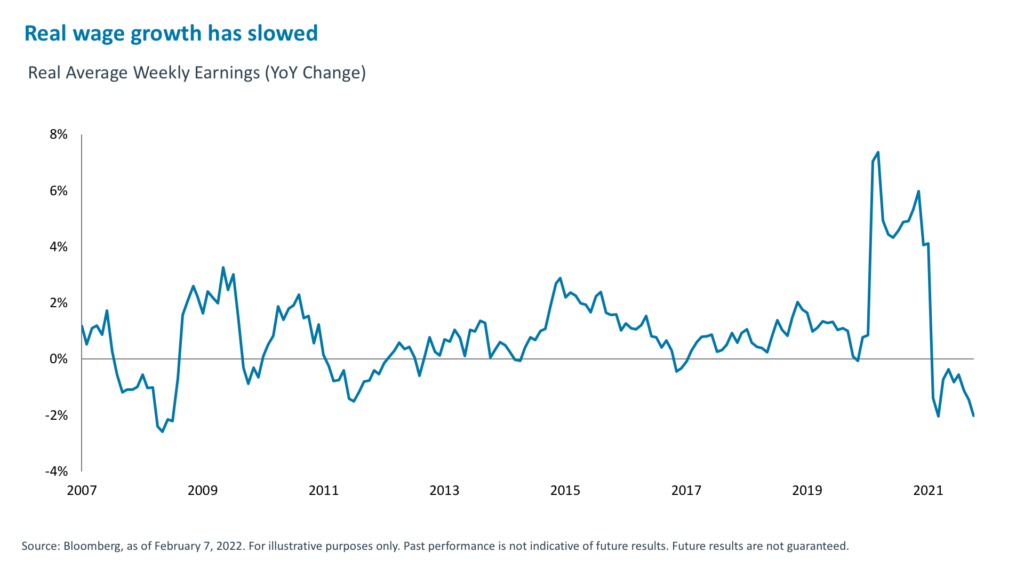

This week’s consumer price index (CPI) release of annual inflation data for January is expected to come in at 7.3%.1 This is once again a new four-decade high. Inflation erodes the purchasing power of your money and disproportionately hits low-income consumers, who spend 94% of disposable income on essentials items like groceries, shelter, utilities, and gasoline.2 With these essentials costing more and more—a basket of these goods and services is 7.9% more expensive than in December 2019—that leaves little room for other discretionary purchases.3 Yes, wages have been rising too, but have not kept pace with inflation, and real wage growth has slowed lately.4

It is no wonder that consumer sentiment in the University of Michigan’s January 2022 survey slipped to its lowest level in 10 years.5 Respondents’ expectations for real income and personal finances deteriorated and sentiment on buying conditions for large household durables and cars slumped to all-time lows.6 This week’s report on consumer confidence is expected to match January’s downbeat assessment.

The market consensus expects inflation to peak in the first quarter of 2022 and ease from there.7 Still, the great concern about inflation is finally prompting the Federal Reserve to act—with a series of upcoming rate hikes and balance sheet tapering. The problem with that for the market? To slow inflation, the Fed’s going to have to slow demand.

