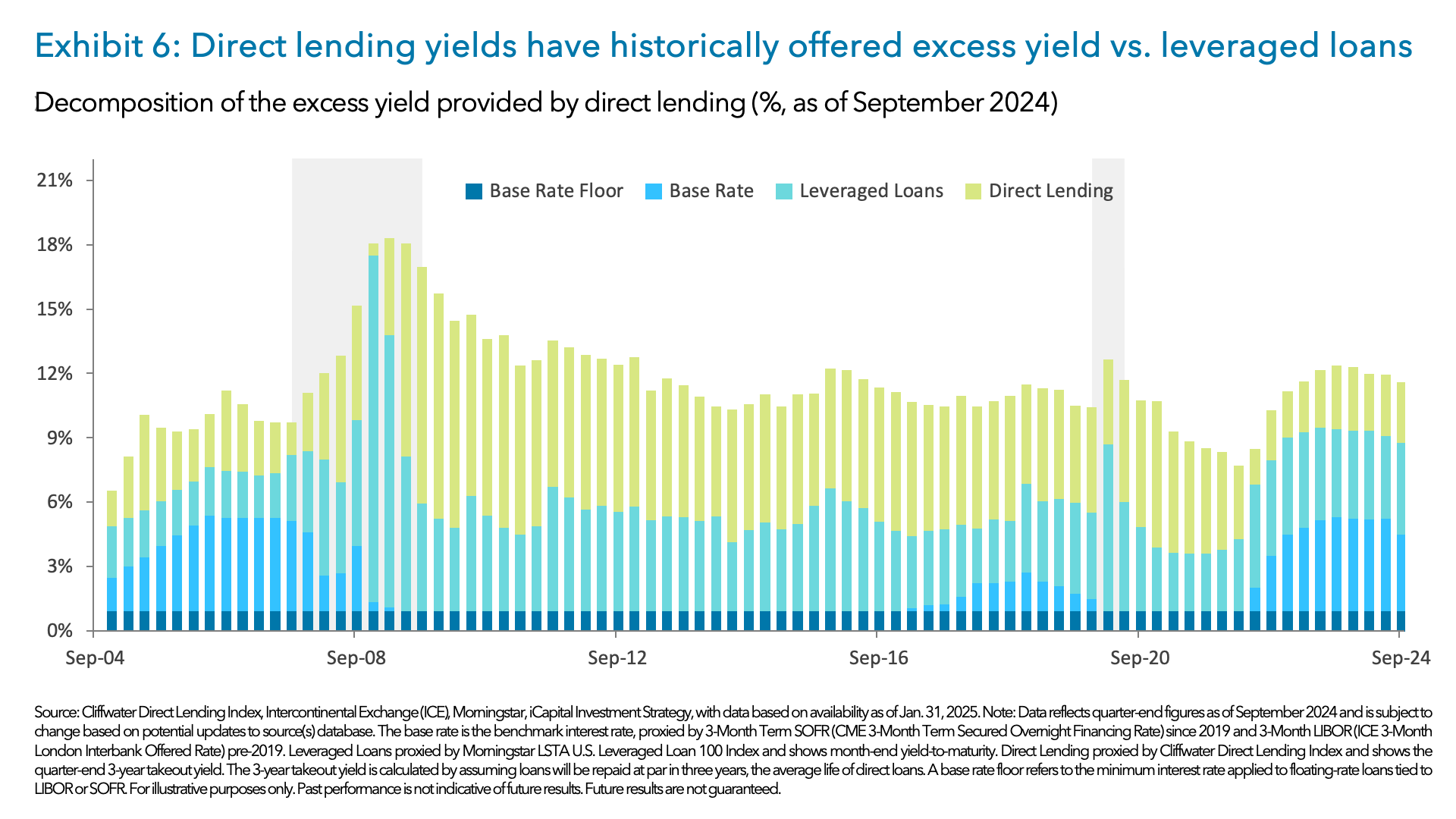

Even with the compression that we have seen in base rates, private credit has maintained an attractive yield of 11.48% through the end of Q3 2024.20 With base rates likely to continue to reset lower as the Fed is expected to cut rates in 2025, private credit has historically shown it can provide attractive spreads. During the period when the Fed lowered rates to the zero lower bound, private credit still provided an average yield of 12%, as we can see in Exhibit 6.21 Therefore, we think private credit may allow you to get “paid for waiting” out the uncertainty from increased tariff rhetoric.

Within the income-producing asset class, we also continue to favor private real estate – both equity and debt strategies. Broadly speaking, the commercial real estate (CRE) market continues to stabilize, with firming fundamentals across sectors. And structural tailwinds such as aging properties and a growing debt funding gap, create significant opportunities and position private real estate as an attractive option in today’s market.

While equities may start to bounce from these levels, given the potential for trade uncertainty to persist, we favor the asset classes and sectors discussed above. Ultimately, we believe these allocations could provide portfolio ballast and help investors ride out any spikes in volatility that we could experience in the coming months.

1. Bloomberg News, as of Mar. 6, 2025.

2. FactSet, as of Mar. 7, 2025.

3. Citi, as of Mar. 3, 2025.

4. Citi, as of Mar. 3, 2025.

5. Bloom, Baker, Davis, as of Mar. 4, 2025.

6. Atlanta Federal Reserve, as of Mar. 13, 2025.

7. Conference Board, U.S. Census Bureau, as of Mar. 13, 2025.

8. Bureau of Labor Statistics, as of Mar. 13, 2025.

9. Atlanta Federal Reserve, as of Mar. 7, 2025.

10. S&P Capital IQ, as of Mar. 12, 2025.

11. S&P Capital IQ, as of Mar. 12, 2025.

12. S&P Capital IQ, as of Mar. 12, 2025.

13. Goldman Sachs, as of Mar. 10, 2025.

14. American Association of Individual Investors, iCapital Investment Strategy, as of Feb. 27, 2025.

15. S&P Capital IQ, as of Mar. 3, 2025.

16. S&P Capital IQ, as of Mar. 7, 2025.

17. S&P Capital IQ, as of Mar. 13, 2025.

18. Institute for Supply Management, as of Mr. 3, 2025.

19. Fred, U.S. Treasury Department as of Mar. 7, 2025.

20. Cliffwater Direct Lending Index, Fred, U.S. Treasury as of Sep. 30, 2024.

21. Cliffwater Direct Lending Index, as of Sep. 30, 2024.

INDEX DEFINITIONS

S&P 500 Index: The S&P 500 is widely regarded as the best single gauge of large-cap U.S. equities. The index includes 500 of the top companies in leading industries of the U.S. economy and covers approximately 80% of available market capitalization.

S&P Real Estate Index: The S&P Real Estate Sector Index, part of the S&P 500, measures the performance of companies classified in the Global Industry Classification Standard (GICS) Real Estate sector, including real estate management and development, and REITs (excluding mortgage REITs).

S&P 500 Utilities Index: Standard and Poor's 500 Utilities Index is a capitalization-weighted index that tracks the performance of utility companies within the S&P 500, providing a view of energy, water, and electric service providers.

IMPORTANT INFORMATION

The material herein has been provided to you for informational purposes only by Institutional Capital Network, Inc. (“iCapital Network”) or one of its affiliates (iCapital Network together with its affiliates, “iCapital”). This material is the property of iCapital and may not be shared without the written permission of iCapital. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of iCapital.

This material is provided for informational purposes only and is not intended as, and may not be relied on in any manner as, legal, tax or investment advice, a recommendation, or as an offer or solicitation to buy or sell any security, financial product or instrument, or otherwise to participate in any particular trading strategy. This material does not intend to address the financial objectives, situation, or specific needs of any individual investor. You should consult your personal accounting, tax and legal advisors to understand the implications of any investment specific to your personal financial situation.

ALTERNATIVE INVESTMENTS ARE CONSIDERED COMPLEX PRODUCTS AND MAY NOT BE SUITABLE FOR ALL INVESTORS. Prospective investors should be aware that an investment in an alternative investment is speculative and involves a high degree of risk. Alternative Investments often engage in leveraging and other speculative investment practices that may increase the risk of investment loss; can be highly illiquid; may not be required to provide periodic pricing or valuation information to investors; may involve complex tax structures and delays in distributing important tax information; are not subject to the same regulatory requirements as mutual funds; and often charge high fees. There is no guarantee that an alternative investment will implement its investment strategy and/or achieve its objectives, generate profits, or avoid loss. An investment should only be considered by sophisticated investors who can afford to lose all or a substantial amount of their investment.

iCapital Markets LLC operates a platform that makes available financial products to financial professionals. In operating this platform, iCapital Markets LLC generally earns revenue based on the volume of transactions that take place in these products and would benefit by an increase in sales for these products.

The information contained herein is an opinion only, as of the date indicated, and should not be relied upon as the only important information available. Any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets is not necessarily indicative of the future or likely performance. The information contained herein is subject to change, incomplete, and may include information and/or data obtained from third party sources that iCapital believes, but does not guarantee, to be accurate. iCapital considers this third-party data reliable, but does not represent that it is accurate, complete and/or up to date, and it should not be relied on as such. iCapital makes no representation as to the accuracy or completeness of this material and accepts no liability for losses arising from the use of the material presented. No representation or warranty is made by iCapital as to the reasonableness or completeness of such forward-looking statements or to any other financial information contained herein.

Securities products and services are offered by iCapital Markets, an SEC-registered broker-dealer, member FINRA and SIPC, and an affiliate of iCapital, Inc. and Institutional Capital Network, Inc. These registrations and memberships in no way imply that the SEC, FINRA, or SIPC have endorsed any of the entities, products, or services discussed herein. Annuities and insurance services are provided by iCapital Annuities and Insurance Services LLC, an affiliate of iCapital, Inc. “iCapital” and “iCapital Network” are registered trademarks of Institutional Capital Network, Inc. Additional information is available upon request.

©2025 Institutional Capital Network, Inc. All Rights Reserved.