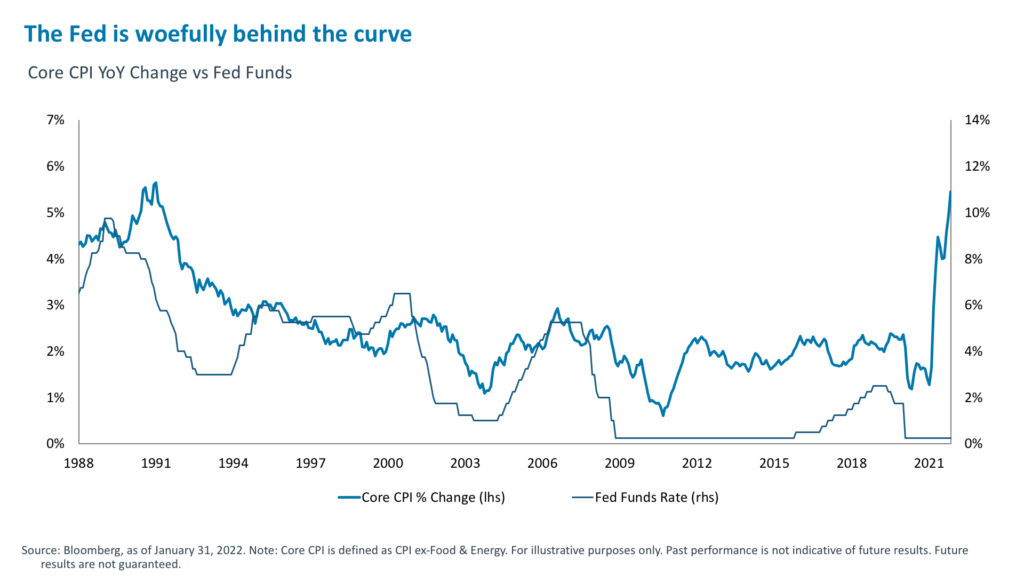

Never in the last 40 years have we seen such accommodative policy with such high inflation, as shown below. The Fed must act and understandably this is making markets nervous. For more than 10 years since the Global Financial Crisis amid record Fed balance sheet expansion and record-low real federal funds rates, we’ve heard a consistent message from the Fed—there is no need to worry about inflation because if it ever were to become a concern, they have “powerful” tools to control it—i.e., rate hikes. Well, the use of these tools is warranted now.

Why should the markets be nervous about the Fed? Because it cannot slow inflation without slowing demand. Since the Fed cannot use monetary policy to solve supply chain issues—such as those with new and used cars, furnishings, houses, semiconductors and more—they will use rate hikes to slow demand. Indeed, U.S. personal consumption spending on durable goods had risen an unprecedented 34% above pre-pandemic levels (or 73% from the collapse in demand in April 2020) by the end of 2021,8 and these supply-constrained categories are estimated to have added 145 basis points to annual inflation in January 2022.9

The good news from an inflation perspective, but bad news for companies that have benefited from this demand, is that we are already seeing slower growth in several cyclical sectors. For example, February’s U.S. PMI Manufacturing Index dropped to its lowest level since October 2020 on soft demand conditions and labor shortages.10 New orders rose at the slowest pace since September 2020.11 Retail sales have been strong but the recent slowdown bears watching.12

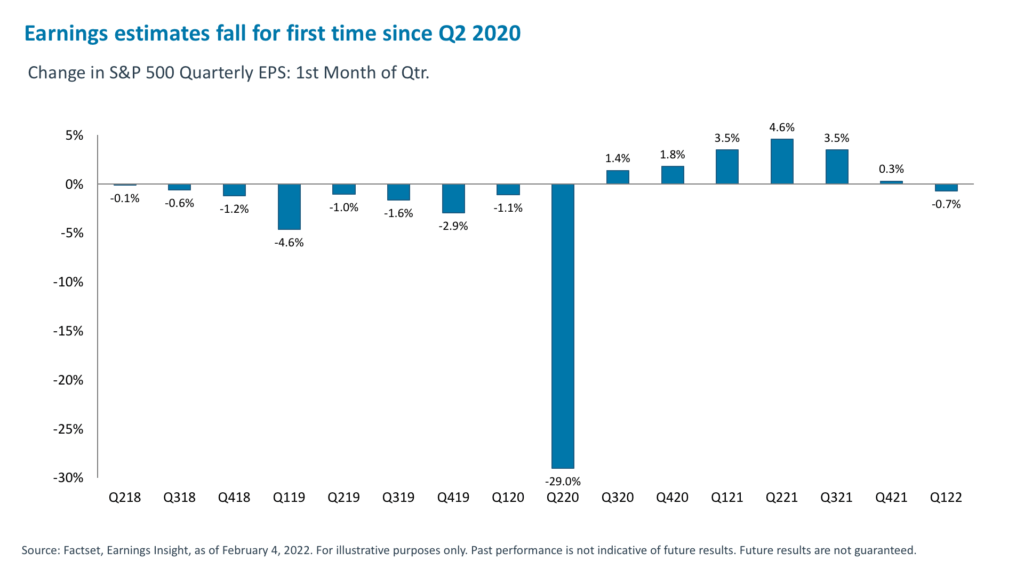

Good for inflation, but downside risk for earnings estimates

FactSet recently flagged that quarterly earnings estimates fell in the first quarter of 2022 after six consecutive quarters of upwards revisions. 13

Similarly, the global earnings revision ratio (which measures the number of analyst upgrades versus downgrades) has been declining since last fall.14 Upwards earnings revisions are no longer a tailwind to equity market performance, and we see risks building that slowing demand and the upcoming rate increases could create further downside to current consensus earnings estimates, which would further dampen equity market performance. On the plus side, as the pandemic eases so should supply chain challenges, but with demand for goods already paring back we think it is unlikely that demand bounces back sharply—especially with financing costs likely to rise.

That said, there is dispersion beneath the surface. Downward revisions have been common in several value and cyclical sectors, like industrials and materials, along with bond proxies, such as utilities and consumer staples. But we are still seeing positive revisions in energy, real estate, and info tech. This is likely to be the story of the year—a slowdown in cyclical parts of the economy, but continued growth in secular parts like digital transformation.

However, since the start of the year, there has been a rotation out of growth and into value, with value outperforming growth to the greatest extent seen since 1995.15 Fund managers have shifted out of tech and into banks and industrials.16 Nevertheless, with downward earnings revisions in mind we prefer to take profits in value and cyclicals and rotate into secular growth in software and semiconductors, structurally well-positioned energy, and airlines—the last of the reopening trades.

We would advise balancing that with assets that can work when most other things are not: High-quality dividend-paying stocks, private credit, and real estate could offer needed yields to help weather volatility and rising rates.

1. Bloomberg, as of February 8, 2022.

2. Morgan Stanley Research, Bureau of Labor Statistics, as of February 4, 2022. Note: Essentials are defined as groceries, shelter, utilities, gas.

3. iCapital, Bureau of Labor Statistics, Bloomberg, as of February 2022.

4. Bloomberg, as of February 7, 2022

5. University of Michigan Consumer Sentiment Survey, Bloomberg, as of February 7, 2022.

6. Ibid.

7. Bloomberg, as of February 7, 2022.

8. Bloomberg, Bureau of Economic Analysis, as of December 31, 2021

9. Goldman Sachs, January 2022

10. IHS Markit US Manufacturing PMI, February 1, 2022

11. Ibid.

12. Bloomberg, RSTAMOM Index, as of February 8, 2022

13. Factset, Earnings Insight, February 4, 2022

14. Bank of America, as of February 7, 2022.

15. Bloomberg, January 4, 2022

16. Bank of America Global Research, Global Fund Manager Survey, January 18, 2022

IMPORTANT INFORMATION

The material herein has been provided to you for informational purposes only by iCapital, Inc. (“iCapital”). This material is the property of iCapital and may not be shared without the written permission of iCapital. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of iCapital.

This material is provided for informational purposes only and is not intended as, and may not be relied on in any manner as, legal, tax or investment advice, a recommendation, or as an offer to sell, a solicitation of an offer to purchase or a recommendation of any interest in any fund or security. You should consult your personal accounting, tax and legal advisors to understand the implications of any investment specific to your personal financial situation. This material does not intend to address the financial objectives, situation or specific needs of any individual investor. Alternative investments are complex, speculative investment vehicles and are not suitable for all investors.

The information contained herein is an opinion only, as of the date indicated, and should not be relied upon as the only important information available. Any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets is not necessarily indicative of the future or likely performance. The information contained herein is subject to change, incomplete, and may include information and/or data obtained from third party sources that iCapital believes, but does not guarantee, to be accurate. iCapital considers this third-party data reliable, but does not represent that it is accurate, complete and/or up to date, and it should not be relied on as such. iCapital makes no representation as to the accuracy or completeness of this material and accepts no liability for losses arising from the use of the material presented. No representation or warranty is made by iCapital as to the reasonableness or completeness of such forward-looking statements or to any other financial information contained herein.

Securities products and services are offered by iCapital Markets, an SEC-registered broker-dealer, member FINRA and SIPC, and an affiliate of iCapital, Inc. and Institutional Capital Network, Inc. These registrations and memberships in no way imply that the SEC, FINRA, or SIPC have endorsed any of the entities, products, or services discussed herein. Annuities and insurance services are provided by iCapital Annuities and Insurance Services LLC, an affiliate of iCapital, Inc. “iCapital” and “iCapital Network” are registered trademarks of Institutional Capital Network, Inc. Additional information is available upon request.

© 2023 Institutional Capital Network, Inc. All Rights Reserved.